Global Optical Satellite Communication Market

Market Size in USD Billion

CAGR :

%

USD

11.06 Billion

USD

51.86 Billion

2024

2032

USD

11.06 Billion

USD

51.86 Billion

2024

2032

| 2025 –2032 | |

| USD 11.06 Billion | |

| USD 51.86 Billion | |

|

|

|

|

Optical Satellite Communication Market Size

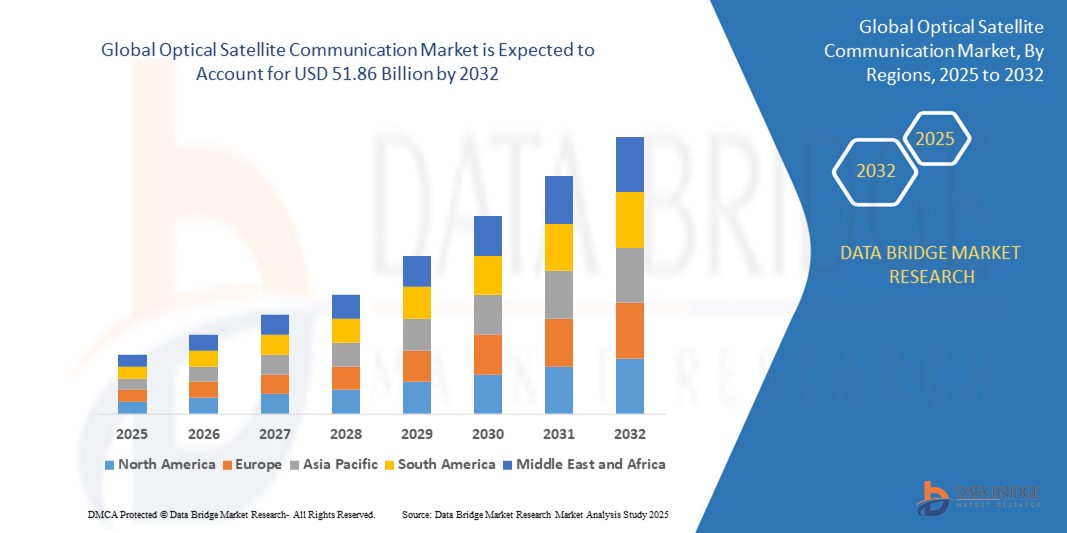

- The global optical satellite communication market was valued at USD 11.06 billion in 2024 and is expected to reach USD 51.86 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 21.30%, primarily driven by the anticipated advancements in satellite communication technologies

- This growth is driven by factors such as the increasing demand for high-speed internet connectivity, low-latency communication solutions, and expansion of 5G networks

Optical Satellite Communication Market Analysis

- Optical satellite communication systems are critical for providing high-speed, low-latency data transmission through space. These systems leverage light waves to transmit data, offering significant advantages over traditional radio frequency communication systems, especially for long-range and high-bandwidth applications

- The demand for optical satellite communication is significantly driven by the increasing need for global high-speed internet connectivity, demand for secure communication channels, and the growth of next-generation 5G and IoT networks. The market sees significant traction from industries such as telecommunications, defense, and space exploration, which require advanced and secure satellite communication systems

- North America remains one of the dominant regions for optical satellite communication, driven by its strong space technology sector, large-scale government and commercial space missions, and substantial investments in satellite communication infrastructure

- For instance, the U.S. is leading in the development and deployment of optical satellite systems for both military and commercial purposes. The region continues to drive innovations in space technology and satellite communication systems, with major players investing in next-generation optical satellite technologies

- Globally, optical satellite communication is gaining traction as a key technology for high-performance, low-latency communication systems, particularly in remote and underserved areas, where traditional communication infrastructures are limited or non-existent

Report Scope and Optical Satellite Communication Market Segmentation

|

Attributes |

Optical Satellite Communication Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Optical Satellite Communication Market Trends

“Integration of Advanced Optical Technologies and High-Speed Data Transmission”

- One prominent trend in the global optical satellite communication market is the increasing integration of advanced optical technologies and the focus on high-speed data transmission

- These innovations are enhancing the performance and efficiency of optical satellite systems by enabling faster, more reliable communication over vast distances with minimal latency

- For instance, the use of laser communication technologies allows satellites to transmit data at significantly higher speeds compared to traditional radio frequency systems, which is crucial for supporting applications like real-time data streaming, 5G backhaul, and space exploration

