Global Oleic Acid Market

Market Size in USD Million

CAGR :

%

USD

537.09 Million

USD

740.72 Million

2025

2033

USD

537.09 Million

USD

740.72 Million

2025

2033

| 2026 –2033 | |

| USD 537.09 Million | |

| USD 740.72 Million | |

|

|

|

|

Oleic Acid Market Size

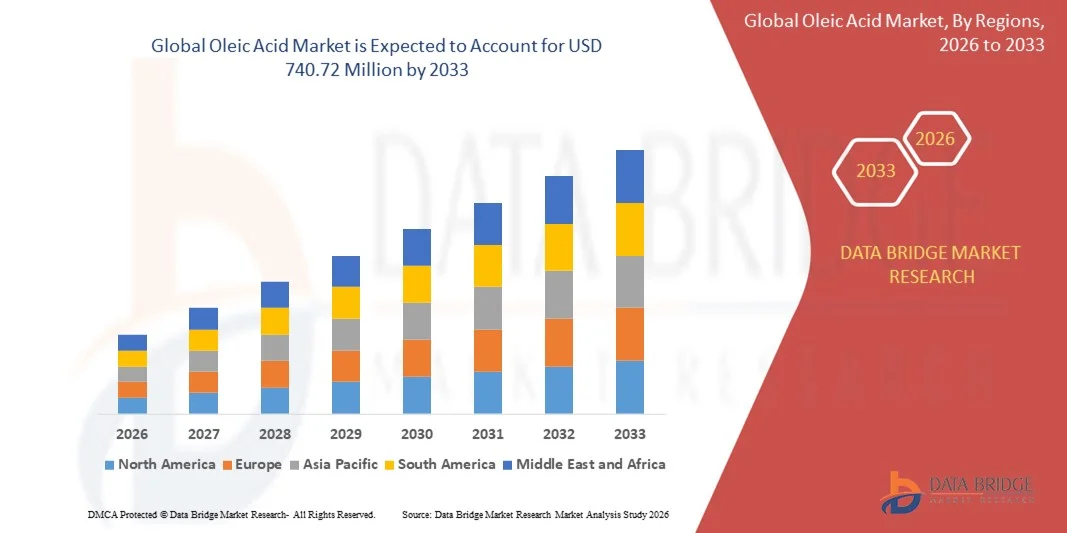

- The global oleic acid market size was valued at USD 537.09 million in 2025 and is expected to reach USD 740.72 million by 2033, at a CAGR of 4.1% during the forecast period

- The market growth is largely fueled by the increasing demand for plant-based and sustainable oleochemicals across food, cosmetics, pharmaceutical, and industrial applications, driving higher adoption of oleic acid in diverse formulations

- Furthermore, rising consumer preference for natural, eco-friendly, and functional ingredients is encouraging manufacturers to incorporate oleic acid in products, thereby accelerating its demand and significantly boosting the industry’s growth

Oleic Acid Market Analysis

- Oleic acid, a monounsaturated fatty acid derived from plant and animal sources, is a critical raw material in the production of emulsifiers, lubricants, surfactants, and chemical intermediates, making it increasingly vital across food, personal care, pharmaceutical, and industrial applications due to its functional and health-related properties

- The escalating demand for oleic acid is primarily fueled by the growing preference for clean-label and bio-based ingredients, expansion of the cosmetics and personal care industry, rising functional food consumption, and increasing industrial applications requiring high-purity fatty acids

- Asia-Pacific dominated the oleic acid market in 2025, due to expanding edible oil production, rising demand in cosmetics and pharmaceutical industries, and a strong presence of plant-based oleic acid suppliers

- North America is expected to be the fastest growing region in the oleic acid market during the forecast period due to rising consumption in food, cosmetics, pharmaceuticals, and industrial applications

