Global Ophthalmic Suspension Market

Market Size in USD Billion

CAGR :

%

USD

4.67 Billion

USD

8.51 Billion

2025

2033

USD

4.67 Billion

USD

8.51 Billion

2025

2033

| 2026 –2033 | |

| USD 4.67 Billion | |

| USD 8.51 Billion | |

|

|

|

|

Ophthalmic Suspension Market Size

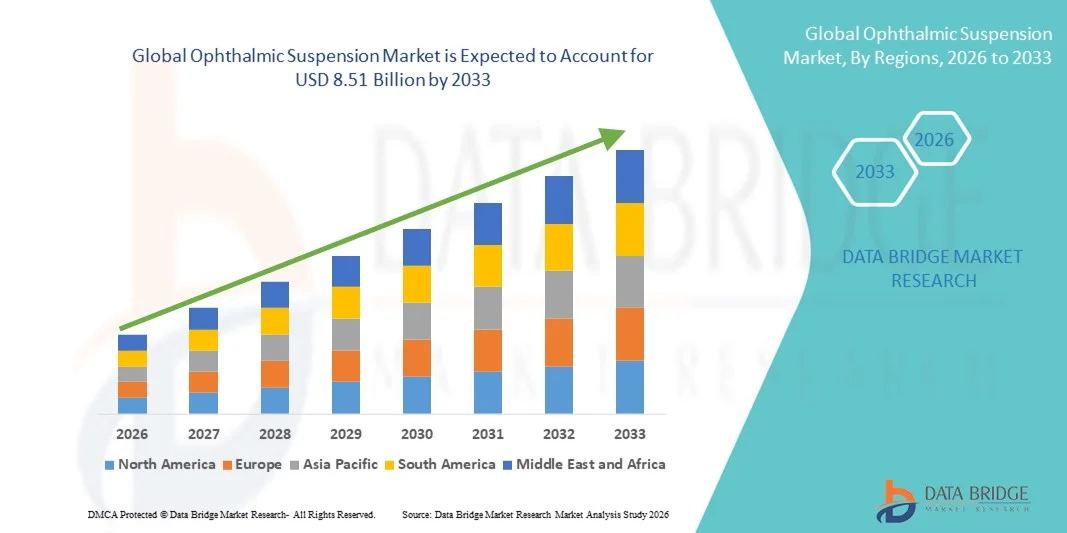

- The global ophthalmic suspension market size was valued at USD 4.67 billion in 2025 and is expected to reach USD 8.51 billion by 2033, at a CAGR of 7.80% during the forecast period

- The market growth is largely driven by increasing prevalence of ocular disorders, rising geriatric population, and expanding awareness about eye health, which are fueling demand for effective ophthalmic formulations

- Furthermore, advancements in drug delivery systems, combined with growing preference for patient-friendly and convenient ophthalmic treatments, are positioning ophthalmic suspensions as a preferred choice for both acute and chronic eye conditions. These factors are collectively accelerating the adoption of ophthalmic suspension products, thereby significantly boosting the market's growth

Ophthalmic Suspension Market Analysis

- Ophthalmic suspensions, offering liquid formulations for delivering drugs directly to the eye, are increasingly vital in treating both acute and chronic ocular conditions in patients across all age groups due to their enhanced bioavailability, targeted delivery, and ease of administration

- The escalating demand for ophthalmic suspensions is primarily fueled by the rising prevalence of eye disorders such as bacterial infections, glaucoma, and retinal disorders, growing geriatric population, and increasing awareness about eye health and preventive care

- North America dominated the ophthalmic suspension market with the largest revenue share of 40.9% in 2025, characterized by a strong healthcare infrastructure, high adoption of advanced eye care treatments, and a robust presence of leading pharmaceutical companies, with the U.S. witnessing substantial growth in prescription and OTC ophthalmic suspensions, driven by innovations in drug formulations and patient-centric delivery systems

