Global Organic Two Percent Milk Market

Market Size in USD Billion

CAGR :

%

USD

2.48 Billion

USD

3.36 Billion

2024

2032

USD

2.48 Billion

USD

3.36 Billion

2024

2032

| 2025 –2032 | |

| USD 2.48 Billion | |

| USD 3.36 Billion | |

|

|

|

|

Global Organic 2% Milk Market Size

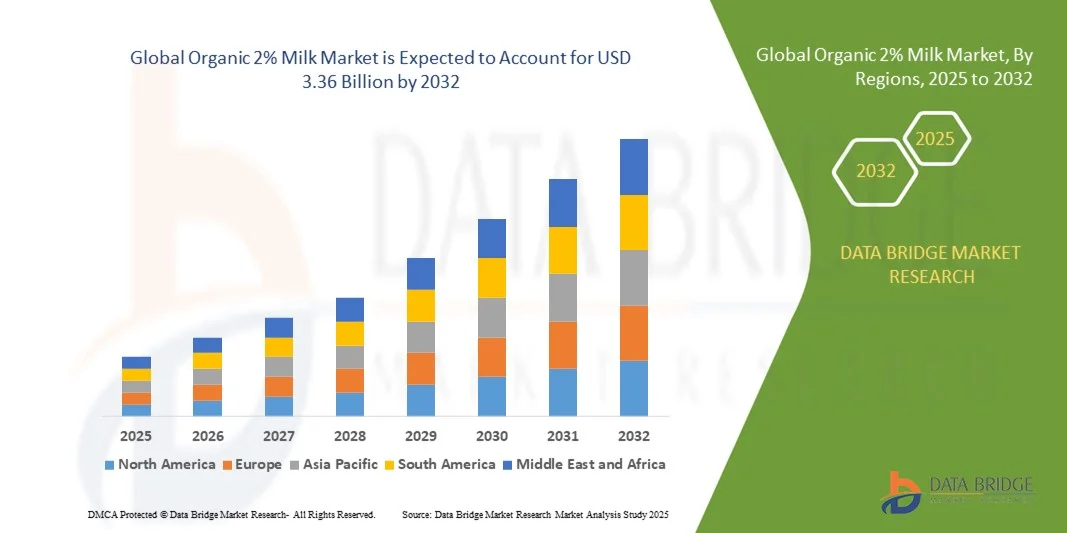

- The global Organic 2% Milk Market size was valued at USD 2.48 billion in 2024 and is expected to reach USD 3.36 billion by 2032, at a CAGR of 3.90% during the forecast period.

- The market growth is largely driven by increasing consumer preference for healthier and chemical-free dairy products, along with rising awareness of the benefits of organic nutrition.

- Furthermore, expanding distribution channels, innovations in packaging, and growing adoption of e-commerce platforms for grocery shopping are enhancing product accessibility and convenience. These converging factors are accelerating the consumption of organic 2% milk, thereby significantly boosting the industry's growth.

Global Organic 2% Milk Market Analysis

- Organic 2% milk, providing reduced-fat dairy with all the nutrients of whole milk, is increasingly gaining prominence in both household and commercial diets due to its health benefits, natural composition, and suitability for a wide range of culinary uses.

- The escalating demand for organic 2% milk is primarily fueled by growing consumer awareness of health and wellness, increasing preference for chemical-free and sustainably produced food, and rising concerns over conventional dairy production practices.

- North America dominated the Global Organic 2% Milk Market with the largest revenue share of 35.2% in 2024, characterized by high health consciousness, strong retail and online distribution networks, and a robust presence of key organic dairy producers, with the U.S. experiencing substantial growth in organic milk consumption, particularly in urban areas and premium grocery channels, driven by innovations in packaging, branding, and farm-to-table supply chains.

- Asia-Pacific is expected to be the fastest-growing region in the Global Organic 2% Milk Market during the forecast period due to increasing urbanization, rising disposable incomes, and shifting dietary preferences toward healthier food options.

- The 1 L segment dominated the market with the largest revenue share of 47.5% in 2024, driven by its convenience for household consumption, widespread availability, and cost-effectiveness.

Report Scope and Global Organic 2% Milk Market Segmentation

|

Attributes |

Organic 2% Milk Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Global Organic 2% Milk Market Trends

Enhanced Convenience Through Online Ordering and Personalized Nutrition

- A significant and accelerating trend in the global Organic 2% Milk Market is the deepening integration of digital platforms and personalized nutrition services, enabling consumers to conveniently purchase organic milk online and tailor their dietary intake to specific health needs.

