Global Organic Coffee Market

Market Size in USD Billion

CAGR :

%

USD

8.66 Billion

USD

16.51 Billion

2024

2032

USD

8.66 Billion

USD

16.51 Billion

2024

2032

| 2025 –2032 | |

| USD 8.66 Billion | |

| USD 16.51 Billion | |

|

|

|

|

Organic Coffee Market Size

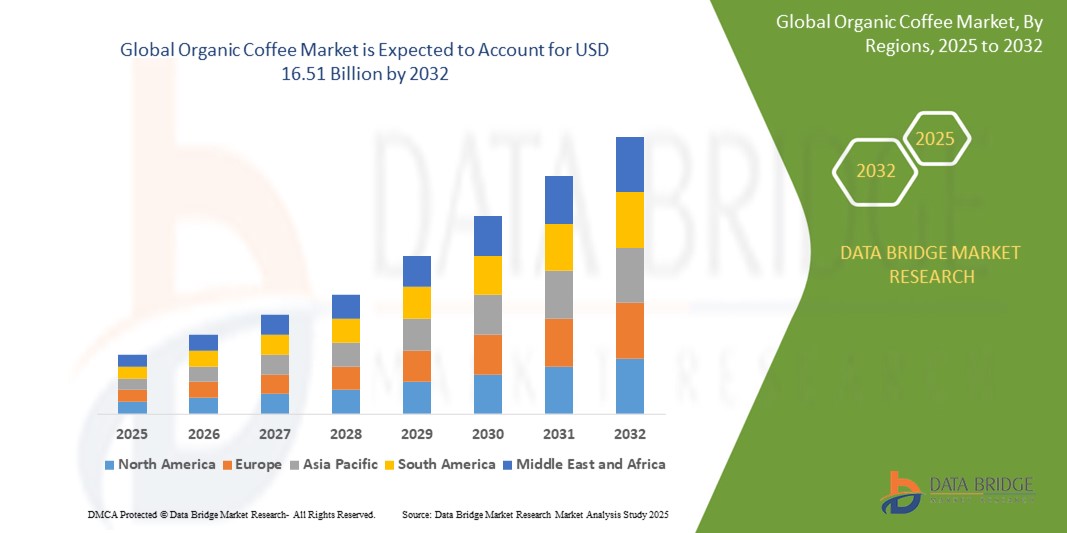

- The global organic coffee market size was valued at USD 8.66 billion in 2024 and is expected to reach USD 16.51 billion by 2032, at a CAGR of 8.40% during the forecast period

- The market growth is primarily driven by increasing consumer awareness of health benefits, sustainable farming practices, and the growing demand for environmentally friendly products in both developed and emerging markets

- Rising preferences for ethically sourced and chemical-free coffee, coupled with the expansion of e-commerce platforms, are significantly boosting the adoption of organic coffee globally

Organic Coffee Market Analysis

- Organic coffee, produced without synthetic pesticides or fertilizers, is gaining traction as a healthier and more sustainable alternative to conventional coffee, appealing to environmentally conscious consumers

- The surge in demand is fueled by growing health consciousness, increasing disposable incomes, and a shift toward premium and specialty coffee products, particularly in urban areas

- North America dominated the organic coffee market with the largest revenue share of 42.5% in 2024, driven by high consumer awareness, a strong presence of specialty coffee shops, and robust demand for fair trade and organic products, particularly in the U.S. and Canada

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by rising urbanization, increasing disposable incomes, and growing consumer preference for premium coffee in countries such as China, India, and Japan

- The Fair Trade Coffee segment dominated the largest market revenue share of 38.5% in 2024, driven by increasing consumer demand for ethically sourced products that ensure fair wages and sustainable practices for farmers

Report Scope and Organic Coffee Market Segmentation

|

Attributes |

Organic Coffee Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Organic Coffee Market Trends

“Increasing Integration of Blockchain and Data Traceability”

- The global organic coffee market is experiencing a notable trend toward the integration of blockchain technology and data traceability systems

- These technologies enable transparent tracking of coffee from farm to cup, providing consumers with detailed insights into sourcing, production methods, and certifications

- Blockchain-powered platforms ensure authenticity of organic claims, reducing fraud and building consumer trust in organic coffee products

