Global On Premise Vdi Market

Market Size in USD Billion

CAGR :

%

USD

20.02 Billion

USD

58.73 Billion

2024

2032

USD

20.02 Billion

USD

58.73 Billion

2024

2032

| 2025 –2032 | |

| USD 20.02 Billion | |

| USD 58.73 Billion | |

|

|

|

|

On Premise VDI Market Size

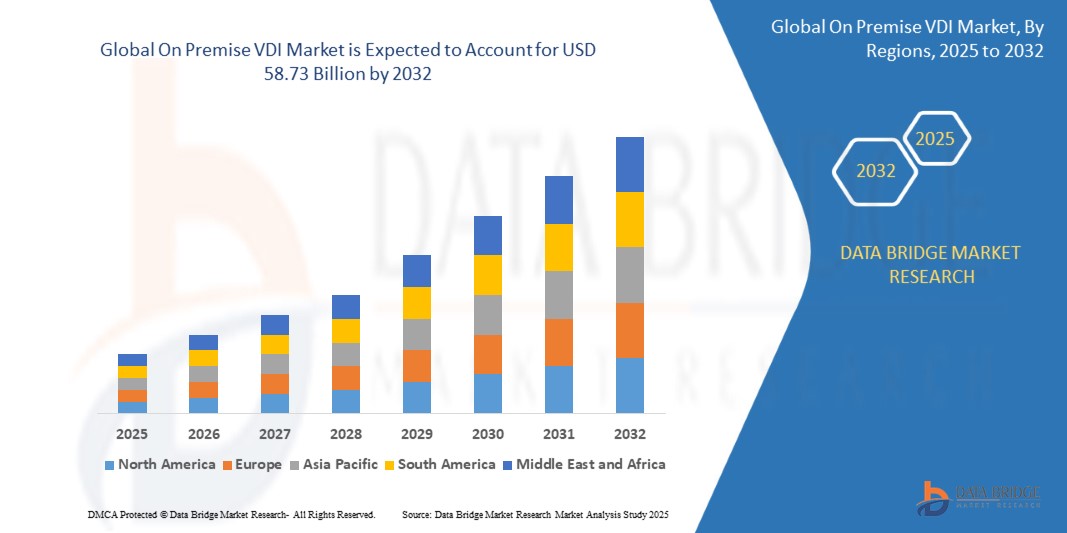

- The global on premise VDI market size was valued at USD 20.02 billion in 2024 and is expected to reach USD 58.73 billion by 2032, at a CAGR of 14.4% during the forecast period

- The market growth is largely fueled by the increasing adoption of virtualization technologies and the growing need for secure, centralized desktop management in enterprise environments. Organizations are seeking solutions that improve operational efficiency, enhance data security, and support hybrid work models, driving the demand for on-premise VDI deployments

- Furthermore, rising enterprise focus on compliance, regulatory adherence, and protection of sensitive business data is establishing on-premise VDI as the preferred choice for organizations across BFSI, healthcare, IT, and government sectors. These converging factors are accelerating the implementation of virtual desktop solutions, thereby significantly boosting the market's growth

On Premise VDI Market Analysis

- On-premise VDI solutions enable organizations to host virtual desktops within their own data centers, allowing centralized control, enhanced security, and customized configurations for end users. These systems provide secure access to applications, data, and desktops, improving productivity while reducing IT management complexity

- The escalating demand for on-premise VDI is primarily driven by growing enterprise investments in digital transformation, heightened cybersecurity concerns, and the need to support remote and hybrid workforce models. Organizations increasingly prefer on-premise deployments for greater control over sensitive data and regulatory compliance, further fueling market adoption

- North America dominated the on premise VDI market with a share of 41% in 2024, due to strong enterprise demand for secure, scalable, and centralized desktop infrastructure

- Asia-Pacific is expected to be the fastest growing region in the on premise VDI market during the forecast period due to rapid digital transformation, rising enterprise IT spending, and the growing demand for secure remote work solutions

- Persistent VDI segment dominated the market with a market share of 61.9% in 2024, due to its ability to provide users with a personalized desktop experience that closely mirrors traditional PCs. Organizations with strict compliance requirements, such as financial services and healthcare, prefer persistent VDI because it allows data to remain stored securely within the enterprise infrastructure. Its strong appeal also lies in ensuring continuity, user familiarity, and seamless access to applications without repeated configurations. The segment’s established adoption across heavily regulated industries has reinforced its position as the leading deployment type

Report Scope and On Premise VDI Market Segmentation

|

Attributes |

On Premise VDI Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

On Premise VDI Market Trends

Increasing Adoption of Remote Work Culture

- The on-premise VDI market is growing as enterprises continue adopting remote and hybrid work models. Organizations prefer on-premise setups for tighter control, data sovereignty, and compliance while ensuring employees remain securely connected

