Global Oral Vaccine Market

Market Size in USD Billion

CAGR :

%

USD

4.29 Billion

USD

7.48 Billion

2025

2033

USD

4.29 Billion

USD

7.48 Billion

2025

2033

| 2026 –2033 | |

| USD 4.29 Billion | |

| USD 7.48 Billion | |

|

|

|

|

Oral Vaccine Market Size

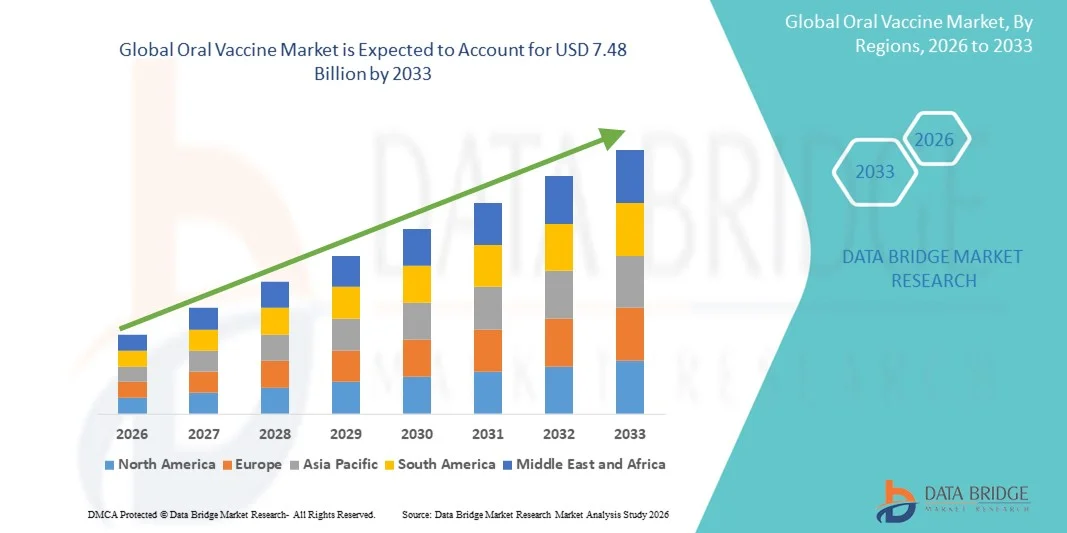

- The global oral vaccine market size was valued at USD 4.29 billion in 2025 and is expected to reach USD 7.48 billion by 2033, at a CAGR of 7.20% during the forecast period

- The market growth is largely fueled by increasing adoption of non-invasive, patient-friendly immunization methods, technological progress in oral formulations, and rising implementation of mass vaccination programs across both developed and developing regions

- Furthermore, rising demand from healthcare providers and governments for safe, easy-to-administer, and effective vaccines is establishing oral vaccines as a preferred alternative to injectable vaccines. These converging factors are accelerating the uptake of oral vaccine solutions, thereby significantly boosting the industry's growth

Oral Vaccine Market Analysis

- Oral vaccines, offering non-invasive and patient-friendly immunization, are increasingly vital components of modern healthcare programs in both developed and developing regions due to their ease of administration, improved compliance, and suitability for mass vaccination campaigns

- The escalating demand for oral vaccines is primarily fueled by the rising need for needle-free vaccination methods, growing awareness of immunization benefits, and a preference for formulations that are easier to transport and administer, particularly in pediatric and remote populations

- North America dominated the oral vaccine market with the largest revenue share of 37.9% in 2025, characterized by strong government immunization programs, early adoption of novel vaccine delivery technologies, and a high presence of key pharmaceutical players, with the U.S. experiencing substantial growth in oral vaccine uptake driven by innovations in pill-based and thermostable formulations

- Asia-Pacific is expected to be the fastest growing region in the oral vaccine market during the forecast period due to increasing healthcare infrastructure, large population base, and government initiatives to improve vaccine coverage

- Live attenuated vaccines segment dominated the oral vaccine market with a market share of 43.2% in 2025, driven by their proven efficacy, long-standing use in global immunization programs, and ease of administration in large-scale campaigns

Report Scope and Oral Vaccine Market Segmentation

|

Attributes |

Oral Vaccine Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Oral Vaccine Market Trends

