Global Oolong Bubble Tea Market

Market Size in USD Million

CAGR :

%

USD

634.46 Million

USD

1,117.30 Million

2024

2032

USD

634.46 Million

USD

1,117.30 Million

2024

2032

| 2025 –2032 | |

| USD 634.46 Million | |

| USD 1,117.30 Million | |

|

|

|

|

Oolong Bubble Tea Market Size

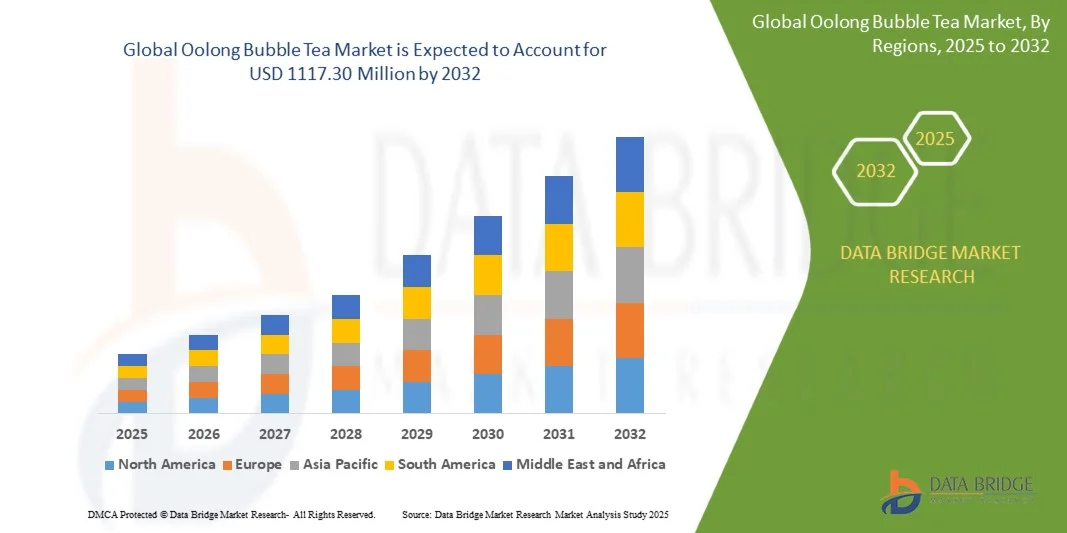

- The global oolong bubble tea market size was valued at USD 634.46 million in 2024 and is expected to reach USD 1117.30 million by 2032, at a CAGR of 7.33% during the forecast period

- The Oolong Bubble Tea market growth is largely fueled by the increasing global popularity of bubble tea beverages, driven by rising consumer interest in flavored and customizable tea-based drinks, particularly among younger demographics and urban populations

- Furthermore, growing café culture, expansion of bubble tea chains, and the introduction of innovative oolong-based flavor combinations are enhancing accessibility and appeal, thereby accelerating market adoption and significantly boosting overall industry growth

Oolong Bubble Tea Market Analysis

- Oolong Bubble Tea, offering a blend of traditional tea flavors with tapioca pearls and other add-ins, is increasingly gaining prominence in both retail and commercial settings due to its unique taste, visual appeal, and customizable options

- The escalating demand for oolong bubble tea is primarily driven by rising health-conscious consumer trends favoring antioxidant-rich teas, growing preference for experiential and Instagram-worthy beverages, and the expansion of specialty tea cafés and ready-to-drink offerings across key markets

- Asia-Pacific dominated the oolong bubble tea market with a share of 43.84% in 2024, due to the strong cultural affinity for tea consumption, the presence of major bubble tea brands, and the rapid urbanization of developing economies

- North America is expected to be the fastest growing region in the oolong bubble tea market during the forecast period due to rising popularity of Asian-inspired beverages and expanding specialty tea café chains

- Fruit flavor segment dominated the market with a market share of 42.1% in 2024, due to the growing preference among younger consumers for refreshing and customizable beverages. Fruit-infused oolong bubble teas such as mango, lychee, and peach have gained popularity due to their vibrant taste profiles and natural appeal, aligning with the rising health-conscious trend. Cafés and bubble tea chains are introducing diverse fruit-based combinations that enhance visual appeal and cater to evolving flavor preferences, strengthening the dominance of this segment across global markets

Report Scope and Oolong Bubble Tea Market Segmentation

|

Attributes |

Oolong Bubble Tea Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Oolong Bubble Tea Market Trends

“Growing Demand for Flavored and Customizable Oolong Bubble Tea”

