Global Organic Almond Yogurt Market

Market Size in USD Billion

CAGR :

%

USD

372.51 Billion

USD

546.19 Billion

2025

2033

USD

372.51 Billion

USD

546.19 Billion

2025

2033

| 2026 –2033 | |

| USD 372.51 Billion | |

| USD 546.19 Billion | |

|

|

|

|

What is the Global Organic Almond Yogurt Market Size and Growth Rate?

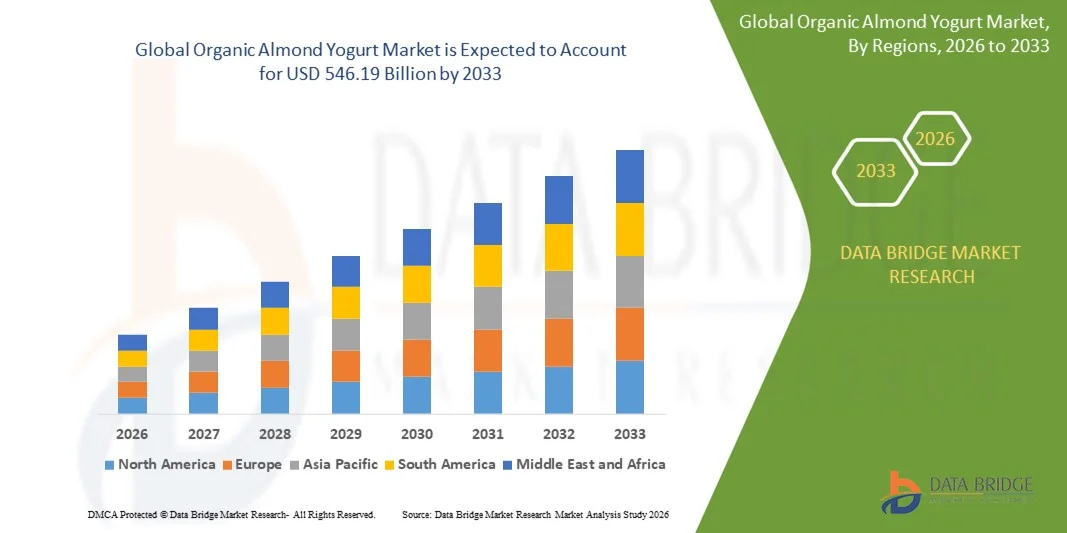

- The global organic almond yogurt market size was valued at USD 372.51 billion in 2025 and is expected to reach USD 546.19 billion by 2033, at a CAGR of4.9% during the forecast period

- The major growing factor towards organic almond yogurt market is the rise in the popularity of the dairy-free trend

- Furthermore, the rapid shift in the consumer’s preferences toward plant-based products and rise in the trend of low-fat non-dairy products are also expected to heighten the overall demand for organic almond yogurt market

What are the Major Takeaways of Organic Almond Yogurt Market?

- The rise in the awareness among people for losing weight and the easy availability in a wide range of flavors are also expected to serve as foremost drivers for the organic almond yogurt market at a global level. In addition, the increase in the number of lactose-intolerant individuals and widespread campaigns undertaken by celebrities are also lifting the growth of the organic almond yogurt market

- However, the in the price of raw material and high cost of the almond yogurt are projected to act as a restraint towards the growth of organic almond yogurt market, whereas the high manufacturing cost can challenge the growth of the organic almond yogurt market

- Europe dominated the organic almond yogurt market with the largest revenue share of 39.35% in 2025, driven by high consumer awareness regarding plant-based diets, strong preference for organic and clean-label food products, and well-established vegan and lactose-free food cultures across countries such as Germany, the U.K., France, and Italy

- Asia-Pacific is projected to register the fastest CAGR of 9.24% from 2026 to 2033, driven by rapid urbanization, rising health awareness, and growing adoption of plant-based and lactose-free diets across China, Japan, India, South Korea, and Southeast Asia

- The Spoonable segment dominated the market with an estimated 58.6% share in 2025, driven by its strong acceptance as a direct dairy yogurt alternative for breakfast, snacks, and desserts

Report Scope and Organic Almond Yogurt Market Segmentation

|

Attributes |

Organic Almond Yogurt Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Organic Almond Yogurt Market?