- For instance, VMware has reinforced its on-premise VDI offering through VMware Horizon, enabling enterprises to retain sensitive data in-house. This hybrid strategy balances scalability with stronger governance for industries bound by strict regulations

- The enhanced need for secure IT access has driven enterprises to deploy localized VDI systems. On-premise VDI reduces risks associated with cloud data breaches, making it highly attractive to financial and healthcare institutions

- In addition, large corporations with global offices are relying on VDI to provide consistent user experiences. On-premise solutions deliver centralized IT management that reduces complexity while supporting seamless cross-location collaboration and enterprise productivity

- The push for infrastructure modernization is reshaping IT strategies. By integrating automation and advanced management tools, enterprises are enhancing their VDI frameworks to deliver reliable, low-latency performance aligned to modern workforce expectations

- Digital transformation budgets are increasingly directed toward virtualization initiatives. Stronger IT leadership focus on flexible but controlled infrastructure is sustaining demand for on-premise VDI platforms despite the rising popularity of cloud-based Desktop-as-a-Service models

On Premise VDI Market Dynamics

Driver

Growing Emphasis on Data Security and Compliance

- The rising importance of cybersecurity and regulatory compliance is propelling on-premise VDI adoption. Organizations handling sensitive data favor in-house infrastructure, ensuring security protocols remain fully controllable within private enterprise IT environments

- For instance, Citrix continues to strengthen its on-premise VDI portfolio, helping banks and hospitals deploy secure desktop virtualization solutions. This approach ensures compliance with strict sectoral regulations while delivering reliable and secure end-user access

- Industries such as government and defense place particular emphasis on data sovereignty. On-premise VDI ensures all information remains contained within organizational boundaries, reducing breach risks commonly associated with third-party public cloud environments

- In addition, stricter data protection laws such as GDPR and HIPAA are reinforcing corporate adoption of on-premise deployments. Enterprises are prioritizing investment into virtual desktop solutions that ensure compliance with diverse regional regulations

- Enhanced security monitoring in local data centers is improving risk management capabilities. IT administrators are leveraging advanced surveillance and system auditing tools to detect threats faster and maintain stronger defense layers in on-premise infrastructure

Restraint/Challenge

Initial Investment and Deployment Costs

- High capital requirements for servers, storage, and networking equipment remain a major challenge. On-premise VDI deployments require substantial upfront budgets that constrain adoption, particularly among small and medium enterprises with limited IT funding

- For instance, SMEs testing VMware Horizon or Citrix Virtual Apps reported concerns about upfront infrastructure spending. Infrastructure hardware, licensing, and integration costs often exceeded ROI projections, delaying broader adoption compared to cloud-hosted alternatives

- Complexity of deployment also adds to initial barriers. Specialized IT professionals are needed for installation, scaling, and configuration, raising labor expenses and extending timelines before enterprises realize productivity gains from on-premise VDI

- In addition, maintaining system resilience requires further costs for redundancy, backups, and failover solutions. These unavoidable operational expenses make total cost of ownership significantly higher compared to cloud-based desktop virtualization environments

- The rapid pace of technology upgrades further impacts cost concerns. Organizations risk locking capital into depreciating IT infrastructure, creating long-term challenges compared to scalable cloud services that deliver greater flexibility and lower initial burdens

On Premise VDI Market Scope

The market is segmented on the basis of deployment type, enterprise size, and application.

- By Deployment Type

On the basis of deployment type, the On-Premise VDI market is segmented into persistent VDI and non-persistent VDI. The persistent VDI segment dominated the largest market revenue share of 61.9% in 2024, driven by its ability to provide users with a personalized desktop experience that closely mirrors traditional PCs. Organizations with strict compliance requirements, such as financial services and healthcare, prefer persistent VDI because it allows data to remain stored securely within the enterprise infrastructure. Its strong appeal also lies in ensuring continuity, user familiarity, and seamless access to applications without repeated configurations. The segment’s established adoption across heavily regulated industries has reinforced its position as the leading deployment type.

The non-persistent VDI segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its cost-efficiency and simplified management. Non-persistent desktops are widely deployed in educational institutions, call centers, and temporary workforce environments where user data persistence is not required. This approach allows IT teams to quickly provision, update, and scale desktops, minimizing overhead and reducing storage costs. Growing adoption of flexible work models and seasonal employment in industries such as retail and services is driving enterprises toward non-persistent solutions, positioning the segment as the fastest-growing.

- By Enterprise Size

On the basis of enterprise size, the On-Premise VDI market is segmented into large enterprises and small and medium enterprises (SMEs). The large enterprises segment accounted for the largest market revenue share in 2024, supported by significant investments in secure and scalable IT infrastructure. Large organizations in sectors such as BFSI, telecom, and manufacturing often operate globally, requiring high performance, compliance-driven, and resilient desktop solutions. On-premise VDI meets these needs by offering centralized control, strong data security, and seamless resource allocation across large employee bases. The ability to integrate advanced cybersecurity protocols and maintain strict control over sensitive data has made large enterprises the dominant adopters.