- The global oolong bubble tea market is witnessing robust growth owing to rising consumer interest in flavored and customizable tea beverages that combine health benefits with indulgent taste experiences. Oolong tea, known for its balanced flavor and antioxidant properties, is increasingly being adopted as a base ingredient in bubble tea, catering to consumers seeking both refreshment and wellness in a single product

- For instance, Gong Cha and Chatime have expanded their oolong bubble tea menus with options including fruit infusions, cheese foam toppings, and plant-based milk alternatives. These product innovations highlight how international brands are leveraging flavor diversity and customization to meet evolving consumer preferences across urban and digital café culture

- The trend toward health-oriented beverages is encouraging a shift away from high-sugar drinks toward tea-based alternatives offering polyphenols and natural flavors. Oolong tea’s semi-fermented characteristics provide a distinctive taste profile that enhances bubble tea formulations while supporting clean-label and low-calorie positioning

- The influence of social media and digital dining trends is strengthening the popularity of visually appealing and customizable oolong bubble teas. Consumers are drawn to aesthetic presentations, unique textures, and flavor combinations that reflect personalization, driving repeat purchases and viral promotions across café chains

- The integration of premium, sustainably sourced tea leaves and natural sweeteners is redefining bubble tea positioning from a casual refreshment to a lifestyle beverage. Global producers are focusing on partnerships with tea growers to ensure traceable sourcing and eco-friendly operations aligned with modern sustainability values

- With the growing demand for sensory experiences and functional drinks, oolong bubble tea is establishing itself as a fusion of traditional tea culture and modern beverage innovation. Its adaptability and consumer-driven customization trends are expected to support sustained expansion in the global specialty beverage market

Oolong Bubble Tea Market Dynamics

Driver

“Expansion of Bubble Tea Cafés and Global Chains”

- The rapid global expansion of bubble tea franchises and specialty beverage cafés is a primary driver boosting the growth of the oolong bubble tea market. Increasing urbanization, rising disposable incomes, and evolving café culture are amplifying consumer exposure to diverse bubble tea offerings featuring oolong as a premium base ingredient

- For instance, The Alley and Kung Fu Tea have aggressively expanded their franchise networks across North America, Europe, and Asia-Pacific by introducing locally inspired oolong bubble tea variations. These expansions demonstrate how prominent brands are driving international market penetration through creative menu differentiation and localized flavor strategies

- Growing demand for experiential beverage consumption is transforming cafés into lifestyle destinations that appeal to younger demographics. Oolong bubble tea fits this trend by combining customizable textures, toppings, and tea strengths with interactive digital ordering systems and branded loyalty programs

- The increasing availability of oolong bubble tea in quick-service restaurants and convenience stores is also diversifying distribution channels. This expansion supports higher consumption frequency and introduces the beverage to audiences beyond the traditional café customer base

- As café culture evolves into an essential aspect of social and digital leisure, global brand expansion and product innovation are expected to remain crucial for driving sustained growth in the oolong bubble tea market worldwide

Restraint/Challenge

“High Competition in Urban Markets”

- The oolong bubble tea market faces intense competition in urban regions due to the saturation of beverage cafés and the rapid entry of new local and international brands. This heightened competition often results in price wars, heavy promotional spending, and reduced profit margins for both established and emerging players

- For instance, brands such as Gong Cha, CoCo Fresh Tea & Juice, and Sharetea are competing intensely in metropolitan markets including Tokyo, London, and New York, leading to aggressive discount campaigns and rapid menu turnover. Such competitive pressures limit differentiation and long-term profitability in densely populated retail zones

- Consumer loyalty in bubble tea markets is influenced strongly by novelty and aesthetics, prompting frequent rebranding and limited-edition offerings. This constant innovation cycle increases product development costs and challenges consistency in supply quality, particularly for premium oolong tea blends

- Rising rental costs and labor expenses in prime urban locations further strain operational margins. For smaller or independent cafés, sustaining profitability becomes increasingly difficult amid the dominance of franchise-driven chains with larger marketing resources

- Mitigating these challenges will require strategic diversification into emerging markets, digital ordering platforms, and brand collaborations with local ingredient suppliers. Focused differentiation through quality, authenticity, and innovative flavor positioning will be essential for maintaining competitiveness in the dynamic oolong bubble tea market

Oolong Bubble Tea Market Scope

The market is segmented on the basis of flavor and end-use.

