Global Ophthalmic Sutures Market

Market Size in USD Million

CAGR :

%

USD

485.50 Million

USD

770.89 Million

2025

2033

USD

485.50 Million

USD

770.89 Million

2025

2033

| 2026 –2033 | |

| USD 485.50 Million | |

| USD 770.89 Million | |

|

|

|

|

Ophthalmic Sutures Market Size

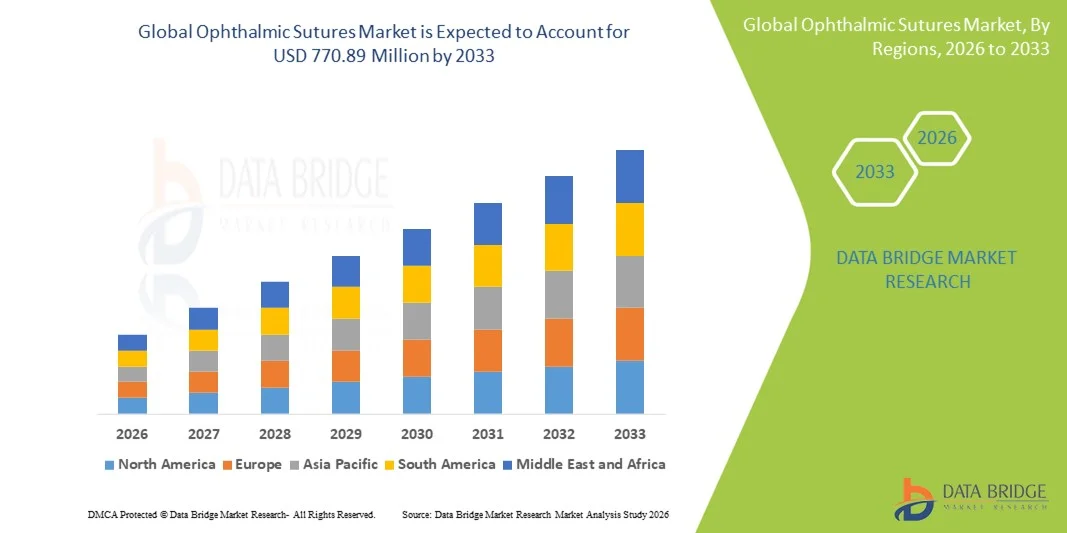

- The global ophthalmic sutures market size was valued at USD 485.5 Million in 2025 and is expected to reach USD 770.89 Million by 2033, at a CAGR of 5.95% during the forecast period

- The market growth is largely fueled by the rising prevalence of ophthalmic disorders, increasing volume of eye surgeries such as cataract, glaucoma, and corneal procedures, and growing awareness about advanced surgical techniques, leading to higher demand for ophthalmic sutures across hospitals and specialty eye clinics

- Furthermore, continuous advancements in suture materials, including absorbable and non-absorbable options with improved biocompatibility and precision, along with the increasing focus on better surgical outcomes and faster patient recovery, are accelerating the uptake of ophthalmic sutures, thereby significantly boosting the overall growth of the Ophthalmic Sutures market

Ophthalmic Sutures Market Analysis

- Ophthalmic sutures, which are specialized surgical sutures used in eye procedures such as cataract, corneal, glaucoma, and refractive surgeries, play a critical role in ensuring wound closure precision, minimizing tissue trauma, and improving postoperative outcomes across hospitals and specialty eye clinic

- The increasing demand for ophthalmic sutures is primarily driven by the rising prevalence of ophthalmic disorders, growing surgical volumes due to an aging population, and continuous advancements in minimally invasive ophthalmic surgical techniques

- North America dominated the ophthalmic sutures market, accounting for approximately 41.8% of the global revenue share in 2025, supported by a high volume of ophthalmic surgeries, advanced healthcare infrastructure, strong reimbursement frameworks, and the presence of leading medical device manufacturers, particularly in the U.S.

- Asia-Pacific is expected to be the fastest-growing region in the ophthalmic sutures market during the forecast period, with an estimated CAGR of 8.6%, driven by a rapidly growing geriatric population, increasing incidence of eye disorders, expanding access to eye care services, and rising investments in healthcare infrastructure across emerging economies

- The synthetic sutures segment dominated the largest market revenue share of 61.4% in 2025, driven by their superior tensile strength, consistent quality, and lower risk of immunogenic reactions compared to natural sutures

Report Scope and Ophthalmic Sutures Market Segmentation

|

Attributes |

Ophthalmic Sutures Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Johnson & Johnson (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Ophthalmic Sutures Market Trends

Rising Adoption of Advanced and Absorbable Ophthalmic Sutures

- A significant and accelerating trend in the global ophthalmic sutures market is the growing adoption of advanced, ultra-fine, and absorbable sutures designed specifically for delicate ocular tissues. These sutures enhance wound healing outcomes while minimizing tissue trauma during ophthalmic surgeries

