Global Organic Food Ingredient Market

Market Size in USD Billion

CAGR :

%

USD

6.78 Billion

USD

12.36 Billion

2025

2033

USD

6.78 Billion

USD

12.36 Billion

2025

2033

| 2026 –2033 | |

| USD 6.78 Billion | |

| USD 12.36 Billion | |

|

|

|

|

Organic Food Ingredient Market Size

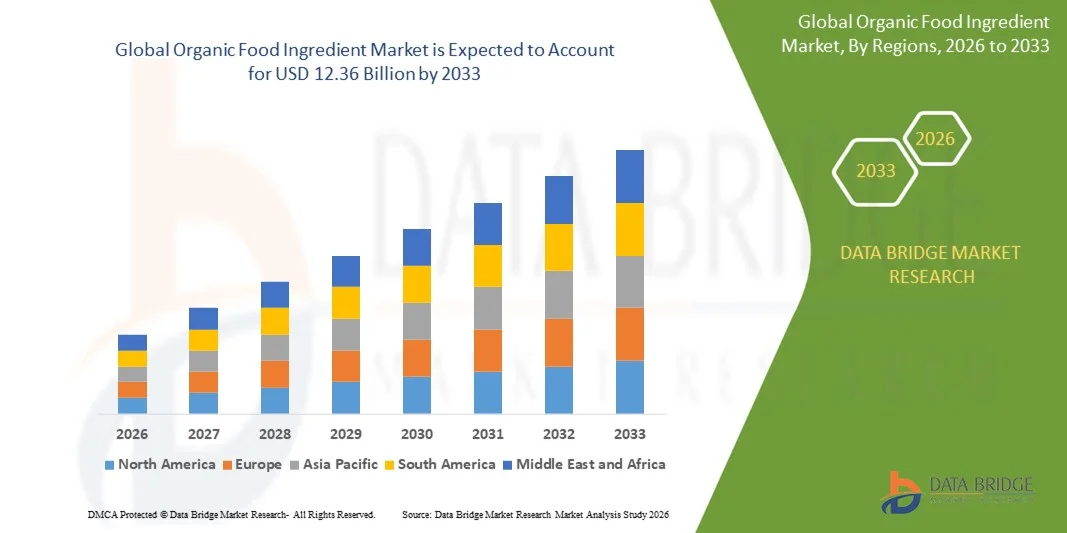

- The global organic food ingredient market size was valued at USD 6.78 billion in 2025 and is expected to reach USD 12.36 billion by 2033, at a CAGR of 7.80% during the forecast period

- The market growth is largely fueled by the rising consumer preference for clean-label, natural, and sustainably sourced products, leading to increased adoption of organic food ingredients across packaged foods, beverages, and supplements

- Furthermore, growing awareness regarding health, wellness, and food safety is establishing organic ingredients as essential components in functional and nutrient-dense products. These converging factors are accelerating the demand for organic food ingredients, thereby significantly boosting the industry's growth

Organic Food Ingredient Market Analysis

- Organic food ingredients, sourced from certified farms and free from synthetic additives, pesticides, and GMOs, are increasingly vital components in modern food and beverage products due to their health benefits, traceability, and alignment with clean-label trends

- The escalating demand for organic food ingredients is primarily fueled by consumers’ focus on preventive nutrition, increasing adoption of plant-based and functional foods, and rising disposable incomes, particularly in Europe and North America. The emphasis on sustainability, ethical sourcing, and regulatory support further strengthens the adoption across retail, foodservice, and nutraceutical segments

- Europe dominated the organic food ingredient market with a share of 34.82% in 2025, due to the rising consumer awareness regarding health and sustainability, as well as stringent regulations supporting organic farming and clean-label products

- Asia-Pacific is expected to be the fastest growing region in the organic food ingredient market during the forecast period due to rising disposable incomes, urbanization, and increasing health awareness in countries such as China, India, and Japan

