Global Optoelectronic Components Market

Market Size in USD Billion

CAGR :

%

USD

52.57 Billion

USD

77.08 Billion

2025

2033

USD

52.57 Billion

USD

77.08 Billion

2025

2033

| 2026 –2033 | |

| USD 52.57 Billion | |

| USD 77.08 Billion | |

|

|

|

|

Optoelectronic Components Market Size

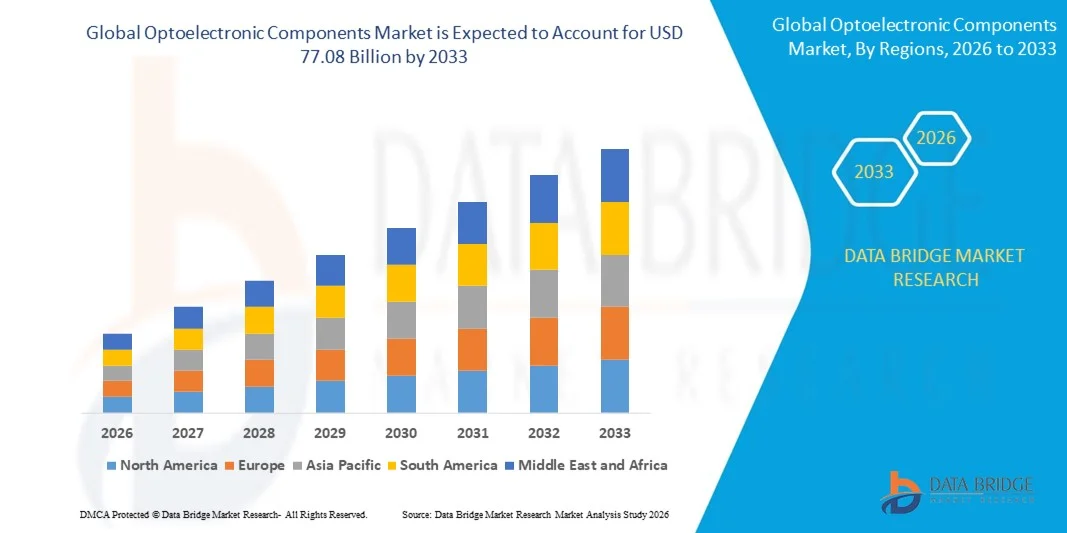

- The global optoelectronic components market size was valued at USD 52.57 billion in 2025 and is expected to reach USD 77.08 billion by 2033, at a CAGR of 4.90% during the forecast period

- The market growth is largely driven by rising demand for advanced light-based technologies across consumer electronics, automotive systems, and communication devices, supported by continuous improvements in LED efficiency, sensor precision, and laser performance. Expanding use of displays, imaging modules, and optical sensors in smartphones, EVs, and industrial automation is strengthening the adoption of optoelectronic components across major sectors

- Furthermore, increasing integration of photonics in high-speed data transmission, medical diagnostics, and industrial monitoring is positioning optoelectronic components as essential elements of next-generation electronic architectures. These converging factors are accelerating deployment across high-growth applications, thereby significantly boosting the market’s expansion

Optoelectronic Components Market Analysis

- Optoelectronic components, including LEDs, sensors, laser diodes, and infrared devices, have become critical to modern electronic systems due to their ability to convert electrical signals into light and vice versa, enabling advanced functionalities in communication, imaging, illumination, and detection. Their expanding use in displays, automotive lighting, fiber-optic networks, and smart devices reflects their increasing importance in both consumer and industrial environments

- The rising demand for optoelectronic components is primarily supported by rapid digitalization, widespread adoption of high-resolution imaging and sensing technologies, and growing reliance on energy-efficient lighting and high-speed optical communication. Increasing use of photonics in autonomous vehicles, medical equipment, and semiconductor manufacturing is further accelerating market momentum

- Asia-Pacific dominated the optoelectronic components market with a share of 51.16% in 2025, due to rapid expansion in consumer electronics manufacturing, strong growth in automotive applications, and increasing adoption of optical communication technologies

- North America is expected to be the fastest growing region in the optoelectronic components market during the forecast period due to strong demand for advanced sensing, imaging, and communication components in industrial, medical, and defense applications

