Global Operational Technology Ot Security Market

Market Size in USD Billion

CAGR :

%

USD

50.29 Billion

USD

127.20 Billion

2024

2032

USD

50.29 Billion

USD

127.20 Billion

2024

2032

| 2025 –2032 | |

| USD 50.29 Billion | |

| USD 127.20 Billion | |

|

|

|

|

Operational Technology (OT) Security Market Size

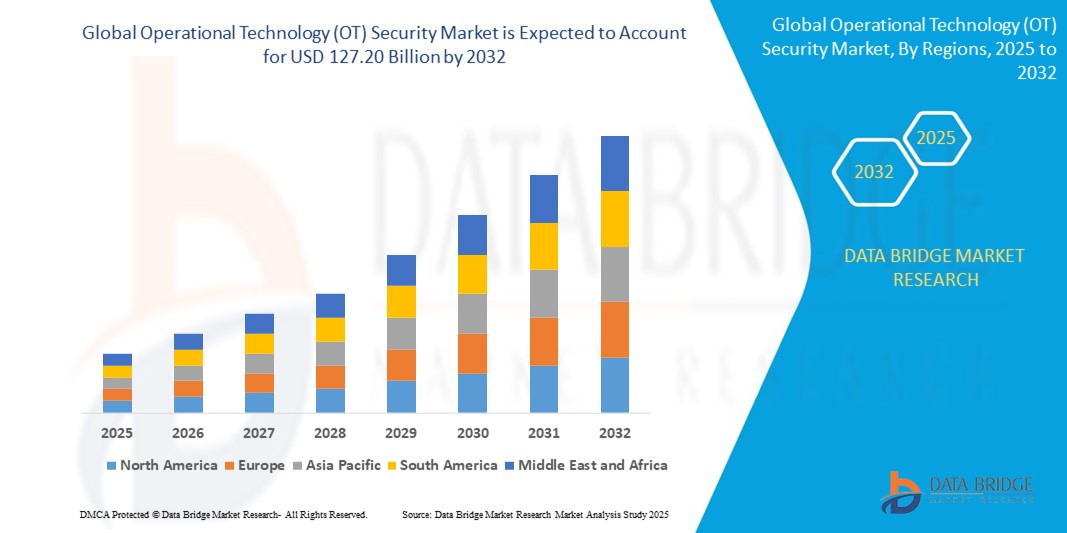

- The global operational technology (OT) security market size was valued at USD 50.29 billion in 2024 and is expected to reach USD 127.20 billion by 2032, at a CAGR of 12.30% during the forecast period

- The market growth is largely fueled by the increasing convergence of IT and OT systems, which expands the attack surface and necessitates robust cybersecurity solutions across industrial environments

- Furthermore, the rise in cyberattacks targeting critical infrastructure—including energy, manufacturing, and utilities—is compelling organizations to invest heavily in OT-specific security frameworks and monitoring tools

Operational Technology (OT) Security Market Analysis

- Operational Technology (OT) security solutions are becoming essential for safeguarding industrial control systems (ICS), SCADA networks, and other critical infrastructure components from escalating cyber threats, ensuring operational continuity and safety

- The growing convergence of IT and OT systems, along with increasing incidents of cyberattacks on critical sectors such as energy, manufacturing, and utilities, is a major factor driving the demand for robust OT cybersecurity frameworks

- North America dominates the OT security market with a revenue share of approximately 38.5% in 2024, backed by early regulatory enforcement, high investment in cybersecurity, and the presence of leading OT security vendors. The U.S. leads within the region due to strong adoption across energy, defense, and smart manufacturing sectors

- Asia-Pacific is expected to be the fastest-growing region, projected to register a CAGR of around 14.8% during the forecast period, driven by rapid industrialization, digital transformation, and increased awareness of infrastructure protection in China, India, and Japan

- The Transportation segment is anticipated to hold the largest market share of about 28.4% in 2024, as increased connectivity in railways, aviation, and logistics drives demand for OT security to protect critical systems from cyber threats and ensure public safety and service continuity

Report Scope and Operational Technology (OT) Security Market Segmentation

|

Attributes |

Operational Technology (OT) Security Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Operational Technology (OT) Security Market Trends

“Advancements in AI-Driven Threat Detection and Response”

- A prominent trend in the global OT security market is the increasing incorporation of artificial intelligence (AI) and machine learning (ML) technologies to enhance threat detection, real-time monitoring, and automated response capabilities. These advanced systems enable faster identification of anomalies and potential cyberattacks within complex operational environments

