Global Omega 3 For Food Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

4.47 Billion

USD

12.15 Billion

2024

2032

USD

4.47 Billion

USD

12.15 Billion

2024

2032

| 2025 –2032 | |

| USD 4.47 Billion | |

| USD 12.15 Billion | |

|

|

|

|

Omega 3 for Food Ingredients Market Size

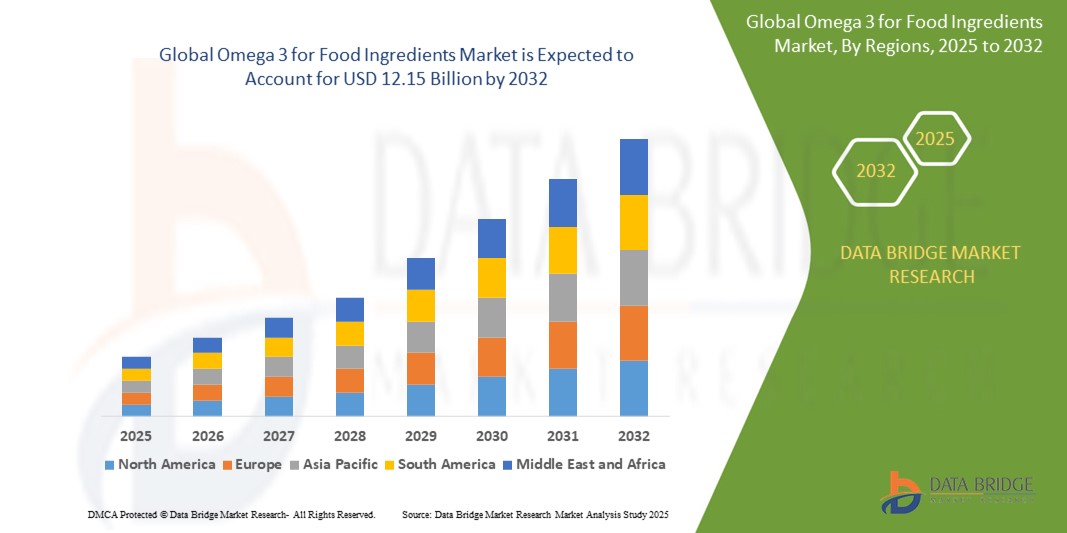

- The global omega 3 for food ingredients market size was valued at USD 4.47 billion in 2024 and is expected to reach USD 12.15 billion by 2032, at a CAGR of 13.30% during the forecast period

- The market growth is primarily driven by increasing consumer awareness of health benefits associated with omega-3 fatty acids, such as heart health, cognitive function, and anti-inflammatory properties, coupled with rising demand for functional foods and dietary supplement

- Growing adoption of omega-3 enriched products in both developed and emerging markets, along with advancements in extraction and formulation technologies, is further propelling market expansion

Omega 3 for Food Ingredients Market Analysis

- Omega-3 fatty acids, essential nutrients derived from plant and marine sources, are increasingly integral to food and beverage products, pharmaceuticals, and infant nutrition due to their scientifically backed health benefits

- The surge in demand is fueled by rising health consciousness, increasing prevalence of lifestyle-related diseases, and growing consumer preference for natural and functional ingredients in food and supplements

- North America dominated the omega 3 for food ingredients market with the largest revenue share of 40.01% in 2024, driven by high consumer awareness, advanced healthcare infrastructure, and strong presence of key industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rising disposable incomes, rapid urbanization, and increasing demand for health-focused products in countries such as China, India, and Japan

- The marine source segment dominated the largest market revenue share of 62.3% in 2024, driven by its high concentration of bioavailable omega-3 fatty acids, particularly DHA and EPA, sourced from fish and algae

Report Scope and Omega 3 for Food Ingredients Market Segmentation

|

Attributes |

Omega 3 for Food Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Omega 3 for Food Ingredients Market Trends

“Increasing Integration of Omega-3 in Functional Foods and Personalized Nutrition”

- The Global Omega-3 for Food Ingredients Market is experiencing a notable trend toward the incorporation of omega-3 fatty acids, such as Docosahexaenoic Acid (DHA), Eicosapentaenoic Acid (EPA), and Alpha-Linolenic Acid (ALA), into functional foods and beverages

