Global Optical Wavelength Services Market

Market Size in USD Billion

CAGR :

%

USD

5.80 Billion

USD

11.60 Billion

2024

2032

USD

5.80 Billion

USD

11.60 Billion

2024

2032

| 2025 –2032 | |

| USD 5.80 Billion | |

| USD 11.60 Billion | |

|

|

|

|

Optical Wavelength Services Market Size

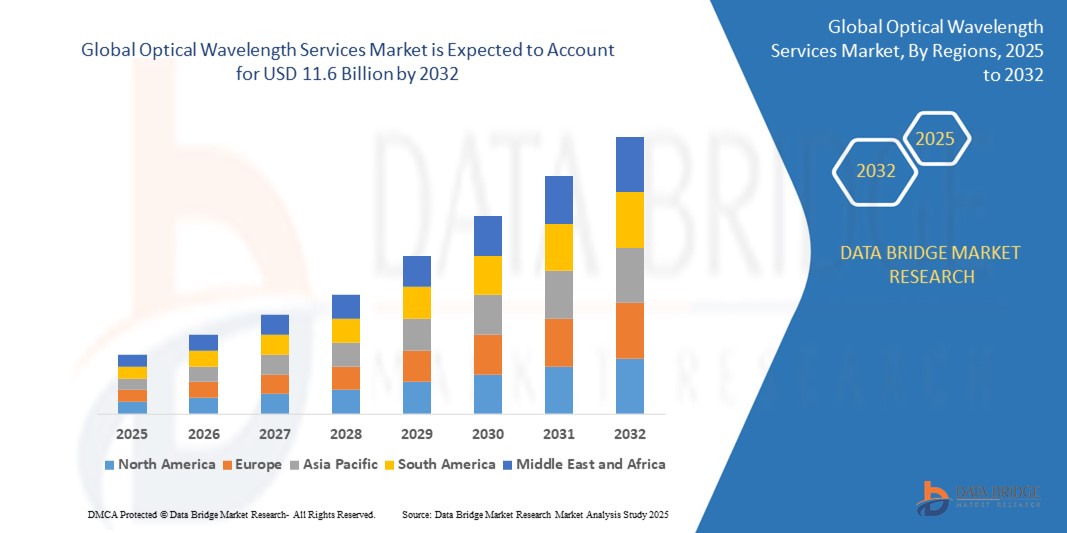

- The Global Optical Wavelength Services Market was valued at USD 5.8 billion in 2025 and is projected to reach USD 11.6 billion by 2032, growing at a CAGR of 10.4% during the forecast period.

- This growth is driven by the exponential rise in data consumption, cloud-based application deployment, and increasing demand for high-speed, low-latency connectivity. Enterprises and communication service providers are investing heavily in wavelength services to ensure efficient and secure transport of critical data over high-capacity optical fiber networks. Optical wavelength services provide scalable, dedicated bandwidth solutions using WDM (Wavelength Division Multiplexing) technology for secure, efficient transmission of large data volumes.

Optical Wavelength Services Market Analysis

- Optical wavelength services refer to high-capacity, point-to-point connectivity solutions delivered via dedicated wavelengths on fiber-optic networks. These services enable enterprises, telecom providers, and government agencies to transmit massive volumes of data securely and efficiently across local, metro, and long-haul routes.

- Technological advancements in Dense Wavelength Division Multiplexing (DWDM), Software-Defined Networking (SDN), and Optical Transport Network (OTN) standards are significantly enhancing network performance, scalability, and flexibility. These innovations support real-time bandwidth provisioning, ultra-low latency, and automated traffic engineering across core and edge networks.

- Telecom providers remain the leading end users in 2025, driven by growing needs for 5G backhaul, video traffic support, and reliable cloud interconnectivity. The ongoing shift to hybrid IT architectures and multi-cloud environments is further fueling demand for robust optical transport systems.

- The enterprise segment—including cloud providers, BFSI, and IT services—is witnessing the fastest growth, supported by increased adoption of data-driven operations, disaster recovery setups, and real-time analytics workloads that demand dedicated, high-throughput connections.

- North America leads the optical wavelength services market in 2025, backed by advanced network infrastructure, early cloud adoption, and strong investments in metro and long-haul fiber expansion. Major U.S. service providers are also integrating AI-driven automation and security into wavelength offerings.

- Asia-Pacific is expected to register the highest CAGR through 2032, driven by surging demand in China, India, and Southeast Asia, where rapid urbanization, 5G rollout, and data center investments are reshaping the regional digital landscape.

