Global On Demand Infotainment Telematics Market

Market Size in USD Billion

CAGR :

%

USD

19.12 Billion

USD

83.88 Billion

2025

2033

USD

19.12 Billion

USD

83.88 Billion

2025

2033

| 2026 –2033 | |

| USD 19.12 Billion | |

| USD 83.88 Billion | |

|

|

|

|

What is the Global On Demand Infotainment Telematics Market Size and Growth Rate?

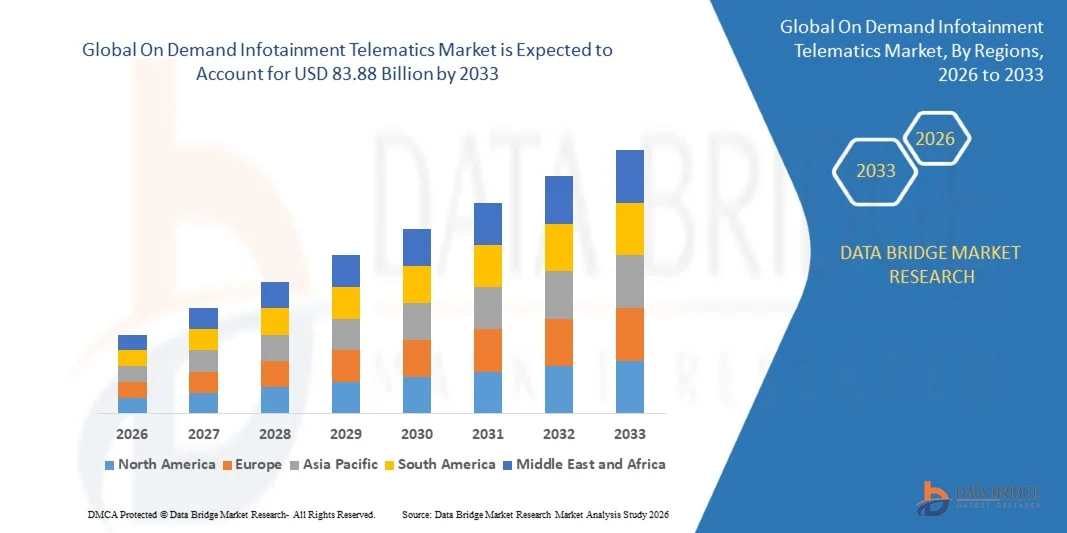

- The global on demand infotainment telematics market size was valued at USD 19.12 billion in 2025 and is expected to reach USD 83.88 billion by 2033, at a CAGR of20.30% during the forecast period

- The growing demand of wireless connectivity in automobiles has been directly influencing the growth of on demand infotainment telematics market

- Also, the rising initiative by the government regarding the on-road public safety is also flourishing the growth of the On demand infotainment telematics market

What are the Major Takeaways of On Demand Infotainment Telematics Market?

- The increasing implementation of renewable sources of energy in electric vehicles as well as the growing information and communication technology and telecommunication across various industrial sectors and high growth in prevalence of vehicles integration with smartphones and various other devices are also positively impacting the growth of the market

- Furthermore, the rapidly emerging digital technology has made possible the communication with machines which are also largely lifting the growth of the on demand infotainment telematics market

- Likewise, the high growth in entertainment, integration of IoT in the automotive industry, safety and security and navigation services as well as increasing cloud adoption and high demand for premium cars with advanced safety and comfort features will further cater ample new opportunities that will lead to the growth of the on demand infotainment telematics market

- North America dominated the On Demand Infotainment Telematics market with a 42.05% revenue share in 2025, driven by strong adoption of connected car platforms, advanced telematics services, cloud-integrated infotainment systems, and high investment in vehicle connectivity innovation across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 8.36% from 2026 to 2033, fueled by rapid automotive production, large-scale adoption of connected car technologies, and strong expansion of infotainment and telematics platforms across China, Japan, India, South Korea, and Southeast Asia

- The Embedded segment dominated the market with a 46.2% share in 2025, driven by widespread integration of factory-installed infotainment units in passenger vehicles, EVs, and premium automotive models

Report Scope and On Demand Infotainment Telematics Market Segmentation

|

Attributes |

On Demand Infotainment Telematics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the On Demand Infotainment Telematics Market?

