Global Oleate Esters Market

Market Size in USD Billion

CAGR :

%

USD

1.59 Billion

USD

2.07 Billion

2024

2032

USD

1.59 Billion

USD

2.07 Billion

2024

2032

| 2025 –2032 | |

| USD 1.59 Billion | |

| USD 2.07 Billion | |

|

|

|

|

Oleate Esters Market Size

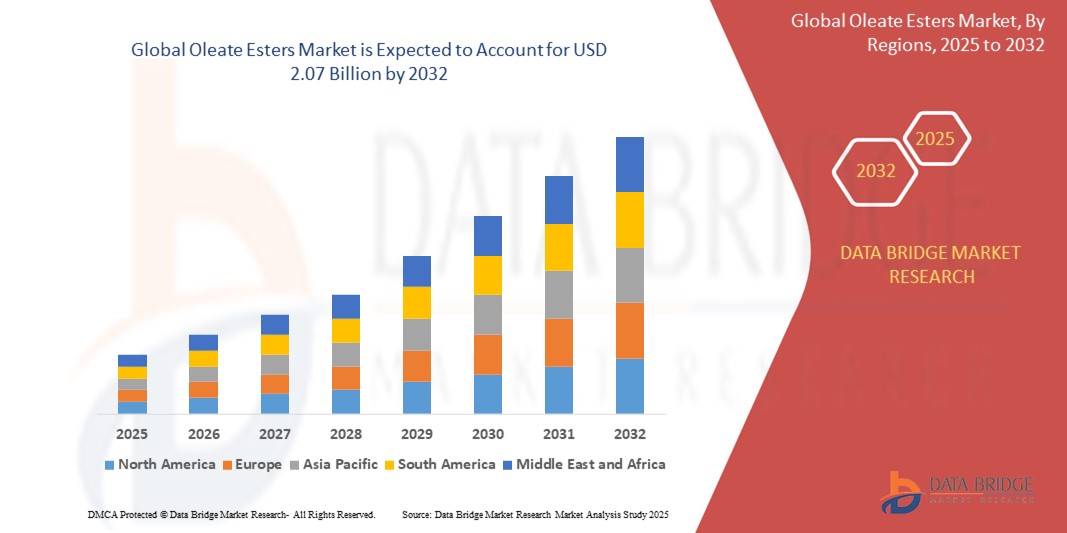

- The global oleate esters market size was valued at USD 1.59 billion in 2024 and is expected to reach USD 2.07 billion by 2032, at a CAGR of 3.37% during the forecast period

- The market growth is largely fuelled by rising demand for biodegradable and non-toxic lubricants, increasing environmental awareness, and expanding applications in cosmetics, agrochemicals, and industrial sectors

Oleate Esters Market Analysis

- Oleate esters are increasingly used as sustainable alternatives to petroleum-based lubricants and solvents due to their high lubricity, low volatility, and excellent biodegradability

- The personal care industry is witnessing strong demand for oleate esters in skin-conditioning agents and emulsifiers, especially in clean-label and natural cosmetic formulations

- Asia-Pacific dominated the oleate esters market with the largest revenue share of 39.2% in 2024, driven by the region’s strong presence of oleochemical manufacturers, expanding agrochemical sector, and rising demand for bio-based lubricants

- North America region is expected to witness the highest growth rate in the global oleate esters market, driven by innovation in green chemistry, rising demand for clean-label cosmetics, and expanded use of bio-lubricants and specialty esters in industrial and automotive applications, along with strong research and development infrastructure supporting product innovation and sustainable sourcing practices

- The methyl oleate segment dominated the market with the largest revenue share of 38.5% in 2024, attributed to its widespread usage as a solvent, lubricant, and intermediate in industrial and agrochemical applications. Its excellent solvency, low toxicity, and biodegradability make it a preferred choice across environmentally regulated sectors. Methyl oleate is also increasingly favored in metalworking fluids and cleaning agents due to its performance consistency and cost-effectiveness.

