Global Oligosaccharides In Infant Nutrition Market

Market Size in USD Million

CAGR :

%

USD

235.64 Million

USD

469.54 Million

2024

2032

USD

235.64 Million

USD

469.54 Million

2024

2032

| 2025 –2032 | |

| USD 235.64 Million | |

| USD 469.54 Million | |

|

|

|

|

Oligosaccharides in Infant Nutrition Market Size

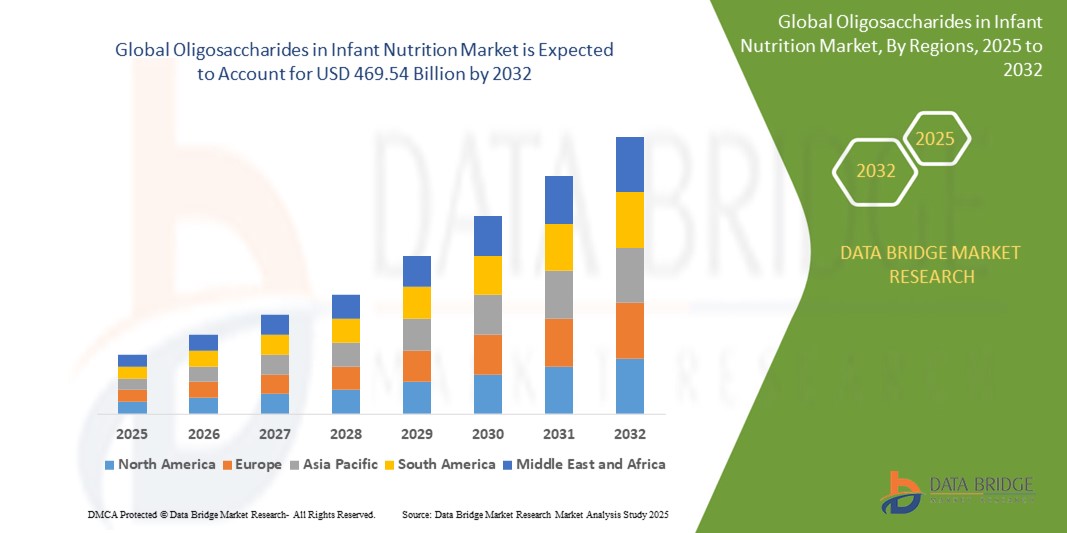

- The global oligosaccharides in infant nutrition market size were valued at USD 235.64 billion in 2024 and is expected to reach USD 469.54 billion by 2032, at a CAGR of 9.00 % during the forecast period

- The market growth is largely fuelled by the increasing awareness of the health benefits of oligosaccharides in infant development and the rising demand for premium infant formula products

- Growing research highlighting the prebiotic effects and immune-boosting properties of oligosaccharides further propels their incorporation into infant nutrition

Oligosaccharides in Infant Nutrition Market Analysis

- The current market for oligosaccharides in infant nutrition is demonstrating significant growth, driven by an increasing understanding of their benefits for infant health and development. There is a strong emphasis on the prebiotic effects of these carbohydrates, which help in establishing a healthy gut microbiota in infants, crucial for digestion and immunity

- Ongoing research continues to uncover the specific roles of different types of oligosaccharides, particularly human milk oligosaccharides, in supporting various aspects of infant health, including immune system modulation and protection against pathogens. This growing body of evidence is further fuelling the demand for their inclusion in infant formula products as a way to mimic the benefits of breast milk

- North America dominates the oligosaccharides in infant nutrition market with the largest revenue share of 35-40% in 2025, due to a combination of high disposable incomes allowing parents to purchase premium infant formulas, a strong awareness of the nutritional benefits of ingredients such as oligosaccharides for infant health, and a well-established market with significant presence of key international and domestic players. The region's robust healthcare infrastructure and stringent regulatory standards also contribute to consumer trust and market dominance

- Asia-Pacific is expected to be the fastest growing region in the oligosaccharides in infant nutrition market during the forecast period due to increasing disposable incomes, rising awareness of infant nutrition, rapid urbanization, and a growing middle-class population in key countries such as China and India

- The human milk oligosaccharides segment dominates the largest market revenue share of 45.1% in 2025, driven by its increasing recognition as the gold standard for infant gut health and immune system development, directly mirroring the benefits of breast milk. This dominance is further propelled by a growing body of scientific research consistently validating the diverse health advantages of various HMO structures for infants, alongside rising parental awareness and demand for premium infant formulas that closely replicate the nutritional complexity of breast milk. Significant advancements in biotechnology are also making the production of specific HMOs, such as 2'-Fucosyllactose, more commercially viable and accessible for incorporation into infant formula, supported by strong recommendations from pediatricians and healthcare professionals. Continuous innovation by infant formula manufacturers to include a wider array of HMOs in their products further strengthens the segment's market position.

