Global Orange Mint Essential Oils Market

Market Size in USD Billion

CAGR :

%

USD

6.45 Billion

USD

8.90 Billion

2024

2032

USD

6.45 Billion

USD

8.90 Billion

2024

2032

| 2025 –2032 | |

| USD 6.45 Billion | |

| USD 8.90 Billion | |

|

|

|

|

Orange Mint Essential Oils Market Size

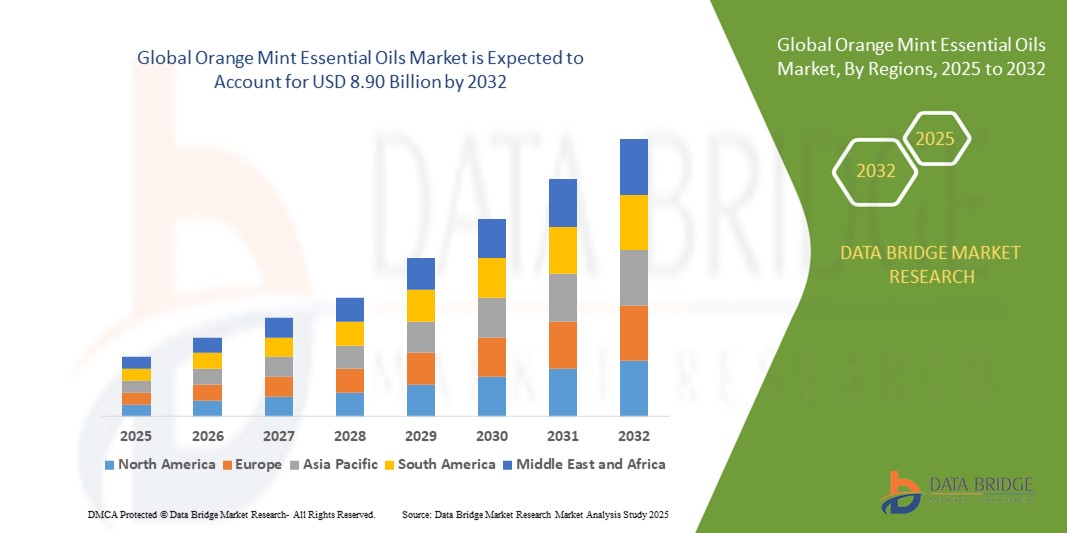

- The global orange mint essential oils market size was valued at USD 6.45 billion in 2024 and is expected to reach USD 8.90 billion by 2032, at a CAGR of 4.1% during the forecast period

- The market growth is largely fueled by the increasing adoption of natural and organic products across personal care, aromatherapy, food and beverages, and home care applications, driving demand for high-quality orange mint essential oils

- Furthermore, rising consumer awareness regarding wellness, stress management, and holistic health solutions is encouraging the use of essential oils. These converging factors are accelerating the uptake of orange mint essential oils, thereby significantly boosting the industry's growth

Orange Mint Essential Oils Market Analysis

- Orange mint essential oils are natural plant extracts derived from the leaves and peels of mint and citrus plants, widely used in aromatherapy, personal care, food and beverage flavoring, pharmaceuticals, and home care products. These oils are valued for their therapeutic properties, refreshing aroma, and versatility in formulations

- The escalating demand for orange mint essential oils is primarily fueled by growing consumer preference for chemical-free and natural ingredients, increasing adoption in wellness and aromatherapy products, and rising industrial applications in cosmetics, food flavoring, and therapeutic formulations

- Europe dominated the orange mint essential oils market with a share of 39.8% in 2024, due to stringent quality and safety regulations, high consumer preference for natural and organic wellness products, and strong investments in specialty essential oil production

- North America is expected to be the fastest growing region in the orange mint essential oils market during the forecast period due to rising demand for natural flavors and therapeutic-grade oils in aromatherapy, personal care, and food and beverage products

- Sweet orange mint oil segment dominated the market with a market share of 45.8% in 2024, due to its well-rounded aroma and versatility in multiple applications. It is widely used in aromatherapy, food and beverages, personal care, and home care products due to its refreshing scent and perceived health benefits, such as stress reduction and digestive support. Its high compatibility with other essential oils and ease of blending further enhance its adoption among manufacturers