- For instances, several companies are developing blockchain-based systems that allow consumers to scan QR codes on packaging to verify the organic certification, fair trade status, and sustainability practices of coffee producers

- This trend is enhancing the appeal of organic coffee, making it more attractive to environmentally conscious consumers and specialty coffee retailers

- Data analytics can track consumer preferences, such as demand for specific origins or roast types, enabling producers to optimize supply chains and marketing strategies

Organic Coffee Market Dynamics

Driver

“Rising Demand for Sustainable and Health-Conscious Products”

- Growing consumer awareness of environmental sustainability and health benefits is a major driver for the global organic coffee market

- Organic coffee, free from synthetic pesticides and fertilizers, appeals to health-conscious consumers seeking natural and chemical-free products

- Certifications such as Fair Trade and organic labels enhance consumer trust, driving demand for premium coffee types such as Gourmet Coffee, Espresso Coffee, and Coffee Pods

- Government initiatives promoting sustainable agriculture, particularly in North America, which dominates the market, are supporting the adoption of organic coffee production

- The expansion of e-commerce and online distribution channels, coupled with the rise of specialty coffee shops, is enabling greater access to organic coffee, further fueling market growth, especially in the Asia-Pacific region, which is the fastest-growing market

- Coffee brands are increasingly offering organic options as standard or premium products to meet consumer expectations and align with global sustainability goals

Restraint/Challenge

“High Production Costs and Supply Chain Complexities”

- The significant costs associated with organic coffee production, including labor-intensive farming practices, organic certification, and compliance with strict standards, pose a barrier to market growth, particularly for small-scale farmers in emerging markets

- Sourcing high-quality organic beans and maintaining consistent supply chains can be complex and expensive

- In addition, concerns about supply chain transparency and certification authenticity raise challenges. Consumers are increasingly demanding verifiable proof of organic claims, and any discrepancies can erode trust and brand reputation

- The varying regulatory standards for organic certification across countries complicate operations for global producers and distributors

- These factors can discourage potential producers and limit market expansion, especially in cost-sensitive regions or where consumer awareness of organic products is still developing

Organic Coffee market Scope

The market is segmented on the basis of type, origin, roast, distribution channel, and end user.

- By Type

On the basis of type, the organic coffee market is segmented into Fair Trade Coffee, Gourmet Coffee, Espresso Coffee, and Coffee Pods. The Fair Trade Coffee segment dominated the largest market revenue share of 38.5% in 2024, driven by increasing consumer demand for ethically sourced products that ensure fair wages and sustainable practices for farmers. Certifications such as USDA Organic and Fair Trade enhance consumer trust, boosting adoption across regions.

The Coffee Pods segment is expected to witness the fastest growth rate of 9.8% from 2025 to 2032, fueled by rising demand for convenience and single-serve brewing systems. Advancements in compostable and eco-friendly pod packaging align with sustainability trends, further accelerating adoption among environmentally conscious consumers.

- By Origin

On the basis of origin, the organic coffee market is segmented into Coffea Arabica and Coffea Canephora. The Coffea Arabica segment dominated with a 69.2% market revenue share in 2024, attributed to its superior flavor profile, lower caffeine content, and preference among specialty coffee drinkers. Arabica’s smooth taste and certifications for organic and fair trade practices reinforce its market leadership.

The Coffea Canephora segment is anticipated to experience significant growth from 2025 to 2032, driven by increasing demand for robusta in espresso blends and instant coffee. Its resilience to harsh climates and lower production costs make it appealing for organic cultivation in emerging markets.

- By Roast

On the basis of roast, the organic coffee market is segmented into Light, Medium, and Dark roasts. The Medium Roast segment held the largest market revenue share of 51.2% in 2024, owing to its balanced flavor profile, which appeals to a broad consumer base. Its versatility across brewing methods, from drip to espresso, supports its dominance in both home and commercial settings.

The Light Roast segment is expected to witness the fastest growth from 2025 to 2032, driven by growing consumer preference for nuanced, fruity, and acidic flavor profiles. The rise of specialty coffee culture and artisanal roasters promotes light roasts as a premium organic option.

- By Distribution Channel

On the basis of distribution channel, the organic coffee market is segmented into Online, Offline, Supermarkets and Hypermarkets, Independent Retailers, Convenience Stores, Specialist Retailers, and Others. The Supermarkets and Hypermarkets segment accounted for the largest market revenue share of 38.3% in 2024, due to their extensive distribution networks, one-stop shopping convenience, and wide product displays enabling easy comparison of organic coffee brands.