- Communications segment dominated the market with a market share of 45.2% in 2025, due to the accelerating deployment of fiber-optic networks, high-speed data infrastructure, and next-generation telecommunication systems. Optoelectronic components are fundamental to achieving low-latency, long-distance signal transmission across internet backbones and cloud computing environments. The rising adoption of optical transceivers, photodetectors, and laser-based communication modules strengthens the segment’s demand profile. Expansion of 5G and hyperscale data centers continues to reinforce the leadership of communication applications

Report Scope and Optoelectronic Components Market Segmentation

|

Attributes |

Optoelectronic Components Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Optoelectronic Components Market Trends

Rising Integration of Optoelectronics in Advanced Sensing and Communication Systems

- A significant trend in the optoelectronic components market is the increasing integration of these components into next-generation sensing and communication systems, driven by the rising need for precision detection and ultra-fast data transfer across key industries. This integration is elevating the role of optoelectronics as foundational elements for advanced applications in automotive, healthcare, and telecommunications

- For instance, Broadcom and Osram supply high-performance optoelectronic sensors and emitters that are widely used in communication modules and industrial automation equipment. Such components strengthen system reliability and enable accurate data capture in environments that demand continuous monitoring and superior signal quality

- The adoption of optoelectronics in autonomous mobility systems is growing rapidly as sensors such as photodiodes and laser modules enable depth perception, object analysis, and navigation support. This is positioning optoelectronic components as critical elements for emerging intelligent transportation systems that rely on stable sensing capabilities

- The healthcare sector is integrating advanced optoelectronic technologies for diagnostics and imaging systems where applications such as pulse oximetry and medical scanning require highly sensitive and fast-responding components. This trend is accelerating innovation in non-invasive medical devices and improving real-time health assessment

- Industries focusing on automation and robotics are expanding their use of optoelectronic sensors to support precise motion control, environmental detection, and process optimization. This is shaping a stronger preference for components capable of operating reliably under variable industrial conditions

- The market is witnessing strong growth in high-performance communication systems where optical transmitters, receivers, and LEDs contribute to faster and more efficient data exchange. This rising incorporation of optoelectronics is reinforcing the overall transition toward smarter sensing, faster communication, and more interconnected system architectures across global industries

Optoelectronic Components Market Dynamics

Driver

Growing Demand for High-Speed Data Transmission Components

- The growing reliance on high-speed data transfer across cloud computing, data centers, and telecommunication networks is driving the demand for optoelectronic components that support superior bandwidth and faster signal processing. These components enable efficient long-distance connectivity and improve the overall responsiveness of digital infrastructures

- For instance, companies such as Lumentum supply high-speed optical transceivers that support rapid data movement within hyperscale data centers. These components help maintain network performance under high traffic loads and enable operators to scale capacity with greater efficiency

- The rising adoption of fiber-optic communication systems is fueling the need for highly reliable optoelectronic devices such as laser diodes and photodetectors that ensure stable and efficient signal conversion. These components support expanding network infrastructures and enhance transmission accuracy across high-volume data environments

- The shift toward 5G and next-generation wireless technologies is increasing demand for optoelectronic components that provide high signal integrity and rapid data throughput. These technologies rely on optical parts to maintain low latency and ensure seamless user experiences across varied applications

- Many industries are modernizing their digital systems to accommodate greater data loads, which is boosting investments in optical components designed to improve operational efficiency. This sustained reliance on high-speed connectivity is reinforcing the need for advanced optoelectronic solutions

- The growing expectation for uninterrupted data processing and real-time communication across global networks continues to strengthen this driver. The requirement for faster, more durable, and energy-efficient data transmission components is influencing market growth and positioning optoelectronics as essential enablers of digital expansion

Restraint/Challenge

Complex Manufacturing Processes and High Production Costs

- The optoelectronic components market faces challenges due to the complex processes involved in manufacturing precision optical devices, which require advanced materials, high-grade equipment, and specialized fabrication environments. These requirements increase production difficulty and elevate overall cost structures for manufacturers

- For instance, companies such as Hamamatsu Photonics deploy highly specialized wafer processing techniques and precision assembly methods to produce optoelectronic sensors. These intricate procedures demand skilled labor and advanced technological capabilities, raising production expenses and limiting cost flexibility

