Global Organic Period Care Products Market

Market Size in USD Billion

CAGR :

%

USD

2.99 Billion

USD

5.13 Billion

2024

2032

USD

2.99 Billion

USD

5.13 Billion

2024

2032

| 2025 –2032 | |

| USD 2.99 Billion | |

| USD 5.13 Billion | |

|

|

|

|

Organic Period Care Products Market Analysis

The global organic period care products market is witnessing significant growth due to heightened awareness about menstrual hygiene and the environmental toll of conventional products. Consumers are increasingly drawn to sustainable, eco-friendly alternatives that align with a commitment to health and sustainability. Synthetic period care products, often associated with allergies, skin irritations, and infections, are driving a shift towards organic options made from natural, biodegradable materials. This trend is further fueled by growing education on menstrual health and environmental preservation. As more individuals prioritize safety, comfort, and eco-conscious choices, the demand for organic period care products continues to expand globally.

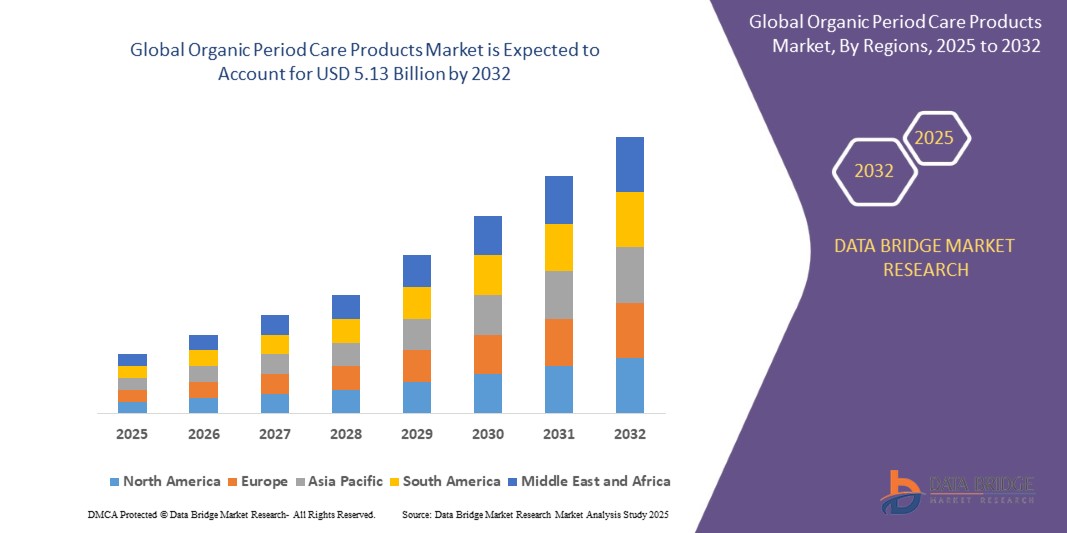

Organic Period Care Products Market Size

Global organic period care products market size was valued at USD 2.99 billion in 2024 and is projected to reach USD 5.13 billion by 2032, with a CAGR of 7.0% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Organic Period Care Products Market Trends

“Growing Health Awareness”

The rising awareness of the harmful effects of synthetic chemicals, such as dioxins, rayon, and synthetic fragrances, in conventional menstrual products has led to a surge in demand for chemical-free alternatives. These substances, often present in mainstream pads and tampons, have been linked to potential health risks, including hormonal disruptions, skin irritations, and increased sensitivity over time. As a result, many consumers are opting for organic period care products made from hypoallergenic and natural materials, such as organic cotton, which are free from harsh chemicals and pesticides. In adddition, concerns about allergies and infections have further boosted the popularity of organic alternatives. Synthetic products can cause rashes, irritation, and other adverse reactions, especially for individuals with sensitive skin. Organic options, being gentler and designed to minimize discomfort, have become the preferred choice for those seeking a safer and healthier menstrual care solution, contributing to the market's rapid expansion.

Report Scope and Organic Period Care Products Market Segmentation

|

Attributes |

Organic Period Care Products Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa, Brazil, Argentina, and Rest of South America |

|

Key Market Players |

L., Inc. (U.S.), Natracare Ltd. (England), The Honest Company, Inc. (U.S.), Cora, Inc. (U.S.), Seventh Generation, Inc. (U.S.), Highamp Srl (Italy), Rael, Inc. (U.S.), Happy Period, Inc. (U.S.), Lunapads International, Inc. (now Aisle) (Canada), Greenspace Brands Inc. (Canada), Sustain Natural, Inc. (U.S.), Eco by Naty AB (Sweden), Anigan, Inc. (U.S.), Moon Time, Inc. (U.S.), and Organic Initiative (Australia) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Organic Period Care Products Market Definition

Organic period care products refer to menstrual hygiene products made from natural, biodegradable materials, free from synthetic chemicals, pesticides, and harmful additives. These products include pads, tampons, menstrual cups, and pantyliners, designed to offer a healthier alternative to conventional menstrual products. Common materials used are organic cotton, which is grown without the use of toxic chemicals or GMOs. Organic period care products are environmentally friendly, reducing waste and promoting sustainability by being biodegradable or compostable. They are ideal for individuals with sensitive skin or allergies, providing comfort and reliability while supporting better health and eco-conscious choices.

