Global Organic Milk Replacers Market

Market Size in USD Billion

CAGR :

%

USD

1.57 Billion

USD

2.65 Billion

2024

2032

USD

1.57 Billion

USD

2.65 Billion

2024

2032

| 2025 –2032 | |

| USD 1.57 Billion | |

| USD 2.65 Billion | |

|

|

|

|

Organic Milk Replacers Market Size

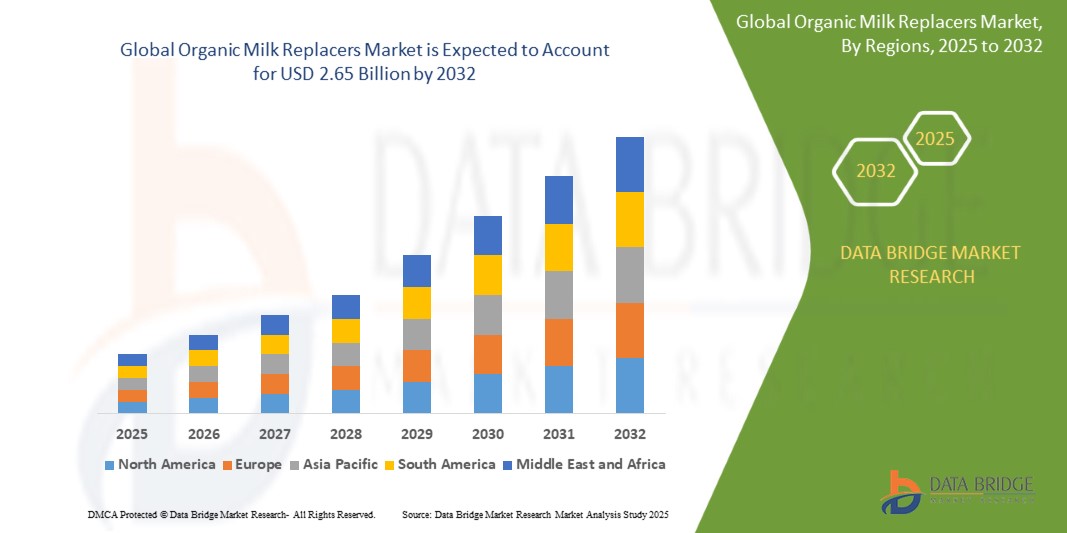

- The global organic milk replacers market size was valued at USD 1.57 billion in 2024 and is expected to reach USD 2.65 billion by 2032, at a CAGR of 6.8% during the forecast period

- The market growth is largely fueled by the increasing adoption of organic farming practices and rising awareness regarding the health benefits of chemical-free livestock nutrition, which is encouraging farmers to shift toward organic milk replacers for young calves and other livestock

- Furthermore, growing consumer demand for sustainable and ethically produced dairy alternatives is pushing producers to adopt organic feed solutions, thereby accelerating the uptake of organic milk replacers, significantly boosting the industry’s expansion

Organic Milk Replacers Market Analysis

- Organic milk replacers are specially formulated nutritional substitutes made from certified organic ingredients to replace natural cow’s milk for feeding calves and other young animals. They provide essential proteins, vitamins, and minerals while ensuring compliance with organic farming standards and eliminating the use of synthetic additives or genetically modified components

- The rising demand for organic milk replacers is primarily driven by the growth of organic dairy farming, increasing awareness about animal welfare, and the preference for sustainable livestock rearing practices that align with consumer demand for organic and premium-quality dairy products

- North America dominated the organic milk replacers market with a share of 46.30% in 2024, due to a growing preference for organic livestock nutrition and the rising adoption of sustainable farming practices

- Asia-Pacific is expected to be the fastest growing region in the organic milk replacers market during the forecast period due to increasing livestock farming, rising disposable incomes, and the adoption of modern farming techniques in countries such as China, India, and Japan

- Powder segment dominated the market with a market share of 48.5% in 2024, due to its long shelf life, easy storage, and convenient transport across regions. Powdered organic milk replacers allow precise measurement for feeding, flexibility in preparation, and suitability for both small-scale and industrial farming setups. They are often available in fortified variants, catering to the specific nutritional requirements of different livestock species. The segment’s dominance is also supported by established production processes and farmer familiarity with powdered feeding systems

Report Scope and Organic Milk Replacers Market Segmentation

|

Attributes |

Organic Milk Replacers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Organic Milk Replacers Market Trends

