Global Optical Fiber Components Market

Market Size in USD Billion

CAGR :

%

USD

26.53 Billion

USD

50.20 Billion

2024

2032

USD

26.53 Billion

USD

50.20 Billion

2024

2032

| 2025 –2032 | |

| USD 26.53 Billion | |

| USD 50.20 Billion | |

|

|

|

|

Optical Fiber Components Market Size

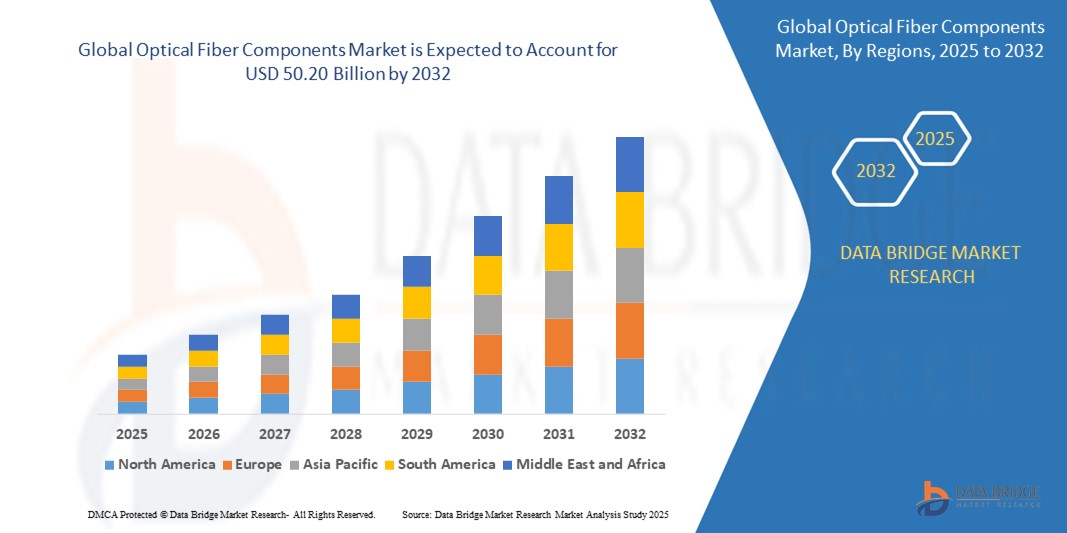

- The global optical fiber components market size was valued at USD 26.53 billion in 2024 and is expected to reach USD 50.20 billion by 2032, at a CAGR of 8.3% during the forecast period

- The market growth is largely fueled by the accelerating expansion of 5G networks, cloud computing, and data center infrastructure, driving demand for high-speed and low-latency optical fiber communication systems across industries

- Furthermore, increasing investments in FTTH (Fiber to the Home) deployments and the rising need for secure, high-bandwidth transmission in telecom, defense, and medical applications are establishing optical fiber components as essential elements of next-generation connectivity. These converging factors are significantly boosting the adoption of optical fiber technologies, thereby propelling market expansion

Optical Fiber Components Market Analysis

- Optical fiber components, including transceivers, amplifiers, splitters, and connectors, are critical enablers of high-speed, high-capacity data transmission systems, playing a foundational role in modern communication networks, data centers, and broadband infrastructure across sectors

- The escalating demand for optical fiber components is primarily fueled by the rapid proliferation of internet-connected devices, growing reliance on cloud-based services, 5G rollout, and increasing bandwidth requirements in both commercial and industrial applications

- Asia-Pacific dominated the optical fiber components market with a share of 44.5% in 2024, due to rapid digital transformation, expanding 5G infrastructure, and high data consumption across emerging economies

- North America is expected to be the fastest growing region in the optical fiber components market during the forecast period due to accelerating demand for high-speed internet, rapid cloud adoption, and upgrades in telecom infrastructure

- FTTH segment dominated the market with a market share of 60.5% in 2024, due to rapid urbanization, government digitalization initiatives, and increasing consumer demand for high-speed internet connectivity. Telecom service providers are significantly investing in last-mile fiber installations to meet the growing bandwidth demands from video streaming, IoT, and remote working

