Global Organic Personal Care Products Market

Market Size in USD Billion

CAGR :

%

USD

22.01 Billion

USD

49.10 Billion

2024

2032

USD

22.01 Billion

USD

49.10 Billion

2024

2032

| 2025 –2032 | |

| USD 22.01 Billion | |

| USD 49.10 Billion | |

|

|

|

|

Organic Personal Care Products Market Size

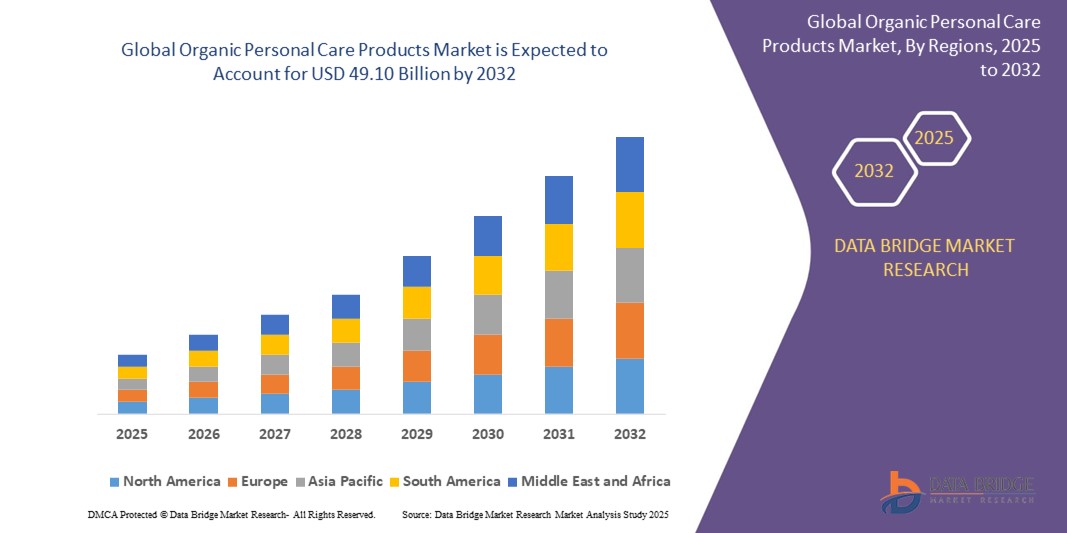

- The global organic personal care products market size was valued at USD 22.01 billion in 2024 and is expected to reach USD 49.10 billion by 2032, at a CAGR of 10.55% during the forecast period

- The market growth is driven by increasing consumer awareness of sustainable and chemical-free products, growing demand for eco-friendly and natural ingredients, and rising preferences for organic certifications in personal care products

- In addition, heightened health consciousness and environmental concerns are pushing consumers toward organic personal care solutions, significantly boosting market expansion

Organic Personal Care Products Market Analysis

- Organic personal care products, made from natural and sustainably sourced ingredients, are gaining traction due to their perceived safety, eco-friendliness, and alignment with wellness trends in both male and female consumer segments

- The surge in demand is fueled by growing awareness of the harmful effects of synthetic chemicals, a shift toward sustainable lifestyles, and the convenience of online purchasing through e-commerce platforms

- Europe dominated the organic personal care products market with the largest revenue share of 38.5% in 2024, driven by stringent regulations on synthetic ingredients, high consumer awareness, and a strong presence of organic beauty brands. Countries such as Germany, France, and the U.K. are leading due to widespread adoption of organic certifications and eco-conscious consumer behavior

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, propelled by increasing urbanization, rising disposable incomes, and growing demand for natural and organic products in countries such as China, India, and Japan

- The skin care segment dominated the largest market revenue share of 50.5% in 2023, driven by growing consumer preference for chemical-free products and heightened awareness of skin health

Report Scope and Organic Personal Care Products Market Segmentation

|

Attributes |

Organic Personal Care Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Organic Personal Care Products Market Trends

“Increasing Integration of AI and Big Data Analytics”

- The global organic personal care products market is experiencing a notable trend of incorporating Artificial Intelligence (AI) and Big Data analytics

- These technologies facilitate advanced consumer data processing, offering deeper insights into purchasing patterns, product preferences, and personalized marketing strategies

- AI-driven solutions enable proactive consumer engagement, predicting trends and recommending tailored products based on individual skin types, hair conditions, or lifestyle preferences

- For instances, companies are leveraging AI platforms to analyze consumer feedback and social media trends to develop customized organic skincare or haircare formulations, or to optimize e-commerce recommendations

- This trend enhances the appeal of organic personal care products, making them more desirable for both individual buyers and retailers

- AI algorithms can evaluate vast datasets, including consumer reviews, ingredient preferences, and environmental impact concerns, to refine product development and marketing.

