Global Oral Expectorant Market

Market Size in USD Billion

CAGR :

%

USD

4.38 Billion

USD

5.58 Billion

2024

2032

USD

4.38 Billion

USD

5.58 Billion

2024

2032

| 2025 –2032 | |

| USD 4.38 Billion | |

| USD 5.58 Billion | |

|

|

|

|

Oral Expectorant Market Size

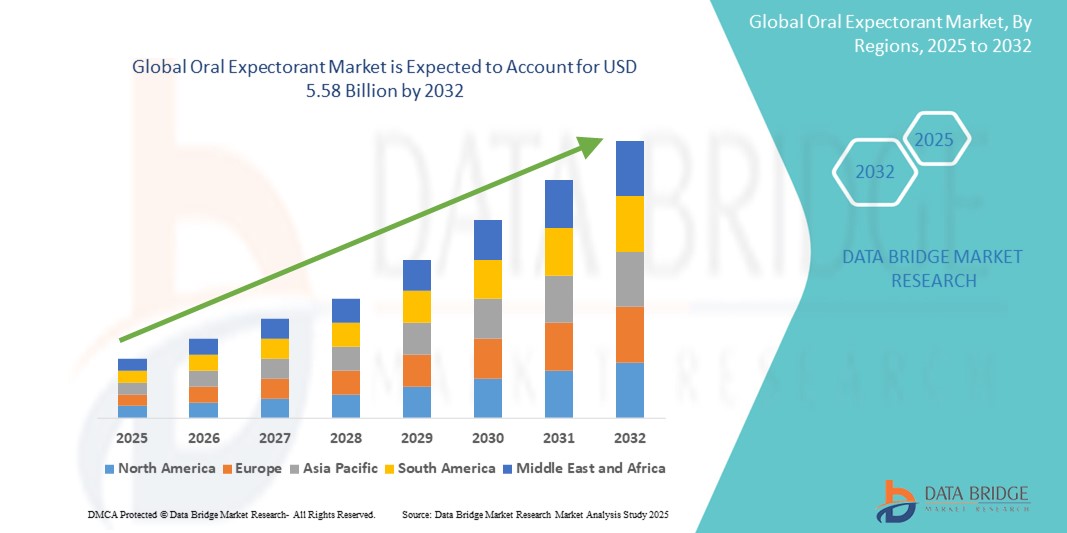

- The global oral expectorant market size was valued at USD 4.38 billion in 2024 and is expected to reach USD 5.58 billion by 2032, at a CAGR of 3.10% during the forecast period

- The market growth is largely fueled by the increasing prevalence of respiratory disorders such as asthma, bronchitis, and chronic obstructive pulmonary disease (COPD), coupled with rising awareness of mucus-clearing treatments that improve breathing comfort and lung function.

- Furthermore, growing demand for over-the-counter (OTC) medications, coupled with the availability of herbal and non-drowsy formulations, is establishing oral expectorants as a preferred first-line treatment for productive coughs. These converging factors are accelerating the adoption of oral expectorant solutions, thereby significantly boosting the industry's growth.

Oral Expectorant Market Analysis

- Oral expectorants, which provide effective relief by thinning and loosening mucus in the respiratory tract, are increasingly essential in managing conditions such as colds, bronchitis, and COPD across both over-the-counter and prescription drug categories. Their convenience, efficacy, and wide availability make them a preferred choice in respiratory therapeutics

- The global demand for oral expectorants is being driven by rising cases of respiratory infections, growing air pollution levels, and heightened public awareness of respiratory health, alongside increased adoption of self-medication practices in many countries

- North America dominated the oral expectorant market with the largest revenue share of 41.6% in 2024, fueled by the high incidence of chronic respiratory diseases, robust pharmaceutical infrastructure, and easy access to a variety of OTC and prescription medications. In the U.S., the popularity of mucolytics and expectorants continues to rise due to increased seasonal flu cases and consumer preference for quick symptom relief

