Global Orthopedic Joint Reconstruction Market

Market Size in USD Billion

CAGR :

%

USD

19.92 Billion

USD

27.06 Billion

2024

2032

USD

19.92 Billion

USD

27.06 Billion

2024

2032

| 2025 –2032 | |

| USD 19.92 Billion | |

| USD 27.06 Billion | |

|

|

|

|

Orthopedic Joint Reconstruction Market Size

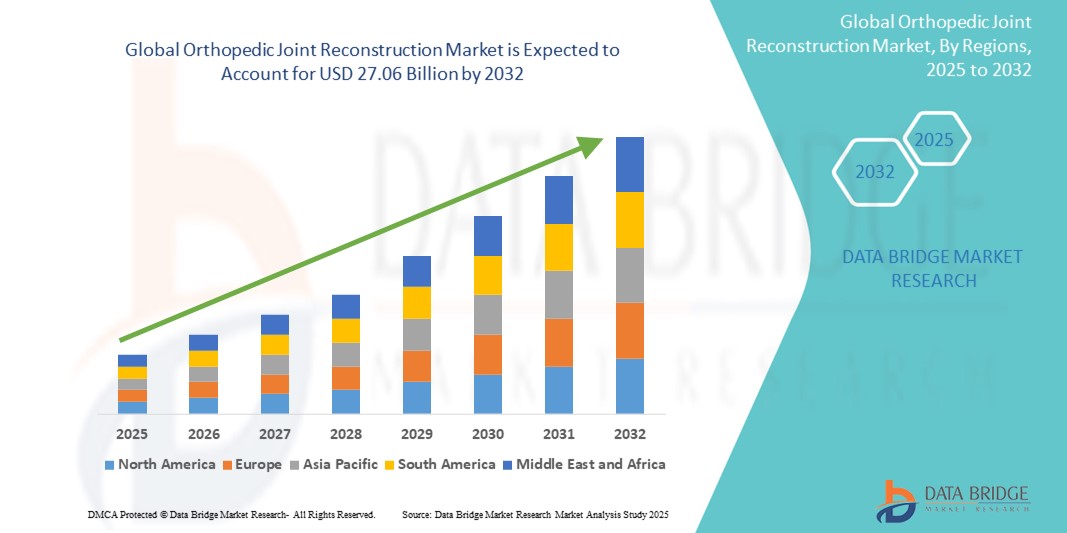

- The global orthopedic joint reconstruction market size was valued at USD 19.92 billion in 2024 and is expected to reach USD 27.06 billion by 2032, at a CAGR of 3.90 % during the forecast period

- This growth is driven by factors such as the increasing aging population, rising prevalence of joint disorders, advancements in surgical techniques and implants, and growing demand for minimally invasive procedures

Orthopedic Joint Reconstruction Market Analysis

- The orthopedic joint reconstruction market is experiencing steady growth due to the increasing number of joint replacement surgeries globally, driven by aging populations and a rise in orthopedic conditions. This growth reflects a higher demand for advanced surgical procedures and innovative products

- Technological advancements in joint reconstruction implants and surgical techniques are significantly improving outcomes and recovery times. These innovations are expanding the market potential by enhancing patient satisfaction and surgical precision

- North America is expected to dominate the orthopedic joint reconstructions market due to its advanced healthcare infrastructure, high adoption of innovative medical technologies, and a large aging population requiring joint replacement surgeries.

- Asia-Pacific is expected to be the fastest growing region in the Orthopedic Joint Reconstruction market during the forecast period due to increasing healthcare access, a rising aging population, and growing awareness of orthopedic treatments.

- Allografts segment is expected to dominate the global orthopedic joint reconstruction market holding a major market share 60.7% in 2025, due to the osteoconductivity, reduced surgical time, and wide availability through tissue banks.

