Global Optocoupler Ic Market

Market Size in USD Billion

CAGR :

%

USD

2.81 Billion

USD

4.51 Billion

2025

2033

USD

2.81 Billion

USD

4.51 Billion

2025

2033

| 2026 –2033 | |

| USD 2.81 Billion | |

| USD 4.51 Billion | |

|

|

|

|

What is the Global Optocoupler IC Market Size and Growth Rate?

- The global optocoupler IC market size was valued at USD 2.81 billion in 2025 and is expected to reach USD 4.51 billion by 2033, at a CAGR of6.10% during the forecast period

- Rising smart home devices market and increasing need for energy-efficient & compact optocoupler IC worldwide is a crucial factor accelerating the market growth, also increasing consumer electronics market all over the globe, surge in the adoption of electric vehicles worldwide rising need for device miniaturization, rising wide application of optocoupler IC in numerous devices such as audio processors, subsystems, MEMS microphones audio amplifiers, and others

What are the Major Takeaways of Optocoupler IC Market?

- Increasing research and development activities and rising technological advancements and modernization in the machinery used will further create new opportunities for optocoupler IC market

- However, rising prices of the component is the vital factor among others restraining the market growth, and will further challenge the optocoupler IC market

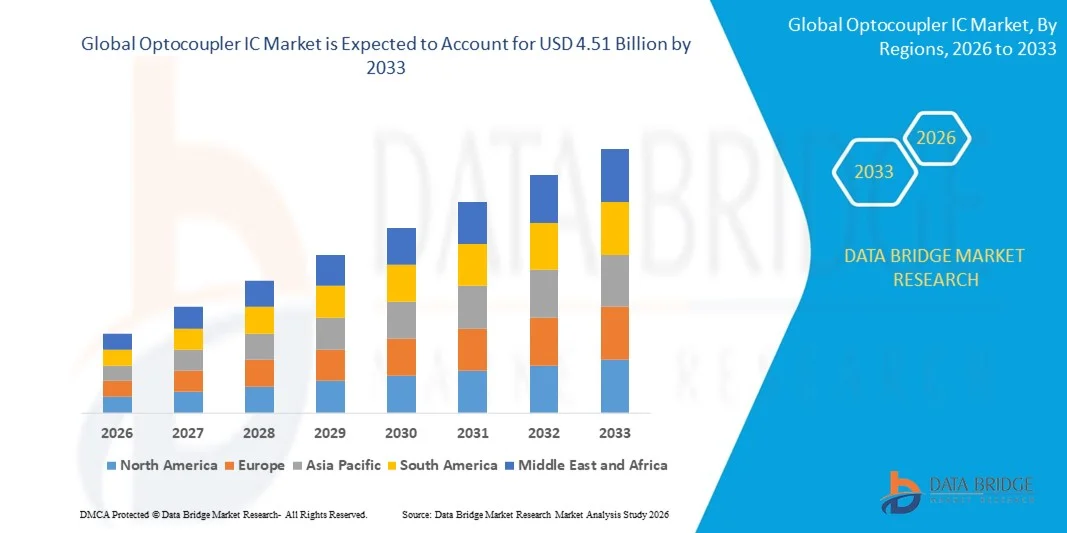

- North America dominated the Optocoupler IC market with a 44.05% revenue share in 2025, driven by rapid expansion of semiconductor design, embedded system development, and electronics manufacturing across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 10.69% from 2026 to 2033, driven by rapid semiconductor expansion, growing electronics manufacturing ecosystems, 5G deployment, and rising adoption of embedded systems across China, Japan, India, South Korea, and Southeast Asia

- The High-Speed Optocouplers segment dominated the market with a 41.2% share in 2025, driven by growing demand for fast signal transmission, low propagation delay, and high-reliability isolation in industrial automation, automotive electronics, and telecommunication equipment

Report Scope and Optocoupler IC Market Segmentation

|

Attributes |

Optocoupler IC Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Optocoupler IC Market?

Increasing Shift Toward High-Speed, Compact, and PC-Based Optocoupler ICs

- The Optocoupler IC market is witnessing strong adoption of compact, energy-efficient, and high-speed optocouplers designed to support embedded systems, IoT devices, automotive electronics, and industrial automation

- Manufacturers are introducing multi-channel, high-bandwidth, and optically isolated ICs that offer enhanced data integrity, low propagation delay, and compatibility with modern digital and analog circuits

- Growing demand for cost-effective, lightweight, and field-deployable optocouplers is driving usage across industrial control systems, consumer electronics, telecommunication equipment, and automotive modules

- For instance, companies such as Renesas, Broadcom, Toshiba, Infineon, and Vishay Intertechnology have upgraded their optocoupler portfolios with higher isolation voltages, faster switching speeds, and improved thermal stability

- Increasing need for high-reliability isolation, real-time signal transfer, and compact integration is accelerating the shift toward multi-channel and miniature optocouplers

- As electronics become more compact and digitally complex, Optocoupler ICs will remain vital for isolation, signal integrity, and protection in modern electronic systems

What are the Key Drivers of Optocoupler IC Market?

