Global Ophthalmic Ultrasound Imaging Systems Market

Market Size in USD Million

CAGR :

%

USD

663.94 Million

USD

1,019.71 Million

2025

2033

USD

663.94 Million

USD

1,019.71 Million

2025

2033

| 2026 –2033 | |

| USD 663.94 Million | |

| USD 1,019.71 Million | |

|

|

|

|

Ophthalmic Ultrasound Imaging Systems Market Size

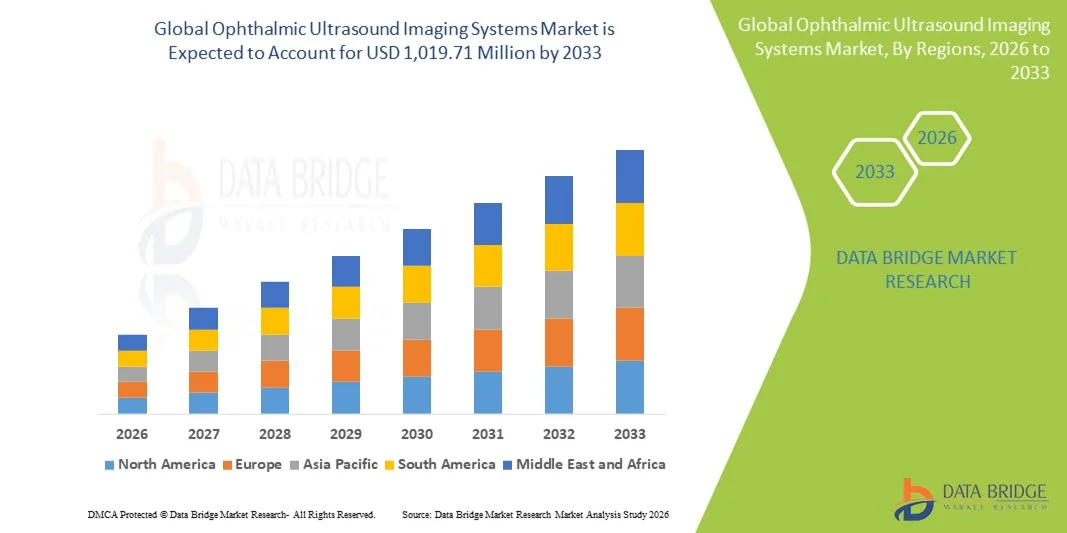

- The global ophthalmic ultrasound imaging systems market size was valued at USD 663.94 million in 2025 and is expected to reach USD 1,019.71 million by 2033, at a CAGR of 5.51% during the forecast period

- The market growth is largely fueled by technological advancements in ultrasound imaging, rising prevalence of eye disorders such as cataracts, glaucoma, and diabetic retinopathy, and increasing demand for precise, non‑invasive diagnostic tools in ophthalmology

- Furthermore, expanding applications of ophthalmic ultrasound in anterior and posterior segment imaging, growing geriatric populations globally, and increasing healthcare expenditure are driving adoption of advanced imaging systems by hospitals and eye care clinics, positioning these solutions as essential for early detection and management of ocular diseases

Ophthalmic Ultrasound Imaging Systems Market Analysis

- Ophthalmic ultrasound imaging systems, providing high-resolution imaging for both anterior and posterior segments of the eye, are increasingly essential tools in modern ophthalmology clinics and hospitals due to their non-invasive diagnostics, real-time imaging capabilities, and ability to support precise treatment planning

- The growing demand for these systems is primarily driven by the rising prevalence of ocular disorders such as cataracts, glaucoma, and diabetic retinopathy, increasing awareness of early eye disease detection, and technological advancements in ultrasound imaging devices

- North America dominated the ophthalmic ultrasound imaging systems market with the largest revenue share of 38.7% in 2025, supported by well-established healthcare infrastructure, high adoption of advanced diagnostic technologies, and strong presence of key industry players, with the U.S. witnessing substantial growth in ophthalmic imaging adoption across hospitals and specialized eye care centers

- Asia-Pacific is expected to be the fastest-growing region in the market during the forecast period due to increasing geriatric populations, rising prevalence of eye disorders, and expanding healthcare access in emerging economies such as China and India

