Global Organic Personal Care And Cosmetic Products Market

Market Size in USD Billion

CAGR :

%

USD

36.40 Billion

USD

55.02 Billion

2024

2032

USD

36.40 Billion

USD

55.02 Billion

2024

2032

| 2025 –2032 | |

| USD 36.40 Billion | |

| USD 55.02 Billion | |

|

|

|

|

Organic Personal Care and Cosmetic Products Market Size

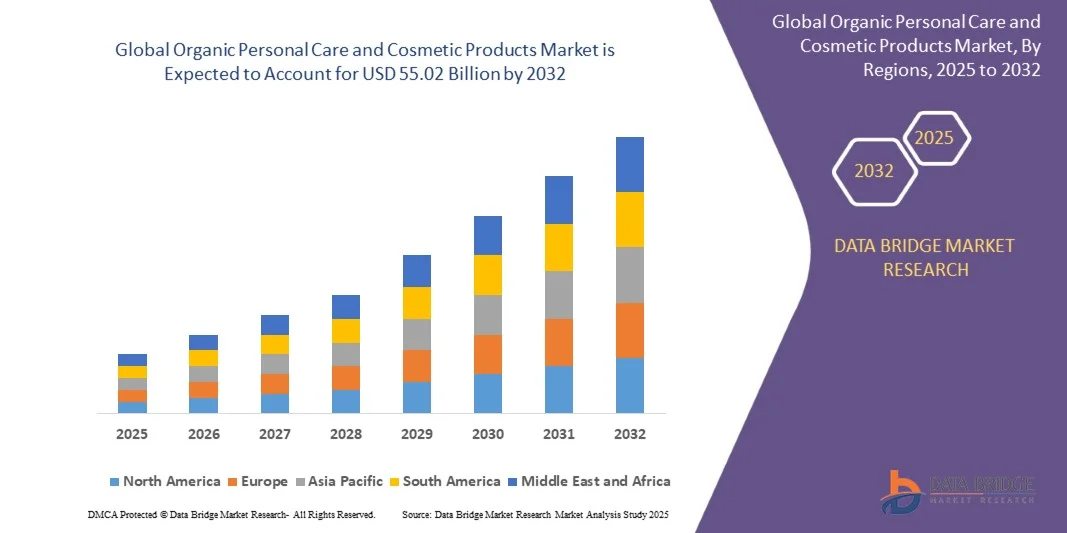

- The Organic Personal Care and Cosmetic Products Market size was valued at USD 36.40 billion in 2024 and is expected to reach USD 55.02 billion by 2032, at a CAGR of 5.30% during the forecast period.

- The market growth is largely fueled by increasing consumer awareness about the harmful effects of synthetic chemicals and a rising preference for natural and eco-friendly ingredients in skincare, haircare, and cosmetic products.

- Furthermore, growing trends in sustainable living, clean beauty, and ethical sourcing are driving demand for certified organic products, while innovations in formulations and packaging are enhancing product appeal and accessibility. These converging factors are accelerating the adoption of organic personal care solutions, thereby significantly boosting the industry's growth.

Organic Personal Care and Cosmetic Products Market Analysis

- Organic personal care and cosmetic products, including skincare, haircare, and makeup formulations made from natural and certified organic ingredients, are increasingly vital components of modern beauty and wellness routines in both personal and professional settings due to their perceived safety, sustainability, and reduced environmental impact.

- The escalating demand for organic personal care products is primarily fueled by growing consumer awareness of the harmful effects of synthetic chemicals, rising preference for natural and eco-friendly ingredients, and increased adoption of clean beauty and ethical consumption trends.

- Europe dominated the Organic Personal Care and Cosmetic Products Market with the largest revenue share of 34% in 2024, characterized by early adoption of organic products, high disposable incomes, and a strong presence of key industry players, with the U.S. experiencing substantial growth in organic skincare and cosmetic product consumption, driven by innovations from both established beauty brands and emerging clean beauty startups.

- Asia-Pacific is expected to be the fastest growing region in the Organic Personal Care and Cosmetic Products Market during the forecast period due to increasing urbanization, rising disposable incomes, and growing consumer awareness of sustainable and natural beauty solutions.

- The skin care segment dominated the market with the largest revenue share of 45.6% in 2024, driven by rising consumer awareness of chemical-free, natural ingredients and increasing demand for organic moisturizers, anti-aging creams, and sensitive skin-friendly products.

Report Scope and Organic Personal Care and Cosmetic Products Market Segmentation

|

Attributes |

Organic Personal Care and Cosmetic Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Organic Personal Care and Cosmetic Products Market Trends

“Enhanced Convenience Through AI-Driven Personalized Beauty Solutions”

- A significant and accelerating trend in the Organic Personal Care and Cosmetic Products Market is the growing integration of artificial intelligence (AI) and digital platforms in product development, skincare diagnostics, and personalized beauty recommendations. This fusion of technologies is significantly enhancing user convenience and the effectiveness of personal care routines.

