Global Ophthalmic Disposables Market

Market Size in USD Billion

CAGR :

%

USD

2.16 Billion

USD

4.23 Billion

2024

2032

USD

2.16 Billion

USD

4.23 Billion

2024

2032

| 2025 –2032 | |

| USD 2.16 Billion | |

| USD 4.23 Billion | |

|

|

|

|

Ophthalmic Disposables Market Size

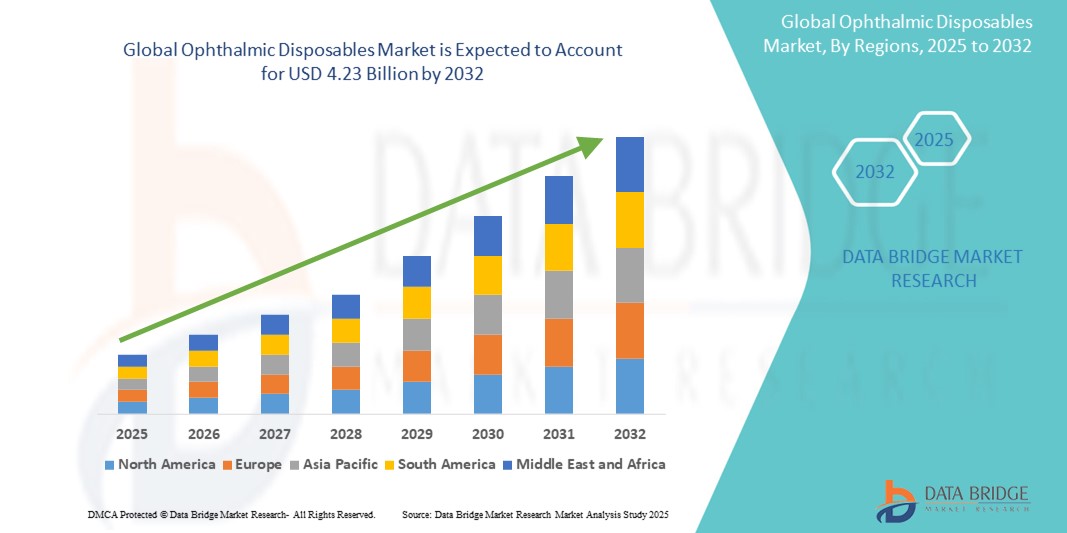

- The global ophthalmic disposables market size was valued at USD 2.16 billion in 2024 and is expected to reach USD 4.23 billion by 2032, at a CAGR of 5.30% during the forecast period

- The market growth is largely driven by the rising incidence of ophthalmic disorders, an increasing number of surgical eye procedures, and the growing adoption of single-use medical products to reduce infection risks in clinical environments

- Furthermore, the demand for sterile, convenient, and cost-effective solutions in ophthalmic care—especially in hospitals, ambulatory surgical centers, and eye clinics—is promoting the widespread use of disposables such as surgical instruments, drapes, viscoelastic devices, and packaging materials

Ophthalmic Disposables Market Analysis

- Ophthalmic disposables, comprising single-use surgical instruments, viscoelastic devices, drapes, and sterile packaging components, are increasingly vital elements of modern ophthalmic care and surgical procedures in both hospital and ambulatory settings due to their enhanced safety, infection control, and compatibility with high-volume surgical environments

- The escalating demand for ophthalmic disposables is primarily fueled by the growing prevalence of eye diseases, rising volumes of cataract and refractive surgeries, and a strong emphasis on infection prevention and compliance with global sterilization standards across healthcare systems

- North America dominates the ophthalmic disposables market with the largest revenue share of 38.5% in 2024, characterized by a high rate of ophthalmic surgeries, robust healthcare infrastructure, and the presence of key global manufacturers

- Asia-Pacific is expected to be the fastest growing region in the ophthalmic disposables market during the forecast period due to rapid urbanization, increasing healthcare investments, and a rising elderly population, which is contributing to a higher incidence of vision-related conditions requiring surgical intervention

- Surgical Instruments segment dominates the ophthalmic disposables market with a market share of 44.5% in 2024, driven by its established necessity in routine and complex ophthalmic procedures and the increasing shift toward single-use tools to enhance surgical efficiency and minimize contamination risks

Report Scope and Ophthalmic Disposables Market Segmentation

|

Attributes |

Ophthalmic Disposables Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ophthalmic Disposables Market Trends