Report Scope and Orange Mint Essential Oils Market Segmentation

|

Attributes |

Orange Mint Essential Oils Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Orange Mint Essential Oils Market Trends

Increasing Adoption of Aromatherapy and Home Wellness Solutions

- The orange mint essential oils market is experiencing rising demand as consumers turn to holistic therapies for physical relaxation, stress relief, and wellness. This aligns with growing preference toward natural healing and non-invasive health practices

- For instance, doTERRA has expanded its product range by introducing orange mint essential oil blends into its aromatherapy collections. These blends cater to consumers seeking convenient wellness solutions while aligning with the clean-label and natural product movement

- Increasing integration of essential oils into home diffusers and personal care products is fueling market adoption. Consumers are using orange mint oils in candles, sprays, and skincare products to enhance relaxation-oriented lifestyle routines

- In addition, the preference for do-it-yourself home wellness kits is boosting innovation. Companies are marketing essential oil starter packs containing orange mint oils, allowing consumers to create customized wellness solutions tailored to individual preferences and needs

- Retailers and e-commerce channels are supporting greater accessibility by offering affordable essential oil products in varied packaging sizes. This democratizes their usage, attracting both premium wellness buyers and mainstream consumers seeking affordable therapeutic options

- Sustainability-conscious consumers are influenced by companies adopting eco-friendly sourcing and packaging methods. Brands positioning orange mint essential oils with organic certifications and recyclable packaging appeal strongly to buyers seeking wellness solutions with environmental responsibility

Orange Mint Essential Oils Market Dynamics

Driver

Growing Demand for Natural and Organic Products

- Consumer preference for natural and organic products is significantly driving the demand for orange mint essential oils. Growing health awareness has shifted focus toward plant-based, chemical-free products in personal care, aromatherapy, and healthcare industries

- For instance, Young Living has highlighted its organic orange mint essential oils in marketing campaigns. By emphasizing purity, traceability, and sustainability, the company is catering to the surging demand for natural alternatives across global wellness markets

- The rising rejection of synthetic fragrances and chemical formulations is steering consumers toward essential oils. Orange mint essential oils, with their multifunctional uses in stress relief, skincare, and fragrance, perfectly match this transition in consumer priorities

- In addition, the pharmaceutical and nutraceutical sectors increasingly utilize natural essential oils as functional ingredients. Orange mint oils are valued for their antimicrobial and antioxidant properties, which expand their applications in immunity-boosting and therapeutic solutions

- The expanding global organic product certification standards are aiding producers in strengthening consumer trust. Compliance with these standards positions orange mint essential oils as premium wellness options, capable of commanding higher value across international marketplaces

Restraint/Challenge

Supply Chain Disruptions and Seasonal Variability

- Seasonal variability in orange mint cultivation creates unstable raw material supply, leading to production inefficiencies. Climate factors such as droughts or heavy rainfall cycles impact oil yields and drive fluctuations in cost and product quality

- For instance, Essential Oil Company in the United States has faced challenges with seasonal sourcing of orange mint varieties. These supply issues impacted consistent output volumes and temporarily raised manufacturing costs, affecting profitability margins

- Global supply chain disruptions, exacerbated by logistics delays, continue to limit availability in export-driven markets. Companies depending on imports face delays in large-volume procurement, threatening timely distribution channels and retail commitments for wellness products

- In addition, small-scale farmers often dominate the cultivation of orange mint crops, leading to inconsistent scalability. Production inefficiencies and lack of modern farming technology make it difficult to ensure stable bulk supplies to meet rising demand

- Currency exchange rate fluctuations, rising energy costs, and geopolitical tensions add pressure on supply chain management. These challenges further increase uncertainties, making long-term pricing stability and sustainable supply contracts difficult for producers of orange mint essential oils

Orange Mint Essential Oils Market Scope

The market is segmented on the basis of type, distribution channel, packaging type, grade, application, and end-user.

