Global Orphan Drugs Market

Market Size in USD Billion

CAGR :

%

USD

208.76 Billion

USD

431.48 Billion

2024

2032

USD

208.76 Billion

USD

431.48 Billion

2024

2032

| 2025 –2032 | |

| USD 208.76 Billion | |

| USD 431.48 Billion | |

|

|

|

|

Orphan Drugs Market Size

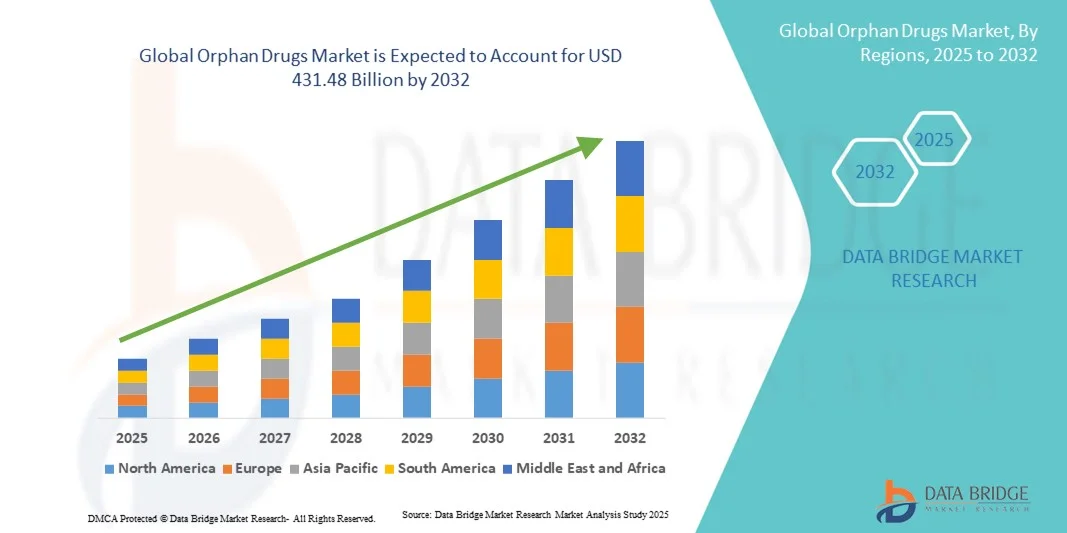

- The global orphan drugs market size was valued at USD 208.76 billion in 2024 and is expected to reach USD 431.48 billion by 2032, at a CAGR of 9.50% during the forecast period

- The market growth is largely fueled by the increasing prevalence of rare diseases and rising demand for specialized treatments, along with advancements in genomics, personalized medicine, and supportive regulatory frameworks

- Furthermore, the oncology segment leads in revenue share due to high demand for cancer treatments, while biological orphan drugs dominate because of their effectiveness and fewer side effects. Hospital pharmacies remain the primary distribution channel, with online and retail channels growing steadily

Orphan Drugs Market Analysis

- Orphan drugs, designed to treat rare diseases affecting a small patient population, are increasingly critical in modern healthcare due to their ability to address unmet medical needs, improve patient outcomes, and integrate with advanced treatment protocols in both hospital and specialty clinic settings

- The rising demand for orphan drugs is primarily fueled by the growing prevalence of rare diseases, increased patient awareness, advancements in genomics and personalized medicine, and supportive regulatory incentives that accelerate drug development and approval

- North America dominated the orphan drugs market with the largest revenue share of 43% in 2024, driven by strong government support, high healthcare expenditure, and a robust pipeline of innovative therapies. The U.S. continues to see significant growth in orphan drug approvals and adoption, propelled by investment from both large pharmaceutical companies and biotech startups focusing on gene and targeted therapies

- Asia-Pacific are expected to be the fastest-growing regions during the forecast period, due to increasing investment in rare disease research, expanding healthcare infrastructure, and rising patient access to specialized treatments

