Global Online Brand Protection Software Market

Market Size in USD Billion

CAGR :

%

USD

0.72 Billion

USD

1.64 Billion

2024

2032

USD

0.72 Billion

USD

1.64 Billion

2024

2032

| 2025 –2032 | |

| USD 0.72 Billion | |

| USD 1.64 Billion | |

|

|

|

|

Online Brand Protection Software Market Size

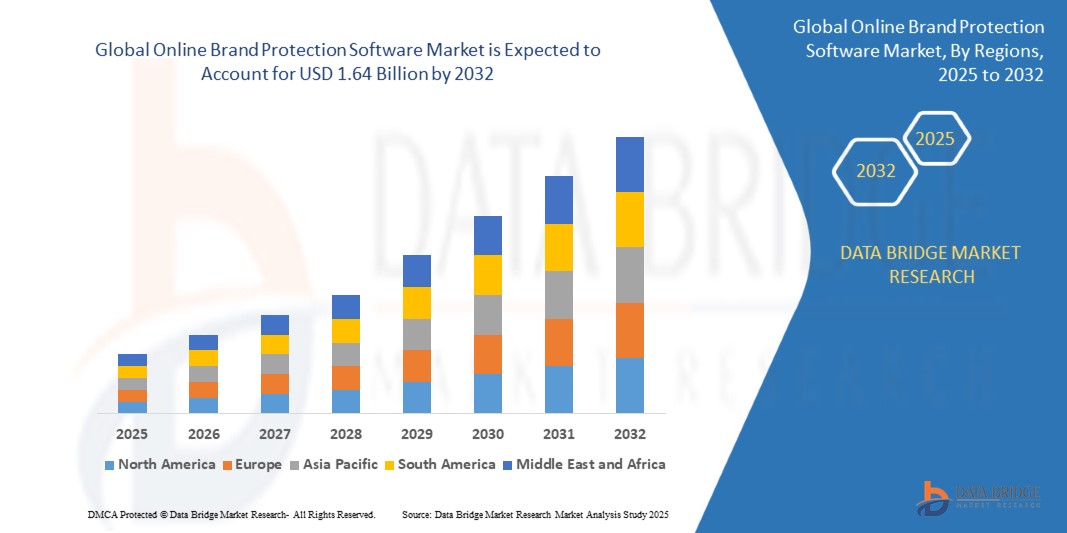

- The Global Online Brand Protection Software Market was valued at USD 0.72 billion in 2024 and is projected to reach USD 1.64 billion by 2032, growing at a CAGR of 12.48% during the forecast period.

- This growth is driven by the increasing incidence of brand abuse, counterfeiting, phishing, and digital impersonation, especially across e-commerce platforms, social media, and third-party marketplaces.

Online Brand Protection Software Market Analysis

- Online brand protection software enables businesses to monitor, detect, and take down unauthorized use of their intellectual property (IP), logos, content, and product listings across the internet.

- The rise in digital transformation, direct-to-consumer models, and global online marketplaces has created new attack vectors for brand exploitation—necessitating proactive brand protection strategies.

- Organizations are increasingly using these platforms for threat intelligence, piracy detection, anti-fraud operations, and IP enforcement to safeguard brand equity and customer trust.

- AI and machine learning models are being integrated into these tools for real-time monitoring, image and text recognition, and automated takedown processes to improve threat response speed and accuracy.

- With the rapid growth of cross-border e-commerce, counterfeit goods and brand abuse have become global threats, prompting adoption by retail, healthcare, BFSI, fashion, and consumer electronics companies.

Report Scope and Online Brand Protection Software Market Segmentation

|

Attributes |

Online Brand Protection Software Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Online Brand Protection Software Market Trends

Rise of AI-Driven Threat Detection and Cross-Platform Enforcement

- AI and Machine Learning in Threat Intelligence, Vendors are integrating machine learning to automatically detect counterfeit products, pirated content, or impersonation attempts across domains, marketplaces, and social platforms.

- Cross-Platform Enforcement and Omnichannel Monitoring, As brands expand across e-commerce, social media, and search engines, demand for unified dashboards to monitor and enforce brand protection across multiple digital assets is rising.

- Image and Logo Recognition Tools, increasing use of visual AI and image matching algorithms to identify logo misuse and fake packaging on reseller websites and social commerce platforms.