- By Type

On the basis of type, the market is segmented into Sweet Orange Mint Oil, Wild Orange Mint Oil, and Others. The Sweet Orange Mint Oil segment dominated the market in 2024 with the largest revenue share of 45.8%, attributed to its well-rounded aroma and versatility in multiple applications. It is widely used in aromatherapy, food and beverages, personal care, and home care products due to its refreshing scent and perceived health benefits, such as stress reduction and digestive support. Its high compatibility with other essential oils and ease of blending further enhance its adoption among manufacturers. In addition, its availability in different grades and packaging formats makes it convenient for both commercial and residential consumers. Consumer preference for premium and natural products continues to strengthen the segment’s dominance globally.

The Wild Orange Mint Oil segment is projected to witness the fastest growth from 2025 to 2032, driven by increasing awareness of organic and naturally sourced essential oils. Consumers are shifting toward products with distinct aromatic profiles and natural wellness benefits, particularly in aromatherapy and specialty cosmetics. Technological improvements in extraction and purification processes have enhanced oil quality and consistency, boosting adoption. Rising demand in niche wellness markets and boutique personal care brands is further accelerating growth. Its use in natural formulations and innovative product blends supports strong market potential.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Online Retail, Specialty Stores, Supermarkets, Drug Stores, Direct Sales, and Others. The Online Retail segment dominated in 2024, driven by the growing convenience of e-commerce platforms, global accessibility, and easy product comparison. Online channels provide consumers access to a wide variety of premium and niche orange mint oils, often accompanied by detailed product descriptions, reviews, and subscription options. Direct-to-consumer sales reduce intermediaries, offering cost benefits and customized service. The COVID-19 pandemic accelerated online purchasing habits, which continue to influence consumer behavior. Moreover, online retail enables manufacturers to showcase authenticity certifications and organic labeling, increasing consumer trust.

The Specialty Stores segment is expected to witness the fastest growth from 2025 to 2032, fueled by the increasing popularity of curated shopping experiences. Specialty stores offer personalized recommendations, premium product ranges, and the ability to test oils before purchase, which appeals to discerning buyers. Rising consumer interest in wellness-focused retail outlets, boutique aromatherapy shops, and natural personal care stores is driving adoption. Specialty stores also emphasize product authenticity, origin transparency, and organic certifications, which encourage consumer trust. Increasing urbanization and the emergence of lifestyle-oriented shopping destinations are further supporting growth.

- By Packaging Type

On the basis of packaging type, the market is segmented into Bottles, Drums, Bulk Packaging, and Others. The Bottles segment dominated the market in 2024 due to its convenience for home use, retail sales, and precise dosing. Bottled packaging ensures easy storage, better preservation of aroma and quality, and user-friendly handling for aromatherapy, culinary, and personal care applications. Premium labeling, decorative packaging, and small-format options enhance consumer appeal. Bottles are highly compatible with diffusers, massage oils, and DIY blends, making them the preferred choice across end-user segments. Ease of transport and gifting suitability also contribute to its market dominance.

The Bulk Packaging segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing demand from industrial end-users and large-scale manufacturers. Bulk packaging ensures cost-effectiveness, reduced per-unit pricing, and suitability for high-volume applications in cosmetics, pharmaceuticals, and food processing. Large-scale buyers prefer bulk oil to maintain consistent quality while optimizing production costs. The segment is further boosted by the growing industrial applications of natural and organic ingredients. Rising exports of raw essential oils and increasing adoption in commercial formulations are contributing to accelerated growth.

- By Grade

On the basis of grade, the market is segmented into Therapeutic Grade, Food Grade, and Industrial Grade. The Therapeutic Grade segment dominated the market in 2024 due to its high purity, concentration of active compounds, and preference in aromatherapy, wellness, and personal care applications. It is widely sought after for stress relief, mood enhancement, and holistic wellness practices. Certification and adherence to quality standards further strengthen its market position. Growing consumer awareness regarding the health benefits of essential oils and the shift toward natural remedies support its dominance. Therapeutic grade oils also appeal to premium product manufacturers, which enhances market revenue.

The Food Grade segment is expected to witness the fastest growth from 2025 to 2032, driven by increasing incorporation of natural flavoring agents in beverages, confectionery, and culinary products. Rising consumer preference for clean-label, plant-based, and organic ingredients is boosting demand. Manufacturers are innovating with ready-to-use blends to enhance flavor and aroma, which further accelerates growth. Food-grade oils are also valued for safety and compliance with food regulations, increasing adoption across industrial and commercial applications. Expansion in the global food and beverage sector continues to create opportunities.