- Oncology-related orphan drugs dominated the orphan drugs market in 2024 with a share of 36.9%, driven by the high prevalence of rare cancers and the effectiveness of biological and gene-based therapies in improving patient outcomes

Report Scope and Orphan Drugs Market Segmentation

|

Attributes |

Orphan Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Orphan Drugs Market Trends

Advancements in Gene Therapy and Personalized Medicine

- A significant and accelerating trend in the global orphan drugs market is the increasing adoption of gene therapies and personalized medicine approaches, allowing treatments to be tailored to specific genetic mutations and rare disease profiles

- For instance, Zolgensma, a gene therapy for spinal muscular atrophy, demonstrates how targeting the underlying genetic cause can drastically improve patient outcomes

- Personalized therapies also enable precise dosing, reduced side effects, and enhanced efficacy, leading to improved quality of life for patients with rare diseases

- The integration of advanced diagnostics and genomic profiling with orphan drug treatments facilitates more accurate patient stratification and therapy optimization

- This trend towards highly targeted, individualized treatment regimens is reshaping healthcare approaches for rare disease management. Consequently, companies such as BioMarin and Sarepta are focusing on personalized gene therapies with specific mutation targeting

- Expanded collaboration between biotech startups and large pharmaceutical companies is accelerating the development of novel therapies for ultra-rare diseases, reducing the time from discovery to market launch

- Integration of digital health tools, such as telemedicine and patient registries, with orphan drug programs is enabling better patient monitoring, adherence, and real-world data collection to inform future treatment strategies

- The demand for orphan drugs offering gene-based and personalized treatment solutions is growing rapidly across both hospital and specialty clinic settings, as patients and healthcare providers increasingly prioritize treatment efficacy and safety

Orphan Drugs Market Dynamics

Driver

Rising Prevalence of Rare Diseases and Supportive Regulations

- The increasing prevalence of rare diseases, coupled with government incentives and regulatory frameworks promoting orphan drug development, is a major driver for the global orphan drugs market

- For instance, the U.S. Orphan Drug Act provides tax credits, grant funding, and market exclusivity, encouraging companies to invest in rare disease therapeutics

- As awareness of rare diseases grows among patients and healthcare providers, demand for effective treatment options rises, propelling orphan drug adoption

- Furthermore, pharmaceutical companies are investing heavily in R&D for rare disease therapies, creating a robust pipeline of innovative orphan drugs

- Increasing public and private funding for rare disease research is fostering innovation and enabling faster clinical development of orphan drugs

- Growing global patient advocacy initiatives are raising awareness, supporting early diagnosis, and driving policy changes that facilitate broader access to orphan drugs

- Improved patient access programs, clinical trial expansions, and partnerships between biotech firms and large pharma are accelerating market growth and bringing novel therapies to market more efficiently

Restraint/Challenge

High Cost of Treatments and Reimbursement Barriers

- The high cost of orphan drugs and limited reimbursement policies pose significant challenges to widespread adoption in global markets

- For instance, the list price of enzyme replacement therapies for lysosomal storage disorders can exceed several hundred thousand dollars per year, limiting accessibility for many patients

- Healthcare payers and insurance systems often impose stringent reimbursement criteria, delaying patient access to essential treatments

- Production complexities, small patient populations, and expensive R&D investments contribute to elevated prices, which can hinder market penetration in developing regions

- Complex regulatory requirements across different countries can delay drug approvals and market entry, limiting the global availability of orphan therapies

- Low awareness among healthcare providers and patients in certain regions about rare diseases and orphan drugs can reduce adoption rates and slow market growth

- Overcoming these challenges through innovative pricing models, patient assistance programs, and policy reforms will be critical for expanding the reach of orphan drugs and ensuring sustained market growth

Orphan Drugs Market Scope

The market is segmented on the basis of drug type, disease type, indication type, drug brand, sale type, therapy class, and distribution channel.

