Global Ophthalmic Drugs Market

Market Size in USD Billion

CAGR :

%

USD

32.58 Billion

USD

57.25 Billion

2024

2032

USD

32.58 Billion

USD

57.25 Billion

2024

2032

| 2025 –2032 | |

| USD 32.58 Billion | |

| USD 57.25 Billion | |

|

|

|

|

Ophthalmic Drugs Market Size

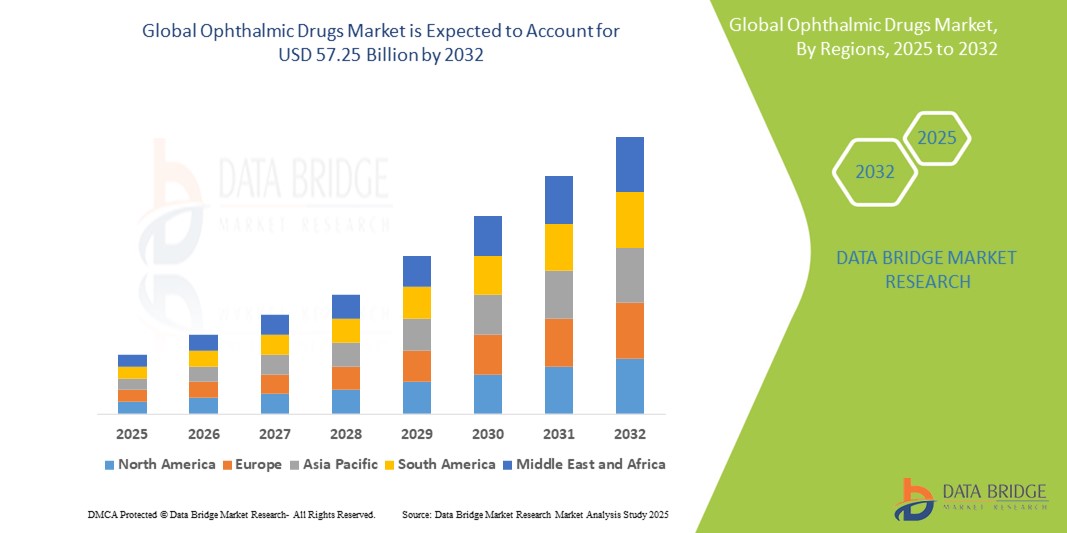

- The global ophthalmic drugs market size was valued at USD 32.58 billion in 2024 and is expected to reach USD 57.25 billion by 2032, at a CAGR of 7.30% during the forecast period

- The market growth is largely fueled by the growing adoption of advanced ocular therapies and technological innovations in drug delivery systems, leading to enhanced treatment efficacy for various eye disorders in both developed and developing regions

- Furthermore, rising consumer demand for safe, effective, and patient-compliant ophthalmic solutions is establishing ophthalmic drugs as the primary choice for managing conditions such as glaucoma, dry eye disease, and macular degeneration. These converging factors are accelerating the uptake of ophthalmic drug solutions, thereby significantly boosting the industry's growth

Ophthalmic Drugs Market Analysis

- Ophthalmic drugs, used to treat eye conditions such as glaucoma, dry eye disease, conjunctivitis, and macular degeneration, are increasingly vital components of modern eye care due to their effectiveness, ease of administration, and targeted drug delivery methods in both hospital and homecare settings

- The escalating demand for ophthalmic drugs is primarily fueled by the rising prevalence of eye disorders, aging populations, increased screen time leading to digital eye strain, and technological advancements in ophthalmic formulations and delivery systems

- North America dominated the ophthalmic drugs market with the largest revenue share of 41.8% in 2024, characterized by high healthcare spending, advanced diagnostic infrastructure, and the strong presence of key pharmaceutical players

- Asia-Pacific is expected to be the fastest-growing region in the ophthalmic drugs market during the forecast period with a CAGR of 7.6%, driven by a rising elderly population, increasing urbanization, greater access to healthcare, and the growing burden of diabetes-related eye disorders in countries such as China and India

- Anti-glaucoma drugs dominated the ophthalmic drugs market with a market share of 38.9% in 2024, driven by the high global incidence of glaucoma, especially among the aging population, and the availability of multiple effective drug classes such as prostaglandin analogs and beta-blockers. Combination therapies and preservative-free formulations are further enhancing segment growth

Report Scope and Ophthalmic Drugs Market Segmentation

|

Attributes |

Ophthalmic Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ophthalmic Drugs Market Trends

“Advancement in Personalized and Smart Ophthalmic Treatments”

- A significant and accelerating trend in the global ophthalmic drugs market is the evolution of personalized treatment regimens and the adoption of digital therapeutics and connected healthcare ecosystems, enhancing patient monitoring and disease management