Report Scope and Oligosaccharides in Infant Nutrition Market Segmentation

|

Attributes |

Oligosaccharides in Infant Nutrition Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Oligosaccharides in Infant Nutrition Market Trends

“Rising Demand for Human Milk Oligosaccharides (HMOs)”

- HMOs are increasingly recognized as vital for infant health, mirroring breastfeeding advantages. These understanding drives parental interest in formulas enriched with these components

- For instance, a widely shared parenting blog in India (early 2025) highlighted HMOs for strong infant immunity, referencing Mumbai conference findings. This increased parental awareness and demand

- Parents in urban centers such as Gurugram and Bangalore increasingly choose premium HMO-enriched formulas despite higher costs. They prioritize advanced nutrition for their babies' well-being

- For instance, Online baby product retailers in India reported a consistent sales surge for HMO formulas in Q1 2025 compared to last year. This reflects a clear consumer preference

- Innovations in biotechnology are making a broader range of HMOs commercially accessible and sustainable. This allows manufacturers to incorporate diverse HMOs into their products

- Emerging studies continuously highlight the diverse health advantages of different HMO structures for infants. This scientific validation further strengthens the case for their inclusion in infant formula

- Major infant formula brands are actively expanding their product lines to include HMO-enriched options. This reflects the industry's response to consumer demand and scientific progress

Oligosaccharides in Infant Nutrition Market Dynamics

Driver

“Growing Awareness and Scientific Validation Fuel Demand”

- Parents increasingly recognize HMOs' crucial role in mirroring breast milk's health benefits. These understanding fuels their preference for HMO-enriched infant formulas

- For instance, Online forums in India frequently host discussions where parents share information about the benefits of HMOs for infant immunity and gut health. This peer-to-peer learning amplifies awareness

- Strong scientific evidence underpins HMO benefits: Extensive research highlights HMOs' positive impact on gut health, immunity, and overall infant development. This scientific validation reinforces parental confidence

- For instance, Studies published in reputable medical journals in early 2025 continue to demonstrate the prebiotic effects of HMOs such as 2'FL on the infant gut microbiome. This provides credible support for their use

- HMOs mimic breast milk's nutritional superiority: They are seen as key components in replicating the gold standard of infant nutrition. This positioning makes HMO-enriched formulas highly desirable

- Improved gut microbiome is a key outcome: HMOs act as prebiotics, fostering the growth of beneficial bacteria such as Bifidobacteria and Lactobacilli. A healthy gut is fundamental for infant well-being

- Reduced risk of infections is another significant advantage: Certain HMOs exhibit direct immune-modulating effects, helping to protect infants from common illnesses. This health benefit drives parental demand

Restraint/Challenge

“High Production Costs and Complexity Limit Wider Adoption”

- Manufacturing complex HMOs at scale is expensive, restricting their widespread use and affordability for many families

- For instance, the significant price difference observed between standard infant formulas and HMO-enriched options in Gurugram demonstrates this cost barrier for average consumers

- Purification challenges inflate prices: Achieving the necessary high purity levels for infant consumption demands sophisticated and costly purification processes during HMO production

- For instance, a recent analysis of the infant formula industry in India pointed out the substantial investments required by manufacturers to implement advanced HMO purification technologies

- Affordability restricts market reach: The higher prices of HMO-enriched formulas make them less accessible to a significant portion of the population in a price-sensitive market such as India

- Complex manufacturing hinders scale-up: The intricate structures of diverse HMOs necessitate specialized and expensive technologies for their large-scale production

- Disparities in access raise equity concerns: The cost barrier to HMO-enriched formulas creates unequal access to their potential health benefits for infants from different socioeconomic backgrounds

Oligosaccharides in Infant Nutrition Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the Oligosaccharides in Infant Nutrition market is segmented into galactoligosaccharides, human milk oligosaccharides, and fructooligosaccharides. The human milk oligosaccharides segment dominates the largest market revenue share of 45.1% in 2025, driven by its increasing recognition as the gold standard for infant gut health and immune system development, directly mirroring the benefits of breast milk. This dominance is further propelled by a growing body of scientific research consistently validating the diverse health advantages of various HMO structures for infants, alongside rising parental awareness and demand for premium infant formulas that closely replicate the nutritional complexity of breast milk. Significant advancements in biotechnology are also making the production of specific HMOs, such as 2'-Fucosyllactose, more commercially viable and accessible for incorporation into infant formula, supported by strong recommendations from pediatricians and healthcare professionals. Continuous innovation by infant formula manufacturers to include a wider array of HMOs in their products further strengthens the segment's market position.