Report Scope and Optical Fiber Components Market Segmentation

|

Attributes |

Optical Fiber Components Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Optical Fiber Components Market Trends

“Rising Demand for High-Speed Internet Boosts Market Growth”

- A significant and accelerating trend in the global optical fiber components market is the surging demand for high-speed internet connectivity, driven by data-intensive applications, cloud services, and video streaming. This rising need is pushing telecom operators and governments to upgrade network infrastructures with advanced fiber optics

- For instance, Corning Incorporated is supplying optical fiber cables for major 5G and broadband expansion projects across North America, while Prysmian Group has been contracted to deliver optical components for large-scale FTTH (Fiber-to-the-Home) rollouts in Europe

- High-speed internet demands are encouraging the development of low-loss, high-bandwidth optical components such as DWDM transceivers and optical amplifiers. Companies such as Lumentum and II-VI Incorporated are innovating in these areas, offering compact, high-performance solutions that support higher data transmission rates with minimal latency

- The integration of optical fiber components into metro and long-haul networks is enabling faster and more efficient data transfer across vast distances, which is essential for supporting 5G, IoT, and edge computing infrastructure

- This trend is significantly reshaping telecom and enterprise network architectures, prompting key players such as Fujikura Ltd. and Sumitomo Electric Industries to develop next-generation fiber solutions that meet the rising bandwidth and reliability requirements of modern digital ecosystems

- The demand for optical fiber components that support ultra-fast, stable internet is growing rapidly across telecommunications, data centers, and industrial automation sectors, as connectivity becomes foundational to global digital transformation efforts

Optical Fiber Components Market Dynamics

Driver

“Rising Demand for HD and 4K Video Streaming”

- The increasing consumption of high-definition (HD) and 4K video content across platforms such as Netflix, YouTube, and Amazon Prime Video is a significant driver for the rising demand for optical fiber components

- For instance, in 2024, Prysmian Group expanded its optical cable production capacity in response to growing broadband demand fueled by ultra-high-definition content streaming, while Corning Incorporated continues to supply advanced optical fibers for data-heavy applications supporting content providers and telecom operators

- As consumers and enterprises shift toward bandwidth-intensive video streaming, traditional copper-based networks are proving inadequate, thereby accelerating the transition to optical fiber infrastructure capable of handling high-speed, high-volume data transmission

- Furthermore, the rise of video conferencing, live gaming, and OTT platforms in both residential and commercial spaces is elevating expectations for uninterrupted, high-quality streaming, which is made possible through low-latency, high-capacity fiber optic networks

- The rapid growth of HD and 4K streaming is propelling telecom providers, ISPs, and infrastructure companies to invest in optical fiber networks, thereby driving sustained demand for advanced fiber optic components across global markets

Restraint/Challenge

“Complex Installation and Maintenance”

- The intricate installation process and specialized maintenance requirements of optical fiber components present a significant challenge to broader market adoption, particularly in less developed infrastructure environments

- For instance, companies such as Sumitomo Electric and Fujikura Ltd. offer advanced fusion splicing equipment and training programs, yet deploying fiber networks still demands skilled labor, precision tools, and time-intensive procedures, which can increase project costs and timelines

- Furthermore, maintenance of large-scale fiber networks involves complex testing tools such as OTDRs (Optical Time-Domain Reflectometers), which add to operational complexity and cost

- These technical and cost-related challenges often act as a deterrent for new entrants and smaller service providers, particularly in rural or underdeveloped regions where skilled technicians and resources are limited

- Addressing these challenges through innovations in plug-and-play fiber modules, simplified connector systems, and workforce development initiatives by companies such as Corning and OFS Fitel will be essential to enhance scalability and adoption of optical fiber infrastructure globally

Optical Fiber Components Market Scope

The market is segmented on the basis of component, system, application, and end-user.