- For instance, e-commerce platforms such as Amazon Fresh, Instacart, and Walmart Grocery allow users to subscribe for regular deliveries of organic 2% milk, ensuring a steady supply without repeated store visits. Similarly, apps like Yumi and Nutrino can recommend dairy products based on individual nutritional goals, lifestyle, and dietary preferences.

- Data-driven personalization in organic dairy consumption enables features such as tracking fat intake, suggesting portion sizes, or recommending complementary organic products. For example, some brands now offer mobile app notifications to remind consumers when their milk supply is running low, or suggest meal pairings to maximize nutrition benefits.

- The seamless integration of organic 2% milk with broader health and wellness platforms facilitates centralized management of diet and grocery planning. Through a single interface, consumers can monitor consumption, manage subscriptions, and receive tailored recommendations for other organic products, creating a convenient and health-focused lifestyle.

- This trend towards more intelligent, intuitive, and personalized dietary solutions is fundamentally reshaping consumer expectations for organic dairy. Consequently, companies such as Organic Valley and Horizon Organic are developing digital-first programs with features like subscription-based delivery, personalized nutrition insights, and integration with wellness apps.

- The demand for organic 2% milk that offers convenience through online accessibility and personalized nutrition is growing rapidly across both urban and suburban markets, as consumers increasingly prioritize health, sustainability, and time-saving solutions in their daily routines.

Global Organic 2% Milk Market Dynamics

Driver

Growing Demand Driven by Health Awareness and Shift to Organic Diets

- The increasing focus on health and wellness among consumers, coupled with a growing preference for chemical-free and sustainably produced foods, is a significant driver for the heightened demand for organic 2% milk.

- For instance, in 2024, Organic Valley expanded its digital marketing campaigns and subscription-based delivery services to promote organic dairy consumption, targeting health-conscious households. Such initiatives by key companies are expected to drive growth in the organic milk market during the forecast period.

- As consumers become more aware of the potential health risks associated with conventional dairy products, organic 2% milk offers benefits such as reduced exposure to pesticides, antibiotics, and hormones, making it a preferred choice for families and individuals seeking healthier dietary options.

- Furthermore, the growing popularity of e-commerce platforms and subscription-based grocery services is making organic milk more accessible, supporting seamless integration into consumers’ daily routines.

- The convenience of doorstep delivery, easy access to a variety of organic dairy products, and the ability to select options tailored to specific dietary needs are key factors propelling the adoption of organic 2% milk across urban and suburban households. The trend towards personalized nutrition plans and greater awareness of food sourcing further contributes to market growth.

Restraint/Challenge

High Price Points and Limited Awareness in Emerging Regions

- The relatively higher price of organic 2% milk compared to conventional milk poses a significant challenge to broader market penetration, particularly in price-sensitive or developing regions. Premium pricing can limit adoption among consumers who prioritize cost over health benefits.

- For instance, while subscription-based delivery models offer convenience, the recurring cost can be perceived as a premium compared to standard grocery purchases, deterring potential buyers.

- Addressing these barriers through competitive pricing strategies, promotional campaigns, and consumer education about the health and environmental benefits of organic milk is crucial for expanding market reach. Companies such as Horizon Organic and Arla Foods are investing in marketing and awareness programs to emphasize the value of organic dairy.

- Additionally, limited awareness about organic certification standards and the benefits of reduced-fat organic milk can restrict growth in regions where conventional dairy dominates.

- Overcoming these challenges through targeted education, expansion of distribution channels, and gradual reduction of production costs to lower retail prices will be vital for sustained market growth.

Global Organic 2% Milk Market Scope

Organic 2% milk market is segmented on the basis of type, application, flavor type, packaging type, distribution channel and source.

- By Type

On the basis of type, the Global Organic 2% Milk Market is segmented into below 300 ml, 1 L, and other pack sizes. The 1 L segment dominated the market with the largest revenue share of 47.5% in 2024, driven by its convenience for household consumption, widespread availability, and cost-effectiveness. 1 L packs are ideal for daily usage in homes and are compatible with refrigeration storage, making them a preferred choice for urban and semi-urban households.

The below 300 ml segment is expected to witness the fastest CAGR of 18.9% from 2025 to 2032, fueled by growing demand for single-serve portions suitable for schools, workplaces, and on-the-go consumption. The increasing preference for portion-controlled packaging and rising awareness about minimizing waste further support the growth of smaller pack sizes in both retail and e-commerce channels.

- By Application

On the basis of application, the market is segmented into children, adults, and the aged. The adult segment accounted for the largest market revenue share of 52.3% in 2024, driven by rising health awareness, preference for organic diets, and higher disposable income enabling daily consumption. Adults consume organic 2% milk for its perceived health benefits, including protein, calcium, and reduced exposure to pesticides or hormones. The children segment is expected to witness the fastest CAGR of 19.5% from 2025 to 2032, propelled by parental focus on early nutrition and the introduction of fortified variants. Products targeting children often come in smaller, easy-to-use packaging with flavors that appeal to younger consumers, supporting adoption in schools, daycare centers, and households.

