Global Ophthalmic Viscoelastic Devices Ovd Market

Market Size in USD Billion

CAGR :

%

USD

3.08 Billion

USD

6.70 Billion

2025

2033

USD

3.08 Billion

USD

6.70 Billion

2025

2033

| 2026 –2033 | |

| USD 3.08 Billion | |

| USD 6.70 Billion | |

|

|

|

|

Ophthalmic Viscoelastic Devices (Ovd) Market Size

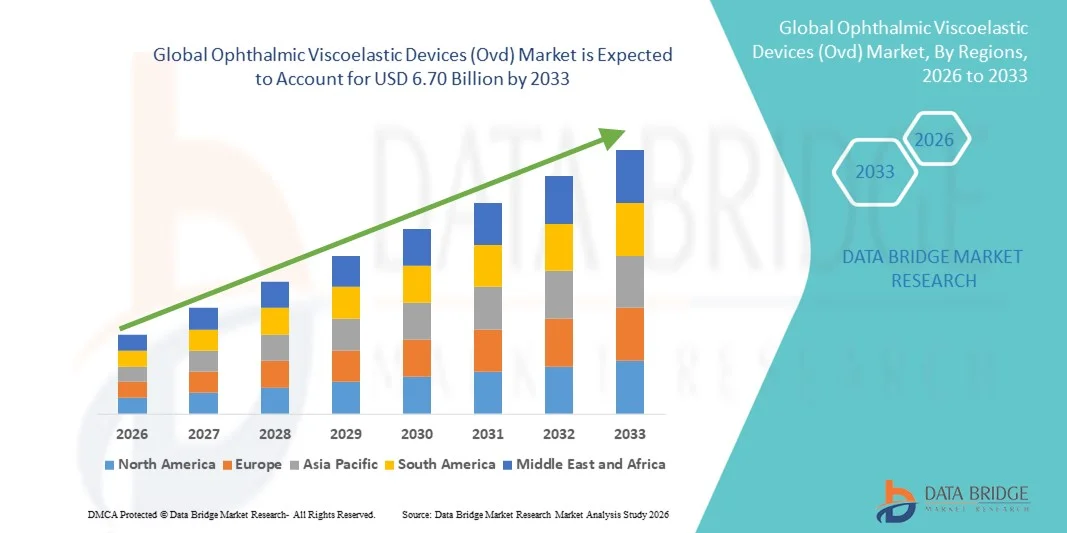

- The global Ophthalmic Viscoelastic Devices (Ovd) market size was valued at USD 3.08 billion in 2025 and is expected to reach USD 6.70 billion by 2033, at a CAGR of 10.18% during the forecast period

- The market growth is largely fueled by the increasing number of ophthalmic surgeries ongoing technological advancements in surgical techniques, and expanding healthcare infrastructure, which collectively drive higher adoption of OVDs in both developed and emerging regions

- Furthermore, rising prevalence of age‑related eye disorders, a growing geriatric population, and heightened awareness of eye health are increasing demand for advanced viscoelastic solutions that protect delicate ocular tissues during surgery establishing ophthalmic viscoelastic devices as essential components in modern eye care. These converging factors are accelerating uptake of OVDs, thereby significantly boosting the industry’s growth.

Ophthalmic Viscoelastic Devices (Ovd) Market Analysis

- Ophthalmic Viscoelastic Devices (OVD), providing protective and space-maintaining solutions during ocular surgeries, are increasingly vital components in modern ophthalmic procedures in both cataract and other anterior segment surgeries due to their tissue-protective properties, ease of handling, and compatibility with advanced surgical techniques

- The escalating demand for Ophthalmic Viscoelastic Devices (OVD) is primarily fueled by the growing number of ophthalmic surgeries worldwide, rising prevalence of age-related eye disorders, and increased adoption of minimally invasive surgical techniques that require high-quality viscoelastic materials