- For instance, AI-powered skincare apps can analyze skin type, texture, and concerns to suggest tailored organic products, while smart mirrors and beauty devices offer real-time feedback on skin hydration, tone, and elasticity. Similarly, some brands such as Proven Skincare use AI algorithms to create highly customized formulations based on individual user profiles and lifestyle data.

- AI integration in the organic beauty sector enables features such as tracking product usage patterns, predicting skin reactions to certain ingredients, and providing intelligent recommendations for optimized routines. For example, brands like Atolla and Skinsei leverage AI to continuously refine personalized formulations and send updates to consumers as their skin changes over time. Furthermore, digital tools allow for a seamless, hands-on personalized experience without requiring in-person consultations.

- The integration of AI-driven platforms with e-commerce and mobile apps facilitates centralized management of personal care routines. Through a single interface, users can track product usage, receive customized recommendations, reorder organic products, and monitor improvements in skin and hair health, creating a unified and intelligent beauty experience.

- This trend towards more personalized, data-driven, and intuitive beauty solutions is fundamentally reshaping consumer expectations for organic personal care. Consequently, companies such as Proven Skincare, Atolla, and Skinsei are developing AI-enabled products and platforms that offer real-time customization, ingredient transparency, and optimized routines for every user.

- The demand for organic personal care products that offer AI-driven personalization and digital integration is growing rapidly across both residential and professional sectors, as consumers increasingly prioritize convenience, efficacy, and sustainability in their beauty routines.

Organic Personal Care and Cosmetic Products Market Dynamics

Driver

“Growing Need Due to Rising Health and Sustainability Awareness”

- The increasing prevalence of health-conscious lifestyles and rising consumer awareness regarding harmful chemicals in conventional personal care products is a significant driver for the heightened demand for organic personal care and cosmetic products.

- For instance, in 2024, L’Oréal launched several new certified organic skincare and cosmetic lines, emphasizing natural ingredients, sustainable sourcing, and clean formulations. Such initiatives by key companies are expected to drive market growth during the forecast period.

- As consumers become more aware of potential health risks and environmental impacts, organic personal care products offer safer, eco-friendly alternatives with natural formulations, appealing to both health-conscious and environmentally aware customers.

- Furthermore, the growing popularity of sustainable and “clean beauty” trends is making organic products an integral component of modern personal care routines, offering options free from synthetic chemicals, parabens, sulfates, and artificial fragrances.

- The convenience of widely available certified organic products, online accessibility, and increasing product variety in skincare, haircare, and cosmetics are key factors propelling adoption across residential and professional segments. The trend towards informed, health-focused purchasing and the growing presence of user-friendly organic brands further contribute to market growth.

Restraint/Challenge

“Concerns Regarding Higher Prices and Product Authenticity”

- The relatively higher cost of certified organic personal care products compared to conventional alternatives poses a significant challenge to broader market penetration. Premium pricing can limit adoption, particularly among price-sensitive consumers in developing regions.

- For instance, despite growing awareness, some consumers remain hesitant to pay extra for organic labels due to perceived marginal benefits, slowing widespread uptake.

- Addressing these concerns through competitive pricing strategies, transparent labeling, and third-party certifications is crucial for building consumer trust. Companies such as Burt’s Bees and Weleda emphasize certified organic ingredients and ethical sourcing in their marketing to reassure buyers.

- Additionally, concerns regarding counterfeit or misleading “organic” claims can undermine confidence in the market. Educating consumers on reading labels, recognizing authentic certifications, and promoting verified organic brands is essential.

- While prices are gradually becoming more competitive and product accessibility is increasing, perceived premium costs and doubts about authenticity can still hinder broader adoption. Overcoming these challenges through transparent sourcing, certification, and consumer education will be vital for sustained market growth.

Organic Personal Care and Cosmetic Products Market Scope

The market is segmented on the basis of type, price change, Distribution Channel, consumer.

• By Type

On the basis of type, the Organic Personal Care and Cosmetic Products Market is segmented into hair care and skin care. The skin care segment dominated the market with the largest revenue share of 45.6% in 2024, driven by rising consumer awareness of chemical-free, natural ingredients and increasing demand for organic moisturizers, anti-aging creams, and sensitive skin-friendly products. Consumers prioritize organic skin care for its perceived safety, efficacy, and long-term health benefits.

The hair care segment is expected to witness the fastest CAGR of 20.8% from 2025 to 2032, fueled by the growing demand for organic shampoos, conditioners, oils, and serums that cater to hair damage repair, scalp health, and color protection. Rising urbanization, increased disposable income, and influencer-led marketing campaigns are further driving adoption of organic hair care solutions across both residential and professional segments.