- Additionally, high-speed optical links are increasingly being adopted for satellite constellations, enabling global low-latency internet services in remote and underserved regions

- This trend is transforming the satellite communication landscape, improving service quality, expanding coverage, and driving demand for more sophisticated optical satellite communication systems

Optical Satellite Communication Market Dynamics

Driver

“Increasing Demand for High-Speed, Low-Latency Communication”

- The rising demand for high-speed, low-latency communication is significantly driving the growth of the optical satellite communication market

- As global internet usage increases, especially in remote areas and underserved regions, there is a growing need for faster, more reliable connectivity to support activities like 5G deployment, IoT applications, and high-definition video streaming

- Satellite constellations using optical communication technology offer a way to deliver faster and more efficient data transmission across vast distances, with minimal delays

- The ongoing advancements in optical communication technologies further highlight the need for cutting-edge satellite systems that can support high-bandwidth applications, enhancing global connectivity and meeting the needs of growing digital ecosystems

- As more businesses, governments, and consumers demand faster, more reliable data services, the market for optical satellite communication systems is expected to expand significantly

For instance,

- In December 2023, SpaceX’s Starlink project expanded its use of optical satellite links, showcasing the growing role of optical communication in supporting low-latency, high-speed internet access across the globe

- In March 2024, a joint venture between government space agencies and private satellite companies launched new satellite constellations designed to provide high-speed, low-latency connectivity for both remote and urban areas

- As a result, the growing demand for high-speed, low-latency communication, driven by increasing global internet usage and the need for 5G, IoT, and video streaming, is propelling the optical satellite communication market. Advancements in optical technologies and satellite constellations are enabling faster, more reliable connectivity, expanding market opportunities for businesses, governments, and consumers worldwide

Opportunity

“Leveraging Artificial Intelligence for Optimized Satellite Communication”

- AI integration in optical satellite communication systems offers the opportunity to enhance data transmission efficiency, optimize satellite operations, and improve network management in real-time

- AI algorithms can analyze large datasets generated by satellite constellations, enabling predictive maintenance, identifying potential system failures, and automating operations for improved system performance

- Additionally, AI can assist in optimizing resource allocation and managing satellite traffic, which is crucial for supporting high-bandwidth applications and reducing latency in communication

For instance,

- In December 2024, a leading satellite communications company announced the use of AI to predict satellite health and optimize signal processing in real-time, improving both the efficiency and lifespan of their satellite constellations

- In February 2025, AI-powered systems were used to automatically adjust satellite beam configurations in response to real-time demand for high-speed data, significantly enhancing connectivity in both remote and urban regions

- The integration of AI in optical satellite communication systems provides an opportunity to improve the overall quality and reliability of services, expanding the potential for global connectivity and supporting emerging technologies like 5G, IoT, and smart cities

Restraint/Challenge

“High Equipment and Infrastructure Costs Hindering Market Penetration”

- The high cost of optical satellite communication equipment and infrastructure presents a significant challenge for market expansion, particularly in developing regions and smaller satellite operators

- These systems, which involve advanced satellite constellations, ground stations, and optical communication technology, require significant upfront investment, often amounting to millions of dollars

- This substantial financial barrier can deter smaller firms and emerging markets from entering the industry or upgrading their existing systems, leading to reliance on traditional RF (radio frequency) communication methods

For instance,

- In January 2025, according to an article published by SpaceTech Analytics, the steep costs associated with optical satellite infrastructure, including the development and deployment of satellites and ground systems, have been identified as a key obstacle for many regional satellite operators, impacting their ability to compete with larger players

- In March 2024, an analysis by the Global Space Consortium highlighted how the high cost of optical communication systems limits their adoption in regions where affordable and reliable connectivity is needed the most, further exacerbating global digital divide issues.