Report Scope and Oleate Esters Market Segmentation

|

Attributes |

Oleate Esters Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion into Bio-Based Industrial Lubricants Segment • Rising Demand from Natural Cosmetics and Personal Care Industry |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Oleate Esters Market Trends

“Growing Utilization in Sustainable Industrial Applications”

- The demand for oleate esters is rising across multiple industries due to their biodegradable nature and low toxicity, making them ideal alternatives to petroleum-based chemicals in environmentally sensitive applications such as lubricants and metalworking fluids

- Manufacturers are increasingly shifting toward oleate esters derived from renewable feedstocks such as vegetable oils to meet regulatory and consumer demand for sustainable products while reducing carbon footprints in production processes

- Product innovation in oleate ester formulations is expanding their applicability in specialized sectors such as agrochemicals, where low volatility and superior solvency improve pesticide dispersion and environmental safety

- The cosmetics and personal care industry is embracing oleate esters for their emollient properties and mildness on skin, leading to increased use in formulations such as creams, lotions, and sunscreens targeting clean-label beauty trends

- For instance, BASF has introduced a series of bio-based oleate esters that meet stringent environmental standards and are tailored for use in both industrial and personal care formulations, reflecting the growing shift toward green chemistry

Oleate Esters Market Dynamics

Driver

“Increasing Demand for Bio-Based Lubricants and Solvents”

- The rising global focus on reducing dependency on fossil fuels is driving demand for oleate esters in the production of bio-based lubricants that are biodegradable and less toxic to ecosystems, particularly in marine and forestry applications

- Oleate esters offer excellent solvency and lubrication properties, which makes them attractive substitutes in metalworking, textile processing, and industrial cleaning where high-performance green alternatives are in demand

- Regulatory frameworks such as the European Union’s REACH and U.S. EPA’s Safer Choice Program are pushing industries to adopt safer and renewable chemical inputs, further accelerating the adoption of oleate esters across manufacturing sectors

- Industries are increasingly using oleate esters in high-performance formulations due to their stability at varying temperatures and their compatibility with additives, which reduces the need for synthetic stabilizers

- For instance, companies such as Croda International have expanded their oleate ester product lines to meet demand from industrial clients seeking eco-certified lubricants and solvents for heavy machinery and metal finishing operations

Restraint/Challenge

“Volatile Raw Material Prices and Competition from Synthetic Alternatives”

- Oleate esters are primarily derived from vegetable oils such as palm, soybean, and rapeseed, whose prices fluctuate due to climatic conditions, trade restrictions, and supply chain disruptions, thereby impacting production cost stability

- Synthetic esters often provide higher oxidative stability and longer shelf life than oleate esters, making them more desirable in certain high-performance applications despite their environmental drawbacks, which poses a competitive threat

- Limited awareness and slower adoption of bio-based chemicals in developing economies restrict market growth potential for oleate esters, as industries continue to favor conventional, cost-efficient alternatives without strong regulatory pressure

- Storage and handling challenges such as hydrolysis and microbial contamination can affect the shelf life and performance of oleate esters, requiring manufacturers to invest in formulation enhancements and preservation techniques

- For instance, during the 2022–2023 period, producers in Southeast Asia faced rising feedstock costs due to poor oilseed harvests and export bans, resulting in tightened margins for oleate ester manufacturers and delays in global shipments

Oleate Esters Market Scope

The market is segmented on the basis of product, source, and application.

- By Product

On the basis of product, the oleate esters market is segmented into methyl oleate, ethyl oleate, butyl oleate, tri-methylolpropane trioleate (TMPTO), and others. The methyl oleate segment dominated the market with the largest revenue share of 38.5% in 2024, attributed to its widespread usage as a solvent, lubricant, and intermediate in industrial and agrochemical applications. Its excellent solvency, low toxicity, and biodegradability make it a preferred choice across environmentally regulated sectors. Methyl oleate is also increasingly favored in metalworking fluids and cleaning agents due to its performance consistency and cost-effectiveness.