“Advancements in Sterile, Single-Use Solutions Enhancing Surgical Safety and Efficiency”

- A significant and accelerating trend in the global ophthalmic disposables market is the growing adoption of single-use sterile instruments and consumables that minimize infection risks and improve surgical outcomes in both hospital and outpatient settings. This shift is driven by increasing regulatory standards and heightened awareness of patient safety protocols

- For instance, disposable forceps, blades, and viscoelastic devices are now routinely used in cataract and retinal surgeries to reduce cross-contamination and streamline surgical workflows. Similarly, sterile packaging innovations ensure product integrity and ease of use in fast-paced clinical environments

- Technological advancements in materials have enhanced the safety, durability, and biocompatibility of ophthalmic disposables, enabling better patient comfort and surgical precision. Manufacturers are developing specialized plastics and coatings tailored for sensitive ocular procedures

- The preference for single-use disposables also supports higher surgical throughput and operational efficiency, which is critical for ambulatory surgical centers and high-volume ophthalmic clinics. This trend is reshaping how eye care providers manage infection control and procedural logistics

- Leading players such as Alcon and Bausch + Lomb are expanding their offerings of disposable ophthalmic devices and procedure-specific kits, reflecting the growing demand for convenient, ready-to-use solutions

- The rising demand for ophthalmic disposables is evident globally, with strong growth in developed markets adhering to strict hygiene standards and emerging markets expanding access to eye care surgeries

Ophthalmic Disposables Market Dynamics

Driver

“Increasing Demand Due to Rising Prevalence of Eye Disorders and Growing Surgical Procedures”

- The rising incidence of eye disorders such as cataracts, glaucoma, diabetic retinopathy, and refractive errors is a significant driver for the growing demand for ophthalmic disposables worldwide

- For instance, in 2024, several leading ophthalmic device manufacturers introduced advanced single-use surgical instruments and viscoelastic devices tailored to improve safety and surgical outcomes in high-volume cataract surgeries. Such innovations by key players are expected to fuel market growth during the forecast period

- As awareness of vision health increases and access to quality eye care improves globally, there is a growing preference for disposable products that reduce infection risks and enhance procedural efficiency compared to reusable alternatives

- Furthermore, the expansion of outpatient ophthalmic clinics and ambulatory surgical centers, combined with the rising number of minimally invasive surgeries, is making disposable surgical tools and consumables essential components of ophthalmic care delivery

- The convenience and assurance provided by sterile, single-use disposables in preventing cross-contamination, reducing sterilization time, and supporting faster surgical turnaround are key factors propelling their adoption across hospitals, clinics, and surgical centers. Increasing government initiatives and insurance coverage for eye surgeries further boost demand in both developed and emerging markets

Restraint/Challenge

“Concerns Regarding High Costs and Regulatory Compliance Challenges”

- The relatively high cost of advanced single-use ophthalmic disposables, including specialized surgical instruments and viscoelastic devices, poses a significant challenge to broader market adoption, especially in price-sensitive and emerging markets

- For instance, many healthcare providers in developing regions face budget constraints that limit their ability to transition fully from reusable to disposable instruments, slowing market penetration despite the known benefits of disposables in infection control

- In addition, stringent and varying regulatory requirements across different countries increase the complexity and cost of bringing new ophthalmic disposable products to market. Manufacturers must navigate diverse approval processes related to sterilization standards, biocompatibility, and packaging integrity, which can delay product launches and add to overall expenses

- While innovations aimed at cost reduction and improved manufacturing efficiency are underway, the premium pricing of high-quality ophthalmic disposables compared to traditional reusable alternatives continues to be a barrier for some providers

- Overcoming these challenges through increased focus on cost-effective product development, harmonization of regulatory pathways, and education of healthcare providers on the long-term economic and clinical benefits of disposables will be vital for sustained growth in the ophthalmic disposables market

Ophthalmic Disposables Market Scope

The market is segmented on the basis of product type, material, packaging type, application, and end user,

- By Product Type

On the basis of product type, the global ophthalmic disposables market is segmented into surgical instruments, viscoelastic devices (OVDs), and consumables. The surgical instruments segment dominates the market with the largest revenue share of 44.5% in 2024, driven by the critical role of single-use instruments such as forceps, scissors, and blades in ophthalmic surgeries, which reduce infection risks and improve procedural efficiency.

