Global Ophthalmology Anti Vegf Biosimilars Market

Market Size in USD Million

CAGR :

%

USD

475.20 Million

USD

958.74 Million

2025

2033

USD

475.20 Million

USD

958.74 Million

2025

2033

| 2026 –2033 | |

| USD 475.20 Million | |

| USD 958.74 Million | |

|

|

|

|

Ophthalmology Anti-VEGF Biosimilars Market Size

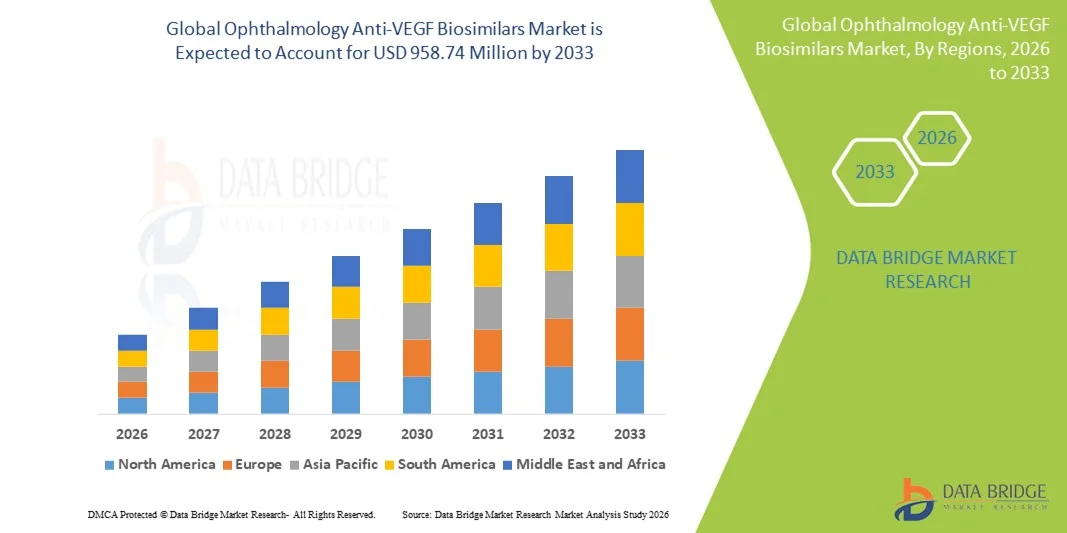

- The global ophthalmology Anti-VEGF biosimilars market size was valued at USD 475.2 Million in 2025 and is expected to reach USD 958.74 Million by 2033, at a CAGR of 9.17% during the forecast period

- The market growth is largely driven by the increasing prevalence of retinal disorders such as age-related macular degeneration, diabetic macular edema, and retinal vein occlusion, along with rising awareness about early diagnosis and timely ophthalmic treatment across both developed and emerging economies

- Furthermore, growing demand for cost-effective alternatives to branded biologics, expanding patient access to advanced biologic therapies, and favorable regulatory approvals are establishing ophthalmology anti-VEGF biosimilars as preferred treatment options. These converging factors are accelerating the adoption of Ophthalmology Anti-VEGF Biosimilars solutions, thereby significantly boosting the market’s overall growth

Ophthalmology Anti-VEGF Biosimilars Market Analysis

- Ophthalmology Anti-VEGF Biosimilars, which provide cost-effective biologic therapies for retinal vascular diseases, are becoming increasingly critical in modern ophthalmic care across hospitals and specialty eye clinics due to their comparable efficacy, improved patient access, and reduced treatment costs

- The rising demand for Ophthalmology Anti-VEGF Biosimilars is primarily driven by the growing prevalence of age-related macular degeneration (AMD), diabetic macular edema (DME), and retinal vein occlusion, along with increasing pressure on healthcare systems to adopt affordable alternatives to originator biologics

- North America dominated the ophthalmology Anti-VEGF Biosimilars market with a revenue share of approximately 41.5% in 2025, supported by strong biologics adoption, well-established reimbursement frameworks, and a high burden of retinal disorders. The U.S. continues to witness robust uptake of biosimilars following regulatory approvals and clinician confidence in therapeutic equivalence

- Asia-Pacific is expected to be the fastest-growing region in the ophthalmology Anti-VEGF Biosimilars market during the forecast period, driven by a rapidly aging population, rising diabetes prevalence, improving access to ophthalmic care, and increasing government initiatives to promote biosimilar usage