The Online segment is projected to grow at the fastest rate of 11.5% from 2025 to 2032, driven by the rise in e-commerce, increasing smartphone penetration, and targeted marketing strategies by online retailers. Lucrative discounts and the availability of a wide range of organic coffee products enhance consumer preference for online channels.

- By End User

On the basis of end user, the organic coffee market is segmented into Food & Beverage, Pharmaceutical, Cosmetic, and Personal Care. The Food & Beverage segment dominated with a 78.5% market revenue share in 2024, driven by the widespread use of organic coffee in specialty beverages, cold brews, and as a flavoring agent in chocolates, desserts, and energy bars. Growing demand for organic options in cafes and restaurants further bolsters this segment.

The Cosmetic and Personal Care segment is expected to witness robust growth from 2025 to 2032, with a projected CAGR of 9.8%. The increasing use of organic coffee in skincare products, leveraging its antioxidant properties for soothing and revitalizing skin, aligns with rising consumer awareness of natural and sustainable beauty solutions.

Organic Coffee Market Regional Analysis

- North America dominated the organic coffee market with the largest revenue share of 42.5% in 2024, driven by high consumer awareness, a strong presence of specialty coffee shops, and robust demand for fair trade and organic products, particularly in the U.S. and Canada

- Consumers prioritize organic coffee for its health benefits, environmental sustainability, and superior taste, particularly in regions with strong awareness of ethical consumption

- Growth is supported by innovations in organic coffee production, including fair trade certifications and eco-friendly packaging, alongside increasing adoption across food & beverage, pharmaceutical, cosmetic, and personal care sectors

U.S. Organic Coffee Market Insight

The U.S. organic coffee market captured the largest revenue share of 86.6% in 2024 within North America, fueled by strong demand for premium and specialty coffee products. Growing consumer awareness of organic certifications, health benefits, and sustainability drives market expansion. The trend toward at-home coffee consumption and the rise of e-commerce platforms further boost sales, with both supermarkets and independent retailers contributing to a robust distribution ecosystem.

Europe Organic Coffee Market Insight

The Europe organic coffee market is expected to witness significant growth, supported by stringent regulations promoting sustainable agriculture and consumer preference for ethically sourced products. Demand for organic coffee is prominent in countries such as Germany and France, driven by environmental consciousness and a growing café culture. The market sees uptake in both online and offline channels, with supermarkets and specialist retailers leading distribution.

U.K. Organic Coffee Market Insight

The U.K. market for organic coffee is expected to witness rapid growth, driven by increasing consumer demand for high-quality, sustainable coffee products in urban and suburban areas. Rising awareness of fair trade practices and health benefits encourages adoption. Evolving regulations promoting eco-friendly packaging and ethical sourcing influence consumer choices, balancing taste with sustainability.

Germany Organic Coffee Market Insight

Germany is expected to witness significant growth in the organic coffee market, attributed to its advanced food & beverage sector and strong consumer focus on sustainability and health. German consumers prefer organic coffee varieties such as Coffea Arabica and medium roasts for their rich flavor and eco-friendly production. The integration of organic coffee in cafés, supermarkets, and online platforms supports sustained market growth.

Asia-Pacific Organic Coffee Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by rising disposable incomes, expanding coffee consumption, and growing awareness of organic products in countries such as China, India, and Japan. Government initiatives promoting sustainable agriculture and increasing demand for premium coffee varieties fuel market expansion. The rise of e-commerce and specialty retail enhances accessibility.

Japan Organic Coffee Market Insight

Japan’s organic coffee market is expected to witness rapid growth due to strong consumer preference for high-quality, sustainably sourced coffee products that align with health and environmental values. The presence of major coffee brands and the integration of organic coffee in cafés and supermarkets accelerate market penetration. Growing interest in at-home brewing and specialty coffee pods also contributes to growth.

China Organic Coffee Market Insight

China holds the largest share of the Asia-Pacific organic coffee market, propelled by rapid urbanization, rising coffee consumption, and increasing demand for organic and fair trade products. The country’s growing middle class and focus on health-conscious lifestyles support the adoption of premium organic coffee varieties. Strong domestic production capabilities and competitive pricing enhance market accessibility.