Organic Personal Care Products Market Dynamics

Driver

“Rising Demand for Sustainable and Natural Products”

- Growing consumer demand for eco-friendly, chemical-free, and sustainable personal care products, such as organic shampoos, skincare, and oral care, is a key driver for the market

- Organic personal care products enhance consumer trust by offering transparency in ingredient sourcing, cruelty-free certifications, and environmentally friendly packaging

- Government regulations, particularly in Europe with stringent organic certification standards, are supporting the widespread adoption of organic products

- The rise of e-commerce and social media influence, coupled with advancements in supply chain transparency, further enables market growth by providing easier access to organic products

- Brands are increasingly offering certified organic products across categories such as hair care, skin care, and men’s grooming to meet consumer expectations and enhance brand value

Restraint/Challenge

“High Cost of Production and Consumer Privacy Concerns”

- The significant initial investment required for sourcing organic ingredients, obtaining certifications, and sustainable packaging can be a barrier to adoption, particularly in price-sensitive markets

- Developing and scaling organic personal care product lines is complex and costly due to stringent quality standards and limited raw material availability

- In addition, data security and privacy concerns pose a major challenge. E-commerce platforms and AI-driven marketing collect vast amounts of consumer data, raising concerns about potential breaches, misuse of information, and compliance with data protection regulations such as GDPR

- The fragmented regulatory landscape across countries regarding organic certifications, labeling, and data usage complicates operations for global manufacturers and retailers

- These factors can deter potential buyers and limit market expansion, especially in regions with high awareness of data privacy or where cost sensitivity is prevalent

Organic Personal Care Products market Scope

The market is segmented on the basis of type, price range, distribution channel, and consumer

- By Type

On the basis of type, the organic personal care products market is segmented into hair care, skin care, lip care, body care, oral care, and men's grooming. The skin care segment dominated the largest market revenue share of 50.5% in 2023, driven by growing consumer preference for chemical-free products and heightened awareness of skin health. Demand for anti-aging, hydration, and skin protection products, particularly among women, fuels this segment's dominance.

The hair care segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for natural alternatives to conventional hair treatment solutions. Consumers are seeking organic shampoos, conditioners, and treatments with herbal and ayurvedic ingredients, particularly in regions such as Asia-Pacific, where traditional knowledge of natural ingredients is strong.

- By Price Range

On the basis of price range, the organic personal care products market is segmented into economy, mid-range, and premium price ranges. The mid-range segment held the largest market revenue share of approximately 45% in 2023, as it balances affordability with quality, appealing to a broad consumer base, including budget-conscious buyers seeking organic options. Brands are introducing affordable organic cleansers, moisturizers, and lip balms to cater to this segment.

The premium segment is anticipated to experience the fastest growth rate from 2025 to 2032, with a CAGR of around 10.5%. This growth is driven by rising disposable incomes, particularly in Asia-Pacific, and increasing consumer willingness to invest in high-quality, sustainable, and ethically sourced products. Premium products often feature advanced formulations and innovative packaging, enhancing their appeal.

- By Distribution Channel

On the basis of distribution channel, the organic personal care products market is segmented into hypermarkets/supermarkets, e-commerce, retail stores, health and beauty stores, direct selling, convenience stores, departmental stores, and others. The hypermarkets/supermarkets segment dominated with a 43.6% market share in 2023, owing to their wide product range, accessibility, and in-person shopping experience. Major chains such as Walmart and Tesco have expanded organic product offerings, boosting consumer access.

The e-commerce segment is expected to witness the fastest growth from 2025 to 2032, with a CAGR of 11.2%. Rising smartphone penetration, growing internet access, and the convenience of online shopping, coupled with targeted digital marketing and influencer partnerships, are driving rapid adoption, particularly in Asia-Pacific.

- By Consumer

On the basis of consumer, the organic personal care products market is segmented into men and women. The women segment dominated with a 76.3% market share in 2023, driven by greater interest in skincare and personal care routines. Women are more likely to invest in organic products for anti-aging, hydration, and skin protection, supported by evolving societal norms and self-care trends.

The men segment is anticipated to grow rapidly from 2025 to 2032, with a CAGR of 10.1%. Increasing awareness of grooming and the introduction of organic products tailored for men, such as beard care, face washes, and post-shave solutions, are driving demand. Brands such as Lyonsleaf and Bulldog Skincare are catering to this growing market.

Organic Personal Care Products Market Regional Analysis

- Europe dominated the organic personal care products market with the largest revenue share of 38.5% in 2024, driven by stringent regulations on synthetic ingredients, high consumer awareness, and a strong presence of organic beauty brands. Countries such as Germany, France, and the U.K. are leading due to widespread adoption of organic certifications and eco-conscious consumer behavior

- Consumers prioritize products free from synthetic chemicals, parabens, and sulfates, seeking natural alternatives that promote skin health and eco-friendly practices

- Growth is supported by innovations in product formulations, such as botanical extracts and sustainable packaging, alongside rising demand in both retail and e-commerce channels

U.S. Organic Personal Care Products Market Insight

The U.S. organic personal care products market is expected to witness significant growth, fueled by strong consumer demand for natural and chemical-free products, driven by heightened awareness of health risks associated with synthetic ingredients. The trend toward clean beauty and sustainable consumption, coupled with robust e-commerce growth and widespread availability in hypermarkets/supermarkets, boosts market expansion. Major brands are launching organic skincare and haircare lines, complementing both retail and direct-to-consumer sales, creating a diverse product ecosystem.