- North America dominated the Ophthalmic Viscoelastic Devices (OVD) market with the largest revenue share of 40% in 2025, characterized by a high number of cataract surgeries, advanced healthcare infrastructure, and strong presence of key industry players, with the U.S. experiencing substantial growth in OVD usage driven by technological innovations and increasing awareness among ophthalmologists

- Asia-Pacific is expected to be the fastest growing region in the Ophthalmic Viscoelastic Devices (OVD) market during the forecast period due to increasing geriatric population, rising prevalence of cataracts, expanding healthcare infrastructure, and improving access to advanced ophthalmic surgical solutions

- Cohesive Ophthalmic Viscoelastic Devices segment dominated the Ophthalmic Viscoelastic Devices (OVD) market with a market share of 42.9% in 2025, driven by its superior ease of use, effectiveness in maintaining anterior chamber space, and growing adoption among surgeons across various ophthalmic procedures

Report Scope and Ophthalmic Viscoelastic Devices (Ovd) Market Segmentation

|

Attributes |

Ophthalmic Viscoelastic Devices (Ovd) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Ophthalmic Viscoelastic Devices (Ovd) Market Trends

Advancements in Surgical Techniques and Formulations

- A significant and accelerating trend in the global Ophthalmic Viscoelastic Devices (OVD) market is the development of advanced viscoelastic formulations that enhance safety and efficiency during cataract and anterior segment surgeries

- For instance, dispersive and cohesive viscoelastic blends are being designed to provide better endothelial protection while maintaining anterior chamber stability during phacoemulsification procedures

- Technological innovations in OVDs, such as formulations tailored for femtosecond laser-assisted cataract surgery, are enabling surgeons to achieve improved surgical outcomes and reduce intraoperative complications

- The introduction of prefilled OVD syringes and single-use packaging facilitates ease of handling, minimizes contamination risks, and streamlines operating room workflows, enhancing overall surgical efficiency

- This trend toward more sophisticated, surgeon-friendly, and patient-safe OVDs is reshaping ophthalmic surgery practices, prompting companies such as Alcon and Johnson & Johnson Vision to develop next-generation viscoelastic products

- The demand for OVDs with enhanced formulations, ease of application, and safety features is growing rapidly across both established and emerging healthcare markets, as ophthalmologists prioritize surgical precision and patient outcomes

- Development of OVDs with specialized properties for niche procedures, including glaucoma and corneal surgeries, is creating new avenues for product differentiation

Ophthalmic Viscoelastic Devices (Ovd) Market Dynamics

Driver

Rising Ophthalmic Surgeries and Aging Population

- The increasing number of cataract and other anterior segment surgeries worldwide, coupled with a growing geriatric population, is a significant driver for the heightened demand for Ophthalmic Viscoelastic Devices (OVD)

- For instance, in March 2025, Alcon launched new cohesive dispersive OVDs targeting complex cataract procedures, highlighting product innovation as a growth catalyst for the market

- As awareness of eye health increases and more patients seek timely surgical interventions, OVDs offer critical benefits such as corneal protection, maintenance of anterior chamber depth, and reduction of intraoperative complications

- Furthermore, the expansion of healthcare infrastructure in emerging regions and the rising accessibility of modern ophthalmic surgical centers are making OVDs an integral component of cataract surgery procedures

- The convenience of prefilled OVD syringes, enhanced formulations, and consistent surgical outcomes are key factors propelling adoption in both developed and developing markets

- The trend towards minimally invasive surgeries and the growing preference for premium OVD products among ophthalmologists further contribute to market growth

- Increasing collaborations between OVD manufacturers and ophthalmic surgical device companies are driving tailored product development and improved market penetration

- Growing government and private initiatives to reduce cataract-related blindness in emerging countries are boosting demand for quality OVDs

Restraint/Challenge

High Cost and Regulatory Compliance Hurdles

- The relatively high cost of premium Ophthalmic Viscoelastic Devices (OVD) and stringent regulatory approval requirements pose significant challenges to broader market adoption

