Global Operating Room Equipment Supplies Market

Market Size in USD Billion

CAGR :

%

USD

32.18 Billion

USD

42.37 Billion

2024

2032

USD

32.18 Billion

USD

42.37 Billion

2024

2032

| 2025 –2032 | |

| USD 32.18 Billion | |

| USD 42.37 Billion | |

|

|

|

|

Operating Room Equipment and Supplies Market Size

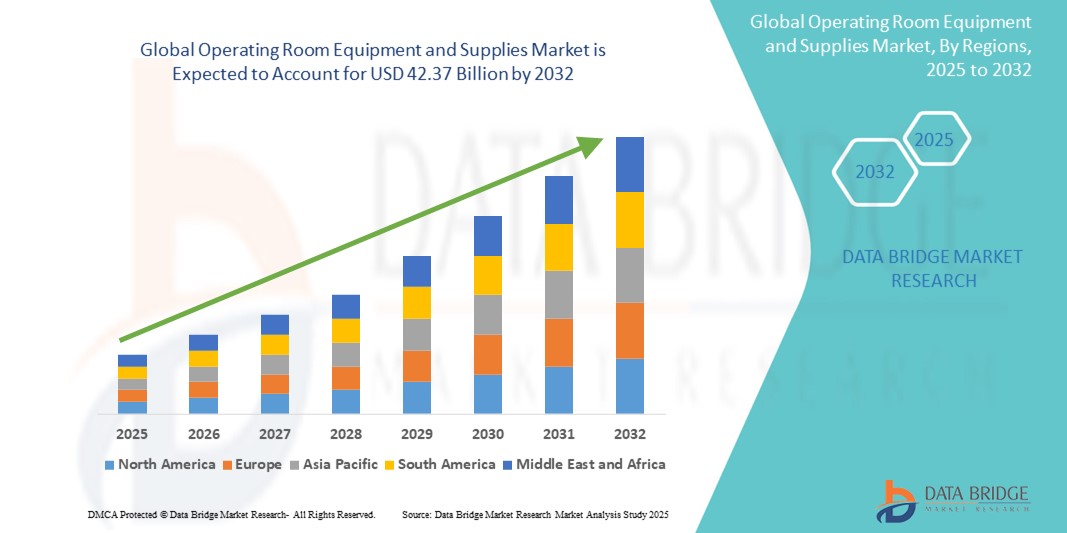

- The global operating room equipment and supplies market size was valued at USD 32.18 billion in 2024 and is expected to reach USD 42.37 billion by 2032, at a CAGR of 3.50% during the forecast period

- The market growth is largely fueled by increasing demand for minimally invasive surgeries, rising prevalence of chronic diseases, and advancements in surgical technologies

- The market growth is largely fueled by the increasing demand for advanced surgical equipment driven by the rise in minimally invasive procedures. Improvements in technology, such as robotic-assisted surgeries and enhanced imaging systems, are enabling better precision and reducing recovery times, which boosts market adoption

- The growing prevalence of chronic diseases such as cardiovascular conditions and cancer is increasing the volume of surgical interventions. Expansion of healthcare infrastructure and rising healthcare spending in developing regions further support the demand for operating room equipment and supplies

Operating Room Equipment and Supplies Market Analysis

- The operating room equipment and supplies market is steadily growing as hospitals increasingly invest in modernizing their surgical suites to improve patient care and procedural efficiency, for instance, by incorporating advanced imaging tools and ergonomic surgical instruments that enhance precision and reduce operation times

- Continuous innovation in equipment design and materials is reshaping the market, with manufacturers focusing on developing more durable, lightweight, and easy-to-sterilize products that meet the evolving needs of surgical teams, for instance, instruments that support minimally invasive techniques and enhance overall surgical safety and outcomes

- North America dominated the operating room equipment and supplies market with the share of 36.07% in 2024, driven by a growing demand for home automation and security, as well as increased awareness of smart home technology

- Asia-Pacific is expected to be the fastest growing region in the operating room equipment and supplies market during the forecast period due to by rapid urbanization, rising healthcare spending, and increasing prevalence of chronic diseases in countries such as China, India, and Japan

- The anaesthesia machines segment dominated the market with the largest market share of 54.64% in 2024, driven by their critical role in patient safety and continuous advancements in technology enhancing precision and monitoring.