- Plant segment dominated the market with a market share of 62.5% in 2025, due to the growing preference for sustainable and renewable raw materials. Consumers and manufacturers increasingly favor plant-derived oleic acid for its eco-friendly production process and compatibility with vegetarian and vegan formulations. Plant sources such as olive, sunflower, and soybean provide a consistent and high-quality supply of oleic acid suitable for diverse applications across food, cosmetics, and pharmaceuticals. The segment also benefits from established agricultural supply chains and technological advancements in extraction and purification methods. In addition, plant-based oleic acid often meets stringent regulatory standards, reinforcing its leadership in the market

Report Scope and Oleic Acid Market Segmentation

|

Attributes |

Oleic Acid Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Oleic Acid Market Trends

Rising Adoption of Plant-Based and Sustainable Oleic Acid

- A significant trend in the oleic acid market is the increasing adoption of plant-based and sustainable oleochemicals across food, cosmetics, pharmaceutical, and industrial applications, driven by growing awareness of eco-friendly ingredients and health-conscious consumption. This adoption is positioning oleic acid as a preferred raw material for manufacturers seeking renewable and functional solutions in diverse end-use industries

- For instance, Oleon and Emery Oleochemicals supply high-quality plant-derived oleic acid and derivatives that are widely used in emulsifiers, surfactants, and personal care formulations. These products strengthen formulation performance and support sustainability goals, meeting rising consumer expectations for clean-label and bio-based ingredients

- The food and beverage sector is increasingly utilizing oleic acid in edible oils, salad dressings, and fortified products due to its beneficial monounsaturated fatty acid content. This trend is driving growth in high-demand applications while emphasizing nutritional and functional benefits for health-conscious consumers

- The cosmetics and personal care industry is integrating oleic acid for its moisturizing and emollient properties, where its use in skincare, haircare, and topical formulations enhances product stability, texture, and efficacy. This is contributing to a stronger preference for natural and multifunctional ingredients in premium product lines

- Industries such as pharmaceuticals and specialty chemicals are expanding the use of oleic acid as a chemical intermediate and functional ingredient in drug formulations, lubricants, and surfactants. This is increasing market penetration and reinforcing the relevance of oleic acid across industrial applications

- The market is witnessing robust growth as manufacturers increasingly replace synthetic or less sustainable fatty acids with plant-derived oleic acid, supporting cleaner production practices, reducing environmental impact, and reinforcing the overall transition toward sustainable and high-performance chemical solutions

Oleic Acid Market Dynamics

Driver

Increasing Demand in Food, Cosmetics, and Pharmaceutical Applications

- The growing use of oleic acid in food, cosmetics, and pharmaceutical formulations is driving market growth, as industries require functional and sustainable ingredients to meet consumer expectations. Its role in improving product quality, stability, and nutritional or therapeutic value is creating consistent demand across multiple sectors

- For instance, companies such as BASF SE and Croda International Plc are developing specialized oleic acid derivatives to enhance functionality in personal care and food products. These offerings support manufacturers in producing premium, high-performance formulations while addressing consumer preference for plant-based and bio-derived ingredients

- Rising demand for clean-label, bio-based, and sustainable products is fueling investments in high-quality oleic acid sourcing and production, enabling manufacturers to differentiate their product lines and expand market share

- The increasing incorporation of oleic acid in pharmaceuticals for drug delivery, topical applications, and excipient formulations is further supporting its growth. This highlights the importance of consistent supply, purity, and functional versatility for end-use industries

- Continuous innovation and research into oleic acid-based formulations are boosting its adoption in emerging applications, including functional foods, cosmetics, and specialty chemicals. This sustained reliance on versatile fatty acids is reinforcing market expansion

Restraint/Challenge

Fluctuating Raw Material Prices and Supply Chain Constraints

- The oleic acid market faces challenges due to volatility in raw material availability, including plant oils and animal-derived sources, which impacts production costs and pricing stability. Dependence on agricultural outputs exposes manufacturers to seasonal fluctuations, climate conditions, and geopolitical factors

- For instance, disruptions in sunflower, soybean, or palm oil supply chains can lead to short-term shortages, affecting oleic acid production volumes and delivery timelines. These fluctuations create uncertainty for manufacturers relying on consistent raw material quality and availability

- Processing and refining oleic acid to meet food, pharmaceutical, and cosmetic-grade standards requires specialized facilities and stringent quality controls, adding operational complexity and cost pressures

- The market also encounters constraints in balancing supply and demand across global regions due to logistics, transportation costs, and regional regulatory requirements. These factors collectively place pressure on manufacturers to optimize sourcing strategies, ensure sustainable production, and maintain competitive pricing

- Ongoing fluctuations in feedstock prices, combined with supply chain challenges, continue to limit margin stability and can restrict growth potential unless addressed through diversification of raw material sources and supply chain resilience strategies

Oleic Acid Market Scope

The market is segmented on the basis of source, grade, application, and end-use industries.