- B-scan segment dominated the ophthalmic ultrasound imaging market with a market share of 46.5% in 2025, driven by their versatility in diagnosing both anterior and posterior segment conditions and widespread clinical adoption in ophthalmology practices

Report Scope and Ophthalmic Ultrasound Imaging Systems Market Segmentation

|

Attributes |

Ophthalmic Ultrasound Imaging Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Ophthalmic Ultrasound Imaging Systems Market Trends

Advancements in AI-Enabled and High-Resolution Imaging

- A significant and accelerating trend in the global ophthalmic ultrasound imaging systems market is the integration of AI-powered image analysis and high-resolution scanning, enhancing diagnostic accuracy and enabling more precise monitoring of ocular conditions

- For instance, the EyeScan Pro B-scan system employs AI algorithms to automatically detect retinal detachment and posterior segment abnormalities, providing ophthalmologists with rapid diagnostic insights AI integration enables features such as automated lesion segmentation, pattern recognition for common eye diseases, and predictive analytics to support early intervention. For instance, some EyeTech systems can track changes in glaucoma progression over time and alert clinicians to deviations from expected patterns

- The adoption of advanced imaging systems that combine AI with 3D and high-frequency ultrasound facilitates comprehensive assessment of both anterior and posterior eye segments, reducing the need for multiple diagnostic procedures. Through a single platform, clinicians can evaluate ocular structure, measure intraocular masses, and monitor surgical outcomes efficiently

- This trend toward more intelligent, precise, and multifunctional ophthalmic imaging is reshaping expectations for eye care diagnostics. Consequently, companies such as Quantel Medical are developing AI-enhanced systems capable of automated measurements and early disease detection for anterior and posterior segments

- The demand for ophthalmic ultrasound systems with AI-enabled high-resolution imaging is growing rapidly across hospitals, specialized clinics, and teleophthalmology centers, as clinicians increasingly prioritize diagnostic accuracy, workflow efficiency, and early detection of vision-threatening conditions

- Integration with electronic health records (EHRs) and hospital IT systems is becoming a key trend, enabling better patient data management and longitudinal tracking of ocular health

Ophthalmic Ultrasound Imaging Systems Market Dynamics

Driver

Rising Prevalence of Eye Disorders and Demand for Early Diagnosis

- The increasing prevalence of ocular diseases such as glaucoma, cataracts, diabetic retinopathy, and retinal detachment is a major driver for the growing adoption of ophthalmic ultrasound imaging systems

- For instance, in March 2025, Ellex Medical announced the launch of a high-frequency B-scan system aimed at improving early detection of retinal pathologies in aging populations, targeting hospitals and eye care centers

- As awareness of early detection benefits grows among healthcare providers and patients, ophthalmic ultrasound systems offer non-invasive, real-time imaging for improved diagnosis and treatment planning

- Furthermore, the rising adoption of teleophthalmology and portable diagnostic devices is making ultrasound imaging increasingly integral in remote and underserved regions, enabling ophthalmologists to evaluate conditions without requiring in-person visits

- High-resolution imaging capabilities, AI-assisted diagnostics, and compatibility with electronic health record systems are key factors propelling adoption in hospitals and specialized clinics. The trend toward integrated diagnostic platforms and clinician-friendly software further accelerates market growth

- Growing investments by governments and private healthcare organizations in vision care initiatives, particularly in developing countries, are creating opportunities for wider deployment of advanced ophthalmic ultrasound systems

- The increasing number of ophthalmic surgeries, including cataract and retinal procedures, is driving demand for precise preoperative and postoperative imaging, further boosting the market

Restraint/Challenge

High Device Costs and Limited Skilled Workforce

- The relatively high purchase and maintenance costs of advanced ophthalmic ultrasound imaging systems pose a challenge to adoption, particularly in small clinics and developing regions

- For instance, portable high-frequency systems with AI capabilities are significantly more expensive than traditional B-scan devices, limiting accessibility in price-sensitive markets

- In addition, a shortage of trained technicians and ophthalmologists skilled in operating advanced imaging equipment restricts effective utilization of these systems in several regions

- While AI can assist in interpretation, training is still required for accurate diagnosis and workflow integration, creating a barrier for smaller or resource-limited healthcare facilities

- Overcoming these challenges through cost-effective device models, training programs, and remote AI-assisted operation will be crucial for broader market penetration and sustained growth in ophthalmic ultrasound imaging systems

- Regulatory approvals and compliance with medical device standards across multiple regions can slow product launches and market entry, presenting an additional adoption hurdle

- Maintenance requirements and the need for periodic calibration of high-frequency ultrasound probes may increase operational costs, which can deter small clinics and independent practitioners from upgrading their equipment

Ophthalmic Ultrasound Imaging Systems Market Scope

The market is segmented on the basis of product type, modality, and end user.