Report Scope and Unmanned Aerial Vehicle Market Segmentation

|

Attributes |

Unmanned Aerial Vehicle Market Key Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to comprehensive market valuation, segmentation, and growth forecasts, the Global Optical Wavelength Services Market report includes in-depth insights on regulatory frameworks (e.g., net neutrality mandates, telecom licensing policies, and open-access fiber regulations), bandwidth scalability models, and standardization efforts impacting wavelength provisioning. The report features technology benchmarking of key interfaces (Ethernet, SONET, OTN), deployment cost analysis across metro and long-haul routes, and optical performance comparisons for latency-sensitive workloads. It highlights wavelength capacity planning strategies, capital expenditure trends, and innovations in coherent optics, transponders, and ROADMs (Reconfigurable Optical Add-Drop Multiplexers). It also includes supply chain evaluations, optical hardware sourcing trends, and data on multi-tenant infrastructure integration. Tools such as PESTLE analysis, Porter’s Five Forces, and regional telecom investment profiles are used for strategic assessment by operators, investors, and network architects. |

Optical Wavelength Services Market Trends

“Software-Defined Networks, Edge Connectivity, and On-Demand Optical Services are Reshaping Digital Transport”

- A leading trend shaping the optical wavelength services market is the integration of SDN (Software-Defined Networking) and NFV (Network Functions Virtualization), which enables real-time bandwidth provisioning, automated rerouting, and service orchestration—enhancing flexibility and operational efficiency.

- Edge computing and the proliferation of latency-sensitive applications such as cloud gaming, IoT, and AR/VR are accelerating demand for metro and regional wavelength services. Providers are deploying high-density DWDM systems closer to the edge to support localized data processing.

- Enterprises and cloud operators are increasingly adopting dynamic, wavelength-on-demand services to handle workload spikes, disaster recovery scenarios and inter-data center traffic surges. These flexible models are replacing traditional static capacity planning.

- High-capacity optical interconnects are becoming the backbone of 5G transport networks. Carriers are leveraging optical services to manage fronthaul and backhaul traffic while maintaining ultra-low latency and reliability.

- Environmental and energy efficiency concerns are prompting investment in green optical transport technologies, including coherent optics, intelligent routing and photonic integration, to reduce power consumption per bit transmitted.

Optical Wavelength Services Market Dynamics

Driver

“Rising Bandwidth Demand from Cloud Workloads, Video Streaming, and IoT Devices”

- The exponential increase in global data traffic—driven by hyperscale cloud operations, HD/4K video consumption, and billions of connected IoT devices—is fueling the need for scalable, secure, and high-throughput transport solutions. Optical wavelength services provide dedicated fiber connectivity that meets the performance requirements of modern digital ecosystems.

- Businesses are increasingly migrating to hybrid cloud models, necessitating consistent, low-latency connectivity between on-premises data centers and cloud infrastructure. Optical wavelength links provide guaranteed service levels for mission-critical applications.

- Government digitization initiatives, financial sector modernization, and real-time healthcare services are also adopting wavelength-based connections to ensure data sovereignty, business continuity, and patient data security.

- As smart cities expand and edge analytics grow in adoption, optical services are playing a key role in supporting traffic management, surveillance, and urban IoT infrastructure through fiber-deep connectivity.

Restraint/Challenge

“High Deployment Costs and Regulatory Complexity Constrain Network Expansion”

- Building fiber-optic infrastructure for long-haul and metro wavelength services involves substantial capital expenditure, including trenching, equipment deployment, and regulatory approvals for rights-of-way. These costs can deter investment, particularly in developing and rural regions.

- Lengthy permitting processes, fragmented local regulations, and restrictive policies on fiber sharing and open access pose major barriers to market expansion. These legal and bureaucratic hurdles delay time-to-market for new service deployments.

- Increased competition and price sensitivity among enterprise customers are pressuring service providers to reduce costs while maintaining performance. Balancing CapEx-heavy network builds with the need for service differentiation remains a core challenge.

- Cybersecurity risks in optical transport—including potential tapping at the physical layer—are prompting demand for end-to-end encryption and authentication frameworks. Compliance with evolving data protection regulations such as GDPR and HIPAA further increases operational complexity.

Global Optical Wavelength Services Market Scope

The market is segmented based on Bandwidth, Interface, application, and end user.

- By Bandwidth

Categorized into Less than 10 Gbps, 10 Gbps to 40 Gbps, 40 Gbps to 100 Gbps, and More than 100 Gbps, this segmentation reflects growing customer requirements for scalable high-speed connections, particularly in cloud computing, AI, and 8K video transmission.

- By Interface:

Includes SONET (legacy), Ethernet (widely used in enterprise and data centers), and OTN (modern standard for large-scale carrier-grade transport), showcasing the evolution from TDM to packet and optical transport convergence.

- By Application:

Short Haul (enterprise campuses, intra-city), Metro (urban aggregation and cloud access), and Long Haul (intercity and international backbones), illustrating diverse deployment scales and use cases.

- By End User:

Telecom Providers, Government & Defense, Cloud Providers, BFSI, Healthcare, IT & ITeS, and Others, capturing vertical-specific usage of secure, high-throughput connectivity for critical data services.