Rising Shift Toward Sustainable and Organic Livestock Nutrition

- Growing consumer demand for organic and ethically produced dairy products is encouraging farmers to adopt organic milk replacers that support sustainable livestock nutrition. These replacers are formulated using certified organic ingredients to ensure natural growth support

- For instance, Kent Nutrition Group offers premium organic milk replacers tailored for dairy calves, focusing on nutrient bioavailability and compliance with organic farming standards, strengthening their leadership in the evolving organic feed market

- Increasing adoption of organic farming policies and certifications worldwide is further boosting market growth. Governments and industry bodies promote sustainable practices, enhancing the credibility and demand for organic animal nutrition products

- Advancements in formulation science are improving product digestibility and nutritional profiles. The inclusion of plant-based proteins and vitamins caters to the specific needs of organic dairy livestock, resulting in better health outcomes and performance

- Market expansion in emerging regions such as Asia-Pacific is driven by rising disposable incomes and growing demand for high-quality dairy products. Local producers are adopting organic feed solutions to capture this premium segment's consumer interest

- Sustainability initiatives within the feed industry emphasize reducing synthetic inputs and promoting renewable raw materials, aligning product development with broader environmental responsibility goals

Organic Milk Replacers Market Dynamics

Driver

Increasing Consumer Demand for Organic Dairy Products

- Consumer preference for organic dairy products is fueling demand for organic milk replacers as essential components of the organic dairy supply chain. This demand translates into higher investments in organic feed solutions by dairy farmers

- For instance, Manna Pro has expanded its portfolio of organic milk replacers designed to cater to rising consumer interest in organic milk and dairy derivatives, enabling producers to meet stringent organic certification standards

- Growing awareness of health benefits associated with organic dairy, including absence of hormones and antibiotics, is encouraging end-user purchases. This trend supports upstream adoption of organic livestock nutrition products

- The premium pricing of organic dairy products incentivizes farmers to maintain organic integrity at all stages, from animal feeding to milk processing, thereby driving the organic replacer market

- Retail penetration of organic dairy products through supermarkets and specialty stores increases visibility and accessibility, creating more opportunities for organic milk replacer suppliers to scale their distribution

Restraint/Challenge

High Production Cost

Organic Milk Replacers Market Scope

The market is segmented on the basis of livestock type, specialty type, form, fortification, and distribution channel.

• By Livestock Type

On the basis of livestock type, the organic milk replacers market is segmented into cattle, sheep, goats, swine, horse, and others. The cattle segment dominated the market in 2024, owing to the large-scale cattle farming industry and the high demand for dairy replacement products to ensure healthy growth of calves. Cattle milk replacers are preferred for their nutrient-rich formulations that support immunity, weight gain, and digestive health. Farmers increasingly choose organic options to reduce the risk of disease and avoid synthetic additives, aligning with the growing trend toward sustainable and ethical livestock practices. The segment’s dominance is also supported by easy integration into existing feeding systems and widespread availability of fortified products tailored to different stages of calf development.

The goat segment is expected to witness the fastest growth from 2025 to 2032, driven by the rising adoption of goat farming for milk, meat, and specialty dairy products. Organic milk replacers for goats help improve kid survival rates and overall herd health, making them increasingly popular among small and medium-scale farms. Growing consumer demand for goat milk products and the rise of alternative livestock farming are major contributors to the rapid expansion of this segment.

• By Specialty Type

On the basis of specialty type, the market is segmented into protein-rich, energy booster, fiber-rich, lactose-rich, and others. The protein-rich segment dominated the market in 2024, driven by the essential role of proteins in supporting rapid growth, muscle development, and immune system strengthening in young livestock. Protein-rich organic milk replacers are widely preferred for optimizing feed efficiency, improving weight gain, and ensuring healthy development across multiple livestock species. The segment’s market leadership is reinforced by the increasing adoption of precision feeding practices and age-specific formulations to address the specific nutritional needs of calves, kids, and piglets.

The energy booster segment is anticipated to register the fastest growth from 2025 to 2032, fueled by growing awareness among farmers about the importance of energy supplementation for resilience, growth, and productivity. Energy-boosting milk replacers are especially critical in intensive farming systems where environmental stress and high metabolic demands require additional support. Their rising popularity is also driven by proven improvements in survival rates, performance, and overall livestock vitality.

• By Form

On the basis of form, the market is segmented into powder, liquid, and others. The powder segment dominated the market with a share of 48.5% in 2024, owing to its long shelf life, easy storage, and convenient transport across regions. Powdered organic milk replacers allow precise measurement for feeding, flexibility in preparation, and suitability for both small-scale and industrial farming setups. They are often available in fortified variants, catering to the specific nutritional requirements of different livestock species. The segment’s dominance is also supported by established production processes and farmer familiarity with powdered feeding systems.