Europe Organic Personal Care Products Market Insight

The Europe dominates the global organic personal care products market with a revenue share of 39% in 2024, driven by widespread adoption of healthy lifestyles and consumer willingness to invest in organic, animal-friendly, and sustainable products. The region’s growth is supported by stringent regulations on product ingredients and a focus on eco-conscious beauty solutions. Countries such as Germany, France, and the U.K. show significant uptake due to rising environmental concerns and demand for natural skincare and haircare products, with both retail and e-commerce channels thriving.

U.K. Organic Personal Care Products Market Insight

The U.K. market is poised for rapid growth within Europe, driven by increasing demand for organic personal care products that enhance skin health and align with environmental consciousness. Consumers prioritize natural ingredients such as aloe vera and essential oils for skincare and haircare, with a focus on reducing chemical exposure. The growth is supported by the availability of products in supermarkets/hypermarkets, which held a 43.9% share in 2021, and a rapidly expanding e-commerce sector, offering convenience and competitive pricing. Evolving regulations promoting clean beauty further encourage adoption.

Germany Organic Personal Care Products Market Insight

Germany is expected to witness significant growth in the organic personal care products market, attributed to its advanced cosmetics industry and high consumer focus on health and sustainability. German consumers prefer products with natural, plant-based ingredients that offer skin-friendly benefits and align with eco-friendly practices. The integration of organic products in premium brands and the growing popularity of e-commerce platforms, alongside traditional retail channels such as hypermarkets, support sustained market growth. The country’s emphasis on innovation and quality further drives demand.

Asia-Pacific Organic Personal Care Products Market Insight

The Asia-Pacific region is the fastest-growing market for organic personal care products, with a projected CAGR of 9.7% through 2032, driven by expanding disposable incomes, rapid urbanization, and increasing consumer awareness of health and environmental benefits. Countries such as China, India, and Japan are leading the charge, with demand for organic skincare, haircare, and oral care products surging. Government initiatives promoting clean beauty and sustainability, coupled with the rise of e-commerce platforms such as Tmall and JD.com, enhance market accessibility and growth.

Japan Organic Personal Care Products Market Insight

Japan’s organic personal care products market is experiencing rapid growth, driven by strong consumer preference for high-quality, natural products that prioritize safety and long-term skin benefits. The cultural emphasis on aesthetic minimalism and traditional ingredients such as rice bran, camellia oil, and seaweed fuels demand for organic skincare and haircare. The presence of major brands and the integration of organic products in OEM offerings, combined with growing aftermarket demand, accelerate market penetration. E-commerce and department stores further enhance accessibility.

China Organic Personal Care Products Market Insight

China holds the largest share of the Asia-Pacific organic personal care products market, propelled by rapid urbanization, rising vehicle ownership, and increasing demand for natural and sustainable products. The growing middle class and focus on health-conscious lifestyles drive the adoption of organic skincare, haircare, and oral care products. Strong domestic manufacturing capabilities and competitive pricing, alongside the expansion of e-commerce platforms and social commerce, enhance market accessibility. Government support for clean beauty initiatives further boosts growth.

Organic Personal Care Products Market Share

The organic personal care products industry is primarily led by well-established companies, including:

- AVEDA CORP (U.S.)

- THE BODY SHOP INTERNATIONAL LIMITED (U.K.)

- Hain Celestial (U.S.)

- Yves Rocher (France)

- Amway Corp. (U.S.)

- bareminerals (U.S.)

- Arbonne International LLC (U.S.)

- L'Occitane (France)

- L'Oréal (France)

- Korres S.A. (Greece)

- Shiseido Company Limited (Japan)

- The Clorox Company (U.S.)

- Beiersdorf AG (Germany)

- Bio Veda Action Research Co. (India)

- The Estée Lauder Companies (U.S.)

- Oriflame Cosmetics AG (Switzerland)

- Coty Inc. (U.S.)

What are the Recent Developments in Global Organic Personal Care Products Market?

- In May 2024, Eminence Organic Skin Care introduced its Charcoal & Black Seed Collection, a trio of products designed to purify and rejuvenate the skin. The range includes the Charcoal & Black Seed Clay Masque for deep cleansing, the Clarifying Oil to balance sebum and reduce dark spots, and the Pro Desincrustation Gel, a professional-only formula to aid extractions. Infused with binchotan charcoal and antioxidant-rich black seed extract, the collection targets congested pores, dullness, and excess oil—offering a natural solution for clearer, healthier-looking skin

- In October 2023, Georgia May Jagger debuted May Botanicals, an organic skincare brand crafted to bridge the gap between clean beauty and high-performance results. The five-product line—featuring a cleanser, moisturiser, spot solution, balm, and kelp sheet mask—is formulated with ethically sourced, natural ingredients and housed in recycled packaging. Inspired by her personal skincare journey and a desire for simplicity, Jagger designed the range to be effective, sustainable, and visually appealing. A portion of proceeds supports WWF, and the packaging features artwork by designer Matty Bovan, reinforcing the brand’s eco-conscious and artistic ethos