- Rising demand for high-performance, reliable, and compact optocouplers to support rapid signal isolation and protection in microcontroller, FPGA, and high-speed digital circuits

- For instance, in 2025, leading companies such as Renesas, Broadcom, Toshiba, Infineon, and Vishay enhanced their portfolios with high-speed, low-power, and multi-channel optocouplers to meet industry requirements

- Growing adoption of IoT devices, automotive electronics, industrial automation, EV systems, and consumer electronics is boosting demand for optocoupler ICs globally

- Advancements in switching speed, isolation voltage, miniaturization, and thermal performance have strengthened reliability, efficiency, and deployment flexibility

- Rising use of high-speed processors, AI chips, industrial communication protocols, and mixed-signal circuits is creating demand for robust, compact, and high-isolation optocouplers

- Supported by steady investments in electronics R&D, semiconductor innovation, and automation infrastructure, the Optocoupler IC market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Optocoupler IC Market?

- High costs associated with high-speed, multi-channel, and high-isolation optocouplers restrict adoption among SMEs and smaller electronics manufacturers

- For instance, during 2024–2025, fluctuations in semiconductor raw material prices, specialized chip shortages, and extended lead times increased production costs for several global vendors

- Complexity in designing circuits with high-speed isolation, precise timing, and thermal management increases the need for skilled engineers and technical expertise

- Limited awareness in emerging markets regarding optocoupler types, specifications, and integration best practices slows adoption

- Competition from digital isolators, transformers, and alternative isolation technologies creates pricing pressure and reduces differentiation

- To address these issues, companies are focusing on cost-optimized designs, higher integration, training resources, and enhanced reliability features to increase global adoption of Optocoupler ICs

How is the Optocoupler IC Market Segmented?

The market is segmented on the basis of type, pin, and vertical.

- By Type

On the basis of type, the Optocoupler IC market is segmented into High Linearity Optocouplers, High-Speed Optocouplers, Logic Output Optocouplers, MOSFET Output Optocouplers, Transistor Output Optocouplers, TRIAC & SCR Output Optocouplers, and Others. The High-Speed Optocouplers segment dominated the market with a 41.2% share in 2025, driven by growing demand for fast signal transmission, low propagation delay, and high-reliability isolation in industrial automation, automotive electronics, and telecommunication equipment. These devices are widely adopted in high-speed digital circuits, microcontroller-based systems, and communication interfaces due to their performance, miniaturized design, and thermal stability.

The Logic Output Optocouplers segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by increasing adoption of embedded systems, IoT devices, and consumer electronics requiring compact, low-power, and versatile isolation solutions. Rising use of AI processors, high-speed data buses, and mixed-signal circuits is further fueling their deployment across various applications.

- By Pin

On the basis of pin configuration, the market is segmented into 4-Pin, 5-Pin, 6-Pin, and 7-Pin optocouplers. The 4-Pin segment dominated the market with a 44.5% share in 2025, as it remains the most common configuration for cost-effective signal isolation, compact PCB integration, and ease of implementation in microcontroller and industrial applications. Its widespread usage in automation, automotive electronics, and consumer devices is driven by standardization, reliability, and simplicity.

The 6-Pin segment is expected to grow at the fastest CAGR from 2026 to 2033, due to rising demand for dual-channel isolation, advanced signal routing, and enhanced noise immunity in high-speed industrial and telecommunication applications. Increasing complexity in digital and analog circuits, as well as demand for multi-channel isolation, is propelling adoption of 6-Pin optocouplers in high-performance electronic systems.

- By Vertical

On the basis of vertical, the Optocoupler IC market is segmented into Automotive, Aerospace & Defense, Solar, Consumer Electronics, and Others. The Automotive segment dominated the market with a 38.7% share in 2025, fueled by extensive use in EV electronics, ADAS systems, in-vehicle networking, battery management systems, and high-reliability power modules. Automotive OEMs and Tier-1 suppliers prefer optocouplers for isolation, protection, and signal integrity across embedded electronics and high-speed communication buses.

The Consumer Electronics segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising adoption of smart home devices, portable electronics, IoT-enabled gadgets, and AI-based appliances. Increasing integration of compact, high-speed, and low-power optocouplers in consumer circuits is further accelerating demand across global electronics markets.

Which Region Holds the Largest Share of the Optocoupler IC Market?

- North America dominated the Optocoupler IC market with a 44.05% revenue share in 2025, driven by rapid expansion of semiconductor design, embedded system development, and electronics manufacturing across the U.S. and Canada

- High adoption of microcontrollers, FPGA-based systems, high-speed communication protocols, and digital interfaces fuels demand for optocoupler ICs across automotive electronics, aerospace, defense, and university research centers. Leading companies in the region are introducing advanced optocouplers with higher bandwidth, lower propagation delay, multi-channel integration, and software-enabled design tools, strengthening technological leadership

- Continuous investment in AI hardware, IoT devices, and high-performance computing drives long-term market growth. Strong engineering talent, robust innovation ecosystems, and sustained investment in electronics R&D further reinforce North America’s market dominance

U.S. Optocoupler IC Market Insight

The U.S. is the largest contributor in North America, supported by high semiconductor R&D, rapid adoption of embedded electronics, and extensive use of optocouplers in automotive, aerospace, defense, telecom, and industrial automation. Growing development of EV electronics, high-speed processors, AI accelerators, and advanced communication modules intensifies demand for high-performance optocouplers. Presence of electronic design labs, strong startup ecosystems, and high demand for test & measurement solutions further supports growth.