- As a result, such financial challenges can lead to disparities in access to advanced satellite communication services, potentially slowing the market’s growth and limiting the scalability of optical satellite communication networks

Optical Satellite Communication Market Scope

The market is segmented on the basis of laser types, components, transmission mediums, sales channels, and application

|

Segmentation |

Sub-Segmentation |

|

By Laser Types |

|

|

By Components |

|

|

By Transmission Mediums |

|

|

By Sales Channels |

|

|

By Application |

|

Optical Satellite Communication Market Regional Analysis

“North America is the Dominant Region in the Optical Satellite Communication Market”

- North America dominates the optical satellite communication market, driven by its advanced space infrastructure, high adoption of cutting-edge communication technologies, and the presence of leading satellite companies

- The U.S. holds a significant share due to increasing demand for high-speed, low-latency communication services, growing investments in satellite constellations, and continuous advancements in optical communication systems

- The availability of well-established space policies, government initiatives such as NASA's satellite projects, and significant research & development investments further strengthen the market

- In addition, the increasing demand for reliable connectivity in remote and underserved areas, alongside advancements in 5G and IoT applications, is fueling market growth in the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the optical satellite communication market, driven by rapid advancements in satellite infrastructure, increasing investments in space exploration, and rising demand for high-speed internet services

- Countries such as China, India, and Japan are emerging as key markets due to their expanding space programs, large populations, and increasing demand for broadband connectivity, especially in rural and remote areas

- China, with its ambitious space initiatives and growing satellite constellations, is leading the charge in adopting optical satellite communication technology to enhance global connectivity

- India, with its large-scale satellite missions and increasing need for reliable communication solutions, and Japan, with its advancements in optical communication technology, continue to contribute significantly to the regional market growth. The region's expanding private sector participation and government-backed projects further boost market development

Optical Satellite Communication Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- SpaceX (U.S.)

- SES S.A. (Luxembourg)

- OneWeb (U.K.)

- Telesat (Canada)

- L3Harris Technologies (U.S.)

- Lockheed Martin (U.S.)

- Thales Group (France)

- NASA (U.S.)

- Airbus Defence and Space (France)

- Northrop Grumman (U.S.)

- Amazon Kuiper Systems (U.S.)

- Inmarsat (U.K.)

- Hughes Network Systems (U.S.)

- AST & Science (U.S.)

- Intelsat (Luxembourg)

- Virgin Orbit (U.S.)

- O3b Networks (U.K.)

- Ball Aerospace (U.S.)

- Eutelsat Communications (France)

- Mitsubishi Electric (Japan)

Latest Developments in Global Optical Satellite Communication Market

- In December 2022, SpaceX officially introduced Starshield, an advanced satellite communication initiative aimed at building a secure, laser-based network designed specifically for government and military applications. The project is engineered to offer unparalleled data security, resilience against cyber threats, and enhanced protection from jamming and hacking through optical communication links. The launch of Starshield holds strong relevance to the global Optical Satellite Communication Market, as it highlights the growing adoption of laser communication systems in critical defense infrastructure

- In May 2024, SES launched its Open Orbits Inflight Connectivity (IFC) Network, a pioneering platform designed to provide seamless in-flight internet connectivity by integrating Low Earth Orbit (LEO), Medium Earth Orbit (MEO), and Geostationary Earth Orbit (GEO) satellite networks. This interoperable Ka-band network combines SES’s multi-orbit fleet with regional partners, including NEO Space Group (NSG), AeroSat Link (ASL), and Hughes Communications India (HCI), to deliver high-speed, low-latency Wi-Fi services to airlines worldwide. This development is highly pertinent to the global Optical Satellite Communication Market, as it underscores the increasing adoption of multi-orbit optical communication technologies to meet the growing demand for reliable and high-performance in-flight connectivity

- In June 2023, BlackSky Technology Inc. was awarded a two-year, multimillion-dollar contract to augment its ground station infrastructure, establishing a strategic framework for serving a major international advanced tactical Intelligence, Surveillance, and Reconnaissance (ISR) customer. This initiative aims to enhance BlackSky's capability to deliver high-frequency, low-latency imagery and analytics services, reinforcing the importance of robust ground stations equipped with laser communication terminals. This development holds significant relevance to the global Optical Satellite Communication Market, as the expansion of optical ground station infrastructure is crucial for supporting scalable and reliable laser communication systems

- In August 2021, Lockheed Martin unveiled the Wide-Angle ESA Fed Reflector (WAEFR) antenna, a hybrid technology combining a phased array Electronically Steerable Antenna (ESA) with a parabolic dish. This innovation aims to increase coverage area by approximately 190% compared to traditional phased array antennas, offering enhanced performance for applications including space-based 5G, radar, and remote sensing. This development underscore a significant industry trend towards hybrid communication systems that leverage both optical and RF links

- In January 2021, NASA successfully launched the Laser Communications Relay Demonstration (LCRD), marking a significant advancement in space communication technology. The LCRD serves as NASA’s first-ever two-way laser relay communication system, capable of transmitting data at significantly higher rates than traditional radio frequency systems. Its advanced optical communication capabilities allow for faster, more secure, and more efficient data exchange between satellites and ground stations. The deployment of the LCRD underscores the transformative potential of optical satellite communication in enhancing space-based data transmission