- By Drug Type

On the basis of drug type, the orphan drugs market is segmented into biological and non-biological drugs. The biological segment dominated the market with the largest revenue share of 58.3% in 2024, owing to its high efficacy, targeted action, and reduced side effects compared to traditional therapies. Biological drugs include monoclonal antibodies, gene therapies, and enzyme replacement therapies, which are widely adopted in oncology, metabolic, and hematologic indications. These therapies are highly compatible with personalized medicine approaches, allowing treatment to be tailored to individual patient needs. Major pharmaceutical companies continue to invest heavily in biological orphan drug development, reinforcing dominance. Regulatory incentives, such as market exclusivity and tax credits, encourage research and commercialization. The ability of biological drugs to address previously untreatable rare diseases drives continued global adoption.

The non-biological segment is expected to witness the fastest growth rate of 14.8% from 2025 to 2032, fueled by rising innovation in small molecule drugs for rare metabolic and hematologic disorders. Non-biological drugs are easier to manufacture, store, and distribute, making them attractive in emerging markets with limited infrastructure. Patient preference for oral formulations over injectables supports growth in certain regions. Generics and biosimilar versions are expanding access to cost-sensitive populations. Accelerated regulatory pathways for orphan drugs enhance market entry and adoption. The versatility of non-biological drugs across multiple rare disease indications ensures rapid uptake in hospitals, specialty clinics, and retail channels.

- By Disease Type

On the basis of disease type, the orphan drugs market is segmented into oncologic, metabolic, hematologic & immunologic, infectious, neurological diseases, and others. The oncologic diseases segment dominated the market with a share of 36.9% in 2024, driven by the increasing prevalence of rare cancers and high demand for targeted therapies. Drugs such as Rituxan, Revlimid, and Keytruda offer higher efficacy and lower toxicity than conventional chemotherapy. Hospitals and specialty clinics are rapidly adopting these treatments, supported by reimbursement coverage and insurance policies. Strong R&D investment continues to expand oncology pipelines. Awareness campaigns and early detection programs further increase patient access. Biotech and pharmaceutical companies prioritize oncology orphan drugs, ensuring ongoing market dominance.

The metabolic disease segment is expected to witness the fastest growth at a CAGR of 13.6% from 2025 to 2032, driven by rising incidence of rare inherited metabolic disorders and enzyme replacement therapy advancements. Newborn screening programs enable early diagnosis and prompt intervention. Patient advocacy initiatives increase awareness and demand. Home-based therapy options improve adherence and convenience for families. Gene therapy development for metabolic disorders is expanding treatment availability. Emerging markets with rising healthcare infrastructure present untapped growth opportunities.

- By Indication Type

On the basis of indication, the orphan drugs market is segmented into non-Hodgkin lymphoma, acute myeloid leukemia, cystic fibrosis, glioma, pancreatic cancer, ovarian cancer, multiple myeloma, Duchenne muscular dystrophy, renal cell carcinoma, graft vs host disease, and others. The non-Hodgkin lymphoma segment dominated the market in 2024 due to high prevalence and availability of targeted therapies such as Rituxan and Revlimid. These treatments provide significant survival benefits and reduced side effects compared to conventional chemotherapy. Hospitals prioritize monoclonal antibody therapies for better patient outcomes. Reimbursement coverage supports adoption in developed regions. Ongoing R&D in combination therapies enhances treatment effectiveness. Physician familiarity and robust clinical evidence maintain dominance.

The Duchenne muscular dystrophy segment is expected to witness the fastest growth at a CAGR of 15.2% from 2025 to 2032, driven by gene therapy approvals and increasing awareness of rare neuromuscular diseases. Early genetic screening improves diagnosis rates. Advocacy campaigns support treatment uptake. Specialty biotech investments accelerate pipeline development. Home-based and clinic-administered therapies enhance patient convenience. Regulatory incentives facilitate faster market entry and adoption globally.

- By Drug Brand

On the basis of brand, the orphan drugs market is segmented into Revlimid, Rituxan, Opdivo, Keytruda, Imbruvica, Soliris, Jakafi, Pomalyst, Darzalex, Spinraza, Adcetris. The Revlimid segment dominated in 2024 due to wide use in multiple myeloma and strong physician confidence from proven efficacy. Its safety profile, multi-market availability, and hospital adoption contribute to leadership. Patient assistance programs enhance accessibility and adherence. Strategic collaborations and marketing support reinforce penetration. Robust clinical evidence and long-term outcomes maintain physician preference. Reimbursement coverage ensures sustained dominance across developed markets.