Report Scope and Operating Room Equipment and Supplies Market Segmentation

|

Attributes |

Operating Room Equipment and Supplies Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Operating Room Equipment and Supplies Market Trends

“Increasing Focus on Minimally Invasive Surgical Equipment”

- The operating room equipment and supplies market is increasingly shaped by the trend toward minimally invasive surgical techniques that reduce patient recovery times and hospital stays

- Hospitals and surgical centers are investing more in specialized tools and equipment designed to support these less invasive procedures, which demand precision and flexibility

- For instance, the adoption of laparoscopic instruments and endoscopic devices is rising as they enable surgeons to perform complex operations through smaller incisions

- Manufacturers are responding by innovating lighter, more ergonomic, and highly durable equipment that meets the specific needs of minimally invasive surgeries, improving surgeon comfort and patient outcomes

- This trend is expected to continue driving product development and purchasing decisions as healthcare providers aim to improve efficiency and safety in the operating room

- In conclusion, the focus on minimally invasive surgery is a defining factor in the market’s growth, influencing how equipment is designed and adopted across healthcare facilities worldwide

Operating Room Equipment and Supplies Market Dynamics

Driver

“Rising Prevalence of Chronic Diseases Increasing Surgical Procedures”

- The rising prevalence of chronic diseases such as cardiovascular conditions, cancer, diabetes, and respiratory disorders is driving increased demand for surgical interventions, leading to higher consumption of advanced operating room equipment

- For instance, the growing number of coronary artery bypass surgeries worldwide. Chronic diseases often require complex surgical procedures, which necessitate specialized instruments and equipment to ensure precision and patient safety, as seen in the use of tumor resection tools during cancer surgeries

- An aging global population contributes to the increasing incidence of these conditions, which in turn expands the volume of surgical cases and fuels demand for reliable and innovative operating room supplies

- Healthcare facilities are actively upgrading to state-of-the-art surgical devices, such as advanced laparoscopic instruments, to improve patient outcomes and reduce postoperative complications, reflecting a shift towards more sophisticated equipment

- Investments in expanding surgical infrastructure and capacity, particularly in hospitals handling high volumes of chronic disease-related surgeries, support continuous market growth and increased adoption of modern operating room equipment

- In conclusion, the persistent rise in chronic disease cases consistently boosts the need for advanced surgical equipment, sustaining growth in the operating room equipment and supplies market

Restraint/Challenge

“High Costs and Maintenance of Advanced Surgical Equipment”

- The high cost of advanced surgical technologies such as robotic surgery systems, advanced imaging devices, and specialized minimally invasive instruments poses a significant barrier to market growth, especially for smaller healthcare facilities with limited budgets

- Initial investment for cutting-edge equipment is substantial, and ongoing expenses including maintenance, calibration, software updates, and staff training further increase the financial burden on healthcare providers

- For instance, robotic-assisted surgical systems require not only expensive procurement but also regular servicing and highly skilled personnel to operate, leading to increased operational costs that many facilities struggle to afford

- The complexity of advanced equipment demands specialized maintenance contracts and replacement parts, which can be both costly and logistically challenging, particularly in remote or underserved areas where resources are scarce

- Budget constraints often force healthcare providers to delay equipment upgrades or continue using traditional surgical tools, slowing the adoption of innovative technologies and hindering overall market growth

- In conclusion, the high cost and maintenance requirements of sophisticated operating room equipment remain critical challenges that limit the speed and scale of market expansion

Operating Room Equipment and Supplies Market Scope

The market is segmented on the basis of equipment, supplies, and end users.