- By Application

On the basis of application, the market is segmented into Aromatherapy, Food and Beverages, Pharmaceuticals, Personal Care and Cosmetics, Home Care Products, and Others. The Aromatherapy segment dominated the market in 2024 due to rising consumer adoption of essential oils for wellness, stress management, and relaxation. The expansion of spa and wellness centers, home diffusers, and massage therapy practices has strengthened demand. Ease of blending with other oils and incorporation into oils, candles, and bath products enhances its versatility. Increased awareness of natural wellness solutions and lifestyle-oriented health practices continues to fuel market growth. Aromatherapy also benefits from premium pricing strategies and a strong online presence.

The Food and Beverages segment is projected to witness the fastest growth from 2025 to 2032, driven by rising use of natural flavoring and aroma enhancers in beverages, confectionery, bakery, and gourmet foods. Consumers are increasingly preferring plant-based and additive-free ingredients, boosting adoption. Innovations in natural flavor formulations and clean-label solutions are supporting product diversification. Growth is also fueled by expanding commercial kitchens, food processing units, and ready-to-drink product lines. Regulatory compliance and focus on sustainable sourcing further enhance market potential.

- By End-User

On the basis of end-user, the market is segmented into Residential, Commercial, and Industrial. The Residential segment dominated in 2024 due to the rising trend of home aromatherapy, DIY personal care products, and natural home care solutions. Consumers are increasingly integrating essential oils into daily wellness routines, diffusers, cleaning products, and DIY cosmetics. Availability of small and convenient packaging formats, coupled with premium options, supports adoption. The segment also benefits from growing e-commerce penetration and home-based wellness trends. Rising awareness of natural and chemical-free alternatives continues to drive growth.

The Industrial segment is expected to witness the fastest growth from 2025 to 2032, fueled by the expanding use of orange mint essential oils in cosmetics, pharmaceuticals, and food and beverage manufacturing. Industrial buyers prefer bulk-grade oils for cost-effectiveness, quality consistency, and large-scale formulation needs. Rising global demand for natural, sustainable, and clean-label ingredients accelerates adoption. Increasing exports and industrial-scale production of personal care and wellness products also support this segment’s rapid growth.

Orange Mint Essential Oils Market Regional Analysis

- Europe dominated the orange mint essential oils market with the largest revenue share of 39.8% in 2024, driven by stringent quality and safety regulations, high consumer preference for natural and organic wellness products, and strong investments in specialty essential oil production

- The region emphasizes sustainable sourcing, advanced extraction methods, and premium-grade oils for aromatherapy, personal care, and food applications

- High demand for therapeutic-grade oils and increasing focus on clean-label and eco-friendly products are further driving market expansion. Countries such as Germany, France, and the U.K. are leading the adoption of high-quality essential oils across commercial and residential applications

Germany Orange Mint Essential Oils Market Insight

Germany held the largest market share within Europe, driven by its leadership in aromatherapy, personal care, and natural cosmetic manufacturing, supported by advanced R&D infrastructure and strong regulatory compliance standards. The country has well-established supply chains and partnerships between essential oil producers and wellness product manufacturers. Demand is particularly strong for therapeutic-grade oils and organic formulations, which are widely used in spas, wellness centers, and premium personal care products. Germany also benefits from significant exports to neighboring European countries and other global markets.

U.K. Orange Mint Essential Oils Market Insight

The U.K. market is supported by increasing consumer awareness of natural wellness, aromatherapy, and personal care applications. Rising adoption of organic and clean-label products, along with a strong presence of specialty retailers and online channels, is fueling growth. The country also benefits from collaborations between essential oil producers and cosmetics, pharmaceutical, and food manufacturers, driving product innovation. Premium packaging and therapeutic-grade oils are gaining traction in both residential and commercial sectors.