- Asia-Pacific is expected to be the fastest growing region in the ophthalmic suspension market during the forecast period due to increasing prevalence of eye disorders, expanding healthcare facilities, and rising disposable incomes, particularly in countries such as China and India

- Antibiotic segment dominated the ophthalmic suspension market with a market share of 41.7% in 2025, driven by its established efficacy in treating bacterial eye infections and widespread physician preference for infection management

Report Scope and Ophthalmic Suspension Market Segmentation

|

Attributes |

Ophthalmic Suspension Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Ophthalmic Suspension Market Trends

Innovative Drug Delivery Systems and Patient-Centric Formulations

- A significant and accelerating trend in the global ophthalmic suspension market is the development of advanced drug delivery systems, including nanoparticle-based and mucoadhesive suspensions, enhancing therapeutic efficacy and patient compliance

- For instance, preservative-free ophthalmic suspensions are being designed to reduce ocular irritation while maintaining stability, offering safer long-term use for sensitive patients

- Formulation advancements enable sustained drug release, reduced dosing frequency, and improved ocular bioavailability, addressing patient convenience and adherence challenges

- The integration of ophthalmic suspensions with multi-therapy and combination treatments allows simultaneous management of multiple eye conditions, simplifying treatment regimens

- This trend towards patient-friendly, highly effective, and targeted ophthalmic therapies is reshaping physician and consumer expectations, prompting companies such as Bausch + Lomb to develop innovative suspension formulations with improved tolerability

- The demand for advanced ophthalmic suspensions is growing rapidly across hospitals, eye clinics, and retail pharmacies, driven by the need for safer, more effective, and convenient eye care solutions

- Rising collaborations between pharmaceutical companies and biotech startups are accelerating research into next-generation ophthalmic suspensions, including formulations for rare and chronic eye disorders

Ophthalmic Suspension Market Dynamics

Driver

Increasing Prevalence of Ocular Disorders and Geriatric Population

- The rising prevalence of ocular disorders such as bacterial infections, glaucoma, and retinal disorders, combined with a growing geriatric population, is a significant driver for the heightened demand for ophthalmic suspensions

- For instance, in March 2025, Bausch + Lomb launched a new preservative-free antibiotic suspension targeting bacterial conjunctivitis, reflecting the growing need for safer, patient-friendly formulations

- As awareness of eye health improves and patients seek effective treatment options, ophthalmic suspensions offer advantages such as targeted delivery, higher bioavailability, and reduced systemic side effects

- Furthermore, increasing healthcare infrastructure, expanding eye care clinics, and growing accessibility of OTC formulations are making ophthalmic suspensions more widely available

- The convenience of easy administration, reduced dosing frequency, and physician preference for effective suspension formulations are key factors propelling market adoption across hospitals, clinics, and pharmacies

- Regulatory approvals for new and innovative ophthalmic suspensions, combined with rising patient demand, further contribute to market growth during the forecast period

- Expansion of insurance coverage for ophthalmic medications and growing government initiatives for eye health awareness are increasing patient access to advanced suspension therapies

- Technological advancements in formulation monitoring and quality control are improving product consistency and safety, boosting physician confidence and prescription rates

Restraint/Challenge

Formulation Stability and Regulatory Compliance Hurdles

- Concerns surrounding formulation stability, potential ocular irritation, and stringent regulatory requirements pose significant challenges to broader market penetration of ophthalmic suspensions

- For instance, some multi-ingredient suspensions may face challenges in maintaining chemical stability and homogeneity over shelf life, limiting product adoption

- Addressing these formulation and stability concerns through advanced manufacturing techniques, rigorous testing, and preservative-free technologies is crucial for building physician and patient trust

- In addition, compliance with regional and international regulatory guidelines for ophthalmic drug approval can delay product launches and increase development costs

- While some cost-effective formulations are available, premium suspensions with advanced delivery systems or combination therapies often come at a higher price, which can limit uptake in price-sensitive markets

- Overcoming these challenges through robust formulation development, streamlined regulatory approvals, and patient education on product benefits will be vital for sustained market growth

- Limited patient awareness regarding proper storage and handling of ophthalmic suspensions can affect treatment efficacy, creating challenges for manufacturers and healthcare providers

- Competition from alternative ocular drug delivery forms, such as gels, drops, and inserts, can restrain market share growth for suspensions unless differentiation through efficacy and convenience is clearly demonstrated

Ophthalmic Suspension Market Scope

The market is segmented on the basis of type of content, application, and end user.

