Global On Demand Warehousing Market

Market Size in USD Billion

CAGR :

%

USD

14.88 Billion

USD

47.51 Billion

2025

2033

USD

14.88 Billion

USD

47.51 Billion

2025

2033

| 2026 –2033 | |

| USD 14.88 Billion | |

| USD 47.51 Billion | |

|

|

|

|

On-Demand Warehousing Market Size

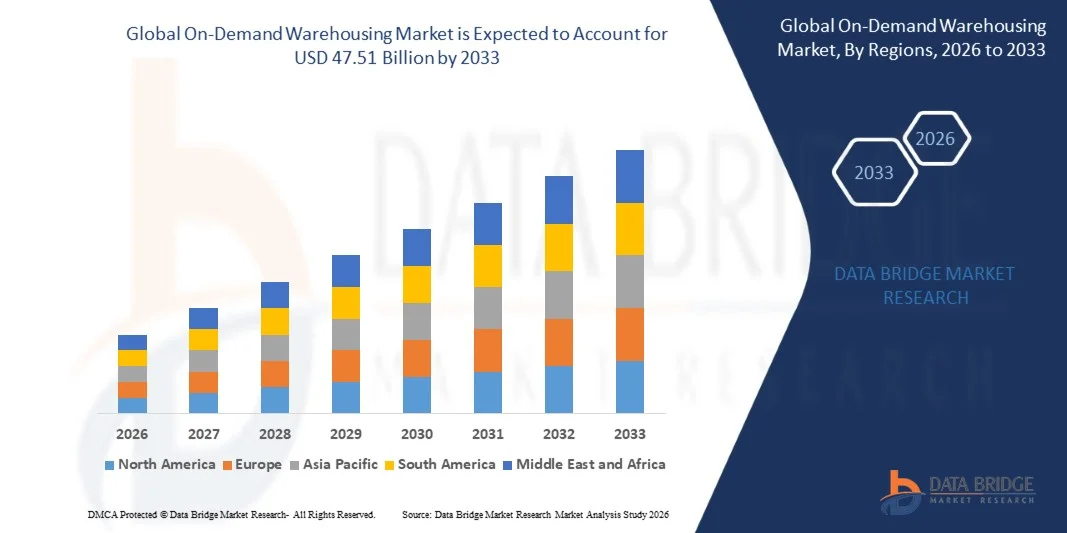

- The global on-demand warehousing market size was valued at USD 14.88 billion in 2025 and is expected to reach USD 47.51 billion by 2033, at a CAGR of 15.62% during the forecast period

- The market growth is largely fuelled by the rising need for flexible storage solutions, rapid growth of e-commerce, and increasing demand for cost-efficient inventory management

- Expansion of last-mile delivery networks and the shift towards cloud-based warehouse management systems are further driving market adoption

On-Demand Warehousing Market Analysis

- The market is witnessing increased integration of digital platforms, AI, and IoT to optimize warehouse operations, track inventory, and enhance supply chain visibility

- Rising global logistics complexity, seasonal demand fluctuations, and the need for agile warehousing solutions are shaping strategic investments and service innovations

- North America dominated the global on-demand warehousing market with the largest revenue share in 2025 driven by the strong presence of e-commerce players, advanced logistics infrastructure, and early adoption of flexible supply chain models

- Asia-Pacific region is expected to witness the highest growth rate in the global on-demand warehousing market, driven by accelerating urbanization, expanding manufacturing and trade activity, and increasing investments in logistics infrastructure and technology across emerging economies

- The Warehousing and Storage segment held the largest market revenue share in 2025 driven by the increasing need for flexible storage capacity, inventory overflow management, and short-term space optimization. Businesses across e-commerce, retail, and manufacturing prefer on-demand warehousing and storage services due to reduced fixed costs, scalability, and the ability to respond quickly to demand fluctuations without long-term lease commitments

Report Scope and On-Demand Warehousing Market Segmentation

|

Attributes |

On-Demand Warehousing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

On-Demand Warehousing Market Trends

“Rising Demand For Flexible And Scalable Storage Solutions”

- The growing need for agility in supply chains is significantly shaping the global on-demand warehousing market, as businesses increasingly seek flexible, short-term storage solutions to manage fluctuating inventory levels. On-demand warehousing enables companies to access storage space as needed without long-term commitments, helping optimize costs and improve operational efficiency. This trend is strengthening adoption across e-commerce, retail, manufacturing, and logistics sectors, encouraging service providers to expand capacity and digital capabilities