- By Equipment

On the basis of type, the operating room equipment and supplies market is segmented into anaesthesia machines, operating tables, electrosurgical units, multi-parameter patient monitors, surgical imaging devices, operating room lights. The anaesthesia machines segment dominated the with the largest market share of 54.64% in 2024, driven by their critical role in patient safety and continuous advancements in technology enhancing precision and monitoring. Hospitals and surgical centers prioritize these machines for their reliability and integration capabilities with other or systems. Meanwhile, multi-parameter patient monitors are anticipated to witness the fastest growth rate over the forecast period, fueled by increasing demand for real-time patient data and improved diagnostic accuracy during surgeries.

- By Supplies

On the basis of supplies, the operating room equipment and supplies market is segmented into surgical instruments, disposable materials, accessories, and others. The surgical instruments segment holds the largest market share in 2024, owing to their indispensable role in various surgical procedures and continuous innovations improving precision and ergonomics.

Disposable materials are expected to experience the fastest growth from 2025 to 2032, driven by rising concerns over infection control, increasing surgical volumes, and growing preference for single-use items to ensure patient safety and reduce cross-contamination risks.

- By End Users

On the basis of end users, the operating room equipment and supplies market is segmented into hospitals, outpatient facilities, and ambulatory surgery centres. Hospitals represent the largest revenue share of 74.71% in 2024, attributed to their extensive surgical capabilities and higher patient throughput. Ambulatory surgery centres are projected to exhibit the fastest growth rate during the forecast period, supported by the increasing trend toward outpatient surgeries due to cost-effectiveness, convenience, and advancements in minimally invasive procedures. Outpatient facilities also contribute significantly, driven by the growing demand for diagnostic and minor surgical services outside traditional hospital settings.

Operating Room Equipment and Supplies Market Regional Analysis

- North America dominated the operating room equipment and supplies market with the share of 36.07% in 2024, driven by advanced healthcare infrastructure and strong adoption of cutting-edge surgical technologies

- The region’s high healthcare expenditure supports continuous upgrades and expansion of operating rooms, with a focus on integrating innovative devices such as electrosurgical units and multi-parameter patient monitors. This trend is further accelerated by government initiatives aimed at improving healthcare quality and access, encouraging healthcare providers to modernize their surgical facilities

- North America is witnessing a rise in chronic diseases such as cardiovascular conditions and cancer, leading to an increased number of surgical procedures. This growing patient pool, combined with technological advancements and rising awareness of minimally invasive surgeries, sustains steady demand for reliable and efficient operating room equipment and supplies across the region

U.S. Operating Room Equipment and Supplies Market Insight

The U.S. operating room equipment and supplies market captured the largest share in North America in 2024, driven by the increasing adoption of advanced surgical technologies and expanding healthcare infrastructure. Hospitals and ambulatory surgical centers are investing heavily in upgrading operating rooms with state-of-the-art equipment such as electrosurgical units and multi-parameter patient monitors. The rise in surgical procedures and growing emphasis on improving patient outcomes and operational efficiency further fuel market growth. Additionally, government initiatives supporting healthcare modernization and reimbursement policies promote the acquisition of advanced surgical equipment.

Europe Operating Room Equipment and Supplies Market Insight

The Europe operating room equipment and supplies market is projected to grow steadily throughout the forecast period, supported by the region’s focus on technological innovation and stringent healthcare regulations. Increasing healthcare expenditure and the expansion of surgical facilities are encouraging the adoption of high-quality operating room equipment. For instance, the demand for minimally invasive surgical tools and imaging devices is rising due to their benefits in reducing hospital stays and improving recovery rates. The trend towards upgrading legacy surgical equipment in both public and private healthcare sectors also drives market expansion.

U.K. Operating Room Equipment and Supplies Market Insight

The U.K. operating room equipment and supplies market is expected to witness consistent growth, driven by increasing investments in healthcare infrastructure and the growing number of outpatient surgical procedures. Hospitals and outpatient facilities are prioritizing the integration of advanced surgical devices to enhance efficiency and patient safety. The rise in elective surgeries and government funding to improve surgical services further support market development. The country’s focus on adopting innovative surgical technologies, such as electrosurgical units and anesthesia machines, also contributes to growth.