- Asia-Pacific is expected to be the fastest growing region in the oral expectorant market during the forecast period, driven by increasing healthcare awareness, urban pollution, and growing geriatric and pediatric populations. Countries such as China and India are seeing substantial increases in demand due to rising disposable incomes and better access to retail pharmaceutical outlets

- Oral segment dominated the oral expectorant market with a market share of 65.1% in 2024, owing to its convenience, palatability, and rapid onset of action. Oral expectorants such as syrups, tablets, and lozenges are widely preferred by both patients and healthcare providers for their ease of administration, making them the most commonly used route in managing respiratory conditions such as coughs, bronchitis, and colds

Report Scope and Oral Expectorant Market Segmentation

|

Attributes |

Oral Expectorant Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Oral Expectorant Market Trends

“Enhanced Convenience and Integration Driving Market Adoption”

- A significant and accelerating trend in the global oral expectorant market is the rising demand for more accessible and user-friendly formulations, particularly those that allow for at-home administration and symptom relief. This trend is further fueled by advancements in digital healthcare solutions, which are improving how patients manage respiratory symptoms remotely and conveniently

- For instance, companies are increasingly offering combination expectorant products that not only address mucus clearance but also provide anti-inflammatory or cough-relieving benefits. Such multifunctional solutions are gaining popularity among consumers seeking comprehensive care without multiple medications

- In addition, product formats such as extended-release tablets, effervescent granules, and flavored syrups are gaining momentum, especially among pediatric and elderly patients who face challenges with conventional tablets or capsules

- The convenience of over-the-counter availability, particularly through e-commerce platforms and online pharmacies, is significantly boosting the market for oral expectorants. Consumers are increasingly turning to digital platforms for quick access, reviews, and contactless delivery, further encouraging product adoption

- Moreover, healthcare providers are recommending personalized treatment approaches, with oral expectorants being integrated into chronic respiratory care plans, especially for conditions such as bronchitis, asthma, and COPD

- This evolution toward personalized, convenient, and multifunctional therapies is reshaping consumer expectations, driving both innovation and demand in the global Oral Expectorant market across hospitals, homecare, and retail settings

Oral Expectorant Market Dynamics

Driver

“Growing Need Due to Rising Respiratory Conditions and Demand for Symptomatic Relief”

- The increasing global burden of respiratory illnesses such as bronchitis, asthma, and chronic obstructive pulmonary disease (COPD), particularly during seasonal changes, is a major driver for the growing demand for oral expectorants

- For instance, in April 2024, Reckitt Benckiser Group PLC expanded its product line in emerging markets with enhanced formulations of Mucinex, aiming to offer faster relief from mucus congestion. These product developments are expected to significantly boost the oral expectorant market during the forecast period

- As consumers seek faster and more effective relief from cough and cold symptoms, oral expectorants offer a convenient solution by thinning and loosening mucus, thereby promoting productive coughing

- Moreover, increased awareness about over-the-counter (OTC) respiratory medications, combined with improved accessibility through pharmacies and online retail platforms, is accelerating product uptake among both urban and rural populations

- The growing consumer preference for combination formulations, including oral expectorants with antihistamines and cough suppressants, further supports market expansion. The trend towards self-medication and availability of user-friendly dosage formats such as syrups, tablets, and dissolvable powders also contributes to demand

Restraint/Challenge

“Concerns Regarding Side Effects and Regulatory Hurdles”

- The potential side effects associated with certain oral expectorants—such as gastrointestinal discomfort, dizziness, or allergic reactions—pose a restraint to market growth, especially in pediatric and geriatric populations

- For instance, regulatory agencies such as the U.S. FDA have issued periodic warnings on the misuse of guaifenesin-based products in children under specific age groups, prompting tighter labeling requirements and usage guidelines