- In October 2023, Sky Organics unveiled a new lineup of organic skincare innovations, reinforcing its dedication to sustainability and clean beauty. The expanded range includes thoughtfully crafted oil serums, balms, and body butters, formulated with potent botanical ingredients like rosehip, turmeric, moringa, and prickly pear. These products aim to deliver deep hydration, skin rejuvenation, and a radiant glow—meeting the rising demand for nourishing, moisturizing organic skincare. As a Certified B Corporation, Sky Organics continues to prioritize eco-conscious packaging and ethical sourcing in its mission to make effective, planet-friendly beauty accessible to all

- In May 2023, Amway’s Artistry Skin Nutrition™ line received The Skin Cancer Foundation Seal of Recommendation for four of its SPF day lotions, including the Hydrating Day Lotion SPF 30 and Renewing Reactivation Day Cream SPF 30. This prestigious recognition affirms the products’ efficacy and safety in sun protection, reinforcing Amway’s credibility in the organic personal care market. The award followed Amway’s membership in the Foundation’s Corporate Council and highlights the brand’s commitment to healthy beauty through science-backed skincare

- In January 2022, Good Glamm Group, a leading South Asian content-to-commerce conglomerate, acquired a majority stake in Organic Harvest, an Ecocert-certified Indian beauty and personal care brand. This strategic move marked Good Glamm’s official foray into the organic beauty and personal care (BPC) segment. With plans to invest and furthermore, the acquisition enables Organic Harvest to leverage Good Glamm’s expansive digital ecosystem, influencer marketing capabilities, and offline retail network. The partnership aims to accelerate product innovation and scale distribution, aligning with the Group’s vision to build a robust portfolio of clean, sustainable beauty brands

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL ORGANIC PERSONAL CARE PRODUCTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL ORGANIC PERSONAL CARE PRODUCTS MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL ORGANIC PERSONAL CARE PRODUCTS MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 CONSUMER BUYING BEHAVIOUR

