Global Online Salvage Auctions Market

Market Size in USD Billion

CAGR :

%

USD

12.57 Billion

USD

45.71 Billion

2025

2033

USD

12.57 Billion

USD

45.71 Billion

2025

2033

| 2026 –2033 | |

| USD 12.57 Billion | |

| USD 45.71 Billion | |

|

|

|

|

Online Salvage Auctions Market Size

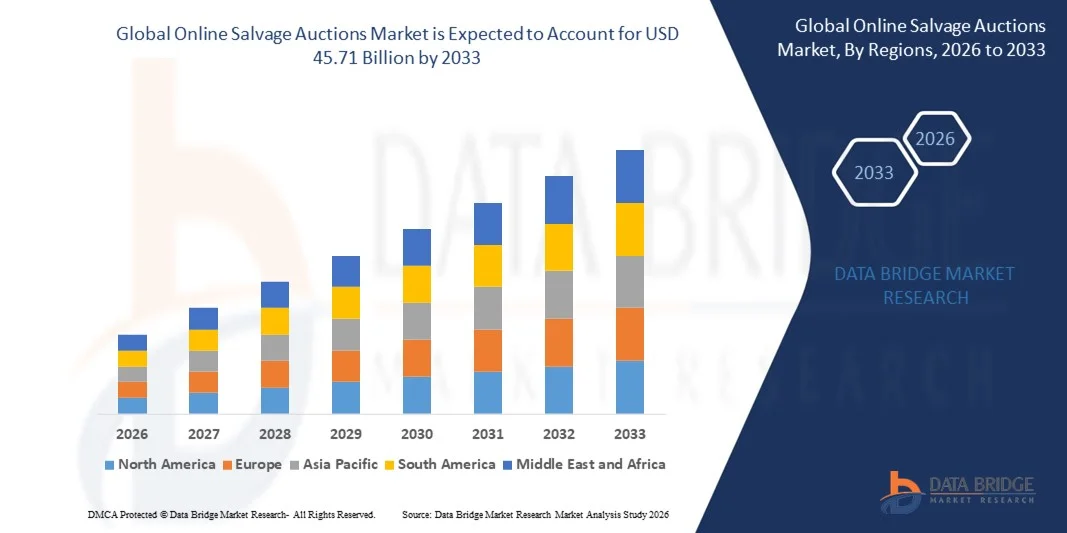

- The global online salvage auctions market size was valued at USD 12.57 billion in 2025 and is expected to reach USD 45.71 billion by 2033, at a CAGR of 17.51% during the forecast period

- The market growth is largely fuelled by increasing digitization of auction platforms, growing demand for cost-effective vehicle and equipment procurement, and rising adoption of online marketplaces for salvaged assets

- Expanding internet penetration, mobile connectivity, and improved online payment systems are further driving the growth of online salvage auctions

Online Salvage Auctions Market Analysis

- The market is witnessing rapid growth due to the convenience, transparency, and efficiency offered by online platforms compared to traditional physical salvage auctions

- Technological advancements, such as AI-driven bidding systems, real-time tracking, and automated valuation tools, are enhancing the buyer experience and boosting adoption

- North America dominated the online salvage auctions market with the largest revenue share of 38.75% in 2025, driven by a growing preference for digital vehicle transactions and increased adoption of online auction platforms

- Asia-Pacific region is expected to witness the highest growth rate in the global online salvage auctions market, driven by digital transformation initiatives, growing vehicle fleet, and government support for online automotive trade platforms

- The Used Vehicles segment held the largest market revenue share in 2025, driven by the high demand for affordable pre-owned vehicles and the ease of accessing them through digital auction platforms. Used vehicle auctions offer buyers transparency, competitive pricing, and convenient bidding processes, making them the preferred choice for individual buyers and dealerships

Report Scope and Online Salvage Auctions Market Segmentation

|

Attributes |

Online Salvage Auctions Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Online Salvage Auctions Market Trends

Rising Demand for Efficient, Transparent, and Cost-Effective Salvage Transactions

- The increasing focus on digital platforms is significantly shaping the online salvage auctions market, as buyers and sellers prefer fast, transparent, and accessible auction processes. Online platforms are gaining traction due to their ability to simplify bidding, tracking, and payment while reducing operational costs, encouraging wider adoption across automotive, equipment, and industrial sectors

- Growing awareness of cost-saving opportunities and streamlined procurement has accelerated the demand for online salvage auctions. Businesses, insurers, and individual buyers are actively seeking platforms that allow for efficient acquisition of vehicles, machinery, and equipment at competitive prices, prompting operators to enhance platform functionality and service offerings

- Transparency, convenience, and real-time bidding features are influencing participation, with auction providers emphasizing secure payment systems, easy-to-use interfaces, and detailed asset information. These factors are helping platforms differentiate themselves in a competitive market and build trust among users