- Fresh segment dominated the market with a market share of 44.7% in 2025, due to consumer demand for minimally processed and nutrient-rich foods. Fresh organic ingredients retain higher nutritional value and are preferred for daily consumption. For instance, Dole Packaged Foods has emphasized fresh-cut organic vegetables and fruits to appeal to busy urban consumers. The convenience of ready-to-eat and pre-washed options in fresh packaging also enhances appeal. Fresh packaging ensures shorter supply chains, better traceability, and enhanced flavor, which encourages repeat purchases. Retailers promote fresh organic products prominently due to higher margins and consumer willingness to pay premium prices

Report Scope and Organic Food Ingredient Market Segmentation

|

Attributes |

Organic Food Ingredient Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Organic Food Ingredient Market Trends

Rising Consumer Preference for Clean-Label and Natural Products

- The global organic food ingredient market is witnessing significant growth driven by consumers’ increasing awareness regarding health, wellness, and food safety, prompting a preference for natural and minimally processed products. Organic ingredients are becoming essential in packaged foods, beverages, and supplements, as consumers actively seek products free from synthetic additives, pesticides, and GMOs

- For instance, General Mills Inc. has expanded its portfolio of organic cereals and snacks, incorporating certified organic grains to meet the surging consumer demand for clean-label and natural ingredients. This initiative demonstrates how leading companies are responding to consumer expectations and driving adoption of organic ingredients across various product categories

- The growing trend toward plant-based diets and functional foods is further fueling the demand for organic ingredients, with consumers prioritizing nutritional value, transparency, and ethical sourcing in their purchase decisions. Organic ingredients are increasingly incorporated into functional beverages, snacks, and supplements to deliver both health benefits and natural composition

- Sustainability concerns and environmental awareness are encouraging manufacturers to source ingredients from certified organic farms, ensuring traceability and responsible farming practices. Consumers are increasingly considering the environmental impact of their food choices, which supports market expansion for organically produced ingredients

- Technological advancements in processing, preservation, and fortification of organic ingredients are enabling manufacturers to develop innovative products that retain nutritional quality while extending shelf life. Enhanced extraction techniques and clean-label formulations allow food and beverage companies to cater to evolving consumer preferences effectively

- The convergence of health consciousness, regulatory support for organic certification, and ethical sourcing practices is solidifying the role of organic ingredients in modern food and beverage manufacturing. These factors collectively are establishing organic food ingredients as critical components for brands targeting wellness-focused and sustainability-conscious consumers

Organic Food Ingredient Market Dynamics

Driver

Increasing Demand for Nutrient-Dense and Functional Foods

- Rising consumer focus on preventive nutrition and health benefits beyond basic sustenance is a key driver for the organic food ingredient market. Consumers are increasingly seeking products that provide vitamins, antioxidants, plant-based proteins, and other functional benefits, making organic ingredients highly desirable

- For instance, Clif Bar & Company has introduced energy bars and snacks made from certified organic grains and plant proteins, catering to the health-conscious and functional food segments. Such initiatives highlight how companies are leveraging organic ingredients to meet consumer demand for products that promote wellness and nutrition

- The growth of functional beverages, fortified snacks, and dietary supplements is further accelerating the adoption of organic ingredients, as these categories increasingly emphasize health benefits and clean-label positioning. Consumers are willing to pay a premium for products that deliver enhanced nutritional value and maintain natural composition

- Government initiatives and favorable regulations promoting organic farming and certification processes are encouraging manufacturers to expand production and supply of organic ingredients. Supportive policies in Europe, North America, and parts of Asia are strengthening market confidence and driving sustained growth

- Urbanization and changing lifestyles are increasing the consumption of convenience foods enriched with organic ingredients. The rising preference for ready-to-eat and easy-to-prepare meals that incorporate healthful organic components is contributing to the expansion of the organic food ingredient market

Restraint/Challenge

High Cost and Limited Availability of Raw Organic Materials

- The high production cost of certified organic raw materials compared to conventional alternatives is a significant challenge constraining market growth. Price-sensitive consumers may be hesitant to adopt products with organic ingredients due to the premium pricing associated with sourcing, certification, and processing

- For instance, Walmart Inc. has reported supply challenges in scaling organic raw material sourcing to meet growing demand. Such limitations can affect product pricing, availability, and overall market penetration, particularly in large-scale manufacturing and retail distribution