“Increasing Shift Toward Connected, Cloud-Enabled, and Vehicle-Centric On-Demand Infotainment Platforms”

- The market is experiencing rapid adoption of cloud-integrated, smartphone-synced, and AI-powered infotainment ecosystems that deliver personalized media, navigation, and driver-assistance services

- Automakers and OEMs are deploying compact, high-performance, and software-defined infotainment modules supporting seamless connectivity, real-time telematics, and multi-device integration

- Rising demand for lightweight, high-speed, and over-the-air (OTA) upgradeable infotainment solutions is driving innovation across passenger vehicles, EVs, and premium automotive segments

- For instance, companies such as Ford, BMW, Qualcomm, and Harman International have enhanced their infotainment architectures with upgraded processors, 5G telematics, advanced navigation, and AI-based user-experience engines

- The increasing need for real-time data access, advanced vehicle diagnostics, and personalized entertainment continues to accelerate the shift toward connected and cloud-based infotainment telematics

- As vehicles become more software-centric, On Demand Infotainment Telematics will remain essential for intelligent mobility, immersive in-vehicle experiences, and next-generation connected car platforms

What are the Key Drivers of On Demand Infotainment Telematics Market?

- Growing demand for cost-efficient, intuitive, and high-performance infotainment systems to support navigation, streaming services, vehicle health monitoring, and driver assistance

- For instance, in 2025, Harman International, Qualcomm, and Visteon expanded their infotainment portfolios with enhanced processors, richer UX interfaces, and multi-modal connectivity options

- Surging adoption of connected vehicles, EVs, IoT sensors, ADAS systems, and telematics-enabled smart mobility is driving infotainment demand across the U.S., Europe, and Asia-Pacific

- Advancements in 5G connectivity, cloud computing, GPU-accelerated graphics, and edge-AI processing have strengthened performance, responsiveness, and personalization capabilities

- Rising integration of voice assistants, app ecosystems, and multi-screen entertainment is boosting demand for flexible and scalable infotainment systems

- Supported by continuous automotive R&D investments, software-defined vehicle (SDV) development, and rising digital services revenue models, the On Demand Infotainment Telematics market continues to grow robustly

Which Factor is Challenging the Growth of the On Demand Infotainment Telematics Market?

- High costs associated with premium, high-bandwidth, and feature-rich infotainment platforms restrict adoption among cost-sensitive vehicle segments and emerging markets

- For instance, during 2024–2025, rising semiconductor prices, chipset shortages, and supply-chain disruptions increased production costs for several global infotainment vendors

- The growing complexity of multi-layered interfaces, AI-based recommendations, high-speed data processing, and cybersecurity requirements increases the need for skilled engineers and advanced system integration

- Limited awareness in developing regions about connected infotainment features, OTA upgrades, and data-driven vehicle services slows adoption

- Competition from aftermarket infotainment systems, smartphone-based navigation apps, and OEM-built digital ecosystems creates pricing pressure and reduces differentiation

- To overcome these challenges, companies are focusing on cost-optimized architecture, improved cybersecurity, cloud-linked services, and software-centric innovations to expand global adoption of On Demand Infotainment Telematics solutions

How is the On Demand Infotainment Telematics Market Segmented?

The market is segmented on the basis of technology, application, and distribution channel.

• By Technology

On the basis of technology, the On Demand Infotainment Telematics market is segmented into Embedded, Portable, and Hybrid systems. The Embedded segment dominated the market with a 46.2% share in 2025, driven by widespread integration of factory-installed infotainment units in passenger vehicles, EVs, and premium automotive models. Embedded platforms offer high reliability, seamless connectivity, deep vehicle integration, and support for real-time navigation, telematics, diagnostics, and multimedia services. Automakers increasingly rely on embedded modules due to their OTA upgrade support, AI-powered interfaces, and enhanced compatibility with ADAS and vehicle OS environments.

The Hybrid segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by rising demand for systems combining built-in vehicle hardware with smartphone-based applications, cloud services, and app-store ecosystems. As vehicles transition toward software-defined architectures, hybrid infotainment solutions are becoming essential for delivering flexible, personalized, and continuously upgradeable in-car experiences.