• By Price Range

On the basis of price range, the Organic Personal Care and Cosmetic Products Market is segmented into economy, mid-range, and premium products. The mid-range segment dominated the market with a revenue share of 42.3% in 2024, driven by its balance of affordability and high-quality organic formulations, making it accessible to a broad consumer base. Consumers perceive mid-range products as offering superior value without compromising on ingredient integrity or sustainability.

The economy segment is expected to witness the fastest CAGR of 19.5% from 2025 to 2032, fueled by the growing penetration of certified organic personal care products in developing regions and increasing consumer preference for cost-effective, chemical-free alternatives. Rising e-commerce availability and brand promotions further accelerate the adoption of budget-friendly organic products.

• By Distribution Channel

On the basis of distribution channel, the Organic Personal Care and Cosmetic Products Market is segmented into hypermarkets/supermarkets, e-commerce, specialty stores, and pharmacies. The hypermarket/supermarket segment dominated the market with the largest revenue share of 46.1% in 2024, driven by the widespread availability of organic products, attractive in-store displays, and the convenience of one-stop shopping for health-conscious consumers.

The e-commerce segment is expected to witness the fastest CAGR of 21.2% from 2025 to 2032, fueled by the rapid growth of online platforms, direct-to-consumer brands, subscription services, and personalized product recommendations. Increasing smartphone penetration, digital marketing campaigns, and the convenience of doorstep delivery contribute to the accelerating growth of e-commerce as a preferred distribution channel.

• By Consumer

On the basis of consumer, the Organic Personal Care and Cosmetic Products Market is segmented into men and women. The women’s segment dominated the market with the largest revenue share of 53.5% in 2024, driven by higher adoption of skincare, hair care, and cosmetic products among female consumers, along with increased awareness of organic and sustainable personal care options.

The men’s segment is expected to witness the fastest CAGR of 18.7% from 2025 to 2032, fueled by the rising demand for organic grooming products, including hair care, beard oils, and skincare solutions tailored for male consumers. Marketing campaigns targeting men’s personal care and the growing acceptance of grooming routines among male consumers are accelerating growth in this segment.

Organic Personal Care and Cosmetic Products Market Regional Analysis

- Europe dominated the Organic Personal Care and Cosmetic Products Market with the largest revenue share of 34% in 2024, driven by rising consumer awareness of organic and natural personal care products, increasing disposable incomes, and a strong preference for chemical-free, sustainable alternatives.

- Consumers in the region highly value product safety, efficacy, and eco-friendly formulations, with a growing demand for certified organic skincare, hair care, and cosmetic products. Health-conscious lifestyles and wellness trends further encourage the adoption of natural personal care routines.

- This widespread adoption is supported by a well-established retail infrastructure, including supermarkets, specialty stores, and a rapidly expanding e-commerce presence. Additionally, strong marketing campaigns, influencer endorsements, and regulatory support for organic certifications have positioned North America as a key market, making it the preferred region for both established and emerging organic personal care brands.

U.S. Organic Personal Care and Cosmetic Products Market Insight

The U.S. market captured the largest revenue share of 81% in North America in 2024, driven by increasing consumer awareness about chemical-free, sustainable, and eco-friendly personal care products. Rising disposable incomes, health-conscious lifestyles, and the growing influence of wellness trends are encouraging adoption of organic skincare, haircare, and cosmetic products. The market growth is further supported by strong e-commerce penetration, influencer-led marketing, and certifications like USDA Organic, which build consumer trust. Both retail and online channels are witnessing a surge in demand for natural and vegan formulations, making the U.S. a dominant regional market for organic personal care.

Europe Organic Personal Care and Cosmetic Products Market Insight

The Europe market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent regulations regarding harmful chemicals, increasing consumer preference for natural products, and the rising adoption of sustainable lifestyles. Countries like Germany, France, and the U.K. are witnessing significant demand across skincare, haircare, and makeup products. The market is also buoyed by eco-conscious packaging, the growing popularity of vegan formulations, and the integration of organic certifications, which are influencing purchase decisions.

U.K. Organic Personal Care and Cosmetic Products Market Insight

The U.K. market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising awareness about the harmful effects of synthetic chemicals and a strong preference for sustainable, cruelty-free, and vegan personal care products. Consumers increasingly prioritize product transparency, certifications, and environmentally friendly packaging. The proliferation of e-commerce platforms, subscription-based organic boxes, and social media campaigns promoting wellness and natural beauty products are further boosting adoption in both urban and suburban areas.

