Global Organic Tea Market

Market Size in USD Billion

CAGR :

%

USD

1.70 Billion

USD

2.83 Billion

2023

2031

USD

1.70 Billion

USD

2.83 Billion

2023

2031

| 2024 –2031 | |

| USD 1.70 Billion | |

| USD 2.83 Billion | |

|

|

|

|

Organic Tea Market Size

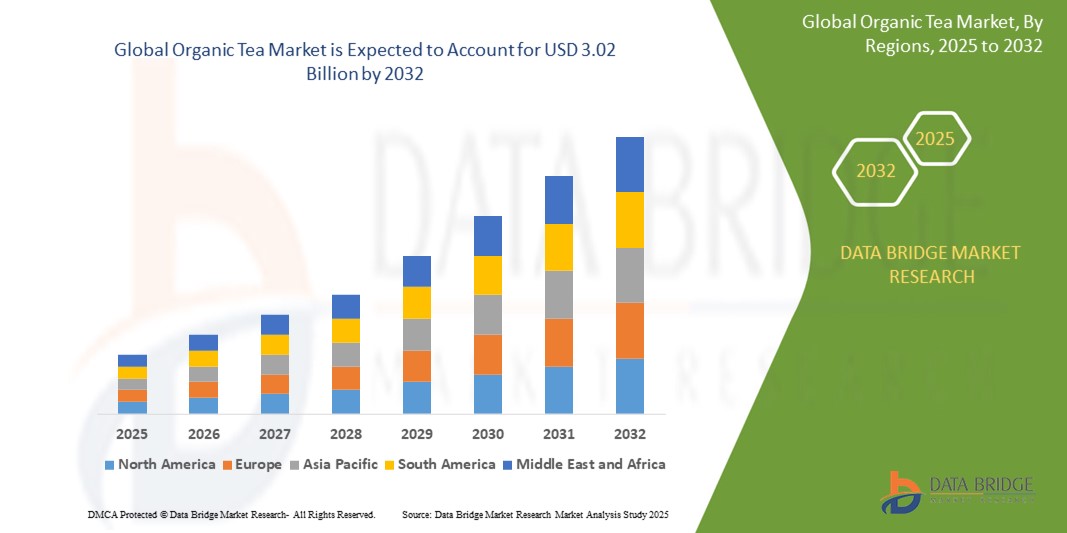

- The global organic tea market size was valued at USD 1.81 billion in 2024 and is expected to reach USD 3.02 billion by 2032, at a CAGR of 6.60% during the forecast period

- The market growth is largely fueled by the growing consumer awareness regarding health and wellness, increasing preference for natural and chemical-free products, and rising disposable incomes, particularly in developing economies

- Furthermore, the expanding availability of organic tea through diverse distribution channels, including online retail and specialized health stores, coupled with a rising interest in sustainable and ethically sourced products, is significantly boosting the industry's growth

Organic Tea Market Analysis

- Organic tea, cultivated without synthetic pesticides, herbicides, or fertilizers, is gaining significant traction as a preferred beverage choice due to its perceived health benefits, environmental sustainability, and superior taste profile, making it a vital component of the natural and organic food and beverage industry

- The escalating demand for organic tea is primarily fueled by the widespread adoption of healthier lifestyles, growing concerns about food safety and environmental impact, and a rising preference for premium and specialty tea varieties

- Europe dominated the organic tea market with the largest revenue share of 35.5% in 2024, characterized by a strong consumer base for organic products, well-established distribution networks, and stringent organic certification standards, with countries such as Germany and the U.K. experiencing substantial growth driven by increasing health consciousness and a diverse range of organic tea offerings

- Asia-Pacific is expected to be the fastest growing region in the organic tea market during the forecast period due to increasing urbanization, rising disposable incomes, and a growing awareness of organic products

- The green tea segment dominated the largest market share of 35.4% in 2024, driven by its widely recognized health benefits, such as its antioxidant properties and potential for weight management, aligning with current consumer demand for wellness products