- By Component

On the basis of component, the optical fiber components market is segmented into hardware, software, and services. The hardware segment dominated the largest market revenue share in 2024, driven by the rising deployment of high-bandwidth fiber optic cables and associated infrastructure in telecommunications and data centers. Components such as connectors, amplifiers, transceivers, and splitters form the backbone of high-speed internet delivery, and their increased deployment in expanding 5G networks further supports segment growth. The rising investments in undersea and long-haul fiber optic networks by telecom operators worldwide also contribute significantly to hardware demand.

The services segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by the growing need for deployment consulting, integration, and ongoing maintenance services in complex optical systems. The rising trend of network outsourcing and the demand for tailored solutions across industries such as healthcare and BFSI enhance the requirement for specialized service providers with domain expertise.

- By System

On the basis of system, the market is categorized into control units, central control units, and regional control units. The central control units segment held the largest revenue share in 2024, owing to their critical role in managing and coordinating signal transmission, fault detection, and network control across distributed fiber optic systems. Their widespread use in telecom and data center infrastructures for real-time performance monitoring and bandwidth optimization supports strong adoption.

The regional control units segment is expected to witness the fastest CAGR from 2025 to 2032, driven by increasing deployment in distributed sensing applications and regional fiber management systems. These units enable localized signal processing and operational independence, which is crucial for large-scale installations across geographies such as smart grids and oil pipelines.

- By Application

On the basis of application, the market is segmented into FTTH, distributed sensing, data centre, analytical and medical equipment, power transmission, and others. The FTTH (Fiber to the Home) segment accounted for the largest market revenue share of 60.5% in 2024, supported by rapid urbanization, government digitalization initiatives, and increasing consumer demand for high-speed internet connectivity. Telecom service providers are significantly investing in last-mile fiber installations to meet the growing bandwidth demands from video streaming, IoT, and remote working.

The distributed sensing segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its growing use in structural health monitoring, perimeter security, and downhole oilfield applications. The ability of distributed fiber systems to measure temperature, strain, and acoustic signals over long distances with high accuracy is spurring adoption in both civil infrastructure and industrial sectors.

- By End User

On the basis of end user, the optical fiber components market is segmented into telecommunication, military and aerospace, oil and gas, medical, railway, banking and finance services and insurance (BFSI), and others. The telecommunication segment led the market with the highest revenue share in 2024, attributed to the massive expansion of fiber networks to support 5G, cloud computing, and high-speed broadband services. The increasing deployment of optical components in metro and long-haul networks and the migration to all-fiber architectures continue to drive segment growth.

The medical segment is projected to register the fastest CAGR from 2025 to 2032, driven by the increasing use of optical fiber in minimally invasive surgeries, endoscopic imaging, and diagnostic devices. The rise in demand for precision-based healthcare solutions and the growing adoption of fiber-optic technologies in biomedical instrumentation are key contributors to this growth.

Optical Fiber Components Market Regional Analysis

- Asia-Pacific dominated the optical fiber components market with the largest revenue share of 44.5% in 2024, driven by rapid digital transformation, expanding 5G infrastructure, and high data consumption across emerging economies

- The region’s increasing internet penetration, demand for cloud-based services, and growth in fiber-to-the-home (FTTH) projects are major contributors to market growth

- In addition, government-led initiatives in smart city development and large-scale investments in broadband connectivity are accelerating the adoption of optical fiber components in both residential and industrial sectors

Japan Optical Fiber Components Market Insight

The Japan market is expanding due to continuous innovation in optical technology and growing demand for high-speed, secure communication in industrial automation and healthcare sectors. Japan’s strong telecom infrastructure and push towards advanced 5G networks support robust uptake of optical fiber components. Local firms are investing in compact, energy-efficient transceivers and sensors for applications ranging from robotics to smart diagnostics.

China Optical Fiber Components Market Insight

The China optical fiber components market held the largest share in Asia-Pacific in 2024, supported by its dominance in fiber optic cable manufacturing and aggressive national strategies for 5G and data center expansion. Rising demand from telecom, cloud computing, and surveillance sectors, along with local production advantages, is driving market growth. Chinese enterprises are also investing in advanced optical components to enhance domestic technology capabilities and reduce import reliance.