Asia-Pacific Orange Mint Essential Oils Market Insight

Asia-Pacific is witnessing significant growth in the orange mint essential oils market, driven by expanding aromatherapy, personal care, and food and beverage industries. The region’s cost-effective manufacturing landscape, abundant availability of raw materials, and growing exports of essential oils are accelerating market expansion. Rapid urbanization, rising disposable incomes, and increasing consumer awareness regarding natural wellness products are further contributing to higher adoption. Countries such as China and India are seeing strong demand due to their established spice and herb cultivation sectors, enabling large-scale production and processing of essential oils.

China Orange Mint Essential Oils Market Insight

China held the largest share in the Asia-Pacific market in 2024, owing to its vast agricultural base, established essential oil processing facilities, and strong export capabilities. The country benefits from government initiatives supporting agricultural and herbal product industries, along with growing investments in natural and organic wellness products. Rising domestic demand for aromatherapy, personal care, and food flavoring applications is driving growth. In addition, ongoing R&D in extraction techniques and quality standardization supports higher production efficiency and product consistency.

India Orange Mint Essential Oils Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing cultivation of mint and citrus crops, rising production of essential oils, and a rapidly expanding food, personal care, and aromatherapy sector. Government programs promoting herbal exports and initiatives under “Make in India” for value-added natural products are strengthening market expansion. The rising trend of organic and naturally sourced wellness products, along with increased investments in processing infrastructure, is accelerating adoption. Export demand for orange mint oils in Europe and North America further supports growth.

North America Orange Mint Essential Oils Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, driven by rising demand for natural flavors and therapeutic-grade oils in aromatherapy, personal care, and food and beverage products. Increased consumer preference for organic and plant-based ingredients, coupled with rising e-commerce penetration, is boosting adoption. The U.S. and Canada are witnessing growing production capabilities, investments in sustainable farming, and strong R&D for innovative applications, supporting overall market expansion.

U.S. Orange Mint Essential Oils Market Insight

The U.S. accounted for the largest share in the North America market in 2024, underpinned by its well-established aromatherapy and personal care industries, strong research infrastructure, and high demand for premium essential oils. Increasing focus on wellness, natural ingredients, and clean-label products is encouraging the use of orange mint oils. The country benefits from mature distribution channels, strong export capabilities, and ongoing product innovations in food, cosmetics, and therapeutic applications, solidifying its leading position in the region.

Orange Mint Essential Oils Market Share

The orange mint essential oils industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- DSM (Netherlands)

- Givaudan (Switzerland)

- International Flavors and Fragrances Inc. (U.S.)

- Sensient Technologies Corporation (U.S.)

- Symrise (Germany)

- Robertet SA (France)

- MANE (France)

- NOW Foods (U.S.)

Latest Developments in Global Orange Mint Essential Oils Market

- In July 2022, dōTERRA expanded its business and established distillation units in India for extracting essential oils. dōTERRA’s investment contributed to supplying distillation apparatus to the princely towns of Bihar and Odisha, allowing farmers to access advanced distillation technology locally. Through the construction of these units, traders relieved farmers from long-distance transportation, which increased profit margins on the final product. Given the wide acceptance of dōTERRA food and wellness products, the initiative created employment for 30,000 farmers in India

- In May 2020, Young Living incorporated Young Living Essential Oils India Private Limited to enter the Indian market. The company aimed to meet growing demand for natural wellness products and expand its global footprint. Through this establishment, Young Living strengthened regional operations, provided training and support to local distributors, and improved the availability of premium essential oils across major Indian cities. This expansion also opened opportunities for collaborations with local suppliers, enhancing market penetration

- In February 2020, Young Living reorganized its regional operations, separating the IAM region (India, Africa, Middle East) from the EU-RU region (Europe-Russia). This strategic move allowed the company to focus on growth in India and neighboring markets, streamline supply chains, and provide localized support to distributors and consumers. It enabled faster product launches and enhanced marketing and training programs tailored for the Indian consumer base

- In 2021, Plant Therapy, a U.S.-based essential oils company, expanded its engagement in the Indian market through participation in the red sandalwood and aromatic oils sector. The company partnered with local suppliers to source high-quality essential oils, ensuring sustainable and ethical procurement practices. This expansion helped boost local farming income and provided Indian consumers access to premium imported essential oils while strengthening Plant Therapy’s supply chain for international markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Orange Mint Essential Oils Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Orange Mint Essential Oils Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Orange Mint Essential Oils Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.