Global Opioid Induced Constipation Drugs Market

Market Size in USD Billion

CAGR :

%

USD

2.87 Billion

USD

4.82 Billion

2024

2032

USD

2.87 Billion

USD

4.82 Billion

2024

2032

| 2025 –2032 | |

| USD 2.87 Billion | |

| USD 4.82 Billion | |

|

|

|

|

Opioid Induced Constipation Drugs Market Size

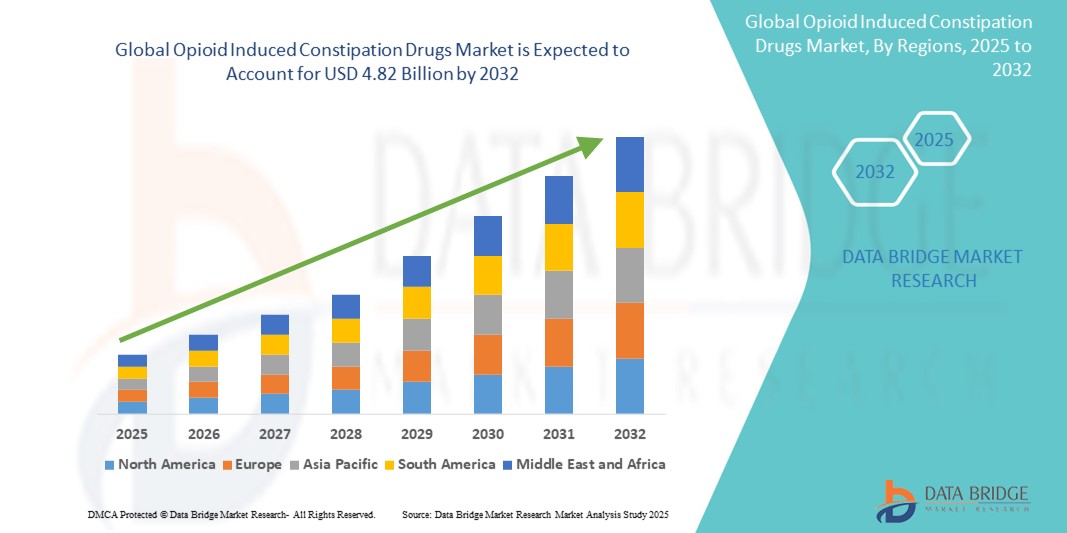

- The global opioid induced constipation drugs market size was valued at USD 2.87 billion in 2024 and is expected to reach USD 4.82 billion by 2032, at a CAGR of 6.70% during the forecast period

- The market growth is largely fueled by the increased use of opioid medications for chronic pain management, particularly in aging populations and patients undergoing cancer treatments, which has subsequently led to a surge in cases of opioid-induced constipation

- Furthermore, rising awareness among healthcare professionals and patients about the adverse effects of long-term opioid use and the availability of targeted pharmacological therapies are strengthening demand. These converging factors are accelerating the adoption of OIC drugs as a critical adjunct to opioid therapy, promoting market expansion in both inpatient and outpatient care settings

Opioid Induced Constipation Drugs Market Analysis

- Opioid induced constipation (OIC) drugs, designed to alleviate constipation caused by opioid use without compromising analgesic efficacy, are becoming increasingly vital in pain management regimens, especially in patients with chronic non-cancer and cancer-related pain. These drugs play a key role in improving patient quality of life and adherence to opioid therapy, especially in long-term care scenarios

- The escalating demand for OIC drugs is primarily fueled by the rising global consumption of opioid analgesics, increasing incidence of chronic pain disorders, and growing awareness of opioid-induced side effects

- North America dominated the opioid induced constipation drugs market with the largest revenue share of 44.8% in 2024, attributed to the high opioid prescription rates, advanced healthcare infrastructure, and strong presence of market-leading pharmaceutical companies

- Asia-Pacific is expected to be the fastest growing region in the opioid induced constipation drugs market during the forecast period due to rapidly aging populations, increasing prevalence of cancer and chronic pain conditions, and improving access to opioid medications across emerging economies

- Methylnaltrexone Bromide segment dominated the opioid induced constipation drugs market with a market share of 35.9% in 2024, driven by its targeted peripheral action that relieves constipation without affecting opioid-induced analgesia, making it highly suitable for advanced care settings

Report Scope and Opioid Induced Constipation Drugs Market Segmentation

|

Attributes |

Opioid Induced Constipation Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Opioid Induced Constipation Drugs Market Trends

“Rising Preference for Targeted Therapies and Novel Drug Delivery Mechanisms”