Germany Operating Room Equipment and Supplies Market Insight

The Germany operating room equipment and supplies market is forecasted to expand steadily owing to the country’s well-established healthcare system and commitment to technological advancement. There is a strong focus on adopting precision surgical equipment and upgrading operating rooms to meet high safety standards. Growing investments in hospital renovations and the increasing number of surgical interventions related to chronic diseases contribute to market demand. Additionally, the preference for energy-efficient and ergonomic surgical devices aligns with Germany’s sustainability goals.

Asia-Pacific Operating Room Equipment and Supplies Market Insight

The Asia-Pacific operating room equipment and supplies market is expected to record the fastest growth rate % in 2024, propelled by rapid urbanization, rising healthcare spending, and increasing prevalence of chronic diseases in countries such as China, India, and Japan. Expansion of hospital networks and ambulatory surgery centers, combined with government initiatives to improve healthcare access, boosts demand for modern operating room equipment. For instance, China’s large manufacturing base and growing domestic consumption of surgical devices play a key role in market expansion.

Japan Operating Room Equipment and Supplies Market Insight

The Japan operating room equipment and supplies market is gaining momentum due to the country’s advanced medical technology adoption and aging population. There is growing demand for user-friendly and highly precise surgical instruments that cater to minimally invasive procedures. Hospitals are increasingly equipping operating rooms with sophisticated monitors and imaging devices to enhance surgical accuracy. Moreover, government efforts to promote healthcare innovation and digital integration support sustained market growth.

China Operating Room Equipment and Supplies Market Insight

The China operating room equipment and supplies market held the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, expanding healthcare infrastructure, and rising middle-class healthcare demand. The country’s push for smart hospitals and increasing number of surgical procedures fuel the adoption of advanced operating room technologies. Domestic manufacturers are focusing on innovation and cost-effective solutions, making surgical equipment more accessible. Additionally, government policies encouraging healthcare modernization and investment in hospital upgrades accelerate market growth.

Operating Room Equipment and Supplies Market Share

The operating room equipment and supplies industry is primarily led by well-established companies, including:

- supplies market STERIS (U.S.)

- Getinge AB (Sweden)

- Stryker (U.S.)

- Hill-Rom Holdings, Inc. (U.S.)

- Drägerwerk AG & Co. KGaA (Dräger) (Germany)

- General Electric (US)

- Mizuho OSI (U.S.)

- Medtronic (Ireland)

- KARL STORZ and Co. KG (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Siemens Healthcare GmbH (Germany)

- Arthrex (US)

- Smith+Nephew (UK)

- CONMED Corporation (US)

- FUJIFILM Holdings Corporation (Japan)

- Olympus Corporation (Japan)

Latest Developments in Global Operating Room Equipment and Supplies Market

- In January 2025, Mindray launched the HyBase V6 Surgical Table in North America, marking its entry into the surgical table market and expanding its footprint in the operating room (OR) equipment space. The HyBase V6 is engineered to meet diverse patient needs, offering exceptional flexibility to support both routine and complex surgical procedures. Its innovative design enhances surgical efficiency, patient positioning, and overall OR workflow

- In November 2024, Stille AB introduced the imagiQ3™, a next-generation C-arm table that sets new benchmarks in visualization, OR efficiency, and patient safety. The imagiQ3™ is designed to provide superior imaging clarity while improving workflow efficiency. A key feature is its ability to significantly reduce radiation exposure for surgeons, OR staff, and patients, making it an optimal choice for complex and minimally invasive procedures requiring extended fluoroscopy use

- In February 2024, Virtual Incision Corporation received U.S. Food and Drug Administration (FDA) marketing authorization for the MIRA™ Surgical System (MIRA) the world’s first miniaturized robotic-assisted surgery (miniRAS) device. Approved for use in adults undergoing colectomy procedures, the MIRA system represents a significant breakthrough in minimally invasive surgery, offering enhanced portability, versatility, and ease of use compared to traditional robotic systems. Its compact design enables broader access to robotic-assisted surgery, even in settings with limited space or resources

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.