Global Oncology Biosimilar Monoclonal Antibodies Market

Market Size in USD Billion

CAGR :

%

USD

1.38 Billion

USD

2.79 Billion

2025

2033

USD

1.38 Billion

USD

2.79 Billion

2025

2033

| 2026 –2033 | |

| USD 1.38 Billion | |

| USD 2.79 Billion | |

|

|

|

|

Oncology Biosimilar Monoclonal Antibodies Market Size

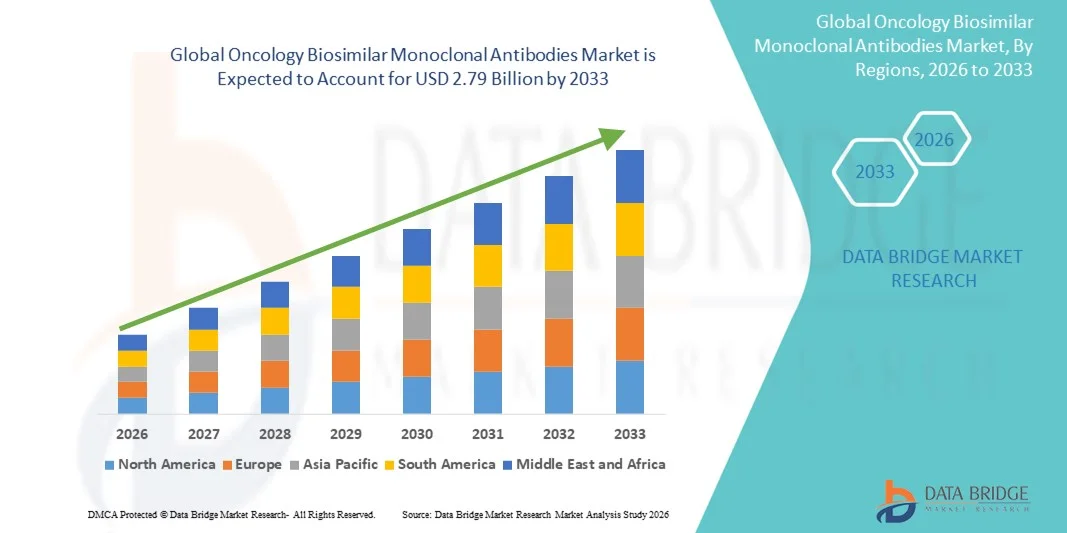

- The global oncology biosimilar monoclonal antibodies market size was valued at USD 1.38 billion in 2025 and is expected to reach USD 2.79 billion by 2033, at a CAGR of 9.10% during the forecast period

- The market growth is largely driven by rising cancer prevalence worldwide, increasing demand for cost-effective biologic therapies, and patent expirations of reference monoclonal antibodies, enabling wider adoption of biosimilar alternatives across oncology care

- Furthermore, supportive regulatory frameworks, improving physician acceptance, and growing emphasis on expanding patient access to advanced cancer treatments are positioning oncology biosimilar monoclonal antibodies as a key component of modern oncology therapeutics, thereby significantly accelerating overall market growth

Oncology Biosimilar Monoclonal Antibodies Market Analysis

- Oncology biosimilar monoclonal antibodies, developed as cost-effective alternatives to reference biologics for cancer treatment, are increasingly becoming integral to modern oncology care due to their comparable efficacy, safety, and ability to expand patient access to advanced targeted therapies across hospital and specialty care settings

- The growing demand for oncology biosimilar monoclonal antibodies is primarily driven by the rising global cancer burden, high cost of originator biologics, increasing patent expirations of branded monoclonal antibodies, and greater acceptance of biosimilars among oncologists, healthcare providers, and payers

- North America dominated the oncology biosimilar monoclonal antibodies market with the largest revenue share of 41.2% in 2025, supported by high oncology treatment spending, strong presence of leading biosimilar manufacturers, rapid regulatory approvals, and increasing uptake of biosimilars across the U.S. healthcare system

- Asia-Pacific is expected to be the fastest growing region in the oncology biosimilar monoclonal antibodies market during the forecast period, registering a double-digit CAGR, driven by expanding cancer patient populations, improving access to biologic therapies, and growing local biosimilar production capabilities