Canada Optocoupler IC Market Insight

Canada significantly contributes to regional growth, driven by electronics design clusters, rising adoption of embedded systems, and investments in automotive electronics, telecom, and defense R&D. Engineering labs and universities increasingly use optocouplers for FPGA development, PCB debugging, and IoT device testing. Government-backed innovation programs, skilled workforce availability, and growing interest in robotics and smart manufacturing strengthen market adoption.

Asia-Pacific Optocoupler IC Market

Asia-Pacific is projected to register the fastest CAGR of 10.69% from 2026 to 2033, driven by rapid semiconductor expansion, growing electronics manufacturing ecosystems, 5G deployment, and rising adoption of embedded systems across China, Japan, India, South Korea, and Southeast Asia. High-volume production of consumer electronics, automotive ECUs, PCBs, and IoT devices increases demand for reliable optocouplers. Growth in AI hardware, industrial automation, and smart devices accelerates the need for high-speed, compact, and energy-efficient optocoupler ICs in engineering and manufacturing applications.

China Optocoupler IC Market Insight

China is the largest contributor to Asia-Pacific, supported by massive semiconductor investments, leading electronics manufacturing capacity, and government initiatives promoting digital innovation. Development of high-speed circuits, AI chips, and advanced communication systems drives demand for optocouplers with high isolation, fast response, and multi-channel support. Local manufacturing capabilities and competitive pricing further expand domestic and export adoption.

Japan Optocoupler IC Market Insight

Japan exhibits steady growth, supported by precision electronics manufacturing, advanced telecom infrastructure, and continuous modernization of automotive and industrial control systems. High-quality engineering standards and focus on reliability drive adoption of premium optocouplers. Increasing demand for low-latency systems, robotics, and high-performance embedded solutions reinforces long-term market expansion.

India Optocoupler IC Market Insight

India is emerging as a major growth hub, driven by semiconductor design centers, rising startup activity, and government-backed electronics manufacturing initiatives. Growing demand for embedded controllers, IoT devices, automotive electronics, and telecom equipment fuels adoption of optocouplers in testing, prototyping, and mass production. Increasing R&D investments and digital infrastructure expansion further accelerate market penetration.

South Korea Optocoupler IC Market Insight

South Korea contributes significantly due to high demand for advanced processors, memory devices, 5G systems, and high-performance consumer electronics. Rapid development of AI servers, automotive electronics, and display technologies drives adoption of optocouplers with high-speed response, low propagation delay, and high reliability. Strong manufacturing capabilities and robust digital ecosystems support sustained growth.

Which are the Top Companies in Optocoupler IC Market?

The optocoupler IC industry is primarily led by well-established companies, including:

- Renesas Electronics Corporation (Japan)

- Toshiba Corporation (Japan)

- Semiconductor Components Industries, LLC (U.S.)

- Broadcom (U.S.)

- Vishay Intertechnology, Inc. (U.S.)

- Taiwan Semiconductor Manufacturing Company Limited (Taiwan)

- LITE-ON Technology Corporation (Taiwan)

- EVERLIGHT ELECTRONICS CO., LTD. (Taiwan)

- Infineon Technologies AG (Germany)

- IXYS Corporation (U.S.)

- Panasonic Corporation (Japan)

- Sharp Corporation (Japan)

- PHOENIX CONTACT (Germany)

- Standex Electronics, Inc (U.S.)

- TT Electronics (U.K.)

What are the Recent Developments in Global Optocoupler IC Market?

- In February 2025, NXP Semiconductors signed a USD 307 million agreement to acquire Kinara, adding discrete neural-processing IP that could drive new isolation requirements between AI accelerators and analog sensor front-ends, strengthening the company’s position in advanced semiconductor solutions

- In January 2025, ON Semiconductor completed a USD 115 million acquisition of Qorvo’s SiC JFET technology, enabling the development of integrated optocoupler-SiC gate-driver modules for EV battery disconnect applications, enhancing product offerings for automotive electrification

- In January 2025, Renesas Electronics reported FY 2024 revenue of JPY 1,348.5 billion (USD 9.1 billion), noting 6.4% growth in automotive but a 20.3% decline in industrial and IoT segments, signaling cautious market expectations for optocoupler demand while reinforcing focus on strategic segments.

- In December 2024, Toshiba announced the TLP3640A MOSFET-output optocoupler, certified to EN IEC 60747-5-5 standards, aimed at functional-safety-centric EV and factory-automation designs, strengthening its portfolio in safety-critical optocoupler solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Optocoupler Ic Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Optocoupler Ic Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Optocoupler Ic Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.