Germany Organic Personal Care and Cosmetic Products Market Insight

The Germany market is expected to expand at a considerable CAGR, supported by strong regulatory frameworks, high consumer awareness, and a preference for premium organic skincare, haircare, and cosmetic products. German consumers emphasize product efficacy, safety, and sustainability, driving innovation in natural formulations and eco-friendly packaging. A mature retail infrastructure, combined with growing online sales, is enabling greater accessibility to organic personal care products. Additionally, government incentives and campaigns promoting sustainable consumption further encourage adoption.

Asia-Pacific Organic Personal Care and Cosmetic Products Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR of 24% during the forecast period, fueled by rising disposable incomes, urbanization, and increasing health and wellness awareness in countries such as China, Japan, and India. Growing concerns about synthetic chemicals, rising interest in natural ingredients, and expanding e-commerce platforms are driving adoption. Moreover, local manufacturing of organic personal care products and government initiatives promoting safety and sustainability are making these products more accessible to a wider population.

Japan Organic Personal Care and Cosmetic Products Market Insight

The Japan market is gaining momentum due to the country’s high focus on health, wellness, and anti-aging products. Consumers increasingly prefer organic and natural skincare and cosmetic solutions that combine efficacy with safety. Rising demand for vegan and chemical-free formulations, coupled with high disposable incomes and an aging population seeking gentle yet effective products, is propelling market growth. E-commerce adoption and product innovations with natural ingredients are further boosting sales across both retail and online channels.

China Organic Personal Care and Cosmetic Products Market Insight

The China market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, growing disposable incomes, and rising awareness of natural and chemical-free personal care. The expanding middle class, coupled with increasing demand for premium and imported organic products, is fueling growth in skincare, haircare, and cosmetics. Government regulations promoting safe and sustainable products, along with the proliferation of e-commerce and social media marketing, are enabling broader access and higher adoption rates across both urban and semi-urban regions.

Organic Personal Care and Cosmetic Products Market Share

The Organic Personal Care and Cosmetic Products industry is primarily led by well-established companies, including:

- L’Oréal (France)

- Unilever (U.K.)

- Procter & Gamble (U.S.)

- Beiersdorf (Germany)

- Johnson & Johnson (U.S.)

- The Estée Lauder Companies (U.S.)

- Shiseido (Japan)

- Himalaya Drug Company (India)

- The Honest Company (U.S.)

- Avon Products (U.S.)

- Dove (U.K.)

- Burt’s Bees (U.S.)

- Tata Harper (U.S.)

- Weleda (Switzerland)

- Cosmax (South Korea)

- Amway (U.S.)

- Innisfree (South Korea)

- Forest Essentials (India)

- Herbivore Botanicals (U.S.)

- Clarins (France)

What are the Recent Developments in Organic Personal Care and Cosmetic Products Market?

- In April 2023, L’Oréal Group, a global leader in beauty and personal care, launched a strategic initiative in South Africa to expand its organic personal care and cosmetic product offerings. The initiative focuses on introducing chemical-free skincare and haircare solutions tailored to the unique preferences and environmental conditions of the local market. By leveraging its global expertise in R&D and sustainable formulations, L’Oréal aims to strengthen its presence in the rapidly growing organic personal care segment in Africa while promoting eco-friendly and health-conscious beauty solutions.

- In March 2023, The Honest Company, a U.S.-based brand, introduced a new line of organic personal care products specifically designed for children and sensitive skin. The launch includes sulfate-free shampoos, plant-based body washes, and naturally derived lotions. This development underscores the company’s commitment to producing safe, non-toxic formulations while addressing the growing consumer demand for clean, environmentally responsible personal care products.

- In March 2023, Shiseido Co., Ltd. successfully expanded its organic skincare portfolio in India, targeting urban consumers seeking chemical-free, high-performance products. The initiative emphasizes sustainable sourcing of ingredients and eco-friendly packaging. By combining traditional Japanese skincare practices with natural, organic formulations, Shiseido is meeting the rising consumer demand for effective yet safe beauty solutions, further establishing its footprint in the Asia-Pacific organic personal care market.

- In February 2023, Beiersdorf AG, a leading global skincare company, announced a strategic partnership with local organic farms in Germany to source sustainably grown ingredients for its Nivea Naturals product line. The collaboration aims to enhance transparency, sustainability, and product efficacy while supporting the local economy. This initiative highlights Beiersdorf’s commitment to sustainable innovation and expanding the organic personal care segment in Europe.

- In January 2023, Johnson & Johnson unveiled its new line of plant-based, toxin-free skincare products under the Neutrogena Naturals brand at the International Beauty Expo 2023. The products, including moisturizers, facial cleansers, and serums, are designed for eco-conscious consumers seeking high-quality organic formulations. This launch reinforces Johnson & Johnson’s focus on integrating sustainability, safety, and consumer wellness into its global organic personal care and cosmetic portfolio.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.