Increasing Shift Toward Clean-Label, Plant-Based, and Functional Organic Almond Yogurts

- The organic almond yogurt market is witnessing strong growth driven by rising consumer preference for plant-based, dairy-free, and lactose-free alternatives that align with vegan, flexitarian, and health-conscious lifestyles

- Manufacturers are increasingly focusing on clean-label formulations, using organic almonds, natural cultures, minimal additives, and no artificial preservatives to meet transparency and wellness expectations

- Growing demand for functional yogurts enriched with probiotics, fiber, calcium, and vitamin D is reshaping product innovation and positioning in premium retail channels

- For instance, companies such as Danone, Blue Diamond Growers, Oatly, Califia Farms, and Forager Project have expanded organic almond yogurt portfolios featuring probiotic blends and low-sugar variants

- Increasing adoption of sustainable packaging, recyclable materials, and carbon-conscious sourcing is strengthening brand differentiation and consumer loyalty

- As consumers prioritize nutrition, sustainability, and ethical sourcing, organic almond yogurts are becoming a mainstream choice within the global plant-based dairy alternatives market

What are the Key Drivers of Organic Almond Yogurt Market?

- Rising prevalence of lactose intolerance, dairy allergies, and cholesterol concerns is accelerating demand for almond-based organic yogurt products

- For instance, in 2024–2025, leading brands such as Danone, Nestlé, and Chobani expanded plant-based yogurt lines to capture growing health-focused consumer segments

- Increasing popularity of vegan, organic, and non-GMO diets across the U.S., Europe, and Asia-Pacific is boosting market penetration

- Expanding availability through online retail, specialty organic stores, and supermarkets improves accessibility and product visibility

- Growing awareness of almonds’ nutritional benefits, including healthy fats, antioxidants, and low calorie content, supports sustained consumption growth

- Backed by innovation in food processing, flavor development, and probiotic integration, the Organic Almond Yogurt market is expected to experience strong long-term expansion

Which Factor is Challenging the Growth of the Organic Almond Yogurt Market?

- High production and raw material costs associated with organic almonds and certification processes increase product pricing

- For instance, during 2024–2025, fluctuations in almond supply, water-intensive cultivation concerns, and rising logistics costs pressured profit margins for manufacturers

- Taste and texture limitations compared to traditional dairy yogurts can restrict adoption among first-time consumers

- Limited consumer awareness in emerging markets regarding plant-based yogurt benefits slows market penetration

- Strong competition from other plant-based alternatives such as soy, coconut, oat, and cashew yogurts intensifies pricing and shelf-space pressure

- To overcome these challenges, companies are investing in flavor innovation, cost optimization, localized sourcing, and consumer education to expand global adoption of Organic Almond Yogurts

How is the Organic Almond Yogurt Market Segmented?

The market is segmented on the basis of form, flavor, application, distribution channel, and end use.

- By Form

On the basis of form, the organic almond yogurt market is segmented into Spoonable and Drinkable. The Spoonable segment dominated the market with an estimated 58.6% share in 2025, driven by its strong acceptance as a direct dairy yogurt alternative for breakfast, snacks, and desserts. Spoonable variants offer thicker texture, better satiety, and higher compatibility with fruits, granola, and toppings, making them popular among health-conscious and vegan consumers.

The Drinkable segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising on-the-go consumption, demand for functional beverages, and increasing availability of probiotic-rich almond yogurt drinks in convenient packaging formats.

- By Flavor

On the basis of flavor, the market is segmented into Vanilla, Strawberry, Mixed Berry, Raspberry, Peach, and Others. The Vanilla segment dominated the market with around 34.2% share in 2025, as it serves as a versatile base flavor widely preferred across age groups and regions.

The Mixed Berry segment is projected to register the fastest growth, driven by rising demand for antioxidant-rich fruits, natural coloring, and premium taste profiles among younger consumers.

- By Application

On the basis of application, the Organic Almond Yogurt market is segmented into Frozen Dessert, Food, Beverages, and Others. The Food segment dominated the market with nearly 41.7% share in 2025, supported by extensive use in breakfast bowls, smoothies, desserts, and baking applications.

The Beverages segment is expected to grow at the fastest CAGR, fueled by increasing popularity of drinkable yogurts and functional nutrition drinks.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Hypermarkets, Supermarkets, Convenience Stores, Specialty Stores, Online, and Others. Supermarkets dominated the market with approximately 46.9% share in 2025, due to wide product availability and strong brand visibility.

The Online segment is anticipated to grow fastest, driven by expanding e-commerce, subscription models, and rising digital grocery adoption.

- By End Use

On the basis of end use, the market is segmented into HORECA and Household. The Household segment dominated with about 63.4% market share in 2025, reflecting high at-home consumption.

The HORECA segment is expected to grow rapidly, supported by rising adoption of plant-based menus in cafés, hotels, and restaurants.

Which Region Holds the Largest Share of the Organic Almond Yogurt Market?

