Global Optical Position Sensor Market

Market Size in USD Billion

CAGR :

%

USD

3.29 Billion

USD

7.53 Billion

2025

2033

USD

3.29 Billion

USD

7.53 Billion

2025

2033

| 2026 –2033 | |

| USD 3.29 Billion | |

| USD 7.53 Billion | |

|

|

|

|

Optical Position Sensor Market Size

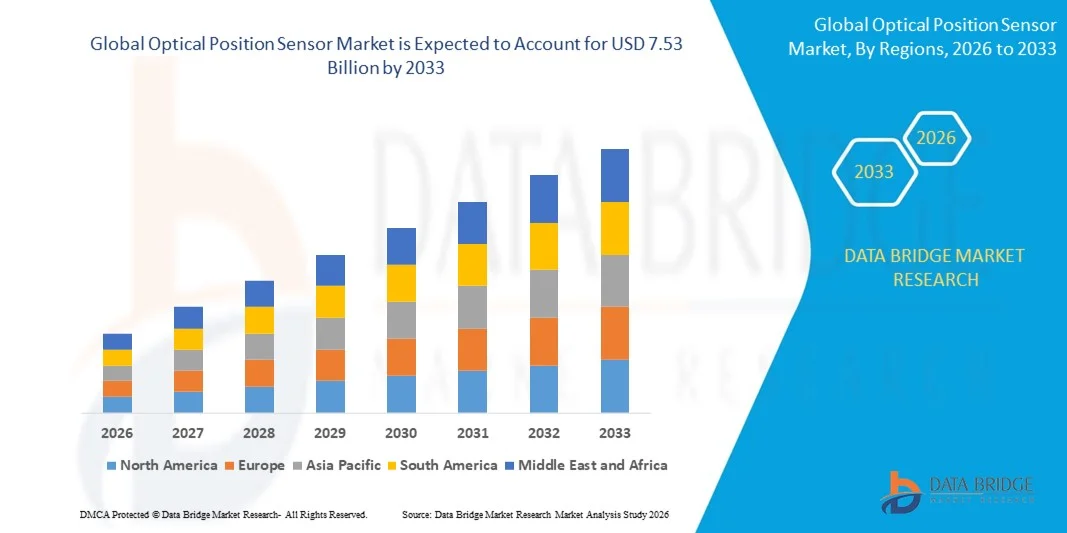

- The global optical position sensor market size was valued at USD 3.29 billion in 2025 and is expected to reach USD 7.53 billion by 2033, at a CAGR of 10.90% during the forecast period

- The market growth is largely fueled by the increasing adoption of automation and robotics across industrial, automotive, aerospace, and electronics sectors, driving the demand for high-precision and reliable position sensing solutions

- Furthermore, rising requirements for real-time monitoring, process optimization, and high-accuracy motion control in manufacturing and inspection applications are establishing optical position sensors as essential components in modern industrial and commercial systems. These converging factors are accelerating the deployment of optical sensors, thereby significantly boosting the market’s growth

Optical Position Sensor Market Analysis

- Optical position sensors, providing precise measurement of linear or rotational positions, are increasingly vital for robotics, industrial automation, assembly lines, and quality control systems due to their high accuracy, fast response, and robustness in demanding environments

- The escalating demand for optical position sensors is primarily fueled by the growing adoption of Industry 4.0, smart manufacturing technologies, and automated production systems, alongside the need for improved operational efficiency, reduced errors, and real-time feedback in critical industrial processes

- North America dominated the optical position sensor market in 2025, due to strong adoption in aerospace, automotive, and industrial automation sectors

- Asia-Pacific is expected to be the fastest growing region in the optical position sensor market during the forecast period due to rising industrial automation, rapid urbanization, and technological advancements in countries such as China, Japan, and India

- Two-dimensional segment dominated the market with a market share of 46.8% in 2025, due to its ability to measure horizontal and vertical movements with high accuracy for automotive, consumer electronics, and industrial automation. Integration with robotic systems enables real-time feedback and automated corrections, enhancing efficiency and precision. For instance, Keyence provides two-dimensional optical sensors for high-speed inspection in electronics manufacturing. Its compact design, ease of calibration, and consistent performance across conditions further support its market dominance

Report Scope and Optical Position Sensor Market Segmentation

|

Attributes |

Optical Position Sensor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Optical Position Sensor Market Trends

Growing Adoption of Optical Sensors in Industrial Automation

- A significant trend in the optical position sensor market is the increasing adoption of these sensors across industrial automation, robotics, and precision manufacturing, driven by the need for high-accuracy motion control and real-time process monitoring. This trend is elevating the role of optical position sensors as essential components for achieving efficient, automated operations in automotive, aerospace, electronics, and industrial machinery