- The Age-Related Macular Degeneration (AMD) segment accounted for the largest market revenue share of 48.7% in 2025, driven by the high prevalence of wet AMD in aging populations

Report Scope and Ophthalmology Anti-VEGF Biosimilars Market Segmentation

|

Attributes |

Ophthalmology Anti-VEGF Biosimilars Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Novartis AG (Switzerland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Ophthalmology Anti-VEGF Biosimilars Market Trends

Advancements in Ophthalmology Anti-VEGF Biosimilars for Retinal Disease Management

- A significant and accelerating trend in the global ophthalmology Anti-VEGF biosimilars market is the increasing development and adoption of cost-effective biosimilar therapies for retinal diseases such as age-related macular degeneration (AMD), diabetic macular edema (DME), and retinal vein occlusion (RVO). These biosimilars are providing clinicians with more affordable treatment alternatives without compromising efficacy or safety

- For instance, improvements in molecular engineering and manufacturing processes have enabled biosimilars to closely match the reference biologics in terms of therapeutic outcomes, helping expand patient access in both developed and emerging markets

- In addition, the growing preference for outpatient and clinic-based intravitreal injection procedures has increased the demand for reliable, accessible anti-VEGF biosimilars that support repeated treatment cycles with minimized risk of adverse effects

- Ongoing clinical trials and regulatory approvals are further enhancing physician confidence in biosimilars, driving their integration into standard treatment protocols for retinal diseases

- The trend toward patient-centric ophthalmology care, combined with cost-conscious healthcare systems, is encouraging the adoption of biosimilars as a sustainable and scalable treatment option

- Consequently, pharmaceutical companies and biotech firms are actively expanding their biosimilar portfolios, developing formulations that offer improved storage stability, longer shelf-life, and comparable clinical efficacy to the original biologics

- This shift toward affordable, effective, and widely accessible anti-VEGF therapies is reshaping ophthalmic care and enabling broader management of vision-threatening conditions worldwide

Ophthalmology Anti-VEGF Biosimilars Market Dynamics

Driver

Rising Prevalence of Retinal Diseases and Increasing Geriatric Population

- The growing global prevalence of retinal disorders such as AMD, DME, and RVO, along with the increasing aging population, is a key driver for the Ophthalmology Anti-VEGF Biosimilars market. Aging populations are more prone to vision-threatening conditions, necessitating regular anti-VEGF therapy

- For instance, in 2025, several healthcare systems and ophthalmology clinics reported expanded adoption of biosimilar therapies to manage the increasing patient load while controlling treatment costs, supporting market growth during the forecast period

- Enhanced awareness among patients and ophthalmologists regarding early intervention and vision preservation is further driving the use of anti-VEGF biosimilars in routine care

- In addition, healthcare payers and insurance providers are promoting cost-effective biosimilar alternatives to improve accessibility while managing the economic burden associated with repeated biologic therapy

- Rising investments in research, clinical trials, and regulatory approvals for new biosimilar formulations are expected to continue fueling the market growth globally

Restraint/Challenge

High Development Costs and Regulatory Hurdles

- The high cost of biosimilar development, including clinical trials, regulatory approvals, and manufacturing, presents a significant challenge to market growth. Developing biosimilars requires substantial investment to ensure comparable efficacy and safety to reference biologics

- For instance, navigating stringent regulatory requirements from authorities such as the FDA and EMA can delay product launches and limit immediate market penetration

- Limited awareness among some healthcare providers and patients regarding the equivalence and safety of biosimilars can also slow adoption, especially in regions where originator biologics are well-established

- In addition, market competition with reference biologics and newer innovative therapies may affect pricing strategies and overall market share for biosimilars

- Overcoming these challenges through streamlined regulatory pathways, physician education, patient awareness programs, and cost optimization in manufacturing will be critical for sustained growth in the Ophthalmology Anti-VEGF Biosimilars market

Ophthalmology Anti-VEGF Biosimilars Market Scope

The market is segmented on the basis of product type, indication, and end user.