- Brand Protection in the Metaverse and Web3, With the rise of NFTs and virtual branding, companies are investing in solutions to monitor digital twin misuse, trademark infringement, and phishing schemes in immersive platforms.

- Rise of BPaaS (Brand Protection as a Service), Cloud-native, subscription-based brand protection platforms are gaining popularity among mid-sized firms and digital-native brands, offering faster onboarding and automated enforcement tools.

Online Brand Protection Software Market Dynamics

Driver

Rapid Digitalization and Surge in Online Counterfeiting Drive Software Adoption

- The explosion of digital content, e-commerce transactions, and cross-border sales has increased the risk of brand impersonation, product cloning, and IP theft across platforms.

- Counterfeit and pirated goods account for nearly 3.3% of global trade, prompting strong demand for real-time brand abuse detection systems.

- Large enterprises and SMEs alike are turning to online brand protection tools to safeguard revenue, maintain customer trust, and ensure compliance with trademark and IP laws.

- Rising use of influencer marketing and brand collaborations is increasing exposure to fraudulent campaigns, fake accounts, and unauthorized brand usage—driving the need for social media monitoring tools.

- The increased sophistication of phishing attacks and malicious lookalike domains is further compelling BFSI, e-commerce, and healthcare sectors to implement brand protection software.

Restraint/Challenge

High Cost of Integration and Limited Awareness Among SMEs

- Many SMEs and early-stage businesses lack awareness of digital IP threats or assume brand protection is only a concern for large multinational corporations.

- The cost of comprehensive monitoring, including AI integration, takedown services, and legal support, can be a barrier for smaller firms with limited cybersecurity budgets.

- Manual review workflows, jurisdictional differences in IP enforcement laws, and fragmented online marketplace policies complicate enforcement consistency across regions.

- Some companies also face challenges in measuring ROI from brand protection efforts, especially when brand damage is indirect or long-term (e.g., lost trust or fake reviews).

Online Brand Protection Software Market Scope

The market is segmented by component, deployment, application, and industry vertical, reflecting broad applicability across sectors vulnerable to online brand abuse.

- By Component

The software segment dominates the market in 2025, supported by growing demand for AI-enabled IP surveillance, automated detection, and cloud-based dashboards. The services segment is expected to grow rapidly, with consulting, takedown enforcement, and managed detection services gaining traction across enterprise and mid-market clients.

- By Application

Anti-counterfeiting and fraud detection hold the largest share, driven by the growing need to monitor unauthorized product listings, especially on third-party marketplaces like Amazon, Alibaba, and eBay. Threat intelligence and IP monitoring are the fastest-growing applications as companies adopt proactive brand threat detection, litigation readiness tools, and reputation management solutions.

- By Deployment

Cloud-based solutions dominate in 2025 due to ease of integration, scalability, and remote access for global brand teams. On-premises deployment remains relevant in regulated sectors like banking and healthcare where sensitive IP data must remain in-house.

- By Industry Vertical

The retail & e-commerce segment leads the market due to its vulnerability to counterfeit goods, domain spoofing, and online piracy. The media & entertainment and BFSI sectors are growing fast, with rising concerns over phishing sites, identity spoofing, and monetization abuse across digital channels.

Online Brand Protection Software Market Regional Analysis

- North America dominates the market in 2025 due to high brand concentration, early adoption of cybersecurity tools, and strong enforcement of intellectual property laws. The U.S. leads in automated domain monitoring, anti-phishing solutions, and social media brand protection.

- Europe is a major market, driven by stringent IP laws (like EU IPR and GDPR), and rising counterfeit concerns across fashion, auto parts, and luxury goods sectors. The U.K., Germany, and France are leading adopters of AI-based anti-piracy tools.

- Asia-Pacific is the fastest-growing region due to increasing e-commerce penetration, rising brand awareness, and growing counterfeit activity on regional marketplaces. Countries like China, India, Japan, and South Korea are investing in IP enforcement technologies.

- Middle East and Africa (MEA) is seeing growth with digital brand expansion in UAE, Saudi Arabia, and South Africa. Multinational firms are deploying brand protection tools in the region to counter fake pharmaceuticals, apparel, and FMCG products.

- South America is emerging as a strategic market, especially in Brazil and Mexico, where brands face challenges from counterfeit goods, pirated digital content, and fake online storefronts. Regulatory enforcement and e-commerce growth are boosting demand.