- By Type of Content

On the basis of type of content, the ophthalmic suspension market is segmented into antibiotic, antifungal, antibacterial, steroids, non-steroidal anti-inflammatory drugs (NSAIDs), and others. The antibiotic segment dominated the market with the largest revenue share of 41.7% in 2025, driven by its established efficacy in treating bacterial eye infections such as conjunctivitis and keratitis. Physicians and ophthalmologists often prefer antibiotic suspensions due to their rapid therapeutic action, minimal systemic absorption, and suitability for a wide range of patients, including pediatric and geriatric populations. The segment also benefits from ongoing product innovation, including preservative-free formulations and combination therapies. High adoption in hospitals, clinics, and pharmacies further reinforces the market dominance of antibiotics. Consumer awareness and increasing eye infection prevalence globally continue to drive strong demand for these formulations.

The steroids segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by rising prevalence of inflammatory eye conditions such as uveitis, postoperative inflammation, and severe allergies. Steroid ophthalmic suspensions are preferred for their potent anti-inflammatory effects and ability to reduce ocular swelling and discomfort. Innovations in formulation, such as low-dose and preservative-free steroid suspensions, are expanding patient acceptance. Growing awareness among ophthalmologists about managing chronic inflammatory eye disorders is contributing to increased prescriptions. Steroid suspensions are also seeing higher uptake in emerging markets due to better accessibility and affordability. Integration with patient-centric treatment plans, including combination therapies, is further accelerating segment growth.

- By Application

On the basis of application, the ophthalmic suspension market is segmented into bacterial infections, retinal disorders, glaucoma, allergies, diabetic eye disease, and others. The bacterial infections segment dominated the market in 2025, attributed to the high global prevalence of conjunctivitis, corneal ulcers, and blepharitis. Ophthalmic suspensions targeting bacterial infections offer rapid relief, high local bioavailability, and minimal systemic side effects, making them preferred by healthcare providers. Hospitals and eye clinics play a key role in driving prescriptions, especially in pediatric and geriatric populations. Awareness campaigns about ocular hygiene and early infection management have further reinforced demand. Antibiotic suspensions remain the backbone of this segment, supported by continuous innovation in drug delivery. Growing prevalence of antibiotic-resistant infections is also prompting the development of advanced formulations to maintain efficacy.

The glaucoma segment is expected to witness the fastest CAGR during 2026–2033 due to the rising geriatric population and increasing incidence of elevated intraocular pressure globally. Ophthalmic suspensions for glaucoma, such as prostaglandin analogs and beta-blockers, help in long-term management and prevent vision loss. Advances in preservative-free and combination therapies enhance patient adherence, making these treatments increasingly popular. Teleophthalmology and home delivery services are expanding access to glaucoma suspensions in remote areas. Physicians are prioritizing early intervention and patient-friendly dosing regimens, driving adoption. Growing awareness about chronic eye disease management and reimbursement schemes for eye care medications are further supporting rapid growth.

- By End User

On the basis of end user, the ophthalmic suspension market is segmented into hospitals, eye clinics, clinics, pharmacies, and others. The hospitals segment dominated the market in 2025, driven by higher patient inflow, advanced ophthalmology departments, and the preference for prescription-based treatments under professional supervision. Hospitals offer access to a wide range of ophthalmic suspensions for bacterial infections, inflammatory disorders, and chronic eye diseases. Large-scale procurement and bulk purchases by hospitals strengthen their revenue contribution. Hospitals also act as key distribution hubs for newer, high-cost formulations, including preservative-free and combination therapies. Physician trust in hospital-administered treatments ensures continued dominance of this segment.