- By Product Type

On the basis of product type, the market is segmented into A-Scan, B-Scan, pachymeter, combined scanning device, and ultrasound bio microscope. The B-Scan segment dominated the market with the largest market revenue share of 46.5% in 2025, driven by its versatility in imaging both anterior and posterior segments of the eye. Ophthalmologists prefer B-Scan systems for their ability to detect retinal detachment, vitreous hemorrhage, and intraocular masses with high accuracy. Hospitals and specialized eye care centers prioritize B-Scan devices due to their reliability in preoperative and postoperative assessments. In addition, B-Scan systems are widely compatible with AI-enabled software, enabling automated lesion detection and longitudinal monitoring of ocular conditions. The extensive clinical adoption and robust functionality of B-Scan systems make them the go-to choice for comprehensive ophthalmic imaging.

The A-Scan segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing use in precise biometry and intraocular lens (IOL) calculations for cataract surgeries. A-Scan devices provide rapid, accurate axial length measurements, which are critical for improving surgical outcomes and patient satisfaction. The growth is further supported by rising cataract prevalence globally and the increasing number of ophthalmic surgeries. Advances in portable A-Scan devices are also enabling clinics and remote screening programs to adopt the technology more easily. Furthermore, the integration of A-Scan with AI and automated calculation software is improving measurement precision and workflow efficiency, enhancing its adoption in both hospital and clinic settings.

- By Modality

On the basis of modality, the market is segmented into portable and standalone systems. The Standalone segment dominated the market with the largest revenue share of 52.3% in 2025, attributed to their high-resolution imaging, extensive functionality, and suitability for hospital and specialized eye care center deployment. Standalone systems typically offer superior imaging depth, multiple scanning modes, and compatibility with AI-assisted diagnostics, making them essential in surgical planning and advanced ocular disease detection. Hospitals favor standalone systems for comprehensive patient evaluation and preoperative planning, while research institutes utilize them for advanced ophthalmic studies. These systems also support integration with hospital IT infrastructure and electronic health records, providing a centralized platform for patient management. Their robustness, durability, and ability to handle high patient volumes further reinforce their dominance.

The Portable segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by increasing demand for remote ophthalmic diagnostics, teleophthalmology, and outreach programs. Portable systems enable eye care professionals to perform accurate imaging in rural or underserved regions where standalone systems are impractical. Lightweight, handheld devices with battery operation allow clinicians to provide rapid assessments without compromising diagnostic quality. The growing adoption of AI-assisted portable imaging devices enhances diagnostic accuracy and reduces dependency on highly skilled operators. In addition, rising government and NGO initiatives for mobile eye care screening programs are accelerating the adoption of portable ophthalmic ultrasound systems.

- By End User

On the basis of end user, the market is segmented into eye hospitals, eye clinics, ambulatory surgical centers, and eye research institutes. The Eye Hospitals segment dominated the market with the largest revenue share of 44.8% in 2025, driven by the presence of advanced ophthalmic diagnostic infrastructure, higher patient volumes, and the requirement for multiple imaging modalities in one facility. Eye hospitals prefer high-resolution, AI-enabled systems to conduct detailed preoperative assessments, monitor postoperative outcomes, and manage complex ocular pathologies. Their adoption is also supported by the integration of ophthalmic imaging with hospital IT systems for comprehensive patient management. Eye hospitals often purchase a combination of B-Scan, A-Scan, and Pachymeter devices to provide end-to-end care, enhancing their market share. The ability to support large-scale ophthalmic procedures, research studies, and training programs reinforces their dominance in the market.