- For instance, KEYENCE Corporation and Micro-Epsilon supply high-resolution optical sensors that are widely used in robotic arms, assembly lines, and CNC machines. Such sensors improve operational precision, reduce errors, and enable continuous monitoring under demanding industrial conditions

- The adoption of optical sensors is expanding in automated manufacturing systems where precise position detection supports assembly accuracy, material handling, and inspection tasks. This is positioning optical position sensors as critical enablers of smart factories and Industry 4.0 initiatives that rely on reliable and high-speed sensing capabilities

- The automotive sector is integrating optical position sensors for applications such as steering, throttle, and pedal position detection, enhancing safety and operational efficiency. This trend is accelerating innovation in electric vehicles, autonomous driving systems, and advanced driver-assistance solutions

- Industries focusing on robotics and industrial automation are increasingly deploying optical sensors to optimize motion control, minimize downtime, and improve throughput. This is shaping a stronger preference for sensors capable of high precision, fast response, and durability in harsh working environments

- The aerospace and defense sectors are leveraging optical position sensors for navigation, flight control, and high-accuracy machining, where operational reliability is paramount. This rising incorporation is reinforcing the overall transition toward precision automation and advanced monitoring systems in critical applications

Optical Position Sensor Market Dynamics

Driver

Increasing Demand for High-Precision Motion Control

- The growing reliance on precise motion detection across robotics, industrial automation, and manufacturing systems is driving demand for optical position sensors that ensure accurate, reliable, and real-time measurements. These sensors enhance operational efficiency, reduce errors, and support high-speed automated processesFor instance, Hamamatsu Photonics and Siemens provide optical position sensors for robotic and automated manufacturing systems that deliver sub-micron accuracy, enabling high-quality assembly and inspection

- The rising adoption of smart factories and Industry 4.0 technologies is fueling the need for sensors capable of real-time feedback, predictive maintenance, and process optimization. Optical position sensors help industries achieve seamless integration with automated systems, boosting productivity and reducing operational risks

- Industries such as automotive, electronics, and aerospace increasingly require high-resolution, robust sensors to maintain manufacturing quality and meet regulatory precision standards. This growing emphasis on accuracy and repeatability continues to strengthen the driver for market expansion

- The trend toward automation in production facilities is expanding the application scope of optical position sensors across linear and rotational motion tracking, positioning them as indispensable components for modern industrial systems

Restraint/Challenge

High Implementation Costs and Integration Complexity

- The optical position sensor market faces challenges due to the high costs associated with precision manufacturing, calibration, and integration into existing automation systems. These factors increase the initial investment required and can limit adoption in cost-sensitive applications

- For instance, companies such as Sensata Technologies and Micro-Epsilon invest heavily in precision fabrication and high-resolution calibration processes to ensure sensor reliability. The complexity of these processes adds to the total cost of deployment

- Integrating optical position sensors into multi-axis robotic systems, industrial machinery, or legacy equipment requires specialized expertise, software support, and compatible interfaces, which can complicate implementation and prolong deployment timelines

- The dependence on high-quality optical materials, advanced manufacturing technologies, and rigorous quality control increases production difficulty and limits scalability for some manufacturers

- These challenges collectively require industries to balance the benefits of high-precision sensing with cost and integration considerations, placing pressure on suppliers to develop more efficient, affordable, and compatible optical sensor solutions

Optical Position Sensor Market Scope

The market is segmented on the basis of type, sensor type, and application.

- By Type

On the basis of type, the optical position sensor market is segmented into Electrical Discharge Machines (EDM), Laser Cutting Machines, and Others. The EDM segment dominated the market in 2025 due to its role in precision machining and high-accuracy component production. Optical sensors in EDM provide real-time feedback, reduce defects, and improve operational efficiency. Industries such as aerospace and automotive prefer EDM-integrated sensors for their reliability and compact design. For instance, manufacturers use these sensors to enhance machining accuracy and reduce downtime. The segment benefits from continuous technological advancements that improve sensor performance, speed, and durability.

The Laser Cutting Machines segment is expected to witness the fastest growth from 2026 to 2033, driven by rising adoption in metal fabrication and electronics manufacturing. Optical sensors enable precise beam alignment and motion control, improving cutting accuracy and efficiency. For instance, Trumpf integrates optical sensors in its laser systems for micron-level precision. Growing automation and demand for reduced human intervention support this segment’s expansion. These sensors also facilitate predictive maintenance and process optimization, enhancing overall productivity.