• By Application

Based on application, the market is segmented into Commercial, Automotive, IT & Telecommunication, Healthcare, and Government. The Automotive segment dominated the market with a 41.7% share in 2025, as modern vehicles increasingly depend on connected infotainment, navigation services, telematics monitoring, and real-time vehicle-to-cloud communication. Automakers integrate these systems to enhance safety, personalization, entertainment, and predictive maintenance. Growing EV adoption and rising demand for smart mobility are further boosting deployment.

The Commercial segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by the rapid adoption of cloud-connected infotainment solutions across fleet management, logistics platforms, ride-hailing services, rental services, and smart public transportation. Increasing need for operational visibility, driver behavior analytics, and infotainment-enabled passenger engagement solutions is accelerating commercial deployment. Businesses increasingly rely on telematics-integrated infotainment systems to improve efficiency, connectivity, and customer experience.

• By Distribution Channel

On the basis of distribution channel, the On Demand Infotainment Telematics market is segmented into OEM and Aftermarket channels. The OEM segment dominated the market with a 58.9% share in 2025, supported by strong demand for factory-fitted infotainment and telematics systems across newly manufactured vehicles. Automakers are integrating advanced processors, AI-driven voice assistants, multi-screen dashboards, and 5G-based telematics modules directly into vehicle architectures. OEM-installed systems ensure higher reliability, better hardware-software synchronization, and seamless compatibility with vehicle electronics and safety systems.

The Aftermarket segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by rising consumer demand for feature-rich upgrades, smartphone-mirroring infotainment units, and cost-effective connected car solutions. Growing vehicle age, rapid penetration of Android-based infotainment systems, and increasing preference for retrofit connectivity modules contribute to strong aftermarket expansion. The availability of customizable, plug-and-play systems further drives adoption across developing markets.

Which Region Holds the Largest Share of the On Demand Infotainment Telematics Market?

- North America dominated the On Demand Infotainment Telematics market with a 42.05% revenue share in 2025, driven by strong adoption of connected car platforms, advanced telematics services, cloud-integrated infotainment systems, and high investment in vehicle connectivity innovation across the U.S. and Canada. Growing integration of 5G-enabled infotainment, V2X communications, autonomous driving features, and real-time diagnostics strengthens regional leadership

- Leading OEMs and technology providers in North America continue to deploy AI-powered vehicle interfaces, software-defined cockpit architectures, and high-performance telematics modules, enhancing market competitiveness

- Strong digital infrastructure, presence of major automotive innovators, and increasing demand for personalized in-vehicle experiences reinforce the region’s dominant position

U.S. On Demand Infotainment Telematics Market Insight

The U.S. represents the largest share in North America, supported by rapid adoption of connected vehicles, strong automotive electronics R&D, and extensive use of telematics-enabled services across passenger cars, commercial fleets, EVs, and autonomous platforms. The country’s leadership in AI processors, 5G integration, cloud infotainment, and in-car digital services drives strong demand for high-speed On Demand Infotainment Telematics systems. Presence of major OEMs, advanced testing facilities, and a robust innovation ecosystem further accelerates market expansion.

Canada On Demand Infotainment Telematics Market Insight

Canada contributes significantly to regional growth due to rising investment in connected mobility, telematics-driven fleet services, and advanced automotive electronics R&D. Increasing adoption of infotainment-integrated fleet management platforms, rising penetration of EVs, and government-backed innovation initiatives support strong market demand. Universities and engineering centres actively deploy next-generation infotainment and telematics solutions for vehicle connectivity research, strengthening long-term growth prospects.

Asia-Pacific On Demand Infotainment Telematics Market

Asia-Pacific is projected to register the fastest CAGR of 8.36% from 2026 to 2033, fueled by rapid automotive production, large-scale adoption of connected car technologies, and strong expansion of infotainment and telematics platforms across China, Japan, India, South Korea, and Southeast Asia. Mass manufacturing of vehicles, EV penetration, and widespread integration of digital dashboards, AI voice assistants, and real-time navigation systems drive significant regional momentum. Growing investments in smart mobility, 5G deployment, and automotive software further accelerate demand.