Global Optical Wavelength Services Market Regional Analysis

- North America leads the global optical wavelength services market in 2025, driven by mature telecom infrastructure, significant investments in cloud connectivity, and aggressive 5G rollouts. The United States is at the forefront, with widespread adoption across government, hyperscale data centers, and enterprise cloud backbones. Regional players like Lumen Technologies, AT&T, and Verizon are pioneering metro and long-haul wavelength expansion across major urban corridors.

- Europe presents a robust market, bolstered by cross-border interconnectivity, national broadband strategies, and digital infrastructure modernization efforts. Countries such as Germany, France, and the U.K. are investing in wavelength services to support smart manufacturing, financial trading hubs, and EU-wide digital transformation goals.

- Asia-Pacific is projected to register the highest CAGR from 2025 to 2032, driven by massive demand in China, India, and Japan. These countries are experiencing exponential growth in internet usage, cloud service adoption, and edge computing requirements. National digital economy initiatives and rapid fiber deployments are propelling the need for high-capacity wavelength services across both metro and intercity networks.

- Middle East and Africa (MEA) is witnessing steady growth, particularly in the UAE, Saudi Arabia, and South Africa. These markets are expanding submarine cable connectivity and international gateway infrastructure to support rising bandwidth needs in financial services, media streaming, and public sector digitization.

- South America is seeing increased demand for optical wavelength services, led by Brazil and Argentina. These countries are leveraging wavelength solutions to support digital banking, agriculture analytics, and cloud-based enterprise modernization. Government efforts to improve rural connectivity and data sovereignty are further fueling market expansion.

Country-Level Insights

- United States

The U.S. dominates the global optical wavelength services market, fueled by high fiber penetration, 5G network densification, and strong presence of cloud hyperscalers. Major financial centers like New York, Chicago, and San Francisco rely heavily on low-latency wavelength services for trading and data center interconnect.

- China

Rapid urbanization, cloud-native growth, and state-led 5G infrastructure programs make China a key driver of wavelength demand. Companies such as China Telecom and China Unicom are building extensive metro and long-haul optical networks linking smart cities and digital zones.

- India

With accelerating data consumption, digital governance initiatives, and cloud localization policies, India is emerging as a hotspot for wavelength service investment. Tier-1 and Tier-2 city linkages are expanding to support enterprise, e-commerce, and public cloud ecosystems.

- Germany

Germany supports optical wavelength service growth through initiatives such as Industry 4.0 and cross-border fiber corridors across the EU. Enterprises are utilizing optical transport for secure, high-throughput data exchange in automotive, manufacturing, and logistics.

- UAE

As a digital connectivity hub in the Middle East, the UAE is investing in high-capacity fiber and wavelength infrastructure to support international data flows, smart city services, and regional cloud zones hosted by global tech giants.

Global Optical Wavelength Services Market Share

The competitive landscape of the global optical wavelength services market is shaped by the technological capabilities, fiber network reach, scalability of offerings, and strategic alliances among telecom operators and infrastructure providers. Market share is largely influenced by the ability to deliver secure, low-latency, and high-bandwidth connectivity solutions that cater to rapidly evolving enterprise and carrier demands.

Leading companies such as Lumen Technologies (U.S.), Zayo Group (U.S.), Verizon Communications (U.S.), AT&T Inc. (U.S.), and NTT Communications (Japan) dominate the market due to their vast fiber optic infrastructure, established relationships with hyperscale cloud providers, and integrated service portfolios across metro and long-haul routes.

Emerging players and regional carriers are gaining traction by offering wavelength-on-demand platforms, SDN-enabled transport, and competitively priced services for underserved markets. These companies are also capitalizing on edge computing, regional data center expansion, and open-access policies to grow their customer base.

The market continues to evolve with ongoing innovation in optical transport technologies, regulatory support for competitive network access, and growing demand for enterprise-grade connectivity in industries such as BFSI, healthcare, manufacturing, and cloud services.

- Lumen Technologies (U.S.),

- Zayo Group (U.S.)

- Verizon Communications (U.S.)

- AT&T Inc. (U.S.)

- NTT Communications (Japan)

- Ciena Corporation (U.S.)

- Colt Technology Services (U.K.)

- Cox Communications (U.S.)

- Crown Castle (U.S.)

- Orange S.A. (France)

- Tata Communications (India).

Latest Developments in Global Optical Wavelength Services Market

- In April 2025, Ciena Corporation announced a 1.6 Tbps upgrade to its optical platform enabling multi-terabit interconnect for cloud data centers across North America and Europe.

- In March 2025, Tata Communications partnered with AWS to deliver wavelength services integrated with Direct Connect for hybrid cloud deployments in APAC.

- In February 2025, Zayo Group launched its intelligent wavelength-on-demand platform for enterprise users requiring dynamic connectivity and traffic engineering.

- In January 2025, Verizon expanded its ultra-low latency wavelength network linking financial centers in New York, London, and Tokyo.

- In December 2024, NTT Communications deployed a new submarine cable route offering 100G wavelength services between Japan and Southeast Asia.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.