The tri-methylolpropane trioleate (TMPTO) segment is expected to witness the fastest growth rate from 2025 to 2032, owing to its high oxidative stability and lubricating properties, especially in high-temperature industrial applications. TMPTO’s usage is rising in synthetic lubricants, hydraulic fluids, and plasticizers where long-term durability and low volatility are essential. The growing demand for high-performance, bio-based esters in machinery and automotive applications is expected to drive this segment’s rapid expansion.

- By Source

On the basis of source, the market is segmented into corn, granules, soy, and urea. The soy segment held the largest market revenue share in 2024, driven by the abundant global availability of soybean oil and its role as a sustainable feedstock for ester production. Soy-based oleate esters are widely used in lubricants, agrochemicals, and cosmetics, supported by increasing consumer and regulatory preference for bio-based ingredients. The cost efficiency and renewable nature of soy make it a key driver in the oleochemicals sector.

The urea segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by the increasing innovation in esterification processes utilizing urea as a reagent for enhanced yield and purity. Urea-based synthesis allows for more controlled reactions and lower energy consumption, attracting interest from manufacturers focused on green chemistry practices. Its rising use in specialty esters and performance additives is expected to support segment growth over the forecast period.

- By Application

On the basis of application, the oleate esters market is segmented into agrochemical, cosmetics, lubricant, plasticizer, absorbent, and others. The agrochemical segment dominated the market in 2024 with the largest share due to its essential role in pesticide and herbicide formulations, where oleate esters act as carriers, emulsifiers, and dispersants. Their non-toxic, biodegradable profile supports sustainable farming practices and compliance with stringent agricultural regulations. The segment continues to benefit from rising demand for eco-friendly crop protection solutions globally.

The cosmetics segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer demand for plant-based emollients and moisturizing agents in personal care products. Oleate esters are being widely incorporated into skincare, haircare, and bath products for their mildness, spreadability, and compatibility with sensitive skin. The growing clean beauty movement and regulatory push for natural ingredients are expected to further boost adoption in cosmetic formulations.

Oleate Esters Market Regional Analysis

• Asia-Pacific dominated the oleate esters market with the largest revenue share of 39.2% in 2024, driven by the region’s strong presence of oleochemical manufacturers, expanding agrochemical sector, and rising demand for bio-based lubricants

• The growing use of oleate esters in industrial and cosmetic formulations, particularly in countries such as China, India, and Malaysia, is supported by the availability of raw materials and government initiatives promoting sustainable chemical production

• Rising awareness regarding biodegradable and non-toxic esters is also driving product adoption in applications such as plasticizers and personal care, while regional R&D advancements are fueling innovation in oleate-based formulations

China Oleate Esters Market Insight

The China oleate esters market captured the largest revenue share in Asia-Pacific in 2024, supported by large-scale production of vegetable oils and an expanding chemical processing industry. The country’s increasing emphasis on eco-friendly additives in plastics, agrochemicals, and coatings is bolstering oleate esters consumption. In addition, China's active role in bio-lubricant manufacturing and government policies promoting green chemistry practices are further accelerating market growth across industrial and commercial applications

Japan Oleate Esters Market Insight

The Japan oleate esters market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for high-performance, skin-friendly ingredients in personal care and cosmetic formulations. Japanese manufacturers are actively incorporating oleate esters in premium skincare and haircare products to align with consumer preferences for natural and low-irritation materials. Moreover, the country’s advanced chemical processing capabilities and strong focus on product innovation are supporting the development of oleate-based specialty chemicals for use in electronics, coatings, and lubricants

North America Oleate Esters Market Insight

The North America oleate esters market is expected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for clean-label ingredients in cosmetics, personal care, and food-contact applications. The United States, in particular, is experiencing strong traction for oleate esters in emollients and lubricants, supported by consumer preference for non-toxic, bio-based alternatives. In addition, regulatory encouragement for reducing petrochemical use in industrial formulations is contributing to the rise in demand for oleate esters across sectors such as agriculture and plastics