The fructooligosaccharides segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its expanding applications beyond infant nutrition into a wide range of functional foods, beverages, and dietary supplements for adults, driven by increasing gut health awareness. The relatively lower production costs and established manufacturing processes compared to more complex HMOs also make them a more accessible prebiotic ingredient. Furthermore, the growing consumer preference for prebiotic ingredients that support digestive health and overall well-being across all age groups, coupled with their versatility in formulation, contributes to this rapid growth. Increasing research highlighting the beneficial effects of FOS on the gut microbiome composition and potential systemic health benefits in both infants and adults, along with the rising trend of self-medication and proactive health management, further fuels the demand for FOS in various applications.

- By Application

On the basis of application, the oligosaccharides in infant nutrition market is segmented into food, health products, drinks, medicine, and others. The food held the largest market revenue share in 2025, driven by the widespread incorporation of oligosaccharides, particularly Human Milk Oligosaccharides (HMOs) and Galactooligosaccharides (GOS), into infant formula products. Infant formula represents a significant portion of the overall food category within this market, as manufacturers strive to mimic the beneficial components of breast milk. The high birth rates globally and the increasing adoption of formula feeding, either exclusively or as a supplement to breastfeeding, contribute significantly to the large market share held by the food segment. Furthermore, the established use of GOS as a prebiotic in various processed baby foods also bolsters this segment's dominance. The continuous innovation in infant formula formulations, with a growing emphasis on gut health and immune support through oligosaccharide inclusion, further solidifies the food segment's leading position.

The health product segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its expanding applications in dietary supplements and functional foods aimed at improving gut health and overall well-being in infants and young children. Increasing parental awareness regarding the importance of a balanced gut microbiome for infant development and immunity is fueling the demand for oligosaccharide-based supplements. The ease of incorporating oligosaccharides into various health product formats, such as powders and drops, makes them a convenient option for parents. Moreover, ongoing research highlighting the specific benefits of different oligosaccharides, including HMOs, GOS, and Fructooligosaccharides (FOS), in supporting infant health conditions such as colic and allergies, is further propelling the growth of this segment. The rising trend of proactive healthcare and the increasing recommendations from pediatricians for targeted nutritional interventions are also contributing to the rapid expansion of oligosaccharides in health products for infants.

Oligosaccharides in Infant Nutrition Market Regional Analysis

- North America dominates the oligosaccharides in infant nutrition market with the largest revenue share in 2025, driven by a high demand for premium infant nutrition products, increased awareness of the health benefits of HMOs, and strong presence of key market players.

- The region benefits from a high disposable income among its population, allowing for greater expenditure on premium infant nutrition products. This economic advantage translates to a strong consumer base willing to invest in specialized formulations

- A well-established awareness of the benefits of advanced infant nutrition, coupled with robust healthcare infrastructure, contributes significantly to the dominance of North America. Parents in this region are often well-informed about the nutritional needs of their infants

- Stringent regulatory frameworks and quality standards in North America foster consumer trust in infant nutrition products. This emphasis on safety and efficacy further solidifies the market position of established players

- Continuous innovation and the presence of key market players with strong research and development capabilities drive market growth and maintain North America's leading position. These companies consistently introduce advanced formulations catering to specific infant needs

U.S. Oligosaccharides in Infant Nutrition Market Insight

The U.S. market is projected to hold a significant revenue share of the North American oligosaccharides in infant nutrition market in 2025. This substantial share is fueled by a strong consumer focus on infant health and wellness, leading to a high demand for premium infant formulas enriched with beneficial ingredients such as oligosaccharides. The well-established retail infrastructure and the presence of major international and domestic infant formula brands further contribute to the market size. Moreover, the increasing awareness of the crucial role of gut health in early childhood development among American parents drives the preference for formulas containing prebiotics such as oligosaccharides.

Europe Oligosaccharides in Infant Nutrition Market Insight

The European market is anticipated to witness a robust expansion in its share of the global oligosaccharides in infant nutrition market throughout the forecast period. This growth is underpinned by stringent regulatory standards that often encourage the inclusion of beneficial ingredients in infant formula, alongside a growing consumer understanding of the scientific backing for ingredients such as oligosaccharides. Furthermore, the increasing prevalence of dual-income households and a demand for convenient yet nutritious feeding options for infants contribute to the adoption of advanced formula formulations across various European countries. The market is also influenced by a strong emphasis on infant health by healthcare professionals and public health initiatives.