Report Scope and Organic Tea Market Segmentation

|

Attributes |

Organic Tea Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Organic Tea Market Trends

“Increasing Integration of Advanced Data Analytics and Consumer Insights”

- The Global Organic Tea Market is witnessing a significant trend of integrating advanced data analytics and consumer insights

- These technologies enable deep processing and analysis of consumer preferences, sales patterns, and agricultural data, providing deeper insights into product development, marketing strategies, and supply chain optimization

- Data-driven organic tea solutions allow for more proactive market responses, identifying potential demand shifts or supply chain inefficiencies before they lead to market imbalances

- For instance, several companies are developing platforms that analyze consumer purchasing patterns to offer personalized tea blends or optimize cultivation practices based on climate data and soil conditions

- This trend is enhancing the value proposition of organic tea products, making them more attractive to both consumers and producers

- Advanced analytics can scrutinize a vast array of consumer behaviors, including flavor preferences, preferred packaging types, online shopping habits, and even the influence of health and wellness trends

Organic Tea Market Dynamics

Driver

“Rising Consumer Demand for Health and Wellness Products and Sustainable Practices”

- The increasing consumer demand for healthy and natural products, especially those perceived as chemical-free and beneficial for well-being, is a major driver for the global organic tea market

- Organic tea offers numerous health benefits, including high antioxidant content and the absence of harmful chemical residues from pesticides and fertilizers

- Growing awareness of environmental sustainability and ethical sourcing practices among consumers is also contributing to the widespread adoption of organic tea

- The proliferation of e-commerce platforms and the development of direct-to-consumer models are further enabling the expansion of organic tea sales, offering wider accessibility and convenience for consumers

- Tea producers are increasingly adopting organic certification and promoting sustainable cultivation methods to meet consumer expectations and enhance brand value

Restraint/Challenge

“High Production Costs and Supply Chain Complexities”

- The substantial initial investment required for organic certification, adherence to strict organic farming standards, and often lower yields compared to conventional farming can be a significant barrier for many producers, especially small-scale farmers in emerging markets

- Integrating organic tea cultivation into existing agricultural systems can be complex and costly.

- In addition, supply chain complexities and limited infrastructure pose a major challenge. Ensuring the integrity and traceability of organic tea from farm to consumer can be difficult, raising concerns about potential contamination, mislabeling, and compliance with organic regulations across different countries

- The fragmented regulatory landscape across various regions regarding organic certification, processing, and labeling further complicates operations for international manufacturers and service providers

- These factors can deter potential producers and limit market expansion, particularly in regions where awareness of organic certification and sustainability is low or where cost sensitivity is a significant factor

Organic Tea market Scope

The market is segmented on the basis of type, form, packaging type, and distribution channel.

- By Type

On the basis of type, the global organic tea market is segmented into black tea, green tea, oolong tea, herbal tea, and others. The green tea segment dominated the largest market share of 35.4% in 2024, driven by its widely recognized health benefits, such as its antioxidant properties and potential for weight management, aligning with current consumer demand for wellness products.

The herbal tea segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing consumer awareness and preference for energy-giving and naturally augmented tea options, especially as consumers seek caffeine-free alternatives with specific wellness benefits such as improved digestion, relaxation, and immune support.

- By Form

On the basis of form, the global organic tea market is segmented into dried leaf, powder, liquid, and others. The dried leaf and powder segment is expected to hold the largest market revenue share, primarily driven by traditional tea enthusiasts' inclination towards more authentic and pure forms of tea that offer a richer flavor and aromatic experience. Powdered forms such as matcha also appeal to health-conscious consumers for their high antioxidant levels.

The liquid (ready-to-drink) segment is expected to witness robust growth from 2025 to 2032, driven by the increasing demand for convenient and on-the-go healthy hydration options, catering to busy lifestyles and a growing preference for nutrient-enriched specialty teas in a ready-to-consume format.