- Advances in food processing technologies enable manufacturers to fortify products such as dairy, bakery, and beverages with omega-3 without compromising taste or shelf life, appealing to health-conscious consumers

- Personalized nutrition, driven by consumer awareness of omega-3’s benefits for heart, brain, and immune health, is boosting demand for tailored dietary supplements and fortified foods

- For instances, companies are developing omega-3-enriched products such as plant-based milk, snacks, and infant formulas, leveraging marine and plant sources to cater to diverse dietary preferences, including vegan and vegetarian diets

- This trend enhances the appeal of omega-3 fortified products for both individual consumers and the food industry, driving innovation in product formulations

- Data analytics and consumer behavior studies are being used to design omega-3 products that align with specific health needs, such as cognitive development in infants or cardiovascular health in adults

Omega 3 for Food Ingredients Market Dynamics

Driver

“Rising Consumer Demand for Health and Wellness Products”

- Growing awareness of the health benefits of omega-3 fatty acids, including improved cardiovascular health, cognitive function, and anti-inflammatory properties, is a key driver for the Global Omega-3 for Food Ingredients Market

- Omega-3 ingredients are increasingly incorporated into dietary supplements, functional foods and beverages, pharmaceuticals, infant formulas, and pet food and feed, meeting consumer demand for health-focused products

- Government and health organization endorsements, particularly in North America, which dominates the market, are promoting omega-3 consumption for preventive healthcare

- The rise of e-commerce and digital marketing has made omega-3 products more accessible, further fueling market growth, especially in the Asia-Pacific region, which is the fastest-growing market due to rising disposable incomes and health awareness

- Food manufacturers are increasingly offering omega-3-fortified products as standard or premium options to meet consumer expectations for functional and health-enhancing foods

Restraint/Challenge

“High Production Costs and Sustainability Concerns”

- The high cost of sourcing and processing omega-3 ingredients, particularly from marine sources such as fish oil, poses a significant barrier to market growth, especially in price-sensitive regions such as parts of Asia-Pacific

- Extracting omega-3 from plant sources or marine sources requires advanced technology and sustainable practices, which increase production costs

- Sustainability concerns, such as overfishing and environmental impact on marine ecosystems, raise challenges for marine-sourced omega-3, prompting demand for eco-friendly alternatives such as algae-based DHA and EPA

- Regulatory complexities surrounding health claims and labeling for omega-3 products vary across countries, creating challenges for manufacturers operating in multiple regions

- These factors can limit market expansion, particularly in regions with high cost sensitivity or stringent environmental and regulatory standards

Omega 3 for Food Ingredients market Scope

The market is segmented on the basis of source, product type, and application.

- By Source

On the basis of source, the global omega 3 for food ingredients market is segmented into plant source and marine source. The marine source segment dominated the largest market revenue share of 62.3% in 2024, driven by its high concentration of bioavailable omega-3 fatty acids, particularly DHA and EPA, sourced from fish and algae. The widespread use of marine-derived omega-3 in dietary supplements and functional foods, coupled with consumer awareness of its health benefits, fuels this dominance.

The plant source segment is expected to witness the fastest growth rate of 8.7% from 2025 to 2032, driven by increasing demand for vegan and sustainable omega-3 alternatives, such as flaxseed and chia seed oils rich in ALA. Growing environmental concerns and dietary preferences for plant-based products further accelerate adoption.

- By Product Type

On the basis of product type, the global omega 3 for food ingredients market is segmented into Docosahexaenoic Acid (DHA), Eicosapentaenoic Acid (EPA), and Alpha-Linolenic Acid (ALA). The DHA segment dominated the market with a revenue share of 45.2% in 2024, owing to its critical role in brain and eye health, making it a preferred ingredient in infant formula, dietary supplements, and functional foods. Its high efficacy and widespread use in pharmaceutical applications also contribute to its leading position.

The ALA segment is anticipated to experience the fastest growth rate of 9.1% from 2025 to 2032, fueled by rising consumer preference for plant-based omega-3 sources and increasing incorporation of ALA-rich ingredients, such as flaxseed and hemp oils, in functional foods and beverages. Advancements in extraction technologies further enhance its market potential.

