Global Organic Beer Market

Market Size in USD Billion

CAGR :

%

USD

7.24 Billion

USD

11.90 Billion

2024

2032

USD

7.24 Billion

USD

11.90 Billion

2024

2032

| 2025 –2032 | |

| USD 7.24 Billion | |

| USD 11.90 Billion | |

|

|

|

|

Organic Beer Market Size

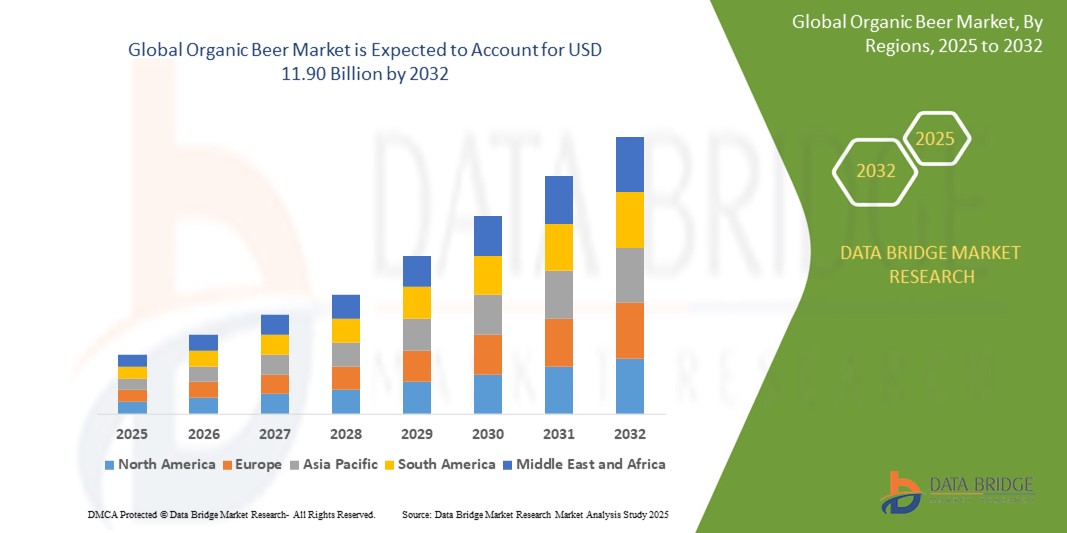

- The global organic beer market size was valued at USD 7.24 billion in 2024 and is expected to reach USD 11.90 billion by 2032, at a CAGR of 6.4% during the forecast period

- The market growth is largely fueled by rising consumer preference for organic and clean-label beverages, driven by increasing health awareness and environmental concerns. Consumers are actively seeking beer options made with organic hops, malt, and natural ingredients, free from synthetic pesticides or GMOs

- Furthermore, breweries are increasingly investing in sustainable brewing practices, eco-friendly packaging, and organic certifications to appeal to the growing segment of health-conscious and environmentally-aware consumers. These converging factors are accelerating the uptake of organic beer, thereby significantly boosting the industry's growth

Organic Beer Market Analysis

- Organic beer, brewed using certified organic ingredients and sustainable practices, is gaining prominence across both mature and emerging markets due to rising health consciousness, environmental awareness, and increasing preference for clean-label alcoholic beverages. These products appeal to consumers seeking transparency, traceability, and chemical-free alternatives in their alcoholic choices

- The escalating demand for organic beer is primarily fueled by the growing shift toward natural and eco-friendly consumption, supportive regulatory frameworks for organic labeling, and expanding retail shelf space for organic beverages, especially in supermarkets, organic food chains, and craft beer outlets

- Europe dominates the organic beer market with the largest revenue share of 41.6% in 2025, supported by long-standing organic agriculture regulations, widespread consumer awareness of sustainable products, and the strong presence of established organic breweries in countries such as Germany, the U.K., and Denmark. The region also benefits from government support for organic farming and eco-friendly initiatives

- Asia-Pacific is expected to be the fastest-growing region in the organic beer market during the forecast period, owing to rising disposable incomes, rapid urbanization, and increasing Western influence on consumption patterns in countries such as China, Japan, and India. The growing craft beer culture and emerging interest in wellness beverages are accelerating market adoption

- The layer segment is expected to dominate the organic beer market with a market share of 39.8% in 2025, driven by its wide consumer base, smooth taste profile, and increasing availability of organic variants. Organic lagers are often favored for their crisp flavor and accessibility among new consumers transitioning to organic alcoholic products