- For instance, solutions such as Claroty’s AI-powered platform analyze network behavior to detect suspicious activities early and trigger automated containment actions, reducing response times and limiting damage. Similarly, Dragos uses ML algorithms to identify zero-day vulnerabilities and insider threats across industrial control systems

- AI integration in OT security supports predictive maintenance and risk assessment by continuously learning from operational data, thereby improving system resilience and minimizing downtime. This enables organizations to proactively safeguard critical infrastructure while optimizing operational efficiency

- The trend towards centralized AI-driven security platforms allows operators to manage cyber risks across distributed and heterogeneous OT environments, integrating data from endpoints, sensors, and networks into unified dashboards. This comprehensive visibility strengthens situational awareness and facilitates faster decision-making

- Leading vendors such as Siemens and Honeywell are investing heavily in AI-enhanced OT security solutions, offering features like automated threat hunting, behavioral analytics, and adaptive policy enforcement tailored for industrial and critical infrastructure sectors

- The growing demand for AI-enabled OT security is fueled by increasing cyber threats targeting essential industries, regulatory compliance requirements, and the need for scalable, intelligent protection as industrial digitalization and connectivity expand globally

Operational Technology (OT) Security Market Dynamics

Driver

“Increasing Cybersecurity Threats and Industrial Digitalization”

- The rising frequency and sophistication of cyberattacks targeting critical infrastructure and industrial control systems are key drivers boosting demand for advanced OT security solutions globally

- For instance, in March 2024, Dragos launched enhanced threat detection capabilities focusing on ransomware and supply chain attacks specific to operational technology environments, underscoring industry efforts to combat evolving threats

- As industries rapidly adopt digitalization and IoT integration within OT environments, the attack surface expands, creating urgent needs for robust monitoring, network segmentation, and real-time threat response solutions

- Regulatory mandates and compliance requirements from governments and standards organizations are also pushing companies to invest in comprehensive OT security frameworks to safeguard essential services such as energy, manufacturing, and transportation

- The increasing deployment of AI and machine learning in OT security systems enhances automated threat detection and response, supporting the protection of complex industrial networks against both internal and external cyber risks. This combination of rising threats and digital transformation drives sustained growth in the global OT security market

Restraint/Challenge

“Complex Integration and High Implementation Costs”

- The complexity of integrating OT security solutions with legacy industrial systems poses a significant challenge, as many operational environments involve outdated equipment not originally designed for cybersecurity, increasing deployment difficulties

- For instance, industries such as manufacturing and energy often face compatibility issues when trying to implement modern OT security tools alongside existing operational technology, leading to higher integration costs and extended timelines

- In addition, the substantial initial investment required for deploying comprehensive OT security infrastructure—including advanced monitoring, network segmentation, and threat detection systems—can be a barrier for small to medium enterprises and cost-sensitive sectors

- Concerns over potential operational disruptions during implementation and the need for specialized cybersecurity expertise further complicate adoption, limiting widespread market penetration in certain regions or industries

- Addressing these challenges through scalable, interoperable solutions, vendor partnerships for smooth integration, and cost-effective deployment models will be critical to accelerating OT security adoption globally

Operational Technology (OT) Security Market Scope

The market is segmented on the basis of component, deployment, end-use, enterprise size, and service.

• By Component

On the basis of component, the operational technology (OT) security market is segmented into solution and services. The solution segment dominates the largest market revenue share of 58.4% in 2025, driven by the growing need to protect industrial control systems (ICS), supervisory control and data acquisition (SCADA) platforms, and other mission-critical OT environments from increasingly sophisticated cyberattacks. Organizations across sectors such as energy, manufacturing, and transportation are prioritizing standalone and integrated security solutions that ensure operational continuity and reduce vulnerability exposure.

The services segment is anticipated to witness the fastest growth rate of 20.1% from 2025 to 2032, fueled by rising demand for expert-led services including system assessments, continuous monitoring, and incident response. The complexity of OT networks and legacy systems often requires specialized services to implement, configure, and optimize OT security frameworks aligned with both IT and industrial requirements.

• By Deployment

On the basis of deployment, the OT security market is segmented into on-premise, cloud, hybrid, and others. The on-premise segment held the largest market revenue share in 2025, driven by its strong presence in critical infrastructure sectors that prioritize data sovereignty, regulatory compliance, and real-time control over security operations. On-premise deployments remain the preferred option in industries such as oil & gas and utilities, where minimizing latency and maintaining full control over data are essential.

The cloud segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the growing adoption of remote monitoring, centralized threat detection, and scalable security architectures. cloud-based OT security solutions provide real-time visibility into distributed assets and enable automated response mechanisms, supporting digital transformation across industrial environments.