Advancements in Thermostable and Pill-Based Formulations

- A significant and accelerating trend in the global oral vaccine market is the development of thermostable and pill-based vaccine formulations that simplify storage, transportation, and administration, making vaccines more accessible in remote and resource-limited regions

- For instance, Vaxart’s oral COVID-19 vaccine candidate is a tablet-based formulation designed for room-temperature storage, reducing cold-chain dependency and facilitating easier mass immunization campaigns

- Technological innovations in oral vaccines also enable enhanced mucosal immunity, potentially improving protection compared to traditional injectable vaccines, while formulations are being optimized for pediatric and adult populations

- These advancements support large-scale public health initiatives by enabling easier distribution, self-administration, and reduced logistical challenges, particularly in low- and middle-income countries

- This trend towards more stable, patient-friendly, and easily administrable oral vaccines is fundamentally reshaping global vaccination strategies. Consequently, companies such as Vaxart and Bharat Biotech are developing oral vaccines with simplified dosing and broader shelf-life stability

- The demand for oral vaccines that offer convenience, improved compliance, and robust immunity is growing rapidly across both developed and developing nations as governments and healthcare providers prioritize efficient and accessible immunization solutions

- The integration of digital health technologies, such as mobile tracking for oral vaccine adherence, is emerging as a complementary trend to ensure higher compliance and effective immunization coverage

- Collaborative initiatives between pharmaceutical companies and governments to deploy oral vaccines in humanitarian and outbreak response programs are accelerating adoption, particularly in regions with limited healthcare infrastructure

Oral Vaccine Market Dynamics

Driver

Rising Need Due to Non-Invasive Vaccination and Public Health Programs

- The increasing prevalence of infectious diseases, coupled with growing public health initiatives promoting vaccination, is a significant driver for the heightened demand for oral vaccines

- For instance, in March 2025, Bharat Biotech launched its novel oral rotavirus vaccine to enhance accessibility in rural areas, leveraging ease-of-administration to boost coverage rates

- As governments and healthcare organizations seek methods to increase vaccine compliance, oral vaccines offer needle-free delivery, simplified logistics, and higher acceptance, particularly in pediatric populations

- Furthermore, large-scale immunization campaigns and school-based vaccination programs are making oral vaccines an integral part of public health strategies, supporting herd immunity objectives

- The convenience of non-invasive administration, lower logistical burden, and potential for mass dosing are key factors propelling the adoption of oral vaccines globally. The trend towards combination oral vaccines and user-friendly delivery formats further contributes to market growth

- Increasing investment in R&D for novel oral vaccines against emerging infectious diseases, such as norovirus and enteric pathogens, is creating new growth avenues for the market

- Government incentives and subsidies for oral vaccine programs, especially in developing nations, are reducing costs and encouraging wider adoption across public health networks

Restraint/Challenge

Limited Efficacy in Certain Populations and Regulatory Hurdles

- Concerns regarding reduced efficacy of some oral vaccines in specific populations or geographies pose a significant challenge to broader market penetration. Oral vaccines may be less effective in areas with high prevalence of enteric infections or malnutrition

- For instance, studies on oral polio and rotavirus vaccines in some regions have shown variable immune responses, causing cautious adoption by public health authorities

- Addressing these efficacy concerns through improved formulations, adjuvants, and strain selection is crucial for building confidence among healthcare providers. Companies such as Vaxart emphasize clinical trials and efficacy studies to reassure stakeholders. In addition, strict regulatory approval requirements and compliance with WHO and local health authority guidelines can delay product launch and market entry

- While oral vaccines offer significant advantages, regulatory complexity and the need for region-specific clinical validation can hinder swift adoption, especially in low-resource settings

- Overcoming these challenges through enhanced vaccine formulations, robust clinical evidence, and streamlined regulatory pathways will be vital for sustained growth of the oral vaccine market

- Supply chain disruptions, particularly during pandemics or geopolitical tensions, can affect the availability of oral vaccines, posing additional challenges to consistent immunization programs

- Public skepticism or lack of awareness about oral vaccine efficacy in comparison to injectable vaccines can slow uptake, requiring targeted education campaigns and advocacy by health authorities

Oral Vaccine Market Scope

The market is segmented on the basis of type, product type, application, end-users, and distribution channel.