Report Scope and Organic Beer Market Segmentation

|

Attributes |

Organic Beer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Organic Beer Market Trends

“Rising Demand for Health-Conscious and Sustainable Alcoholic Beverages”

- A significant and accelerating trend in the global organic beer market is the growing consumer shift toward health-conscious and sustainable drinking options. Consumers, particularly millennials and Gen Z, are prioritizing beverages that are free from synthetic pesticides, GMOs, and artificial additives, aligning with broader wellness and environmental values

- For instance, in March 2023, New Belgium Brewing expanded its organic Fat Tire Ale with a new “Torched Earth” variant that highlights the impact of climate change on beer ingredients, aiming to raise awareness about environmental sustainability and climate-resilient agriculture. This initiative underscores how organic breweries are merging product innovation with advocacy for environmental action

- In addition, brands such as Sierra Nevada Brewing Co. and Hopworks Urban Brewery have invested in solar-powered facilities, water conservation systems, and local organic sourcing practices to align with eco-conscious consumer values. These initiatives not only support organic integrity but also appeal to environmentally responsible audiences

- The demand for transparency in sourcing and production methods is also driving breweries to obtain organic certifications and display clear labeling. Breweries that commit to fully organic brewing processes are gaining traction in health food stores, eco-centric retail chains, and even on-premise dining locations that emphasize sustainability

- Moreover, packaging innovations such as recyclable cans, biodegradable rings, and reduced carbon footprint logistics are being adopted by companies such as Stone & Wood Brewing Co. (Australia) to reinforce their environmental commitments. These packaging choices are becoming key differentiators in retail environments

- The trend toward organic beer is not only driven by health and sustainability, but also by premiumization in the alcoholic beverage market. Consumers are increasingly willing to pay a premium for high-quality, small-batch organic beers that offer distinct taste profiles and artisanal craftsmanship

- Consequently, large brewers such as Heineken and AB InBev are exploring or acquiring organic and craft labels to expand their presence in this fast-growing segment. The trend is reshaping brand portfolios, with a rising number of new product launches under organic and “better-for-you” labels in the beer aisle

Organic Beer Market Dynamics

Driver

“Growing Demand Driven by Health Awareness and Sustainable Consumption Preferences”

- The increasing awareness of health and wellness among consumers, alongside the rising demand for sustainably produced goods, is a significant driver for the growing popularity of organic beer globally

- For instance, in February 2024, Sierra Nevada Brewing Co. announced its expansion into a new organic beer line using certified organic malt and hops, reinforcing its commitment to sustainable brewing practices. Such product innovations by established brewers are expected to further drive the organic beer market in the forecast period

- As consumers become more cautious about what they consume, organic beers—free from synthetic fertilizers, chemical pesticides, and genetically modified organisms—are viewed as a cleaner and healthier alternative to conventional beer options. This shift is particularly evident among millennial and Gen Z demographics, who prioritize transparency and ethical sourcing

- Furthermore, the growing trend of eco-conscious consumerism is compelling brands to adopt green brewing technologies, including water conservation, renewable energy use, and carbon-neutral packaging. These sustainability-driven strategies are aligning with evolving consumer values, making organic beer a preferred choice in both on-trade (bars, restaurants) and off-trade (retail) channels

- The rising popularity of craft and specialty beers is also contributing to organic beer growth, as many craft breweries leverage small-batch production to experiment with organic ingredients, unique flavor profiles, and regional authenticity. Consumers are increasingly seeking premium, artisanal products that offer both taste and a cleaner label

- In addition, the expansion of distribution networks, including organic retail chains and e-commerce platforms, has significantly improved accessibility to organic beer brands. Breweries now have more direct channels to reach health-conscious consumers, further supporting market penetration and growth across developed and emerging markets

Restraint/Challenge

“High Production Costs and Limited Consumer Awareness in Emerging Markets”

- One of the primary challenges impeding the broader growth of the organic beer market is the relatively high cost of production, which often translates to higher retail prices compared to conventional beer. Organic certification, sourcing non-GMO ingredients, and adhering to strict farming and brewing practices significantly increase overheads for breweries

- For instance, Eel River Brewing Company (U.S.), one of the pioneers in organic beer, has highlighted the complex supply chain and limited availability of certified organic ingredients as barriers to scaling operations. These constraints can impact pricing, profit margins, and overall competitiveness, especially against mass-market beer brands