Organic Coffee Market Share

The organic coffee industry is primarily led by well-established companies, including:

- The Coffee Bean & Tea Leaf (U.S.)

- Unilever (U.K.)

- Gourmesso (U.S.)

- Harney & Sons Fine Teas (U.S.)

- Dualit (U.K.)

- Nestlé SA (Switzerland)

- Dilmah Ceylon Tea Company PLC (Sri Lanka)

- Ippodo Tea (China)

- Tranquini (U.S.)

- Chillbev (U.S.)

- Som Sleep (U.S.)

- Phi Drinks, Inc.(U.S.)

- BevNet (U.S.)

What are the Recent Developments in Global Organic Coffee Market?

- In March 2024, Nespresso Professional, a division of Nestlé S.A., launched its Brazil Organic coffee as part of its Origins range. This new product features a smooth, balanced flavor with chocolate and nut notes, targeting professional settings such as offices and hospitality venues. The launch reflects Nespresso’s focus on expanding its organic coffee portfolio to meet growing demand for sustainable and premium coffee options

- In January 2024, Cambio Roasters introduced aluminum coffee pods compatible with K-Cup machines, offering an eco-friendly alternative to plastic pods. Made from recyclable aluminum, these pods preserve coffee freshness while reducing plastic waste, aligning with consumer preferences for sustainable packaging in the organic coffee market

- In July 2023, Keurig Dr Pepper Inc. acquired a minority stake in La Colombe, a premium ready-to-drink coffee brand, for USD 300 million. This strategic acquisition allows Keurig Dr Pepper to distribute La Colombe’s organic ready-to-drink coffee and K-Cup pods, expanding its presence in the fast-growing organic coffee segment

- In April 2023, Starbucks Corporation partnered with Fair Trade USA to enhance its sourcing of organic coffee beans. This collaboration reinforces Starbucks’ commitment to ethical and sustainable practices, ensuring fair prices for farmers and increasing the availability of certified organic coffee in its global stores

- In February 2023, Allegro Coffee Company, a subsidiary of Whole Foods Market, collaborated with small-scale organic coffee farmers in Ethiopia to launch a new single-origin organic coffee blend. This partnership emphasizes sustainable sourcing and transparency, catering to consumer demand for traceable, high-quality organic coffee

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ORGANIC COFFEE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 ARRIVING AT THE GLOBAL ORGANIC COFFEE MARKET

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 COMPANY POSITIONING GRID

2.7 COMAPANY MARKET SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 DEMAND AND SUPPLY-SIDE VARIABLES

2.1 CONSUMPTION TREND OF END PRODUCTS

2.11 TOP TO BOTTOM ANALYSIS

2.12 STANDARDS OF MEASUREMENT

2.13 VENDOR SHARE ANALYSIS

2.14 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.15 DATA POINTS FROM KEY SECONDARY DATABASES