- Variability in agricultural yield, seasonal fluctuations, and climate-related factors can lead to inconsistent supply and higher prices for organic ingredients. These uncertainties pose risks for manufacturers attempting to maintain reliable sourcing and consistent quality across product lines

- Complexity in obtaining and maintaining organic certifications, coupled with stringent regulatory compliance requirements, increases operational costs for manufacturers. Smaller producers may struggle to meet these standards, limiting market participation and expansion opportunities

- Fragmented supply chains and higher logistics costs associated with transporting and storing organic ingredients present additional barriers. Overcoming these challenges through better supply chain integration, improved sourcing networks, and scalable farming practices will be essential for the long-term growth of the organic food ingredient market

Organic Food Ingredient Market Scope

The market is segmented on the basis of product type, retail channel, packaging, and process.

- By Product Type

On the basis of product type, the organic food ingredient market is segmented into organic meat, poultry and dairy, organic fruits and vegetables, and organic processed food. The organic fruits and vegetables segment dominated the market with the largest market revenue share in 2025, driven by increasing consumer preference for natural, chemical-free, and nutrient-rich produce. Consumers are becoming more health-conscious, leading to higher adoption of organic fruits and vegetables due to their perceived benefits in immunity and overall wellness. The segment also benefits from the availability of diverse varieties, seasonal selections, and ready-to-use organic produce options. Strong distribution networks and visibility in modern retail and e-commerce channels further boost the segment’s growth and consumer accessibility. For instance, companies such as Earthbound Farm have significantly expanded their organic fruit and vegetable lines to cater to rising consumer demand. The integration of sustainability messaging and traceability features also enhances trust and loyalty among buyers.

The organic meat, poultry and dairy segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing consumer awareness of antibiotic-free and hormone-free animal products. Health-conscious households and premium consumers prefer organic dairy and meat for their quality, safety, and nutritional advantages. Restaurants, food service providers, and boutique food brands are incorporating organic meat and dairy into menus, further driving demand. For instance, Organic Valley has expanded its dairy offerings, highlighting ethical farming practices and high-quality standards. The segment’s growth is also supported by innovations in organic feed and farming methods that improve taste, texture, and shelf-life, increasing consumer adoption.

- By Retail Channel

On the basis of retail channel, the organic food ingredient market is segmented into food retail, supermarkets, and farmer markets. The supermarket segment dominated the market with the largest revenue share in 2025, driven by the convenience of one-stop shopping and wide availability of certified organic products. Supermarkets offer diverse product assortments under standardized quality certifications, which boosts consumer confidence and promotes repeat purchases. For instance, Whole Foods Market has been a key player in driving organic product sales through structured in-store displays, loyalty programs, and promotional campaigns. The presence of online supermarket channels also enables home delivery, further supporting market dominance. Supermarkets’ ability to maintain temperature-controlled storage and supply chain efficiency ensures product freshness and reduces wastage, encouraging consumers to prefer this channel.

The farmer market segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by growing consumer interest in local, farm-to-table produce and direct interaction with producers. Farmers markets allow consumers to verify sourcing practices, which enhances trust in product quality. For instance, companies such as LocalHarvest facilitate access to small-scale organic farms, promoting fresh seasonal produce. These markets also enable organic producers to charge premium pricing due to perceived authenticity and freshness. Consumer preference for sustainable and locally sourced products is contributing to steady growth in farmer markets.

- By Packaging

On the basis of packaging, the organic food ingredient market is segmented into fresh, frozen, canned, and dried products. The fresh segment dominated the market with the largest revenue share of 44.7% in 2025, driven by consumer demand for minimally processed and nutrient-rich foods. Fresh organic ingredients retain higher nutritional value and are preferred for daily consumption. For instance, Dole Packaged Foods has emphasized fresh-cut organic vegetables and fruits to appeal to busy urban consumers. The convenience of ready-to-eat and pre-washed options in fresh packaging also enhances appeal. Fresh packaging ensures shorter supply chains, better traceability, and enhanced flavor, which encourages repeat purchases. Retailers promote fresh organic products prominently due to higher margins and consumer willingness to pay premium prices.