- By Packaging Type

On the basis of packaging type, the global organic tea market is segmented into paper pouches, cans, cartons, tea bags, and others. The tea bags segment dominated the largest market revenue share in 2024, due to their widespread popularity, ease of preparation, and convenience for on-the-go consumption.

Paper pouches are expected to witness significant growth from 2025 to 2032, driven by increasing consumer preference for eco-friendly and sustainable packaging solutions, as well as the ability of flexible packaging to preserve tea freshness and aroma through superior barrier properties.

- By Distribution Channel

On the basis of distribution channel, the global organic tea market is segmented into supermarkets/hypermarkets, convenience/grocery stores, online retail stores, and others. The supermarkets/hypermarkets segment dominated the largest market revenue share in 2024, driven by their extensive reach and the convenience they offer to consumers to explore a wide variety of organic tea options under one roof.

The online retail stores segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the increasing digital adoption among consumers, the ease of accessibility and convenience offered by online platforms, and the ability for both leading and small-scale organic tea makers to reach a broader customer base.

Organic Tea Market Regional Analysis

- Europe dominated the organic tea market with the largest revenue share of 35.5% in 2024, characterized by a strong consumer base for organic products, well-established distribution networks, and stringent organic certification standards, with countries such as Germany and the U.K. experiencing substantial growth driven by increasing health consciousness and a diverse range of organic tea offerings

- Consumers in Europe prioritize organic tea for its perceived health advantages, including antioxidant properties and general wellness, leading to high demand across various tea types

- Growth is further supported by government initiatives promoting organic farming and the expansion of specialty tea cafes and ethical sourcing practices

U.S. Organic Tea Market Insight

The U.S. organic tea market is expected to witness significant growth, fueled strong consumer awareness of health benefits and a growing trend towards functional organic beverages. Demand is boosted by an increasing focus on natural, safe, and clean-label products. The market also benefits from the development and launch of innovative organic tea variants in novel packaging, catering to health-conscious consumers in the region.

Europe Organic Tea Market Insight

The Europe organic tea market dominated the organic tea market with the largest revenue share of 77.8% in 2024, fueled by a strong regulatory emphasis on sustainable agriculture and rising consumer demand for organic and herbal teas. Consumers in Europe actively seek teas that offer health benefits and align with their growing awareness of sustainability and ethical sourcing. The growth is prominent in both established and emerging markets, with countries such as Germany and the UK showing significant uptake due to rising health consciousness and premiumization trends.

U.K. Organic Tea Market Insight

The U.K. market for organic tea is expected to witness the fastest growth rate, driven by demand for improved health and wellness solutions, particularly herbal and green teas. Increased interest in natural and organic products, coupled with a focus on ethical sourcing and sustainable practices, encourages adoption. Evolving consumer preferences for unique flavors and convenient formats, such as tea bags, further boost market expansion.

Germany Organic Tea Market Insight

Germany is expected to witness the fastest growth rate in organic tea, attributed to its advanced food and beverage sector and high consumer focus on health and sustainability. German consumers prefer technologically advanced and natural teas that offer various health benefits. The integration of organic teas in mainstream retail channels, including hypermarkets and supermarkets, and the rising popularity of herbal teas contribute to sustained market growth.

Asia-Pacific Organic Tea Market Insight

The Asia-Pacific region is expected to witness significant growth, driven by expanding organic tea production and rising disposable incomes in countries such as China, India, and Japan. Increasing awareness of health benefits, coupled with a growing preference for natural and premium products, is boosting demand. Government initiatives promoting organic farming and the expanding retail landscape further encourage the use of organic tea.

Japan Organic Tea Market Insight

Japan's organic tea market is expected to witness strong growth due to robust consumer preference for high-quality, technologically advanced organic teas that enhance well-being and offer specific health benefits. The presence of major tea manufacturers and the integration of organic teas in traditional and modern consumption patterns accelerate market penetration. Rising interest in health-oriented products and functional teas also contributes to growth.

