Global Ortho Xylene Market

Market Size in USD Billion

CAGR :

%

USD

4.10 Billion

USD

5.52 Billion

2024

2032

USD

4.10 Billion

USD

5.52 Billion

2024

2032

| 2025 –2032 | |

| USD 4.10 Billion | |

| USD 5.52 Billion | |

|

|

|

|

Ortho-Xylene Market Size

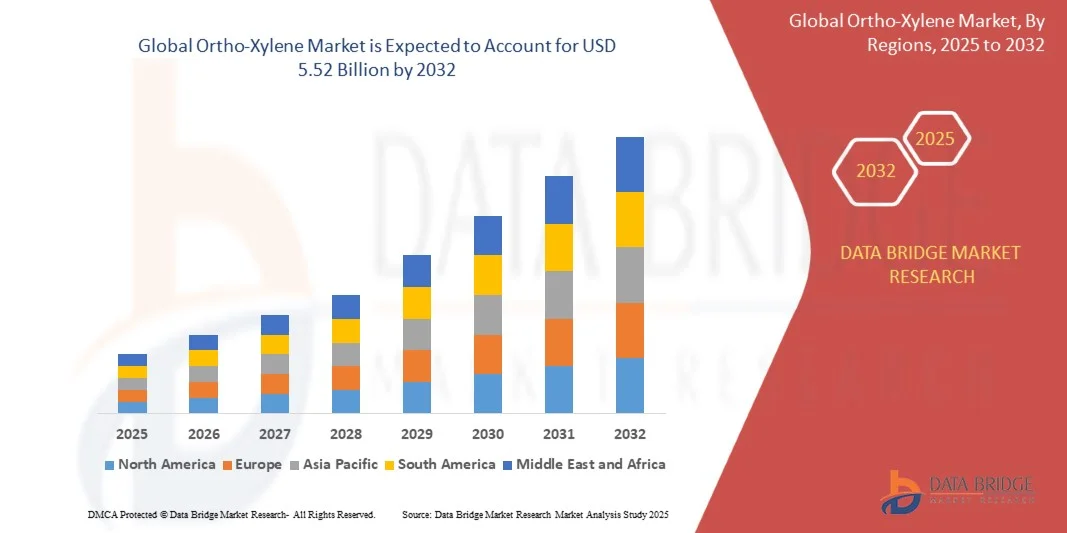

- The Ortho-Xylene Market size was valued at USD 4.10 billion in 2024 and is projected to reach USD 5.52 billion by 2032, growing at a CAGR of 3.80% during the forecast period.

- The market growth is primarily driven by increasing demand for phthalic anhydride, a key derivative used in plasticizers, paints, dyes, and polyester resins across construction and automotive industries.

- Additionally, expanding industrialization in emerging economies, coupled with rising investments in chemical manufacturing and infrastructure, is boosting the consumption of ortho-xylene, thereby accelerating overall market expansion.

Ortho-Xylene Market Analysis

- Ortho-xylene, a key aromatic hydrocarbon, is essential in the production of phthalic anhydride, widely used in plasticizers, resins, dyes, and agrochemicals, making it a critical input for various industrial applications including automotive, construction, and packaging sectors.

- The rising demand for phthalate-based plasticizers and polyester resins is a primary growth driver, fueled by rapid urbanization, infrastructure development, and increased consumption of consumer goods, especially in developing regions.

- Asia-Pacific dominated the ortho-xylene market with the largest revenue share of 42.8% in 2024, driven by robust industrial output, expanding construction activities, and strong demand from end-use sectors in countries like China and India, where domestic production and consumption remain high.

- North America is expected to witness steady growth in the ortho-xylene market due to technological advancements in production, a well-established chemical industry, and consistent demand from plastics and coatings manufacturers.

- The phthalic anhydride segment dominated the market with the largest revenue share of 62.5% in 2024, primarily due to its extensive use in manufacturing plasticizers, alkyd resins, and polyester resins.

Report Scope and Ortho-Xylene Market Segmentation

|

Attributes |

Ortho-Xylene Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ortho-Xylene Market Trends

“Technological Advancements and Process Optimization in Ortho-Xylene Production”

- A significant and accelerating trend in the Ortho-Xylene Market is the integration of advanced production technologies and process optimization techniques, aimed at improving yield, energy efficiency, and environmental performance. These innovations are crucial as manufacturers strive to meet growing demand while adhering to increasingly stringent environmental regulations.