The frozen segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by innovations in freezing technologies that preserve nutrients and flavor while extending shelf life. Frozen organic ingredients cater to consumers seeking convenience and year-round availability of seasonal products. For instance, Green Giant has expanded its frozen organic vegetable portfolio to meet demand for quick meal preparation options. The segment also benefits from online retail channels that require longer shelf life for delivery. Consumers increasingly prefer frozen products for their portion-controlled packs and reduced food waste.

- By Process

On the basis of process, the organic food ingredient market is segmented into unprocessed, processed, and ultra-processed products. The unprocessed segment dominated the market with the largest revenue share in 2025, driven by consumer preference for pure, raw, and minimally altered organic ingredients. Unprocessed products are perceived as healthier, containing maximum nutritional value and free from synthetic additives. For instance, Nature’s Path offers a wide range of unprocessed organic grains and cereals to attract health-conscious consumers. The segment also aligns with trends of clean-label products and whole-food diets. Retailers emphasize unprocessed organic ingredients for their authenticity, freshness, and suitability for home cooking. Traceability from farm to table enhances consumer trust, further strengthening market share.

The processed segment is expected to witness the fastest CAGR from 2026 to 2033, fueled by increasing demand for ready-to-use organic products that offer convenience and extended shelf life. Processed organic foods cater to urban lifestyles where time-saving solutions are preferred without compromising health. For instance, Amy’s Kitchen has expanded processed organic meals and snacks to meet growing household demand. The segment benefits from innovations in natural preservation, packaging solutions, and functional additives that maintain nutritional quality. Rising adoption of processed organic ingredients in food service and packaged food production further supports segment growth.

Organic Food Ingredient Market Regional Analysis

- Europe dominated the organic food ingredient market with the largest revenue share of 34.82% in 2025, driven by the rising consumer awareness regarding health and sustainability, as well as stringent regulations supporting organic farming and clean-label products

- Consumers in the region prioritize high-quality, chemical-free, and sustainably sourced ingredients, contributing to the widespread adoption of organic products across both retail and foodservice channels

- This adoption is further supported by increasing disposable incomes, strong distribution networks, and the growing trend of plant-based and clean-label diets, establishing Europe as a central hub for organic food ingredient innovation

Germany Organic Food Ingredient Market Insight

The Germany organic food ingredient market captured the largest revenue share in 2025 within Europe, fueled by strong government support for organic farming, high consumer awareness regarding food safety, and the increasing demand for plant-based alternatives. Consumers in Germany are increasingly focused on transparency and traceability, encouraging manufacturers to adopt certified organic ingredients. Moreover, the rise of e-commerce platforms and specialty organic stores is further facilitating accessibility and market expansion.

France Organic Food Ingredient Market Insight

The France organic food ingredient market is projected to grow at a substantial CAGR during the forecast period, primarily driven by the increasing preference for natural and minimally processed products, coupled with government initiatives promoting organic agriculture. For instance, companies such as Danone are expanding their organic product portfolios to meet the growing consumer demand, thereby propelling market growth. French consumers also emphasize environmental sustainability and ethical sourcing, contributing to a surge in organic product adoption.

U.K. Organic Food Ingredient Market Insight

The U.K. organic food ingredient market is anticipated to expand at a noteworthy CAGR during the forecast period, driven by a surge in demand for health-conscious and clean-label food products. For instance, retailers such as Tesco are actively promoting organic ranges to cater to health-aware consumers. Increased media coverage on the benefits of organic diets, combined with a strong retail and e-commerce network, continues to stimulate market growth across both packaged foods and beverages.

North America Organic Food Ingredient Market Insight

The North America organic food ingredient market is expected to grow at a significant CAGR during the forecast period, fueled by the expanding consumer preference for natural and functional foods. For instance, companies such as General Mills are introducing a wider range of organic ingredients across cereals and snacks to meet evolving consumer expectations. The region’s well-established organic certification system, coupled with increasing awareness of health and wellness trends, continues to drive adoption across retail, foodservice, and nutraceutical applications.