- Breast cancer segment dominated the market with a share of 32.9% in 2025, attributed to the high global incidence of breast cancer and widespread clinical adoption of biosimilar targeted therapies in both early-stage and advanced disease settings

Report Scope and Oncology Biosimilar Monoclonal Antibodies Market Segmentation

|

Attributes |

Oncology Biosimilar Monoclonal Antibodies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Oncology Biosimilar Monoclonal Antibodies Market Trends

Rising Adoption of Cost-Effective Targeted Cancer Therapies

- A significant and accelerating trend in the global oncology biosimilar monoclonal antibodies market is the increasing clinical adoption of biosimilars as cost-effective alternatives to high-priced originator biologics, without compromising efficacy or safety outcomes

- For instance, the growing uptake of biosimilar versions of trastuzumab and bevacizumab across hospital oncology departments has enabled healthcare systems to treat a larger patient population while managing escalating cancer care costs

- Advancements in biologics manufacturing technologies and analytical characterization methods are enhancing the quality, consistency, and comparability of oncology biosimilar monoclonal antibodies, thereby strengthening physician confidence in their use

- The integration of oncology biosimilars into national treatment guidelines and hospital formularies is further driving standardization and routine use, particularly in publicly funded healthcare systems seeking sustainable oncology care models

- This trend toward wider biosimilar penetration is reshaping treatment pathways by improving affordability and access to targeted therapies, especially for chronic and late-stage cancers requiring long-term biologic treatment

- Consequently, pharmaceutical companies are increasingly focusing on expanding oncology biosimilar portfolios and launching next-generation biosimilars to capture growing demand across both developed and emerging markets

- Increasing real-world evidence and post-marketing surveillance data are reinforcing the clinical reliability of oncology biosimilar monoclonal antibodies and supporting broader physician and patient acceptance

- Strategic partnerships between biosimilar developers and regional distributors are accelerating market penetration and improving product availability across emerging oncology markets

Oncology Biosimilar Monoclonal Antibodies Market Dynamics

Driver

Growing Cancer Burden and Cost-Containment Pressure in Oncology Care

- The rising global incidence of cancer, coupled with increasing healthcare expenditure pressures, is a major driver fueling demand for oncology biosimilar monoclonal antibodies

- For instance, the expanding use of biosimilars in large oncology centers across North America has helped reduce treatment costs for payers while maintaining access to advanced biologic therapies

- As biologic cancer treatments remain among the most expensive therapeutic options, biosimilar monoclonal antibodies provide a financially sustainable alternative for hospitals and healthcare systems

- Furthermore, supportive regulatory frameworks and faster approval pathways for oncology biosimilars are encouraging manufacturers to accelerate product launches and market entry

- The growing acceptance of biosimilars among oncologists, driven by real-world clinical evidence and post-marketing surveillance data, is further propelling market growth

- Expanding reimbursement coverage and inclusion of biosimilars in insurance formularies are strengthening adoption across public and private healthcare systems

- The need to optimize oncology treatment budgets while addressing increasing patient volumes is reinforcing long-term demand for biosimilar monoclonal antibody therapies

Restraint/Challenge

Complex Regulatory Requirements and Physician Adoption Barriers

- Stringent regulatory requirements for demonstrating biosimilarity, interchangeability, and long-term safety present a significant challenge for manufacturers in the oncology biosimilar monoclonal antibodies market

- For instance, extensive clinical comparability studies and post-approval pharmacovigilance obligations increase development timelines and costs, limiting rapid market entry for smaller players

- Concerns among some oncologists regarding immunogenicity, switching protocols, and long-term outcomes can slow biosimilar adoption, particularly in complex cancer indications

- In addition, inconsistent reimbursement policies and pricing pressures across regions may restrict market penetration and profitability for biosimilar manufacturers

- Overcoming these challenges through physician education, transparent clinical data dissemination, and harmonized regulatory and reimbursement frameworks will be critical for sustained market expansion

- Limited differentiation between biosimilar products can intensify price competition and compress margins for manufacturers

- Supply chain complexity and the need for specialized cold-chain logistics can pose operational challenges, particularly in low- and middle-income regions

Oncology Biosimilar Monoclonal Antibodies Market Scope

The market is segmented on the basis of drug type, disease indication, distribution channel, and end user.