- In addition, the presence of counterfeit or substandard expectorant products in some developing regions undermines consumer trust and presents safety risks, thereby impacting market penetration

- The regulatory challenges surrounding approval, labeling, and claims for efficacy also pose significant barriers for new product entrants, especially for herbal and natural-based formulations seeking to position as safer alternatives

- While manufacturers are working towards improving tolerability and compliance—especially through sugar-free or alcohol-free versions—the need for robust clinical validation and clear communication of usage remains crucial

- To address these challenges, companies are increasingly focusing on transparent labeling, clinician education, and stronger pharmacovigilance practices, alongside expanding R&D investments to introduce next-generation expectorants with fewer side effects and better safety profiles

Oral Expectorant Market Scope

The market is segmented on the basis of type, route of administration, end-user, and distribution channel.

- By Type

On the basis of type, the Oral Expectorant market is segmented into drug, OTC, herbal, and others. The Drug segment dominated the largest market revenue share of 46.8% in 2024, owing to its widespread use in treating productive cough and respiratory infections through prescription-based expectorants. These formulations often contain guaifenesin or ambroxol and are trusted by physicians for efficacy.

The OTC segment is expected to witness the fastest CAGR of 8.7% from 2025 to 2032, driven by increasing consumer preference for self-medication and the easy availability of expectorants without prescriptions. The growing awareness of respiratory health and common cold symptoms supports this trend.

- By Route of Administration

On the basis of route of administration, the market is segmented into oral, inhalational, and others. The oral segment held the largest market share of 65.1% in 2024, as oral expectorants such as syrups, tablets, and lozenges remain the most preferred form due to convenience, palatability, and rapid onset of action.

The inhalational segment is projected to register the fastest CAGR of 9.2% during the forecast period, particularly among patients with chronic bronchitis and COPD, where direct pulmonary delivery offers faster and targeted relief.

- By End-User

On the basis of end-user, the market is segmented into hospitals, homecare, specialty centres, and others. The hospitals segment accounted for the largest revenue share of 42.3% in 2024, driven by higher patient footfall, clinical supervision, and prescription-based administration of expectorants in inpatient and emergency care.

The homecare segment is anticipated to grow at the highest CAGR of 9.8% from 2025 to 2032, supported by the shift towards remote healthcare, increased chronic respiratory cases, and the convenience of managing symptoms at home.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacy, online pharmacy, and retail pharmacy. The retail pharmacy segment dominated with a market share of 48.6% in 2024, attributed to its wide accessibility, immediate availability of OTC products, and trust among consumers for over-the-counter purchases.

The online pharmacy segment is expected to witness the fastest growth with a CAGR of 10.5%, driven by rising internet penetration, e-commerce growth, and consumer preference for home delivery and digital consultations.

Oral Expectorant Market Regional Analysis

- North America dominated the oral expectorant market with the largest revenue share of 41.6% in 2024, driven by a high prevalence of respiratory conditions, a well-established pharmaceutical distribution network, and increased consumer reliance on over-the-counter medications for symptomatic relief

- The U.S. leads the region, supported by continuous product innovations, rising geriatric population, and widespread awareness of expectorant-based therapy for respiratory illnesses

- Growing public awareness, favorable reimbursement structures for prescription drugs, and easy access to retail pharmacies have further contributed to regional dominance

U.S. Oral Expectorant Market Insight

The U.S. oral expectorant market captured 71% of the North American market share in 2024, owing to an increase in cases of asthma, COPD, and seasonal bronchitis. Consumers in the U.S. prefer OTC treatments such as guaifenesin-based formulations, with significant growth driven by e-commerce availability and expanding retail pharmacy chains such as CVS and Walgreens. Rising trends in self-medication and the demand for fast-acting cold and flu products continue to boost the adoption of oral expectorants in both urban and suburban markets.