- For Instance, companies such as ExxonMobil and Reliance Industries are investing in catalytic reforming and aromatic extraction technologies to enhance the purity and recovery rates of ortho-xylene from mixed xylene streams. These advancements reduce energy consumption and minimize by-product waste, making production more cost-effective and sustainable.

- Process automation and AI-driven analytics are also being deployed to monitor key production variables in real time, enabling predictive maintenance, reduced downtime, and optimized resource usage. This results in higher throughput and more stable supply to downstream industries such as plastics, paints, and coatings.

- Moreover, the adoption of closed-loop systems and carbon capture technologies in large-scale chemical complexes is enhancing the environmental sustainability of ortho-xylene production, helping companies align with global carbon reduction goals while maintaining competitiveness.

- As demand for phthalic anhydride and plasticizers surges, particularly in construction and automotive applications, these process innovations are becoming vital in scaling operations efficiently. Leading producers in regions like Asia-Pacific and North America are setting new benchmarks in productivity through continuous R&D and infrastructure upgrades.

- This trend toward technologically advanced and eco-conscious manufacturing is reshaping the competitive landscape of the ortho-xylene market. Companies investing in cleaner, smarter production capabilities are gaining a strategic edge, positioning themselves to meet both current demand and future regulatory expectations globally.

Ortho-Xylene Market Dynamics

Driver

“Growing Demand Driven by Expanding End-Use Industries and Urbanization”

- The rising demand for phthalic anhydride, a key derivative of ortho-xylene, is significantly propelling market growth, particularly in industries such as plastics, automotive, paints & coatings, and construction. These sectors rely heavily on ortho-xylene-based products like plasticizers, dyes, and polyester resins.

- For Instance, the construction boom in Asia-Pacific and the Middle East, along with increased automotive production in India and China, is fueling demand for PVC and alkyd resins, both of which require phthalic anhydride derived from ortho-xylene. As infrastructure and housing projects continue to rise globally, the need for ortho-xylene as a raw material is expected to increase proportionally.

- Moreover, rapid urbanization and growing consumer demand for durable, lightweight, and weather-resistant materials are expanding the application scope of ortho-xylene. These materials are widely used in pipes, wires, synthetic fibers, and coatings for both residential and industrial use.

- In addition, ongoing investments in chemical manufacturing and refining infrastructure—especially in developing regions like Southeast Asia and the Middle East—are bolstering regional supply and supporting long-term market expansion. Strategic initiatives from major players such as Reliance Industries and Lotte Chemical are aimed at increasing production capacity to meet rising global demand.

- The synergy between rising consumer needs, industrial growth, and increased production capabilities makes ortho-xylene a crucial chemical feedstock for various value chains, reinforcing its role as a foundational component in multiple high-growth sectors.

Restraint/Challenge

“Volatility in Raw Material Prices and Environmental Regulations”

- The ortho-xylene market faces notable challenges stemming from volatile crude oil prices, as ortho-xylene is a petrochemical derived from naphtha. Fluctuations in oil markets can significantly impact production costs and profit margins, creating uncertainty for both manufacturers and buyers.

- For instance, global geopolitical tensions and supply chain disruptions often lead to price spikes in feedstocks like mixed xylenes and crude oil, making it difficult for producers to maintain stable pricing and supply consistency. This volatility can hinder long-term investment planning and contract negotiations.

- Furthermore, stringent environmental regulations related to air pollution, chemical waste disposal, and carbon emissions pose compliance challenges for producers. Ortho-xylene production involves processes that can emit volatile organic compounds (VOCs), drawing increased regulatory scrutiny in regions such as the European Union and North America.

- Companies are being pressured to adopt cleaner technologies, emission control systems, and sustainable production practices, which may involve substantial capital expenditures. Smaller firms, in particular, may struggle with the financial burden of meeting these evolving standards.

- To address these challenges, market leaders are investing in process optimization, waste reduction, and greener alternatives. However, the ongoing need to balance regulatory compliance, cost control, and environmental responsibility will remain a key hurdle to sustained market growth.

Ortho-Xylene Market Scope

The ortho-xylene market is segmented on the basis of application and end use industry.