2.16 GLOBAL ORGANIC COFFEE MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 SUPPLY CHAIN ANALYSIS

5.2 PRIVATE LABEL VS BRAND ANALYSIS

5.3 SHOPPING BEHAVIOUR AND DYNAMICS

5.3.1 RECOMMENDATION FROM FAMILY & FRIENDS

5.3.2 RESEARCH

5.3.3 IMPULSIVE

5.3.4 ADVERTISEMENT

5.3.4.1. TELEVISION ADVERTISEMENT

5.3.4.2. ONLINE ADVERTISEMENT

5.3.4.3. IN-STORE ADVERTISEMENT

5.3.4.4. OUTDOOR ADVERTISEMENT

5.4 PROMOTIONAL ACTIVITIES

5.5 NEW PRODUCT LAUNCH STRATEGY

5.5.1 NUMBER OF NEW PRODUCT LAUNCH

5.5.1.1. LINE EXTENSTION

5.5.1.2. NEW PACKAGING

5.5.1.3. RE-LAUNCHED

5.5.1.4. NEW FORMULATION

5.5.2 DIFFERNTIAL PRODUCT OFFERING

5.5.3 MEETING CONSUMER REQUIREMENT

5.5.4 PACKAGE DESIGNING

5.5.5 PRICING ANALYSIS

5.5.6 PRODUCT POSITIONING

5.6 FACTORS INFLUENCING PURCHASING DECISION OF CUSTOMERS

5.7 MARKETING STRATEGIES ADOPTED BY KEY MARKET PLAYERS

5.8 NEW PRODUCT LAUNCHES

6 IMPACT OF ECONOMIC SLOW DOWN ON MARKET

6.1 IMPACT ON PRICE

6.2 IMPACT ON SUPPLY CHAIN

6.3 IMPACT ON SHIPMENT

6.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

7 REGULATORY FRAMEWORK AND GUIDELINES

8 PRICING ANALYSIS

9 PRODUCTION CAPACITY OF KEY MANUFACTURERES

10 BRAND OUTLOOK

10.1 COMPARATIVE BRAND ANALYSIS

10.2 PRODUCT VS BRAND OVERVIEW

11 GLOBAL ORGANIC COFFEE MARKET, BY PRODUCT TYPE, 2022-2031 (USD MILLION)

11.1 OVERVIEW

11.2 WHOLE-BEAN

11.2.1 WHOLE-BEAN, BY COFEE BEAN TYPE

11.2.1.1. COFFEE ARABICA

11.2.1.2. BOURBON

11.2.1.3. YELLOW BOURBON

11.2.1.4. RED BOURBON

11.2.1.5. PINK BOURBON

11.2.1.6. CATIMOR

11.2.1.7. CATUAI

11.2.1.8. CATURRA

11.2.1.9. OTHERS

11.2.1.10. COFFEE ROBUSTA

11.2.1.11. KOPI LUWAK

11.2.1.12. KAPÉNG ALAMID

11.2.1.13. KAHAWA KUBING

11.2.1.14. COFFEE LIBERICA

11.2.1.15. COFFEE EXCELSA

11.2.1.16. WILD COFFEE BEANS

11.2.1.17. BRAZILIAN COFFEE BEANS

11.2.1.18. COFFEE CHARRIERIANA

11.2.1.19. COFFEE MAGNISTIPULA

11.2.1.20. OTHERS

11.3 GROUND COFFEE

11.3.1 GROUND COFFEE , BY COFEE BEAN TYPE

11.3.1.1. COFFEE ARABICA

11.3.1.2. BOURBON

11.3.1.3. YELLOW BOURBON

11.3.1.4. RED BOURBON

11.3.1.5. PINK BOURBON

11.3.1.6. CATIMOR

11.3.1.7. CATUAI

11.3.1.8. CATURRA

11.3.1.9. OTHERS

11.3.1.10. COFFEE ROBUSTA

11.3.1.11. KOPI LUWAK

11.3.1.12. KAPÉNG ALAMID

11.3.1.13. KAHAWA KUBING

11.3.1.14. COFFEE LIBERICA

11.3.1.15. COFFEE EXCELSA

11.3.1.16. WILD COFFEE BEANS

11.3.1.17. BRAZILIAN COFFEE BEANS

11.3.1.18. COFFEE CHARRIERIANA

11.3.1.19. COFFEE MAGNISTIPULA

11.3.1.20. OTHERS

11.4 INSTANT COFFEE

11.4.1 INSTANT COFFEE, BY COFEE BEAN TYPE

11.4.1.1. COFFEE ARABICA

11.4.1.2. BOURBON

11.4.1.3. YELLOW BOURBON

11.4.1.4. RED BOURBON

11.4.1.5. PINK BOURBON

11.4.1.6. CATIMOR