• By End-Use

On the basis of end-use, the market is segmented into power & electrical, mining, transportation, manufacturing, and others. The power & electrical segment accounted for the largest market revenue share in 2025, due to the increasing digitization of energy infrastructure and the sector’s high exposure to cyber threats targeting grid systems, substations, and smart metering. Governments and utilities are investing in robust OT cybersecurity frameworks to prevent disruptions and safeguard national infrastructure.

The transportation segment is anticipated to witness the fastest growth rate, driven by expanding smart mobility networks, connected railways, and intelligent traffic management systems. OT security in this sector ensures safe and uninterrupted operation of transit systems while protecting them from cyber risks such as ransomware and system hijacking.

• By Enterprise Size

On the basis of enterprise size, the market is segmented into SMEs and large enterprises. the large enterprises segment held the dominant market revenue share in 2025, supported by their broader OT asset base, complex network architecture, and higher cybersecurity budgets. These organizations are proactively integrating OT and IT security under a unified strategy to manage operational resilience at scale.

The SMEs segment is expected to experience significant growth from 2025 to 2032, as more small and medium-sized industrial operators adopt managed OT security services and cloud-native solutions. This adoption is further accelerated by government-led cybersecurity awareness initiatives and compliance mandates targeted at smaller firms.

• By Service

On the basis of service, the market is segmented into consulting services, managed security services, integration services, training and education, and support and maintenance. managed security services held the largest market revenue share in 2025, driven by the increasing demand for 24/7 monitoring, threat detection, and incident response tailored for OT environments. These services allow organizations to offload cybersecurity responsibilities to experts while focusing on core operational goals.

Integration services are projected to register the fastest growth rate, as companies seek to integrate advanced security solutions into legacy industrial systems without compromising performance or uptime. Integration plays a critical role in unifying IT and OT cybersecurity layers, thereby enhancing situational awareness and streamlining compliance with global standards like NIST and IEC 62443.

Operational Technology (OT) Security Market Regional Analysis

- North America dominates the OT security market with the largest revenue share of 38.7% in 2024, driven by stringent regulatory frameworks, early adoption of cybersecurity measures, and high investments in critical infrastructure protection

- The U.S. leads the regional market with strong demand across energy, manufacturing, and defense sectors, supported by government initiatives focused on securing operational environments against cyber threats

- This growth is further propelled by a mature cybersecurity ecosystem, presence of key OT security vendors, and increasing awareness of the importance of safeguarding industrial control systems, establishing North America as the forefront region for OT security solutions globally

U.S. Operational Technology (OT) Security Market Insight

The U.S. operational technology (OT) security market captured the largest revenue share of 81% within North America in 2024, driven by rapid adoption of connected devices and the growing trend of home automation. Consumers increasingly prioritize enhancing home security with intelligent, keyless entry systems. The market growth is further supported by rising demand for DIY smart home installations and the popularity of voice-controlled systems integrated with mobile applications. In addition, strong integration with leading smart home platforms such as Amazon Alexa, Google Assistant, and Apple HomeKit significantly fuels the expansion of the operational technology (OT) security industry in the U.S.

Europe Operational Technology (OT) Security Market Insight

The European operational technology (OT) security market is projected to grow at a substantial CAGR during the forecast period, driven by stringent security regulations and rising demand for enhanced security in homes and offices. Increasing urbanization and the growing adoption of connected devices are accelerating operational technology (OT) security usage. European consumers value the convenience and energy efficiency offered by these devices. Significant growth is observed across residential, commercial, and multi-family housing sectors, with operational technology (OT) security is being widely integrated into both new construction and renovation projects.

U.K. Operational Technology (OT) Security Market Insight

The U.K. operational technology (OT) security market is expected to grow at a noteworthy CAGR during the forecast period, driven by increasing home automation trends and the growing demand for enhanced security and convenience. Rising concerns about burglary and safety are prompting homeowners and businesses to adopt keyless entry solutions. In addition, the U.K.’s strong adoption of connected devices, supported by a robust e-commerce and retail infrastructure, continues to fuel market expansion.

Germany Operational Technology (OT) Security Market Insight

The German operational technology (OT) security market is projected to grow at a considerable CAGR during the forecast period, driven by rising awareness of digital security and demand for advanced, eco-friendly solutions. Germany’s robust infrastructure and focus on innovation and sustainability support operational technology (OT) security adoption, especially in residential and commercial sectors. Increasing integration of operational technology (OT) security with home automation systems is notable, with consumers favoring secure, privacy-centric solutions that meet local expectations.