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL OPTICAL SATELLITE COMMUNICATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL OPTICAL SATELLITE COMMUNICATION MARKET

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 MULTIVARIATE MODELLING

2.7 TOP TO BOTTOM ANALYSIS

2.8 STANDARDS OF MEASUREMENT

2.9 VENDOR SHARE ANALYSIS

2.1 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.12 GLOBAL OPTICAL SATELLITE COMMUNICATION MARKET: RESEARCH SNAPSHOT

2.13 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PORTER’S FIVE FORCES MODEL

5.2 TECHNOLOGY ANALYSIS

5.3 VALUE CHAIN ANALYSIS

6 GLOBAL OPTICAL SATELLITE COMMUNICATION MARKET, BY LASER TYPE

6.1 OVERVIEW

6.2 AIGAAS LASER DIODE

6.3 CO2 LASER

6.4 MICROWAVE LASER

6.5 SILEX LASER

6.6 YAG LASER

6.7 OTHERS

7 GLOBAL OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 DEMODULATOR

7.3 MODULATOR

7.4 RECEIVERS

7.5 TRANSMITTERS

7.6 OTHERS

8 GLOBAL OPTICAL SATELLITE COMMUNICATION MARKET, BY TRANSMISSION MEDIUM

8.1 OVERVIEW

8.2 WIRELESS

8.3 INTERSATELLITE LINKS

9 GLOBAL OPTICAL SATELLITE COMMUNICATION MARKET, BY SALES CHANNEL

9.1 OVERVIEW

9.2 DISTRIBUTORS

9.3 TRADERS AND DEALERS

10 GLOBAL OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 BACKHAUL

10.3 EARTH OBSERVATION

10.4 ENTERPRISE CONNECTIVITY

10.5 LAST MILE ACCESS

10.6 RESEARCH AND SPACE EXPLORATION

10.7 SURVEILLANCE AND SECURITY

10.8 TELECOMMUNICATION

10.9 TRACKING AND MONITORING

10.1 OTHERS

11 GLOBAL OPTICAL SATELLITE COMMUNICATION MARKET, BY REGION

11.1 GLOBAL OPTICAL SATELLITE COMMUNICATION MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

11.2 NORTH AMERICA

11.2.1 U.S.

11.2.2 CANADA

11.2.3 MEXICO

11.3 EUROPE

11.3.1 GERMANY

11.3.2 FRANCE

11.3.3 U.K.

11.3.4 ITALY

11.3.5 SPAIN

11.3.6 RUSSIA

11.3.7 TURKEY

11.3.8 BELGIUM

11.3.9 NETHERLANDS

11.3.10 SWITZERLAND

11.3.11 REST OF EUROPE

11.4 ASIA PACIFIC

11.4.1 JAPAN

11.4.2 CHINA

11.4.3 SOUTH KOREA

11.4.4 INDIA

11.4.5 AUSTRALIA

11.4.6 SINGAPORE

11.4.7 THAILAND

11.4.8 MALAYSIA

11.4.9 INDONESIA

11.4.10 PHILIPPINES

11.4.11 REST OF ASIA PACIFIC

11.5 SOUTH AMERICA

11.5.1 BRAZIL

11.5.2 ARGENTINA

11.5.3 REST OF SOUTH AMERICA

11.6 MIDDLE EAST AND AFRICA

11.6.1 SOUTH AFRICA

11.6.2 EGYPT

11.6.3 SAUDI ARABIA

11.6.4 U.A.E.

11.6.5 ISRAEL

11.6.6 REST OF MIDDLE EAST AND AFRICA

11.7 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

12 GLOBAL OPTICAL SATELLITE COMMUNICATION MARKET,COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

12.5 MERGERS & ACQUISITIONS

12.6 NEW PRODUCT DEVELOPMENT & APPROVALS

12.7 EXPANSIONS

12.8 REGULATORY CHANGES

12.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

13 GLOBAL OPTICAL SATELLITE COMMUNICATION MARKET, SWOT ANALYSIS

14 GLOBAL OPTICAL SATELLITE COMMUNICATION MARKET, COMPANY PROFILE

14.1 ANALYTICAL SPACE, INC.

14.1.1 COMPANY OVERVIEW

14.1.2 REVENUE ANALYSIS

14.1.3 PRODUCT PORTFOLIO

14.1.4 GEOGRAPHIC PRESENCE

14.1.5 RECENT DEVELOPMENTS

14.2 ATLAS SPACE OPERATIONS, INC.