- By Type

On the basis of type, the oral vaccine market is segmented into live attenuated, recombinant, inactive, and others. The live attenuated segment dominated the market with the largest revenue share of 43.2% in 2025, driven by its proven efficacy, long-standing use in global immunization programs, and strong mucosal immune response. These vaccines are widely used in programs targeting polio, rotavirus, and cholera, ensuring high adoption across pediatric populations. Governments and healthcare organizations often prefer live attenuated oral vaccines due to their cost-effectiveness and ability to provide immunity after a single dose. Moreover, established manufacturing processes and distribution networks for live attenuated vaccines further reinforce their market dominance. Their compatibility with mass immunization campaigns also contributes to sustained demand in developing countries and remote regions.

The recombinant segment is expected to witness the fastest growth rate of 15.8% from 2026 to 2033, fueled by advancements in biotechnology and the development of safer, genetically engineered vaccines. Recombinant oral vaccines reduce the risk of adverse effects while providing targeted immunity against specific pathogens. Growing R&D investments by pharmaceutical companies in novel recombinant vaccines for diseases such as cholera, norovirus, and COVID-19 are accelerating adoption. These vaccines are gaining popularity in regions with stringent regulatory standards, as they often demonstrate improved safety profiles. Furthermore, recombinant vaccines support the creation of combination oral vaccines, addressing multiple diseases in a single formulation. The scalability of recombinant vaccine production also contributes to their increasing global uptake.

- By Product Type

On the basis of product type, the oral vaccine market is segmented into oral polio vaccine, cholera vaccine, rotavirus vaccine, and others. The oral polio vaccine segment dominated the market in 2025 due to its critical role in global polio eradication initiatives and decades of established public health usage. Governments and non-profit organizations rely heavily on oral polio vaccines for mass immunization, particularly in low- and middle-income countries. The vaccine’s oral administration makes it ideal for campaigns targeting children and rural populations. Furthermore, its cost-effectiveness, proven efficacy, and ease of distribution through public health networks contribute to market dominance. Continuous global efforts by organizations such as WHO and UNICEF further sustain demand.

The rotavirus vaccine segment is expected to witness the fastest growth rate of 14.9% from 2026 to 2033, driven by rising incidence of rotavirus-related diarrhea and gastrointestinal infections in children under five. Innovative oral formulations, including thermostable and liquid vaccines, are increasing accessibility in remote areas. Expanding government vaccination programs and inclusion in national immunization schedules are fueling adoption in emerging markets. The convenience of oral delivery enhances compliance among pediatric populations, encouraging higher vaccination rates. Pharmaceutical companies are also investing in combination rotavirus vaccines to simplify immunization schedules. Rising awareness among parents regarding rotavirus prevention is further propelling growth.

- By Application

On the basis of application, the oral vaccine market is segmented into polio, tuberculosis, rabies, influenza, cholera, and others. The polio application segment dominated the market with a major revenue share in 2025 due to ongoing global eradication initiatives and decades of mass vaccination programs. Oral polio vaccines have been central to immunization campaigns in developing regions, contributing to reduced incidence and long-term disease control. International partnerships and government-backed vaccination drives ensure consistent demand. The oral route allows easy administration to children in rural and low-resource areas. The vaccine’s proven safety, affordability, and effectiveness make it a preferred choice for national and global programs. Continuous monitoring and booster campaigns also maintain steady uptake.

The cholera application segment is expected to witness the fastest CAGR of 13.5% from 2026 to 2033, driven by increasing outbreaks in Asia-Pacific and Africa due to poor sanitation and water contamination. Oral cholera vaccines are crucial in emergency response and preventive campaigns in endemic regions. Thermostable oral formulations and single-dose options are improving vaccine accessibility. Governments and NGOs are increasingly using oral cholera vaccines in large-scale campaigns to mitigate epidemic risks. Public awareness campaigns and funding support from organizations such as Gavi are accelerating adoption. The ease of mass administration and cost-effectiveness further contribute to rapid growth.