Europe Oral Expectorant Market Insight

Europe oral expectorant market held a market share of 27.8% in 2024 and is projected to grow at a steady CAGR during the forecast period, driven by an aging population, increasing prevalence of respiratory infections, and growing consumer awareness of preventive healthcare. Governments across Europe have launched respiratory health campaigns promoting early treatment of symptoms, which in turn supports expectorant sales. Demand is strong in both OTC and prescription segments.

U.K. Oral Expectorant Market Insight

The U.K. oral expectorant market is expected to expand at a CAGR of 5.4% from 2025 to 2032, spurred by rising cold and flu cases, high public healthcare standards, and broad acceptance of mucolytic drugs. Increased online pharmacy adoption and growing inclination toward branded OTC medications such as Benylin and Sudafed are expected to sustain growth.

Germany Oral Expectorant Market Insight

Germany oral expectorant market is expected to register a CAGR of 5.9% during the forecast period, supported by the country’s preference for evidence-based medicine and a high level of health consciousness among consumers. The demand for natural and herbal-based expectorants is also increasing, in line with the country’s push towards clean-label and organic pharmaceutical products.

Asia-Pacific Oral Expectorant Market Insight

Asia-Pacific oral expectorant market is expected to grow at the fastest CAGR of 7.2% from 2025 to 2032, with countries such as China, India, and Japan driving most of the regional growth. This growth is attributed to increasing urban air pollution, rising incidence of respiratory infections, expanding middle-class population, and improvements in healthcare accessibility. The demand for affordable, effective, and easy-to-administer expectorants is on the rise, particularly in rural and semi-urban areas.

Japan Oral Expectorant Market Insight

Japan’s oral expectorant market is projected to grow at a CAGR of 4.9% due to a well-structured healthcare system and a tech-savvy, aging population that frequently uses medications for chronic bronchitis and cough.mInnovation in dosage forms such as dissolvable tablets and pediatric syrups is fueling consumer acceptance and market expansion.

China Oral Expectorant Market Insight

China oral expectorant market held the largest market revenue share in Asia-Pacific in 2024, accounting for 43.2% of the region’s total, driven by a growing middle-class population, pollution-related respiratory conditions, and strong domestic pharmaceutical manufacturing capabilities. Government healthcare reforms and the popularity of Traditional Chinese Medicine (TCM)-based expectorants also contribute to market diversity and growth.

Oral Expectorant Market Share

The oral expectorant industry is primarily led by well-established companies, including:

- Merck KGaA (Germany)

- Novartis AG (Switzerland)

- Beckman Coulter Inc. (U.S.)

- Johnson & Johnson and its affiliates (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Sanofi (France)

- Sun Pharmaceutical Industries Ltd. (India)

- Aurobindo Pharma (India)

- Biocon (India)

- Bristol-Myers Squibb Company (U.S.)

- GSK plc (U.K.)

- Reckitt Benckiser Group PLC (U.K.)

- Acadia Pharmaceuticals Inc. (U.S.)

Latest Developments in Global Oral Expectorant Market

- In December 2023, Perrigo Company plc expanded its generic OTC expectorant portfolio across North America and Europe, focusing on guaifenesin-based formulations for both pediatric and adult markets. The launch includes sugar-free variants and extended-release tablets to cater to changing consumer preferences. This move aligns with the growing consumer trend toward accessible and cost-effective cough and cold treatments

- In October 2023, Dr. Reddy’s Laboratories introduced a new line of herbal-based expectorants in the Indian market under its “NATURZ” range. These products include plant-based ingredients such as tulsi and mulethi, reflecting rising demand for natural alternatives to synthetic drugs. The company aims to capture growing interest in herbal and Ayurvedic formulations for respiratory conditions

- In August 2023, Genexa Inc., a U.S.-based clean medicine company, launched its reformulated organic children’s expectorant syrup made without artificial dyes, parabens, or high-fructose corn syrup. Marketed toward health-conscious parents, this product aims to provide safer, more transparent options in the pediatric OTC medication segment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.