- By Sensor Type

On the basis of sensor type, the market is segmented into One-Dimensional, Two-Dimensional, and Multiaxial. The Two-Dimensional segment dominated with the largest share of 46.8% in 2025, driven by its ability to measure horizontal and vertical movements with high accuracy for automotive, consumer electronics, and industrial automation. Integration with robotic systems enables real-time feedback and automated corrections, enhancing efficiency and precision. For instance, Keyence provides two-dimensional optical sensors for high-speed inspection in electronics manufacturing. Its compact design, ease of calibration, and consistent performance across conditions further support its market dominance.

The Multiaxial segment is expected to grow fastest from 2026 to 2033, driven by the need for simultaneous multi-axis measurements in robotics and aerospace manufacturing. Multiaxial sensors enable spatial tracking and precise motion control. For instance, Renishaw develops multiaxial sensors for multi-directional machining and inspection. Adoption is supported by Industry 4.0 integration, high-precision requirements, and advanced automation needs.

- By Application

On the basis of application, the market is segmented into Aerospace and Defence, Automotive, Consumer Electronics, Healthcare, and Others. The Aerospace and Defence segment dominated in 2025 due to strict precision requirements for aircraft, satellites, and defense systems. Optical sensors are crucial for navigation, flight control, and automated manufacturing. For instance, Honeywell uses optical sensors in avionics and missile guidance systems for enhanced accuracy and safety. Harsh environmental resilience further supports this segment’s preference.

The Automotive segment is expected to grow fastest from 2026 to 2033, fueled by electric vehicles, autonomous technologies, and advanced driver-assistance systems. Optical sensors are used for precise steering, pedal, and throttle position detection and assembly line automation. For instance, Bosch integrates optical sensors in EVs for accurate component positioning. Industry 4.0-enabled smart manufacturing further drives adoption.

Optical Position Sensor Market Regional Analysis

- North America dominated the optical position sensor market with the largest revenue share in 2025, driven by strong adoption in aerospace, automotive, and industrial automation sectors

- Industries in the region highly value the precision, reliability, and real-time feedback offered by optical position sensors for critical manufacturing and inspection processes

- Widespread adoption is supported by advanced manufacturing infrastructure, high technological awareness, and the growing integration of sensors in automated systems, establishing optical position sensors as a preferred solution for precision applications

U.S. Optical Position Sensor Market Insight

The U.S. optical position sensor market captured the largest revenue share in 2025 within North America, fueled by the presence of key aerospace and automotive manufacturers and advanced industrial automation facilities. Companies are increasingly prioritizing high-accuracy position sensing for robotics, assembly lines, and quality control applications. The adoption of Industry 4.0 and smart manufacturing systems, combined with demand for predictive maintenance and real-time monitoring, further drives market growth. Moreover, the integration of optical sensors in defense and aerospace applications for navigation, guidance, and precision machining is significantly contributing to the market expansion.

Europe Optical Position Sensor Market Insight

The Europe optical position sensor market is projected to expand at a substantial CAGR throughout the forecast period, driven by advanced industrial infrastructure, stringent quality standards, and increasing automation in manufacturing. The demand for precision measurement in automotive, aerospace, and electronics sectors is fostering the adoption of optical sensors. European manufacturers are also drawn to the benefits of real-time monitoring, high reliability, and integration with smart machinery. The market is witnessing growth across industrial, aerospace, and defense applications, with sensors being incorporated in both new production setups and modernization projects.

U.K. Optical Position Sensor Market Insight

The U.K. optical position sensor market is expected to grow at a noteworthy CAGR during the forecast period, fueled by increasing automation and the adoption of high-precision manufacturing technologies. Industrial sectors are adopting optical sensors for robotics, assembly, and inspection applications to improve operational efficiency and reduce errors. The U.K.’s emphasis on innovation and smart manufacturing, along with the presence of leading aerospace and automotive companies, continues to stimulate market growth. The preference for reliable, high-accuracy sensors in industrial and defense applications is further supporting expansion.

Germany Optical Position Sensor Market Insight

The Germany optical position sensor market is projected to expand at a considerable CAGR, driven by advanced manufacturing infrastructure, technological innovation, and a strong focus on precision engineering. German industries, particularly automotive and aerospace, rely on optical sensors for real-time feedback and high-accuracy measurements in production processes. The growing integration of sensors with automated systems and robotics enhances manufacturing efficiency and quality. Moreover, Germany’s focus on Industry 4.0 adoption and digitalization promotes the deployment of optical position sensors across both industrial and research applications.

Asia-Pacific Optical Position Sensor Market Insight

The Asia-Pacific optical position sensor market is poised to grow at the fastest CAGR during the forecast period of 2026 to 2033, driven by rising industrial automation, rapid urbanization, and technological advancements in countries such as China, Japan, and India. The increasing adoption of smart manufacturing and robotics is fueling demand for high-precision optical sensors. Furthermore, APAC is emerging as a manufacturing hub for sensor components, which improves affordability and accessibility, supporting market expansion across diverse industrial applications.