- For instance, in 2025, Wilmar International in Singapore partnered with a technology firm to integrate QR code-based traceability, while Cargill and Bunge in the U.S. introduced recyclable and material-efficient packaging for auctioned assets. Such innovations are enhancing user confidence, operational efficiency, and overall market engagement

- While demand for online salvage auctions is growing, sustained market expansion depends on continuous technological upgrades, robust cybersecurity, and reliable logistics. Platform operators are also focusing on improving scalability, cross-border accessibility, and real-time auction management to support broader adoption

Online Salvage Auctions Market Dynamics

Driver

Rising Demand For Efficient And Transparent Online Platforms

- Increasing adoption of digital auction platforms is a key driver for the online salvage auctions market. These platforms offer streamlined bidding, real-time tracking, and reduced operational costs compared to traditional physical auctions, attracting more buyers and sellers

- Expanding applications across vehicles, industrial machinery, and equipment are influencing market growth. Online auctions provide an efficient and convenient way to buy and sell salvage assets while maintaining transparency and fairness in transactions

- Market participants are actively investing in enhanced user interfaces, secure payment gateways, and detailed asset documentation. These improvements cater to the growing demand for transparency and reliability, further boosting platform adoption

- For instance, in 2025, several leading auction platforms integrated AI-driven valuation tools and automated bidding systems, increasing efficiency and user engagement. This expansion followed rising interest from insurers, dealerships, and fleet operators seeking cost-effective procurement

- Although rising digitization supports growth, wider adoption depends on cybersecurity measures, platform reliability, and regulatory compliance. Investment in technology infrastructure, secure payment systems, and robust logistics will be critical for maintaining trust and competitive advantage

Restraint/Challenge

Concerns Over Security, Fraud, And Limited Awareness

- Security and fraud concerns remain significant challenges for online salvage auction platforms, limiting adoption among cautious buyers and sellers. Ensuring secure transactions, accurate asset information, and fraud prevention is critical to maintaining market confidence

- Awareness and familiarity with online salvage auctions remain uneven, particularly in emerging markets. Limited understanding of platform benefits and operational processes restricts adoption across certain regions, slowing market penetration

- Logistical complexities also impact market growth, as shipping and handling of salvaged vehicles and equipment require reliable transport networks, insurance, and legal compliance. Delays or mishandling can affect user trust and transaction efficiency

- For instance, in 2025, several emerging markets reported slower uptake of online salvage auctions due to concerns over asset verification, payment security, and transport reliability. These factors prompted some buyers to prefer traditional auctions, affecting platform adoption

- Overcoming these challenges will require investment in cybersecurity, platform education, and logistics partnerships. Collaboration with insurers, transport providers, and regulatory authorities can help unlock the long-term growth potential of the global online salvage auctions market. In addition, enhancing transparency, user experience, and fraud prevention measures will be essential for widespread adoption

Online Salvage Auctions Market Scope

The market is segmented on the basis of components, application, auction type, and vehicle ownership source.

- By Components

On the basis of components, the online salvage auctions market is segmented into Used Vehicles, Salvage Vehicles, and Other. The Used Vehicles segment held the largest market revenue share in 2025, driven by the high demand for affordable pre-owned vehicles and the ease of accessing them through digital auction platforms. Used vehicle auctions offer buyers transparency, competitive pricing, and convenient bidding processes, making them the preferred choice for individual buyers and dealerships.

The Salvage Vehicles segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising interest of automotive refurbishers and rebuilders in acquiring damaged vehicles for resale or parts. Salvage vehicle auctions provide a cost-effective supply chain for businesses and enthusiasts looking to repair or repurpose vehicles, fueling the segment’s rapid adoption.

- By Application

On the basis of application, the market is segmented into Banks and Financial Service Institutions and Other. The Banks and Financial Service Institutions segment dominated in 2025, due to their increasing use of online salvage auctions to liquidate repossessed or collateral vehicles efficiently.

The Other segment is expected to witness the fastest growth rate from 2026 to 2033, as independent dealers, refurbishers, and individual buyers increasingly adopt digital platforms for vehicle procurement.

- By Auction Type

On the basis of auction type, the market is segmented into Live Online Auctions and Other. Live Online Auctions accounted for the largest revenue share in 2025, owing to their real-time bidding experience, wider buyer reach, and streamlined transaction process.

The Other segment, which includes timed or proxy bidding formats, is projected to register a notable growth rate from 2026 to 2033, driven by increasing platform innovations and user-friendly auction tools.

- By Vehicle Ownership Source

On the basis of vehicle ownership source, the market is segmented into Insurance Carriers, Non-Insurance Fleet & Rental, and Other. The Insurance Carriers segment led the market in 2025, as insurers increasingly utilize online salvage auctions to dispose of damaged or totaled vehicles efficiently.

The Non-Insurance Fleet & Rental segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rental and fleet operators’ adoption of online platforms to resell end-of-life or surplus vehicles, reducing holding costs and maximizing asset recovery.