The liquid segment is projected to witness the fastest growth from 2025 to 2032, driven by its ease of use in on-farm feeding systems and immediate nutrient availability. Liquid milk replacers are increasingly preferred in automated or semi-automated feeding systems, providing consistent nutrition and reducing preparation errors. Rising demand for convenient, time-saving solutions among modern farmers is a key factor supporting this segment’s rapid expansion.

• By Fortification

On the basis of fortification, the market is segmented into vitamins, minerals, medication, probiotics, organic acids, yeast, electrolytes, and others. The vitamins segment dominated the market in 2024, due to the essential role of vitamins in supporting immunity, bone development, and overall health of young livestock. Farmers increasingly adopt vitamin-fortified organic milk replacers to prevent deficiencies, boost resilience, and ensure optimal growth. Regulatory support for organic feed and growing awareness about natural supplementation practices have further strengthened this segment’s market position.

The probiotics segment is expected to witness the fastest growth from 2025 to 2032, driven by the increasing recognition of gut health in livestock and the role of beneficial microbes in improving digestion and nutrient absorption. Probiotic-fortified milk replacers are gaining popularity across both conventional and organic farming systems for reducing mortality, enhancing growth, and supporting overall animal wellbeing. Rising research and innovation in microbial formulations also contribute to this segment’s accelerated adoption.

• By Distribution Channel

On the basis of distribution channel, the market is segmented into store-based and non-store-based channels. The store-based segment dominated the market in 2024, owing to the presence of established retail networks, trusted brands, and the ability to provide a wide range of organic milk replacers with assured quality. Farmers prefer store-based channels for bulk purchases, expert advice, and the convenience of physical verification of products. The segment’s dominance is also supported by strong offline distribution infrastructure and high awareness among traditional farmers about the reliability of store-based sourcing.

The non-store-based segment is expected to witness the fastest growth from 2025 to 2032, fueled by the rapid expansion of e-commerce platforms, direct-to-farm sales, and subscription-based delivery models. Non-store channels provide convenience, competitive pricing, and access to specialized or customized formulations. The growing penetration of digital platforms in rural areas and rising acceptance of online purchase for livestock products are key drivers for this segment’s accelerated growth.

Organic Milk Replacers Market Regional Analysis

- North America dominated the organic milk replacers market with the largest revenue share of 46.30% in 2024, driven by a growing preference for organic livestock nutrition and the rising adoption of sustainable farming practices

- Farmers in the region prioritize high-quality, nutrient-rich milk replacers to improve calf health, weight gain, and overall livestock productivity

- This widespread adoption is further supported by advanced dairy farming infrastructure, high disposable incomes, and increasing awareness about animal welfare and organic farming standards, establishing organic milk replacers as a preferred solution for both small and large-scale livestock operations

U.S. Organic Milk Replacers Market Insight

The U.S. market captured the largest revenue share of 82% in North America in 2024, fueled by strong awareness of organic livestock feeds and a well-established dairy sector. The demand for protein-rich and vitamin-fortified milk replacers is growing as farmers focus on calf health and early growth performance. Rising interest in sustainable and clean-label farming practices, combined with extensive distribution channels and the expansion of dairy automation, further propels market growth. In addition, government initiatives promoting organic agriculture and the increasing availability of specialized formulations are significantly contributing to the market’s expansion.

Europe Organic Milk Replacers Market Insight

The Europe market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent livestock welfare regulations and the increasing demand for organic dairy products. Rising urbanization and consumer preference for sustainably produced animal products are fostering the adoption of organic milk replacers. European farmers are increasingly incorporating these products into both conventional and organic farming systems, with growing awareness about the benefits of protein-rich, probiotic, and vitamin-fortified formulations. The market is experiencing strong growth in countries such as Germany, France, and the Netherlands across both small-scale and industrial dairy operations.

U.K. Organic Milk Replacers Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR, fueled by the rising trend of organic livestock farming and the increasing focus on animal health and productivity. Farmers are prioritizing organic milk replacers to enhance growth, immunity, and overall wellbeing of calves and other young livestock. Government support for sustainable agriculture, along with a robust supply chain and e-commerce penetration for livestock products, is further boosting market adoption. The growing awareness among dairy farmers about the long-term benefits of organic and fortified milk replacers is expected to sustain market growth.