- For instance, in June 2024, Johnson & Johnson Vision expanded its ophthalmic surgical portfolio with advanced absorbable micro-sutures aimed at improving precision and post-operative recovery in cataract and corneal surgeries

- Ophthalmic surgeons increasingly prefer absorbable sutures due to their ability to eliminate the need for suture removal, reducing patient discomfort and follow-up visits

- Continuous innovations in suture materials, including synthetic polymers and coated sutures, are improving tensile strength and knot security

- The trend is further supported by the rising volume of minimally invasive ophthalmic procedures worldwide

- Growing awareness regarding post-surgical complications such as inflammation and infection is encouraging the use of high-quality ophthalmic sutures

- In addition, the expansion of ambulatory surgical centers is accelerating the demand for efficient and reliable suturing solutions

- This trend is fundamentally reshaping surgical standards, with manufacturers focusing on precision-engineered sutures to meet evolving clinical need

Ophthalmic Sutures Market Dynamics

Driver

Growing Prevalence of Eye Disorders and Rising Surgical Volume

- The increasing prevalence of ophthalmic conditions such as cataracts, glaucoma, diabetic retinopathy, and corneal disorders is a major driver for the Ophthalmic Sutures market

- For instance, in March 2025, the World Health Organization highlighted cataracts as the leading cause of blindness globally, prompting governments to scale up cataract surgery programs

- Rising aging populations across developed and emerging economies are significantly increasing the number of ophthalmic surgical procedures

- Technological advancements in ophthalmic surgery are also driving demand for high-performance sutures that ensure precision and safety

- The growing number of trained ophthalmic surgeons and improved access to surgical care further supports market growth

- Increasing healthcare expenditure and insurance coverage for eye surgeries are enabling higher adoption rates. Moreover, rising awareness regarding early treatment of eye disorders is boosting procedural volumes

- Collectively, these factors are accelerating the demand for reliable and specialized ophthalmic sutures across hospitals and specialty clinics

Restraint/Challenge

High Cost of Advanced Sutures and Limited Access in Developing Regions

- The relatively high cost of advanced ophthalmic sutures compared to conventional surgical sutures remains a key challenge for market expansion, particularly in cost-sensitive regions

- For instance, limited reimbursement coverage for premium ophthalmic surgical materials in several low- and middle-income countries restricts widespread adoption

- Advanced sutures often require specialized manufacturing processes, increasing production and procurement costs

- Smaller healthcare facilities may opt for lower-cost alternatives, impacting market penetration

- In addition, lack of skilled surgeons trained to use advanced suturing materials can hinder adoption in rural areas

- Supply chain disruptions and dependence on imports in developing regions further elevate costs

- While prices are gradually declining, affordability remains a concern for many healthcare providers

- Addressing these challenges through cost-effective product development and expanded training programs will be essential for sustained market growth

Ophthalmic Sutures Market Scope

The market is segmented on the basis of type, absorption capacity, application, and end use.

- By Type

On the basis of type, the Ophthalmic Sutures market is segmented into Natural and Synthetic sutures. The synthetic sutures segment dominated the largest market revenue share of 61.4% in 2025, driven by their superior tensile strength, consistent quality, and lower risk of immunogenic reactions compared to natural sutures. Synthetic ophthalmic sutures offer predictable absorption profiles and enhanced knot security, making them highly suitable for delicate ocular tissues. Their widespread use in cataract, corneal, and vitrectomy surgeries has reinforced their dominance. Additionally, advancements in polymer-based materials such as polyglactin and polydioxanone have improved flexibility and handling characteristics. Hospitals and ambulatory surgical centers increasingly prefer synthetic sutures due to standardized manufacturing and longer shelf life. Rising surgical volumes and surgeon preference for reliability further support market leadership. The availability of coated and micro-diameter synthetic sutures has also enhanced precision in ophthalmic procedures. These factors collectively position synthetic sutures as the dominant segment.

The natural sutures segment is expected to witness the fastest CAGR of 6.9% from 2026 to 2033, driven by increasing demand for biologically derived materials in select ophthalmic procedures. Natural sutures such as silk are preferred in specific applications where controlled tissue reaction is beneficial. Growing adoption in developing regions due to lower cost compared to advanced synthetic options supports growth. Improvements in processing techniques have enhanced the consistency and safety of natural sutures. Surgeons in certain specialty procedures continue to favor their handling characteristics. Expanding access to ophthalmic care in emerging markets further accelerates adoption. Increasing focus on cost-effective surgical solutions also contributes to growth momentum.