- In addition, limited consumer awareness and understanding of organic labeling, particularly in price-sensitive and developing regions, poses a substantial hurdle. Many consumers are unfamiliar with the benefits of organic beer or do not perceive a clear distinction from non-organic offerings, resulting in lower demand despite rising health consciousness globally

- Educating consumers about the value of organic certifications, sustainable farming practices, and the health and environmental benefits of organic beer is essential. Leading brands such as New Belgium Brewing have initiated campaigns that promote transparency in sourcing and emphasize carbon neutrality, but such efforts need to be more widespread

- The higher price point of organic beer can also act as a deterrent, especially in markets where purchasing decisions are primarily driven by affordability rather than sustainability or health benefits. While some brands such as Bison Organic Beer (U.S.) are working to reduce costs and introduce mid-tier pricing, premium organic beer remains out of reach for many average consumers

- Overcoming these challenges will require investment in cost-effective organic farming, scaling sustainable brewing technologies, and strategic marketing efforts to bridge the knowledge gap in emerging markets. Greater collaboration between regulatory bodies, brewers, and agricultural suppliers can also streamline certification and lower the entry barriers for new organic beer producers

Organic Beer Market Scope

The market is segmented on the basis source, type, and distribution channel.

By Source

On the basis of source, the organic beer market is segmented into yeast, grain, enzymes, and others. The grain segment dominates the largest market revenue share in 2025, driven by its essential role as the primary ingredient derived from organically grown barley and wheat. Consumers prefer organic grains for their purity and adherence to organic farming standards, which contribute to the overall quality and flavor of organic beers

The yeast segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by advancements in organic yeast strains that improve fermentation efficiency and enhance distinctive flavor profiles in organic beer production

• By Type

On the basis of type, the organic beer market is segmented into lager, ale and stouts, and porter. The lager segment holds the largest market revenue share in 2025, driven by its light and refreshing taste which appeals to a wide range of consumers seeking healthier alcoholic beverage options. The growing availability of organic lagers in retail and online stores further supports its market dominance

The ale and stouts segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising consumer interest in robust and complex flavors offered by craft-style organic ales and stouts, particularly among younger demographics

• By Distribution Channel

On the basis of distribution channel, the organic beer market is segmented into convenience stores, supermarket/hypermarkets, online stores, and others. The supermarket/hypermarket segment accounts for the largest market revenue share in 2025, due to extensive product availability, aggressive marketing, and consumer preference for one-stop shopping for organic and natural products

The online stores segment is anticipated to register the fastest CAGR from 2025 to 2032, supported by increasing e-commerce adoption, ease of access to a wider range of organic beer products, and changing consumer shopping habits favoring home delivery. Convenience stores maintain steady demand driven by impulse purchases and accessibility in urban centers

Organic Beer Market Regional Analysis

- Europe holds a significant share of the organic beer market, accounting for approximately 41.6% of the global revenue in 2024, driven by the strong presence of established organic and craft beer breweries across countries such as Germany, the UK, and the Netherlands

- Consumers in the region show a growing preference for organic beer due to increasing environmental awareness, stringent regulations on organic certification, and a well-developed retail network that supports organic product availability

- The region’s widespread adoption is further supported by a mature beer culture, rising demand for premium and artisanal beverages, and government initiatives promoting sustainable agriculture and organic farming, positioning Europe as a key market for organic beer growth

Germany Organic Beer Market Insight

The German organic beer market captured a significant revenue share within Europe in 2024, fueled by the country’s rich brewing heritage and strong consumer preference for high-quality, sustainable products. Consumers are increasingly prioritizing organically sourced ingredients and eco-friendly production methods. The presence of well-established craft breweries focusing on organic variants, combined with strict organic certification standards, further propels market growth. Moreover, Germany’s commitment to environmental sustainability supports the expanding demand for organic beers in both retail and hospitality sectors

U.K. Organic Beer Market Insight

The U.K. organic beer market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising health awareness and the increasing popularity of organic and craft beer among millennials and Gen Z consumers. Additionally, growing urbanization and evolving consumer lifestyles encourage the adoption of organic beer as a premium, natural beverage option. The U.K.’s robust e-commerce and retail infrastructure facilitates widespread availability, while sustainability initiatives further boost the market’s expansion across residential and commercial consumption

North America Organic Beer Market Insight

The North America organic beer market dominates globally with the largest revenue share in 2024, supported by increasing consumer inclination towards healthier and environmentally friendly alcoholic beverages. The U.S. leads market growth due to the booming craft beer industry, rising disposable incomes, and heightened demand for organic, gluten-free, and low-calorie beer options. Additionally, the growing presence of specialty retail outlets and online sales channels accelerates accessibility and consumer adoption across the region.