- For instance, companies are now integrating smart drug delivery systems, such as digital eye drop dispensers and wearable sensors, to improve dosing accuracy and adherence in treating chronic eye conditions such as glaucoma and dry eye syndrome. These tools notify users of missed doses and track administration times

- Digital platforms also enable ophthalmologists to remotely monitor patient progress, adjust treatment plans in real time, and receive alerts on adverse effects, enhancing therapeutic outcomes and reducing clinic visits

- Technological innovations are also helping optimize dosage delivery through sustained-release formulations, ocular implants, and microdosing devices, offering more effective and longer-lasting treatments with fewer side effects

- This trend toward intelligent and customized ophthalmic therapies is reshaping patient care and setting new standards in ophthalmology. As a result, pharmaceutical companies and med-tech firms are collaborating to develop smarter, patient-centric drug solutions that cater to a growing population of tech-savvy users

- The demand for digitally enhanced ophthalmic treatments is expanding rapidly, especially in developed markets, as both healthcare providers and patients seek efficient, personalized, and outcomes-driven care for eye disorders

Ophthalmic Drugs Market Dynamics

Driver

“Growing Need Due to Increasing Prevalence of Eye Disorders and Aging Population”

- The rising global prevalence of eye-related conditions such as glaucoma, age-related macular degeneration (AMD), diabetic retinopathy, and dry eye syndrome is significantly contributing to the growth of the Ophthalmic Drugs market. With a growing geriatric population and increasing cases of chronic diseases such as diabetes and hypertension, the demand for effective ophthalmic therapies continues to escalate

- For instance, according to the World Health Organization, at least 2.2 billion people globally suffer from vision impairment or blindness, and a large proportion of these cases are either preventable or treatable with proper pharmaceutical intervention. This drives a substantial need for more advanced and accessible eye care solutions

- In addition, increasing awareness about early diagnosis and treatment of ocular conditions is leading to higher rates of patient visits to eye care professionals, further boosting demand for prescription and over-the-counter ophthalmic drugs

- Technological advancements in drug formulations—such as sustained-release drops, ocular inserts, and combination therapies—are improving patient compliance and outcomes, thereby enhancing market appeal

- Pharmaceutical companies are also focusing on personalized medicine approaches, targeting specific genetic markers or disease mechanisms, which is expected to expand treatment options and market size over the forecast period

Restraint/Challenge

“Stringent Regulatory Requirements and High Development Costs”

- The ophthalmic drugs market faces significant challenges in the form of stringent regulatory processes and high research and development (R&D) costs. Bringing a new ophthalmic drug to market requires extensive clinical trials to ensure safety and efficacy, which can delay market entry and increase financial risk

- For instance, ophthalmic formulations must meet strict standards for sterility, particle size, and ocular tolerability, which adds layers of complexity to the manufacturing process. These stringent requirements often result in longer approval timelines and increased overhead costs for drug developers

- Moreover, small and mid-sized pharmaceutical firms may struggle to compete with major players due to the capital-intensive nature of clinical development, regulatory compliance, and product commercialization

- Patent expirations of blockbuster drugs also introduce generic competition, potentially reducing profit margins and market share for innovator companies

- To overcome these challenges, key players are increasingly engaging in strategic collaborations, licensing agreements, and investment in advanced drug delivery technologies that offer differentiation and value-based care. Addressing these regulatory and economic barriers is essential to ensuring a sustainable and competitive Ophthalmic Drugs market landscape

Ophthalmic Drugs Market Scope

The market is segmented on the basis of drugs, disease, dosage form, route of administration, product type, product, end-users, and distribution channel.

• By Drugs

On the basis of drugs, the ophthalmic drugs market is segmented into anti-inflammatory, anti-infective, anti-glaucoma, anti-allergy, anti-vascular endothelial growth factor and others. Anti-glaucoma drugs dominated the market with a market share of 38.9% in 2024, driven by the high global incidence of glaucoma, especially among the aging population, and the availability of multiple effective drug classes such as prostaglandin analogs and beta-blockers. Combination therapies and preservative-free formulations are further enhancing segment growth.

The anti-vascular endothelial growth factor segment is expected to witness the fastest CAGR of 8.4% from 2025 to 2032, due to its growing use in treating retinal disorders such as age-related macular degeneration and diabetic retinopathy.

• By Disease

On the basis of disease, the ophthalmic drugs market is segmented into dry eye, allergies, glaucoma, eye infection, retinal disorders, uveitis, and others. The glaucoma segment held the largest market share in 2024, accounting for 26.3% of global revenue, owing to the increasing number of glaucoma cases and the need for long-term pharmacological therapy.

The retinal disorders segment is projected to grow at the fastest CAGR of 9.1% during 2025–2032, fueled by the rising aging population and incidence of diabetes-related retinal issues.