- Europe dominated the organic almond yogurt market with the largest revenue share of 39.35% in 2025, driven by high consumer awareness regarding plant-based diets, strong preference for organic and clean-label food products, and well-established vegan and lactose-free food cultures across countries such as Germany, the U.K., France, and Italy. Increasing incidences of lactose intolerance and growing focus on gut health and sustainable food consumption continue to fuel demand for organic almond yogurt across the region

- Leading European food and dairy-alternative brands are expanding their organic, sugar-free, and fortified almond yogurt portfolios, supported by strong retail penetration, private-label growth, and continuous product innovation

- Strict EU regulations promoting organic farming, coupled with high disposable income and mature health-food retail ecosystems, further reinforce Europe’s leadership in the global market

Germany Organic Almond Yogurt Market Insight

Germany is the largest contributor in Europe, supported by a strong vegan population, high demand for dairy-free yogurts, and widespread availability through supermarkets and organic food stores. Growing interest in probiotics, low-sugar diets, and sustainable packaging continues to boost market growth.

U.K. Organic Almond Yogurt Market Insight

The U.K. contributes significantly due to rising flexitarian lifestyles, increasing demand for plant-based breakfast and snack options, and strong presence of premium organic food brands. Expansion of online grocery platforms further supports market adoption.

Asia-Pacific Organic Almond Yogurt Market

Asia-Pacific is projected to register the fastest CAGR of 9.24% from 2026 to 2033, driven by rapid urbanization, rising health awareness, and growing adoption of plant-based and lactose-free diets across China, Japan, India, South Korea, and Southeast Asia. Increasing disposable income, westernization of diets, and expanding availability of almond-based dairy alternatives are accelerating market demand.

China Organic Almond Yogurt Market Insight

China leads the Asia-Pacific market due to growing lactose intolerance rates, increasing focus on digestive health, and rising popularity of premium imported and organic food products. Expansion of modern retail and e-commerce platforms further boosts consumption.

Japan Organic Almond Yogurt Market Insight

Japan shows steady growth supported by strong demand for functional foods, clean-label products, and probiotic-rich alternatives. Consumer preference for high-quality, minimally processed food supports premium organic almond yogurt adoption.

India Organic Almond Yogurt Market Insight

India is emerging as a high-growth market, driven by rising veganism, increasing health-conscious urban consumers, and expanding availability of plant-based dairy alternatives through organized retail and quick-commerce platforms.

South Korea Organic Almond Yogurt Market Insight

South Korea contributes significantly due to growing wellness trends, demand for low-calorie and digestive-health products, and strong influence of clean-eating lifestyles. Innovation in flavors and convenient packaging supports sustained market growth.

Which are the Top Companies in Organic Almond Yogurt Market?

The organic almond yogurt industry is primarily led by well-established companies, including:

- Kite Hill (U.S.)

- AYO FOODS, LLC (U.S.)

- Califia Farms, LLC (U.S.)

- PuraDyme LLC (U.S.)

- Hain Celestial (U.S.)

- Danone (France)

- General Mills Inc. (U.S.)

- Stonyfield Farm, Inc. (U.S.)

- DAIYA FOODS INC. (Canada)

- Good Karma Foods (U.S.)

- NANCY'S (U.S.)

- Chobani, LLC (U.S.)

- Ripple Foods (U.S.)

- Forager Project (U.S.)

- Vitasoy (Hong Kong)

- Blue Diamond Growers (U.S.)

- Granarolo S.p.A. (Italy)

- Nestlé (Switzerland)

- Valio Ltd (Finland)

- Oatly Inc. (Sweden)

What are the Recent Developments in Global Organic Almond Yogurt Market?

- In March 2025, The Coconut Collab broadened its Protein Yogurt portfolio with the launch of a new Strawberry Protein variant, blending a creamy coconut and almond base with naturally sweet strawberry flavor to enhance taste and nutrition, reinforcing the brand’s focus on high-protein, plant-based innovation

- In July 2024, Danone expanded its plant-based offerings by introducing vegan probiotic almond yogurts under the Light & Fit “Good Plants” brand, featuring flavors such as Vanilla, Strawberry, Lemon Meringue, and Chocolate Coconut with lower calories, added fiber, and live probiotics, highlighting Danone’s commitment to nutritious dairy-free alternatives

- In April 2024, Danone North America launched Remix, a yogurt and dairy snack range with mix-in toppings under brands including Oikos, Too Good & Co., and Light + Fit, offering flavors such as coco almond chocolate, strawberry cheesecake, and banana dark chocolate almond, strengthening consumer engagement through customizable snacking options

- In January 2024, Nature’s Fynd introduced the world’s first dairy-free, fungi-based yogurt made from its proprietary Fy protein at Whole Foods Market, available in strawberry, peach, and vanilla flavors with high protein and fiber content and free from major allergens, underscoring innovation in sustainable yogurt alternatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Organic Almond Yogurt Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Organic Almond Yogurt Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Organic Almond Yogurt Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.