- Increasing growth of e-commerce, omnichannel retail, and seasonal demand cycles has accelerated the adoption of on-demand warehousing solutions. Businesses facing demand volatility are leveraging shared and flexible warehousing models to support peak periods, promotional campaigns, and regional market expansion. This has led to higher utilization of technology-driven platforms that connect warehouse space providers with end users

- Digitalization and data-driven decision-making are influencing purchasing and partnership decisions, with providers emphasizing real-time visibility, inventory tracking, and seamless integration with transportation and warehouse management systems. These factors are helping companies improve supply chain responsiveness while reducing overhead costs. Service providers are also highlighting speed, scalability, and transparency to strengthen customer trust and long-term relationships

- For instance, in 2024, companies such as Flexe in the U.S. and Stowga in the U.K. expanded their on-demand warehousing networks to support e-commerce and retail clients during peak demand periods. These expansions focused on providing short-term storage, rapid onboarding, and technology-enabled visibility across multiple locations. The services were offered across urban and regional markets, improving fulfillment speed and customer satisfaction

- While demand for on-demand warehousing is rising, sustained market growth depends on platform reliability, geographic coverage, and consistent service quality. Providers are focusing on enhancing technology infrastructure, improving partner warehouse standards, and offering value-added services such as fulfillment and returns management to drive broader adoption

On-Demand Warehousing Market Dynamics

Driver

“Growing Need for Supply Chain Flexibility and Cost Optimization”

- Rising demand for flexible and asset-light logistics models is a major driver for the global on-demand warehousing market. Companies are increasingly shifting away from long-term warehouse leases to reduce fixed costs and improve scalability. On-demand warehousing allows businesses to align storage capacity with real-time demand, supporting efficient inventory management and faster market response

- Expanding applications across e-commerce, retail, consumer goods, and manufacturing are contributing to market growth. On-demand warehousing supports rapid market entry, seasonal inventory management, and last-mile distribution while maintaining cost efficiency. The continued growth of online shopping and same-day or next-day delivery expectations further reinforces this trend

- Logistics providers and technology platforms are actively promoting on-demand warehousing through digital marketplaces, analytics-driven solutions, and integrated fulfillment services. These initiatives are supported by increasing demand for speed, transparency, and flexibility in supply chains, and they also encourage partnerships between warehouse owners, logistics companies, and technology firms

- For instance, in 2023, DHL Supply Chain in Germany and GXO Logistics in the U.S. reported increased use of flexible and shared warehousing models to support retail and e-commerce customers. This expansion was driven by demand volatility, inventory optimization needs, and the push for faster fulfillment. Both companies emphasized technology integration and network scalability to enhance customer value and operational resilience

- Although flexibility-driven demand supports market expansion, long-term growth depends on platform scalability, service standardization, and data security. Continued investment in digital infrastructure, automation, and network optimization will be critical for maintaining competitive advantage and meeting global customer expectations

Restraint/Challenge

“Operational Complexity And Limited Awareness Among Traditional Businesses”

- Managing distributed and shared warehouse networks introduces operational complexity, which remains a key challenge in the on-demand warehousing market. Variability in warehouse standards, labor availability, and service quality can affect consistency and customer experience. Coordinating inventory, transportation, and fulfillment across multiple locations also increases operational and management costs

- Awareness and adoption remain uneven, particularly among traditional manufacturers and small enterprises that are accustomed to long-term warehousing contracts. Limited understanding of the benefits and operational models of on-demand warehousing can slow adoption, especially in regions where digital logistics platforms are still emerging

- Technology integration and data synchronization pose additional challenges, as seamless connectivity between warehouse management systems, transportation systems, and client platforms is essential for real-time visibility. Any gaps in system compatibility or cybersecurity preparedness can hinder adoption and raise concerns among potential users

- For instance, in 2024, logistics providers in India and Southeast Asia reported slower adoption of on-demand warehousing among traditional FMCG and industrial players due to concerns over operational control, data integration, and service reliability. Limited digital readiness and preference for owned or leased warehouses further restricted uptake in certain markets

- Addressing these challenges will require standardization of service levels, increased investment in digital platforms, and targeted education initiatives for businesses. Strengthening partnerships with logistics providers, technology vendors, and regional warehouse operators will be essential to unlock the long-term growth potential of the global on-demand warehousing market. In addition, clear communication of cost, flexibility, and scalability benefits will support wider adoption across industries

On-Demand Warehousing Market Scope

The market is segmented on the basis of service type, storage duration, warehouse size, and industry vertical.

