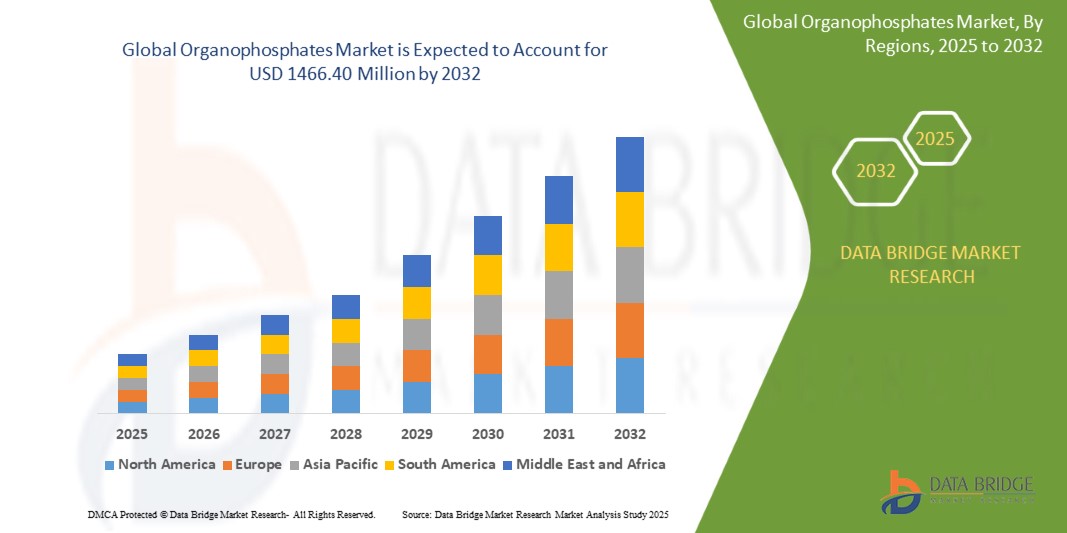

Global Organophosphates Market

Market Size in USD Million

CAGR :

%

USD

847.10 Million

USD

1,466.40 Million

2024

2032

USD

847.10 Million

USD

1,466.40 Million

2024

2032

| 2025 –2032 | |

| USD 847.10 Million | |

| USD 1,466.40 Million | |

|

|

|

|

Organophosphates Market Size

- The global organophosphates market size was valued at USD 847.10 million in 2024 and is expected to reach USD 1466.40 million by 2032, at a CAGR of 7.10% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-efficiency crop protection chemicals in agriculture, rapid expansion of the food production sector, and rising adoption of organophosphate-based pesticides due to their cost-effectiveness and broad-spectrum activity

- Growing usage of organophosphates in non-agricultural sectors such as public health, commercial pest control, and industrial applications is further contributing to overall market expansion

Organophosphates Market Analysis

- Rising global population and shrinking arable land are prompting higher agricultural yields, driving the need for organophosphates in farming practices

- Favorable government policies supporting the use of agrochemicals and subsidies on fertilizers and pesticides are boosting market expansion in emerging economies

- Asia-Pacific dominated the organophosphates market with the largest revenue share of 38.6% in 2024, driven by the region’s vast agricultural base, rising food demand, and heavy reliance on chemical crop protection solutions

- North America region is expected to witness the highest growth rate in the global organophosphates market, driven by advancements in agricultural technology, strong government support for sustainable farming, and growing investment in next-generation pesticide solutions

- The insecticide segment dominated the market with the largest market revenue share of 49.3% in 2024, driven by its extensive use in controlling a wide range of agricultural pests that cause significant crop losses. Insecticides made from organophosphates are widely preferred for their fast action, affordability, and broad-spectrum efficacy, particularly in developing economies where pest pressure is high. Their compatibility with major crops and effectiveness against both chewing and sucking insects contribute to their strong market presence across farming communities

Report Scope and Organophosphates Market Segmentation

|

Attributes |

Organophosphates Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Organophosphates Market Trends

“Growing Shift Toward Eco-Friendly and Low-Residue Pesticides”

- Increasing demand for sustainable crop protection solutions is pushing manufacturers to develop eco-friendly organophosphate formulations

- Regulatory pressure in regions such as the U.S. and Europe is accelerating reformulation efforts for low-residue pesticide products

- Farmers are adopting Integrated Pest Management (IPM) systems that encourage selective and minimal pesticide use

- Precision farming practices are enhancing the application efficiency of organophosphates, reducing environmental impact

- Consumer preference for clean-label and low-residue food products is influencing product choices at the farm level