14.2.1 COMPANY OVERVIEW

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 GEOGRAPHIC PRESENCE

14.2.5 RECENT DEVELOPMENTS

14.3 NATIONAL AERONAUTICS AND SPACE ADMINISTRATION

14.3.1 COMPANY OVERVIEW

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 GEOGRAPHIC PRESENCE

14.3.5 RECENT DEVELOPMENTS

14.4 BRIDGESAT INC.

14.4.1 COMPANY OVERVIEW

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 GEOGRAPHIC PRESENCE

14.4.5 RECENT DEVELOPMENTS

14.5 MAXAR TECHNOLOGIES

14.5.1 COMPANY OVERVIEW

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 GEOGRAPHIC PRESENCE

14.5.5 RECENT DEVELOPMENTS

14.6 MITSUBISHI ELECTRIC CORPORATION

14.6.1 COMPANY OVERVIEW

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 GEOGRAPHIC PRESENCE

14.6.5 RECENT DEVELOPMENTS

14.7 SITAEL S.P.A.

14.7.1 COMPANY OVERVIEW

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 GEOGRAPHIC PRESENCE

14.7.5 RECENT DEVELOPMENTS

14.8 BALL AEROSPACE & TECHNOLOGIES

14.8.1 COMPANY OVERVIEW

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 GEOGRAPHIC PRESENCE

14.8.5 RECENT DEVELOPMENTS

14.9 MYNARIC

14.9.1 COMPANY OVERVIEW

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 GEOGRAPHIC PRESENCE

14.9.5 RECENT DEVELOPMENTS

14.1 LASER LIGHT COMMUNICATIONS

14.10.1 COMPANY OVERVIEW

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 GEOGRAPHIC PRESENCE

14.10.5 RECENT DEVELOPMENTS

14.11 HISDESAT SERVICIOS ESTRATÉGICOS, S.A.

14.11.1 COMPANY OVERVIEW

14.11.2 PRODUCT PORTFOLIO

14.11.3 GEOGRAPHIC PRESENCE

14.11.4 RECENT DEVELOPMENTS

14.12 CAILABS

14.12.1 COMPANY OVERVIEW

14.12.2 REVENUE ANALYSIS

14.12.3 PRODUCT PORTFOLIO

14.12.4 GEOGRAPHIC PRESENCE

14.12.5 RECENT DEVELOPMENTS

14.13 TRANSCELESTIAL

14.13.1 COMPANY OVERVIEW

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 GEOGRAPHIC PRESENCE

14.13.5 RECENT DEVELOPMENTS

14.14 IXBLUE

14.14.1 COMPANY OVERVIEW

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 GEOGRAPHIC PRESENCE

14.14.5 RECENT DEVELOPMENTS

14.15 SONY GROUP CORPORATION

14.15.1 COMPANY OVERVIEW

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 GEOGRAPHIC PRESENCE

14.15.5 RECENT DEVELOPMENTS

14.16 BOEING

14.16.1 COMPANY OVERVIEW

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 GEOGRAPHIC PRESENCE

14.16.5 RECENT DEVELOPMENTS

14.17 MOSTCOM

14.17.1 COMPANY OVERVIEW

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 GEOGRAPHIC PRESENCE

14.17.5 RECENT DEVELOPMENTS

14.18 OPTICAL SATCOM CONSORTIUM

14.18.1 COMPANY OVERVIEW

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 GEOGRAPHIC PRESENCE

14.18.5 RECENT DEVELOPMENTS

14.19 TESAT-SPACECOM GMBH & CO. KG

14.19.1 COMPANY OVERVIEW

14.19.2 PRODUCT PORTFOLIO

14.19.3 GEOGRAPHIC PRESENCE

14.19.4 RECENT DEVELOPMENTS

14.2 HONEYWELL INTERNATIONAL INC.

14.20.1 COMPANY OVERVIEW

14.20.2 REVENUE ANALYSIS

14.20.3 PRODUCT PORTFOLIO

14.20.4 GEOGRAPHIC PRESENCE

14.20.5 RECENT DEVELOPMENTS

15 RELATED REPORTS

16 QUESTIONNAIRE

17 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.