The Spinraza segment is expected to witness the fastest growth, driven by treatment of spinal muscular atrophy and rising awareness of neuromuscular rare diseases. Early diagnosis and genetic screening improve patient access. Insurance coverage facilitates uptake in developed and emerging markets. Expansion into new geographies drives sales growth. Advocacy campaigns and patient support programs encourage adherence. Biotech investments in SMA therapies accelerate pipeline development and market expansion globally.

- By Sale Type

On the basis of sale, the orphan drugs market is segmented into generics and prescribed. The prescribed segment dominated with a share of 71.5% in 2024 due to physician-supervised treatment requirements for rare diseases. Hospitals and specialty clinics ensure proper dosing, monitoring, and patient safety. Insurance coverage supports treatment adoption. Patient assistance programs maintain accessibility. Physician trust in prescribed therapies reinforces market dominance. Specialty programs for rare diseases strengthen demand and growth.

The generics segment is expected to grow fastest at a CAGR of 16.1% from 2025 to 2032, driven by patent expirations, cost-sensitive populations, and increasing patient access in emerging markets. Generics provide affordable alternatives without compromising efficacy. Healthcare systems incentivize generics adoption. Multiple indications for generics expand market reach. Regulatory approvals for biosimilars enhance confidence. Patient education and awareness campaigns support adoption across regions with limited resources.

- By Therapy Class

On the basis of therapy class, the orphan drugs market is segmented into oncology, blood, CNS, endocrine, cardiovascular, and respiratory. The oncology therapy segment dominated in 2024 with a share of 38.7% due to high prevalence of rare cancers and a robust pipeline of targeted therapies. Hospitals adopt oncology orphan drugs widely, supported by reimbursement and patient monitoring. These therapies improve survival rates and reduce side effects. Awareness campaigns enhance early diagnosis. Biotech and pharma investment continues to expand pipelines. Leading companies prioritize oncology orphan drugs for strategic growth.

The CNS therapy segment is expected to witness the fastest growth at 14.5% CAGR from 2025 to 2032, driven by rising rare neurological disorders and increasing gene therapy approvals. Early genetic testing supports treatment. Advocacy programs increase awareness and access. Home-based therapies improve adherence. Biotech investment accelerates pipeline development. Emerging markets expand treatment availability and support market growth.

- By Distribution Channel

On the basis of distribution channel, the orphan drugs market is segmented into hospital pharmacy, retail pharmacy, online sales, and others. The hospital pharmacy segment dominated in 2024 with a share of 62.4%, supported by prescriptions, specialized storage, and direct patient access. Hospitals provide monitoring and clinical support essential for orphan drugs. Strong physician relationships maintain adoption. Insurance coverage and reimbursement encourage hospital use. Patient adherence programs are facilitated through hospital pharmacies. Specialty clinics reinforce demand and growth.

The online sales segment is expected to witness the fastest growth at a CAGR of 17.2% from 2025 to 2032, driven by e-pharmacy adoption, telemedicine integration, and convenience for remote patients. Digital platforms improve therapy accessibility. Home delivery and patient support enhance adherence. Online portals allow better tracking of rare disease treatments. Telehealth consultations complement online sales. Rising internet penetration in emerging markets fuels adoption and supports global growth.