Organic Period Care Products Market Dynamics

Drivers

- Rising Environmental Consciousness

Rising environmental consciousness is driving a shift toward more sustainable period care products. Traditional menstrual products, such as pads and tampons, often contain plastic components that contribute to growing landfill waste and environmental pollution. These products can take hundreds of years to decompose, posing significant harm to ecosystems. As a result, consumers are becoming more aware of the environmental impact of these products and are seeking alternatives. Organic period care products, made from natural, biodegradable materials like organic cotton, are increasingly favored. These products often feature compostable elements, which break down more easily and contribute to reducing waste. By offering an eco-friendly, biodegradable solution, these organic products align with the values of eco-conscious consumers, helping minimize the carbon footprint associated with menstrual care. This growing demand for sustainable and biodegradable solutions is shaping the future of the period care industry. For Instance, Natracare a British brand that offers organic cotton tampons, sanitary pads, and panty liners. Their products are made from biodegradable materials, free of plastics and synthetic substances, providing an eco-friendly alternative for menstrual care. The brand prioritizes sustainability and natural ingredients for a healthier, environmentally conscious choice.

- Advocacy and Education Campaigns

Advocacy and education campaigns are playing a pivotal role in raising awareness about menstrual hygiene, especially in developing nations. Nonprofits, governments, and health organizations are focusing on educating communities about the importance of proper menstrual care and hygiene, addressing the lack of knowledge and resources in many regions. These campaigns emphasize the health risks associated with inadequate menstrual hygiene and the need for safe, hygienic, and eco-friendly products. Furthermore, efforts to destigmatize menstruation have gained momentum in recent years. Cultural taboos around menstruation, which often lead to shame and isolation, are being challenged through global campaigns. By promoting open discussions, providing educational resources, and showcasing real stories, these initiatives are helping to normalize menstruation and encourage product adoption. As menstruation becomes less of a taboo subject, more individuals are empowered to access and choose period care products that align with their health and environmental values. These efforts foster greater product awareness and improve menstrual hygiene globally.

Opportunities

- Increased Demand for Reusable and Eco-Friendly Products

The demand for reusable and eco-friendly period care products is growing as consumers become more conscious of their environmental impact. Reusable items like menstrual cups, period underwear, and cloth pads are gaining popularity due to their long-term cost-effectiveness and minimal environmental footprint. These products can be used for years, reducing the need for single-use disposable items that contribute to landfill waste. As a result, companies are innovating to create high-quality, comfortable, and sustainable alternatives that meet consumer needs while promoting environmental responsibility. The zero-waste movement is further fueling this shift, as consumers seek to reduce waste in all aspects of life. Brands focusing on biodegradable, recyclable, or compostable packaging are capitalizing on this trend by providing more sustainable options. In adddition, product lines made from organic cotton or renewable materials appeal to eco-conscious consumers who want to support brands committed to sustainability. This increasing demand for environmentally friendly menstrual products is shaping the future of the industry. For Instance, GladRags, located in Portland, Oregon, manufactures reusable cloth menstrual pads and menstrual cups. Known for their durability and comfort, these products provide an environmentally friendly alternative to traditional period care, offering a sustainable and reliable option for those seeking eco-conscious menstrual solutions.

- Product Innovation and Diversification

Product innovation and diversification are key to meeting the evolving demands of consumers in the organic period care market. Customized products designed for specific demographic segments, such as teenagers, postpartum women, athletes, or individuals with sensitive skin, present an opportunity for brands to cater to unique needs. For example, lightweight and absorbent products with gentle, organic materials can benefit teenagers just starting their menstrual journey, while postpartum products may require higher absorbency and comfort for new mothers. In adddition, the use of innovative materials like bamboo, hemp, and organic cotton allows brands to differentiate their products. These materials are not only eco-friendly but also offer natural antibacterial properties, comfort, and breathability. New technologies that improve absorbency, comfort, and leak protection can further attract consumer interest, ensuring high-performance products. Combination products that integrate functional benefits such as odor control, moisture-wicking, and antibacterial features with organic materials could appeal to consumers seeking multi-functional, sustainable solutions for their menstrual care needs.