The consumables segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by rising infection control measures and increasing demand for disposable syringes, needles, and other consumables in ophthalmic procedures across hospitals and clinics.

- By Material

On the basis of material, the market is segmented into plastic, glass, and others. The plastic segment held the largest market share in 2024 due to its cost-effectiveness, versatility, and widespread use in manufacturing disposable ophthalmic devices and packaging.

The others segment, which includes specialty materials such as silicone and metal alloys, is expected to register the fastest CAGR during the forecast period, supported by advancements in biocompatible materials enhancing the performance and safety of surgical instruments.

- By Packaging Type

On the basis of packaging type, the market is segmented into single-dose and multi-dose packaging. The single-dose packaging segment dominates the market with the highest revenue share in 2024, favored for minimizing contamination risk and preserving drug efficacy, especially in eye drops and injectable formulations.

The multi-dose packaging segment is projected to witness the fastest growth from 2025 to 2032, driven by innovations in preservative-free multi-dose bottles and increasing demand for convenient, cost-effective packaging solutions in chronic ophthalmic treatments.

- By Application

On the basis of application, the market is segmented into eye drops, gels & ointments, and Anti-VEGF treatments. The eye drops segment holds the largest market revenue share in 2024, owing to its extensive use in managing common ocular diseases such as glaucoma and dry eye.

The Anti-VEGF segment is expected to witness the fastest growth rate over the forecast period, driven by rising prevalence of retinal diseases such as age-related macular degeneration (AMD) and diabetic retinopathy, boosting demand for injectable disposables.

- By End User

On the basis of end user, the market is segmented into hospitals, ophthalmic clinics, and ambulatory surgical centers (ASCs). Hospitals dominate the market with the largest revenue share in 2024 due to their high surgical volumes and advanced infrastructure.

The ambulatory surgical centers segment is anticipated to register the fastest growth from 2025 to 2032, supported by the increasing preference for minimally invasive outpatient surgeries and the demand for cost-effective, disposable ophthalmic products in these settings.

Ophthalmic Disposables Market Regional Analysis

- North America dominates the ophthalmic disposables market with the largest revenue share of 38.5% in 2024, driven by a high rate of ophthalmic surgeries, robust healthcare infrastructure, and the presence of key global manufacturers

- Healthcare providers and patients in the region highly value the availability of innovative disposable ophthalmic products that ensure sterility, reduce infection risks, and improve surgical outcomes

- This widespread adoption is further supported by rising awareness about eye health, strong government initiatives for vision care, and a well-established network of hospitals and specialized ophthalmic clinics, positioning North America as a key revenue contributor in both surgical and outpatient ophthalmic care segments

U.S. Ophthalmic Disposables Market Insight

The U.S. holds the largest share within the North American ophthalmic disposables market, accounting for 69.3% of the region’s revenue in 2024. This dominance is fueled by the country’s advanced healthcare infrastructure, high adoption rates of cutting-edge ophthalmic surgical procedures, and strong patient awareness about eye health. The increasing prevalence of chronic eye diseases such as cataracts, glaucoma, and diabetic retinopathy drives demand for disposable surgical instruments, viscoelastic devices, and consumables to ensure sterile and safe treatments.

Europe Ophthalmic Disposables Market Insight

The Europe ophthalmic disposables market is projected to grow steadily during the forecast period, supported by stringent healthcare regulations emphasizing infection control and patient safety. Rising urbanization, increasing geriatric population, and demand for technologically advanced ophthalmic treatments contribute to the adoption of disposable instruments and consumables. The market growth is also driven by expanding healthcare infrastructure and increased awareness of eye care across countries such as Germany, France, and the U.K.

U.K. Ophthalmic Disposables Market Insight

The U.K. market is expected to register a steady CAGR, fueled by growing investments in healthcare infrastructure and rising incidence of eye diseases. Increasing preference for outpatient ophthalmic procedures and disposable products to reduce infection risks in clinical settings are key growth drivers. Enhanced patient awareness and government support for vision care are also stimulating demand for ophthalmic disposables in the region

Germany Ophthalmic Disposables Market Insight

The Germany is anticipated to witness robust growth, supported by its well-established healthcare system, high standards for medical device quality, and strong focus on innovation in ophthalmic treatments. Increasing demand for disposable surgical instruments and consumables in hospitals and specialized eye clinics is prominent, alongside a growing geriatric population requiring advanced eye care solutions. Sustainability concerns are prompting manufacturers to develop eco-friendly disposable products, aligning with Germany’s environmental policies.