- By Absorption Capacity

On the basis of absorption capacity, the Ophthalmic Sutures market is segmented into Absorbable Sutures and Non-Absorbable Sutures. The absorbable sutures segment accounted for the largest market revenue share of 58.7% in 2025, owing to their ability to naturally degrade in the body, eliminating the need for suture removal. These sutures are widely used in cataract and corneal surgeries, where patient comfort and reduced follow-up visits are critical. Absorbable sutures minimize postoperative complications such as irritation and infection. Increasing preference for minimally invasive procedures further supports segment dominance. Technological advancements have enhanced absorption control and tensile strength retention. Hospitals increasingly adopt absorbable sutures to optimize surgical efficiency and patient outcomes. Their compatibility with advanced ophthalmic techniques strengthens market leadership. Growing patient awareness regarding faster recovery also contributes to high adoption.

The non-absorbable sutures segment is projected to grow at the fastest CAGR of 7.4% from 2026 to 2033, driven by rising use in long-term wound support applications such as vitrectomy and complex oculoplastic surgeries. These sutures provide prolonged tensile strength and stability, essential in procedures requiring extended healing time. Surgeons prefer non-absorbable sutures for cases involving high mechanical stress. Increasing volumes of advanced retinal surgeries support growth. Product innovations focusing on reduced tissue reaction are enhancing acceptance. The expansion of specialty eye clinics further fuels demand. Growing surgeon expertise in complex ophthalmic procedures accelerates adoption.

- By Application

On the basis of application, the Ophthalmic Sutures market is segmented into Corneal Transplantation Surgery, Cataract Surgery, Vitrectomy Surgery, Iridectomy Surgery, Oculoplastic Surgery, and Others. The cataract surgery segment dominated the market with a revenue share of 39.6% in 2025, driven by the high global prevalence of cataracts and increasing surgical volumes. Cataract surgery is one of the most commonly performed ophthalmic procedures worldwide. Rising aging populations significantly contribute to demand. Ophthalmic sutures play a critical role in ensuring wound closure and minimizing postoperative complications. Government-led blindness prevention programs further support procedure growth. Advancements in surgical techniques have increased procedural efficiency. Hospitals and surgical centers prioritize high-quality sutures to improve outcomes. These factors collectively establish cataract surgery as the dominant application segment.

The corneal transplantation surgery segment is expected to register the fastest CAGR of 8.1% from 2026 to 2033, fueled by rising incidence of corneal disorders and trauma-related injuries. Increasing adoption of advanced keratoplasty techniques drives demand for precision sutures. Growing organ donation awareness programs are supporting transplant volumes. Improved success rates of corneal transplants boost surgeon confidence. Technological advancements in suture design enhance graft stability. Expansion of specialized eye hospitals further accelerates growth. Increasing healthcare investments in emerging economies also support market expansion.

- By End Use

On the basis of end use, the Ophthalmic Sutures market is segmented into Hospitals, Ambulatory Surgical Centers (ASCs), and Others. The hospitals segment held the largest market revenue share of 64.2% in 2025, driven by the high concentration of ophthalmic surgical procedures performed in hospital settings. Hospitals offer access to advanced surgical infrastructure and skilled ophthalmologists. Complex eye surgeries are primarily conducted in hospitals, increasing suture demand. Availability of reimbursement coverage supports patient inflow. Hospitals maintain long-term procurement contracts with manufacturers, ensuring consistent supply. Rising investments in hospital-based eye care units strengthen dominance. Increasing surgical volumes further reinforce leadership.

The ambulatory surgical centers (ASCs) segment is anticipated to grow at the fastest CAGR of 9.3% from 2026 to 2033, driven by the shift toward outpatient ophthalmic procedures. ASCs offer cost-effective and time-efficient surgical solutions. Increasing preference for minimally invasive surgeries supports growth. Faster patient turnaround and lower infection risk enhance adoption. Expanding ASC networks in developed regions fuel demand. Technological advancements enabling same-day discharge procedures accelerate growth. Growing patient preference for outpatient care further strengthens segment expansion.

Ophthalmic Sutures Market Regional Analysis

- North America dominated the ophthalmic sutures market, accounting for approximately 41.8% of the global revenue share in 2025

- Supported by a high volume of ophthalmic surgeries, advanced healthcare infrastructure, strong reimbursement frameworks, and the presence of leading medical device manufacturers, particularly in the U.S.

- The region benefits from early adoption of advanced surgical materials, a high prevalence of cataract and refractive surgeries, and continuous technological advancements in ophthalmic surgical procedures across hospitals and ambulatory surgical centers

U.S. Ophthalmic Sutures Market Insight

The U.S. ophthalmic sutures market captured the largest revenue share within North America in 2025, driven by the increasing number of ophthalmic procedures such as cataract, glaucoma, and corneal surgeries. Strong healthcare expenditure, widespread availability of skilled ophthalmic surgeons, and the presence of major suture manufacturers contribute to market growth. Additionally, favorable reimbursement policies and the rapid adoption of advanced absorbable and non-absorbable sutures further support market expansion.