Restraints/Challenges

- High Product Cost

The higher cost of organic period care products is a significant challenge in the market. Premium pricing arises from the use of high-quality raw materials like organic cotton, biodegradable plastics, and other sustainable ingredients, which are more expensive than conventional materials. In adddition, the production processes for organic and eco-friendly products often involve more stringent standards and ethical practices, such as fair labor conditions and environmentally responsible manufacturing methods, further driving up costs. These factors make organic period care products less affordable compared to their conventional counterparts, which typically contain synthetic materials and are mass-produced using less sustainable methods. Affordability becomes a key issue, particularly for consumers in low-income regions or price-sensitive markets. Higher prices can limit the accessibility of these products to a wider population, preventing many from adopting more sustainable menstrual care options. To overcome this, brands need to explore strategies for reducing costs, such as optimizing production processes, expanding scale, or offering lower-cost alternatives without compromising sustainability.

- Strong Competition from Conventional Products

The strong competition from conventional period care products poses a significant challenge for the organic period care market. Established brands like Procter & Gamble and Kimberly-Clark dominate the industry with well-established brand loyalty and extensive consumer bases. These companies have spent decades building trust with consumers and benefit from economies of scale, allowing them to offer products at lower prices. In comparison, organic alternatives often struggle to compete on price, as they use higher-quality materials and more sustainable production methods, which contribute to their premium cost. Moreover, in many markets, price sensitivity remains a major factor in consumer decision-making. Many consumers prioritize affordability and convenience over sustainability, especially in price-conscious or low-income regions. This makes it difficult for organic period care products, which are often priced higher, to appeal to a broader audience. To gain market share, organic brands need to effectively communicate the value of their products, emphasizing long-term health benefits, environmental impact, and cost savings over time.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an analyst brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Organic Period Care Products Market Scope

The market is segmented on the basis of product type, material, end-user, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Sanitary Pads

- Tampons

- Panty Liners

- Menstrual Cups

- Others

Material

- Organic Cotton

- Bamboo

- Plant-based Fibers

- Biodegradable Plastics

- Recycled Materials

End-User

- Teenagers

- Adults

Distribution Channel

- Online

- Offline

Organic Period Care Products Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, product type, material, end-user, and distribution channel as referenced above.

The countries covered in the market are U.S., Canada, Mexico, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, rest of Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, rest of Asia-Pacific, Saudi Arabia, U.A.E., South Africa, Egypt, Israel, rest of Middle East and Africa, Brazil, Argentina, and rest of South America.

North America is expected to dominate the market, especially the U.S. and Canada, has a well-informed consumer base that prioritizes health and sustainability. With increasing awareness of the benefits of organic products, there is a growing demand for eco-friendly period care alternatives. Consumers actively seek chemical-free options like organic cotton pads, tampons, and menstrual cups.

Asia-Pacific region is experiencing rapid growth in the organic period care market, driven by rising consumer awareness of health and environmental concerns. Education and advocacy campaigns are promoting organic options, while expanding disposable income and urbanization in countries like China and India are fueling demand for eco-friendly, premium products.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Organic Period Care Products Market Share

The market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Organic Period Care Products Leaders Operating in the Market Are:

- L., Inc. (U.S.)

- Natracare Ltd. (England)

- The Honest Company, Inc. (U.S.)

- Cora, Inc. (U.S.)

- Seventh Generation, Inc. (U.S.)

- Highamp Srl (Italy)

- Rael, Inc. (U.S.)

- Happy Period, Inc. (U.S.)

- Lunapads International, Inc. (now Aisle) (Canada)

- Greenspace Brands Inc. (Canada)

- Sustain Natural, Inc. (U.S.)

- Eco by Naty AB (Sweden)

- Anigan, Inc. (U.S.)

- Time, Inc. (U.S.)

- Organic Initiative (Australia)

Latest Developments in Organic Period Care Products Market

- In January 2022, Essity AB acquired Modibodi, a Southeast Asian company, and Knix Wear, Inc., a Canadian firm, both known for their leakage-proof intimate apparel products. This acquisition aimed to strengthen Essity's position in the global intimate apparel market and expand its product offerings in the sector

- In February 2022, Sirona Hygiene Private Limited, an Indian manufacturer of menstrual cups, acquired Impower, a women's safety brand. This acquisition enabled Sirona to diversify its portfolio and generate additional revenue from women's safety products in India, expanding its reach in the growing market for women's health and wellness solutions

- In November 2022, The Edgewell Personal Care Company acquired Billie Inc., a U.S.-based consumer brand specializing in women’s personal care products. This acquisition allowed Edgewell to broaden its product portfolio, particularly in the growing women’s grooming and hygiene segment, enhancing its presence in the competitive personal care market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.