Report Scope and Orthopedic Joint Reconstruction Market Segmentation

|

Attributes |

Orthopedic Joint Reconstruction Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Orthopedic Joint Reconstruction Market Trends

“Increasing Adoption of Robotic and AI Integration in Joint Reconstruction”

- Robotic-assisted systems enable sub-millimeter accuracy in joint replacement surgeries, significantly reducing variability in implant placement

- For instance, The Mako SmartRobotics system by Stryker uses CT-based planning and robotic arm assistance to enhance accuracy in total knee arthroplasty

- Personalized surgical plans are created using preoperative imaging (such as 3D CT scans), tailored to each patient's unique anatomy and biomechanics

- AI analyzes large datasets from previous cases to guide surgeons in selecting optimal surgical approaches and implant types based on specific patient profiles

- Precise alignment and balancing of soft tissues reduce complications such as implant loosening, malalignment, and abnormal wear

- Enhanced accuracy leads to quicker recovery times, reduced postoperative pain, and improved long-term outcomes for patients

- Hospitals adopting these technologies report higher patient satisfaction scores and lower revision rates over time

- For instance, A 2023 study in the Journal of Arthroplasty showed that robotic-assisted knee replacements had a 37% lower revision rate compared to manual procedures over a 2-year follow-up

Orthopedic Joint Reconstruction Market Dynamics

Driver

“Rising Geriatric Population and Associated Joint Disorders”

- The global elderly population is growing rapidly, with the WHO estimating 2.1 billion people aged 60+ by 2050, directly increasing cases of osteoarthritis and other joint-related disorders

- Older adults frequently suffer from reduced joint mobility and chronic pain, making them prime candidates for hip, knee, and shoulder replacements

- Technological improvements in surgical techniques and implants are leading to quicker recovery and higher success rates among elderly patients

- For instance, A 2023 report in The Journal of Arthroplasty highlighted a 30% improvement in mobility post-surgery among patients over 70 when robotic assistance was used

- In high-income countries, strong healthcare infrastructure and insurance coverage make joint replacement surgeries more accessible to aging populations

- For instance, Medicare in the US covers most costs for total joint replacements, making them one of the most common elective surgeries among seniors

- Medical device companies are developing implants specifically for geriatric patients, designed for lower bone density and minimal surgical trauma, ensuring safer procedures and better outcomes

Opportunity

“Rising Demand for Minimally Invasive Joint Reconstruction”

- The growing preference for minimally invasive surgery (MIS) is a key opportunity in the orthopedic joint reconstruction market, as it offers reduced pain, faster recovery, and smaller incisions compared to traditional open surgery

- For instance, the adoption of minimally invasive knee and hip replacement surgeries has significantly increased in recent years, with MIS techniques now accounting for nearly 30% of total joint replacement procedures in the U.S.

- MIS procedures often result in shorter hospital stays and quicker return to normal activities, which is appealing to both patients and healthcare providers looking to optimize surgical throughput and minimize costs

- For instance, A 2023 study in the Journal of Orthopaedic Surgery found that patients undergoing minimally invasive hip replacement reported a 25% faster recovery time and 40% less post-surgery pain compared to traditional open surgery

- The rise in outpatient facilities and ASCs, which focus on faster recovery times and fewer complications, is driving the demand for these types of procedures, expanding market opportunities for orthopedic companies focusing on these innovations

- Increased patient demand for less invasive procedures, along with advancements in tools and techniques, is encouraging hospitals to adopt MIS technology, expanding the reach of joint reconstruction to a broader population

- These technologies also lower the risk of infection, which is a significant concern in joint replacement surgeries, further motivating their growth in the global market

Restraint/Challenge

“Limited Access to Advanced Technologies”

- High upfront costs of robotic surgical systems and AI-based platforms restrict adoption to large urban hospitals, leaving rural and underfunded healthcare facilities behind

- For instance, Robotic systems such as Stryker’s Mako or Zimmer Biomet’s ROSA can cost upwards of USD 1 million, not including maintenance and disposable components

- Many healthcare systems in low- and middle-income countries lack the infrastructure and funding required to adopt high-tech orthopedic solutions