China On Demand Infotainment Telematics Market Insight

China leads Asia-Pacific due to massive vehicle production capacity, rapid expansion of EVs, and strong government support for intelligent connected mobility. High demand for AI-driven infotainment, autonomous driving modules, and advanced telematics systems fuels market growth. Domestic OEMs increasingly adopt cloud-connected dashboards, integrated navigation, and real-time vehicle monitoring, strengthening China’s dominant position.

Japan On Demand Infotainment Telematics Market Insight

Japan demonstrates steady growth supported by sophisticated automotive manufacturing, precision electronics, and strong demand for high-reliability infotainment and telematics platforms. Increasing development of autonomous systems, hybrid vehicles, and advanced driver interfaces drives long-term market adoption. Continuous innovation in compact, high-efficiency digital systems further supports market expansion.

India On Demand Infotainment Telematics Market Insight

India is emerging as a key growth hub driven by rapid digitalization, expanding automotive production, and rising consumer demand for connected car features. The adoption of smartphone-linked infotainment, cloud navigation services, and AI-based vehicle interfaces is increasing across mass-market vehicles. Government initiatives promoting electronics manufacturing, EV adoption, and smart mobility infrastructure accelerate market penetration.

South Korea On Demand Infotainment Telematics Market Insight

South Korea contributes significantly due to strong capabilities in automotive electronics, 5G technologies, semiconductor design, and high-end consumer electronics. Rapid growth of connected EVs, smart cockpit technologies, and AI-enabled telematics platforms drives strong market adoption. The presence of advanced OEMs and suppliers strengthens long-term regional expansion.

Which are the Top Companies in On Demand Infotainment Telematics Market?

The on demand infotainment telematics industry is primarily led by well-established companies, including:

- Verizon (U.S.)

- HARMAN International (U.S.)

- Ford Motor Company (U.S.)

- Visteon Corporation (U.S.)

- MiX Telematics (U.S.)

- Trimble Inc. (U.S.)

- BMW GROUP (Germany)

- TomTom International BV (Netherlands)

- Geotab Inc. (Canada)

- Agero, Inc. (U.S.)

- NXP Semiconductors (Netherlands)

- Infotrack Telematics Pvt. Ltd. (Singapore)

- Qualcomm Technologies, Inc. (U.S.)

- Vista Equity Partners Management, LLC (U.S.)

- Aptiv (Ireland)

- ORBCOMM (U.S.)

- CalAmp (U.S.)

- AT&T Intellectual Property (U.S.)

- Vodafone Limited (U.K.)

What are the Recent Developments in Global On Demand Infotainment Telematics Market?

- In January 2025, LG Electronics (LG), in collaboration with Qualcomm Technologies, Inc., introduced its advanced Cross Domain Controller (xDC) platform at CES 2025, integrating Snapdragon Ride Flex SoC with LG’s IVI and ADAS capabilities to unify multiple vehicle functions under a single controller, marking a major milestone in next-generation automotive performance and mobility enhancement. This development is expected to accelerate the adoption of intelligent, software-defined vehicle systems

- In January 2025, u-blox launched its first automotive-grade Wi-Fi 7 module, RUBY-W2, delivering higher throughput, multi-user support, and ultra-low latency to improve the performance of in-vehicle infotainment and telematics applications, offering stronger connectivity across modern automotive platforms. This advancement is anticipated to elevate user experience and strengthen OEMs’ digital infrastructure

- In November 2024, Skyworks Solutions, Inc. achieved IATF 16949 automotive certification at its Newbury Park, California facility, validating its high-quality manufacturing standards for RF front-end modules used in V2X, infotainment, keyless entry, satellite navigation, and 5G telematics systems, reinforcing the company’s position as a trusted supplier for global automotive OEMs. This milestone is set to expand Skyworks’ footprint in the automotive electronics market

- In September 2023, Taisys India introduced the iConnect platform in partnership with Lumax Ituran Telematics Pvt. Ltd., aiming to reshape India’s automotive connectivity ecosystem by offering advanced telematics and OEM-grade connected solutions across the vehicle segment. This initiative is expected to accelerate digital transformation within the domestic automotive connectivity landscape

- In January 2023, New India Assurance (NIA) enabled insurers to roll out telematics-based motor insurance under the “Pay as You Drive” model, allowing customers to manage vehicle insurance costs based on actual usage while benefiting from roadside assistance and extended protection. This policy is projected to boost adoption of usage-based motor insurance across India

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.