- For instance, some high-end OVD formulations for complex surgeries are priced substantially higher than standard products, limiting accessibility in price-sensitive regions

- Meeting regulatory compliance across multiple markets, including the FDA in the U.S. and CE marking in Europe, can delay product launches and increase development costs, affecting overall market expansion

- In addition, concerns about proper handling, storage, and shelf-life stability of viscoelastic devices can limit adoption among smaller ophthalmic centers or clinics

- While generic and more affordable alternatives are emerging, premium OVDs remain essential for advanced surgeries, creating a balance between cost and clinical preference

- Overcoming these challenges through cost optimization, streamlined regulatory approvals, and wider distribution of prefilled and ready-to-use OVD products will be vital for sustained market growth

- Limited awareness and training regarding advanced OVD usage among surgeons in emerging markets can hinder adoption of premium products

- Volatility in raw material costs for viscoelastic compounds can impact product pricing and profit margins, posing a financial challenge for manufacturers

Ophthalmic Viscoelastic Devices (Ovd) Market Scope

The market is segmented on the basis of product type, application, composition, and end-user.

- By Product Type

On the basis of product type, the Ophthalmic Viscoelastic Devices (OVD) market is segmented into dispersive ophthalmic viscoelastic devices and cohesive ophthalmic viscoelastic devices. The Cohesive Ophthalmic Viscoelastic Devices segment dominated the market with the largest revenue share of 42.9% in 2025, driven by their superior ability to maintain anterior chamber depth and facilitate easy removal at the end of surgery. Surgeons often prefer cohesive OVDs in standard cataract procedures for their predictable handling and efficiency during phacoemulsification. The market also sees strong demand due to their wide compatibility with modern surgical techniques and minimal risk of endothelial cell loss. Cohesive OVDs are favored in both developed and emerging regions owing to the growing number of ophthalmic surgeries and the preference for premium surgical materials. In addition, prefilled syringes of cohesive OVDs simplify intraoperative application, enhancing adoption in high-volume surgical centers. Their reliability and consistency make them a staple choice among ophthalmologists, ensuring sustained market dominance.

The Dispersive Ophthalmic Viscoelastic Devices segment is anticipated to witness the fastest growth from 2026 to 2033, driven by their exceptional endothelial protection during complex cataract and anterior segment surgeries. Dispersive OVDs are increasingly adopted in surgeries requiring prolonged chamber maintenance and in patients with compromised corneal endothelium. Their ability to coat and protect delicate ocular tissues makes them essential in emerging markets where complex cases are rising due to aging populations. For instance, surgeons are increasingly using dispersive OVDs in femtosecond laser-assisted cataract procedures to reduce intraoperative trauma. In addition, improvements in formulation and ease of injection are boosting the segment’s acceptance among ophthalmic clinics and hospitals. The growing preference for premium OVDs in complex surgeries is expected to drive their faster CAGR during the forecast period.

- By Application

On the basis of application, the Ophthalmic Viscoelastic Devices (OVD) market is segmented into cataract surgery, glaucoma surgery, vitreoretinal surgery, corneal transplantation surgery, and others. The Cataract Surgery segment dominated the market in 2025, accounting for the largest revenue share due to the high global prevalence of cataracts and the increasing number of surgical procedures performed annually. Ophthalmic surgeons rely heavily on OVDs to protect the corneal endothelium, maintain chamber stability, and facilitate safe lens implantation. For instance, prefilled OVD syringes are frequently used in high-volume cataract surgery centers to streamline procedures. The segment’s dominance is further supported by advancements in minimally invasive phacoemulsification techniques requiring precise OVD performance. In addition, growing geriatric populations and rising awareness of eye health in developed and emerging markets continue to bolster demand. The segment also benefits from increasing insurance coverage and healthcare expenditure for ophthalmic procedures in developed countries.