• By Application

On the basis of application, the Ortho-Xylene Market is segmented into Phthalic Anhydride, Bactericides, Herbicides, Lube Oil Additives, and Others. The Phthalic Anhydride segment dominated the market with the largest revenue share of 62.5% in 2024, primarily due to its extensive use in manufacturing plasticizers, alkyd resins, and polyester resins. These materials are in high demand across industries like construction, automotive, and packaging. The production of PVC, coatings, and dyes further contributes to the strong demand for phthalic anhydride, reinforcing ortho-xylene’s role as a critical feedstock.

The Herbicides segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising global food demand, increased focus on agricultural productivity, and expanding use of agrochemicals in emerging economies. As agricultural modernization spreads, the use of ortho-xylene derivatives in herbicide formulation is increasing, particularly in Asia-Pacific and Latin America.

• By End Use Industry

On the basis of end use industry, the market is segmented into Automotive, Building and Construction, Paints and Coatings, Aerospace and Defense, Marine, Electrical and Electronics, Agrochemical, Oil and Gas, Chemical, and Others. The Paints and Coatings segment dominated with the highest market share of 31.4% in 2024, driven by strong demand for surface coatings, decorative paints, and industrial finishes. Ortho-xylene is a crucial raw material in alkyd resin production, which is widely used in paints due to its durability and aesthetic appeal. This demand is supported by infrastructure growth and housing projects worldwide.

The Automotive segment is projected to register the fastest CAGR from 2025 to 2032, fueled by increased vehicle production, rising demand for lightweight plastics, and use of resins and dyes in automotive components. As manufacturers emphasize fuel efficiency and design innovation, ortho-xylene-based products find growing application in coatings, sealants, and interior plastics.

Ortho-Xylene Market Regional Analysis

- Asia-Pacific dominated the Ortho-Xylene Market with the largest revenue share of 42.8% in 2024, driven by rapid industrialization, expanding chemical manufacturing capacity, and strong demand from end-use industries such as construction, automotive, and plastics.

- Countries like China, India, and South Korea are leading consumers and producers of ortho-xylene, owing to their robust infrastructure development, high consumption of plasticizers and resins, and government support for industrial growth.

- This dominance is further supported by favorable economic conditions, a large-scale manufacturing base, and the presence of major chemical players, enabling cost-effective production and export. The region’s growing middle class, urban expansion, and increasing investments in housing and infrastructure continue to strengthen demand for ortho-xylene and its derivatives, particularly phthalic anhydride, making Asia-Pacific a critical hub for global market growth.

Japan Ortho-Xylene Market Insight

The Japan ortho-xylene market is gaining momentum due to the country’s high-quality standards in automotive and electronics manufacturing. Demand is supported by the need for high-performance plastics and coatings, especially in sectors like automotive interiors, electrical insulation, and construction materials. Japan’s commitment to energy efficiency and environmental compliance is encouraging chemical producers to invest in low-emission technologies and optimize existing ortho-xylene production methods. Furthermore, the rising popularity of eco-friendly packaging and materials is likely to spur innovation in downstream applications, supporting long-term market growth.

China Ortho-Xylene Market Insight

The China ortho-xylene market accounted for the largest revenue share in the Asia-Pacific region in 2024, driven by the country's massive chemical manufacturing capacity, rapid urbanization, and expanding middle class. China is one of the largest global producers and consumers of ortho-xylene, thanks to its thriving construction, automotive, and plastics industries. Government-backed infrastructure projects, increasing demand for durable consumer goods, and the presence of major local producers such as Sinopec continue to support high consumption levels. The country’s push toward self-reliance in petrochemical production and green manufacturing is further reinforcing growth opportunities in the market.

U.S. Ortho-Xylene Market Insight

The U.S. ortho-xylene market captured the largest revenue share 80% within North America in 2024, driven by the country’s well-established chemical industry, increasing demand for phthalic anhydride, and consistent consumption across automotive, construction, and coatings sectors. The U.S. benefits from advanced production infrastructure, the presence of major players like ExxonMobil and Flint Hills Resources, and technological innovation in refining and petrochemical processes. Furthermore, the rising demand for eco-efficient resins and plasticizers used in paints, cables, and automotive interiors continues to bolster market expansion. Regulatory focus on emissions is also pushing producers toward cleaner and more energy-efficient technologies.