Europe Optical Fiber Components Market Insight

The Europe optical fiber components market is projected to grow at a significant CAGR over the forecast period, fueled by strong regulatory support for digital infrastructure, energy efficiency, and cross-border data security. The region’s leadership in industrial automation, connected vehicles, and IoT ecosystems is pushing demand for reliable, high-bandwidth fiber connectivity. Initiatives under the EU’s Digital Decade framework are further strengthening investment in optical fiber networks.

U.K. Optical Fiber Components Market Insight

The U.K. market is anticipated to grow steadily during the forecast period, driven by rising fiber broadband penetration and increased demand for data center interconnect solutions. Government-backed programs to expand full-fiber coverage and reduce digital disparity in rural areas are supporting market expansion. The growing fintech and healthcare sectors also rely on secure, high-speed data transmission, which boosts adoption of optical components.

Germany Optical Fiber Components Market Insight

The Germany optical fiber components market is expected to witness considerable expansion, underpinned by industrial digitization and rising data center activity. As a manufacturing and automotive hub, Germany is investing in fiber networks to support Industry 4.0, autonomous systems, and real-time analytics. Strong demand for reliable and scalable optical links in both public and private sectors is driving deployment across verticals.

North America Optical Fiber Components Market Insight

North America market is projected to grow at the fastest CAGR from 2025 to 2032, driven by the accelerating demand for high-speed internet, rapid cloud adoption, and upgrades in telecom infrastructure. Expanding applications in aerospace, defense, and smart grid systems are propelling the need for robust optical fiber networks. Regulatory initiatives supporting broadband access and growing awareness about cybersecurity and data integrity are also contributing to market expansion.

U.S. Optical Fiber Components Market Insight

The U.S. optical fiber components market captured the largest revenue share in 2024 within North America, supported by heavy investments in 5G rollout, hyperscale data centers, and IoT infrastructure. The presence of key tech players and rising enterprise cloud demand are driving adoption of transceivers, amplifiers, and switches. In addition, federal broadband funding and smart city developments are accelerating deployment across urban and suburban regions.

Optical Fiber Components Market Share

The optical fiber components industry is primarily led by well-established companies, including:

- SLB (U.S.)

- Adtran (U.S.)

- Fujikura Ltd. (Japan)

- EXFO Inc. (Canada)

- Sumitomo Electric Industries, Ltd. (Japan)

- DSIT Solutions Ltd. (Israel)

- Bandweaver (U.K.)

- Lumentum Operations LLC (U.S.)

- Qualitrol Company LLC (U.S.)

- VIAVI Solutions Inc. (U.S.)

- Omnisens (Switzerland)

- NBG HOLDING GMBH (Austria)

- Zayo Group, LLC (U.S.)

- CommVerge Solutions (China)

- Halliburton (U.A.E.)

- LANCIER Monitoring GmbH (Germany)

- M2Optics, Inc. (U.S.)

- FURUKAWA ELECTRIC CO., LTD. (Japan)

Latest Developments in Global Optical Fiber Components Market

- In November 2021, Lumentum (US) acquired NeoPhotonics Corporation, expanding its portfolio in the growing optical components market for cloud and telecom network infrastructure, valued at over USD 10 billion. This acquisition bolstered Lumentum's capabilities and market presence in high-demand optical technologies and solutions

- In July 2021, Furukawa Electric partnered with Fujitsu Optical Components Limited, a leading producer of wiring devices. This collaboration focused on delivering optical devices for digital coherent systems, specifically targeting the transceiver needs of customers in the high-demand Asia region, enhancing their market reach and product offerings

- In January 2021, Fujitsu Network Communications teamed up with HFR Networks to launch the first 25G smart tunable optics as part of their flexiHaul solutions. This partnership aims to provide flexible, cost-effective solutions and enhance open communication, capital structure, and network efficiency across various radio technologies and vendors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.