- Producing high-performance optoelectronic components involves stringent quality control standards that ensure accuracy, durability, and efficiency under demanding applications. These steps extend manufacturing timelines and further contribute to higher operational costs across the supply chain

- The reliance on specialized equipment and rare raw materials such as compound semiconductors increases supply-side vulnerability and impacts cost stability. Manufacturers face greater complexity in balancing performance requirements with economic feasibility

- The market continues to encounter constraints related to scaling high-precision production while maintaining reliability and competitive pricing. These challenges collectively place pressure on manufacturers to optimize processes and lower costs to meet growing demand while sustaining product quality

Optoelectronic Components Market Scope

The market is segmented on the basis of component, material, application, and vertical.

- By Component

On the basis of component, the optoelectronic components market is segmented into sensors, LED, laser diode, and infrared components. The LED segment dominated the market with the largest revenue share in 2025, supported by its widespread deployment in automotive lighting, display technologies, and energy-efficient illumination systems. LEDs continue to lead due to their long operational life, reduced energy consumption, and expanding use in smart lighting applications across residential and commercial spaces. Growing demand from backlit displays, signage, and adaptive automotive headlights further strengthens their market position. The segment benefits from continuous advancements in miniaturization, thermal management, and high-brightness LED technology, enhancing adoption across multiple industrial applications.

The laser diode segment is anticipated to witness the fastest growth rate from 2026 to 2033, propelled by rising demand in LiDAR, optical communication, medical imaging, and industrial material processing. Laser diodes are increasingly used in advanced sensing, 3D mapping, and high-speed data transfer applications due to their precision and compact size. Their critical role in emerging technologies such as autonomous vehicles and high-bandwidth data centers supports rapid market expansion. Improvements in power efficiency, wavelength stability, and beam quality further accelerate the adoption of laser diodes across demanding commercial and industrial environments.

- By Material

On the basis of material, the market is segmented into gallium nitride, gallium arsenide, indium phosphide, silicon germanium, gallium phosphide, and silicon carbide. The gallium nitride segment dominated the market with the largest revenue share in 2025, driven by its superior thermal conductivity, high electron mobility, and suitability for high-power optoelectronic devices. Gallium nitride materials are widely used in LEDs, high-frequency communication modules, and power electronics supporting the transition toward more efficient energy systems. The material’s reliability under extreme operating conditions strengthens its adoption across automotive, industrial, and defense-grade optoelectronic components. Ongoing advancements in GaN-on-silicon technology continue to reduce production costs and enhance scalability.

The indium phosphide segment is projected to register the fastest CAGR from 2026 to 2033, fueled by its strong relevance in high-speed photonic and telecommunication applications. Indium phosphide enables superior signal transmission and low-loss optical performance, making it essential for data centers, 5G infrastructure, and cloud network expansion. Its advantages in producing high-performance laser diodes and photodetectors contribute to its rapid market penetration. The rising need for high-bandwidth communication modules and integrated photonics solutions further accelerates demand for indium phosphide-based optoelectronic devices.

- By Application

On the basis of application, the market is segmented into measurement, lighting, communications, security and surveillance, and others. The communications segment dominated the market with the largest share of 45.2% in 2025 due to the accelerating deployment of fiber-optic networks, high-speed data infrastructure, and next-generation telecommunication systems. Optoelectronic components are fundamental to achieving low-latency, long-distance signal transmission across internet backbones and cloud computing environments. The rising adoption of optical transceivers, photodetectors, and laser-based communication modules strengthens the segment’s demand profile. Expansion of 5G and hyperscale data centers continues to reinforce the leadership of communication applications.

The security and surveillance segment is expected to witness the fastest growth from 2026 to 2033, supported by rising investments in advanced imaging, motion detection, and infrared monitoring systems. Optoelectronic components such as IR sensors, photodiodes, and low-light imaging modules enhance the performance of modern surveillance infrastructure across commercial, industrial, and residential settings. Increasing adoption of smart city initiatives and AI-driven monitoring platforms amplifies the need for high-precision optical sensing. Improvements in low-noise image processing, thermal detection accuracy, and long-range imaging capabilities further accelerate segment expansion.