Europe Ortho-Xylene Market Insight

The Europe ortho-xylene market is projected to grow at a moderate yet steady CAGR throughout the forecast period, supported by the region’s mature manufacturing base and stringent environmental regulations. Demand is primarily driven by the construction, automotive, and paints and coatings sectors, where ortho-xylene derivatives are extensively used. Sustainability initiatives are prompting the development of low-VOC paints and phthalate-free plasticizers, driving demand for innovative applications of ortho-xylene. Additionally, rising investments in green buildings and infrastructure modernization are reinforcing the need for ortho-xylene-based products in paints and polymer resins across the EU.

U.K. Ortho-Xylene Market Insight

The U.K. ortho-xylene market is expected to grow at a noteworthy CAGR during the forecast period, supported by increasing demand for construction chemicals, coating materials, and automotive components. The push toward infrastructure upgrades and the growing adoption of high-performance paints and polymers are key drivers of growth. Moreover, the U.K.'s focus on reducing the environmental impact of chemical processes is encouraging manufacturers to explore energy-efficient production methods and sustainable feedstocks, potentially reshaping future demand dynamics within the ortho-xylene market.

Germany Ortho-Xylene Market Insight

The Germany ortho-xylene market is projected to expand at a healthy CAGR, driven by the country’s strong emphasis on engineering excellence, automotive innovation, and chemical processing efficiency. As a leading hub for specialty chemicals and industrial coatings, Germany continues to see strong demand for phthalic anhydride and alkyd resins, both of which rely on ortho-xylene. Additionally, the German market is heavily influenced by EU environmental directives, which are pushing industries toward greener solvents and coatings, thus fostering innovations in ortho-xylene use and processing technologies.

Ortho-Xylene Market Share

The Ortho-Xylene industry is primarily led by well-established companies, including:

- Braskem S/A (Brazil)

- China Petroleum & Chemical Corporation (Sinopec) (China)

- Exxon Mobil Corporation (U.S.)

- Flint Hills Resources LLC (Koch Industries Inc.) (U.S.)

- Formosa Chemicals & Fibre Corp. (Taiwan)

- Honeywell International Inc. (U.S.)

- Lotte Chemical Corporation (South Korea)

- Nouri Petrochemical Company (Iran)

- Reliance Industries Limited (India)

- SK geo centric Co. Ltd. (SK Innovation Co. Ltd.) (South Korea)

What are the Recent Developments in Ortho-Xylene Market?

- In April 2023, Braskem S/A, a global leader in petrochemical production, announced the expansion of its ortho-xylene production capacity at its Brazil facility. This strategic move aims to meet rising demand from the automotive and construction sectors for phthalic anhydride and plasticizers. By leveraging advanced catalytic technologies and optimizing production efficiency, Braskem is reinforcing its position as a key player in the growing Ortho-Xylene Market.

- In March 2023, China Petroleum & Chemical Corporation (Sinopec) inaugurated a new integrated petrochemical complex in Zhejiang Province, focusing on boosting ortho-xylene output. The facility is designed to support the rising consumption in China’s paints, coatings, and plasticizer industries. This development underscores Sinopec’s commitment to expanding domestic supply chains and addressing evolving market needs with sustainable manufacturing practices.

- In March 2023, Exxon Mobil Corporation announced the successful commissioning of its upgraded ortho-xylene processing unit at its Texas refinery. The upgrade enhances production efficiency and reduces environmental impact through energy-saving technologies. This initiative highlights ExxonMobil’s ongoing dedication to meeting the increasing global demand for high-purity ortho-xylene, particularly for applications in automotive coatings and industrial adhesives.

- In February 2023, Lotte Chemical Corporation entered into a strategic partnership with several regional chemical manufacturers in South Korea to develop advanced ortho-xylene derivatives tailored for the electronics and electrical industries. The collaboration aims to innovate new formulations that improve product performance and sustainability, reflecting Lotte Chemical’s commitment to innovation and market responsiveness.

- In January 2023, Reliance Industries Limited announced the launch of a new downstream processing unit at its Jamnagar complex, focused on producing high-grade ortho-xylene for phthalic anhydride and plasticizer applications. The facility’s enhanced capabilities will support India’s growing demand in the automotive and construction sectors, while also emphasizing Reliance’s strategy of expanding its footprint in the Ortho-Xylene Market through technological advancement and capacity growth.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ortho Xylene Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ortho Xylene Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ortho Xylene Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.