Japan Optical Position Sensor Market Insight

The Japan optical position sensor market is gaining momentum due to the country’s advanced industrial landscape, emphasis on precision manufacturing, and demand for automation. Japanese industries are adopting optical sensors for robotics, assembly, and inspection applications to enhance accuracy and efficiency. Integration with smart manufacturing systems and real-time monitoring is further propelling growth. In addition, the focus on high-tech and automated production processes across automotive and electronics sectors supports market expansion.

China Optical Position Sensor Market Insight

The China optical position sensor market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rapid industrialization, high manufacturing output, and adoption of automation technologies. Optical sensors are increasingly used in automotive, aerospace, electronics, and defense applications for precision measurement and quality control. Government initiatives promoting smart manufacturing and Industry 4.0, along with competitive domestic production capabilities, are key factors driving market growth in China. The rising need for efficient, high-accuracy production processes continues to fuel demand across various industrial sectors.

Optical Position Sensor Market Share

The optical position sensor industry is primarily led by well-established companies, including:

- SHARP Corporation (Japan)

- Hamamatsu Photonics K.K. (Japan)

- Micro-Epsilon (Germany)

- Sensata Technologies, Inc. (U.S.)

- Panasonic Corporation (Japan)

- Illinois Tool Works Inc. (U.S.)

- Siemens (Germany)

- Balluff Automation India Pvt. Ltd. (India)

- Melexis (Belgium)

- First Sensor AG (Germany)

- Wolong Electric Group (China)

- Medel Elektronik (Turkey)

- Baumer (Switzerland)

- AZoNetwork (Australia)

- ALTHEN GmbH (Germany)

- KEYENCE CORPORATION (Japan)

- Vishay Intertechnology, Inc. (U.S.)

- ifm electronic gmbh (Germany)

- Endress+Hauser Group Services AG (Switzerland)

- Centec GmbH (Germany)

- Rockwell Automation, Inc. (U.S.)

- Porex (U.S.)

Latest Developments in Global Optical Position Sensor Market

- In September 2025, Nisshinbo Micro Devices Inc. expanded its lineup of incremental optical position sensors to enhance resolution and accuracy, significantly improving the performance of optical encoders used in industrial automation, robotics, and manufacturing equipment. This development strengthens the market by offering more precise and reliable solutions, enabling manufacturers to achieve higher operational efficiency, improved product quality, and reduced downtime in critical production processes. The enhanced sensors also support compact designs, making them suitable for integration into space-constrained machinery and advanced automation systems, broadening their adoption across diverse industries

- In March 2025, Siemens AG entered a strategic partnership with Sick AG to co-develop high-precision optical linear encoders designed to accelerate deployment of position sensing across factory floors. This collaboration expands the market by enabling broader application of optical position sensors in industrial automation, including robotics, conveyor systems, and material handling equipment. The partnership focuses on improving measurement accuracy, robustness, and system integration, which helps manufacturers enhance productivity, optimize processes, and reduce operational risks

- In January 2025, Renishaw plc unveiled a new multi-turn absolute optical encoder optimized for space-constrained robotic applications. This innovation provides higher resolution and improved environmental resistance, enhancing the adoption of optical position sensors in industrial automation, robotics, and medical equipment. The multi-turn functionality allows precise tracking of rotational positions over multiple revolutions, which increases accuracy and reduces errors in complex motion control systems. This development is expected to drive greater integration of optical sensors into advanced automated processes and precision machinery, reinforcing their role in modern manufacturing

- In August 2024, Balluff launched a new high-resolution optical linear encoder series with rugged IP68/IP69K protection aimed at demanding environments in automotive, food processing, and pharmaceutical manufacturing. This launch supports market growth by enabling optical position sensors to operate reliably under harsh conditions such as dust, moisture, and high-temperature environments. The high-precision and durable design expands the use of optical sensors in critical industrial applications, ensuring accurate position measurements, reduced maintenance needs, and enhanced overall system efficiency

- In February 2023, Hamamatsu Photonics K.K. began construction of a new factory in Japan to increase production capacity for post-processing of opto-semiconductor devices, including dicing, assembly, and inspection. This expansion strengthens the market by enabling higher availability of high-quality optical sensors to meet growing industrial demand. Increased production capacity also facilitates faster delivery, supports scalability for large-scale manufacturing projects, and enhances the company’s ability to innovate in sensor technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Optical Position Sensor Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Optical Position Sensor Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Optical Position Sensor Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.