The Eye Clinics segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing outpatient eye care demand, the rise of specialty clinics, and cost-effective adoption of portable and standalone ultrasound devices. Clinics are expanding their service offerings to include advanced imaging, enabling them to manage cataracts, glaucoma, and diabetic retinopathy more efficiently. Portable and AI-integrated devices reduce operational costs and allow clinics to provide high-quality diagnostics without extensive infrastructure. Rising awareness among patients about early detection and preventive eye care is fueling adoption in smaller clinic setups. Furthermore, private clinics are increasingly investing in advanced imaging equipment to enhance patient trust and attract referrals from general practitioners and ophthalmologists.

Ophthalmic Ultrasound Imaging Systems Market Regional Analysis

- North America dominated the ophthalmic ultrasound imaging systems market with the largest revenue share of 38.7% in 2025, supported by well-established healthcare infrastructure, high adoption of advanced diagnostic technologies, and strong presence of key industry players

- Clinicians and hospitals in the region highly value the accuracy, high-resolution imaging, and AI-assisted diagnostic capabilities offered by ophthalmic ultrasound systems, which support precise preoperative and postoperative assessments for cataract, glaucoma, and retinal procedures

- This strong adoption is further supported by substantial healthcare spending, a well-trained workforce of ophthalmologists and technicians, and growing investment in teleophthalmology and portable imaging solutions, establishing ophthalmic ultrasound systems as essential tools in both hospital and specialized clinic settings

U.S. Ophthalmic Ultrasound Imaging Systems Market Insight

The U.S. ophthalmic ultrasound imaging systems market captured the largest revenue share of 79% in 2025 within North America, fueled by widespread adoption of advanced diagnostic technologies and high prevalence of ocular disorders such as glaucoma and diabetic retinopathy. Hospitals and specialized eye care centers increasingly prioritize high-resolution B-Scan and A-Scan devices for precise preoperative and postoperative assessments. The growing trend of teleophthalmology and portable imaging solutions further propels market adoption. Moreover, integration with AI-assisted diagnostic software and electronic health records (EHRs) is significantly enhancing clinical workflow efficiency and diagnostic accuracy. Rising healthcare expenditure and strong R&D investments by leading ophthalmic imaging companies continue to support market expansion.

Europe Ophthalmic Ultrasound Imaging Systems Market Insight

The Europe ophthalmic ultrasound imaging systems market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing eye care awareness and rising prevalence of cataracts and retinal disorders. The adoption of advanced diagnostic tools in hospitals and specialty clinics is accelerating, supported by stringent healthcare quality regulations. Countries are witnessing higher demand for portable and AI-integrated imaging systems for early detection and surgical planning. Furthermore, European ophthalmologists value precision and reliability, fostering uptake in both public and private healthcare facilities. Growth is observed across clinical, research, and teaching applications, emphasizing comprehensive patient management.

U.K. Ophthalmic Ultrasound Imaging Systems Market Insight

The U.K. ophthalmic ultrasound imaging systems market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the rising trend of advanced eye care services and increased awareness of early detection of vision-threatening conditions. Hospitals and clinics are adopting AI-enabled B-Scan and A-Scan devices for accurate diagnostics. In addition, government initiatives promoting digital health and teleophthalmology are encouraging deployment in remote or underserved areas. The integration of imaging systems with hospital IT infrastructure supports efficient patient management and data tracking. Increased private healthcare investment and robust research activity are expected to continue stimulating market growth.

Germany Ophthalmic Ultrasound Imaging Systems Market Insight

The Germany ophthalmic ultrasound imaging systems market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s well-developed healthcare infrastructure and focus on precision medicine. German hospitals and clinics increasingly adopt standalone high-resolution imaging systems for detailed ocular assessments. There is growing emphasis on AI-assisted diagnostics, reducing manual interpretation errors and improving treatment outcomes. Sustainability and energy efficiency in medical devices also influence procurement decisions. Integration with teleophthalmology and portable systems is becoming prevalent for broader accessibility. Rising research and clinical trials in ophthalmology further drive the demand for advanced imaging technologies.