5.2 FACTORS AFFECTING BUYING DECISION

5.3 PRODUCT ADOPTION SCENARIO

5.4 PORTER’S FIVE FORCES

5.5 REGULATION COVERAGE

5.6 RAW MATERIAL SOURCING ANALYSIS

5.7 IMPORT EXPORT SCENARIO

6 PRODUCTION CAPACITY OUTLOOK

7 PRICING ANALYSIS

8 BRAND OUTLOOK

8.1 BRAND COMPARATIVE ANALYSIS

8.2 PRODUCT VS BRAND OVERVIEW

9 IMPACT OF ECONOMIC SLOWDOWN

9.1 IMPACT ON PRICES

9.2 IMPACT ON SUPPLY CHAIN

9.3 IMPACT ON SHIPMENT

9.4 IMPACT ON DEMAND

9.5 IMPACT ON STRATEGIC DECISIONS

10 SUPPLY CHAIN ANALYSIS

10.1 OVERVIEW

10.2 LOGISTIC COST SCENARIO

10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

11 GLOBAL ORGANIC PERSONAL CARE PRODUCTS MARKET, BY PRODUCT, 2018-2032 (USD MILLION)

11.1 OVERVIEW

11.2 FACIAL CARE

11.2.1 FACE CREAMS/MOISTURIZERS

11.2.2 FACE SERUM

11.2.3 FACE SCRUBS

11.2.4 FACE POWDERS

11.2.5 FACE CLEANSERS

11.2.6 FACE TONERS

11.2.7 FACE MASKS

11.2.7.1. SHEET MASK

11.2.7.2. PEEL OFF MASK

11.2.7.3. CREAM MASK

11.2.7.4. CLAY MASK

11.2.7.5. CHARCOAL MASK

11.2.7.6. SLEEP MASK

11.2.7.7. VITAMIN C(BRIGHTENING) MASK

11.2.7.8. GEL MASK

11.2.7.9. OTHERS

11.2.8 SUNSCREEN

11.2.8.1. LOW SPF (SPF 15-30)

11.2.8.2. MODERATE SPF (SPF 30-50)

11.2.8.3. HIGH SPF (SPF 50+)

11.2.9 SHAVING LOTIONS AND CREAMS

11.2.10 BEARD CARE PRODUCTS

11.2.10.1. BEARD WASH

11.2.10.2. BEARD OIL

11.2.10.3. BEARD CONDITIONER

11.2.10.4. BEARD SOFTENER

11.2.10.5. BEARD WAX

11.2.10.6. BEARD SHAPING GEL

11.2.10.7. BEARD TRIMMER

11.2.10.8. BEARD SCRUB

11.2.10.9. OTHERS

11.2.11 OTHERS

11.3 LIP CARE

11.3.1 LIP BALMS

11.3.1.1. SOLID CREAM LIP BALM

11.3.1.2. LIQUID GEL LIP BALM

11.3.2 LIP SCRUBS

11.3.3 LIP MASKS

11.3.4 LIP GLOSS

11.3.4.1. GLOSSY

11.3.4.2. MATTE

11.3.4.3. GLITTER

11.3.4.4. OTHERS

11.3.5 LIP PLUMPERS

11.3.6 LIP STAINS

11.3.7 OTHERS

11.4 BODY CARE

11.4.1 BODY LOTIONS AND MOISTURIZER

11.4.2 BODY SCRUBS

11.4.2.1. EXFOLIATING BODY SCRUBS

11.4.2.2. MOISTURIZING BODY SCRUBS

11.4.2.3. DETOXIFYING BODY SCRUBS

11.4.2.4. WHITENING/BRIGHTENING BODY SCRUBS

11.4.2.5. OTHERS

11.4.3 BODY SERUMS

11.4.4 BODY OILS

11.4.5 BODY TALC AND POWDERS

11.4.6 BODY BUTTERS AND CREAMS

11.4.7 BODY SHAMPOO / WASH / GELS

11.4.8 OTHERS

11.5 HAIR CARE

11.5.1 HAIR OILS

11.5.2 SHAMPOO

11.5.2.1. SHAMPOO, BY TYPE

11.5.2.1.1. STANDARD SHAMPOO

11.5.2.1.2. CLARIFYING SHAMPOO

11.5.2.1.3. COSMETIC SHAMPOO

11.5.2.1.4. 2-IN-1 SHAMPOO

11.5.2.1.5. ANTI-DANDRUFF

11.5.2.1.6. MEDICATED SHAMPOO

11.5.2.1.7. DRY SHAMPOO

11.5.2.1.8. OTHERS

11.5.2.2. HAIR SHAMPOO, BY NATURE

11.5.2.2.1. ORGANIC

11.5.2.2.2. CONVENTIONAL

11.5.2.2.3. HAIR SHAMPOO, BY FORM

11.5.2.2.4. SOLID

11.5.2.2.5. LIQUID

11.5.2.3. HAIR SHAMPOO, BY HAIR TYPE

11.5.2.3.1. NORMAL HAIR

11.5.2.3.2. DRY HAIR

11.5.2.3.3. OILY HAIR

11.5.2.3.4. DAMAGED HAIR

11.5.2.3.5. COLORED HAIR

11.5.2.3.6. OTHERS

11.5.3 CONDITIONERS

11.5.4 HAIR MASKS

11.5.5 HAIR COLORS

11.5.6 HAIR PERFUMES

11.5.7 HAIR STYLING SPRAYS

11.5.8 OTHERS

11.6 NAIL CARE

11.6.1 CUTICLE OILS

11.6.2 NAIL CREAMS

11.6.3 NAIL PAINTS

11.6.4 NAIL PAINT REMOVERS

11.6.5 OTHERS

11.7 EYE CARE

11.7.1 EYE CARE, BY PRODUCT TYPE

11.7.1.1. EYE SERUM

11.7.1.2. EYE CREAMS

11.7.1.3. EYE MASKS & PATCHES

11.7.1.4. EYE ROLL-ONS

11.7.1.5. EYE MAKEUP REMOVERS

11.7.1.6. OTHERS

11.7.2 EYE CARE, BY TARGET SKIN

11.7.2.1. DARK CIRCLES

11.7.2.2. PUFFINESS

11.7.2.3. WRINKLES & FINE LINES

11.7.2.4. DRYNESS

11.7.2.5. GENERAL EYE FATIGUE

11.7.2.6. OTHERS

11.7.3 EYE CARE, BY APPLICATION

11.7.3.1. TOPICAL

11.7.3.2. ROLL-ON

11.7.3.3. PADS AND MASKS

11.7.3.4. SPRAYS

11.7.3.5. OTHERS

11.8 PERSONAL HYGIENE

11.8.1 WIPES

11.8.1.1. WET FACIAL WIPES

11.8.1.2. DRY FACIAL WIPES

11.8.2 HAND SANITIZERS

11.8.3 ADULT DIAPERS

11.8.3.1. ADULT DIAPERS, BY TYPE

11.8.3.1.1. OVERNIGHT TAPE-TAB STYLE DIAPERS