11.4.1.7. CATUAI

11.4.1.8. CATURRA

11.4.1.9. OTHERS

11.4.1.10. COFFEE ROBUSTA

11.4.1.11. KOPI LUWAK

11.4.1.12. KAPÉNG ALAMID

11.4.1.13. KAHAWA KUBING

11.4.1.14. COFFEE LIBERICA

11.4.1.15. COFFEE EXCELSA

11.4.1.16. WILD COFFEE BEANS

11.4.1.17. BRAZILIAN COFFEE BEANS

11.4.1.18. COFFEE CHARRIERIANA

11.4.1.19. COFFEE MAGNISTIPULA

11.4.1.20. OTHERS

11.5 COFFEE PODS AND CAPSULES

11.5.1 COFFEE PODS AND CAPSULES, BY COFEE BEAN TYPE

11.5.1.1. COFFEE ARABICA

11.5.1.2. BOURBON

11.5.1.3. YELLOW BOURBON

11.5.1.4. RED BOURBON

11.5.1.5. PINK BOURBON

11.5.1.6. CATIMOR

11.5.1.7. CATUAI

11.5.1.8. CATURRA

11.5.1.9. OTHERS

11.5.1.10. COFFEE ROBUSTA

11.5.1.11. KOPI LUWAK

11.5.1.12. KAPÉNG ALAMID

11.5.1.13. KAHAWA KUBING

11.5.1.14. COFFEE LIBERICA

11.5.1.15. COFFEE EXCELSA

11.5.1.16. WILD COFFEE BEANS

11.5.1.17. BRAZILIAN COFFEE BEANS

11.5.1.18. COFFEE CHARRIERIANA

11.5.1.19. COFFEE MAGNISTIPULA

11.5.1.20. OTHERS

12 GLOBAL ORGANIC COFFEE MARKET, BY COFEE TYPE, 2022-2031 (USD MILLION)

12.1 OVERVIEW

12.2 LATTE

12.3 CAPPUCCINO

12.4 AMERICANO

12.5 ESPRESSO

12.6 CORTADO

12.7 MOCHA

12.8 MACCHIATO

12.9 FLAT WHITE

12.1 DECAF

12.11 OTHERS (IF ANY)

13 GLOBAL ORGANIC COFFEE MARKET, BY BEANS TYPE, 2022-2031 (USD MILLION)

13.1 OVERVIEW

13.2 COFFEE ARABICA

13.3 BOURBON

13.4 YELLOW BOURBON

13.5 RED BOURBON

13.6 PINK BOURBON

13.7 CATIMOR

13.8 CATUAI

13.9 CATURRA

13.1 OTHERS

13.11 COFFEE ROBUSTA

13.12 KOPI LUWAK

13.13 KAPÉNG ALAMID

13.14 KAHAWA KUBING

13.15 COFFEE LIBERICA

13.16 COFFEE EXCELSA

13.17 WILD COFFEE BEANS

13.18 BRAZILIAN COFFEE BEANS

13.19 COFFEE CHARRIERIANA

13.2 COFFEE MAGNISTIPULA

13.21 OTHERS

14 GLOBAL ORGANIC COFFEE MARKET, BY SWEETNESS CATEGORY , 2022-2031 (USD MILLION)

14.1 OVERVIEW

14.2 SWEETENED

14.3 UNSWEETENED

15 GLOBAL ORGANIC COFFEE MARKET, BY PACKAGING TYPE , 2022-2031 (USD MILLION)

15.1 OVERVIEW

15.2 JARS

15.3 POUCHES

15.4 BOTTLES

15.5 TETRA PACK

15.6 OTHERS

16 GLOBAL ORGANIC COFFEE MARKET, BY END USER , 2022-2031 (USD MILLION)

16.1 OVERVIEW

16.2 HOUSEHOLS

16.3 COMMERICIAL ESTABLISHMNETS

16.4 CAFÉ

16.5 RESTAURANTS

16.6 HOTELS & BARS

16.7 OFFICES

16.8 EDUCATIONAL INSTITUTE

16.9 HOSPITAL

16.1 OTEHRS

17 GLOBAL ORGANIC COFFEE MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD MILLION)

17.1 OVERVIEW

17.2 OFF-TRADE

17.2.1 CONVENIENCE STORES

17.2.2 SUPERMARKETS/HYPERMARKETS

17.2.3 SPECIALTY STORES

17.2.4 GROCERY STORES

17.2.5 WHOLESALERS

17.2.6 OTHERS

17.3 ON TRADE

18 GLOBAL ORGANIC COFFEE MARKET, BY GEOGRAPHY, 2022-2031 (USD MILLION)

OVERVIEW (ALL SEGMENTATION PROVIDED ABOVE IS REPRESNTED IN THIS CHAPTER BY COUNTRY)