The Glaucoma Surgery segment is expected to witness the fastest growth from 2026 to 2033, fueled by the rising adoption of minimally invasive glaucoma surgery (MIGS) procedures and the need for safe viscoelastic materials to maintain anterior chamber stability. For instance, surgeons increasingly use OVDs during trabeculectomy and tube shunt implantation to prevent tissue collapse and endothelial damage. The segment’s growth is supported by expanding glaucoma awareness programs and early diagnosis initiatives in emerging regions. In addition, technological advancements in viscoelastic formulations tailored for glaucoma surgeries are boosting adoption. Growing prevalence of glaucoma in aging populations is also driving demand for specialized OVDs in hospitals and ophthalmic clinics. The development of dual-function OVDs suitable for both cataract and glaucoma procedures further strengthens this segment’s growth prospects.

- By Composition

On the basis of composition, the Ophthalmic Viscoelastic Devices (OVD) market is segmented into sodium hyaluronate, chondroitin sulfate, and hydroxypropyl methylcellulose. The Sodium Hyaluronate segment dominated the market in 2025 due to its widespread clinical acceptance, superior viscoelastic properties, and effectiveness in protecting the corneal endothelium during ocular surgeries. Sodium hyaluronate-based OVDs are preferred for maintaining anterior chamber depth, facilitating smooth intraocular lens implantation, and minimizing postoperative complications. For instance, surgeons widely use high-molecular-weight sodium hyaluronate in both standard and complex cataract procedures. Its compatibility with a range of surgical techniques and ease of handling contribute to its strong adoption in hospitals and specialized ophthalmic clinics. In addition, prefilled sodium hyaluronate OVDs are increasingly used to improve operational efficiency and reduce the risk of contamination. Growing awareness of patient safety and premium surgical materials continues to drive the segment’s dominance globally.

The Chondroitin Sulfate segment is expected to witness the fastest growth from 2026 to 2033, fueled by its superior endothelial protective properties and growing use in combination with sodium hyaluronate in dispersive OVDs. For instance, these blended formulations are preferred in complex cataract, glaucoma, and corneal transplant surgeries to reduce surgical trauma. The segment’s growth is driven by increasing adoption in emerging markets due to the rising prevalence of age-related eye disorders. Continuous innovation in formulation and delivery methods, including prefilled syringes, enhances usability for surgeons. In addition, chondroitin sulfate-based OVDs are gaining traction in advanced ophthalmic procedures due to their ability to maintain chamber stability under prolonged surgical manipulation. The growing demand for premium, dual-function OVDs in multi-procedure surgeries further supports this segment’s rapid CAGR.

- By End-User

On the basis of end-user, the Ophthalmic Viscoelastic Devices (OVD) market is segmented into ophthalmic clinics, hospitals, and academic & research institutes. The Hospitals segment dominated the market in 2025, driven by their high surgical volumes, advanced infrastructure, and preference for premium OVDs to ensure patient safety and optimal outcomes. Hospitals performing high numbers of cataract and anterior segment surgeries rely on cohesive and dispersive OVDs to minimize complications and improve efficiency. For instance, large ophthalmic hospitals often standardize the use of prefilled OVD syringes to streamline operating room procedures. The segment benefits from high investments in healthcare infrastructure and growing healthcare expenditure in developed regions. In addition, hospitals’ adoption of advanced surgical techniques such as femtosecond laser-assisted procedures further reinforces demand. Their ability to absorb premium OVD costs and provide training for surgeons enhances consistent utilization.

The Ophthalmic Clinics segment is expected to witness the fastest growth from 2026 to 2033, fueled by the increasing number of specialty eye care centers, rising patient awareness, and accessibility to minimally invasive surgical solutions. For instance, small- and mid-sized clinics are increasingly adopting cohesive and dispersive OVDs for cataract and glaucoma procedures due to ease of handling and safety. The segment’s growth is supported by expanding ophthalmology infrastructure in emerging markets and the rising prevalence of age-related eye disorders. Prefilled OVD syringes and dual-function viscoelastic products are boosting efficiency in clinics with limited staff. Furthermore, partnerships with OVD manufacturers for training and product demonstrations are accelerating adoption. The segment’s rapid CAGR is driven by cost-effective solutions, rising outpatient procedures, and increased focus on patient outcomes.