Asia-Pacific Ophthalmic Ultrasound Imaging Systems Market Insight

The Asia-Pacific ophthalmic ultrasound imaging systems market is poised to grow at the fastest CAGR of 22% during the forecast period of 2026 to 2033, driven by increasing prevalence of eye disorders, expanding healthcare infrastructure, and rising disposable incomes in countries such as China, Japan, and India. The region’s growing adoption of AI-enabled and portable imaging solutions is supporting rapid deployment across urban and semi-urban eye care centers. Government initiatives promoting eye health awareness and teleophthalmology services further encourage market penetration. In addition, Asia-Pacific is emerging as a manufacturing hub for ophthalmic imaging devices, improving affordability and accessibility for clinics and hospitals.

Japan Ophthalmic Ultrasound Imaging Systems Market Insight

The Japan ophthalmic ultrasound imaging systems market is gaining momentum due to the country’s advanced healthcare system, high prevalence of age-related ocular disorders, and emphasis on early detection. Ophthalmology clinics and hospitals increasingly adopt AI-assisted B-Scan and A-Scan systems for precise diagnosis and preoperative planning. Integration with hospital IT systems and electronic health records is improving patient management and follow-up care. The aging population further drives demand for user-friendly, portable imaging devices. In addition, Japan’s technological expertise supports innovation in high-resolution and 3D imaging, fueling continuous market expansion.

India Ophthalmic Ultrasound Imaging Systems Market Insight

The India ophthalmic ultrasound imaging systems market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid urbanization, rising healthcare awareness, and increasing prevalence of cataracts and diabetic retinopathy. Eye clinics and hospitals are adopting portable and standalone high-resolution imaging devices to improve accessibility and diagnostic accuracy. The push towards teleophthalmology and government initiatives in eye care are key factors supporting growth. Affordable device options and rising domestic manufacturing of ophthalmic systems further enhance market penetration. Increased investment in outpatient eye care centers and specialty clinics is accelerating the adoption of advanced ophthalmic ultrasound technologies across the country.

Ophthalmic Ultrasound Imaging Systems Market Share

The Ophthalmic Ultrasound Imaging Systems industry is primarily led by well-established companies, including:

- Carl Zeiss Meditec AG (Germany)

- Quantel Medical (France)

- Ellex (Australia)

- Appasamy Associates Private Limited (India)

- Sonomed Escalon (U.S.)

- Escalon Medical Corp. (U.S.)

- Accutome by Keeler (U.S.)

- Keeler (U.K.)

- DGH Technology, Inc. (U.S.)

- Reichert Technologies (U.S.)

- Topcon Corporation (Japan)

- NIDEK Co., Ltd. (Japan)

- Optos plc (U.K.)

- Halma plc (U.K.)

- Tomey Corporation (Japan)

- MEDA Co., Ltd. (Japan)

- Micromedical Devices, Inc. (U.S.)

- ArcScan, Inc. (U.S.)

- Echosens Medical (France)

What are the Recent Developments in Global Ophthalmic Ultrasound Imaging Systems Market?

- In July 2025, The Indira Gandhi Institute of Medical Sciences (IGIMS) in India introduced advanced ultrasound biomicroscopy equipment as part of new ophthalmology services, featuring specialized high‑frequency imaging of the anterior eye segment to improve glaucoma and anterior pathology detection in tertiary care

- In June 2025, Philips launched the Flash Ultrasound System 5100 point-of-care (POC) ultrasound platform, designed for frontline clinical settings with a compact form factor and enhanced user interface, supporting ophthalmic imaging among other diagnostic applications, which may increase accessibility of ultrasound diagnostics in eye care environments

- In October 2024, Ellex Medical Lasers unveiled a new generation of its diagnostic ultrasound system (Eye Cubed) at the American Academy of Ophthalmology annual meeting, featuring an intuitive software interface, expanded measurement tools, and improved image export functionality to support more efficient ocular diagnostics and clinical workflow

- In May 2024, ArcScan, Inc. announced that its Insight® 100 ophthalmic ultrasound device, already FDA‑cleared and CE‑approved, has been highlighted in multiple clinical settings for enhanced visualization of anterior segment structures and precise biometric measurements, demonstrating broader clinical adoption

- In May 2024, ArcScan’s Insight® 100 ophthalmic ultrasound imaging system received NMPA approval in China (along with prior FDA clearance and CE Mark), enabling advanced anterior segment imaging for eye surgeons and assisting precise phakic IOL sizing in myopia treatment. This approval broadens surgical planning and diagnostics capabilities in a high‑prevalence myopia market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.