- By End-Users

On the basis of end-users, the oral vaccine market is segmented into clinics, hospitals, and others. The hospitals segment dominated the market in 2025 due to large-scale vaccination programs, established cold chain infrastructure, and availability of trained healthcare professionals. Hospitals often serve as primary points for pediatric immunization, epidemic response, and booster campaigns, ensuring high vaccine coverage. Integration of oral vaccines into hospital preventive care programs further drives adoption. Hospitals also benefit from partnerships with government health authorities for mass immunization. High patient footfall and routine vaccination schedules sustain consistent demand. Strong logistics and storage facilities support the distribution of both live attenuated and recombinant oral vaccines.

The clinics segment is expected to witness the fastest growth rate of 12.8% from 2026 to 2033, driven by expanding outpatient services, vaccination awareness campaigns, and the rise of community healthcare networks. Oral vaccines simplify administration in clinic settings without the need for injection-trained staff. Clinics provide accessibility in semi-urban and rural areas, enhancing coverage. Innovative delivery formats and combination vaccines are increasing clinic-level uptake. Government incentives and outreach programs encourage clinics to participate in vaccination campaigns. Increasing parental preference for non-invasive vaccination also supports growth.

- By Distribution Channel

On the basis of distribution channel, the oral vaccine market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment dominated the market in 2025 due to the controlled distribution of vaccines through hospital systems, regulatory compliance, and integration with immunization programs. Hospitals act as central hubs for vaccination campaigns, ensuring cold chain maintenance and adherence to guidelines. Partnerships with public health authorities facilitate bulk procurement and distribution. This channel supports both routine immunization and emergency outbreak responses. Hospitals also provide education and monitoring for vaccine recipients. Established logistics and clinical oversight ensure high adoption rates.

The online pharmacy segment is expected to witness the fastest CAGR of 18.3% from 2026 to 2033, fueled by increasing e-pharmacy adoption, telemedicine consultations, and demand for convenient home delivery of vaccines. Online channels improve accessibility for remote or mobility-restricted populations. Digital platforms offer scheduling, reminders, and adherence tracking, enhancing compliance. Direct-to-consumer delivery models reduce the need for physical visits. Awareness campaigns and digital marketing are driving awareness about oral vaccines available online. Regulatory approvals for online distribution and growth of e-health infrastructure further boost this channel’s adoption.

Oral Vaccine Market Regional Analysis

- North America dominated the oral vaccine market with the largest revenue share of 37.9% in 2025, characterized by strong government immunization programs, early adoption of novel vaccine delivery technologies, and a high presence of key pharmaceutical players

- Consumers and healthcare providers in the region highly value the convenience, needle-free administration, and proven efficacy offered by oral vaccines for diseases such as polio, rotavirus, and cholera

- This widespread adoption is further supported by advanced research and development capabilities, government funding, and inclusion of oral vaccines in national immunization schedules, establishing them as a preferred solution for both routine and outbreak vaccination programs in hospitals, clinics, and community healthcare centers

U.S. Oral Vaccine Market Insight

The U.S. oral vaccine market captured the largest revenue share of 79% in 2025 within North America, fueled by well-established immunization programs and high public awareness of vaccine-preventable diseases. Healthcare providers increasingly prioritize oral vaccines for pediatric immunization and mass vaccination campaigns due to their non-invasive administration and proven efficacy. The growing integration of oral vaccines in school-based and community health programs further propels the market. Moreover, advancements in thermostable and pill-based formulations, along with digital tracking of vaccine adherence, are significantly contributing to market expansion.

Europe Oral Vaccine Market Insight

The Europe oral vaccine market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent public health regulations and the rising need to prevent infectious diseases across all age groups. The increase in urbanization and investment in healthcare infrastructure is fostering the adoption of oral vaccines. European consumers and healthcare systems are drawn to the convenience, safety, and efficiency of oral immunization. The region is experiencing significant growth across hospitals, clinics, and public health campaigns, with oral vaccines being incorporated into both routine immunization and outbreak response programs.

U.K. Oral Vaccine Market Insight

The U.K. oral vaccine market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by government-backed vaccination programs and rising awareness regarding infectious disease prevention. Concerns about disease outbreaks and the preference for needle-free immunization encourage both public and private healthcare providers to adopt oral vaccines. The U.K.’s robust healthcare infrastructure, alongside strong digital health and e-pharmacy networks, is expected to continue supporting market growth. Public campaigns emphasizing ease-of-use and compliance further stimulate adoption across pediatric and adult populations.