11.8.3.1.2. PULL-UPS

11.8.3.1.2.1 STANDARD PULL-UPS

11.8.3.1.2.2 REFASTENABLE TABS

11.8.3.1.3. CLOTH DIAPERS

11.8.3.1.4. DISPOSABLE DIAPERS PULL ON STYLE

11.8.3.1.5. DIAPERS WITH TABS

11.8.3.1.6. PLASTIC BACKED ADULT DIAPERS

11.8.3.1.7. UNDERPADS

11.8.3.1.8. ADULT BREIFS

11.8.3.1.8.1 REFASTENABLE

11.8.3.1.8.2 NON-REFASTEN TABS.

11.8.3.1.9. PANT LINERS

11.8.3.1.10. SWIM DIAPERS

11.8.3.1.11. OTHERS

11.8.3.2. ADULT DIAPERS, BY ABSORBENCY LEVEL

11.8.3.2.1. LOW

11.8.3.2.2. MEDIUM

11.8.3.2.3. HEAVY

11.8.3.2.4. EXTRA HEAVY

11.8.4 HAND WASH

11.8.4.1. LIQUID

11.8.4.2. DRY

11.8.5 TISSUES

11.8.6 DISINFECTANTS

11.8.7 ANTI-SEPTICS

11.8.8 DISPOSAL CONTAINERS

11.8.9 TOOTHPASTE

11.8.10 MOUTHWASH

11.8.11 OTHERS

11.9 FRAGRANCES

11.9.1 PERFUMES

11.9.1.1. PERFUMES, BY TYPE

11.9.1.1.1. EXTRAIT DE PARFUM

11.9.1.1.2. EAU DE PERFUME

11.9.1.1.3. EAU DE TOILETTE

11.9.1.1.4. EAU DE COLOGNE

11.9.1.1.5. EAU FRAICHE

11.9.1.1.6. OTHERS

11.9.1.2. PERFUMES, BY FRAGRANCE TYPE

11.9.1.2.1. FRUITY

11.9.1.2.2. FLORAL

11.9.1.2.3. HERBAL AND BOTANICAL

11.9.1.2.4. SWEET AND DESSERT-INSPIRED

11.9.1.2.5. OCEANIC AND AQUATIC

11.9.1.2.6. WOODY

11.9.1.2.7. SPICY

11.9.1.2.8. THERAPEUTIC AND AROMATHERAPY

11.9.1.2.9. SEASONAL FRAGRANCES

11.9.1.2.10. OTHERS

11.9.1.3. PERFUME, BY INGREDIENT

11.9.1.3.1. NATURAL

11.9.1.3.2. SYNTHETIC

11.9.2 DEODORANTS, BY TYPE

11.9.2.1. AEROSOL/SPRAY DEODORANTS

11.9.2.2. ROLL-ON DEODORANTS

11.9.2.3. GEL DEODORANT

11.9.2.4. INVISIBLE SOLID DEODORANT

11.9.2.5. SOLID DEODORANT

11.9.2.6. CRYSTAL DEODORANT

11.9.2.7. WIPES DEODORANT

11.9.2.8. ANTIPERSPIRANT DEODORANT

11.9.2.9. OTHERS

11.1 OTHERS

12 GLOBAL ORGANIC PERSONAL CARE PRODUCTS MARKET, BY SKIN TYPE, 2018-2032 (USD MILLION)

12.1 OVERVIEW

12.2 NORMAL SKIN

12.3 SENSITIVE SKIN

12.4 INFANT SKIN

12.5 DRY SKIN

12.6 OILY SKIN

12.7 MULTI-SKIN TYPE

12.8 OTHERS

13 GLOBAL ORGANIC PERSONAL CARE PRODUCTS MARKET, BY FRAGRANCE TYPE, 2018-2032 (USD MILLION)

13.1 OVERVIEW

13.2 FRUITY

13.3 FLORAL

13.4 HERBAL AND BOTANICAL

13.5 SWEET AND DESSERT-INSPIRED

13.6 OCEANIC AND AQUATIC

13.7 WOODY

13.8 SPICY

13.9 THERAPEUTIC AND AROMATHERAPY

13.1 SEASONAL FRAGRANCES

13.11 OTHERS

14 GLOBAL ORGANIC PERSONAL CARE PRODUCTS MARKET, BY CATEGORY, 2018-2032 (USD MILLION)

14.1 OVERVIEW

14.2 MASS

14.3 PREMIUM

14.4 LUXURY

15 GLOBAL ORGANIC PERSONAL CARE PRODUCTS MARKET, BY PACKAGING TYPE, 2018-2032 (USD MILLION

15.1 OVERVIEW

15.2 TUBES

15.3 JARS

15.4 BOTTLES

15.4.1 GLASS

15.4.2 PLASTIC

15.5 AIRLESS PUMPS

15.6 POUCHES

15.7 SACHETS

15.8 CANS

15.9 GLASS CONTAINERS

15.1 DISPENSERS

15.11 STICKS

15.12 OTHERS

16 GLOBAL ORGANIC PERSONAL CARE PRODUCTS MARKET, BY FUNCTION, 2018-2032 (USD MILLION

16.1 OVERVIEW

16.2 STANDARD

16.3 ANTI AGEING

16.4 ANTI BACTERIAL

16.5 SKIN WHITENING

16.6 SOOTHING & REPAIR

16.7 ANTI POLLUTION

16.8 ANTI-ACNE

16.9 ANTI-SCARS

16.1 MULTI-FUNCTIONAL

16.11 OTHERS

17 GLOBAL ORGANIC PERSONAL CARE PRODUCTS MARKET, BY END USER, 2018-2032 (USD MILLION)

17.1 OVERVIEW

17.2 MEN

17.3 WOMEN

17.4 KIDS

17.5 UNISEX

18 GLOBAL ORGANIC PERSONAL CARE PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD MILLION)

18.1 OVERVIEW

18.2 OFFLINE

18.2.1 HYPERMARKETS / DEPARTMENT STORES / SUPERMARKETS

18.2.2 SPECIALTY STORES

18.2.3 CONVENIENCE STORES

18.2.4 BRAND OUTLETS

18.2.4.1. MONO-BRAND OUTLETS

18.2.4.2. MULTI-BRAND OUTLETS

18.2.5 MOM AND POP STORES

18.2.6 DISCOUNT STORES

18.2.7 DOLLAR STORES

18.2.8 TRAVEL RETAIL

18.2.9 SPORTS STORES

18.2.10 OTHERS

18.3 ONLINE

18.3.1 E-COMMERCE

18.3.2 COMPANY OWNED WEBSITES

19 GLOBAL ORGANIC PERSONAL CARE PRODUCTS MARKET, BY GEOGRAPHY, 2018-2032 (USD MILLION)

GLOBAL ORGANIC PERSONAL CARE PRODUCTS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