Europe Ophthalmic Sutures Market Insight

The Europe ophthalmic sutures market is projected to expand at a steady CAGR throughout the forecast period, driven by an aging population, rising incidence of eye disorders, and increasing demand for minimally invasive ophthalmic surgeries. Countries such as Germany, the U.K., and France are witnessing higher adoption of advanced ophthalmic sutures due to well-established healthcare systems and strong focus on improving surgical outcomes.

U.K. Ophthalmic Sutures Market Insight

The U.K. ophthalmic sutures market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by increasing cataract surgery volumes, growing awareness of eye health, and continuous investments in ophthalmic care services. The presence of specialized eye hospitals and government initiatives aimed at reducing surgical waiting times further contribute to market growth.

Germany Ophthalmic Sutures Market Insight

The Germany ophthalmic sutures market is expected to expand at a considerable CAGR during the forecast period, fueled by a robust healthcare infrastructure, strong emphasis on surgical precision, and increasing adoption of advanced ophthalmic surgical materials. Germany’s leadership in medical device innovation and high standards of clinical care promote the use of high-quality ophthalmic sutures in hospitals and specialty clinics.

Asia-Pacific Ophthalmic Sutures Market Insight

The Asia-Pacific ophthalmic sutures market is expected to be the fastest-growing region, registering an estimated CAGR of 8.6% during the forecast period. Growth is driven by a rapidly growing geriatric population, increasing prevalence of eye disorders such as cataracts and diabetic retinopathy, expanding access to eye care services, and rising healthcare infrastructure investments across emerging economies including China and India.

Japan Ophthalmic Sutures Market Insight

The Japan ophthalmic sutures market is gaining momentum due to the country’s aging population, high demand for cataract and glaucoma surgeries, and advanced ophthalmic healthcare system. Technological advancements in surgical techniques and strong adoption of premium ophthalmic sutures support market growth in both hospitals and specialty eye clinics.

China Ophthalmic Sutures Market Insight

The China ophthalmic sutures market accounted for the largest revenue share in the Asia-Pacific region in 2025, attributed to a large patient pool, increasing incidence of vision disorders, rapid expansion of ophthalmic hospitals, and growing investments in healthcare infrastructure. Government initiatives aimed at improving access to eye care and the presence of cost-effective domestic manufacturers are key factors driving market growth in China.

Ophthalmic Sutures Market Share

The Ophthalmic Sutures industry is primarily led by well-established companies, including:

• Johnson & Johnson (U.S.)

• Alcon Inc. (U.S.)

• B. Braun SE (Germany)

• Medtronic (Ireland)

• Teleflex Incorporated (U.S.)

• DemeTECH Corporation (U.S.)

• Peters Surgical (France)

• Aurolab (India)

• Sutures India Pvt. Ltd. (India)

• Corza Medical (U.S.)

• Kono Seisakusho Co., Ltd. (Japan)

• FSSB Chirurgische Nähte (Germany)

• Unisur Lifecare (India)

• Internacional Farmacéutica S.A. (Spain)

• Healthium Medtech (India)

• Dolphin Sutures (India)

• Surgimedik Healthcare (India)

Latest Developments in Global Ophthalmic Sutures Market

- In October 2024, Corza Medical announced the launch of its Onatec ophthalmic microsurgical suture portfolio — a next-generation line of microsurgical ophthalmic sutures (Onatec) with highly tempered stainless-steel needles and precision geometry introduced at the American Academy of Ophthalmology (AAO) conference

- In September 2024, Meril Life Sciences unveiled the “New Edge” suture — a next-generation surgical suture designed for enhanced penetration, strength and handling that the company positioned as a benchmark across surgical specialties (announced publicly in Sept 2024); while this is a general surgical suture launch, Meril’s product expansion and new manufacturing capacity are relevant to ophthalmic procedure supply chains

- In January 2023, Ethicon (Johnson & Johnson) published an updated suture product catalog and supporting materials for its surgical-suture portfolio (including products indicated for ophthalmic use), reflecting incremental product and labeling updates that are commonly used by hospitals and surgical centers

- In August 2023, Riverpoint Medical announced a multi-million-dollar investment in a new manufacturing facility (Costa Rica), expanding capacity for absorbable and non-absorbable sutures — a supply-chain/manufacturing development relevant to global suture availability for ophthalmic procedures

- In April 2022, the U.S. Food and Drug Administration (FDA) issued guidance and programs that eased the regulatory review burden for certain sutures by encouraging the safety-and-performance based pathway — a regulatory development that affected how suture manufacturers (including ophthalmic suture makers) seek clearances and bring incremental product updates to market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.