- A significant and evolving trend in the global opioid induced constipation (OIC) drugs market is the growing shift toward targeted pharmacological therapies such as peripherally acting mu-opioid receptor antagonists (PAMORAs) and the adoption of novel drug delivery formats that enhance patient compliance and treatment outcomes. These advances are reshaping the landscape of constipation management in opioid-treated patients

- For instance, Movantik (naloxegol) and Relistor (methylnaltrexone bromide) are leading PAMORAs that offer targeted relief of OIC without impacting the central analgesic effect of opioids. They are increasingly prescribed due to their well-tolerated profiles and effectiveness in both cancer and non-cancer pain patients

- Drug development efforts are also focusing on extended-release oral formulations and subcutaneous injectables that provide flexible administration routes based on patient needs and settings. For instance, Relistor is available in both oral and injectable forms, catering to diverse patient profiles

- In addition, combination approaches, such as opioid analgesics co-formulated with constipation-reducing agents, are under investigation to minimize gastrointestinal side effects without compromising pain relief

- These trends align with growing physician and patient awareness of OIC as a distinct and manageable condition, encouraging early diagnosis and proactive treatment planning. The emphasis on patient-centric solutions, particularly in palliative and long-term care settings, is expected to continue driving innovation and market growth

Opioid Induced Constipation Drugs Market Dynamics

Driver

“Increased Opioid Use and Growing Awareness of Opioid-Induced Side Effects”

- The widespread and increasing use of opioid medications for the treatment of chronic pain, cancer-related pain, and post-surgical recovery is a primary driver for the growth of the OIC drugs market

- As healthcare providers and patients become more aware of the adverse effects of long-term opioid use, including constipation, there is a rising demand for adjunctive treatments that allow continued pain relief while addressing gastrointestinal side effects

- For instance, the U.S. Centers for Disease Control and Prevention (CDC) estimates that millions of adults are prescribed opioids annually, making OIC a prevalent complication that requires dedicated therapeutic solutions

- The growing clinical recognition of OIC as a distinct medical condition has led to increased prescription of PAMORAs and approved agents such as Lubiprostone, which offer symptom relief without reversing analgesia

- Furthermore, initiatives by pharmaceutical companies to educate physicians and patients about OIC and its available treatments are helping boost early diagnosis and intervention, thereby driving market expansion

Restraint/Challenge

“High Treatment Costs and Limited Access in Emerging Markets”

- A major challenge restraining the global OIC drugs market is the high cost associated with targeted therapies, particularly newer PAMORA-based treatments, which may not be readily affordable or accessible in low- and middle-income countries (LMICs)

- For instance, drugs like Relistor and Movantik can be expensive for patients without adequate insurance coverage, limiting their adoption to primarily developed countries with comprehensive reimbursement systems

- Additionally, regulatory hurdles and lack of awareness in emerging regions can delay product launches and limit the availability of these advanced treatments. The absence of unified global treatment guidelines for OIC and regional disparities in opioid prescribing practices further complicate market growth in underpenetrated markets

- Overcoming these challenges requires greater emphasis on healthcare infrastructure development, affordable generic formulations, and strategic collaborations between governments and manufacturers to broaden access and reduce costs

- Companies investing in pricing strategies, regional trials, and educational programs are better positioned to expand their footprint and address unmet needs in these markets

Opioid Induced Constipation Drugs Market Scope

The market is segmented on the basis of active ingredients, treatment type, mode of administration, end-users, and distribution channel.

- By Active Ingredients

On the basis of active ingredient, the opioid induced constipation drugs market is segmented into naloxegol, lubiprostone, methylnaltrexone bromide, docusate sodium, and others. The Methylnaltrexone Bromide segment dominated the market with the largest market revenue share of 35.9% in 2024, driven by its targeted action in reversing opioid-induced constipation without affecting central analgesia. It is frequently used in advanced care settings such as oncology and palliative care, with both injectable and oral forms available, making it highly versatile and effective across different patient profiles.

The Lubiprostone segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its broad usage across both OIC and chronic idiopathic constipation cases. Its proven efficacy in female and elderly populations, along with minimal systemic absorption, contributes to its expanding role in outpatient and home-based care.

- By Treatment

On the basis of treatment, the opioid induced constipation drugs market is segmented into Over The Counter (OTC) Medicines, prescription drugs, and natural remedies. The Prescription segment dominated the market with the largest market revenue share of 64.8% in 2024, driven by increasing physician preference for clinically approved therapies such as PAMORAs and Lubiprostone. These drugs offer reliable symptom control in moderate to severe OIC cases and are commonly covered by insurance in developed markets.

The Over The Counter (OTC) segment is projected to witness fastest growth during forecast period, driven by ease of access, low cost, and patient reliance on self-medication for mild symptoms. However, limitations in efficacy are gradually shifting market demand toward prescription options.