- By Source

On the basis of source, the oleic acid market is segmented into plant and animal. The plant-based segment dominated the market with the largest revenue share of 62.5% in 2025, driven by the growing preference for sustainable and renewable raw materials. Consumers and manufacturers increasingly favor plant-derived oleic acid for its eco-friendly production process and compatibility with vegetarian and vegan formulations. Plant sources such as olive, sunflower, and soybean provide a consistent and high-quality supply of oleic acid suitable for diverse applications across food, cosmetics, and pharmaceuticals. The segment also benefits from established agricultural supply chains and technological advancements in extraction and purification methods. In addition, plant-based oleic acid often meets stringent regulatory standards, reinforcing its leadership in the market.

The animal-based segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising demand in specialty applications within the pharmaceutical and chemical industries. Animal-derived oleic acid, sourced from tallow or fish oil, is valued for its unique fatty acid profile and functional properties. Increasing use in high-performance lubricants, surfactants, and certain pharmaceutical formulations drives the segment’s adoption. For instance, companies such as Oleon NV are expanding animal-based oleic acid production to cater to niche industrial and cosmetic needs. The segment also benefits from ongoing research into refining and processing techniques that enhance purity and performance, making it increasingly attractive to manufacturers seeking specialized solutions.

- By Grade

On the basis of grade, the oleic acid market is segmented into food, pharmaceutical, kosher, and regular. The food-grade segment dominated the market with the largest revenue share in 2025, driven by the growing consumption of oleic acid-rich products and rising demand for health-conscious food ingredients. Food-grade oleic acid is widely used in edible oils, salad dressings, and nutraceuticals due to its beneficial monounsaturated fatty acid content. The segment benefits from regulatory approvals and certifications that ensure safe consumption, making it a preferred choice for manufacturers in the food and beverage sector. In addition, the increasing consumer awareness of heart-healthy diets further strengthens the adoption of food-grade oleic acid. The consistent quality and supply reliability of this grade support its continued dominance across global markets.

The pharmaceutical-grade segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by rising applications in drug formulations, topical ointments, and delivery systems. Pharmaceutical-grade oleic acid offers high purity and stringent compliance with pharmacopoeial standards, making it suitable for sensitive medicinal applications. For instance, companies such as BASF SE are focusing on expanding pharmaceutical-grade production to meet the growing demand in global healthcare markets. The segment also benefits from technological advancements in purification and quality control, enabling safer and more effective end products. Increasing investments in pharmaceutical R&D and a focus on bioactive ingredient development are projected to drive further growth.

- By Application

On the basis of application, the oleic acid market is segmented into emulsifying agent, lubricating agent, surfactant, chemical intermediate, and others. The chemical intermediate segment dominated the market with the largest revenue share in 2025, driven by its extensive use in the synthesis of detergents, soaps, and other specialty chemicals. Oleic acid serves as a key building block for producing fatty acid derivatives that are essential in multiple industrial processes. The segment benefits from a stable demand across manufacturing sectors and the versatility of oleic acid in functional chemical formulations. In addition, the scalability of chemical intermediate production allows manufacturers to optimize costs and maintain consistent supply for downstream applications. The ongoing expansion of chemical and personal care industries further reinforces the segment’s market leadership.