• By Service Type

On the basis of service type, the global on-demand warehousing market is segmented into Warehousing and Storage, Distribution and Fulfilment, and Other. The Warehousing and Storage segment held the largest market revenue share in 2025 driven by the increasing need for flexible storage capacity, inventory overflow management, and short-term space optimization. Businesses across e-commerce, retail, and manufacturing prefer on-demand warehousing and storage services due to reduced fixed costs, scalability, and the ability to respond quickly to demand fluctuations without long-term lease commitments.

The Distribution and Fulfilment segment is expected to witness the fastest growth rate from 2026 to 2033 driven by the rapid expansion of e-commerce, omnichannel retail strategies, and rising consumer expectations for faster delivery. On-demand fulfilment services enable companies to position inventory closer to end customers, improve last-mile efficiency, and support same-day or next-day delivery, making them highly attractive for brands focused on speed and customer experience.

• By Storage Duration

On the basis of storage duration, the market is segmented into Short-Term, Medium-Term, and Other. The Short-Term storage segment accounted for the largest market share in 2025 supported by seasonal demand surges, promotional campaigns, and temporary inventory overflow. Companies increasingly rely on short-term on-demand warehousing to manage peak periods without incurring long-term infrastructure costs.

The Medium-Term storage segment is expected to witness the fastest growth rate from 2026 to 2033 driven by expanding market presence, regional distribution strategies, and transitional inventory requirements. Medium-term solutions provide businesses with greater operational flexibility while maintaining cost efficiency, particularly during market expansion or supply chain reconfiguration.

• By Warehouse Size

Based on warehouse size, the global on-demand warehousing market is segmented into Small, Medium, and Large. The Large warehouse segment dominated the market in 2025 due to its ability to handle high inventory volumes, advanced automation capabilities, and suitability for large e-commerce and retail players. Large facilities also support integrated fulfilment and value-added services, enhancing overall supply chain efficiency.

The Medium warehouse segment is expected to register notable growth from 2026 to 2033 driven by increasing adoption among mid-sized enterprises and regional distributors. Medium-sized warehouses offer an optimal balance between capacity, cost, and location flexibility, making them suitable for urban and semi-urban distribution networks.

• By Industry Vertical

On the basis of industry vertical, the market is segmented into E-Commerce and Retail, Consumer Packaged Goods, and Other. The E-Commerce and Retail segment held the largest revenue share in 2025 driven by high order volumes, demand volatility, and the need for rapid fulfilment. On-demand warehousing supports inventory decentralization, faster delivery timelines, and efficient returns management for online and omnichannel retailers.

The Consumer Packaged Goods segment is expected to witness the fastest growth rate from 2026 to 2033 supported by the need for flexible inventory management, seasonal stocking, and efficient distribution. CPG companies are increasingly adopting on-demand warehousing to enhance supply chain resilience, reduce storage costs, and improve responsiveness to changing consumer demand.

On-Demand Warehousing Market Regional Analysis

- North America dominated the global on-demand warehousing market with the largest revenue share in 2025 driven by the strong presence of e-commerce players, advanced logistics infrastructure, and early adoption of flexible supply chain models

- Businesses in the region highly value the scalability, cost efficiency, and real-time visibility offered by on-demand warehousing platforms, particularly for managing demand fluctuations and supporting fast order fulfilment

- This widespread adoption is further supported by high digital maturity, strong third-party logistics ecosystems, and increasing reliance on data-driven inventory management, establishing on-demand warehousing as a preferred solution across retail, manufacturing, and consumer goods sectors

U.S. On-Demand Warehousing Market Insight

The U.S. on-demand warehousing market captured the largest revenue share in 2025 within North America fueled by the rapid growth of e-commerce, omnichannel retail strategies, and the need for agile inventory management. Companies are increasingly prioritizing flexible, short-term storage and fulfilment solutions to reduce fixed costs and improve delivery speed. The strong adoption of digital logistics platforms, coupled with demand for same-day and next-day delivery, continues to propel market growth. In addition, the presence of major technology-driven warehousing providers and robust transportation networks is significantly supporting market expansion.

Europe On-Demand Warehousing Market Insight

The Europe on-demand warehousing market is expected to witness the fastest growth rate from 2026 to 2033 primarily driven by increasing cross-border trade, evolving retail models, and rising demand for supply chain flexibility. Growing urbanization and space constraints are encouraging businesses to adopt shared and short-term warehousing solutions. European companies are also focusing on sustainability and cost optimization, which supports the adoption of asset-light warehousing models across retail, manufacturing, and consumer goods industries.

