Global Operational Technology Network Segmentation Market

Market Size in USD Billion

CAGR :

%

USD

1.94 Billion

USD

30.20 Billion

2025

2033

USD

1.94 Billion

USD

30.20 Billion

2025

2033

| 2026 –2033 | |

| USD 1.94 Billion | |

| USD 30.20 Billion | |

|

|

|

|

Operational Technology Network Segmentation Market Size

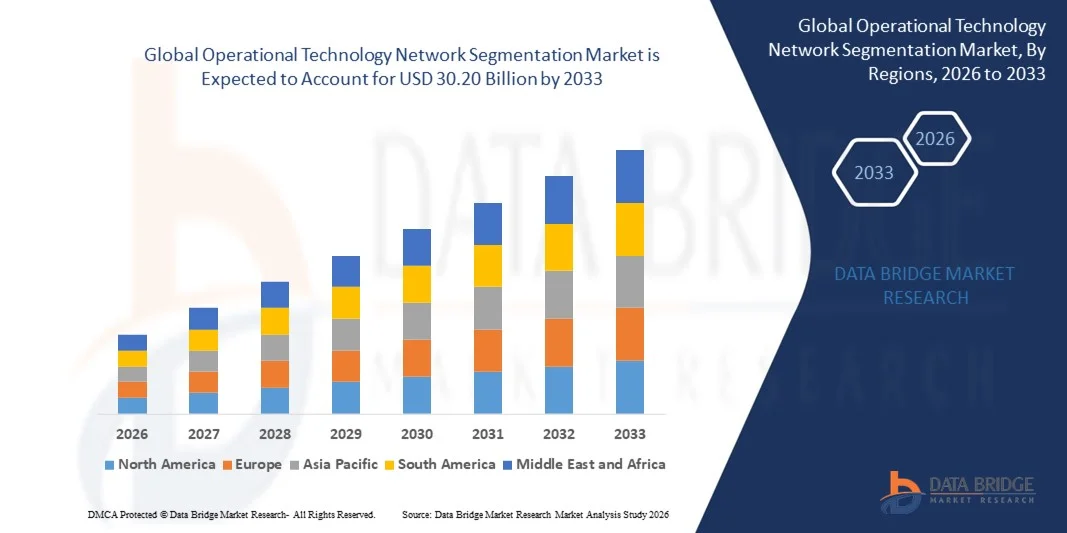

- The global operational technology network segmentation market size was valued at USD 1.94 billion in 2025 and is expected to reach USD 30.20 billion by 2033, at a CAGR of 40.90% during the forecast period

- The market growth is largely fuelled by the increasing adoption of zero-trust security frameworks across industrial environments

- Rising cyber threats targeting critical infrastructure systems is further accelerating the demand for advanced OT network segmentation

Operational Technology Network Segmentation Market Analysis

- The market is witnessing strong momentum as organizations prioritize micro-segmentation and network isolation to protect industrial assets from lateral cyberattacks

- Increased investments in digital transformation across sectors such as manufacturing, energy, utilities, and transportation are driving widespread deployment of OT network segmentation solutions

- North America dominated the operational technology network segmentation market with the largest revenue share in 2025, driven by rising cybersecurity investments across critical infrastructure, industrial automation, and energy sectors

- Asia-Pacific region is expected to witness the highest growth rate in the global operational technology network segmentation market, driven by expanding smart manufacturing, rising industrial IoT deployments, and increasing cybersecurity investments across emerging economies

- The manufacturing segment held the largest market revenue share in 2025 driven by increasing industrial automation, growing adoption of connected devices, and the need to secure critical production systems from cyber threats. OT segmentation in manufacturing ensures isolation of critical assets, reduces the risk of lateral attacks, and improves compliance with industry standards

Report Scope and Operational Technology Network Segmentation Market Segmentation

|

Attributes |

Operational Technology Network Segmentation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• VMware, Inc (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Operational Technology Network Segmentation Market Trends

