Global Organic White Tea Market

Market Size in USD Million

CAGR :

%

USD

514.10 Million

USD

683.54 Million

2025

2033

USD

514.10 Million

USD

683.54 Million

2025

2033

| 2026 –2033 | |

| USD 514.10 Million | |

| USD 683.54 Million | |

|

|

|

|

What is the Global Organic White Tea Market Size and Growth Rate?

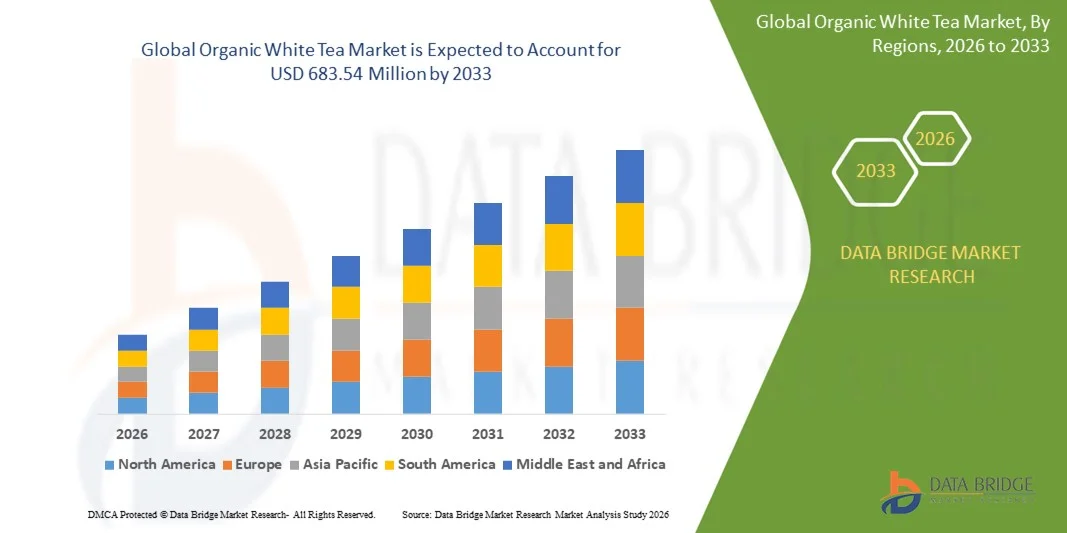

- The global organic white tea market size was valued at USD 514.10 million in 2025 and is expected to reach USD 683.54 million by 2033, at a CAGR of3.7% during the forecast period

- The major growing factor towards organic white tea market is the high catechin content of white tea which helps in protecting the skin from UV damage

- Furthermore, the rise in the importance of these products owing to their antioxidant and antimicrobial properties which boost the immune system and the consumption of white tea reduce risk of cardiovascular diseases and various other problems which are also expected to heighten the overall demand for organic white tea market

What are the Major Takeaways of Organic White Tea Market?

- The rapid rise in the application of organic white tea and the flavonoids in white tea helps reduce the prevalence of obesity, diabetes and heart diseases among others, thus are also expected to serve as foremost drivers for the organic white tea market at a global level. In addition, the rise in population across the world and increase in the disposable income are also lifting the growth of the organic white tea market

- Europe dominated the organic white tea market with a 41.23% revenue share in 2025, driven by strong consumer preference for organic, premium, and sustainably sourced beverages across countries such as Germany, the U.K., France, and Italy

- Asia-Pacific is projected to register the fastest CAGR of 9.58% from 2026 to 2033, driven by rising disposable incomes, rapid urbanization, and growing awareness of health and wellness benefits across China, India, Japan, South Korea, and Southeast Asia

- The Silver Needle White Tea segment dominated the market with a 38.6% share in 2025, driven by its premium positioning, high antioxidant content, minimal processing, and strong preference among health-conscious and specialty tea consumers

Report Scope and Organic White Tea Market Segmentation

|

Attributes |

Organic White Tea Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Organic White Tea Market?

Rising Consumer Preference for Premium, Antioxidant-Rich, and Clean-Label Organic Teas

- The organic white tea market is witnessing growing demand for minimally processed, antioxidant-rich, and naturally sourced tea products, driven by increasing health awareness and wellness-focused lifestyles

- Manufacturers are introducing certified organic, single-origin, and artisan-crafted white teas to meet consumer expectations for authenticity, purity, and traceability

- Rising preference for low-caffeine, natural detox, and functional beverages is accelerating adoption among health-conscious consumers and premium tea drinkers

- For instance, companies such as Dilmah Ceylon Tea Company, The Republic of Tea, and Wollenhaupt Tee GmbH are expanding their organic white tea portfolios with clean-label positioning and sustainable sourcing practices

- Growing influence of organic certification standards, eco-friendly packaging, and digital wellness awareness campaigns is strengthening global market penetration

- As consumers increasingly seek premium wellness beverages with natural health benefits, Organic White Tea is expected to remain a high-value segment within the specialty tea market

What are the Key Drivers of Organic White Tea Market?