Germany Organic Milk Replacers Market Insight

The Germany market is expected to expand at a considerable CAGR, driven by increasing awareness about livestock health, nutrition, and sustainability. German farmers are adopting protein-rich and fortified milk replacers to improve calf survival rates and enhance productivity. The country’s well-developed agricultural infrastructure, focus on technological innovation, and adherence to organic farming standards are supporting market growth. Integration of organic milk replacers into both small-scale and industrial dairy farming practices is becoming increasingly common, with an emphasis on high-quality, eco-friendly, and fortified products.

Asia-Pacific Organic Milk Replacers Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing livestock farming, rising disposable incomes, and the adoption of modern farming techniques in countries such as China, India, and Japan. The region’s growing inclination towards organic livestock nutrition, supported by government initiatives promoting sustainable agriculture, is accelerating market adoption. Rising awareness of the benefits of protein-rich, probiotic, and vitamin-fortified milk replacers, along with expanding distribution networks, is further propelling growth across small and large-scale farms.

Japan Organic Milk Replacers Market Insight

The Japanese market is gaining momentum due to high standards of livestock care, increasing adoption of modern dairy farming practices, and the growing emphasis on sustainable and organic nutrition. Farmers are increasingly adopting fortified and specialty milk replacers to improve calf health, growth, and immunity. Integration of these products into automated and precision feeding systems is supporting market growth. In addition, the aging farming population is likely to drive demand for convenient, high-quality, and easy-to-use organic milk replacers.

China Organic Milk Replacers Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, a growing middle-class population, and increased awareness of animal health. China is emerging as a major consumer of protein-rich, vitamin-fortified, and probiotic milk replacers for calves and other livestock. The push towards sustainable livestock farming, expansion of dairy infrastructure, and strong domestic production of milk replacers are key factors driving market growth. Affordability, accessibility, and the availability of innovative organic formulations are further contributing to the market’s expansion.

Organic Milk Replacers Market Share

The organic milk replacers industry is primarily led by well-established companies, including:

- Kent Nutrition Group (U.S.)

- Royal Milc, Inc. (U.S.)

- Manna Pro Products, LLC (U.S.)

- I.N. Hellas (Greece)

- Biocom Ltd (Belarus)

- KGM Ltd (Latvia)

- Sav-A-Caf (U.S.)

- Nutreco (Netherlands)

- ADM Animal Nutrition (U.S.)

- Phibro Animal Health Corporation (U.S.)

- QualiTech, LLC (U.S.)

- Cargill Animal Nutrition (U.S.)

Latest Developments in Global Organic Milk Replacers Market

- In August 2022, SwadeshiVIP, a prominent A2 organic milk brand in India, launched A2 Shishu milk specifically for babies and children. This launch strengthened the company’s foothold in the infant and toddler nutrition segment, addressing the rising demand for safe, digestible, and natural milk alternatives. The introduction of A2 Shishu milk is expected to boost consumer trust in organic milk products and drive growth in India’s pediatric dairy nutrition market

- In April 2022, Tetra Pak partnered with Horizon Organic to launch the first single-serve organic milk packaged in Tetra Prisma Aseptic cartons in the United States. This innovation made organic milk more convenient and portable for on-the-go consumers, enhancing accessibility in retail and boosting demand for packaged organic milk products. The launch reflects growing consumer preference for convenient, ready-to-consume, and sustainable dairy packaging, positively impacting the U.S. organic milk market

- In August 2020, Arla Foods Ingredients introduced its first organic micellar casein isolate, MicelPure, containing a minimum of 87% native milk proteins. This product strengthened the supply of high-protein organic ingredients for infant formula and specialty dairy products, supporting the rising global demand for protein-rich and organic livestock nutrition. Its launch enhanced Arla’s portfolio and encouraged innovation in organic milk replacers and functional dairy applications

- In February 2021, Danone expanded its organic product line by introducing organic milk powder for calves and young livestock in Europe. This development addressed the growing focus on animal welfare and sustainable farming, providing farmers with high-quality, fortified milk replacers. The launch is expected to increase adoption of organic milk powder in European dairy operations and support the expansion of fortified nutrition for young livestock

- In September 2021, Nestlé announced the rollout of organic lactose-free milk products for infants and toddlers in North America. This initiative responded to rising lactose intolerance awareness among young children and growing demand for specialized dairy nutrition. By offering lactose-free, organic options, Nestlé enhanced its product portfolio and reinforced market confidence in safe, convenient, and health-oriented milk replacers, driving overall market growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.