The eye clinics segment is expected to witness the fastest growth rate during 2026–2033 due to rising outpatient visits for routine eye care, increasing prevalence of ocular disorders, and growing availability of advanced treatment options. Eye clinics provide personalized care and allow frequent monitoring, which is essential for chronic conditions such as glaucoma and retinal disorders. Expanding infrastructure in emerging markets and the integration of teleophthalmology platforms further support rapid adoption. Clinics are increasingly offering both prescription and OTC ophthalmic suspensions, improving accessibility. The convenience of targeted treatments and shorter waiting times compared to hospitals is attracting more patients. Patient education and clinic-driven awareness programs also boost market uptake in this segment.

Ophthalmic Suspension Market Regional Analysis

- North America dominated the ophthalmic suspension market with the largest revenue share of 40.9% in 2025, characterized by a strong healthcare infrastructure, high adoption of advanced eye care treatments, and a robust presence of leading pharmaceutical companies

- Patients and healthcare providers in the region highly value the efficacy, safety, and targeted delivery offered by ophthalmic suspensions, particularly for bacterial infections, glaucoma, and retinal disorders

- This widespread adoption is further supported by the presence of leading pharmaceutical companies, high healthcare expenditure, and easy access to advanced ophthalmic treatments, establishing ophthalmic suspensions as a preferred therapeutic option across hospitals, clinics, and eye care centers

U.S. Ophthalmic Suspension Market Insight

The U.S. ophthalmic suspension market captured the largest revenue share of 42% in 2025 within North America, fueled by the increasing prevalence of ocular disorders such as bacterial infections, glaucoma, and retinal conditions. Patients and healthcare providers are prioritizing effective, targeted eye treatments, while advancements in preservative-free and combination suspensions are enhancing patient compliance. The growing adoption of teleophthalmology, along with easy access to hospitals, clinics, and pharmacies, further propels the ophthalmic suspension industry. Moreover, strong presence of key pharmaceutical players and ongoing R&D in advanced formulations are significantly contributing to the market’s expansion.

Europe Ophthalmic Suspension Market Insight

The Europe ophthalmic suspension market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising incidence of eye disorders and growing awareness about eye health. Increasing urbanization, coupled with the demand for convenient, prescription-based ocular treatments, is fostering adoption of ophthalmic suspensions. European patients are also drawn to advanced, patient-friendly formulations that minimize ocular irritation. The region is experiencing significant growth across hospitals, eye clinics, and retail pharmacies, with ophthalmic suspensions being increasingly prescribed in both new treatment protocols and follow-up care.

U.K. Ophthalmic Suspension Market Insight

The U.K. ophthalmic suspension market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by heightened awareness of preventive eye care and the increasing prevalence of chronic ocular conditions. In addition, rising cases of bacterial infections, allergies, and retinal disorders are encouraging both hospitals and clinics to adopt effective ophthalmic suspension therapies. The U.K.’s robust healthcare infrastructure and strong e-commerce penetration for pharmaceutical products are expected to continue supporting market growth. Patients’ preference for safer, preservative-free, and convenient formulations further stimulates adoption.

Germany Ophthalmic Suspension Market Insight

The Germany ophthalmic suspension market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of ocular health and demand for technologically advanced and safe eye care solutions. Germany’s well-developed healthcare infrastructure, combined with emphasis on innovation and quality standards, promotes adoption of ophthalmic suspensions in hospitals and specialized eye clinics. The use of preservative-free and combination formulations is becoming increasingly prevalent, addressing patient concerns about irritation and enhancing treatment compliance. A strong focus on research and clinical trials is also driving the availability of advanced ophthalmic suspensions.