- By Drug Type

On the basis of drug type, the global oncology biosimilar monoclonal antibodies market is segmented into granulocyte colony-stimulating factor, hematopoietic agents, and other biosimilar oncology therapeutics. The granulocyte colony-stimulating factor (G-CSF) segment dominated the market in 2025, driven by its widespread use in managing chemotherapy-induced neutropenia across multiple cancer types. G-CSF biosimilars are extensively prescribed to reduce infection risk and support uninterrupted chemotherapy regimens, making them a standard supportive oncology therapy. Their relatively earlier patent expirations, strong clinical familiarity, and broad regulatory approvals have further contributed to high adoption across hospitals and cancer centers. In addition, favorable reimbursement policies and high patient volumes have reinforced the dominance of this segment in both developed and emerging markets.

The other biosimilar oncology therapeutics segment is expected to witness the fastest growth during the forecast period, fueled by increasing launches of biosimilar monoclonal antibodies targeting solid tumors and hematological malignancies. This segment includes biosimilars of high-value biologics such as trastuzumab, bevacizumab, and rituximab, which are gaining rapid traction due to significant cost savings. Rising physician confidence, expanding indications, and increasing inclusion in treatment guidelines are accelerating uptake. Furthermore, ongoing pipeline development and upcoming patent expirations of blockbuster oncology biologics are expected to sustain strong growth momentum.

- By Disease Indication

On the basis of disease indication, the market is segmented into breast cancer, non-small cell lung cancer, blood cancers, colorectal cancer, neutropenia, and other cancer indications. The breast cancer segment dominated the market in 2025 with a market share of 32.9%, primarily due to the high global prevalence of breast cancer and extensive use of biosimilar monoclonal antibodies in its treatment. Biosimilar versions of HER2-targeted therapies have been widely adopted, enabling broader patient access to effective targeted treatments. Strong clinical evidence, guideline support, and large patient pools have driven sustained demand. In addition, long treatment durations and use across early-stage and metastatic settings have contributed to higher revenue generation from this segment.

The non-small cell lung cancer (NSCLC) segment is anticipated to be the fastest growing during the forecast period, driven by rising incidence rates and increasing use of targeted and biologic therapies in lung cancer management. Biosimilar monoclonal antibodies used in combination with chemotherapy and immunotherapy are gaining acceptance as cost-effective alternatives. Improvements in diagnostic rates, expanding treatment eligibility, and growing healthcare investments in oncology care are further supporting rapid growth. Emerging markets are also contributing significantly as access to advanced lung cancer treatments improves.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, e-commerce, and others. The hospital pharmacies segment dominated the market in 2025, as oncology biosimilar monoclonal antibodies are primarily administered in hospital and clinical settings under professional supervision. Hospitals play a central role in cancer diagnosis, biologic drug administration, and treatment monitoring, making them the primary procurement point. Strong formulary inclusion, bulk purchasing, and centralized decision-making favor hospital-based distribution. In addition, complex storage requirements and cold-chain logistics further support hospital pharmacy dominance.

The e-commerce segment is expected to register the fastest growth over the forecast period, driven by increasing digitalization of healthcare supply chains and growing acceptance of online pharmaceutical procurement. Specialty pharmacies and licensed digital platforms are expanding access to oncology biosimilars, particularly for outpatient and maintenance therapies. Convenience, improved supply transparency, and cost efficiencies are encouraging adoption. Regulatory support for digital health platforms and improved logistics infrastructure are further accelerating growth in this channel.

- By End User

On the basis of end user, the market is segmented into hospitals, specialty clinics, homecare services, and others. The hospitals segment dominated the market in 2025 due to the high volume of cancer patients receiving biologic therapies in inpatient and outpatient hospital settings. Hospitals are the primary centers for chemotherapy, biologic infusions, and complex oncology care, driving strong demand for biosimilar monoclonal antibodies. Access to trained oncology specialists, infusion facilities, and comprehensive cancer care services reinforces hospital dominance. In addition, hospital-driven cost-containment initiatives favor biosimilar adoption over originator biologics.