- By Flavor Type

On the basis of flavor type, the market is segmented into non-flavored and flavored organic 2% milk. The non-flavored segment dominated with a market share of 63.1% in 2024, attributed to its versatility for cooking, beverages, and cereal consumption, as well as consumer preference for pure, natural taste. Non-flavored milk is widely accepted as a staple in households seeking chemical-free and additive-free dairy.

The flavored segment is expected to witness the fastest CAGR of 17.8% from 2025 to 2032, driven by growing demand from children and young adults for taste-enhanced options like chocolate, vanilla, and strawberry. Innovations in natural and low-sugar flavoring are further supporting growth in this segment, particularly through online retail and modern trade channels.

- By Packaging Type

On the basis of packaging type, the market is segmented into pouches, cans, bottles, tetra packs, and bulk packs. The tetra pack segment dominated with a market share of 45.6% in 2024, due to its long shelf life, ease of storage, and sustainability benefits. Tetra packs are convenient for household consumption and widely available across modern retail and e-commerce platforms.

The pouch segment is expected to witness the fastest CAGR of 20.2% from 2025 to 2032, fueled by the growing demand for single-serve packaging, affordability, and portability. Pouches are particularly popular in institutional settings such as schools, offices, and hospitals, and are increasingly being adopted in emerging markets for on-the-go consumption.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into HoReCa, specialty stores, modern trade, convenience stores, e-retailers, and others. The modern trade segment dominated the market with a 39.8% revenue share in 2024, driven by organized retail expansion, product variety, and better visibility of organic dairy products.

E-retailers are expected to witness the fastest CAGR of 22.1% from 2025 to 2032, fueled by growing adoption of online grocery shopping, subscription models, and direct-to-consumer delivery. The convenience of doorstep delivery and availability of a wide product portfolio are encouraging urban consumers to purchase organic 2% milk online, accelerating growth in this segment.

- By Source

On the basis of source, the market is segmented into cow, buffalo, and other sources. The cow milk segment dominated with a 61.4% market share in 2024, due to its neutral taste, wide availability, and versatility for cooking, beverages, and cereal consumption. Cow milk is highly preferred in urban households and modern retail channels, making it the mainstream source of organic 2% milk.

The buffalo milk segment is expected to witness the fastest CAGR of 18.5% from 2025 to 2032, driven by rising consumer preference for high-fat dairy products, regional adoption in South Asian markets, and increased availability of organic buffalo milk across retail and e-commerce platforms.

Global Organic 2% Milk Market Regional Analysis

- North America dominated the Global Organic 2% Milk Market with the largest revenue share of 35.2% in 2024, driven by rising consumer awareness of organic and healthy dairy options, coupled with high disposable incomes and established retail infrastructure.

- Consumers in the region increasingly prioritize the nutritional benefits, quality assurance, and chemical-free nature of organic 2% milk, which aligns with growing health-conscious lifestyles and dietary preferences.

- This widespread adoption is further supported by the presence of major dairy producers, well-developed supply chains, and the increasing availability of organic milk across modern trade, specialty stores, and e-commerce platforms, establishing North America as a key market for both household consumption and commercial use in cafes, restaurants, and other food service sectors.

U.S. Organic 2% Milk Market Insight

The U.S. dominated the North American Global Organic 2% Milk Market with the largest revenue share of 81% in 2024, driven by increasing consumer awareness of health and wellness, along with strong demand for chemical-free, nutrient-rich dairy products. Rising health consciousness, preference for organic diets, and the availability of diverse product options across retail and e-commerce platforms are fueling growth. Moreover, the growing trend of ready-to-drink and fortified organic milk, combined with the influence of social media on healthy lifestyle choices, is significantly boosting market adoption in both households and the foodservice sector.

Europe Organic 2% Milk Market Insight

The Europe organic 2% milk market is projected to grow steadily during the forecast period, driven by increasing health awareness, stringent food safety regulations, and the rising demand for organic and sustainably sourced dairy products. Urbanization, coupled with higher disposable incomes, is supporting the adoption of organic milk in countries such as Germany, France, and Italy. European consumers are increasingly seeking nutrient-rich, chemical-free dairy options, and the trend spans both retail and hospitality sectors.

U.K. Organic 2% Milk Market Insight

The U.K. market is expected to grow at a notable CAGR during the forecast period, fueled by rising consumer preference for organic, hormone-free, and ethically produced milk. Increasing concerns over health, food safety, and sustainable farming practices are encouraging households and foodservice providers to opt for organic 2% milk. Robust retail and e-commerce infrastructure, along with promotional campaigns on health benefits, is supporting market expansion.