- Limited insurance reimbursement for robotic or AI-assisted surgeries in some regions discourages hospitals from investing in these technologies

- For instance, in many parts of Asia and Latin America, robotic joint replacements are often considered elective and are not fully covered by public or private insurers

- A steep learning curve and lack of widespread training programs make it difficult for surgeons, especially in remote areas, to gain the expertise needed to safely use advanced systems

- Disparities in access to cutting-edge technologies result in unequal surgical outcomes, with urban patients benefitting from precision tools while others rely on conventional, less accurate techniques

Orthopedic Joint Reconstruction Market Scope

The market is segmented on the basis of product type, joint type, procedure, technique, biomaterial, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Joint Type |

|

|

By Procedure |

|

|

By Technique |

|

|

By Biomaterial |

|

|

By End-User |

|

In 2025, the allografts is projected to dominate the market with a largest share in product type segment

The allografts segment is expected to dominate the orthopedic joint reconstruction market with the largest share of 60.7% in 2025 due to its osteoconductivity, reduced surgical time, and wide availability through tissue banks.

The synthetic bone substitutes is expected to account for the largest share during the forecast period in Product Type market

In 2025, the synthetic bone substitutes segment is expected to dominate the market with the largest market share of 35.5% due to its better biocompatibility, lower risk of disease transmission, and continuous innovation in bioactive materials.

Orthopedic Joint Reconstruction Market Regional Analysis

“North America Holds the Largest Share in the orthopedic joint reconstruction Market”

- North America dominates the orthopedic joint reconstruction Market holding 35.5% share of the market

- The high prevalence of orthopedic disorders, with around 21.2% of U.S. adults diagnosed with arthritis, driving demand for joint surgeries

- Advanced healthcare infrastructure, with over 790,000 knee and 544,000 hip replacements performed annually in the U.S.

- Technological innovations such as AI integration and robotic surgery enhancing surgical precision and treatment outcomes

- An aging population in North America, which is increasing the need for joint replacement surgeries

“Asia-Pacific is Projected to Register the Highest CAGR in the orthopedic joint reconstruction Market”

- The Asia-Pacific region is the fastest-growing market for orthopedic joint reconstruction, driven by increasing healthcare access, aging populations, and rising demand for advanced surgical solutions.

- Arthroscopy is the fastest-growing technique segment in the region, reflecting a shift towards minimally invasive procedures

- Japan is expected to register the highest CAGR from 2024 to 2030, indicating a strong demand for joint reconstruction solutions

- The increasing prevalence of osteoporosis and arthritis in countries such as China and India is driving the need for effective orthopedic interventions

Orthopedic Joint Reconstruction Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Zimmer Biomet (U.S.)

- Stryker (U.S.)

- Johnson & Johnson Private Limited (U.S.)

- Smith+Nephew (U.K.)

- Arthrex, Inc (U.S.)

- Exactech, Inc (U.S.)

- Corin Group (U.K.)

- DJO LLC (U.S.)

- Beijing Chunlizhengda Medical Instruments Co.,Ltd (China)

- B. Braun Melsungen AG (Germany)

- GROUP FH ORTHO communication (U.S.)

- Limacorporate S.p.a. (Italy)

- Japan MDM, Inc (Japan)

- PETER BREHM GmbH (Germany)

- Exactech, Inc (U.S.)

- United Orthopedic Corporation (Taiwan)

Latest Developments in Global Orthopedic Joint Reconstruction Market

- In July 2022, Enovis Corporation launched ARVIS, the first FDA-cleared augmented reality (AR) surgical guidance system for total hip and knee replacement surgeries. This hands-free, wearable device provides real-time, in-surgical-field guidance to orthopedic surgeons, enhancing precision. ARVIS aims to improve patient outcomes, reduce costs, and expand access to advanced surgical technology, especially in ambulatory surgical centers. Its compact design also reduces the need for disposable instruments, promoting a more sustainable and efficient operating room environment

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.