Rising Integration Of Zero-Trust Security And Advanced Micro-Segmentation In OT Environments

- The growing adoption of zero-trust security frameworks is transforming the operational technology (OT) network segmentation landscape by enforcing granular access controls and minimizing lateral movement risks. This shift enables real-time threat isolation in industrial settings, particularly where production uptime and safety are critical. Organizations are increasingly implementing continuous verification, identity-based access, and network zoning to ensure robust protection against internal and external threats

- The rising deployment of micro-segmentation across manufacturing, utilities, and critical infrastructure is accelerating the shift toward more flexible and software-defined security architectures. These solutions help organizations address increasing cyber threats in remote and distributed OT environments. By isolating workloads and creating secure micro-perimeters, industrial operators can contain breaches more effectively and prevent propagation across the network

- The affordability and scalability of modern OT network segmentation tools are encouraging their adoption among mid-sized industrial operators, enabling them to strengthen visibility and segment legacy systems without major disruptions. This supports improved security posture and compliance readiness. Operators can now deploy software-defined segmentation in phases, allowing gradual modernization of legacy assets while maintaining operational continuity

- For instance, in 2024, several energy utilities in Europe implemented software-defined micro-segmentation platforms to restrict unauthorized access between operational and IT networks. These deployments helped reduce cyber intrusion attempts while improving incident containment efficiency. The projects also demonstrated measurable reductions in attack surface exposure and faster incident detection across distributed facilities

- While segmentation technologies are boosting industrial security, their success depends on continued innovation, integration with existing OT systems, and effective workforce training. Vendors must prioritize adaptable solutions that meet sector-specific security needs. In addition, ongoing monitoring, automated policy enforcement, and cross-site orchestration are becoming critical for maximizing segmentation effectiveness

Operational Technology Network Segmentation Market Dynamics

Driver

Increasing Frequency Of Cyberattacks Targeting Industrial Control Systems (ICS)

- The surge in cyberattacks on industrial control systems is prompting organizations to adopt OT network segmentation as a core defense strategy. Attacks such as ransomware and supply-chain compromises have heightened the urgency for proactive segmentation and zone-based protection. Segmentation ensures that even if one segment is compromised, attackers cannot easily move laterally to critical systems, reducing potential operational downtime

- Industrial operators are becoming more aware of the operational and financial risks associated with unsegmented OT networks, including production downtime, safety failures, and compliance violations. This awareness is driving rapid adoption of segmentation frameworks across sectors such as manufacturing, oil & gas, and energy. Enterprises are increasingly integrating network monitoring, threat detection, and automated response workflows to enhance overall resilience

- Regulatory bodies and government initiatives promoting industrial cybersecurity are further supporting the implementation of OT network segmentation tools. New compliance mandates encourage asset inventory, network monitoring, and segmented architectures. Companies are aligning with frameworks such as NERC CIP, ISA/IEC 62443, and national critical infrastructure protection guidelines to ensure regulatory compliance and secure operations

- For instance, in 2023, North American energy regulators enforced stricter cybersecurity guidelines requiring segmentation between IT and OT infrastructures, boosting demand for software-defined segmentation and continuous monitoring solutions. These regulations compelled utilities to implement micro-segmentation, asset-level controls, and real-time security analytics to meet compliance standards

- While rising threats and regulatory support are fueling adoption, organizations must enhance infrastructure modernization and integrate segmentation tools with legacy OT systems to maximize long-term security benefits. Continuous updates, threat intelligence sharing, and alignment with emerging cybersecurity standards are also key to maintaining a strong defense posture

Restraint/Challenge

High Deployment Complexity And Limited Skilled Workforce In OT Cybersecurity

- The complexity of deploying OT network segmentation, particularly in environments with aging industrial control systems, remains a major challenge. Integrating segmentation with legacy infrastructure often requires extensive configuration and specialized expertise. Misconfigurations or partial deployments can leave critical assets exposed, increasing operational and cyber risk