Germany Organic 2% Milk Market Insight

Germany’s organic 2% milk market is witnessing considerable growth due to high awareness of nutrition, sustainability, and the environmental impact of conventional dairy farming. Consumers prefer locally sourced, certified organic products, driving demand in both residential and commercial segments. The integration of organic milk in cafés, restaurants, and health-focused retail outlets is also expanding market reach, supported by stringent European Union regulations on organic labeling and production standards.

Asia-Pacific Organic 2% Milk Market Insight

The Asia-Pacific market is poised to grow at the fastest CAGR of 24% from 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and a growing middle class in countries such as China, India, and Japan. Awareness of the health benefits of organic dairy, along with government initiatives promoting food safety and nutrition, is boosting demand. Rapid expansion of modern retail, supermarkets, and online grocery platforms is increasing accessibility and affordability of organic 2% milk across the region.

Japan Organic 2% Milk Market Insight

Japan’s organic 2% milk market is gaining momentum due to the country’s health-conscious population, aging demographic, and high preference for premium, safe, and nutrient-rich dairy products. Growing adoption of fortified and functional organic milk products in both households and institutional settings is fueling demand. Integration with health-focused diets and the influence of lifestyle trends are expected to drive steady growth in the Japanese market.

China Organic 2% Milk Market Insight

China accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, rising disposable incomes, and heightened awareness of food safety and nutrition. The expanding middle class, coupled with government support for safe and sustainable food production, is fueling demand for organic 2% milk. Increasing distribution through modern retail chains, convenience stores, and e-commerce platforms is enhancing product availability, while domestic manufacturers continue to innovate and offer competitively priced organic milk options.

Global Organic 2% Milk Market Share

The Organic 2% Milk industry is primarily led by well-established companies, including:

• Horizon Organic (U.S.)

• Organic Valley (U.S.)

• Dean Foods (U.S.)

• Danone (France)

• Nestlé (Switzerland)

• Amul (India)

• Fonterra (New Zealand)

• Lactalis (France)

• Borden Dairy Company (U.S.)

• Meiji Holdings (Japan)

• Arla Foods (Denmark/Sweden)

• Sapporo Holdings (Japan)

• Parmalat (Italy)

• WhiteWave Foods (U.S.)

• Clover Sonoma (U.S.)

• Milka Dairy (India)

• Stonyfield Farm (U.S.)

• Organic Meadows (Canada)

• Yili Group (China)

• Tnuva (Israel)

What are the Recent Developments in Global Organic 2% Milk Market?

- In April 2023, Danone launched a new line of organic 2% milk products in South Africa, aimed at providing safe, nutritious, and sustainably sourced dairy options for households and foodservice providers. This initiative highlights the company’s commitment to expanding its global organic portfolio and meeting the growing demand for high-quality, certified organic dairy products in emerging markets. By leveraging its global expertise in dairy production and distribution, Danone is reinforcing its presence in the rapidly growing organic 2% milk market.

- In March 2023, Horizon Organic, a U.S.-based organic dairy brand, introduced a fortified 2% milk variant enriched with vitamins and minerals, specifically designed for children and adults seeking enhanced nutrition. The product launch emphasizes Horizon Organic’s dedication to health-focused innovations and providing functional dairy solutions that cater to evolving consumer preferences for organic, nutrient-rich milk products.

- In March 2023, Nestlé successfully rolled out its “Safe & Sustainable Dairy” initiative in Bengaluru, India, aimed at promoting organic and responsibly sourced 2% milk. The program integrates advanced quality control, traceability, and eco-friendly packaging solutions, underscoring Nestlé’s commitment to food safety, environmental sustainability, and the delivery of premium organic dairy products in urban markets.

- In February 2023, Organic Valley, a cooperative of organic farmers in the U.S., announced a strategic partnership with major e-retailers to expand online availability of its 2% organic milk. This collaboration enhances accessibility for health-conscious consumers and strengthens the company’s digital distribution network, reflecting a growing trend toward e-commerce as a key channel for organic dairy products.

- In January 2023, Strauss Group, a leading dairy company in Israel, launched a new line of 2% organic milk packaged in eco-friendly Tetra Paks, designed for both retail and institutional consumption. The launch highlights Strauss Group’s focus on sustainability, convenience, and premium-quality organic dairy offerings, reinforcing its position in the global organic milk market while addressing consumer demand for environmentally responsible packaging solutions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Organic Two Percent Milk Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Organic Two Percent Milk Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Organic Two Percent Milk Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.