- By Product Type

On the basis of product type, the Ophthalmology Anti-VEGF Biosimilars market is segmented into Ranibizumab Biosimilars, Bevacizumab Biosimilars, and Aflibercept Biosimilars. The Ranibizumab Biosimilars segment dominated the largest market revenue share of 45.3% in 2025, driven by its strong clinical adoption for treating wet age-related macular degeneration (AMD) and widespread physician familiarity. Ranibizumab biosimilars are preferred due to their established efficacy and safety profile, mirroring the reference biologic’s performance. The segment benefits from broad regulatory approvals in North America, Europe, and Asia-Pacific, enhancing accessibility. Strong reimbursement policies for AMD therapy in developed markets further reinforce its dominance. Continuous launches of next-generation formulations and improved delivery devices support growth. The cost-effectiveness of biosimilars compared to the originator biologic encourages adoption in hospitals and clinics. High patient volumes for AMD therapy drive revenue generation. Increasing awareness about diabetic macular edema (DME) treatment adds incremental demand. The segment is further strengthened by ophthalmologists’ preference for Ranibizumab over off-label Bevacizumab in certain countries. Clinical studies demonstrating equivalence in vision improvement bolster confidence. Emerging markets are gradually adopting Ranibizumab biosimilars due to improving healthcare infrastructure. Overall, these factors sustain the segment’s market leadership.

The Aflibercept Biosimilars segment is expected to witness the fastest CAGR of 11.8% from 2026 to 2033, driven by expanding indications beyond AMD to diabetic macular edema and retinal vein occlusion (RVO). Increasing clinical trials and approvals in Asia-Pacific and Latin America are supporting rapid uptake. The strong efficacy in severe cases where Ranibizumab may be less effective is driving preference. Cost reductions compared to the originator biologic attract healthcare providers. Strategic partnerships between biosimilar developers and hospitals accelerate market penetration. Growing awareness of retinal vascular disorders boosts prescription rates. Expanding access in emerging economies strengthens CAGR. Advanced delivery mechanisms enhance patient adherence and therapy outcomes. Increasing ophthalmologist confidence due to successful post-marketing studies supports adoption. Favorable government initiatives promoting biosimilars contribute to growth. The segment is also benefiting from private payer reimbursement strategies. Overall, these factors collectively drive strong CAGR for Aflibercept biosimilars.

- By Indication

On the basis of indication, the market is segmented into Age-Related Macular Degeneration (AMD), Diabetic Macular Edema (DME), Retinal Vein Occlusion (RVO), Myopic Choroidal Neovascularization, and Others. The Age-Related Macular Degeneration (AMD) segment accounted for the largest market revenue share of 48.7% in 2025, driven by the high prevalence of wet AMD in aging populations across Europe, North America, and Asia-Pacific. The growing number of geriatric patients coupled with increasing ophthalmology visits fuels demand. Strong evidence from clinical trials supports the efficacy of Anti-VEGF biosimilars in maintaining or improving vision. Widespread reimbursement coverage in developed markets enhances adoption. Physicians prefer biosimilars due to cost savings while maintaining efficacy comparable to the originator biologic. High patient compliance is observed due to established dosing schedules. Hospital pharmacies and specialty clinics stock Ranibizumab and Aflibercept biosimilars as first-line therapy for AMD. Government initiatives in Asia-Pacific to improve access for elderly patients further support growth. Continuous patient education programs about early detection and treatment adherence boost therapy uptake. Strategic collaborations between biotech companies and ophthalmology centers increase awareness. The segment’s dominance is reinforced by expanding outpatient treatment infrastructure. These factors collectively maintain AMD as the leading indication.

The Diabetic Macular Edema (DME) segment is anticipated to grow at the fastest CAGR of 12.4% from 2026 to 2033, owing to the rising global prevalence of diabetes and associated retinal complications. Increasing incidence of DME in emerging markets like India and China drives demand. Expanded approval of biosimilars for DME treatment accelerates adoption. Healthcare providers prefer biosimilars to reduce treatment costs for long-term management. Continuous awareness campaigns about diabetes-related eye complications increase screening and early treatment. Technological improvements in ophthalmic injections and delivery devices support patient adherence. Growing partnerships between pharmaceutical companies and hospitals improve market penetration. Expansion of insurance coverage in key markets enables affordability. Rising physician confidence due to long-term post-marketing surveillance data enhances uptake. Advanced imaging techniques allow precise diagnosis and monitoring, facilitating therapy decisions. Increasing diabetic population globally ensures sustained therapy volumes. These combined factors drive strong CAGR for the DME segment.