- Many industrial facilities face a shortage of cybersecurity professionals trained specifically in OT environments, limiting their ability to manage segmentation tools effectively. This skills gap delays adoption and increases operational risks. Organizations are investing in specialized training programs and partnerships with managed security service providers to address the workforce deficit

- Implementation barriers are heightened in remote or resource-constrained industrial sites where visibility into OT assets remains limited. Lack of consistent monitoring and inadequate infrastructure further restrict segmentation efficiency. These constraints often result in reliance on manual controls, delayed response times, and difficulty in enforcing segmentation policies uniformly across the enterprise

- For instance, in 2024, assessments across manufacturing plants in Southeast Asia found that over 60% lacked the skilled personnel required to deploy and maintain advanced OT security tools, hindering adoption. The shortage of qualified staff slowed project timelines, increased dependency on external consultants, and limited the effectiveness of deployed segmentation solutions

- While segmentation technologies continue to evolve, addressing talent shortages, simplifying integration, and improving OT-specific training remain crucial to accelerating global market penetration. In addition, the adoption of intuitive management interfaces, automated configuration, and AI-assisted monitoring is expected to mitigate operational complexity and improve ROI for industrial operators

Operational Technology Network Segmentation Market Scope

The market is segmented on the basis of end-use industry, deployment, component, and vertical.

- By End-Use Industry

On the basis of end-use industry, the operational technology network segmentation market is segmented into power & electrical, manufacturing, transportation, mining, and others. The manufacturing segment held the largest market revenue share in 2025 driven by increasing industrial automation, growing adoption of connected devices, and the need to secure critical production systems from cyber threats. OT segmentation in manufacturing ensures isolation of critical assets, reduces the risk of lateral attacks, and improves compliance with industry standards.

The power & electrical segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising cyberattacks on critical infrastructure, increasing investments in smart grids, and government initiatives to strengthen national energy security. Segmentation solutions in this sector help maintain operational continuity and protect sensitive control systems.

- By Deployment

On the basis of deployment, the operational technology network segmentation market is segmented into on-premise and cloud. The on-premise segment held the largest market revenue share in 2025 due to strong preference among industrial operators for full control over their critical network infrastructure and compliance with local regulations. On-premise solutions offer direct visibility, centralized policy management, and minimal dependency on external networks.

The cloud segment is expected to witness the fastest growth rate from 2026 to 2033, driven by the increasing adoption of cloud-native industrial applications, remote monitoring needs, and cost-effective scalable deployment options. Cloud-based segmentation enables centralized threat management, faster updates, and integration with AI-driven security analytics.

- By Component

On the basis of component, the operational technology network segmentation market is segmented into solution and services. The solution segment held the largest market revenue share in 2025, fueled by demand for software-defined segmentation tools, firewalls, and micro-segmentation platforms that provide real-time threat isolation and compliance support. Solutions enable industrial operators to design secure network zones tailored to operational requirements.

The services segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising demand for managed OT security services, consulting, deployment support, and ongoing monitoring. Services help enterprises optimize segmentation strategies, ensure proper implementation, and maintain operational resilience.

- By Vertical

On the basis of vertical, the operational technology network segmentation market is segmented into government and defense, BFSI, IT and telecom, healthcare, retail, manufacturing, energy & utilities, and others. The energy & utilities segment held the largest market revenue share in 2025 due to growing adoption of micro-segmentation and zero-trust frameworks to protect critical infrastructure from cyberattacks. Segmentation solutions in this vertical enhance threat containment, operational reliability, and regulatory compliance.

The manufacturing segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by increasing industrial automation, IoT deployments, and rising cybersecurity threats targeting operational technology networks. Segmentation enables isolation of legacy systems, secure connectivity, and improved monitoring across production facilities.

Operational Technology Network Segmentation Market Regional Analysis

- North America dominated the operational technology network segmentation market with the largest revenue share in 2025, driven by rising cybersecurity investments across critical infrastructure, industrial automation, and energy sectors.

