Global Orthopedic Software Market

Market Size in USD Million

CAGR :

%

USD

842.70 Million

USD

1,351.26 Million

2025

2033

USD

842.70 Million

USD

1,351.26 Million

2025

2033

| 2026 –2033 | |

| USD 842.70 Million | |

| USD 1,351.26 Million | |

|

|

|

|

Orthopedic Software Market Size

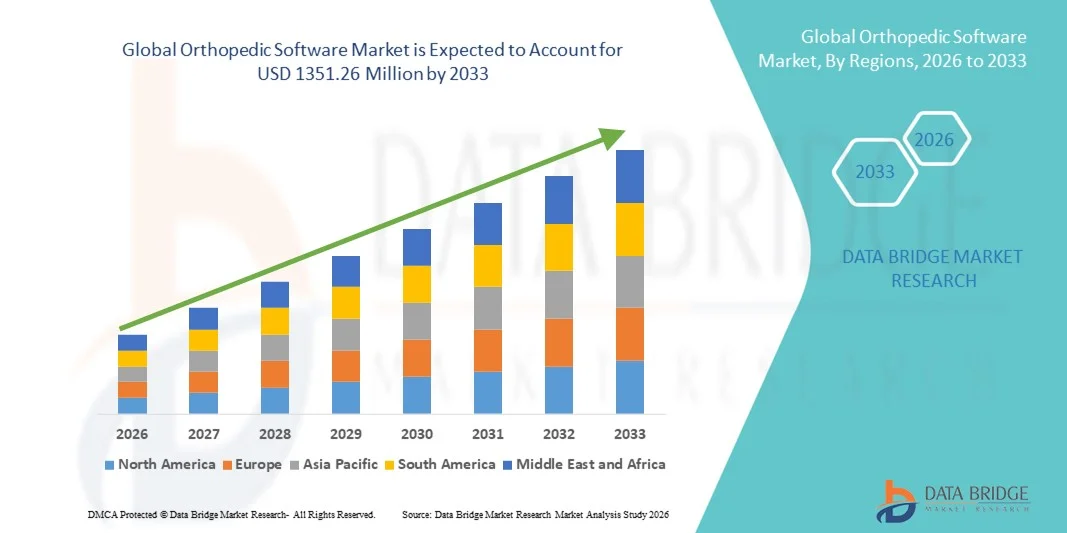

- The global orthopedic software market size was valued at USD 842.7 Million in 2025 and is expected to reach USD 1351.26 Million by 2033, at a CAGR of 6.08% during the forecast period

- The market growth is largely fueled by the increasing adoption of digital solutions and advanced technologies in orthopedic care, enabling improved patient management, surgical planning, and clinical workflow efficiency

- Furthermore, rising demand for data-driven insights, enhanced patient outcomes, and integrated hospital IT systems is accelerating the uptake of orthopedic software solutions, thereby significantly boosting the industry's growth

Orthopedic Software Market Analysis

- Orthopedic software, offering digital solutions for surgical planning, patient management, and post-operative monitoring, is increasingly vital in modern healthcare settings due to its ability to enhance clinical efficiency, improve patient outcomes, and streamline hospital workflows

- The escalating demand for orthopedic software is primarily fueled by the growing adoption of AI-enabled solutions, integrated hospital IT systems, and data-driven decision-making, along with rising focus on reducing surgical complications and improving patient care

- North America dominated the orthopedic software market with the largest revenue share of 42% in 2025, supported by well-established healthcare infrastructure, high healthcare spending, and a strong presence of key industry players, with the U.S. experiencing substantial growth due to increasing adoption of AI-enabled and cloud-based orthopedic solutions in hospitals and clinics

- Asia-Pacific is expected to be the fastest growing region in the orthopedic software market during the forecast period, with a market share of 27% in 2025, driven by rapid digitization of healthcare systems, rising prevalence of orthopedic disorders, and growing investments in hospitals and specialty clinics across countries such as China, India, and Japan

- The Orthopedic Surgery segment held the largest market revenue share of 44.1% in 2025, driven by the increasing number of surgical procedures, growing demand for minimally invasive techniques, and the need for precise surgical planning

Report Scope and Orthopedic Software Market Segmentation

|

Attributes |

Orthopedic Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Orthopedic Software Market Trends