- For instance, In 2024, Bayer AG launched a low-residue organophosphate product line specifically targeting residue-sensitive export markets

Organophosphates Market Dynamics

Driver

“Rising Global Food Demand and the Need for Enhanced Agricultural Productivity”

- Rapidly growing global population is increasing the pressure on agricultural systems to produce higher yields, driving widespread use of organophosphates to reduce pest-related crop losses

- Organophosphates play a key role in protecting high-demand staple crops such as wheat, rice, and corn, especially in food-insecure regions where pest infestations significantly affect harvests

- Shrinking availability of arable land is pushing farmers to optimize productivity using potent pest control methods, with organophosphates being a primary choice due to their affordability and efficiency

- Supportive government initiatives, subsidies, and training programs are encouraging pesticide use in agriculture, especially across emerging economies focused on food self-sufficiency

- For instrance, In 2023, India’s Ministry of Agriculture expanded subsidy coverage to include select organophosphate compounds, increasing their application across major farming states such as Uttar Pradesh and Gujarat

Restraint/Challenge

“Stringent Regulations and Rising Health & Environmental Concerns”

- Health risks associated with long-term organophosphate exposure, including neurological damage and hormonal disruption, are driving public demand for reduced chemical use in agriculture

- Harm to non-target organisms such as pollinators and aquatic species is a growing concern, prompting environmental groups to lobby for stricter control over organophosphate applications

- Increasing regulatory scrutiny worldwide has resulted in bans and limitations on several widely used organophosphates, creating significant hurdles for manufacturers in maintaining market presence

- Consumer shift toward organic and chemical-free food is limiting the appeal of traditional organophosphate-based products, particularly in premium and export-oriented agricultural segments

- For instance, In 2022, the U.S. Environmental Protection Agency (EPA) revoked all food crop uses of chlorpyrifos, a common organophosphate, due to safety concerns, prompting widespread industry reformulation efforts

Organophosphates Market Scope

The market is segmented on the basis of type, ingredient, and application.

• By Type

On the basis of type, the organophosphates market is segmented into herbicide, fungicide, insecticide, and others. The insecticide segment dominated the market with the largest market revenue share of 49.3% in 2024, driven by its extensive use in controlling a wide range of agricultural pests that cause significant crop losses. Insecticides made from organophosphates are widely preferred for their fast action, affordability, and broad-spectrum efficacy, particularly in developing economies where pest pressure is high. Their compatibility with major crops and effectiveness against both chewing and sucking insects contribute to their strong market presence across farming communities.

The herbicide segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising demand for weed control solutions in high-value crops. With the growing adoption of no-till farming and precision agriculture practices, organophosphate-based herbicides are gaining popularity for their targeted action and ease of application, particularly in regions where labor shortages drive the need for chemical alternatives.

• By Ingredient

On the basis of ingredient, the organophosphates market is segmented into parathion, malathion, chlorpyriphos, diazinon, dimethoate, glyphosate, methamidophos, and others. The chlorpyriphos segment held the largest market revenue share in 2024, primarily due to its widespread use across multiple crop types and regions. Known for its strong efficacy against soil and foliage pests, chlorpyriphos has long been a go-to solution for growers seeking reliable pest control in cereals, vegetables, and cotton. Despite increasing regulatory scrutiny, its strong historical usage and availability in various formulations continue to sustain demand in many developing markets.

The glyphosate segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its effectiveness in weed management and its pivotal role in genetically modified (GM) crop cultivation. Its systemic action, non-selective nature, and compatibility with various application techniques make it a preferred choice in large-scale commercial farming, particularly in North and South America.

• By Application

On the basis of application, the organophosphates market is segmented into grains and cereals, pulses and oilseeds, commercial crops, fruits and vegetables, and others. The grains and cereals segment dominated the market in 2024 with the largest revenue share, attributed to the widespread cultivation of crops such as wheat, rice, and corn globally. These staple crops are highly susceptible to pest infestations, prompting the regular use of organophosphate-based pesticides to safeguard yields and maintain food security. Their affordability and availability in multiple formulations make them a top choice for farmers in both developed and developing regions.

The commercial crops segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for high-value crops such as cotton, sugarcane, and tobacco. These crops often require intensive pest management programs, where organophosphates offer reliable and cost-effective protection. Increasing export demand and rising profitability of cash crops further support this segment’s growth trajectory across key agricultural markets.