Orphan Drugs Market Regional Analysis

- North America dominated the orphan drugs market with the largest revenue share of 43% in 2024, driven by strong government support, high healthcare expenditure, and a robust pipeline of innovative therapies

- The market growth in the region is further supported by high healthcare expenditure, strong insurance coverage, advanced hospital and specialty clinic networks, and a technologically savvy population that prioritizes early diagnosis and personalized treatment plans

- In addition, favorable regulatory frameworks, including market exclusivity, tax incentives, and accelerated approval pathways, encourage pharmaceutical companies to invest in orphan drug R&D and commercialization

U.S. Orphan Drugs Market Insight

The U.S. orphan drugs market captured the largest revenue share of 76% in 2024 within North America, driven by the growing prevalence of rare diseases and a strong focus on personalized medicine. Healthcare providers are increasingly prioritizing the use of gene therapies, biologics, and enzyme replacement therapies to address unmet medical needs. The robust R&D pipeline, coupled with supportive regulatory incentives such as the Orphan Drug Act, is accelerating drug approvals and market penetration. In addition, patient access programs, insurance coverage, and hospital adoption contribute to high uptake. The U.S. also benefits from widespread awareness among physicians and patients about rare diseases, further fueling market expansion. Overall, the integration of innovative therapies with advanced healthcare infrastructure positions the U.S. as the dominant regional market.

Europe Orphan Drugs Market Insight

The Europe orphan drugs market is projected to grow at a substantial CAGR throughout the forecast period, driven by increasing government support, regulatory incentives, and rising awareness of rare diseases. The demand for innovative therapies in oncology, metabolic, and hematologic disorders is increasing across hospitals, specialty clinics, and research centers. Countries such as Germany, France, and Italy are witnessing growth due to strong healthcare infrastructure, reimbursement policies, and early diagnosis programs. Patient advocacy initiatives and public-private collaborations are also contributing to the adoption of orphan drugs. The integration of personalized medicine and gene therapy into standard treatment protocols enhances clinical outcomes. Europe’s focus on research, patient access, and sustainable healthcare solutions continues to support market expansion.

U.K. Orphan Drugs Market Insight

The U.K. orphan drugs market is expected to grow at a noteworthy CAGR during the forecast period, driven by the rising prevalence of rare diseases and the government’s commitment to facilitating early access to novel therapies. The adoption of biologics and gene therapies is increasing across hospitals and specialty clinics due to favorable reimbursement and pricing policies. Patient awareness campaigns, coupled with growing interest in precision medicine, are boosting demand. The presence of strong pharmaceutical and biotech companies investing in rare disease pipelines further strengthens market growth. In addition, the U.K.’s well-developed healthcare system and centralized regulatory pathways facilitate faster approvals and therapy adoption. Overall, the combination of innovation, awareness, and supportive policies is propelling the orphan drugs market in the U.K.

Germany Orphan Drugs Market Insight

The Germany orphan drugs market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of rare diseases and high adoption of advanced therapies such as biologics and gene therapies. Germany’s strong healthcare infrastructure, coupled with robust R&D investment and regulatory support, promotes orphan drug development and commercialization. Hospitals and specialty clinics are increasingly integrating orphan drugs into treatment protocols for oncology, metabolic, and hematologic disorders. Patient advocacy programs, reimbursement support, and early diagnosis initiatives contribute to widespread adoption. In addition, Germany’s focus on innovation, sustainability, and patient-centric healthcare aligns with the growth of personalized and targeted therapies. The market benefits from both domestic pharmaceutical players and multinational companies operating within the region.

Asia-Pacific Orphan Drugs Market Insight

The Asia-Pacific orphan drugs market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing prevalence of rare diseases, rising healthcare expenditure, and expanding access to advanced therapies in countries such as China, Japan, and India. Government initiatives to promote rare disease awareness, early diagnosis programs, and patient support schemes are supporting market growth. Emerging markets are witnessing higher adoption of biologics, gene therapies, and enzyme replacement therapies due to improving healthcare infrastructure. Growing patient awareness, coupled with expanding hospital and specialty clinic networks, is increasing treatment accessibility. In addition, Asia-Pacific’s evolving pharmaceutical and biotech landscape is accelerating research, approvals, and commercialization. The region’s combination of large patient populations and supportive policies positions it as the fastest-growing orphan drugs market globally.