China Organic Tea Market Insight

China holds the largest share of the Asia-Pacific organic tea market, propelled by rapid urbanization, rising disposable incomes, and increasing demand for natural and healthy beverages. The country's growing middle class and focus on sustainable agriculture support the adoption of organic tea. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility, and a significant portion of tea production is organic.

Organic Tea Market Share

The organic tea industry is primarily led by well-established companies, including:

- Tata Consumer Product Limited (India)

- Unilever (U.K.)

- VAHDAM (India)

- Celestial Seasonings (U.S.)

- Stash Tea (U.S.)

- Bigelow Tea (U.S.)

- Yogi (U.S.)

- Republic of Tea (U.S.)

- Mighty Leaf Tea (Canada)

- Numi, Inc. P.B.C (U.S.)

- ITO EN LTD. (Japan)

- The Republic of Tea (U.S.)

- Dunkin' Brands Inc. (U.S.)

- Wagh Bakri Tea Group (India)

- Keurig Green Mountain, Inc. (U.S.)

What are the Recent Developments in Global Organic Tea Market?

- In June 2025, ITC Ltd. completed its acquisition of Sresta Natural Bioproducts Pvt. Ltd., the company behind the ‘24 Mantra Organic’ brand, for a total consideration. The deal included an upfront payment and a potential over the next 24 months. With this move, ITC gains full ownership of Sresta’s extensive organic portfolio—spanning over 100 products—and its robust supply chain, which includes 27,500 farmers and 1.4 lakh acres of certified organic farmland across 10 Indian states. The acquisition also brings Sresta’s international subsidiaries in the U.S. and UAE under ITC’s umbrella, reinforcing its global ambitions in the organic food segment.

- In June 2024, Amul announced plans to launch a new line of organic tea, expanding its footprint in India’s growing organic food market. This move aligns with Amul’s broader strategy to diversify beyond dairy and meet rising consumer demand for natural, eco-friendly products. The upcoming tea range will join Amul’s existing portfolio of 24 organic items—including wheat flour, rice, and pulses—and is expected to appeal to health-conscious consumers seeking high-quality, chemical-free options. Amul is also working with tea cooperatives in South India to build a sustainable supply chain modeled after its successful dairy network

- In March 2024, JUST ICE TEA, a brand by Eat the Change, launched a new line of organic, Fair-Trade tea in 12-ounce cans, unveiled at the Natural Products Expo West in Anaheim, California. The lineup includes Lemon Tea, Raspberry Tea, and Dragon Green Tea, crafted with organic green or black tea sourced from Mozambique’s Cha de Magoma estate. Sweetened with agave and containing just 40 calories per can, the teas are designed for on-the-go consumers seeking sustainable, flavorful options. This launch builds on the brand’s rapid growth since its 2022 debut, reinforcing its commitment to ethical sourcing and innovation

- In January 2024, Tata Consumer Products Ltd. (TCPL) signed definitive agreements to acquire 100% equity in Organic India for an all-cash deal. This acquisition strengthens TCPL’s presence in the health and wellness segment, expanding its portfolio into organic food, beverages, and herbal supplements. Organic India, known for its tulsi-based teas and herbal infusions, brings a robust supply chain of over 12,000 farmers and a global footprint across 48+ countries. The move is part of TCPL’s broader strategy to tap into high-growth, premium categories and build a comprehensive wellness platform

- In May 2022, to celebrate International Tea Day, Organic India launched a vibrant lineup of new herbal teas and infusions. The release included Tulsi Detox Kahwa, a wellness-focused blend, and refreshing options like Peppermint Refresh, Moringa Hibiscus, and Simply Chamomile. These additions reflect the brand’s commitment to offering organic, health-conscious beverages that align with evolving consumer preferences for natural and functional teas—especially in the post-pandemic era

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Organic Tea Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Organic Tea Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Organic Tea Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.