U.S. Organic Beer Market Insight

The U.S. organic beer market is expected to expand at a considerable CAGR during the forecast period, driven by increasing consumer focus on wellness, natural ingredients, and sustainable agriculture. The country’s large base of craft breweries experimenting with organic formulations, along with rising investments in organic farming for beer ingredients, fuels market growth. Integration of organic beer in bars, restaurants, and retail stores also contributes to its widespread popularity. Consumers’ preference for innovative flavors and premium products aligns with evolving lifestyle trends

Asia-Pacific Organic Beer Market Insight

The Asia-Pacific organic beer market is poised to grow at the fastest CAGR globally in 2024, driven by rapid urbanization, rising disposable incomes, and expanding awareness of health and wellness in countries such as China, Japan, and India. The increasing number of craft breweries and the growing preference for premium, organic products are key growth factors. Government support for organic agriculture and the rise of modern retail and e-commerce platforms further facilitate market penetration. Emerging markets in the region also present significant opportunities for organic beer adoption

Japan Organic Beer Market Insight

The Japan organic beer market is gaining momentum due to the country’s established beer culture and increasing consumer demand for organic and craft beverages. The aging population and health-conscious consumers are driving interest in low-alcohol and organic beer options. The integration of organic beers into traditional hospitality and retail sectors, along with the expansion of organic product lines by domestic brewers, supports market growth. Technological innovations in brewing and packaging also enhance product appeal

China Organic Beer Market Insight

The China organic beer market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the country’s expanding middle class, rapid urbanization, and growing health awareness. The rise of craft breweries producing organic variants, combined with government initiatives promoting organic agriculture and sustainable consumption, propels market expansion. Increasing availability of organic beer through retail chains, online platforms, and on-premise outlets accelerates consumer access. Additionally, rising demand in tier-1 and tier-2 cities supports the overall market growth

Organic Beer Market Share

The organic beer industry is primarily led by well-established companies, including:

- Anheuser-Busch InBev SA/NV (Belgium)

- Heineken N.V. (Netherlands)

- Asahi Group Holdings, Ltd. (Japan)

- The Boston Beer Company, Inc. (U.S.)

- New Belgium Brewing Company (U.S.)

- Sierra Nevada Brewing Co. (U.S.)

- Eel River Brewing Company (U.S.)

- Samuel Smith Old Brewery (U.K.)

- Bison Organic Beer (U.S.)

- Pinkus Müller Brewery (Germany)

- Hopworks Urban Brewery (U.S.)

- Pisgah Brewing Company (U.S.)

- Stone & Wood Brewing Co. (Australia)

- LaBirra Organic Brewery (Italy)

- Samuel Smith’s Brewery (U.K.)

Latest Developments in Global Organic Beer Market

-

In April, 2024, Patagonia Provisions and Aslan Brewing Company launched the world’s first Regenerative Organic Certified IPA, brewed with 100% regeneratively produced ingredients, including Kernza perennial grain. This milestone in sustainable brewing features Regenerative Organic Certified Pilsner Malt from Breathe Deep Farm and organic Chinook and Strata hops from Washington’s Roy Farms. The IPA boasts bold berry and pine flavors, finishing crisp with balanced bitterness. Available on draft at Aslan Brewing’s Bellingham and Seattle locations, this beer highlights the potential of regenerative organic farming

- In September, 2024, Deschutes Brewery and Patagonia Provisions introduced two certified organic beers brewed with Kernza perennial grain: Kernza Lager and Non-Alcoholic Kernza Golden Brew. The latter marks a milestone as the first certified organic non-alcoholic craft beer in the U.S. These beers emphasize sustainability, using Regenerative Organic Certified ingredients to promote responsible brewing practices. Kernza Lager offers light floral and lemon notes, while the non-alcoholic version delivers the same high-quality taste without alcohol

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Organic Beer Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Organic Beer Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Organic Beer Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.