Ophthalmic Viscoelastic Devices (Ovd) Market Regional Analysis

- North America dominated the Ophthalmic Viscoelastic Devices (OVD) market with the largest revenue share of 40% in 2025, characterized by a high number of cataract surgeries, advanced healthcare infrastructure, and strong presence of key industry players

- Surgeons and healthcare providers in the region highly value the effectiveness, safety, and ease of use offered by OVDs in maintaining anterior chamber depth, protecting the corneal endothelium, and facilitating smooth intraocular lens implantation

- This widespread adoption is further supported by increasing geriatric populations, rising awareness of eye health, and growing preference for minimally invasive and premium ophthalmic surgical solutions, establishing OVDs as a standard in hospitals and specialized ophthalmic centers

U.S. Ophthalmic Viscoelastic Devices (Ovd) Market Insight

The U.S. Ophthalmic Viscoelastic Devices (OVD) market captured the largest revenue share of 81% in North America in 2025, fueled by the high volume of cataract and anterior segment surgeries and the adoption of advanced surgical technologies. Ophthalmologists are increasingly prioritizing patient safety and surgical precision through premium OVDs that maintain anterior chamber depth and protect the corneal endothelium. The growing trend of minimally invasive and femtosecond laser-assisted surgeries, combined with the use of prefilled OVD syringes for efficiency, further propels market growth. Moreover, widespread awareness of ocular health, coupled with advanced hospital infrastructure and trained surgical staff, is significantly contributing to the expansion of the OVD market.

Europe Ophthalmic Viscoelastic Devices (OVD) Market Insight

The Europe Ophthalmic Viscoelastic Devices (OVD) market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the increasing prevalence of cataracts and other anterior segment disorders and the rising number of ophthalmic surgeries. The increase in urbanization, higher healthcare expenditure, and growing adoption of premium OVDs in hospitals and clinics are fostering market growth. European ophthalmologists are also drawn to the precision, safety, and efficiency offered by advanced OVD formulations. The region is experiencing significant growth across both public and private healthcare facilities, with OVDs being incorporated into routine and complex surgical procedures.

U.K. Ophthalmic Viscoelastic Devices (OVD) Market Insight

The U.K. Ophthalmic Viscoelastic Devices (OVD) market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by increasing cataract surgery volumes and the rising adoption of premium and prefilled OVD products. In addition, awareness about age-related eye disorders and patient safety is encouraging ophthalmologists to use high-quality viscoelastic devices. The U.K.’s robust healthcare infrastructure, coupled with advanced ophthalmic surgical practices and training programs, is expected to continue to stimulate market growth.

Germany Ophthalmic Viscoelastic Devices (OVD) Market Insight

The Germany Ophthalmic Viscoelastic Devices (OVD) market is expected to expand at a considerable CAGR during the forecast period, fueled by a strong focus on patient safety and the adoption of technologically advanced OVD formulations. Germany’s well-developed healthcare infrastructure and emphasis on surgical innovation promote the use of premium cohesive and dispersive OVDs, particularly in cataract and complex anterior segment surgeries. Hospitals and specialized ophthalmic centers are increasingly integrating OVDs into advanced surgical procedures to enhance outcomes and minimize complications.

Asia-Pacific Ophthalmic Viscoelastic Devices (OVD) Market Insight

The Asia-Pacific Ophthalmic Viscoelastic Devices (OVD) market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by increasing prevalence of cataracts, rising geriatric populations, and expanding healthcare infrastructure in countries such as China, Japan, and India. The region’s growing inclination towards modern ophthalmic surgical solutions, supported by government initiatives promoting eye care, is driving adoption of OVDs. Furthermore, as APAC emerges as a hub for ophthalmic surgical devices and OVD manufacturing, affordability and accessibility of these products are improving for a wider patient base.