- By End User

On the basis of end user, the market is segmented into Hospitals, Specialty Ophthalmology Clinics, Ambulatory Surgical Centers, and Others. The Hospitals segment held the largest market revenue share of 50.6% in 2025, driven by the concentration of high-volume ophthalmology patients and access to advanced diagnostic and injection facilities. Hospitals are primary centers for treating AMD and DME patients, with integrated outpatient and day-care units. Reimbursement coverage for biosimilars in hospital settings strengthens adoption. Availability of trained ophthalmologists and retina specialists supports high patient throughput. Hospital procurement policies favor cost-effective biosimilars over originators. Increasing elderly population and higher incidence of retinal disorders in hospitalized patients contribute to growth. Adoption of standardized treatment protocols ensures consistent usage of biosimilars. Presence of specialty retina departments accelerates therapy delivery. Hospitals often lead clinical studies and post-marketing surveillance programs, further boosting adoption. Partnerships between biosimilar manufacturers and hospital groups support awareness campaigns. Investment in patient care infrastructure and infusion facilities reinforces market share. These factors collectively maintain hospitals as the dominant end-user segment.

The Specialty Ophthalmology Clinics segment is expected to witness the fastest CAGR of 11.9% from 2026 to 2033, due to rising patient preference for outpatient care in private clinics. Increasing number of specialized retina clinics in urban and semi-urban regions supports rapid uptake. Clinics benefit from biosimilars’ lower cost compared to originators, improving patient affordability. Availability of trained ophthalmologists and modern diagnostic devices enhances adoption. Growing awareness among patients about targeted retinal therapies drives visits. Expanding partnerships between biosimilar developers and clinics improves access. Adoption of advanced injection techniques ensures patient safety and convenience. Increasing insurance coverage for outpatient care enables uptake. Technology-driven clinics offering integrated monitoring and treatment services accelerate penetration. Rising number of diabetic and AMD patients choosing clinic-based therapy further fuels CAGR. Continuous marketing and education programs increase patient awareness. These factors collectively drive strong growth in the specialty ophthalmology clinic segment.

Ophthalmology Anti-VEGF Biosimilars Market Regional Analysis

- North America dominated the ophthalmology Anti-VEGF biosimilars market with a revenue share of approximately 41.5% in 2025, supported by strong biologics adoption, well-established reimbursement frameworks, and a high burden of retinal disorders

- The market continues to witness robust uptake of biosimilars following regulatory approvals and clinician confidence in therapeutic equivalence

- Increasing prevalence of age-related macular degeneration (AMD), diabetic retinopathy, and other retinal diseases is further driving market growth in the region

U.S. Ophthalmology Anti-VEGF Biosimilars Market Insight

The U.S. ophthalmology Anti-VEGF biosimilars market captured the largest revenue share within North America in 2025, fueled by high biologics adoption, strong healthcare infrastructure, and increasing clinician confidence in biosimilar efficacy and safety. Regulatory approvals and favorable reimbursement policies are further promoting the uptake of Anti-VEGF biosimilars. Growing awareness of cost-effective alternatives to originator biologics is also driving adoption across ophthalmology clinics, hospitals, and specialty eye care centers.

Europe Ophthalmology Anti-VEGF Biosimilars Market Insight

The Europe ophthalmology Anti-VEGF biosimilars market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by an aging population, rising prevalence of diabetes, and increasing burden of retinal disorders. Adoption of cost-effective biosimilars, coupled with government initiatives and healthcare policies promoting biologic alternatives, is accelerating market growth. In addition, established ophthalmology infrastructure and expanding clinical research support continued market development.

U.K. Ophthalmology Anti-VEGF Biosimilars Market Insight

The U.K ophthalmology Anti-VEGF biosimilars market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by strong healthcare infrastructure and national initiatives promoting biosimilar adoption. Increasing prevalence of AMD and diabetic retinopathy, alongside rising awareness of treatment cost savings, is encouraging ophthalmologists and healthcare providers to adopt Anti-VEGF biosimilars. Robust e-commerce and pharmaceutical distribution networks are further facilitating market expansion.

Germany Ophthalmology Anti-VEGF Biosimilars Market Insight

The Germany ophthalmology Anti-VEGF biosimilars market is expected to expand at a considerable CAGR during the forecast period, fueled by advanced healthcare infrastructure, high awareness of biosimilars among ophthalmologists, and increasing incidence of retinal disorders. Strong research initiatives, regulatory support, and a growing preference for cost-effective treatment options are driving market adoption in both hospitals and specialty eye care clinics.

Asia-Pacific Ophthalmology Anti-VEGF Biosimilars Market Insight

The Asia-Pacific ophthalmology Anti-VEGF biosimilars market is expected to grow at the fastest CAGR during the forecast period, driven by a rapidly aging population, rising diabetes prevalence, improving access to ophthalmic care, and increasing government initiatives to promote biosimilar usage. Expanding healthcare infrastructure, increasing awareness among clinicians and patients, and cost advantages over originator biologics are further accelerating market growth in countries such as China, India, and Japan.