U.K. On-Demand Warehousing Market Insight

The U.K. on-demand warehousing market is expected to witness the fastest growth rate from 2026 to 2033 driven by the expansion of e-commerce, strong demand for rapid fulfilment, and the need for flexible storage solutions. Businesses are increasingly leveraging on-demand warehousing to manage seasonal demand peaks and support last-mile distribution. The country’s well-developed logistics infrastructure and widespread use of digital supply chain platforms are expected to further stimulate market growth.

Germany On-Demand Warehousing Market Insight

The Germany on-demand warehousing market is expected to witness the fastest growth rate from 2026 to 2033 fueled by the country’s strong manufacturing base, advanced logistics infrastructure, and emphasis on operational efficiency. German businesses are increasingly adopting flexible warehousing models to support just-in-time inventory strategies and regional distribution. The integration of digital warehouse management systems and a strong focus on reliability and process optimization are further driving adoption.

Asia-Pacific On-Demand Warehousing Market Insight

The Asia-Pacific on-demand warehousing market is expected to witness the fastest growth rate from 2026 to 2033 driven by rapid urbanization, expanding e-commerce activity, and rising demand for flexible logistics solutions across emerging economies. Countries such as China, India, and Japan are experiencing increased adoption of on-demand warehousing supported by growing digitalization and investments in logistics infrastructure. The region’s role as a global manufacturing and distribution hub is further enhancing market growth.

Japan On-Demand Warehousing Market Insight

The Japan on-demand warehousing market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s advanced logistics ecosystem, high adoption of automation, and demand for efficient space utilization. Japanese companies place strong emphasis on precision, reliability, and technology integration, which supports the adoption of flexible warehousing solutions. The growth of e-commerce and urban delivery requirements is also driving demand for short-term and distributed storage options.

China On-Demand Warehousing Market Insight

The China on-demand warehousing market accounted for the largest market revenue share in Asia Pacific in 2025 attributed to rapid urbanization, large-scale e-commerce activity, and strong domestic logistics capabilities. China is one of the largest markets for digital supply chain solutions, with on-demand warehousing gaining traction across retail, manufacturing, and cross-border trade. Government initiatives supporting smart logistics, along with the availability of cost-effective warehousing solutions and strong local providers, are key factors propelling market growth in China.

On-Demand Warehousing Market Share

The On-Demand Warehousing industry is primarily led by well-established companies, including:

- Extensiv (U.S.)

- Flexe, Inc. (U.S.)

- Flowspace (U.S.)

- Red Stag Fulfillment (U.S.)

- ShipBob, Inc. (U.S.)

- Stord, Inc. (U.S.)

- Ware2Go Inc. (U.S.)

- Waredock Estonia LLC (Estonia)

- Wareflex (U.K.)

- ZhenHub Technologies Ltd. (Hong Kong)

Latest Developments in Global On-Demand Warehousing Market

- In May 2025, Stord acquired Ware2Go from UPS, a strategic acquisition that added 21 fulfilment centers and around 2.5 million square feet to its network, strengthening Stord’s national coverage and enhancing its ability to offer scalable, on-demand fulfilment solutions to enterprise and e-commerce customers, thereby intensifying competition in the market

- In May 2025, Kenco expanded its warehousing footprint by acquiring the 3PL arm of Drexel Industries, securing four warehouses in Ontario and increasing its total managed space to about 43 million square feet, which enhanced its cross-border capabilities and reinforced its position as a major flexible logistics provider in North America

- In April 2025, ShipBob entered into a partnership with Temu to streamline U.S. marketplace logistics for merchants, improving fulfilment speed, inventory positioning, and seller experience, while supporting Temu’s rapid expansion and boosting demand for technology-enabled on-demand warehousing services

- In April 2025, DHL Group announced an investment of USD 2.16 billion in life-sciences logistics to establish GDP-certified pharmaceutical hubs and expand cold-chain capacity, a move that strengthened specialized on-demand warehousing capabilities and increased the adoption of flexible, compliance-driven storage solutions

- In August 2024, Warehowz partnered with Nexterus to simplify warehouse sourcing by leveraging a database of over 2,500 properties, enabling faster space identification for clients and improving market transparency, while supporting quicker adoption of on-demand warehousing platforms

- In June 2024 and February 2023, Kinaxia Logistics launched flexible on-demand warehousing solutions for seasonal storage needs, while Ware2Go expanded its fulfilment network through a partnership with Whitebox to support Amazon sellers, collectively enhancing flexibility, fulfilment options, and platform-driven growth across the global on-demand warehousing market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.