Asia-Pacific Ophthalmic Suspension Market Insight

The Asia-Pacific ophthalmic suspension market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by rising prevalence of eye disorders, increasing geriatric population, and expanding healthcare facilities in countries such as China, Japan, and India. The region’s growing inclination towards advanced eye care treatments, supported by government initiatives promoting eye health awareness, is driving adoption of ophthalmic suspensions. Furthermore, as APAC emerges as a manufacturing hub for ophthalmic formulations, the affordability and accessibility of suspensions are improving, expanding the patient base.

Japan Ophthalmic Suspension Market Insight

The Japan ophthalmic suspension market is gaining momentum due to the country’s high awareness of eye health, increasing geriatric population, and demand for convenient treatment options. Japanese patients prioritize efficacy, safety, and tolerability, driving preference for preservative-free and combination ophthalmic suspensions. Integration of ophthalmic care with telehealth platforms is also promoting adherence and accessibility. Moreover, increasing incidence of chronic eye conditions such as glaucoma and retinal disorders is expected to sustain demand for targeted therapies in both hospital and clinic settings.

India Ophthalmic Suspension Market Insight

The India ophthalmic suspension market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the country’s expanding middle-class population, rising prevalence of ocular disorders, and increasing healthcare awareness. India represents one of the largest markets for accessible and affordable ophthalmic therapies, with suspensions being widely prescribed in hospitals, clinics, and retail pharmacies. Government initiatives promoting eye health, growing urbanization, and the presence of domestic manufacturers producing cost-effective formulations are key factors propelling the market in India.

Ophthalmic Suspension Market Share

The Ophthalmic Suspension industry is primarily led by well-established companies, including:

- Alcon Laboratories, Inc. (U.S.)

- Bausch + Lomb Incorporated (U.S.)

- Santen Pharmaceutical Co., Ltd. (Japan)

- Novartis AG (Switzerland)

- Allergan, Inc. (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

- Pfizer Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Bayer AG (Germany)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Otsuka Pharmaceutical Co., Ltd. (Japan)

- Hikma Pharmaceuticals PLC (U.K.)

- Sanofi (France)

- AbbVie Inc. (U.S.)

- Genentech, Inc. (U.S.)

- Apotex Inc. (Canada)

- Cipla Ltd. (India)

- Lupin Limited (India)

- Nicox S.A. (France)

- Sentiss Pharma Pvt Ltd (India)

What are the Recent Developments in Global Ophthalmic Suspension Market?

- In December 2025, Alembic Pharmaceuticals secured final U.S. FDA approval for its loteprednol etabonate and tobramycin ophthalmic suspension (0.5%/0.3%), a combination corticosteroid‑antibiotic for inflammatory ocular conditions, gaining Competitive Generic Therapy designation and eligibility for 180 days of exclusivity upon launch

- In June 2025, Amneal Pharmaceuticals received U.S. FDA approval for its prednisolone acetate ophthalmic suspension (1% sterile), a topical anti‑inflammatory indicated for steroid‑responsive ocular inflammation, and plans a commercial launch in Q3 2025 to expand its affordable sterile ophthalmic portfolio

- In September 2024, Eyenovia, Inc. announced the U.S. launch and commercial availability of clobetasol propionate ophthalmic suspension (0.05%), approved to treat post‑operative ocular inflammation and pain, marking the first new ophthalmic steroid in the market in over 15 years

- In March 2024, the U.S. FDA approved clobetasol propionate ophthalmic suspension (0.05%) for post‑ocular surgery pain and inflammation, based on randomized clinical trials showing rapid and sustained inflammation clearance, paving the way for expanded steroid suspension options

- In January 2024, Amneal Pharmaceuticals announced the approval and launch of fluorometholone ophthalmic suspension (0.1%), gaining 180‑day competitive generic therapy exclusivity and providing a corticosteroid option for corticosteroid‑responsive conjunctival and corneal inflammation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.