The SME segment is anticipated to register the fastest CAGR from 2025 to 2032, primarily due to growing awareness of cost-efficient virtualization benefits. SMEs increasingly adopt on-premise VDI to minimize hardware expenses, reduce IT management complexities, and maintain control over sensitive business information. The scalability of on-premise deployments allows SMEs to start with small-scale solutions and expand as business needs grow. Rising cybersecurity concerns and the push for digital transformation among smaller organizations are also encouraging adoption, making SMEs the fastest-growing enterprise size segment.

- By Application

On the basis of application, the On-Premise VDI market is segmented into IT & telecommunication, BFSI, healthcare, manufacturing, retail, and others. The IT & telecommunication segment dominated the market share in 2024, as enterprises in this sector require high computing power, secure application delivery, and reliable connectivity. On-premise VDI ensures enhanced security for sensitive project data and intellectual property, while enabling global teams to work with consistent resources. Its compatibility with complex development tools and ability to support hybrid work models have made it the most prominent application area. The sector’s continuous digital expansion and demand for secure, flexible IT environments have cemented its leadership in the market.

The healthcare segment is projected to witness the fastest growth rate from 2025 to 2032, driven by the industry’s stringent data protection requirements and growing adoption of electronic health records (EHR). On-premise VDI enables healthcare providers to maintain full control over patient data while offering secure remote access to doctors, nurses, and administrative staff. It supports compliance with healthcare regulations such as HIPAA while ensuring uninterrupted service delivery across hospitals and clinics. Rising telemedicine adoption and the need for mobility in healthcare workflows further accelerate demand, positioning healthcare as the fastest-growing application segment.

On Premise VDI Market Regional Analysis

- North America dominated the on premise VDI market with the largest revenue share of 41% in 2024, driven by strong enterprise demand for secure, scalable, and centralized desktop infrastructure

- Organizations across industries are investing in VDI to strengthen data security, improve workforce mobility, and ensure compliance with stringent regulations. The presence of advanced IT infrastructure, early adoption of virtualization technologies, and the increasing shift towards hybrid work environments have reinforced the region’s leadership

- High investments from enterprises in BFSI, healthcare, and IT services further support widespread adoption, making North America the most prominent regional market

U.S. On-Premise VDI Market Insight

The U.S. captured the largest revenue share in 2024 within North America, fueled by the rapid adoption of digital workplace solutions and heightened cybersecurity concerns. Enterprises are increasingly implementing on-premise VDI to maintain strict control over sensitive data while enabling remote and hybrid workforce models. Growing demand from healthcare providers, financial institutions, and government agencies is driving adoption. The U.S. market also benefits from the presence of major technology providers and early integration of AI-driven IT management tools into VDI infrastructure, further enhancing operational efficiency.

Europe On-Premise VDI Market Insight

The Europe On-Premise VDI market is projected to expand at a substantial CAGR throughout the forecast period, supported by the region’s emphasis on data sovereignty and compliance with strict regulations such as GDPR. European enterprises are deploying on-premise VDI to achieve high levels of security and operational control while addressing the growing demand for flexible and remote work solutions. Rising digitalization across manufacturing, retail, and public sectors is also fueling adoption. The region is witnessing significant investments in IT modernization projects, driving steady VDI expansion across both large enterprises and SMEs.

U.K. On-Premise VDI Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising adoption of hybrid work environments and the need for secure data management solutions. Enterprises in BFSI, healthcare, and retail are prioritizing on-premise VDI to safeguard sensitive information while supporting employee productivity. The U.K.’s advanced IT infrastructure and increasing digital transformation initiatives among enterprises are further strengthening the market outlook.

Germany On-Premise VDI Market Insight

The Germany market is expected to expand at a considerable CAGR, fueled by the country’s strong focus on IT innovation, compliance, and data security. German enterprises in sectors such as automotive, manufacturing, and healthcare are adopting on-premise VDI to ensure secure data handling and centralized management of virtual desktops. The country’s preference for privacy-focused IT infrastructure and investment in advanced enterprise solutions are key drivers contributing to market growth.

Asia-Pacific On-Premise VDI Market Insight

The Asia-Pacific On-Premise VDI market is poised to grow at the fastest CAGR from 2025 to 2032, driven by rapid digital transformation, rising enterprise IT spending, and the growing demand for secure remote work solutions. Increasing adoption across BFSI, manufacturing, and healthcare, coupled with government-led initiatives promoting digital infrastructure, is accelerating market growth. As the region emerges as a hub for technology adoption and enterprise IT services, demand for on-premise VDI is expanding rapidly.