• By Dosage Form

On the basis of dosage form, the ophthalmic drugs market is segmented into gels, eye solutions and suspensions, capsules and tablets, eye drops, and ointments. The eye drops segment dominated the market with a share of 44.5% in 2024, due to their ease of application, wide availability, and rapid onset of action in treating a variety of ocular conditions.

The eye solutions and suspensions segment is expected to grow at the fastest CAGR of 7.8% from 2025 to 2032, owing to technological advancements in formulation stability and bioavailability.

• By Route of Administration

On the basis of route of administration, the ophthalmic drugs market is segmented into topical, local ocular, and systemic. The Topical segment held the largest market revenue share in 2024, attributed to its non-invasive nature and preference for localized treatment with minimal side effects.

The local ocular route is expected to record the fastest growth from 2025 to 2032, driven by advancements in intraocular implants and targeted drug delivery technologies.

• By Product Type

On the basis of product type, the ophthalmic drugs market is segmented into prescription drugs and OTC. The prescription drugs segment dominated the market in 2024, accounting for a market share of 67.1%, owing to the need for specialized drugs for chronic and severe eye conditions.

The OTC segment is poised to grow rapidly from 2025 to 2032, due to increased self-medication practices and awareness of mild eye conditions such as dryness and allergies.

• By Product

On the basis of product, the ophthalmic drugs market is segmented into branded drugs and generic drugs. Branded drugs held a major share of 59.4% in 2024, driven by brand loyalty, extensive marketing, and ongoing innovation by pharmaceutical giants.

Generic drugs, are anticipated to witness faster growth from 2025 to 2032, due to their affordability and expanding availability, especially in developing markets.

• By End-Users

On the basis of end-users, the ophthalmic drugs market is segmented into hospitals, specialty clinics, and others. The hospitals segment led the market with the largest share of 48.2% in 2024, driven by the high patient footfall and access to advanced ophthalmic care.

The specialty clinics segment is expected to grow at the highest CAGR over the forecast period, due to their focus on personalized eye treatments and faster service.

• By Distribution Channel

On the basis of distribution channel, the ophthalmic drugs market is segmented into direct and indirect. The indirect segment, dominated the market in 2024, due to the convenience of purchasing and wider accessibility.

The direct segment is expected to grow steadily from 2025 to 2032, especially for hospital procurement and institutional sales where bulk purchasing and negotiated pricing are preferred.

Ophthalmic Drugs Market Regional Analysis

- North America dominated the ophthalmic drugs market with the largest revenue share of 41.8% in 2024, driven by the rising prevalence of eye-related conditions such as glaucoma, dry eye syndrome, and age-related macular degeneration, as well as strong access to advanced healthcare infrastructure

- Patients in the region benefit from widespread insurance coverage, early diagnosis, and the availability of both branded and generic ophthalmic medications, leading to consistent and high demand across hospitals, clinics, and retail pharmacies

- In addition, the strong presence of key pharmaceutical companies, coupled with ongoing research and innovation in ophthalmic drug development, supports market growth. Increased awareness of ocular health and a growing aging population further strengthen North America's leadership in the ophthalmic drugs industry

U.S. Ophthalmic Drugs Market Insight

The U.S. ophthalmic drugs market captured the largest revenue share of 81.2% in 2024 within North America, driven by the rising prevalence of eye disorders such as glaucoma, dry eye syndrome, and age-related macular degeneration. The market benefits from strong healthcare infrastructure, advanced diagnostic capabilities, and the availability of both branded and generic ophthalmic medications. In addition, high healthcare expenditure, a rapidly aging population, and robust investment in R&D by key pharmaceutical companies continue to propel market growth. Prescription drug accessibility through retail pharmacies and the expansion of telemedicine platforms are also contributing to higher treatment adherence in the country.

Europe Ophthalmic Drugs Market Insight

The Europe ophthalmic drugs accounted for 29.6% of the global ophthalmic drugs market revenue in 2024, fueled by an increase in the aging population and heightened awareness about early diagnosis and treatment of eye diseases. Stringent healthcare regulations and rising healthcare spending across countries such as Germany, France, and the U.K. support the adoption of advanced ophthalmic therapies. The demand for anti-inflammatory and anti-glaucoma drugs is particularly high due to the increasing incidence of chronic eye conditions. In addition, growing investment in ophthalmology research and improved access to specialized eye care services are boosting the European market.

U.K. Ophthalmic Drugs Market Insight

The U.K. ophthalmic drugs captured 20.8% of the European ophthalmic drugs market share in 2024, driven by advancements in ocular drug delivery systems and increased public funding for eye care. A rising elderly population and growing prevalence of glaucoma and cataracts are contributing to market expansion. NHS initiatives to reduce preventable blindness and enhance access to ophthalmic medications through primary care are expected to further drive demand. Furthermore, the country’s robust pharmaceutical sector and ongoing clinical trials in ocular therapies support a strong pipeline of future products.