Japan Orphan Drugs Market Insight

The Japan orphan drugs market is gaining momentum due to the country’s high prevalence of rare diseases, advanced healthcare infrastructure, and strong government support for orphan drug development. Hospitals and specialty clinics are adopting biologics, gene therapies, and enzyme replacement therapies at an increasing rate. Early genetic testing and screening programs facilitate timely diagnosis and treatment. Patient awareness campaigns and advocacy programs are improving therapy adoption and adherence. Regulatory incentives, including expedited approval pathways and market exclusivity, further support growth. Japan’s aging population also drives demand for effective therapies for rare neuromuscular, metabolic, and hematologic conditions, boosting market expansion across both residential and institutional healthcare settings.

India Orphan Drugs Market Insight

The India orphan drugs market accounted for a significant share in Asia-Pacific in 2024, attributed to increasing awareness of rare diseases, expanding healthcare infrastructure, and rising adoption of biologics and gene therapies. Hospitals and specialty clinics are incorporating advanced therapies for rare oncology, metabolic, and neurological disorders. Government initiatives supporting rare disease research, patient assistance programs, and healthcare digitization are key growth drivers. The growing middle class and rising disposable incomes enable access to innovative treatments. In addition, local pharmaceutical manufacturers and collaborations with multinational companies are enhancing availability and affordability. Overall, India’s combination of supportive policies, expanding infrastructure, and growing awareness is propelling orphan drug adoption across the country.

Orphan Drugs Market Share

The Orphan Drugs industry is primarily led by well-established companies, including:

- Johnson & Johnson and its affiliates (U.S.)

- Novartis AG (Switzerland)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Bristol-Myers Squibb Company (U.S.)

- Amgen Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Takeda Pharmaceutical Company Limited (Japan)

- Sanofi (France)

- AstraZeneca (U.K.)

- AbbVie Inc. (U.S.)

- Alexion Pharmaceuticals, Inc. (U.S.)

- GSK plc (U.K.)

- Daiichi Sankyo Company, Limited (Japan)

- Bayer AG (Germany)

- Vertex Pharmaceuticals Incorporated (U.S.)

- Horizon Therapeutics plc (Ireland)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- Biomarin Pharmaceutical Inc. (U.S.)

- CSL Behring LLC (U.S.)

- Sarepta Therapeutics, Inc. (U.S.)

What are the Recent Developments in Global Orphan Drugs Market?

- In September 2025, the U.S. FDA granted accelerated approval to Stealth Biotherapeutics' drug Forzinity for Barth syndrome. This marks the first approved treatment for Barth syndrome, a rare, life-threatening mitochondrial disease that mainly affects males. Forzinity improves mitochondrial structure and function, and its approval was based on enhanced knee muscle strength, a marker considered such asly to predict broader functional benefits

- In September 2025, Regeneron Pharmaceuticals announced that its experimental drug, garetosmab, has successfully met the main goal in a late-stage clinical trial for treating fibrodysplasia ossificans progressiva (FOP). The trial demonstrated that garetosmab significantly reduced the formation of new bone abnormalities, with a 94% reduction at a 3 mg/kg dose and 90% at a 10 mg/kg dose compared to a placebo. Regeneron plans to submit a marketing application to the FDA by the end of 2025

- In July 2025, the European Medicines Agency granted orphan drug designation to Spinogenix's SPG601 for the treatment of Fragile X Syndrome (FXS). FXS is a common inherited form of autism, and the EMA's designation offers people with FXS throughout the European Union access to this novel therapeutic

- In June 2025, the U.S. FDA granted orphan drug designation to rilzabrutinib for sickle cell disease. Rilzabrutinib is a novel, advanced, oral, reversible Bruton's tyrosine kinase (BTK) inhibitor that works via multi-immune modulation to target a reduction in vaso-occlusive crises, which may occur via inflammation, in sickle cell disease

- In April 2025, the U.S. FDA approved Incyte's eczema cream for pediatric patients aged 2 to 11. This approval extends the use of Opzelura, the first topical JAK inhibitor approved in 2021 for individuals 12 and older. The decision was based on successful late-stage trial results showing better efficacy than a non-medicated cream. Eczema

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.