Enhanced Convenience Through AI and Advanced Analytics

- A significant and accelerating trend in the global orthopedic software market is the deepening integration with artificial intelligence (AI) and advanced data analytics platforms. This combination enables predictive modeling for patient outcomes, personalized treatment planning, and improved operational efficiency within orthopedic care

- For instance, AI-enabled platforms like OrthoGrid and Surgical Theater provide clinicians with patient-specific anatomical modeling and predictive surgical outcomes, helping surgeons make more precise decisions regarding implants, alignment, and post-operative rehabilitation. These platforms offer 3D visualization, simulation of surgical procedures, and optimization of implant selection

- AI integration allows for continuous learning from patient datasets, enabling the software to recommend optimized surgical plans and flag potential complications before they occur. Machine learning algorithms can identify patterns in recovery trajectories and suggest personalized rehabilitation protocols, improving patient safety and outcomes

- The seamless integration of orthopedic software with electronic health records (EHRs) and hospital information systems facilitates centralized management of patient data, surgical workflows, and implant inventory. Through a single interface, clinicians can track patient progress, monitor outcomes, and make data-driven decisions

- This trend towards data-driven, predictive, and interconnected orthopedic software solutions is fundamentally reshaping expectations for patient care, hospital efficiency, and treatment accuracy. Consequently, companies such as Smith+Nephew and Stryker are developing AI-powered software tools for pre-operative planning, robotic-assisted surgery, and post-operative outcome monitoring

- The demand for orthopedic software that offers advanced analytics, AI-driven predictive models, and workflow optimization is growing rapidly across hospitals, clinics, and rehabilitation centers, as healthcare providers increasingly prioritize personalized care, efficiency, and evidence-based decision-making

Orthopedic Software Market Dynamics

Driver

Rising Demand for Personalized Care and Improved Surgical Outcomes

- The increasing need for personalized and data-driven orthopedic care is a significant driver of the Orthopedic Software market. Surgeons and hospitals are increasingly adopting software solutions to improve surgical precision, reduce complications, and optimize patient recovery

- For instance, in May 2024, Stryker launched its AI-powered digital surgery platform, enabling 3D pre-operative planning, robotic-assisted surgery, and patient-specific implant optimization. Such innovations are expected to drive market growth during the forecast period

- Orthopedic software helps hospitals and surgeons streamline clinical workflows, enhance implant selection, and provide predictive analytics for recovery outcomes, resulting in more efficient and effective treatment

- The increasing focus on minimally invasive surgeries and faster recovery times is encouraging the adoption of software solutions that support detailed surgical planning, simulation, and post-operative monitoring

- Hospitals, clinics, and rehabilitation centers are leveraging these software tools to improve operational efficiency, reduce errors, and enhance patient satisfaction, further boosting market adoption

Restraint/Challenge

High Cost of Advanced Orthopedic Software

- The relatively high cost of advanced orthopedic software solutions poses a barrier to adoption, particularly for smaller clinics or hospitals in developing regions. Premium features such as AI-driven predictive analytics, 3D visualization, and surgical simulation often come with higher implementation and licensing fees

- Data privacy and regulatory compliance concerns also present challenges. Orthopedic software platforms rely heavily on patient data, which must be securely stored and managed according to HIPAA, GDPR, and other regional regulations

- Smaller healthcare providers may face difficulties integrating these advanced systems with existing EHRs and hospital infrastructure, limiting market penetration

- For instance, in October 2023, several U.S. hospitals reported delays in implementing AI-driven orthopedic software due to concerns about HIPAA compliance and secure integration with legacy patient record systems

- While costs are gradually decreasing and cloud-based subscription models are becoming more common, perceived expenses and the need for staff training can still hinder widespread adoption

- Overcoming these challenges requires robust cybersecurity measures, compliance with healthcare regulations, and development of scalable, cost-effective solutions suitable for diverse healthcare settings

Orthopedic Software Market Scope

The market is segmented on the basis of product, application, mode of delivery, and end user.