Germany Ophthalmic Drugs Market Insight

The Germany ophthalmic drugs commanded the largest share within Europe at 26.4% in 2024, supported by its well-established healthcare infrastructure and proactive approach toward early intervention in eye diseases. Germany is a leader in pharmaceutical innovation, and local manufacturers are investing in developing targeted ophthalmic therapies. The market also benefits from comprehensive insurance coverage for eye treatments and the widespread availability of prescription drugs for chronic ocular conditions. Demand is particularly strong for anti-VEGF agents used in retinal disorder treatments.

Asia-Pacific Ophthalmic Drugs Market Insight

The Asia-Pacific ophthalmic drugs market contributed 22.1% to global revenue in 2024 and is poised to grow at the fastest CAGR of 7.6% from 2025 to 2032, owing to rising disposable incomes, increasing awareness of eye health, and rapid urbanization in countries such as China, Japan, and India. Government-led initiatives promoting universal healthcare and early screening for eye disorders are further driving demand. The growing incidence of diabetes and hypertension—key risk factors for eye conditions—has also contributed to the rising need for effective ophthalmic treatments. The availability of low-cost generic drugs and expansion of retail pharmacy networks are making eye medications more accessible to a broader population base.

Japan Ophthalmic Drugs Market Insight

The Japan ophthalmic drugs held 18.3% of the Asia-Pacific ophthalmic drugs market in 2024, fueled by its technologically advanced healthcare system and the increasing prevalence of age-related eye conditions. With one of the world’s oldest populations, the demand for effective treatments for conditions such as macular degeneration and dry eye is rising. Japan is also a major hub for ophthalmic clinical research, and domestic companies are actively developing new drugs and therapies. Integration of teleophthalmology and AI-based diagnostics in routine care is further improving treatment outcomes and boosting the market.

China Ophthalmic Drugs Market Insight

The China ophthalmic drugs dominated the Asia-Pacific market with a 45.2% share in 2024, driven by its large population, rising incidence of myopia and diabetic retinopathy, and increasing healthcare expenditure. China is rapidly adopting advanced pharmaceutical manufacturing and has become a key market for both international and local ophthalmic drug makers. The expansion of public healthcare insurance and government investments in eye health awareness campaigns are accelerating the market. Additionally, the rise of e-pharmacies and digital health platforms is improving medication accessibility in rural and urban areas alike.

Ophthalmic Drugs Market Share

The ophthalmic drugs industry is primarily led by well-established companies, including:

- Akorn Operating Company LLC. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Mitotech Ltd (Germany)

- AbbVie Inc. (U.S.)

- Santen Pharmaceutical Co., Ltd. (Japan)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Bausch Health Companies Inc. (Canada)

- AERIE PHARMACEUTICALS, INC. (U.S.)

- Novartis AG (Switzerland)

- Merck & Co. Inc. (U.S.)

- Bayer AG (Germany)

- F. Hoffmann-La Roche Ltd (Switzerland)

Latest Developments in Global Ophthalmic Drugs Market

- In August 2023, Iveric Bio (now part of Astellas Pharma Inc.) received FDA approval for IZERVAY (avacincaptad pegol intravitreal solution) for the treatment of geographic atrophy (GA) secondary to age-related macular degeneration (AMD). This approval marked a significant milestone, as IZERVAY is the only approved GA treatment demonstrated to slow GA progression by up to 35% in the first year of treatment across two Phase 3 clinical trials. This development provides a much-needed therapeutic option for a leading cause of irreversible vision loss

- In February 2023, Apellis Pharmaceuticals received FDA approval for SYFOVRE (pegcetacoplan injection), also for the treatment of geographic atrophy (GA) secondary to AMD. This made SYFOVRE the first-ever FDA-approved treatment for GA. Clinical trials showed that SYFOVRE could slow the progression of GA by 14% to 20%. This approval created a new class of treatments for a previously untreatable condition, addressing a significant unmet medical need for millions of patients

- In May 2023, Bausch + Lomb and Novaliq GmbH announced the FDA approval of MIEBO (perfluorohexyloctane ophthalmic solution) for the treatment of the signs and symptoms of dry eye disease (DED). MIEBO is notable as the first and only FDA-approved prescription eye drop that directly targets tear evaporation, which is a major contributor to DED. This approval introduces a novel mechanism of action to the dry eye market, which is experiencing significant growth

- In July 2023, Tarsus Pharmaceuticals, Inc. received FDA approval for XDEMVY (lotilaner ophthalmic solution) 0.25% for the treatment of Demodex blepharitis. This marked the first and only FDA-approved treatment specifically for this common eyelid inflammation caused by Demodex mites. The approval was based on clinical trials where patients treated with XDEMVY showed significant improvement in eyelid collarettes (a key sign of Demodex infestation)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.