The emulsifying agent segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing applications in food, cosmetics, and pharmaceutical formulations. Emulsifying-grade oleic acid enhances texture, stability, and shelf life of products, making it essential for modern formulations. For instance, companies such as Croda International are innovating oleic acid-based emulsifiers to meet the growing demand for clean-label and multifunctional ingredients. Rising consumer preference for natural and plant-derived emulsifiers further supports segment growth. Advancements in formulation science and customized emulsifier solutions are expected to drive sustained adoption across various industries.

- By End-Use Industries

On the basis of end-use industries, the oleic acid market is segmented into food, cosmetics, oil and gas, rubber, textile, pharmaceutical, and others. The food industry dominated the market with the largest revenue share in 2025, driven by rising demand for healthy edible oils, functional foods, and fortified ingredients enriched with monounsaturated fats. Oleic acid is widely used in processed foods, salad oils, and bakery products due to its nutritional and functional benefits. The segment benefits from increasing consumer awareness of heart health and clean-label products, along with regulatory approvals ensuring food safety. In addition, expanding food manufacturing and processing capabilities in developing regions strengthen the food industry’s dominance in oleic acid consumption. The availability of high-quality plant-based oleic acid also reinforces the market leadership of the food sector.

The cosmetics industry is projected to witness the fastest CAGR from 2026 to 2033, fueled by growing demand for natural and plant-derived ingredients in skincare, haircare, and personal care products. Oleic acid acts as a moisturizing agent, emollient, and texture enhancer, making it highly desirable in cosmetic formulations. For instance, companies such as Evonik Industries AG are increasing production of cosmetic-grade oleic acid to cater to expanding skincare and anti-aging product lines. Rising consumer preference for sustainable and bio-based ingredients supports the growth of this segment. Continuous innovation in cosmetic formulations and a focus on premium product offerings are expected to drive long-term demand.

Oleic Acid Market Regional Analysis

- Asia-Pacific dominated the oleic acid market with the largest revenue share in 2025, driven by expanding edible oil production, rising demand in cosmetics and pharmaceutical industries, and a strong presence of plant-based oleic acid suppliers

- The region’s cost-effective manufacturing landscape, growing cultivation of oleic acid-rich crops, and increasing exports of refined oleic acid products are accelerating market expansion

- The availability of skilled labor, supportive government policies, and rapid industrialization across developing economies are contributing to increased consumption of oleic acid in both food and industrial applications

China Oleic Acid Market Insight

China held the largest share in the Asia-Pacific oleic acid market in 2025, owing to its status as a leading producer of edible oils and oleic acid derivatives. The country’s strong agricultural base, favorable policies supporting chemical and food processing industries, and extensive export capabilities are major growth drivers. Demand is further bolstered by investments in oleochemicals, cosmetics, and pharmaceutical-grade oleic acid production for both domestic and international markets.

India Oleic Acid Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing production of oleic acid-rich oils, growing use in cosmetics and personal care, and rising pharmaceutical applications. Government initiatives to promote oilseed cultivation and local processing are strengthening the demand for oleic acid. In addition, growing exports of edible oils and rising adoption in industrial formulations are contributing to robust market expansion.

Europe Oleic Acid Market Insight

The Europe oleic acid market is expanding steadily, supported by stringent food safety regulations, high demand for pharmaceutical and cosmetic-grade oleic acid, and growing investments in sustainable production methods. The region emphasizes high-quality, eco-friendly, and certified products, particularly in food, cosmetics, and specialty chemical applications. Increasing use of plant-derived oleic acid in green formulations is further enhancing market growth.

Germany Oleic Acid Market Insight

Germany’s oleic acid market is driven by its leadership in high-quality chemical and pharmaceutical production, strong food processing industry, and focus on sustainable supply chains. The country has well-established R&D networks and collaborations between academic institutions and manufacturers, fostering continuous innovation in oleic acid applications. Demand is particularly strong for use in specialty chemicals, cosmetics, and functional foods.

U.K. Oleic Acid Market Insight

The U.K. market is supported by a mature food and personal care industry, increasing focus on natural and plant-based ingredients, and rising demand for high-purity oleic acid. With growing emphasis on research, regulatory compliance, and sustainable production, the U.K. continues to play a significant role in high-value oleic acid markets. Expansion of specialty formulations and cosmetic-grade products is further driving growth.