United States

The U.S. leads in both software innovation and adoption, with robust IP enforcement mechanisms, widespread use of AI in cybercrime prevention, and a large base of multinational brands vulnerable to digital impersonation.

United Kingdom

Post-Brexit, the U.K. has invested heavily in IP compliance frameworks and brand protection technologies, especially for retail, fashion, and consumer electronics sectors operating in global online markets.

India

India is experiencing rapid growth in demand for brand protection solutions due to a booming e-commerce sector and increasing awareness of counterfeiting issues. Government-led digital IP campaigns are also supporting software adoption.

China

While China is known as a source of counterfeit activity, its domestic brands and platforms are increasingly deploying anti-fraud software to safeguard IP, driven by tightening regulations and global partnerships.

Brazil

Brazil faces high levels of online piracy and brand misuse, especially in consumer electronics and digital streaming sectors. Government support for IP reform and growing cross-border trade are driving brand protection adoption.

Online Brand Protection Software Market Share

The Online Brand Protection Software industry is primarily led by well-established companies, including:

- Red Points (Spain)

- BrandShield Ltd. (Israel)

- CSC Global (U.S.)

- Corsearch Inc. (U.S.)

- OpSec Security (U.S.)

- Smart Protection (Spain)

- PhishLabs (HelpSystems) (U.S.)

- MarkMonitor (Clarivate Analytics) (U.S.)

- ZeroFOX (U.S.)

- Incopro (Corsearch) (U.K.)

Latest Developments in Global Online Brand Protection Software Market

- In April 2025, Red Points launched its enhanced AI-powered counterfeiting detection engine capable of recognizing brand impersonation across 40+ e-commerce and social media platforms in real time.

- In March 2025, BrandShield Ltd. announced a strategic partnership with a major European luxury group to expand its IP threat intelligence and accelerate automated phishing domain takedown services.

- In February 2025, Smart Protection introduced its Real-Time Piracy Tracker for OTT platforms, offering advanced fingerprinting to detect unauthorized streams and pirated copies on torrent and streaming websites.

- In January 2025, Corsearch Inc. rolled out an IP enforcement suite that combines legal workflow management, image matching, and global trademark monitoring in a single cloud platform for cross-border litigation support.

- In December 2024, ZeroFOX integrated its platform with enterprise SIEM systems, enabling real-time alerts for brand impersonation, phishing attacks, and fake executive profiles as part of broader cyber threat monitoring.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ONLINE BRAND PROTECTION SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ONLINE BRAND PROTECTION SOFTWARE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL ONLINE BRAND PROTECTION SOFTWARE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 REGULATORY FRAMEWORK

5.2 PORTERS MODEL

5.3 BRAND/ SOLUTION ANALYSIS

5.4 TECHNOLOGY ADOPTION IN ONLINE BRAND PROTECTION STRATEGIES

5.5 INFRINGEMENT ON MULTIPLE CHANNELS- WEBSITE, EMAIL, SOCIAL MEDIA, MOBILE APPS, ONLINE MARKETPLACE

6 IMPACT OF COVID-19 PANDEMIC ON THE GLOBAL ONLINE BRAND PROTECTION SOFTWARE MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTER MATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 GLOBAL ONLINE BRAND PROTECTION SOFTWARE MARKET, BY OFFERING

7.1 OVERVIEW

7.2 SOLUTION

7.3 SERVICES

7.3.1 MANAGED SERVICES

7.3.2 PROFESSIONAL SERVICES

7.3.2.1. CONSULTING

7.3.2.2. TRAINING

7.3.2.3. SUPPORT AND MANINTENANCE

8 GLOBAL ONLINE BRAND PROTECTION SOFTWARE MARKET, BY DEPLOYMENT MODEL

8.1 OVERVIEW

8.2 CLOUD

8.3 ON PREMISES

8.4 HYBRID

9 GLOBAL ONLINE BRAND PROTECTION SOFTWARE MARKET, BY ENTERPRISE SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.2.1 BY DEPLOYMENT MODEL