Asia-Pacific Ophthalmic Disposables Market Insight

The Asia-Pacific ophthalmic disposables market is poised to register the fastest CAGR from 2025 to 2032, driven by rising prevalence of eye disorders, expanding healthcare infrastructure, and growing affordability of advanced ophthalmic procedures in countries such as China, India, and Japan. Government initiatives focusing on vision health, increasing number of ophthalmic clinics, and improving healthcare access in rural areas are accelerating market adoption. The region’s expanding middle class and rising disposable incomes further contribute to the increasing demand for high-quality, single-use ophthalmic products.

Japan Ophthalmic Disposables Market Insight

The Japan’s market is gaining traction due to rapid technological advancements in medical devices and a high prevalence of age-related eye conditions such as cataracts and glaucoma. The country’s aging population drives demand for disposable ophthalmic instruments and consumables that enhance surgical outcomes and reduce infection risks. Integration of innovative ophthalmic products within hospital and outpatient care settings supports steady market growth.

India Ophthalmic Disposables Market Insight

The India accounted for the largest revenue share in the Asia-Pacific region in 2024, attributed to its rapidly growing population, increasing awareness of eye health, and expansion of private healthcare facilities. The government’s push towards improving vision care infrastructure, along with the rise in outpatient ophthalmic surgeries, has boosted the demand for disposable surgical instruments and consumables. Affordability and accessibility of ophthalmic disposables, coupled with local manufacturing capabilities, are key factors propelling growth in India’s market.

Ophthalmic Disposables Market Share

The ophthalmic disposables industry is primarily led by well-established companies, including:

- Alcon Inc. (Switzerland)

- Bausch + Lomb (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Carl Zeiss AG (Germany)

- HOYA Corporation (Japan)

- Nidek Co., Ltd. (Japan)

- Rayner Group (U.K.)

- OcuSoft (U.S.)

- Abbvie Inc. (U.S.)

- CooperCompanies (U.S.)

- STAAR SURGICAL (U.S.)

- Aurolab (India)

- Oasis Medical, Inc. (U.S.)

- Glaukos Corporation (U.S.)

- Hanita Lenses Ltd (Israel)

- Appasamy Associates Private Limited (India)

- Lenstec, Inc. (U.S.)

- Santen Pharmaceutical Co., Ltd. (Japan)

- Ziemer Ophthalmic Systems AG (Switzerland)

- Rumex International Co. (U.S.)

Latest Developments in Global Ophthalmic Disposables Market

- In April 2025, Alcon Research, LLC. received U.S. FDA approval for its UNIPURE C3F8 Ophthalmic Gas, designed for injection into the eye to treat uncomplicated retinal detachment. This product, to be commercially available in 2025, utilizes Alcon's UNIFEYE or UNIPEXY Gas Delivery Systems. This highlights advancements in specific, targeted disposable solutions for retinal conditions

- In June 2024, C3 Med-Tech received Rs. 2 crores (USD 0.24 million) from Industrial Metal Powers India Pvt Ltd. to develop AI-enabled portable ophthalmic devices for telemedicine. This initiative aims to enhance eye checkups and real-time disease detection, emphasizing the increasing integration of AI and disposable components in diagnostic tools for remote care

- In June 2023, Bausch + Lomb Launches INFUSE Multifocal Daily Disposable Contact Lenses: Bausch + Lomb Corporation launched its INFUSE Multifocal silicone hydrogel (SiHy) daily disposable contact lenses in the U.S. These lenses are designed to offer comfort and clear vision for patients with presbyopia, indicating a continued push for advanced daily disposable contact lens solutions

- In August 2023, Johnson & Johnson Vision presented its Elita laser correction device in the U.S. launch. This platform is described as revolutionary for correcting short-sightedness through a minimally invasive laser-assisted lens removal procedure. While a device, it likely leverages various disposable components for sterility and precision during surgery.

- In April 2023, Canadian eye health company Bausch + Lomb announced the launch of these two products in the U.S.. StableVisc and TotalVisc provide eye surgeons with new options for dual-action protection during cataract surgery, indicating ongoing innovation in disposable surgical aids

- In January 2022, Alcon introduced its Dailies Total1 for Astigmatism, the company's third disposable water gradient contact lens for U.S. patients. This further expands the range of daily disposable options catering to specific vision correction needs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.