18.1 NORTH AMERICA

18.1.1 U.S.

18.1.2 CANADA

18.1.3 MEXICO

18.2 EUROPE

18.2.1 GERMANY

18.2.2 U.K.

18.2.3 ITALY

18.2.4 FRANCE

18.2.5 SPAIN

18.2.6 SWITZERLAND

18.2.7 NETHERLANDS

18.2.8 BELGIUM

18.2.9 RUSSIA

18.2.10 TURKEY

18.2.11 LUXEMBURG

18.2.12 NORWAY

18.2.13 SWEDEN

18.2.14 FINLAND

18.2.15 DENMARK

18.2.16 POLAND

18.2.17 REST OF EUROPE

18.3 ASIA-PACIFIC

18.3.1 JAPAN

18.3.2 CHINA

18.3.3 SOUTH KOREA

18.3.4 INDIA

18.3.5 AUSTRALIA

18.3.6 SINGAPORE

18.3.7 THAILAND

18.3.8 INDONESIA

18.3.9 MALAYSIA

18.3.10 PHILIPPINES

18.3.11 NEW ZEALAND

18.3.12 TAIWAN

18.3.13 VIETNAM

18.3.14 REST OF ASIA-PACIFIC

18.4 SOUTH AMERICA

18.4.1 BRAZIL

18.4.2 ARGENTINA

18.4.3 REST OF SOUTH AMERICA

18.5 MIDDLE EAST AND AFRICA

18.5.1 SOUTH AFRICA

18.5.2 UAE

18.5.3 SAUDI ARABIA

18.5.4 KUWAIT

18.5.5 OMAN

18.5.6 BAHRAIN

18.5.7 ISRAEL

18.5.8 EGYPT

18.5.9 QATAR

18.5.10 REST OF MIDDLE EAST AND AFRICA

19 GLOBAL ORGANIC COFFEE MARKET, COMPANY LANDSCAPE

19.1 COMPANY SHARE ANALYSIS: GLOBAL

19.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

19.3 COMPANY SHARE ANALYSIS: EUROPE

19.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

19.5 MERGERS & ACQUISITIONS

19.6 NEW PRODUCT DEVELOPMENT & APPROVALS

19.7 EXPANSIONS & PARTNERSHIP

19.8 REGULATORY CHANGES

20 SWOT AND DBMR ANALYSIS, GLOBAL ORGANIC COFFEE MARKET

21 GLOBAL ORGANIC COFFEE MARKET, COMPANY PROFILE

21.1 HINDUSTAN UNILEVER LIMITED

21.1.1 COMPANY OVERVIEW

21.1.2 REVENUE ANALYSIS

21.1.3 PRODUCT PORTFOLIO

21.1.4 GEOGRAPHIC PRESENCE

21.1.5 RECENT DEVELOPMENTS

21.2 NESTLE

21.2.1 COMPANY OVERVIEW

21.2.2 REVENUE ANALYSIS

21.2.3 PRODUCT PORTFOLIO

21.2.4 GEOGRAPHIC PRESENCE

21.2.5 RECENT DEVELOPMENTS

21.3 BARISTA COFFEE COMPANY LIMITED

21.3.1 COMPANY OVERVIEW

21.3.2 REVENUE ANALYSIS

21.3.3 PRODUCT PORTFOLIO

21.3.4 GEOGRAPHIC PRESENCE

21.3.5 RECENT DEVELOPMENTS

21.4 GLORIA JEAN'S GOURMET COFFEES

21.4.1 COMPANY OVERVIEW

21.4.2 REVENUE ANALYSIS

21.4.3 PRODUCT PORTFOLIO

21.4.4 GEOGRAPHIC PRESENCE

21.4.5 RECENT DEVELOPMENTS

21.5 BLACK RIFLE COFFEE COMPANY

21.5.1 COMPANY OVERVIEW

21.5.2 REVENUE ANALYSIS

21.5.3 PRODUCT PORTFOLIO

21.5.4 GEOGRAPHIC PRESENCE

21.5.5 RECENT DEVELOPMENTS

21.6 COFFEE BEANERY

21.6.1 COMPANY OVERVIEW

21.6.2 REVENUE ANALYSIS

21.6.3 PRODUCT PORTFOLIO

21.6.4 GEOGRAPHIC PRESENCE

21.6.5 RECENT DEVELOPMENTS

21.7 MCDONALD'S

21.7.1 COMPANY OVERVIEW

21.7.2 REVENUE ANALYSIS

21.7.3 PRODUCT PORTFOLIO

21.7.4 GEOGRAPHIC PRESENCE

21.7.5 RECENT DEVELOPMENTS