U.S. Oleate Esters Market Insight

The U.S. oleate esters market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising use of bio-lubricants, natural emollients, and plasticizer applications in packaging and automotive sectors. Domestic manufacturers are increasingly adopting oleate esters in compliance with green chemistry principles and to meet the sustainability expectations of both industrial and end-user clients. Furthermore, strong investments in R&D and biotechnology are aiding the development of oleate-based products with improved thermal stability and performance

Europe Oleate Esters Market Insight

The Europe oleate esters market is expected to witness the fastest growth rate from 2025 to 2032, owing to stringent environmental regulations, growing sustainability initiatives, and the adoption of bio-based chemicals across industries. The European Union’s REACH regulation is encouraging the use of safer alternatives to conventional plasticizers and lubricants, where oleate esters offer a biodegradable and cost-efficient solution. Demand is particularly strong in the cosmetics, agrochemical, and coatings sectors across countries such as Germany, France, and the Netherlands

Germany Oleate Esters Market Insight

The Germany oleate esters market is expected to witness the fastest growth rate from 2025 to 2032, backed by the country's commitment to green chemistry, industrial innovation, and eco-conscious consumer demand. Oleate esters are gaining popularity in applications ranging from personal care products to specialty lubricants, supported by strong industrial infrastructure and environmental compliance standards. The integration of oleate esters in specialty formulations that require low toxicity and high performance is further expanding their use in high-value segments such as automotive fluids and bioplastics

U.K. Oleate Esters Market Insight

The U.K. oleate esters market is expected to witness the fastest growth rate from 2025 to 2032, fueled by the growing push for sustainability in industrial and consumer product formulations. The market is seeing rising demand for oleate esters in biodegradable lubricants, eco-friendly plasticizers, and natural cosmetic bases. U.K. companies are increasingly adopting oleate esters to comply with green manufacturing standards and reduce reliance on petroleum-based inputs, especially in light of tightening environmental regulations and consumer awareness surrounding product safety and environmental impact

Oleate Esters Market Share

The oleate esters industry is primarily led by well-established companies, including:

- Croda International Plc (U.K.)

- acme synthetic chemicals (India)

- Victorian Chemical Company Pty Ltd.(Australia)

- PT. Ecogreen Oleochemicals (Malaysia)

- Procter & Gamble (U.S.)

- KLK OLEO (Malaysia)

- Cayman Chemical (U.S.)

- Wilmar International Ltd (Singapore)

- Kao Corporation (Japan)

- Italmatch Chemical S.p.A. (Italy)

- Midwest Liquid Feeds, LLC (U.S.)

- Cargill, Incorporated (U.S.)

- BASF SE (Germany)

- ADM (U.S.)

- Ridley Corporation Limited (Australia)

- Graincorp (Australia)

- Quality Liquid Feeds, Inc. (U.S.)

- Keith Electronics Pvt. Ltd (India)

- Kowa India Pvt. Ltd (India)

- CHS Industrial Products Industry. Tic. Inc., (Turkey)

- Hebei Jingu Plasticizer Co., Ltd. (China)

Latest Developments in Global Oleate Esters Market

- In December 2022, BASF SE introduced EUPERLAN NL, a pearl wax-based pearlizer formulated with hydrogenated vegetable oil, Cocamidopropyl betaine, and glyceryl oleate. This product launch supports the company’s sustainability strategy by offering a natural alternative to traditional cosmetic additives. It enhances visual appeal in personal care formulations through its shimmering effect, strengthening BASF’s presence in the eco-friendly cosmetics segment

- In November 2022, BASF SE acquired a majority stake in Invigor Health Hybrids and its canola seed facility in Idaho. This strategic acquisition expands BASF’s capabilities in oleate ester integration, particularly within its health and nutrition division. It enhances R&D strength and broadens the company’s sustainable product portfolio, contributing to stronger market positioning

- In 2021, Emery Oleochemicals entered a partnership with Omya Inc. to support its Green Polymer Additives (GPA) line in North America. The collaboration focuses on enhancing technical support and service delivery across the U.S., improving access to sustainable additive solutions. This move strengthens Emery's commitment to environmentally responsible innovation and boosts its regional competitiveness

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Oleate Esters Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Oleate Esters Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Oleate Esters Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.