19.1 NORTH AMERICA

19.1.1 U.S.

19.1.2 CANADA

19.1.3 MEXICO

19.2 EUROPE

19.2.1 GERMANY

19.2.2 U.K.

19.2.3 ITALY

19.2.4 FRANCE

19.2.5 SPAIN

19.2.6 RUSSIA

19.2.7 SWITZERLAND

19.2.8 TURKEY

19.2.9 BELGIUM

19.2.10 NETHERLANDS

19.2.11 REST OF EUROPE

19.3 ASIA-PACIFIC

19.3.1 JAPAN

19.3.2 CHINA

19.3.3 SOUTH KOREA

19.3.4 INDIA

19.3.5 SINGAPORE

19.3.6 THAILAND

19.3.7 INDONESIA

19.3.8 MALAYSIA

19.3.9 PHILIPPINES

19.3.10 AUSTRALIA & NEW ZEALAND

19.3.11 REST OF ASIA-PACIFIC

19.4 SOUTH AMERICA

19.4.1 BRAZIL

19.4.2 ARGENTINA

19.4.3 REST OF SOUTH AMERICA

19.5 MIDDLE EAST AND AFRICA

19.5.1 SOUTH AFRICA

19.5.2 EGYPT

19.5.3 SAUDI ARABIA

19.5.4 UNITED ARAB EMIRATES

19.5.5 ISRAEL

19.5.6 REST OF MIDDLE EAST AND AFRICA

20 GLOBAL ORGANIC PERSONAL CARE PRODUCTS MARKET, COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: GLOBAL

20.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

20.3 COMPANY SHARE ANALYSIS: EUROPE

20.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

20.5 MERGERS AND ACQUISITIONS

20.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

20.7 EXPANSIONS

20.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

21 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

22 GLOBAL ORGANIC PERSONAL CARE PRODUCTS MARKET - COMPANY PROFILES

22.1 L'ORÉAL GROUP

22.1.1 COMPANY SNAPSHOT

22.1.2 REVENUE ANALYSIS

22.1.3 PRODUCT PORTFOLIO

22.1.4 RECENT UPDATES

22.2 UNILEVER PLC

22.2.1 COMPANY SNAPSHOT

22.2.2 REVENUE ANALYSIS

22.2.3 PRODUCT PORTFOLIO

22.2.4 RECENT UPDATES

22.3 PROCTER & GAMBLE

22.3.1 COMPANY SNAPSHOT

22.3.2 REVENUE ANALYSIS

22.3.3 PRODUCT PORTFOLIO

22.3.4 RECENT UPDATES

22.4 KAO CORPORATION

22.4.1 COMPANY SNAPSHOT

22.4.2 REVENUE ANALYSIS

22.4.3 PRODUCT PORTFOLIO

22.4.4 RECENT UPDATES

22.5 JOHNSON & JOHNSON

22.5.1 COMPANY SNAPSHOT

22.5.2 REVENUE ANALYSIS

22.5.3 PRODUCT PORTFOLIO

22.5.4 RECENT UPDATES

22.6 CHURCH & DWIGHT CO., INC.

22.6.1 COMPANY SNAPSHOT

22.6.2 REVENUE ANALYSIS

22.6.3 PRODUCT PORTFOLIO

22.6.4 RECENT UPDATES

22.7 HENKEL AG & CO. KGAA

22.7.1 COMPANY SNAPSHOT

22.7.2 REVENUE ANALYSIS

22.7.3 PRODUCT PORTFOLIO

22.7.4 RECENT UPDATES

22.8 SHISEIDO COMPANY

22.8.1 COMPANY SNAPSHOT

22.8.2 REVENUE ANALYSIS

22.8.3 PRODUCT PORTFOLIO

22.8.4 RECENT UPDATES

22.9 COTY, INC.

22.9.1 COMPANY SNAPSHOT

22.9.2 REVENUE ANALYSIS

22.9.3 PRODUCT PORTFOLIO

22.9.4 RECENT UPDATES

22.1 BEIERSDORF AG

22.10.1 COMPANY SNAPSHOT

22.10.2 REVENUE ANALYSIS

22.10.3 PRODUCT PORTFOLIO

22.10.4 RECENT UPDATES

22.11 COLGATE-PALMOLIVE COMPANY

22.11.1 COMPANY SNAPSHOT

22.11.2 REVENUE ANALYSIS

22.11.3 PRODUCT PORTFOLIO

22.11.4 RECENT UPDATES