- By Mode Of Administration

On the basis of mode of administration, the opioid induced constipation drugs market is segmented into oral, parenteral, and others. The oral segment held the largest market revenue share of 72.5% in 2024, driven by the convenience of self-administration, high patient compliance, and the widespread availability of leading drugs in oral formats such as Naloxegol and Lubiprostone. Oral medications remain the preferred route, especially in outpatient and long-term care settings.

The parenteral segment is projected to witness fastest growth during forecast period, due to its notable demand in hospital environments, particularly for patients with advanced illness, limited gastrointestinal function, or rapid symptom onset.

- By End User

On the basis of end-users, the opioid induced constipation drugs market is segmented into hospitals, homecare, specialty centres, and others. The hospital segment dominated the market with the largest market revenue share of 41.7% in 2024, driven by a high volume of opioid-treated inpatients, complex case management, and immediate access to intravenous or subcutaneous treatments. Hospitals are a primary point of care for patients requiring advanced therapies and acute symptom relief.

The homecare segment is anticipated to witness the fastest growth during forecast period, supported by the availability of effective oral therapies and the rising adoption of home-based opioid pain management. Increasing emphasis on patient comfort and the growing elderly population are further propelling demand in this segment.

- By Distribution Channel

On the basis of distribution channel, the opioid induced constipation drugs market is segmented into hospital pharmacy, online pharmacy, and retail pharmacy. The hospital pharmacy segment held the largest market revenue share of 39.9% in 2024, driven by the centralized distribution of high-cost prescription medications and injectable therapies within institutional settings. Hospital pharmacies are essential in ensuring timely and monitored administration of OIC drugs, especially in post-operative and oncology units.

The online pharmacy segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by increased digital healthcare adoption, the convenience of home delivery, and expanding access to prescription renewals for chronic care patients. The ease of use, privacy, and lower costs are appealing factors driving rapid adoption across developed and emerging markets alike.

Opioid Induced Constipation Drugs Market Regional Analysis

- North America dominated the opioid induced constipation drugs market with the largest revenue share of 44.8% in 2024, attributed to the high opioid prescription rates, advanced healthcare infrastructure, and strong presence of market-leading pharmaceutical companies

- Consumers and healthcare providers in the region increasingly recognize OIC as a distinct and manageable condition, leading to higher adoption of targeted prescription therapies such as PAMORAs and Lubiprostone

- This dominant position is further supported by favorable reimbursement policies, advanced clinical research environments, and a strong presence of key pharmaceutical manufacturers, positioning North America as the leading region for both innovation and consumption in the OIC drugs market

U.S. Opioid Induced Constipation Drugs Market Insight

The U.S. opioid induced constipation drugs market captured the largest revenue share of 79.2% in 2024 within North America, fueled by the nation’s high opioid prescription rate and increasing awareness of opioid-related gastrointestinal side effects. The growing focus on patient quality of life and adherence to pain therapies is leading to widespread adoption of targeted treatments such as PAMORAs and Lubiprostone. Favorable reimbursement frameworks, strong clinical research infrastructure, and the presence of leading pharmaceutical companies are further propelling the market. Additionally, patient and physician education initiatives by healthcare providers and drug manufacturers are enhancing early diagnosis and treatment uptake across healthcare settings.

Europe Opioid Induced Constipation Drugs Market Insight

The Europe opioid induced constipation drugs market is projected to expand at a steady CAGR throughout the forecast period, supported by stringent treatment guidelines for opioid use and rising awareness regarding opioid-induced complications. As pain management becomes increasingly regulated in the region, physicians are more inclined to prescribe adjunctive treatments for constipation. The demand for improved patient outcomes in oncology and palliative care is also promoting the uptake of targeted therapies. Additionally, the region’s emphasis on healthcare accessibility and innovation, particularly in Western Europe, contributes to the consistent growth of OIC drug prescriptions across outpatient and hospital settings.

U.K. Opioid Induced Constipation Drugs Market Insight

The U.K. opioid induced constipation drugs market is anticipated to grow at a notable CAGR during the forecast period, driven by growing concerns about opioid dependency and side effects, including constipation. As national health policies push for improved pain management protocols and reduced opioid-related complications, there is a rising trend in prescribing PAMORAs for patients undergoing long-term opioid therapy. The integration of OIC management into broader cancer and chronic care pathways, coupled with NHS support for advanced therapeutics, is expected to drive sustained market expansion in the U.K.