- By Product

On the basis of product, the Orthopedic Software market is segmented into Pre-Operative Planning, Orthopedic EHR, and Orthopedic PACS. The Pre-Operative Planning segment dominated the largest market revenue share of 41.8% in 2025, driven by its ability to help surgeons plan complex procedures with enhanced accuracy, reduce surgical errors, and optimize implant selection. Hospitals and orthopedic centers prefer pre-operative planning tools for personalized surgical guidance, 3D modeling, and simulation, which improve patient outcomes and operational efficiency. The segment’s compatibility with other digital orthopedic platforms and integration with electronic health records further boosts adoption. Additionally, increasing awareness about surgical precision and the growing number of orthopedic surgeries globally are strengthening its position. Pre-operative planning software also offers predictive analytics to minimize complications and enhance post-operative recovery. The segment benefits from advanced imaging capabilities, facilitating better surgical preparation. Surgeons can simulate various surgical scenarios, ensuring the most effective approach. The integration of AI and machine learning for predictive modeling is further enhancing its utility. Regulatory compliance and hospital accreditation requirements also favor adoption. Pre-operative planning tools are increasingly being incorporated into hospital IT infrastructures, providing seamless access to patient data and historical surgical outcomes. The overall market penetration of this segment is supported by continuous technological innovations and collaborations with medical device manufacturers.

The Orthopedic EHR segment is expected to witness the fastest CAGR of 22.3% from 2026 to 2033, fueled by the growing need for digitized patient records, real-time access to clinical data, and streamlined workflow management. Cloud-based EHR platforms provide orthopedic specialists with secure and accessible data management, enabling faster diagnosis, improved care coordination, and compliance with regulatory standards. The rising adoption of digital health initiatives and government incentives for electronic medical records further accelerate growth. Orthopedic EHR solutions are increasingly integrated with telemedicine platforms, supporting remote consultations and follow-ups. Advanced analytics within EHR systems allow physicians to monitor patient progress and predict outcomes. The shift from paper-based to electronic records in hospitals and clinics is creating substantial market opportunities. Growing patient demand for faster service and accurate record-keeping is boosting adoption. The ease of access to patient history and surgical plans improves decision-making and operational efficiency. Continuous updates and interoperability with other hospital systems strengthen the segment’s competitive advantage. Increasing partnerships between EHR providers and orthopedic technology companies also drive expansion.

- By Applications

On the basis of application, the Orthopedic Software market is segmented into Orthopedic Surgery, Joint Replacement, Fracture Management, and Pediatric Assessment. The Orthopedic Surgery segment held the largest market revenue share of 44.1% in 2025, driven by the increasing number of surgical procedures, growing demand for minimally invasive techniques, and the need for precise surgical planning. Software tools assisting in surgical simulation, outcome prediction, and implant selection are highly valued by surgeons and hospitals. This segment’s integration with other hospital IT systems further supports its dominance. The rise in elective orthopedic surgeries and increased healthcare expenditure are major contributing factors. Hospitals prioritize this software to reduce errors and improve patient safety. The ability to simulate surgeries virtually reduces intraoperative risks. Pre- and post-operative planning tools enhance surgical efficiency and patient satisfaction. Increased adoption of robotic-assisted surgeries complements this segment. Clinical research and training applications further enhance usage. The growing geriatric population requiring orthopedic interventions boosts demand. Integration with imaging systems allows comprehensive pre-surgical assessments. The segment benefits from continuous innovation and AI-based predictive features.

The Joint Replacement application is anticipated to witness the fastest CAGR of 21.5% from 2026 to 2033, owing to the rising geriatric population, higher incidence of osteoarthritis, and technological advancements in implant design. Joint replacement software solutions provide surgeons with pre-operative analytics, post-operative monitoring, and AI-assisted decision support, enhancing procedural accuracy and patient recovery. Hospitals increasingly adopt these solutions to optimize implant selection and surgical outcomes. Advanced 3D modeling and simulation improve implant fitting and reduce revision rates. Integration with hospital EHR and PACS systems ensures accurate data flow. Growth in elective joint replacement surgeries worldwide further accelerates adoption. Rising patient awareness about minimally invasive procedures contributes to demand. Government initiatives promoting joint health and orthopedic care are supportive. The segment benefits from collaborations between software providers and implant manufacturers. Remote monitoring and tele-rehabilitation integration enhance post-operative care.