The specialty clinics segment is projected to grow at the fastest rate during the forecast period, supported by the rising number of dedicated oncology clinics and outpatient cancer centers. These facilities increasingly administer biosimilar monoclonal antibodies as part of cost-efficient treatment protocols. Shorter treatment cycles, patient convenience, and reduced hospital burden are contributing to growth. Expanding private oncology networks and increasing insurance coverage for outpatient biologic therapies are further accelerating adoption in this segment.

Oncology Biosimilar Monoclonal Antibodies Market Regional Analysis

- North America dominated the oncology biosimilar monoclonal antibodies market with the largest revenue share of 41.2% in 2025, supported by high oncology treatment spending, strong presence of leading biosimilar manufacturers, rapid regulatory approvals, and increasing uptake of biosimilars across the U.S. healthcare system

- Healthcare providers and payers in the region place strong emphasis on reducing oncology treatment costs while maintaining clinical efficacy, leading to increasing acceptance of biosimilar monoclonal antibodies across hospitals and cancer treatment centers

- This widespread adoption is further supported by favorable regulatory approvals, well-established reimbursement frameworks, and the presence of leading biosimilar manufacturers, positioning North America as a key hub for biosimilar oncology innovation and commercialization

U.S. Oncology Biosimilar Monoclonal Antibodies Market Insight

The U.S. oncology biosimilar monoclonal antibodies market captured the largest revenue share within North America in 2025, driven by high cancer incidence, strong healthcare expenditure, and increasing pressure to reduce biologic drug costs. Healthcare providers and payers are actively adopting biosimilar monoclonal antibodies to improve patient access to advanced cancer therapies while managing treatment budgets. The growing acceptance of biosimilars among oncologists, supported by robust clinical evidence and FDA approvals, is further propelling market growth. Moreover, favorable reimbursement policies and the presence of major biosimilar manufacturers are significantly contributing to the expansion of the U.S. market.

Europe Oncology Biosimilar Monoclonal Antibodies Market Insight

The Europe oncology biosimilar monoclonal antibodies market is projected to expand at a substantial CAGR during the forecast period, primarily driven by strong regulatory support and early adoption of biosimilars across national healthcare systems. Cost-containment initiatives and centralized procurement policies are encouraging widespread biosimilar use in oncology. European countries emphasize improving access to cancer care while controlling healthcare spending, making biosimilars a preferred option. The region is witnessing strong uptake across hospitals and specialty cancer centers, supported by favorable reimbursement frameworks and established clinical guidelines.

U.K. Oncology Biosimilar Monoclonal Antibodies Market Insight

The U.K. oncology biosimilar monoclonal antibodies market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the National Health Service’s focus on cost-effective cancer treatments. The adoption of biosimilars is strongly supported through policy-driven switching programs and clinician engagement initiatives. Increasing cancer prevalence and the need to optimize oncology budgets are further accelerating demand. The U.K.’s structured healthcare system and strong emphasis on value-based care continue to stimulate biosimilar uptake.

Germany Oncology Biosimilar Monoclonal Antibodies Market Insight

The Germany oncology biosimilar monoclonal antibodies market is expected to expand at a considerable CAGR, fueled by high awareness of biosimilars and a strong emphasis on cost efficiency in oncology care. Germany’s robust healthcare infrastructure and early adoption of biosimilar substitution policies support market growth. Hospitals and sickness funds actively promote biosimilar use to reduce biologic therapy expenditures. In addition, strong domestic pharmaceutical manufacturing capabilities enhance product availability and adoption across the country.

Asia-Pacific Oncology Biosimilar Monoclonal Antibodies Market Insight

The Asia-Pacific oncology biosimilar monoclonal antibodies market is poised to grow at the fastest CAGR during the forecast period, driven by rising cancer burden, improving healthcare infrastructure, and expanding access to biologic therapies. Countries such as China, Japan, and India are witnessing rapid adoption of biosimilars as governments prioritize affordable cancer treatment options. Increasing investments in local biologics manufacturing and supportive regulatory reforms are further accelerating market growth. The region’s large patient pool and growing healthcare spending are key contributors to its rapid expansion.

Japan Oncology Biosimilar Monoclonal Antibodies Market Insight

The Japan oncology biosimilar monoclonal antibodies market is gaining momentum due to the country’s aging population and rising incidence of cancer. Japan places strong emphasis on treatment quality and safety, and growing clinical confidence in biosimilars is supporting adoption. Government initiatives promoting cost-effective healthcare solutions are encouraging biosimilar use in oncology. In addition, the integration of biosimilars into hospital formularies and treatment protocols is steadily driving market growth.