Asia-Pacific Organic Food Ingredient Market Insight

The Asia-Pacific organic food ingredient market is poised to grow at the fastest CAGR during the forecast period, driven by rising disposable incomes, urbanization, and increasing health awareness in countries such as China, India, and Japan. For instance, China’s expanding middle-class population and growing interest in functional foods are significantly boosting the demand for certified organic ingredients. The region is witnessing rapid expansion of both domestic production and imports, making organic products more accessible to a broader consumer base.

China Organic Food Ingredient Market Insight

The China organic food ingredient market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising urbanization, increasing health consciousness, and strong government policies promoting organic farming. Chinese consumers are actively seeking traceable, high-quality ingredients, and the growth of e-commerce platforms has improved availability across urban and semi-urban areas. Furthermore, the collaboration of local manufacturers with international organic brands is strengthening the market landscape and encouraging further adoption.

Organic Food Ingredient Market Share

The organic food ingredient industry is primarily led by well-established companies, including:

- Tesco PLC (U.K.)

- Ahold Delhaize (Netherlands)

- The Kraft Heinz Company (U.S.)

- Walmart Inc. (U.S.)

- Conagra Brands Inc. (U.S.)

- Coleman Natural (U.S.)

- Clif Bar & Company (U.S.)

- HiPP (Germany)

- Applegate Farms LLC (U.S.)

- General Mills Inc. (U.S.)

- Morrisons Ltd (U.K.)

- Florida Crystals Corporation (U.S.)

- Carrefour S.A. (France)

- AEON Co., Ltd. (Japan)

- United Natural Foods, Inc. (U.S.)

- Waitrose & Partners (U.K.)

- Hain Celestial Group, Inc. (U.S.)

- REWE Group (Germany)

- Wegmans Food Markets, Inc. (U.S.)

- Costco Wholesale Corporation (U.S.)

- Whole Foods Market IP, L.P. (U.S.)

Latest Developments in Global Organic Food Ingredient Market

- In October 2025, MartinBauer, a leading global supplier of botanical ingredients, acquired American Botanicals, a U.S.-based wild-crafted botanicals supplier. This acquisition strengthens MartinBauer’s U.S. sourcing capabilities, ensuring stable supply of high-quality, sustainably harvested organic botanicals. By expanding its portfolio and footprint in North America, MartinBauer is well-positioned to cater to the growing demand for traceable and ethically sourced organic ingredients in the food, beverage, and supplement markets

- In October 2025, BASF introduced Ameriflor Calm, a bioactive ingredient derived from regenerative organic farms using Prunella vulgaris (self-heal). This launch highlights BASF’s focus on sustainable and traceable ingredient sourcing to meet clean-label requirements. By expanding its portfolio of eco-friendly, organic-certified actives, BASF is addressing the growing market demand for ethically produced, high-quality ingredients in both nutrition and personal care segments

- In July 2025, Danone acquired a majority stake in Kate Farms, a U.S. company producing plant-based, organic nutrition formulas and shakes. This acquisition reinforces Danone’s leadership in specialized nutrition and the fast-growing organic segment. By expanding its portfolio with trusted, high-quality organic nutrition products, Danone is catering to increasing consumer and patient demand while consolidating its position in the competitive global organic food ingredient markets

- In June 2025, MartinBauer launched a new line of prebiotic-infused botanical solutions combining organic botanical extracts with prebiotic fibers such as apple cider vinegar and kombucha. This launch emphasizes the company’s commitment to functional and wellness-driven ingredients that support gut health. By offering innovative, label-friendly solutions, MartinBauer is enabling food and beverage manufacturers to meet the rising consumer demand for health-focused, organic products

- In April 2025, BASF unveiled three natural-based innovations at in-cosmetics Global: Verdessence Maize, Lamesoft OP Plus, and Dehyton PK45 GA/RA, derived from plant and Rainforest Alliance-certified sources. This initiative demonstrates BASF’s commitment to biodegradable, natural-origin ingredients that align with sustainability trends. By delivering responsibly sourced, organic-aligned solutions, BASF strengthens its position as a key supplier to personal care and functional food manufacturers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Organic Food Ingredient Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Organic Food Ingredient Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Organic Food Ingredient Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.