- By Mode of Delivery

On the basis of mode of delivery, the Orthopedic Software market is segmented into Web-Based, Cloud-Based, and On-Premises. The Cloud-Based segment dominated the largest market revenue share of 40.7% in 2025, driven by its scalability, real-time access to patient and procedural data, and cost-effectiveness compared to traditional IT infrastructure. Hospitals and clinics benefit from remote access, seamless software updates, and centralized data storage, reducing operational complexity. Integration with electronic health records and other hospital management systems further drives adoption. Cloud solutions support multi-location hospitals with synchronized data access. The segment offers enhanced cybersecurity and data backup solutions. It enables seamless collaboration between surgical teams and administrative staff. The demand is also fueled by growing investment in healthcare IT infrastructure. Reduced hardware costs and pay-as-you-go models make cloud adoption attractive. Cloud delivery ensures compliance with data privacy regulations. Vendor support and training for cloud platforms enhance implementation. AI-enabled analytics in cloud platforms optimize surgical planning and patient outcomes.

The Web-Based segment is expected to witness the fastest CAGR of 23.1% from 2026 to 2033, fueled by the increasing adoption of SaaS-based orthopedic solutions, ease of deployment, and compatibility with multiple devices. Web-based platforms allow orthopedic specialists to access clinical tools from anywhere, improving collaboration and patient care outcomes. Hospitals and ambulatory centers adopt web-based solutions for remote diagnostics and pre-surgical planning. Rapid deployment without complex IT infrastructure accelerates adoption. Web solutions support integration with imaging and PACS systems. Cloud and web-based hybrid models enhance flexibility. The segment benefits from increasing internet penetration and digital literacy in healthcare. Continuous software updates improve functionality and security. Cost-effectiveness compared to on-premises models drives adoption. Growing preference for mobile-compatible platforms supports market growth.

- By End Users

On the basis of end users, the Orthopedic Software market is segmented into Hospitals, Ambulatory Care Centers, and Others. The Hospitals segment held the largest market revenue share of 46.3% in 2025, attributed to high volumes of orthopedic procedures, greater technological adoption, and the requirement for integrated digital solutions to manage patient workflows and surgical planning. Hospitals leverage software for enhanced operational efficiency, reduced errors, and better patient care, supporting their dominant position. Increasing hospital investments in digital health and surgical robotics reinforce this trend. Multi-specialty hospitals adopt orthopedic software to standardize procedures. Large hospital networks benefit from centralized software deployment. Regulatory compliance and accreditation requirements drive adoption. Training programs within hospitals encourage software utilization. Integration with other clinical departments boosts operational efficiency. Continuous innovation and AI-powered modules further strengthen adoption. Hospitals prioritize patient safety and clinical accuracy, supporting market dominance.

Ambulatory Care Centers are projected to witness the fastest CAGR of 22.8% from 2026 to 2033, driven by the increasing number of outpatient procedures, preference for cost-effective and efficient care delivery, and the adoption of cloud-based and web-based orthopedic solutions to manage surgical planning, patient records, and post-operative follow-ups. The growing number of ambulatory surgical facilities worldwide further accelerates the adoption of orthopedic software solutions in this segment. These centers benefit from streamlined workflows, reduced administrative burden, and improved patient experience. The segment also sees growth due to partnerships with larger hospitals for specialized procedures. Telemedicine integration supports follow-up care and monitoring. Rising patient awareness of advanced outpatient care drives demand. Easy scalability and subscription models encourage adoption. Ambulatory centers leverage analytics for performance monitoring and quality improvement. Increasing investments in digital health infrastructure support rapid adoption.

Orthopedic Software Market Regional Analysis

- North America dominated the orthopedic software market with the largest revenue share of 42% in 2025

- Supported by a well-established healthcare infrastructure, high healthcare spending, and a strong presence of key industry players

- The market is witnessing substantial growth due to the increasing adoption of AI-enabled and cloud-based orthopedic solutions in hospitals and clinics, coupled with rising demand for digital tools that improve surgical planning, patient management, and clinical outcomes

U.S. Orthopedic Software Market Insight

The U.S. orthopedic software market captured the largest revenue share in North America in 2025, fueled by the implementation of advanced orthopedic solutions in hospitals and specialty clinics. The adoption of AI-driven surgical planning, electronic health records specific to orthopedics, and cloud-based PACS systems is enhancing operational efficiency, patient outcomes, and overall care quality. Moreover, ongoing R&D initiatives and the integration of analytics for predictive insights are further driving market expansion.