• By Flavor

On the basis of flavor, the Oolong Bubble Tea market is segmented into fruit flavor, original flavor, chocolate flavor, coffee flavor, and other flavors. The fruit flavor segment dominated the market with the largest revenue share of 42.1% in 2024, driven by the growing preference among younger consumers for refreshing and customizable beverages. Fruit-infused oolong bubble teas such as mango, lychee, and peach have gained popularity due to their vibrant taste profiles and natural appeal, aligning with the rising health-conscious trend. Cafés and bubble tea chains are introducing diverse fruit-based combinations that enhance visual appeal and cater to evolving flavor preferences, strengthening the dominance of this segment across global markets.

The coffee flavor segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the increasing demand for hybrid beverage options combining tea and coffee attributes. The growing café culture and the popularity of premium, energy-boosting drinks among working professionals are supporting the rapid adoption of coffee-flavored oolong bubble tea. Brands are launching innovative offerings with cold brew and espresso infusions to attract coffee enthusiasts seeking a balanced yet distinctive alternative to traditional beverages, thereby accelerating segment growth.

• By End-Use

On the basis of end-use, the Oolong Bubble Tea market is segmented into commercial and household. The commercial segment accounted for the largest market share in 2024, driven by the expanding number of bubble tea outlets, cafés, and quick-service restaurants worldwide. Growing consumer inclination toward experiential dining and the availability of diverse flavor options in commercial outlets have strengthened the segment’s dominance. In addition, global franchises and regional brands are investing in aesthetic presentation and digital ordering platforms, which continue to enhance market penetration in the commercial space.

The household segment is expected to record the fastest growth rate from 2025 to 2032, supported by increasing adoption of DIY bubble tea kits and ready-to-drink products. Consumers are increasingly preparing oolong bubble tea at home due to convenience, cost-effectiveness, and the availability of premium tea bases through online platforms. Rising e-commerce access, along with the trend of home-based beverage customization, is creating lucrative opportunities for packaged bubble tea brands targeting residential users.

Oolong Bubble Tea Market Regional Analysis

- Asia-Pacific dominated the oolong bubble tea market with the largest revenue share of 43.84% in 2024, driven by the strong cultural affinity for tea consumption, the presence of major bubble tea brands, and the rapid urbanization of developing economies

- The region’s expanding youth population, evolving café culture, and rising disposable incomes are fostering high demand for oolong-based beverages

- The widespread popularity of Taiwanese-style tea chains and continuous flavor innovation are further accelerating market expansion across key markets such as China, Japan, South Korea, and Taiwan

China Oolong Bubble Tea Market Insight

China held the largest share in the Asia-Pacific Oolong Bubble Tea market in 2024, supported by its strong tea heritage and dominance in oolong tea production. The rising preference for premium and health-oriented beverages, coupled with the influence of domestic bubble tea brands such as Heytea and Nayuki, continues to fuel demand. Technological integration through mobile ordering and digital marketing strategies has strengthened brand engagement, boosting sales across urban centers.

India Oolong Bubble Tea Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, driven by an increasing shift toward modern beverage trends and rising popularity of tea-based cafés. The expanding middle-class population, higher youth interest in experimental beverages, and growing penetration of global bubble tea chains are supporting market growth. In addition, local startups introducing fusion flavors and affordable beverage options are creating a strong foundation for sustained demand expansion.

Europe Oolong Bubble Tea Market Insight

The Europe Oolong Bubble Tea market is expanding steadily, driven by increasing consumer awareness of Asian beverages and growing demand for low-sugar, customizable drinks. The market benefits from strong retail distribution channels and the entry of Asian beverage brands into Western markets. Rising popularity among health-conscious millennials and the inclusion of bubble tea in mainstream café menus are boosting regional consumption.

Germany Oolong Bubble Tea Market Insight

Germany’s Oolong Bubble Tea market is supported by a robust café culture, increasing availability of premium imported teas, and a strong consumer base seeking healthier beverage alternatives. The rise of bubble tea specialty outlets and growing retail presence of ready-to-drink products have amplified sales. In addition, the market is benefiting from online delivery platforms that make Asian beverages more accessible to younger demographics.

U.K. Oolong Bubble Tea Market Insight

The U.K. market is expanding due to the increasing adoption of Asian beverage trends, high urban café penetration, and a growing preference for tea-based indulgent drinks. The post-pandemic surge in takeaway and delivery services has strengthened the availability of bubble tea across major cities. Continuous flavor diversification and strong marketing targeting Gen Z and millennials are positioning the U.K. as one of Europe’s most dynamic Oolong Bubble Tea markets.