- By Application

On the basis of application, the global omega 3 for food ingredients market is segmented into dietary supplements, functional foods and beverages, pharmaceuticals, infant formula, and pet food and feed. The dietary supplements segment accounted for the largest market revenue share of 38.6% in 2024, driven by growing consumer awareness of omega-3’s benefits for heart, brain, and immune health. The rising prevalence of lifestyle-related diseases and proactive health management trends bolster this segment’s dominance.

The functional foods and beverages segment is expected to witness the fastest growth rate of 10.3% from 2025 to 2032, fueled by increasing demand for fortified foods and beverages that promote health and wellness. Innovations in product formulations, such as omega-3-enriched dairy, snacks, and beverages, along with rising consumer focus on preventive healthcare, drive this growth.

Omega 3 for Food Ingredients Market Regional Analysis

- North America dominated the omega 3 for food ingredients market with the largest revenue share of 40.01% in 2024, driven by high consumer awareness, advanced healthcare infrastructure, and strong presence of key industry players

- Consumers prioritize omega-3 ingredients for their cardiovascular health benefits, cognitive support, and anti-inflammatory properties, particularly in regions with high health awareness

- Growth is supported by advancements in omega-3 extraction and formulation technologies, including sustainable marine and plant-based sources, alongside rising adoption in dietary supplements, functional foods, and pharmaceuticals

U.S. Omega 3 for Food Ingredients Market Insight

The U.S. omega 3 for food ingredients market captured the largest revenue share of 78.8% in 2024 within North America, fueled by strong demand for dietary supplements and functional foods enriched with omega-3s. Growing consumer awareness of health benefits, such as heart and brain health, drives market expansion. The trend toward clean-label and sustainable products, coupled with increasing regulatory support for health claims, further boosts market growth. The integration of omega-3s in both retail and pharmaceutical sectors supports a diverse product ecosystem.

Europe Omega 3 for Food Ingredients Market Insight

The Europe omega 3 for food ingredients market is expected to witness significant growth, supported by regulatory emphasis on health and nutrition standards. Consumers seek omega-3 enriched products for improved heart health, cognitive function, and overall wellness. Growth is prominent in dietary supplements and functional foods, with countries such as Germany and France showing significant uptake due to rising health consciousness and demand for sustainable sourcing.

U.K. Omega 3 for Food Ingredients Market Insight

The U.K. market for omega 3 for food ingredients is expected to witness rapid growth, driven by increasing demand for health-focused food products and dietary supplements. Consumers prioritize omega-3s for their role in reducing inflammation and supporting mental health. Rising awareness of sustainability and plant-based omega-3 sources, such as alpha-linolenic acid (ALA) from flaxseed, encourages adoption. Evolving health regulations also influence consumer choices, balancing efficacy with compliance.

Germany Omega 3 for Food Ingredients Market Insight

Germany is expected to witness rapid growth in the omega 3 for food ingredients market, attributed to its advanced food and pharmaceutical sectors and high consumer focus on preventive healthcare. German consumers prefer technologically advanced omega-3 products, such as those with high docosahexaenoic acid (DHA) and eicosapentaenoic acid (EPA) content, to support heart and cognitive health. The integration of omega-3s in premium functional foods and dietary supplements supports sustained market growth.

Asia-Pacific Omega 3 for Food Ingredients Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding food and beverage production, rising disposable incomes, and increasing health awareness in countries such as China, India, and Japan. Growing demand for omega-3s in dietary supplements, functional foods, and infant formula is boosting market expansion. Government initiatives promoting nutrition and wellness further encourage the use of advanced omega-3 ingredients.

Japan Omega 3 for Food Ingredients Market Insight

Japan’s omega 3 for food ingredients market is expected to witness rapid growth due to strong consumer preference for high-quality, health-promoting food ingredients. The presence of major food and pharmaceutical manufacturers and the integration of omega-3s in functional foods and supplements accelerate market penetration. Rising interest in sustainable marine sources, such as fish oil, and plant-based ALA sources also contributes to growth.