Asia-Pacific Operational Technology (OT) Security Market Insight

The Asia-Pacific operational technology (OT) security market is set to grow at the fastest CAGR of over 24% in 2024, propelled by rapid urbanization, rising disposable incomes, and technological progress in China, Japan, and India. Government initiatives promoting digitalization and smart home adoption further accelerate demand. In addition, APAC’s emergence as a manufacturing hub for operational technology (OT) security components enhances affordability and accessibility, broadening the consumer base across the region.

Japan Operational Technology (OT) Security Market Insight

The Japan operational technology (OT) security market is gaining momentum due to the country’s high-tech culture, rapid urbanization, and strong demand for convenience. Emphasizing security, Japan is witnessing increased adoption of operational technology (OT) security in smart homes and connected buildings. Integration with other IoT devices like security cameras and lighting systems is driving growth. In addition, Japan’s aging population is expected to boost demand for easier-to-use, secure access solutions across residential and commercial sectors.

China Operational Technology (OT) Security Market Insight

The China operational technology (OT) security market accounted for the largest revenue share in Asia Pacific in 2025, driven by the expanding middle class, rapid urbanization, and high technological adoption. As one of the largest markets for smart home devices, operational technology (OT) security are increasingly popular across residential, commercial, and rental properties. The government’s push towards smart cities, availability of affordable operational technology (OT) security options, and strong domestic manufacturers are key factors propelling China’s market growth.

Operational Technology (OT) Security Market Share

The operational technology (OT) security industry is primarily led by well-established companies, including:

- Fortinet Inc. (U.S.)

- Cisco Systems Inc. (U.S.)

- Palo Alto Networks (U.S.)

- Schneider Electric (France)

- Siemens AG (Germany)

- ABB Ltd. (Switzerland)

- Honeywell International Inc. (U.S.)

- Rockwell Automation Inc. (U.S.

- Nozomi Networks (U.S.)

- Darktrace Holdings Limited (U.K.)

- Claroty (U.S.)

- Check Point Software Technologies Ltd. (Israel)

- Kaspersky Lab (Russia)

- Thales Group (France)

- Radiflow (Israel)

Latest Developments in Global Operational Technology (OT) Security Market

- In April 2025, OT Cyber Direct launched a digital marketplace to help small and medium-sized businesses (SMBs) access tested and cost-effective operational technology (OT) security applications. The platform offers a curated selection of cybersecurity solutions, enabling businesses to reduce risks to their industrial networks with ease. It features transparent pricing, installation guides, and vendor partnerships, making OT security more accessible for SMBs

- In March 2025, Armis acquired OTORIO, a leading provider of Operational Technology (OT) and Cyber Physical Systems (CPS) security. This acquisition expands Armis’ capabilities in industrial cybersecurity, integrating OTORIO’s Titan platform into Armis Centrix™ to enhance protection for air-gapped and critical infrastructure environments. The move strengthens Armis’ position in cyber exposure management, offering on-premises solutions for industries like energy, utilities, and manufacturing

- In February 2025, I-TRACING and Bridewell formed a strategic partnership to establish the leading independent European cybersecurity service provider. This alliance combines expertise from France and the UK, creating a cybersecurity powerhouse to protect enterprise and mid-market clients amid rising cyber threats. The partnership is backed by Oakley Capital, Eurazeo, and Sagard NewGen, reinforcing its growth strategy across Europe and the USA

- In January 2025, Dragos Inc. partnered with Yokogawa Electric Corporation to enhance cybersecurity for operational technology (OT) environments. This collaboration integrates Dragos’ OT Cybersecurity Platform with Yokogawa’s CENTUM VP distributed control system (DCS), providing advanced threat detection, response capabilities, and enhanced visibility for industrial networks. The partnership aims to secure critical infrastructure worldwide, ensuring comprehensive OT-native network monitoring for industries like manufacturing and energy

- In November 2024, Zscaler introduced Zero Trust Segmentation, a groundbreaking solution designed to extend secure connectivity to branches, factories, and clouds. This innovation eliminates firewalls, SD-WAN, and VPNs, preventing ransomware spread while simplifying network architecture. By leveraging the Zscaler Zero Trust Exchange platform, businesses can apply customized security policies to protect users, devices, and workloads across distributed environments. The solution enhances cyber resilience, reduces network complexity, and offers a cost-effective approach to modern security challenge

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Operational Technology Ot Security Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Operational Technology Ot Security Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Operational Technology Ot Security Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.