- By Vertical

On the basis of vertical, the market is segmented into consumer electronics, residential, commercial, industrial, automotive, telecommunication, military and aerospace, medical, and others. The consumer electronics segment dominated the market in 2025 owing to the high-volume integration of optoelectronic components in smartphones, tablets, wearables, and entertainment devices. Demand is reinforced by the adoption of advanced display technologies, proximity sensors, biometric scanners, and camera modules. Continuous enhancement of device compactness, performance efficiency, and multifunctional optical sensing supports the segment’s dominant revenue share. The proliferation of IoT-enabled consumer devices further strengthens the market outlook.

The automotive segment is predicted to grow at the fastest rate from 2026 to 2033 driven by increasing deployment of optoelectronic components in ADAS, LiDAR, interior lighting, and driver monitoring systems. Automakers are rapidly expanding the use of optical sensors and laser-based modules to enhance vehicle safety, automation, and situational awareness. Rising adoption of electric vehicles and autonomous platforms fuels demand for high-precision optical components. Advancements in optical rangefinding, night-vision capabilities, and high-efficiency illumination systems continue to accelerate automotive vertical growth.

Optoelectronic Components Market Regional Analysis

- Asia-Pacific dominated the optoelectronic components market with the largest revenue share of 51.16% in 2025, driven by rapid expansion in consumer electronics manufacturing, strong growth in automotive applications, and increasing adoption of optical communication technologies

- The region benefits from a high concentration of semiconductor fabrication facilities and component suppliers, strengthening the supply chain for LEDs, sensors, and laser devices. Surging demand for smartphones, display panels, and advanced imaging solutions continues to drive large-scale consumption of optoelectronic components across major economies

- In addition, government-backed investments in industrial automation, smart manufacturing, and photonics research are enhancing regional market performance

China Optoelectronic Components Market Insight

China held the largest share in the Asia-Pacific optoelectronic components market in 2025, supported by its expansive electronics manufacturing ecosystem and dominant position in LED and semiconductor production. The country’s strong industrial infrastructure, high-volume fabrication capabilities, and strategic focus on photonics and 5G development strengthen its leadership. Growing adoption of optoelectronic components in consumer electronics, electric vehicles, and telecom equipment continues to propel market demand. Large-scale government initiatives promoting semiconductor independence further enhance China's market position.

India Optoelectronic Components Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, driven by rising demand for optoelectronic components in consumer electronics, automotive lighting, and communication systems. Expanding domestic electronics manufacturing under initiatives such as “Make in India” is bolstering production of devices utilizing LEDs, sensors, and IR modules. Increasing investments in fiber-optic networks, digital infrastructure, and industrial automation are accelerating component adoption. Growing interest in EVs and smart city projects further supports strong market expansion.

Europe Optoelectronic Components Market Insight

The Europe optoelectronic components market is expanding steadily, supported by high adoption of advanced photonics, rising deployment of optical communication networks, and strong emphasis on energy-efficient lighting. The region’s focus on precision engineering, quality standards, and sustainable technology development enhances demand for LEDs, laser diodes, and infrared components. Growth is further supported by rising applications in automotive ADAS, medical imaging, and industrial automation. Increasing R&D investments and government-backed photonics innovation programs contribute to continued market advancement.

Germany Optoelectronic Components Market Insight

Germany’s optoelectronic components market is propelled by its leadership in automotive innovation, industrial automation, and optical engineering. The country’s strong manufacturing ecosystem supports extensive use of LEDs, sensors, and laser technologies in robotics, factory automation, and intelligent mobility solutions. A well-established research network involving universities, photonics institutes, and technology companies fosters continuous advancement in optoelectronic performance and design. Demand is further fueled by expanding EV production and adoption of high-efficiency lighting and sensing modules.

U.K. Optoelectronic Components Market Insight

The U.K. market is supported by a robust electronics design ecosystem, strong photonics research capabilities, and rising demand for optoelectronic components in medical devices, telecom, and security solutions. Increasing investments in fiber-optic infrastructure, semiconductor R&D, and next-generation sensing technologies contribute to sustained market growth. Collaboration between academic institutions and technology manufacturers supports innovation in laser modules, imaging systems, and IR components. The country’s growing focus on high-value manufacturing strengthens its role in the regional market.