Japan On-Premise VDI Market Insight

The Japan market is gaining momentum due to its strong IT culture, increasing urbanization, and emphasis on secure digital infrastructure. Japanese enterprises are deploying on-premise VDI to support remote work, enhance data protection, and integrate seamlessly with existing IT ecosystems. The aging workforce is also driving demand for reliable and easy-to-manage desktop virtualization solutions in both corporate and healthcare environments.

China On-Premise VDI Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, supported by the country’s large enterprise base, rapid urbanization, and government-led digitalization initiatives. On-premise VDI adoption is rising across financial services, manufacturing, and public sectors, driven by the need for enhanced cybersecurity and data control. Strong domestic technology providers and increasing enterprise-scale investments in digital workplace solutions are accelerating growth, positioning China as the leading market in the region.

On Premise VDI Market Share

The on premise VDI industry is primarily led by well-established companies, including:

- VMware, Inc. (U.S.)

- Citrix Systems, Inc. (U.S.)

- Microsoft Corporation (U.S.)

- Cisco Systems, Inc. (U.S.)

- Nutanix, Inc. (U.S.)

- IBM Corporation (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Dell Technologies, Inc. (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Fujitsu Limited (Japan)

- NEC Corporation (Japan)

- NetApp, Inc. (U.S.)

- HCL Technologies Limited (India)

- NComputing Co., Ltd. (South Korea)

- IGEL Technology GmbH (Germany)

Latest Developments in Global On Premise VDI Market

- In June 2025, Microsoft strengthened its presence in the on-premise VDI market by enhancing its guidance for enterprises deploying virtual desktops through Azure Stack HCI. This development emphasized hybrid-enabled infrastructure designed for organizations requiring strong data control, lower latency, and strict compliance adherence. By providing enterprises with a pathway to combine local infrastructure control with cloud-driven monitoring and scalability, Microsoft reinforced its role as a strategic enabler of secure and flexible VDI environments. This move is expected to appeal strongly to sectors such as healthcare, BFSI, and government, where regulatory compliance and high-performance workloads are critical

- In January 2025, Omnissa released version 2412 of its Horizon platform, marking a major milestone in the evolution of on-premise VDI solutions. As the rebranded continuation of VMware Horizon, the update under Omnissa’s leadership reassured enterprises of long-term innovation and support. The release delivered refinements in security, management, and integration, enabling enterprises to maintain advanced VDI environments with confidence. This development underscored Omnissa’s commitment to sustaining momentum in enterprise-grade virtualization, ensuring organizations relying on Horizon could continue to modernize while maintaining on-premise control

- In January 2025, Zoom advanced its role in the virtual desktop ecosystem by releasing the VDI Plugin version 6.2.11, which ensured compatibility with both legacy VMware Horizon and the new Omnissa Horizon client. This update allowed enterprises to smoothly transition during the brand shift while maintaining uninterrupted video conferencing capabilities within virtual desktops. By prioritizing cross-client support across Windows, macOS, and Ubuntu environments, Zoom enhanced its integration with VDI ecosystems, strengthening its value proposition in enabling productivity and communication in enterprise virtualization setups

- In October 2024, CrowdStrike and Omnissa formed a partnership to integrate advanced threat detection and response into virtual desktop and physical desktop environments. This collaboration aimed to provide enterprises with real-time security insights and proactive defenses against cyber threats, directly embedded within VDI frameworks. By combining CrowdStrike’s cybersecurity capabilities with Omnissa’s VDI infrastructure, the partnership elevated the resilience of desktop environments against sophisticated attacks. The initiative significantly bolstered the appeal of on-premise VDI deployments for security-conscious organizations, ensuring that enterprises could achieve both virtualization efficiency and advanced protection

- In January 2024, VMware announced the launch of Horizon 9, its latest on-premise VDI platform, featuring enhanced security tools and performance optimizations. This update reinforced VMware’s leadership in enterprise desktop virtualization, offering customers a solution capable of handling increasingly complex workloads. The improvements in Horizon 9 addressed growing enterprise concerns around data security, remote accessibility, and operational efficiency. By refining both backend architecture and user experience, VMware set new standards for reliability and performance in the on-premise VDI market

- In November 2023, Citrix Systems introduced Workspace 365, a new VDI solution designed for on-premise deployment, with a strong focus on simplifying desktop management and boosting workforce productivity. This launch expanded Citrix’s competitive positioning by offering enterprises a comprehensive workspace that integrated applications, data, and collaboration tools. By reducing complexity in administration and streamlining workflows, Workspace 365 addressed the increasing demand for efficient desktop management. The product positioned Citrix as a key player for organizations seeking user-friendly yet robust on-premise virtualization solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.