- Increasing focus on preventive healthcare, antioxidant intake, and natural immunity-boosting beverages is driving demand for organic white tea products

- For instance, in 2025, leading tea brands such as Dilmah, Subodh Brothers, and Carrubba Inc. increased investments in organic cultivation, sustainable packaging, and premium product launches

- Growing popularity of organic, non-GMO, and pesticide-free beverages is boosting adoption across North America, Europe, and Asia-Pacific

- Advancements in organic farming practices, cold-brew processing, and flavor preservation technologies have improved product quality and shelf appeal

- Expansion of specialty tea stores, supermarkets, and e-commerce platforms is enhancing accessibility and global reach

- Supported by rising health consciousness, sustainability trends, and premiumization, the Organic White Tea market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Organic White Tea Market?

- Higher production and certification costs associated with organic cultivation and limited yield of white tea leaves increase product pricing

- For instance, during 2024–2025, climate variability and rising labor costs in key tea-producing regions affected supply consistency and pricing stability

- Limited consumer awareness regarding the health benefits and brewing methods of white tea restricts broader adoption

- Shorter shelf life and sensitivity to storage conditions pose logistical and distribution challenges

- Competition from green tea, herbal infusions, and functional beverages creates pricing and shelf-space pressure

- To address these challenges, companies are focusing on consumer education, premium branding, sustainable sourcing, and improved packaging solutions to expand global adoption of organic white tea

How is the Organic White Tea Market Segmented?

The market is segmented on the basis of product type, flavor, application, and distribution channel.

- By Product Type

On the basis of product type, the organic white tea market is segmented into White Peony White Tea, Silver Needle White Tea, Darjeeling White Tea, Moonlight White Tea, Shou Mei White Tea, and White Matcha Tea. The Silver Needle White Tea segment dominated the market with a 38.6% share in 2025, driven by its premium positioning, high antioxidant content, minimal processing, and strong preference among health-conscious and specialty tea consumers. Silver Needle is widely perceived as the purest form of white tea, supporting strong demand across North America and Europe.

The White Matcha Tea segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by rising interest in functional beverages, powdered tea formats, and versatility in food, beverage, and cosmetic applications. Growing adoption in smoothies, lattes, and wellness formulations is accelerating demand, particularly among younger consumers and premium lifestyle segments.

- By Flavor

On the basis of flavor, the organic white tea market is segmented into Flowery and Fruity flavors. The Flowery flavor segment dominated the market with a 56.4% share in 2025, supported by strong consumer preference for delicate, natural aromas such as jasmine, rose, and chamomile. Flowery white teas are widely associated with relaxation, detox benefits, and premium sensory appeal, making them popular in specialty tea shops and wellness-focused retail channels.

The Fruity flavor segment is projected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for refreshing, naturally infused beverages with notes of peach, berry, citrus, and tropical fruits. Rising consumption among younger demographics, expansion of ready-to-drink white tea products, and growing experimentation with flavor blends are accelerating adoption across both developed and emerging markets.

- By Application

On the basis of application, the organic white tea market is segmented into Beverages, Cosmetics & Toiletries, and Pharmaceuticals. The Beverages segment dominated the market with a 72.1% share in 2025, driven by high consumption of organic white tea as hot brews, cold brews, and ready-to-drink formulations. Rising awareness of antioxidant, anti-aging, and immune-support benefits continues to strengthen beverage demand globally.

The Cosmetics & Toiletries segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by increasing use of white tea extracts in skincare, anti-aging creams, and personal care products. Growing demand for natural and organic cosmetic ingredients is accelerating adoption among premium beauty brands and clean-label product manufacturers.

- By Distribution Channel

On the basis of distribution channel, the organic white tea market is segmented into Offline and Online channels. The Offline segment dominated the market with a 63.8% share in 2025, driven by strong sales through supermarkets, specialty tea stores, organic food outlets, and wellness retailers. Physical stores allow consumers to assess quality, origin, and aroma, reinforcing trust and purchase confidence.