Germany Oral Vaccine Market Insight

The Germany oral vaccine market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of immunization benefits and government initiatives to enhance public health. Germany’s well-developed healthcare infrastructure, combined with a focus on research and innovation in biotechnology, promotes the adoption of oral vaccines in hospitals and clinics. Integration of oral vaccines into routine immunization schedules and outbreak preparedness programs is becoming increasingly prevalent, with strong emphasis on safety, efficacy, and accessibility aligning with local regulatory standards.

Asia-Pacific Oral Vaccine Market Insight

The Asia-Pacific oral vaccine market is poised to grow at the fastest CAGR of 21% during the forecast period of 2026 to 2033, driven by rising population, increasing incidence of vaccine-preventable diseases, and government-supported immunization programs in countries such as China, India, and Japan. The region's growing focus on public health infrastructure, supported by national vaccination campaigns, is driving the adoption of oral vaccines. Furthermore, APAC’s emergence as a manufacturing hub for oral vaccine production improves affordability and accessibility, expanding availability to rural and urban populations asuch as.

Japan Oral Vaccine Market Insight

The Japan oral vaccine market is gaining momentum due to the country’s focus on preventive healthcare and advanced biotechnology adoption. Japan places significant emphasis on pediatric and elderly vaccination programs, and the uptake of oral vaccines is driven by their ease-of-use and compliance advantages. Integration with digital health monitoring systems for tracking immunization schedules is fueling growth. Moreover, Japan’s aging population is such asly to spur demand for convenient, non-invasive vaccination options in both residential and clinical settings.

India Oral Vaccine Market Insight

The India oral vaccine market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to strong government immunization initiatives, high population base, and rising public awareness of vaccine-preventable diseases. India represents one of the largest emerging markets for oral vaccines, with widespread adoption across hospitals, clinics, and community health programs. The push towards universal immunization, coupled with the availability of cost-effective oral vaccine options and domestic manufacturing capacity, are key factors propelling the market in India.

Oral Vaccine Market Share

The Oral Vaccine industry is primarily led by well-established companies, including:

- Merck & Co., Inc. (U.S.)

- GSK plc (U.K.)

- Sanofi France)

- Pfizer Inc. (U.S.)

- AstraZeneca (U.K.)

- Novartis AG (Switzerland)

- Bharat Biotech International Ltd (India)

- Serum Institute of India Pvt. Ltd. (India)

- Vaxart, Inc. (U.S.)

- Oramed Pharmaceuticals Inc. (U.S.)

- Emergent BioSolutions Inc. (U.S.)

- Zydus Lifesciences Ltd (India)

- Haffkine Biopharmaceutical Co. Ltd. (India)

- Panacea Biotec Ltd (India)

- Changchun BCHT Biotechnology Co., Ltd. (China)

- Medigen Vaccine Biologics Corp (Taiwan)

- BlueWillow Biologics Inc. (U.S.)

- BioNet Asia Co. Ltd. (Thailand)

- Innovax (China)

What are the Recent Developments in Global Oral Vaccine Market?

- In May 2025, Vaxart published complete data from its Phase 2b challenge study of its first‑generation oral norovirus vaccine, showing it met five of six primary endpoints, was safe, reduced viral shedding, and identified key correlates of protection using machine‑learning analysis findings that will guide its second‑generation vaccine development

- In May 2025, Bharat Biotech announced that its oral cholera vaccine Hillchol successfully completed Phase III clinical trials in India (1,800 participants), demonstrating non‑inferiority versus the existing licensed vaccine (Shanchol) for both Ogawa and Inaba serotypes along with a strong safety profile

- In May 2025, WHO reported the detection of circulating vaccine-derived poliovirus type 2 (cVDPV2) in stool samples of healthy children from Papua New Guinea, highlighting persistent challenges in oral polio vaccine (OPV) coverage and the critical need for sustained immunization surveillance

- In April 2025, Vaxart completed enrollment in a Phase 1 clinical trial of its second‑generation oral norovirus vaccine constructs, testing them head‑to‑head against first‑generation versions. The study aims to evaluate improved potency, and topline data are expected by mid‑2025

- In March 2025, Vaxart officially initiated the Phase 1, dose-ranging, open-label trial for its second‑generation norovirus oral vaccine (pill formulation), targeting enhanced immune responses over its first-generation candidate to better prevent norovirus gastroenteritis

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.