Europe Orthopedic Software Market Insight

The Europe orthopedic software market is projected to expand at a substantial CAGR during the forecast period, driven by increasing digitalization in healthcare, stringent regulatory standards, and the rising need for efficient orthopedic workflow management. Countries such as Germany, France, and the U.K. are witnessing adoption in hospitals and outpatient clinics for applications including joint replacement, fracture management, and pediatric assessment.

U.K. Orthopedic Software Market Insight

The U.K. orthopedic software market is anticipated to grow at a notable CAGR during the forecast period, supported by the rising focus on improving patient care quality and increasing investments in digital health infrastructure. Hospitals and ambulatory care centers are adopting pre-operative planning and EHR solutions for orthopedic procedures to enhance surgical precision and post-operative monitoring.

Germany Orthopedic Software Market Insight

The Germany orthopedic software market is expected to grow steadily during the forecast period, driven by high healthcare expenditure, technological advancements, and an emphasis on digital transformation in orthopedic care. Hospitals and specialty clinics are integrating orthopedic PACS and EHR solutions to improve diagnostic accuracy, treatment planning, and clinical workflow efficiency.

Asia-Pacific Orthopedic Software Market Insight

The Asia-Pacific orthopedic software market poised to grow at the fastest CAGR of 25% during the forecast period of 2026 to 2033, supported by the rapid digitization of healthcare systems, increasing prevalence of orthopedic disorders, and rising investments in hospitals and specialty clinics across countries such as China, India, and Japan. Growing awareness of advanced orthopedic procedures and adoption of AI-enabled and cloud-based solutions are key growth drivers in the region.

Japan Orthopedic Software Market Insight

The Japan orthopedic software market is gaining momentum due to the country’s technologically advanced healthcare system, rising aging population, and increasing demand for digital tools to support orthopedic surgery and rehabilitation. Hospitals are adopting orthopedic EHRs and pre-operative planning solutions to enhance patient outcomes, reduce surgical errors, and streamline clinical workflows.

China Orthopedic Software Market Insight

The China orthopedic software market accounted for the largest market revenue share in Asia-Pacific in 2025, driven by rapid healthcare digitization, rising prevalence of orthopedic conditions, and high adoption of AI-enabled and cloud-based orthopedic solutions in hospitals and specialty clinics. Government initiatives promoting digital healthcare and increasing investment in orthopedic infrastructure are key factors propelling market growth in China.

Orthopedic Software Market Share

The Orthopedic Software industry is primarily led by well-established companies, including:

• Stryker (U.S.)

• Zimmer Biomet (U.S.)

• Medtronic (Ireland)

• Smith & Nephew (U.K.)

• NuVasive (U.S.)

• OrthoView (U.K.)

• Brainlab (Germany)

• Exactech (U.S.)

• Joint Academy (Sweden)

• Carestream Health (U.S.)

• Sectra (Sweden)

• Corin Group (U.K.)

• OrthAlign (U.S.)

• Gyrus ACMI (U.S.)

Latest Developments in Global Orthopedic Software Market

- In September 2024, Arthrex launched OrthoPedia Patient, an interactive digital platform aimed at educating patients about common orthopedic conditions and treatments. The platform features videos and animations created with input from clinical specialists, helping patients better understand their surgical procedures and rehabilitation plans. This development emphasizes the growing trend of patient-centric digital tools in orthopedic care

- In April 2024, Arthrex celebrated the 10-year anniversary of its InternalBrace ligament augmentation system, highlighting its continuous innovation in ligament repair technologies. As part of this milestone, the company expanded its digital education and planning initiatives, integrating more orthopedic software tools to enhance preoperative planning and surgical outcomes

- In October 2024, OneStep, a company specializing in smartphone-based motion analysis, raised USD 36 million in Series B funding to further develop its orthopedic rehabilitation software. The platform focuses on gait and mobility assessment, offering real-time analytics and personalized recovery plans, demonstrating the increasing adoption of AI and data-driven tools in orthopedic care

- In April 2025, PrecisionOS launched FractureLab, a simulation platform that allows orthopedic surgeons and trainees to practice virtually unlimited fracture cases in a realistic digital environment. This software leverages advanced simulation technologies to improve surgical training, reduce errors, and enhance procedural confidence before operating on actual patients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.