North America Optoelectronic Components Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, propelled by strong demand for advanced sensing, imaging, and communication components in industrial, medical, and defense applications. The region’s rapid expansion of data centers, 5G infrastructure, and autonomous vehicle development is accelerating adoption of high-performance laser diodes, sensors, and photonic devices. A well-established semiconductor ecosystem and increasing focus on reshoring chip production further support market growth. Advancements in aerospace optics and material science continue to reinforce North America’s expansion trajectory.

U.S. Optoelectronic Components Market Insight

The U.S. accounted for the largest share in the North America market in 2025, driven by its strong presence in semiconductor manufacturing, advanced research infrastructure, and high adoption of optoelectronics across industries. Growing demand for optical communication modules, LED lighting systems, and sensing technologies supports robust market performance. The country’s leadership in defense electronics, medical imaging, and autonomous mobility accelerates the use of high-precision photonic components. Extensive investment in innovation, supported by leading technology firms and research institutions, continues to strengthen the U.S. market position.

Optoelectronic Components Market Share

The optoelectronic components industry is primarily led by well-established companies, including:

- Hamamatsu Photonics K.K. (Japan)

- OSRAM Opto Semiconductors GmbH (Germany)

- TT Electronics (U.K.)

- Vishay Intertechnology, Inc. (U.S.)

- Semiconductor Components Industries, LLC (U.S.)

- Cree, Inc. (U.S.)

- TRUMPF (Germany)

- SICK AG (Germany)

- Samsung (South Korea)

- Broadcom (U.S.)

- OmniVision Technologies, Inc. (U.S.)

- Micropac Industries, Inc. (U.S.)

- ROHM Co., Ltd. (Japan)

- OSI Optoelectronics (U.S.)

- Sharp Devices Europe (U.K.)

- Newport Corporation (U.S.)

- Himax Technologies, Inc. (Taiwan)

- Renesas Electronics Corporation (Japan)

- LITE-ON Technology, Inc. (Taiwan)

- SK Hynix Inc. (South Korea)

Latest Developments in Global Optoelectronic Components Market

- In August 2025, San’an Optoelectronics’ acquisition of Lumileds for USD 239 million significantly reshaped the competitive landscape of the global optoelectronic components market. This move strengthened San’an’s position in high-value LED segments such as automotive lighting, mobile flash modules, and premium illumination systems. The deal also improved supply-chain stability by integrating Lumileds’ advanced manufacturing and strong customer base, allowing San’an to expand its global reach and accelerate innovation across LED technologies

- In July 2025, Marktech Optoelectronics introduced its new high-efficiency RCLEDs featuring a compact 25-micron design and approximately 33% improvement in optical output, which bolstered the adoption of next-generation optoelectronic sensing solutions. This product launch enhanced market competitiveness by offering higher-precision targeting and improved performance for low-power devices used in consumer electronics, medical sensors, and smart industrial systems. The upgrade positioned Marktech as a stronger player in miniaturized optical components catering to high-accuracy, battery-operated applications

- In July 2025, STMicroelectronics entered into a major licensing partnership with Metalenz to scale metasurface optics production for mass-market deployment. This collaboration had a substantial impact on the optoelectronic market by accelerating commercialization of flat-optics technology for smartphones, autonomous vehicles, and industrial robotics. The agreement enabled STMicroelectronics to integrate advanced photonic functionality into compact optical modules, setting the stage for thinner sensors, improved 3D imaging, and more efficient LiDAR solutions

- In June 2025, Nichia Corporation launched a high-power laser diode module delivering over 10 watts of optical output, marking a key advancement in industrial-grade optoelectronic components. This innovation strengthened Nichia’s presence in segments that require precision laser sources, including manufacturing, medical diagnostics, and high-performance illumination systems. The introduction of this high-output module contributed to increased adoption of laser-based technologies across industries transitioning toward automation and optical processing

- In May 2025, Excelitas Technologies announced its acquisition plan for Luxium Solutions, aiming to expand its capabilities in advanced optical materials and precision photonics. This strategic move enhanced Excelitas’ ability to offer vertically integrated solutions across sensing, illumination, and detection applications. The acquisition is expected to positively influence the optoelectronic components market by improving production scalability, strengthening supply-chain resilience, and enabling the development of next-generation optical modules for medical, defense, and industrial sectors

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Optoelectronic Components Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Optoelectronic Components Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Optoelectronic Components Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.