- Organizations in the region prioritize securing operational technology networks against cyber threats, ensuring compliance with regulations, and minimizing production downtime.

- The widespread adoption is further supported by the presence of leading OT security vendors, advanced industrial infrastructure, and a strong focus on smart manufacturing and digital transformation initiatives.

U.S. Operational Technology Network Segmentation Market Insight

The U.S. operational technology network segmentation market captured the largest revenue share in 2025 within North America, fueled by stringent cybersecurity regulations, growing industrial automation, and increasing integration of IT and OT systems. Industrial operators are prioritizing network zoning, micro-segmentation, and real-time threat detection to protect critical assets. In addition, federal and state mandates on critical infrastructure protection are boosting the adoption of software-defined segmentation solutions.

Europe Operational Technology Network Segmentation Market Insight

The Europe operational technology network segmentation market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by regulatory requirements and the growing need for secure industrial networks. Increasing digitalization in manufacturing, energy, and transportation sectors is fostering adoption. Organizations are deploying micro-segmentation, access controls, and monitoring tools to enhance network resilience and protect industrial control systems.

U.K. Operational Technology Network Segmentation Market Insight

The U.K. operational technology network segmentation market is expected to witness the fastest growth rate from 2026 to 2033, driven by rising industrial cyberattacks and the government’s focus on critical infrastructure protection. Industrial operators and utilities are increasingly implementing zone-based network segmentation and micro-perimeters to mitigate risks. The expansion of smart factories and industrial IoT integration is further stimulating market growth.

Germany Operational Technology Network Segmentation Market Insight

The Germany operational technology network segmentation market is expected to witness the fastest growth rate from 2026 to 2033, fueled by high awareness of industrial cybersecurity and adoption of advanced, sustainable technologies. The country’s strong industrial base and emphasis on innovation promote segmentation deployment across manufacturing, energy, and transportation verticals. Integration of segmentation solutions with IT/OT convergence initiatives enhances overall network security and operational efficiency.

Asia-Pacific Operational Technology Network Segmentation Market Insight

The Asia-Pacific operational technology network segmentation market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid industrialization, smart manufacturing initiatives, and increasing cybersecurity investments in countries such as China, Japan, and India. Government programs promoting digital infrastructure and industrial automation are accelerating adoption. The growing presence of OT security solution providers in APAC is also enhancing affordability and accessibility for industrial operators.

Japan Operational Technology Network Segmentation Market Insight

The Japan operational technology network segmentation market is expected to witness the fastest growth rate from 2026 to 2033 due to high adoption of smart manufacturing, industrial IoT, and a strong focus on operational security. Companies are deploying micro-segmentation and zero-trust frameworks to protect OT networks. Aging infrastructure modernization combined with automation projects further drives market demand.

China Operational Technology Network Segmentation Market Insight

The China operational technology network segmentation market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid industrial growth, widespread digitalization, and rising cybersecurity awareness. Segmentation solutions are increasingly deployed in manufacturing plants, energy grids, and transportation networks. Government initiatives on critical infrastructure protection, combined with the presence of domestic OT security vendors, are key factors supporting market expansion.

Operational Technology Network Segmentation Market Share

The Operational Technology Network Segmentation industry is primarily led by well-established companies, including:

• VMware, Inc (U.S.)

• Honeywell International Inc (U.S.)

• Schneider Electric (France)

• Cisco Systems (U.S.)

• Broadcom, Inc (U.S.)

• AO Kaspersky Lab (Russia)

• General Electric (U.S.)

• Rockwell Automation (U.S.)

• Comodo Security Solutions, Inc (U.S.)

• Tenable, Inc (U.S.)

• Armor Defense Inc (U.S.)

• Torrid Networks (U.S.)

• Fortinet, Inc (U.S.)

• PAS Global LLC (U.S.)

• Palo Alto Networks (U.S.)

• Darktrace (U.K.)

• Forescout Technologies Inc (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.