Organophosphates Market Regional Analysis

- Asia-Pacific dominated the organophosphates market with the largest revenue share of 38.6% in 2024, driven by the region’s vast agricultural base, rising food demand, and heavy reliance on chemical crop protection solutions

- Countries across the region are investing in improving agricultural output, and organophosphate-based pesticides are widely used due to their affordability and effectiveness against a broad spectrum of pests

- The strong presence of agrochemical manufacturers, coupled with government support for high-yield farming and pest management programs, continues to bolster the market’s growth across both staple and commercial crops

China Organophosphates Market Insight

The China organophosphates market with the largest revenue share in 2024, driven by modernization in agricultural practices and the country's growing focus on food self-sufficiency. With the adoption of high-yield and hybrid crops, the need for effective pest control is critical, leading to steady demand for organophosphate-based formulations. Government-led initiatives aimed at improving crop productivity and crop protection, along with a strong manufacturing base, further fuel market growth. In addition, the expansion of precision farming practices is opening new opportunities for targeted pesticide use.

Japan Organophosphates Market Insight

The Japan organophosphates market is expected to witness the fastest growth rate from 2025 to 2032, due to the country's focus on agricultural productivity and precision farming. Although the overall use of chemical pesticides is tightly regulated, organophosphates continue to be utilized in key applications such as rice and vegetable cultivation. The market benefits from advanced farming technologies, research-driven crop protection strategies, and government support for sustainable agriculture. Japan’s aging farming population is also driving demand for efficient, easy-to-apply pesticide solutions that reduce labor intensity. Furthermore, the emphasis on food safety and export quality is prompting the use of well-regulated organophosphate formulations in compliance with international standards.

North America Organophosphates Market Insight

The North America organophosphates market is expected to witness the fastest growth rate from 2025 to 2032, driven by the region’s well-developed agricultural sector and continued use of chemical pesticides for high-value crop protection. Despite growing regulatory scrutiny, organophosphates remain important for managing pests in crops such as corn and soybeans. Adoption of advanced pesticide delivery systems and the integration of organophosphates with precision agriculture technologies support their ongoing use. The market also benefits from investments in reformulation and safer chemical variants aligned with environmental regulations.

U.S. Organophosphates Market Insight

The U.S. organophosphates market is expected to witness the fastest growth rate from 2025 to 2032, driven by intensive farming practices, high pesticide application rates, and the need for efficient pest management in row crops. Farmers utilize organophosphates for their quick action and cost-effectiveness, particularly in large-scale farms. Although regulatory pressures have led to the withdrawal of some compounds, ongoing innovation and reformulation efforts ensure the continued relevance of organophosphates in U.S. agriculture. In addition, the adoption of integrated pest management (IPM) practices is encouraging more precise and sustainable usage.

Europe Organophosphates Market Insight

The Europe organophosphates market is expected to witness the fastest growth rate from 2025 to 2032, due to stringent environmental and health regulations. However, the continued use of approved organophosphates in select applications, especially in Eastern Europe, sustains regional demand. The market benefits from controlled and professional pesticide applications in commercial farming, as well as R&D investments in low-toxicity organophosphate variants. The push for sustainable farming is prompting both innovation and a gradual transition to safer pesticide practices.

Germany Organophosphates Market Insight

The Germany organophosphates market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country's high agricultural efficiency and growing focus on regulated pesticide use. Farmers in Germany rely on carefully managed organophosphate applications, especially in cereals and oilseeds. Increased attention to environmental safety has encouraged the use of precision application methods, ensuring minimal environmental impact. The country’s strong stance on sustainability and innovation supports the development of advanced, low-risk organophosphate formulations suitable for future use.

U.K. Organophosphates Market Insight

The U.K. organophosphates market is expected to witness the fastest growth rate from 2025 to 2032, shaped by stringent environmental policies and increasing demand for integrated pest management practices. While the use of organophosphates is restricted, they remain relevant in certain agricultural settings, particularly for managing pests in cereals and root crops. Farmers and agronomists are turning to regulated, lower-toxicity variants that align with sustainability goals. The U.K.'s shift toward environmentally conscious farming, combined with innovation in precision pesticide application, is fostering demand for safer organophosphate options in a controlled, compliance-driven environment.

Organophosphates Market Share

The Organophosphates industry is primarily led by well-established companies, including:

- Bayer AG (U.S.)

- Solvay (Belgium)

- Merck KGaA (Germany)

- LAXNESS (Germany)

- PCC Rokita Spólka Akcyjna (Poland)

- ICL (Israel)

- SANDHYA GROUP (India)

- Parchem fine & specialty chemicals (U.S.)

- Anhui Guangxin Agrochemical Co., Ltd. (China)

- Excel Industries Ltd (India)

- Shandong Futong Chemical Co., Ltd. (China)

- UPL Limited (India)

- Xuzhou Yongli Fine Chemical Co., Ltd. (China)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.