Japan Ophthalmology Anti-VEGF Biosimilars Market Insight

The Japan ophthalmology Anti-VEGF biosimilars market is gaining momentum due to the country’s aging population, high prevalence of diabetic retinopathy, and well-developed ophthalmology infrastructure. Clinician confidence in biosimilars, strong reimbursement support, and initiatives to reduce treatment costs are promoting adoption. Integration of biosimilars into hospital and clinic protocols is driving steady market expansion.

China Ophthalmology Anti-VEGF Biosimilars Market Insight

The China ophthalmology Anti-VEGF biosimilars market accounted for a significant revenue share in Asia-Pacific in 2025, supported by a growing geriatric population, rising prevalence of diabetes, and expanding ophthalmology services. Government initiatives to improve access to cost-effective treatments, combined with increasing clinician awareness of biosimilar efficacy, are key factors propelling market growth. Strong domestic manufacturing and distribution networks are further facilitating widespread adoption.

Ophthalmology Anti-VEGF Biosimilars Market Share

The Ophthalmology Anti-VEGF Biosimilars industry is primarily led by well-established companies, including:

• Novartis AG (Switzerland)

• Roche Holding AG (Switzerland)

• Bayer AG (Germany)

• Sandoz International GmbH (Switzerland)

• Regeneron Pharmaceuticals, Inc. (U.S.)

• Apotex Inc. (Canada)

• Amgen Inc. (U.S.)

• Celltrion, Inc. (South Korea)

• Lupin Limited (India)

• Biocon Limited (India)

• Intas Pharmaceuticals Ltd. (India)

• Samsung Bioepis (South Korea)

• Pfizer Inc. (U.S.)

• Hetero Biopharma Limited (India)

• Zydus Cadila (India)

• Alvotech (Iceland)

• Stada Arzneimittel AG (Germany)

• F. Hoffmann-La Roche Ltd. (Switzerland)

• Sun Pharmaceutical Industries Ltd. (India)

Latest Developments in Global Ophthalmology Anti-VEGF Biosimilars Market

- In May 2024, Biocon Biologics announced that its biosimilar aflibercept product Yesafili™(aflibercept‑jbvf) received U.S. FDA approval, marking the first interchangeable biosimilar to the reference product EYLEA for ophthalmology indications including wet age‑related macular degeneration (AMD), diabetic macular edema (DME), and retinal vein occlusion (RVO). This approval represents a significant expansion of biosimilar treatment options in the U.S. retina care landscape and improves patient access to cost‑effective anti‑VEGF therapy

- In November 2024, the European Commission (EC) granted marketing approval to OPUVIZ (SB15), an aflibercept biosimilar developed by Samsung Bioepis and Biogen, for the treatment of neovascular (wet) AMD, DME, RVO, and myopic choroidal neovascularization across the EU. The approval confirms biosimilarity to the reference EYLEA and expands affordable biologic therapy options for retinal diseases in European markets

- In August 2024, Sandoz announced that its aflibercept biosimilar Enzeevu (aflibercept‑abzv) received U.S. FDA approval for the same indications as EYLEA and is to enter the U.S. market following a settlement agreement with Regeneron, resolving patent disputes and clearing the way for biosimilar competition. This milestone adds a second interchangeable aflibercept biosimilar in the U.S., driving competitive pricing and broader clinical adoption

- In September 2023, Biocon Biologics received European Commission approval for Yesafili (aflibercept biosimilar), making it one of the first aflibercept biosimilars approved in the EU, and expanding access to treatment for multiple retinal diseases across European healthcare systems. This early approval paved the way for subsequent regulatory advancements and global commercialization plans

- In March 2024, Biocon Biologics secured a settlement and license agreement with Regeneron that cleared patent litigation barriers, enabling the commercial rollout of Yesafili biosimilar aflibercept in Canada with a planned launch no later than July 1, 2025. This settlement represents significant progress in expanding biosimilar availability beyond key regulatory regions

- In September 2025, STADA received European Commission marketing authorization for Afiveg (aflibercept biosimilar), expanding its specialty ophthalmology portfolio alongside its ranibizumab biosimilar and planning a lead launch in Germany following expected loss of exclusivity for the reference EYLEA product. This reflects continued growth of approved anti‑VEGF biosimilars in European markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.