9.2.1.1. CLOUD

9.2.1.2. ON PREMISES

9.2.1.3. HYBRID

9.3 SMALL AND MEDIUM ENTERPRISES (SMES)

9.3.1 BY DEPLOYMENT MODEL

9.3.1.1. CLOUD

9.3.1.2. ON PREMISES

9.3.1.3. HYBRID

10 GLOBAL ONLINE BRAND PROTECTION SOFTWARE MARKET, BY OPERATING DEVICE

10.1 OVERVIEW

10.2 MAC

10.3 WINDOWS

10.4 LINUX

10.5 IPHONE

10.6 IPAD

10.7 ANDROID

11 GLOBAL ONLINE BRAND PROTECTION SOFTWARE MARKET, BY PRICING CATEGORY

11.1 OVERVIEW

11.2 FREE

11.3 SUBSCRIPTION

11.3.1 ANNUAL

11.3.2 MONTHLY

11.4 ONE TIME LICENSE

12 GLOBAL ONLINE BRAND PROTECTION SOFTWARE MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 CASE MANAGEMENT

12.3 MARKETPLACE MONITORING

12.4 MOBILE APP MONITORING

12.5 PRIORITIZATION

12.6 SOCIAL MEDIA MONITORING

12.7 MOBILE APP MONITORING

12.8 DOMIAN MONITORING

12.9 ADVERTISING MONITORING

12.1 BRAND PROTECTION /ANTI-COUNTERFEITING:

12.11 OTHERS

13 GLOBAL ONLINE BRAND PROTECTION SOFTWARE MARKET, BY END USER

13.1 OVERVIEW

13.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

13.2.1 BY OFFERING

13.2.1.1. PLATFORM

13.2.1.2. SERVICES

13.3 GOVERNMENT AND PUBLIC SECTOR

13.3.1 BY OFFERING

13.3.1.1. PLATFORM

13.3.1.2. SERVICES

13.4 AUTOMOTIVE

13.4.1 BY OFFERING

13.4.1.1. PLATFORM

13.4.1.2. SERVICES

13.5 MANUFACTURING

13.5.1 BY OFFERING

13.5.1.1. PLATFORM

13.5.1.2. SERVICES

13.6 TRAVEL AND HOSPITALITY

13.6.1 BY OFFERING

13.6.1.1. PLATFORM

13.6.1.2. SERVICES

13.7 MEDIA AND ENTERTAINMENT

13.7.1 BY OFFERING

13.7.1.1. PLATFORM

13.7.1.2. SERVICES

13.8 RETAIL AND CONSUMER GOODS

13.8.1 BY OFFERING

13.8.1.1. PLATFORM

13.8.1.2. SERVICES

13.9 TRANSPORTATION AND LOGISTIC

13.9.1 BY OFFERING

13.9.1.1. PLATFORM

13.9.1.2. SERVICES

13.1 ENERGY AND UTILITIES

13.10.1 BY OFFERING

13.10.1.1. PLATFORM

13.10.1.2. SERVICES

13.11 OTHERS

14 GLOBAL ONLINE BRAND PROTECTION SOFTWARE MARKET, BY REGION

14.1 GLOBAL ONLINE BRAND PROTECTION SOFTWARE MARKET SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.1.1 NORTH AMERICA

14.1.1.1. U.S.

14.1.1.2. CANADA

14.1.1.3. MEXICO

14.1.2 EUROPE

14.1.2.1. GERMANY

14.1.2.2. U.K.

14.1.2.3. FRANCE

14.1.2.4. ITALY

14.1.2.5. SPAIN

14.1.2.6. THE NETHERLANDS

14.1.2.7. SWITZERLAND

14.1.2.8. TURKEY

14.1.2.9. BELGIUM

14.1.2.10. RUSSIA

14.1.2.11. REST OF EUROPE

14.1.3 ASIA-PACIFIC

14.1.3.1. CHINA

14.1.3.2. JAPAN

14.1.3.3. SOUTH KOREA

14.1.3.4. INDIA

14.1.3.5. SINGAPORE

14.1.3.6. AUSTRALIA

14.1.3.7. MALAYSIA

14.1.3.8. PHILIPPINES

14.1.3.9. THAILAND

14.1.3.10. INDONESIA

14.1.3.11. REST OF ASIA-PACIFIC

14.1.4 SOUTH AMERICA

14.1.4.1. BRAZIL

14.1.4.2. ARGENTINA

14.1.4.3. REST OF SOUTH AMERICA

14.1.5 MIDDLE EAST AND AFRICA

14.1.5.1. SOUTH AFRICA

14.1.5.2. EGYPT

14.1.5.3. SAUDI ARABIA

14.1.5.4. U.A.E

14.1.5.5. ISRAEL

14.1.5.6. REST OF MIDDLE EAST AND AFRICA

14.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

15 GLOBAL DIGITAL EXPERIENCE PLATFORM MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS & ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT & APPROVALS