22.12 THE ESTEE LAUDER COMPANIES INC.

22.12.1 COMPANY SNAPSHOT

22.12.2 REVENUE ANALYSIS

22.12.3 PRODUCT PORTFOLIO

22.12.4 RECENT UPDATES

22.13 REVLON, INC.

22.13.1 COMPANY SNAPSHOT

22.13.2 REVENUE ANALYSIS

22.13.3 PRODUCT PORTFOLIO

22.13.4 RECENT UPDATES

22.14 KCWW (KIMBERLY-CLARK CORPORATION)

22.14.1 COMPANY SNAPSHOT

22.14.2 REVENUE ANALYSIS

22.14.3 PRODUCT PORTFOLIO

22.14.4 RECENT UPDATES

22.15 3M

22.15.1 COMPANY SNAPSHOT

22.15.2 REVENUE ANALYSIS

22.15.3 PRODUCT PORTFOLIO

22.15.4 RECENT UPDATES

22.16 RECKITT BENCKISER PLC

22.16.1 COMPANY SNAPSHOT

22.16.2 REVENUE ANALYSIS

22.16.3 PRODUCT PORTFOLIO

22.16.4 RECENT UPDATES

22.17 GUCCI

22.17.1 COMPANY SNAPSHOT

22.17.2 REVENUE ANALYSIS

22.17.3 PRODUCT PORTFOLIO

22.17.4 RECENT UPDATES

22.18 AVON PRODUCTS INC.

22.18.1 COMPANY SNAPSHOT

22.18.2 REVENUE ANALYSIS

22.18.3 PRODUCT PORTFOLIO

22.18.4 RECENT UPDATES

22.19 CLARINS

22.19.1 COMPANY SNAPSHOT

22.19.2 REVENUE ANALYSIS

22.19.3 PRODUCT PORTFOLIO

22.19.4 RECENT UPDATES

22.2 SULWAHSOO

22.20.1 COMPANY SNAPSHOT

22.20.2 REVENUE ANALYSIS

22.20.3 PRODUCT PORTFOLIO

22.20.4 RECENT UPDATES

22.21 THE BODY SHOP

22.21.1 COMPANY SNAPSHOT

22.21.2 REVENUE ANALYSIS

22.21.3 PRODUCT PORTFOLIO

22.21.4 RECENT UPDATES

22.22 CLINIQUE

22.22.1 COMPANY SNAPSHOT

22.22.2 REVENUE ANALYSIS

22.22.3 PRODUCT PORTFOLIO

22.22.4 RECENT UPDATES

22.23 GUERLAIN

22.23.1 COMPANY SNAPSHOT

22.23.2 REVENUE ANALYSIS

22.23.3 PRODUCT PORTFOLIO

22.23.4 RECENT UPDATES

22.24 CHANEL

22.24.1 COMPANY SNAPSHOT

22.24.2 REVENUE ANALYSIS

22.24.3 PRODUCT PORTFOLIO

22.24.4 RECENT UPDATES

22.25 NATURA & CO

22.25.1 COMPANY SNAPSHOT

22.25.2 REVENUE ANALYSIS

22.25.3 PRODUCT PORTFOLIO

22.25.4 RECENT UPDATES

22.26 AMOREPACIFIC CORPORATION

22.26.1 COMPANY SNAPSHOT

22.26.2 REVENUE ANALYSIS

22.26.3 PRODUCT PORTFOLIO

22.26.4 RECENT UPDATES

22.27 ORIFLAME COSMETICS GLOBAL SA

22.27.1 COMPANY SNAPSHOT

22.27.2 REVENUE ANALYSIS

22.27.3 PRODUCT PORTFOLIO

22.27.4 RECENT UPDATES

22.28 BLACKSTONE GROUP

22.28.1 COMPANY SNAPSHOT

22.28.2 REVENUE ANALYSIS

22.28.3 PRODUCT PORTFOLIO

22.28.4 RECENT UPDATES

22.29 GIORGIO ARMANI S.P.A.

22.29.1 COMPANY SNAPSHOT

22.29.2 REVENUE ANALYSIS

22.29.3 PRODUCT PORTFOLIO

22.29.4 RECENT UPDATES

22.3 DHC, INC

22.30.1 COMPANY SNAPSHOT

22.30.2 REVENUE ANALYSIS

22.30.3 PRODUCT PORTFOLIO

22.30.4 RECENT UPDATES

22.31 AMWAY

22.31.1 COMPANY SNAPSHOT

22.31.2 REVENUE ANALYSIS

22.31.3 PRODUCT PORTFOLIO

22.31.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

23 RELATED REPORTS

24 QUESTIONNAIRE

25 CONCLUSION

26 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.