U.K. Oligosaccharides in Infant Nutrition Market Insight

The U.K. market is expected to capture a noteworthy share of the European oligosaccharides in infant nutrition market, driven by a rising trend of health-conscious parenting and an increasing willingness among consumers to invest in premium infant nutrition products. Heightened awareness regarding the importance of gut microbiota in infant immunity and overall health is a significant factor propelling the demand for oligosaccharide-enriched formulas. The strong retail presence of both global and local brands, coupled with effective marketing highlighting the benefits of these ingredients, further supports market growth in the U.K.

Germany Oligosaccharides in Infant Nutrition Market Insight

Germany is projected to hold a considerable share of the European oligosaccharides in infant nutrition market, fueled by a strong emphasis on high-quality and scientifically validated infant food products. German consumers exhibit a high level of awareness regarding the nutritional needs of infants and are inclined to choose formulas that offer additional health benefits, such as those provided by oligosaccharides. The country's well-developed healthcare system and the trust placed in pediatric recommendations also contribute to the adoption of advanced infant formula options. Furthermore, Germany's focus on research and development in food technology supports the innovation and marketing of such products

Asia-Pacific Oligosaccharides in Infant Nutrition Market Insight

The Asia-Pacific region is poised to exhibit the fastest growth in its share of the global oligosaccharides in infant nutrition market in 2025. This rapid expansion is driven by increasing disposable incomes in key markets such as China, India, and Southeast Asian countries, coupled with a growing awareness of the importance of early childhood nutrition. Rapid urbanization and a rising number of working parents are also contributing to the demand for convenient and nutritionally enhanced infant formula options. Government initiatives promoting infant health and the increasing availability of international and domestic brands offering oligosaccharide-enriched products are further propelling market growth in this region.

Japan Oligosaccharides in Infant Nutrition Market Insight

The Japan market is expected to steadily increase its share in the Asia-Pacific oligosaccharides in infant nutrition market. This growth is supported by the country's high standards for infant care and a strong consumer preference for scientifically formulated and high-quality infant products. The aging population and a greater reliance on convenience products for childcare also contribute to the demand for advanced infant formulas containing beneficial ingredients such as oligosaccharides. Furthermore, the strong influence of pediatricians and healthcare professionals in guiding parents' choices regarding infant nutrition plays a significant role in market adoption.

China Oligosaccharides in Infant Nutrition Market Insight

China is anticipated to command the largest revenue share within the Asia-Pacific oligosaccharides in infant nutrition market in 2025. This dominance is attributed to its vast population, increasing disposable incomes, and a heightened awareness among parents regarding the critical role of infant nutrition in healthy development. The relaxation of the one-child policy and the subsequent increase in birth rates have further amplified the demand for infant formula. Moreover, the growing middle class in China is increasingly willing to spend on premium infant nutrition products that offer added health benefits, such as those containing oligosaccharides for gut health and immunity. The strong presence of both domestic and international brands actively marketing the benefits of these ingredients also contributes to the market's substantial share.

Oligosaccharides in Infant Nutrition Market Share

The Oligosaccharides in Infant Nutrition industry is primarily led by well-established companies, including:

- Abbott (U.S.)

- DuPont Nutrition & Health (U.S.)

- FrieslandCampina Domo (Netherlands)

- Ingredion (U.S.)

- Carbosynth (U.K.)

- Dairy Crest (U.K.)

- Inbiose (Belgium)

- Jennewein Biotechnologie (Germany)

- Tereos (France)

- ZuChem (U.S.)

- Elicityl (France)

- Dextra (U.K.)

Latest Developments in Global Oligosaccharides in Infant Nutrition Market

- In November 2023, Nestlé introduced a new product under its Wyeth illuma brand, a science-based growing-up milk enriched with Human Milk Oligosaccharides (HMOs) in mainland China. This development follows the recent approval by China's National Health Commission for the use of HMOs. The product aims to support early life nutrition by closely mimicking the benefits of human breast milk. This strategic move enhances Nestlé's position in the pediatric nutrition market, offering scientifically backed health benefits and meeting growing consumer demand for advanced infant formulas

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Oligosaccharides In Infant Nutrition Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Oligosaccharides In Infant Nutrition Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Oligosaccharides In Infant Nutrition Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.