Japan Ophthalmic Viscoelastic Devices (OVD) Market Insight

The Japan Ophthalmic Viscoelastic Devices (OVD) market is gaining momentum due to the country’s advanced healthcare system, high volume of cataract surgeries, and demand for surgical precision. Ophthalmic surgeons emphasize safety and effectiveness, driving the adoption of cohesive and dispersive OVDs in both cataract and anterior segment procedures. Moreover, Japan’s aging population is likely to increase the demand for viscoelastic devices that simplify surgical procedures while ensuring optimal patient outcomes. Integration with advanced surgical technologies further fuels market growth in the country.

India Ophthalmic Viscoelastic Devices (OVD) Market Insight

The India Ophthalmic Viscoelastic Devices (OVD) market accounted for the largest revenue share in Asia-Pacific in 2025, attributed to the country’s growing geriatric population, rapid urbanization, and increasing number of ophthalmic surgeries. India stands as one of the largest emerging markets for ophthalmic surgical devices, and OVDs are becoming increasingly popular in hospitals, ophthalmic clinics, and specialized eye care centers. The expansion of healthcare infrastructure, government initiatives promoting eye care, and increasing awareness of cataract and glaucoma management are driving adoption across residential and commercial healthcare setups.

Ophthalmic Viscoelastic Devices (Ovd) Market Share

The Ophthalmic Viscoelastic Devices (Ovd) industry is primarily led by well-established companies, including:

- Alcon Inc. (Switzerland)

- Johnson & Johnson Services, Inc. (U.S.)

- Bausch + Lomb (U.S.)

- Carl Zeiss Meditec AG (Germany)

- Hoya Corporation (Japan)

- Beaver Visitec International (U.S.)

- Rayner (U.K.)

- Lifecore Biomedical, LLC (U.S.)

- CIMA Technology Inc. (U.S.)

- Bohus BioTech AB (Sweden)

- Santen Pharmaceutical Co., Ltd. (Japan)

- Croma Pharma GmbH (Austria)

- Ophtechnics Unlimited (India)

- Haohai Biological Technology Co., Ltd. (China)

- Eyekon Medical Inc. (U.S.)

- RUMEX International Co. (U.S.)

- Ocular Systems, Inc. (U.S.)

- Precision Lens (U.S.)

- Hyaltech Ltd. (U.K.)

- Aurolab (India)

What are the Recent Developments in Global Ophthalmic Viscoelastic Devices (Ovd) Market?

- In February 2025, New World Medical received FDA 510(k) clearance for its VIA360™ Surgical System, a device designed for the delivery of controlled amounts of viscoelastic fluid during ophthalmic surgeries and also indicated to cut trabecular meshwork tissue during trabeculotomy procedures, offering surgeons enhanced precision and control in combined or standalone procedure

- In April 2023, Bausch + Lomb launched the StableVisc™ cohesive ophthalmic viscosurgical device (OVD) and the TotalVisc™ Viscoelastic System in the United States, providing surgeons dual‑action protection during cataract surgery with both cohesive and dispersive OVD options, helping improve outcomes and procedural efficiency

- In February 2023, The FDA granted approval for Bausch + Lomb’s StableVisc™ Ophthalmic Viscoelastic Device (OVD) including standalone and co‑packaged (TotalVisc™) forms to be used as a surgical aid in anterior segment procedures such as cataract extraction and intraocular lens implantation

- In April 2021, The U.S. FDA approved Bausch + Lomb’s ClearVisc™ dispersive ophthalmic viscoelastic device (OVD), offering significant corneal protection and enhanced visibility during ophthalmic surgery as a new option to support tissue manipulation and anterior chamber maintenance in cataract procedures

- In March 2021, The FDA completed its PMA review and approved the ClearVisc™ Ophthalmic Viscosurgical Device (OVD) for commercial distribution in the U.S., reinforcing the availability of high‑performance viscoelastic solutions for ophthalmic surgeries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.