North America Oolong Bubble Tea Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, supported by rising popularity of Asian-inspired beverages and expanding specialty tea café chains. Growing awareness of the health benefits of oolong tea and the introduction of dairy-free and vegan options are boosting appeal among health-conscious consumers. Rapid expansion of franchise outlets, coupled with social media-driven beverage trends, continues to strengthen market momentum.

U.S. Oolong Bubble Tea Market Insight

The U.S. accounted for the largest share in the North America market in 2024, fueled by the expanding bubble tea café network and strong demand for customizable, premium beverages. Major brands such as Gong Cha, Kung Fu Tea, and The Alley are expanding their footprint across metropolitan areas. The U.S. market is further supported by innovation in flavor profiles, inclusion of natural ingredients, and a growing preference for cold, refreshing tea-based drinks among younger consumers.

Oolong Bubble Tea Market Share

The oolong bubble tea industry is primarily led by well-established companies, including:

- Gong Cha (U.K.)

- Quickly (U.S.)

- Chatime (Taiwan)

- Xing Fu Tang (Taiwan)

- TIGER SUGAR (Taiwan)

- KUNG FU TEA (U.S.)

- Sharetea (U.S.)

- Bubbleology (U.K.)

- PresoTea (U.K.)

- CoCo Fresh Tea & Juice (Taiwan)

- The Alley (Taiwan)

- YiFang Taiwan Fruit Tea (Taiwan)

- HEYTEA (China)

- Nayuki (China)

- Boba Guys (U.S.)

- Jenjudan (Taiwan)

- Dakasi (China)

- Playmade (Singapore)

- LiHO TEA (Singapore)

Latest Developments in Global Oolong Bubble Tea Market

- In March 2025, Chain Chupp, a U.K.-based emerging bubble tea manufacturer, signed its first international franchise agreement to expand its operations across India, Saudi Arabia, and the U.S. This strategic expansion marks the company’s entry into high-growth beverage markets, aiming to capture rising consumer demand for premium tea-based drinks and lifestyle beverages. The move will enhance global brand recognition while promoting cross-regional product innovation tailored to local tastes. It also highlights the growing trend of internationalization among U.K. bubble tea brands seeking to tap into the increasing popularity of oolong and fruit-based tea beverages worldwide

- In March 2025, Gong Cha, one of the leading global bubble tea chains, unveiled its plan to open at least 225 new outlets in the U.K. over the coming years. This large-scale expansion underscores the accelerating demand for bubble tea in Western markets and solidifies the U.K.’s role as a key hub for Asian-inspired beverages. The move aims to strengthen Gong Cha’s retail footprint, create employment opportunities, and introduce diverse oolong-based offerings to a broader consumer base. It also reflects the brand’s strategy to meet growing European consumer preferences for customizable, premium-quality bubble tea experiences

- In November 2023, Boba Tea Company, a rising U.S. bubble tea brand, launched a new store at International Plaza and Bay Street in Florida, marking another step in its national retail expansion. This opening enhances the company’s presence in a major retail destination, targeting both local residents and tourists drawn to experiential beverage offerings. The move reinforces the growing popularity of bubble tea across the U.S., particularly in southern states where demand for refreshing, customizable beverages is increasing. The company’s expansion strategy supports the broader growth trajectory of the Oolong Bubble Tea market in North America

- In April 2022, BUBLUV, Inc., a New York-based beverage innovator, introduced a line of ready-to-drink, better-for-you boba teas in three variants—Black Milk Tea, Matcha Soy Latte, and Passionfruit Oolong Tea. These beverages emphasize health-forward formulations with no added sugar, no artificial ingredients, and low-calorie content, aligning with the growing wellness movement in the beverage sector. The launch has broadened the appeal of bubble tea to health-conscious consumers and expanded accessibility through convenient retail packaging. It also represents an important step toward the mainstreaming of oolong-based beverages within the functional and ready-to-drink tea segment

- In February 2022, ONE ZO, a Taiwan-based bubble tea brand, opened its first U.K. store in Notting Hill Gate, London, marking its official entry into the European market. The company’s expansion brings authentic Taiwanese bubble tea craftsmanship to a new audience and strengthens cultural exchange through beverage innovation. ONE ZO’s diverse offerings, including oolong, black, white, and green tea-based drinks, cater to a wide range of flavor preferences, supporting the diversification of the U.K. bubble tea landscape. This entry also underscores the increasing influence of Asian beverage brands in shaping the European specialty tea market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Oolong Bubble Tea Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Oolong Bubble Tea Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Oolong Bubble Tea Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.