The Online segment is projected to grow at the fastest CAGR from 2026 to 2033, supported by rising e-commerce penetration, direct-to-consumer tea brands, subscription-based offerings, and growing preference for convenient home delivery. Expanding digital marketing, influencer promotions, and global product accessibility are accelerating online channel growth.

Which Region Holds the Largest Share of the Organic White Tea Market?

- Europe dominated the organic white tea market with a 41.23% revenue share in 2025, driven by strong consumer preference for organic, premium, and sustainably sourced beverages across countries such as Germany, the U.K., France, and Italy. High awareness regarding antioxidant benefits, clean-label consumption, and preventive healthcare continues to support strong demand for organic white tea

- Leading tea brands and specialty beverage companies in Europe are expanding certified organic white tea offerings, focusing on single-origin sourcing, eco-friendly packaging, and premium positioning

- Well-developed specialty tea retail networks, strong regulatory support for organic products, and high purchasing power further reinforce Europe’s market leadership

Germany Organic White Tea Market Insight

Germany is the largest contributor within Europe, supported by strong demand for organic and functional beverages, high penetration of organic food retailers, and a mature health-conscious consumer base. Specialty tea consumption and sustainability-driven purchasing decisions fuel market growth.

U.K. Organic White Tea Market Insight

The U.K. contributes significantly to regional growth due to rising interest in wellness teas, premium hot beverages, and clean-label products. Expanding online tea retail and subscription models further strengthen adoption.

Asia-Pacific Organic White Tea Market

Asia-Pacific is projected to register the fastest CAGR of 9.58% from 2026 to 2033, driven by rising disposable incomes, rapid urbanization, and growing awareness of health and wellness benefits across China, India, Japan, South Korea, and Southeast Asia. Increasing consumption of premium teas, expanding middle-class populations, and strong cultural acceptance of tea consumption are accelerating market growth. Growth of modern retail and e-commerce platforms further supports regional expansion.

China Organic White Tea Market Insight

China is the largest contributor in Asia-Pacific, supported by its status as a major white tea producer, growing domestic consumption of organic teas, and rising export demand. Increasing focus on quality certification and premium tea offerings strengthens market adoption.

Japan Organic White Tea Market Insight

Japan shows steady growth due to strong demand for functional beverages, aging population needs, and preference for antioxidant-rich, low-caffeine teas. Emphasis on quality, purity, and health benefits supports long-term growth.

India Organic White Tea Market Insight

India is emerging as a key growth hub, driven by expanding organic tea cultivation, increasing urban health awareness, and rising demand for premium and specialty teas. Growth of e-commerce and specialty tea brands accelerates market penetration.

South Korea Organic White Tea Market Insight

South Korea contributes steadily due to high health consciousness, premium beverage consumption, and increasing interest in organic and wellness-oriented tea products. Innovation in ready-to-drink and functional tea formats supports continued market growth.

Which are the Top Companies in Organic White Tea Market?

The organic white tea industry is primarily led by well-established companies, including:

- Dilmah Ceylon Tea Company PLC (Sri Lanka)

- Carrubba INC. (U.S.)

- Wollenhaupt Tee GmbH (Germany)

- Subodh Brothers (India)

- The Republic of Tea (U.S.)

What are the Recent Developments in Global Organic White Tea Market?

- In September 2024, Dilmah relaunched its t-Shop at t-Lounge, Horton Place, Colombo, introducing an elevated retail experience featuring exclusive specialty teas, including Very Special Rare Teas (VSRTs) from the Kahawatta Plantation, along with premium collections such as the Watte Series and t-Series, while also hosting tea masterclasses and guided tea pairing sessions, reinforcing Dilmah’s premium positioning and experiential brand strategy

- In June 2024, Elizabeth Arden announced the launch of White Tea Eau Florale, a refreshed interpretation of its White Tea fragrance, which was introduced across multiple travel retail locations worldwide, strengthening the brand’s fragrance portfolio and global travel retail presence

- In March 2024, Dilmah initiated its “A Sip of Sri Lanka” campaign to highlight the natural beauty of Sri Lanka’s tea gardens and landscapes, emphasizing the authenticity of Dilmah Ceylon Iced Tea made from handpicked, garden-fresh leaves rich in natural antioxidants, enhancing brand storytelling and origin-based differentiation

- In December 2022, Elizabeth Arden expanded its White Tea portfolio with the launch of White Tea Skin Solutions, a skincare line formulated with Epigallocatechin Gallate Glucoside (EGCG), a powerful natural antioxidant, marking the brand’s strategic extension of the White Tea franchise into functional skincare

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Organic White Tea Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Organic White Tea Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Organic White Tea Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.