15.7 EXPANSIONS

15.8 REGULATORY CHANGES

15.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 GLOBAL ONLINE BRAND PROTECTION SOFTWARE MARKET, SWOT AND DBMR ANALYSIS

17 GLOBAL ONLINE BRAND PROTECTION SOFTWARE MARKET, COMPANY PROFILE

17.1 INCOPRO LTD.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 GEOGRAPHIC PRESENCE

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 CPA GLOBAL LTD.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 GEOGRAPHIC PRESENCE

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 OPSEC SECURITY GROUP LTD.

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 GEOGRAPHIC PRESENCE

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 CORSEARCH INC.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 GEOGRAPHIC PRESENCE

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 PHISHLABS

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 GEOGRAPHIC PRESENCE

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 APIRASOL GMBH

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 GEOGRAPHIC PRESENCE

17.6.4 PRODUCT PORTFOLIO

17.6.5 RECENT DEVELOPMENTS

17.7 BRANDSHIELD LTD.

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 GEOGRAPHIC PRESENCE

17.7.4 PRODUCT PORTFOLIO

17.7.5 RECENT DEVELOPMENTS

17.8 FRAUDWATCH INTERNATIONAL PTY LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 GEOGRAPHIC PRESENCE

17.8.4 PRODUCT PORTFOLIO

17.8.5 RECENT DEVELOPMENTS

17.9 RED POINTS SOLUTIONS, S.L.

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 GEOGRAPHIC PRESENCE

17.9.4 PRODUCT PORTFOLIO

17.9.5 RECENT DEVELOPMENTS

17.1 PERCEPTION PARTNERS, INC.

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 GEOGRAPHIC PRESENCE

17.10.4 PRODUCT PORTFOLIO

17.10.5 RECENT DEVELOPMENTS

17.11 COUNTERFIND

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 GEOGRAPHIC PRESENCE

17.11.4 PRODUCT PORTFOLIO

17.11.5 RECENT DEVELOPMENTS

17.12 HUBSTREAM, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 GEOGRAPHIC PRESENCE

17.12.4 PRODUCT PORTFOLIO

17.12.5 RECENT DEVELOPMENTS

17.13 SNAPDRAGON MONITORING LTD.

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 GEOGRAPHIC PRESENCE

17.13.4 PRODUCT PORTFOLIO

17.13.5 RECENT DEVELOPMENTS

17.14 PERFORMANCE HORIZON GROUP LTD.

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 GEOGRAPHIC PRESENCE

17.14.4 PRODUCT PORTFOLIO

17.14.5 RECENT DEVELOPMENTS

17.15 TRACKSTREET, INC.

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 GEOGRAPHIC PRESENCE

17.15.4 PRODUCT PORTFOLIO

17.15.5 RECENT DEVELOPMENTS

17.16 CORPORATION SERVICE CO.

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 GEOGRAPHIC PRESENCE

17.16.4 PRODUCT PORTFOLIO

17.16.5 RECENT DEVELOPMENTS

17.17 APPDETEX

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 GEOGRAPHIC PRESENCE

17.17.4 PRODUCT PORTFOLIO

17.17.5 RECENT DEVELOPMENTS

17.18 OPTEL

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 GEOGRAPHIC PRESENCE

17.18.4 PRODUCT PORTFOLIO

17.18.5 RECENT DEVELOPMENTS

17.19 RUVIXX

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 GEOGRAPHIC PRESENCE

17.19.4 PRODUCT PORTFOLIO

17.19.5 RECENT DEVELOPMENTS

17.2 I-SIGHT

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 GEOGRAPHIC PRESENCE

17.20.4 PRODUCT PORTFOLIO

17.20.5 RECENT DEVELOPMENTS

17.21 BRANDVERITY

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 GEOGRAPHIC PRESENCE

17.21.4 PRODUCT PORTFOLIO

17.21.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 CONCLUSION

19 QUESTIONNAIRE

20 RELATED REPORTS

21 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.