21.8 CONTINENTAL COFFEE

21.8.1 COMPANY OVERVIEW

21.8.2 REVENUE ANALYSIS

21.8.3 PRODUCT PORTFOLIO

21.8.4 GEOGRAPHIC PRESENCE

21.8.5 RECENT DEVELOPMENTS

21.9 PROCAFFÉ SPA

21.9.1 COMPANY OVERVIEW

21.9.2 REVENUE ANALYSIS

21.9.3 PRODUCT PORTFOLIO

21.9.4 GEOGRAPHIC PRESENCE

21.9.5 RECENT DEVELOPMENTS

21.1 CARIBOU COFFEE OPERATING COMPANY, INC.

21.10.1 COMPANY OVERVIEW

21.10.2 REVENUE ANALYSIS

21.10.3 PRODUCT PORTFOLIO

21.10.4 GEOGRAPHIC PRESENCE

21.10.5 RECENT DEVELOPMENTS

21.11 ARCO COFFEE COMPANY

21.11.1 COMPANY OVERVIEW

21.11.2 REVENUE ANALYSIS

21.11.3 PRODUCT PORTFOLIO

21.11.4 GEOGRAPHIC PRESENCE

21.11.5 RECENT DEVELOPMENTS

21.12 F. GAVINA & SONS, INC.

21.12.1 COMPANY OVERVIEW

21.12.2 REVENUE ANALYSIS

21.12.3 PRODUCT PORTFOLIO

21.12.4 GEOGRAPHIC PRESENCE

21.12.5 RECENT DEVELOPMENTS

21.13 COUNTRY BEAN

21.13.1 COMPANY OVERVIEW

21.13.2 REVENUE ANALYSIS

21.13.3 PRODUCT PORTFOLIO

21.13.4 GEOGRAPHIC PRESENCE

21.13.5 RECENT DEVELOPMENTS

21.14 RAGE COFFEE

21.14.1 COMPANY OVERVIEW

21.14.2 REVENUE ANALYSIS

21.14.3 PRODUCT PORTFOLIO

21.14.4 GEOGRAPHIC PRESENCE

21.14.5 RECENT DEVELOPMENTS

21.15 ILLYCAFFÈ S.P.A.

21.15.1 COMPANY OVERVIEW

21.15.2 REVENUE ANALYSIS

21.15.3 PRODUCT PORTFOLIO

21.15.4 GEOGRAPHIC PRESENCE

21.15.5 RECENT DEVELOPMENTS

21.16 ZINO DAVIDOFF

21.16.1 COMPANY OVERVIEW

21.16.2 REVENUE ANALYSIS

21.16.3 PRODUCT PORTFOLIO

21.16.4 GEOGRAPHIC PRESENCE

21.16.5 RECENT DEVELOPMENTS

21.17 DOOR COUNTY COFFEE & TEA CO.

21.17.1 COMPANY OVERVIEW

21.17.2 REVENUE ANALYSIS

21.17.3 PRODUCT PORTFOLIO

21.17.4 GEOGRAPHIC PRESENCE

21.17.5 RECENT DEVELOPMENTS

21.18 LEVISTA

21.18.1 COMPANY OVERVIEW

21.18.2 REVENUE ANALYSIS

21.18.3 PRODUCT PORTFOLIO

21.18.4 GEOGRAPHIC PRESENCE

21.18.5 RECENT DEVELOPMENTS

21.19 BLACK RIFLE COFFEE COMPANY

21.19.1 COMPANY OVERVIEW

21.19.2 REVENUE ANALYSIS

21.19.3 PRODUCT PORTFOLIO

21.19.4 GEOGRAPHIC PRESENCE

21.19.5 RECENT DEVELOPMENTS

21.2 DUNKIN' DONUTS

21.20.1 COMPANY OVERVIEW

21.20.2 REVENUE ANALYSIS

21.20.3 PRODUCT PORTFOLIO

21.20.4 GEOGRAPHIC PRESENCE

21.20.5 RECENT DEVELOPMENTS

NOTE: THE LIST OF COMPANIES IS A TENTATIVE AND THIS CAN BE MODIFIED ACCORDING TO THE CLIENT’S REQUEST AND SUGGESTION.

22 CONCLUSION

23 REFERENCES

24 QUESTIONNAIRE

25 RELATED REPORTS

26 ABOUT DATA BRIDGE MARKET RESEARCH

Global Organic Coffee Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Organic Coffee Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Organic Coffee Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.