Germany Opioid Induced Constipation Drugs Market Insight

The Germany opioid induced constipation drugs market is expected to expand at a considerable CAGR during the forecast period, supported by its advanced healthcare infrastructure and proactive pharmaceutical regulations. With an aging population and high rates of chronic illnesses such as cancer and musculoskeletal disorders, opioid prescriptions remain prevalent—creating a substantial market for adjunctive therapies. Germany’s emphasis on pharmaceutical innovation and reimbursement for prescription drugs, particularly those used in palliative and elderly care, further fuels demand for clinically approved OIC treatments.

Asia-Pacific Opioid Induced Constipation Drugs Market Insight

The Asia-Pacific opioid induced constipation drugs market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing opioid utilization for pain management, rising chronic disease prevalence, and growing healthcare awareness across countries such as China, Japan, and India. Governments across the region are investing in healthcare access and regulatory modernization, enabling faster introduction of advanced drugs. Additionally, increasing palliative care services and patient-centric approaches are driving demand for effective constipation management solutions in opioid-treated populations.

Japan Opioid Induced Constipation Drugs Market Insight

The Japan opioid induced constipation drugs market is gaining momentum due to the country’s aging population, strong healthcare infrastructure, and high awareness of pain management best practices. As the use of opioids in cancer and post-operative care rises, the need for effective and well-tolerated OIC drugs is also increasing. Japanese consumers prioritize high-quality and minimally invasive treatments, which supports the growing use of oral PAMORAs. The integration of OIC drugs into standard care pathways and ongoing clinical research initiatives are expected to further accelerate market growth in Japan.

India Opioid Induced Constipation Drugs Market Insight

The India opioid induced constipation drugs market accounted for the largest market revenue share in Asia Pacific in 2024, driven by the rising prevalence of chronic pain conditions, rapid expansion of palliative care services, and increased opioid prescriptions in oncology. India’s growing middle class and enhanced access to healthcare infrastructure are facilitating the adoption of prescription drugs for managing side effects like OIC. Domestic pharmaceutical production, coupled with rising awareness of opioid-related side effects, is helping make OIC treatments more accessible and affordable across urban and semi-urban populations.

Opioid Induced Constipation Drugs Market Share

The opioid induced constipation drugs industry is primarily led by well-established companies, including:

- Pfizer Inc (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Viatris Inc. (U.S.)

- Fresenius Kabi AG (Germany)

- Hikma Pharmaceuticals PLC (U.K.)

- Novartis AG (Switzerland)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Bristol Myers Squibb Company (U.S.)

- GSK Plc. (U.K.)

- Bayer AG (Germany)

- Aurobindo Pharma (India)

- S.L.A. Pharma AG (U.K.)

- Salix Pharmaceuticals (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- Abbott (U.S.)

- Boehringer Ingelheim International GmbH. (Germany)

- Merck & Co Inc. (U.S.)

- Daewoong Pharmaceutical Company (South Korea)

- Cosmo Pharmaceuticals (Ireland)

What are the Recent Developments in Global Opioid Induced Constipation Drugs Market?

- In March 2024, Bausch Health Companies Inc. and Alfasigma S.p.A. entered a licensing agreement to co-develop and commercialize Relistor (methylnaltrexone bromide) in selected European markets. The collaboration aims to expand the accessibility of PAMORAs across regions with growing opioid usage, particularly in oncology care. This strategic move underscores both companies’ commitment to advancing gastrointestinal safety in opioid-treated patients and addressing unmet needs in chronic care management

- In February 2024, Takeda Pharmaceutical Company Limited announced the initiation of a Phase III clinical trial evaluating a novel oral formulation of its investigational OIC treatment Naldemedine in patients with chronic non-cancer pain. The study highlights ongoing R&D investment in the segment and Takeda’s strategy to expand its portfolio in gastrointestinal supportive therapies through targeted, evidence-backed innovation

- In November 2023, AstraZeneca launched an expanded patient access program for Movantik (naloxegol) in North America to improve affordability for low-income patients suffering from OIC. The initiative focuses on widening access to effective prescription treatments for those on long-term opioid regimens, reinforcing AstraZeneca’s focus on patient-centric solutions and equitable healthcare delivery

- In October 2023, Mallinckrodt Pharmaceuticals announced the successful completion of a real-world evidence study on the use of Lubiprostone in opioid-treated palliative care patients. The findings demonstrated significant improvement in patient-reported quality of life and bowel movement frequency, further supporting Lubiprostone’s role in end-of-life and supportive care pathways

- In September 2023, Daiichi Sankyo Co., Ltd. partnered with several leading hospitals in Japan to pilot the use of AI-supported adherence tracking for OIC therapies, integrating digital health tools to improve compliance with prescribed OIC medications. The initiative reflects an emerging trend in combining pharmacotherapy with digital solutions to enhance outcomes, particularly in elderly and long-term care populations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.