China Omega 3 for Food Ingredients Market Insight

China holds the largest share of the Asia-Pacific omega 3 for food ingredients market, propelled by rapid urbanization, rising health consciousness, and increasing demand for functional foods and dietary supplements. The country’s growing middle class and focus on preventive healthcare support the adoption of omega-3 enriched products. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Omega 3 for Food Ingredients Market Share

The omega 3 for food ingredients industry is primarily led by well-established companies, including:

- Cargill, Incorporated (US)

- BASF SE (Germany)

- DSM (Netherlands)

- Orkla (Norway)

- Croda International Plc (UK)

- Lonza (Switzerland)

- KD Pharma Group (Germany)

- Corbion (Netehrlands)

- GC Rieber (India)

- Epax (Norway)

- Runke Bioengineering (China)

- Nordic Naturals, Inc. (US)

- Golden Omega (Chile)

- Kinomega Biopharm Inc. (China)

- Sinomega Biotech Engineering Co. Ltd. (China)

- Polaris (US)

- Pharma Marine AS (Norway)

- Huatai Biopharm (China)

- ALGISYS LLC (US)

- Biosearch Life (Spain)

What are the Recent Developments in Global Omega 3 for Food Ingredients Market?

- In March 2024, the EPA and DHA omega-3 ingredients market experienced notable growth as companies ramped up efforts to strengthen algae-based supply chains, responding to rising demand for plant-based and sustainable alternatives. Traditional marine sources such as fish oil face sustainability challenges and supply constraints, prompting innovation in microalgae cultivation and extraction technologies. Algal-origin omega-3s offer equivalent health benefits to fish-derived EPA and DHA, while supporting environmental goals and appealing to eco-conscious consumers—with 64% reportedly preferring plant-based options

- In October 2023, DSM-Firmenich unveiled Life’s OMEGA 03020, a breakthrough single-source algal omega-3 supplement designed to match the EPA: DHA ratio found in traditional fish oil—while offering twice the potency. Produced via precision fermentation in a controlled, non-GMO environment, it ensures purity and zero impact on marine ecosystems. This innovation provides supplement brands with a sustainable alternative to fish-based omega-3s, supporting cardiovascular, brain, and eye health. Life’s OMEGA 03020 reflects DSM-Firmenich’s commitment to expanding plant-based nutrition and addressing global omega-3 deficiencies with high-performance, eco-conscious solutions

- In September 2023, Aker BioMarine partnered with Swisse to launch Swisse Ultiboost High Strength Krill Oil, which was officially listed in Australia’s Listed Assessed medicine category. This designation by the Therapeutic Goods Administration (TGA) confirms the product’s efficacy for two exclusive indications: reducing knee pain and stiffness and improving physical function in cases of mild to moderate osteoarthritis. The formulation features Aker BioMarine’s Superba™ Boost Krill Oil, a phospholipid-based omega-3 source backed by extensive clinical research, including a trial conducted by CSIRO involving 235 participants. This milestone underscores the growing demand for evidence-based, krill-derived omega-3 supplements in the therapeutic space

- In May 2023, Nuseed Global launched Nutriterra, a groundbreaking plant-based omega-3 oil developed from proprietary Omega-3 Canola. Tailored for the human nutrition and dietary supplement markets, Nutriterra delivers a complete omega-3 profile—DHA, EPA, and ALA—comparable to marine oils, but with twice the ALA of conventional canola. Backed by clinical trials confirming its safety and efficacy, Nutriterra offers a sustainable alternative to fish-derived omega-3s, addressing growing consumer demand for eco-friendly, non-marine sources. Available in formats such as softgels, powders, and liquids, it supports cardiovascular, cognitive, and prenatal health while reducing pressure on ocean ecosystems

- In March 2023, Epax unveiled a upgrade to its facility in Ålesund, Norway, introducing advanced molecular distillation technology to elevate the production of ultra-concentrated omega-3 ingredients. Central to this investment is EQP+Tech, a proprietary process that separates and concentrates individual fatty acids from fish oil without excessive heat or harsh chemicals. This innovation enables Epax to maintain a 90% minimum triglyceride content across its EPA and DHA products, while improving purity, consistency, and sensory properties. The upgrade reflects Epax’s commitment to quality, sustainability, and next-generation omega-3 solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Omega 3 For Food Ingredients Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Omega 3 For Food Ingredients Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Omega 3 For Food Ingredients Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.