India Oncology Biosimilar Monoclonal Antibodies Market Insight

The India oncology biosimilar monoclonal antibodies market accounted for a significant revenue share in Asia-Pacific in 2025, attributed to the country’s large cancer patient population and strong domestic biosimilar manufacturing base. India is a key producer of biosimilar monoclonal antibodies, enabling wider affordability and access to advanced cancer treatments. Government support for local biologics production and increasing adoption across public and private hospitals are driving market expansion. The growing focus on improving cancer care access and reducing treatment costs continues to propel demand in India.

Oncology Biosimilar Monoclonal Antibodies Market Share

The Oncology Biosimilar Monoclonal Antibodies industry is primarily led by well-established companies, including:

- Amgen Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Dr. Reddy’s Laboratories Ltd. (India)

- Intas Pharmaceuticals Ltd. (India)

- STADA Arzneimittel AG (Germany)

- Teva Pharmaceuticals (Israel)

- Coherus BioSciences, Inc. (U.S.)

- Biocon Biologics Limited (India)

- Samsung Biologics Co., Ltd. (South Korea)

- Celltrion, Inc. (South Korea)

- Sandoz Group AG (Switzerland)

- Viatris Inc. (U.S.)

- Apotex Inc. (Canada)

- Fresenius Kabi AG (Germany)

- Bio-Thera Solutions, Ltd. (China)

- BIOCAD Biotechnology Company (Russia)

- Henlius Biopharmaceuticals, Inc. (China)

- Organon & Co. (U.S.)

- Accord Healthcare (U.K.)

- Alkem Laboratories Ltd. (India)

What are the Recent Developments in Global Oncology Biosimilar Monoclonal Antibodies Market?

- In September 2025, real-world evidence data demonstrated that the trastuzumab biosimilar HLX02 showed comparable efficacy and safety to the reference product in patients with metastatic HER2-positive breast cancer. The findings, derived from real-world clinical practice, reinforced physician confidence in switching from originator biologics to biosimilars. Such evidence plays a critical role in accelerating biosimilar adoption by addressing concerns related to long-term effectiveness and safety outside controlled clinical trials

- In September 2025, the first interchangeable biosimilar to pertuzumab (Perjeta), pertuzumab-dpzb (Poherdy), received approval for medical use in the United States. Interchangeability designation allows pharmacy-level substitution without prescriber intervention, potentially driving faster adoption and cost savings. This milestone marks a significant advancement in the oncology biosimilar landscape by enabling broader market access and intensifying competition within HER2-targeted cancer therapies

- In April 2025, Biocon Biologics announced that the U.S. FDA approved its biosimilar bevacizumab “Jobevne™” (bevacizumab-nwgd), expanding its oncology biosimilar portfolio for multiple cancer types. Jobevne™ is approved for several indications including colorectal, lung, glioblastoma, renal cell carcinoma, cervical, and ovarian cancers. This approval strengthens Biocon Biologics’ presence in the U.S. oncology market and supports broader patient access to cost-effective targeted monoclonal antibody therapies, while increasing competitive pressure on originator biologics

- In June 2025, Dr. Reddy’s Laboratories announced a strategic collaboration with Alvotech to co-develop and commercialize a biosimilar version of the immunotherapy drug Keytruda (pembrolizumab). This partnership targets one of the world’s highest-revenue oncology monoclonal antibodies, signaling a major expansion of biosimilar development into immune checkpoint inhibitors. The collaboration highlights the growing focus on next-generation oncology biosimilars aimed at addressing the high cost burden of cancer immunotherapies

- In April 2024, the U.S. Food and Drug Administration approved HERCESSI™ (trastuzumab-strf), a biosimilar to Herceptin® (trastuzumab), for the treatment of HER2-overexpressing breast and gastric cancers. The approval was based on comprehensive analytical, clinical, and pharmacokinetic data demonstrating biosimilarity to the reference product. This development expands treatment options for HER2-positive cancer patients and supports healthcare systems seeking to reduce biologic therapy costs without compromising clinical outcomes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.