Online Salvage Auctions Market Regional Analysis

- North America dominated the online salvage auctions market with the largest revenue share of 38.75% in 2025, driven by a growing preference for digital vehicle transactions and increased adoption of online auction platforms

- Consumers in the region highly value the convenience, transparency, and competitive pricing offered by online salvage auctions, making it easier to buy and sell used and salvage vehicles efficiently

- This widespread adoption is further supported by advanced internet infrastructure, high smartphone penetration, and a technologically inclined population, establishing online salvage auctions as a preferred solution for banks, dealerships, and individual buyers

U.S. Online Salvage Auctions Market Insight

The U.S. online salvage auctions market captured the largest revenue share in 2025 within North America, fueled by the rapid adoption of digital platforms and increasing demand for used and salvage vehicles. Financial institutions and insurance companies are leveraging online auctions to efficiently dispose of repossessed and damaged vehicles. In addition, the growing trend of vehicle refurbishment and resale, combined with a strong presence of online auction service providers, is significantly propelling market growth. The integration of user-friendly bidding platforms and mobile applications further enhances accessibility and adoption.

Europe Online Salvage Auctions Market Insight

The Europe online salvage auctions market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by strict regulatory compliance for vehicle disposal and the increasing need for cost-effective vehicle procurement. Urbanization and a rising focus on sustainability and recycling of automotive parts are fostering the adoption of online salvage platforms. European buyers are also drawn to the efficiency, transparency, and competitive pricing offered by these auctions, promoting market growth across both private and commercial sectors.

U.K. Online Salvage Auctions Market Insight

The U.K. online salvage auctions market is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing use of digital platforms for vehicle resale and the growing preference for convenient, contactless transactions. Concerns regarding vehicle depreciation and cost-effectiveness are encouraging both businesses and individual buyers to leverage online auctions. The U.K.’s strong e-commerce infrastructure and technological readiness further support the expansion of the online salvage auctions market.

Germany Online Salvage Auctions Market Insight

The Germany online salvage auctions market is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising awareness of cost-effective vehicle acquisition and the demand for environmentally sustainable solutions. Germany’s advanced automotive industry, well-established digital infrastructure, and regulatory support for vehicle recycling promote the adoption of online salvage auctions. The integration of advanced auction technologies, including real-time bidding and vehicle inspection tools, is also boosting market adoption across private and commercial buyers.

Asia-Pacific Online Salvage Auctions Market Insight

The Asia-Pacific online salvage auctions market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing vehicle ownership, rising disposable incomes, and digital transformation initiatives in countries such as China, Japan, and India. The growing inclination towards cost-efficient vehicle procurement, supported by government policies promoting digitalization, is driving adoption. Furthermore, APAC’s emergence as a manufacturing hub for automotive components and the increasing availability of affordable online auction platforms are expanding market accessibility to a wider consumer base.

Japan Online Salvage Auctions Market Insight

The Japan online salvage auctions market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s technologically advanced culture, high vehicle ownership, and demand for convenience. Japanese consumers and businesses are increasingly adopting online platforms for buying and selling used and salvage vehicles. Integration with mobile applications, real-time bidding, and detailed vehicle information enhances transparency and efficiency, fueling market growth

China Online Salvage Auctions Market Insight

The China online salvage auctions market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, a growing middle class, and high digital adoption rates. China represents one of the largest markets for used and salvage vehicles, and online auctions are becoming increasingly popular among financial institutions, dealerships, and individual buyers. The push towards digital platforms, coupled with a strong presence of domestic auction providers and competitive pricing, is driving the expansion of the market in China.

Online Salvage Auctions Market Share

The Online Salvage Auctions industry is primarily led by well-established companies, including:

- Copart, Inc. (U.S.)

- IAA Holdings, LLC (U.S.)

- Manheim (U.S.)

- ACV Auctions (U.S.)

- Adesa Auctions (U.S.)

- RAW2K (U.K.)

- Silverlake Autoparts (U.K.)

- SCA Auctions (U.K.)

- RideSafely (U.K.)

- Bid N Drive Inc. (U.K.)

Latest Developments in Global Online Salvage Auctions Market

- In February 2025, Adesa conducted a platform expansion by enhancing its ADESA Clear system with AI-powered recommendations and extending its geographic reach. This integration of Carvana technology with Adesa’s wholesale auction expertise aims to streamline vehicle sourcing and improve auction efficiency, strengthening Adesa’s competitive position in the global online salvage auctions market

- In January 2025, ACV Auctions launched new tools at the NADA 2025 show, including ClearCar appraisal, QuickQuote lead sourcing, and the ACV MAX mobile application. These innovations provide real-time vehicle valuations and faster transaction processes, enhancing buyer confidence and supporting market growth

- In April 2023, IAA Holdings, LLC formed a strategic alliance with Antonio, SARL in Benin, West Africa. The partnership enables Antonio-operated auction centers to facilitate bidding, payment, shipping, and importing of vehicles from IAA auctions in the U.S., expanding IAA’s global digital marketplace and increasing access to its inventory for international buyers, boosting market reach and adoption

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.