North America Oleic Acid Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising consumption in food, cosmetics, pharmaceuticals, and industrial applications. A strong focus on functional foods, personal care products, and high-purity oleic acid derivatives is boosting demand. In addition, increasing domestic production, research initiatives, and partnerships between food and chemical manufacturers are supporting market expansion.

U.S. Oleic Acid Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its expansive food processing, pharmaceutical, and cosmetics industries. The country’s focus on innovation, regulatory compliance, and sustainable sourcing is encouraging the use of high-quality oleic acid in various applications. Presence of key players, advanced extraction and refining infrastructure, and a mature distribution network further solidify the U.S.'s leading position in the region.

Oleic Acid Market Share

The oleic acid industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- Eastman Chemical Company (U.S.)

- Berg + Schmidt (Germany)

- VVF L.L.C. (U.S.)

- KLK OLEO (Malaysia)

- Emery Oleochemicals (U.S.)

- Wilmar International Ltd (Singapore)

- Oleon NV (Belgium)

- White Group Public Co., Ltd (Thailand)

- Godrej Industries (India)

- Akzo Nobel N.V. (Netherlands)

- KRATON CORPORATION (U.S.)

- Ashland (U.S.)

- Croda International Plc (U.K.)

- Colgate-Palmolive Company (India) Limited (India)

- Vantage Oleochemicals (U.S.)

- Wujiang Jinyu Lanolin Co., Ltd (China)

- Ferro Corporation (U.S.)

Latest Developments in Global Oleic Acid Market

- In May 2025, Oleon formally rebranded its Brazilian subsidiary A.Azevedo Óleos as Oleon Brasil S.A.. This rebranding signifies full operational integration and strengthens Oleon’s presence in the Latin American oleochemical market. It enhances local production capacity, improves supply reliability, and enables the company to better serve growing demand for oleic acid and related derivatives in industries such as food, cosmetics, and pharmaceuticals. The move also reinforces Oleon’s commitment to sustainable production practices, making plant-based oleic acid more accessible to manufacturers seeking eco-friendly raw materials

- In November 2024, BASF entered into a partnership with Acies Bio to advance fermentation technologies for producing fatty acids and related intermediates. This collaboration aims to create more sustainable and renewable sources of oleochemical feedstocks, supporting the production of oleic acid derivatives used in food, cosmetics, and industrial applications. By diversifying raw material sources, the partnership enhances supply chain resilience, reduces dependency on traditional plant or animal sources, and promotes innovation in high-purity and specialty oleic acid products, which is increasingly important for environmentally conscious markets

- In October 2024, Oleon completed the acquisition of a majority stake in A.Azevedo Óleos, a Brazilian oleochemical producer. This acquisition expanded Oleon’s geographic reach and diversified its product portfolio, providing access to South America’s growing oleochemical demand. It strengthens supply chain capabilities for oleic acid and enhances the company’s ability to meet regional requirements for both industrial and consumer applications. The acquisition also positions Oleon to capture emerging opportunities in the fast-growing personal care and food ingredient markets, where high-quality oleic acid is in increasing demand

- In April 2024, Emery Oleochemicals opened a new application development lab in Rayong, Thailand, expanding its global R&D and product innovation capabilities. This investment strengthens technical support for customers and accelerates the development of customized oleochemical solutions, including oleic acid derivatives for emulsifiers, surfactants, and lubricants. The lab enables faster testing, formulation, and scale-up for industrial and consumer products, enhancing the company’s competitiveness in Asia-Pacific’s growing oleic acid market

- In 2024, Emery Oleochemicals expanded its 100% biobased product portfolio, introducing additional certified sustainable products. This expansion aligns with rising global demand for eco-friendly oleochemical ingredients and supports industries that rely on oleic acid, including food, personal care, and specialty chemicals. By offering certified sustainable options, the company is enabling manufacturers to meet regulatory and consumer expectations for clean-label and green products, while simultaneously strengthening its market position in high-growth, environmentally conscious segments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Oleic Acid Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Oleic Acid Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Oleic Acid Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.