Global Orthopedic Surgical Robotic Devices Market

Market Size in USD Billion

CAGR :

%

USD

4.34 Billion

USD

24.75 Billion

2024

2032

USD

4.34 Billion

USD

24.75 Billion

2024

2032

| 2025 –2032 | |

| USD 4.34 Billion | |

| USD 24.75 Billion | |

|

|

|

|

Orthopaedic Surgical Robotic Devices Market Size

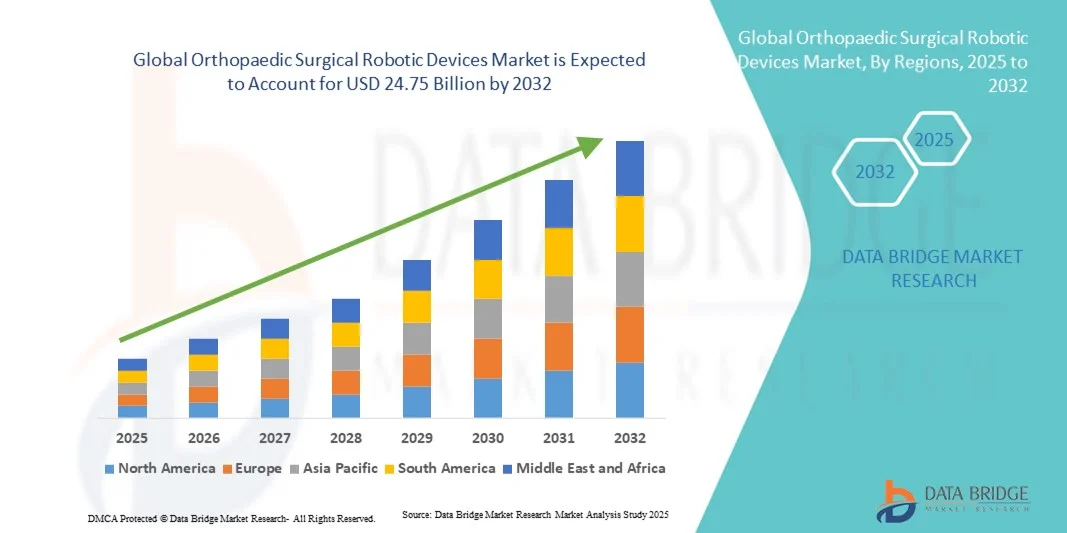

- The global orthopaedic surgical robotic devices market size was valued at USD 4.34 billion in 2024 and is expected to reach USD 24.75 billion by 2032, at a CAGR of 24.3% during the forecast period

- The market growth is primarily driven by the increasing prevalence of orthopedic disorders and the rising adoption of minimally invasive robotic-assisted surgeries, which enhance precision, reduce recovery time, and improve clinical outcomes

- Moreover, technological advancements in robotic systems, coupled with growing investments in healthcare infrastructure and surgeon training, are fostering rapid adoption of these systems worldwide. These converging factors are accelerating the integration of robotic technologies in orthopedic procedures, thereby significantly boosting the industry’s growth

Orthopaedic Surgical Robotic Devices Market Analysis

- Orthopaedic surgical robotic devices, integrating advanced robotics, imaging, and navigation technologies, are increasingly transforming orthopedic surgery by enhancing surgical precision, minimizing invasiveness, and improving patient recovery outcomes across hospital and outpatient settings

- The rising demand for these devices is primarily driven by the growing burden of orthopedic disorders, increasing adoption of robot-assisted procedures, and ongoing technological advancements that enhance the accuracy and efficiency of orthopedic surgeries

- North America dominated the orthopaedic surgical robotic devices market with the largest revenue share of 43% in 2024, supported by high healthcare expenditure, early technology adoption, and a strong presence of key manufacturers in the U.S., where robotic systems are being rapidly integrated into orthopedic centers and specialized surgical networks

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, fueled by expanding healthcare infrastructure, rising medical tourism, and increasing awareness of the clinical benefits of robotic-assisted orthopedic procedures

- The Robotic Systems segment dominated the orthopaedic surgical robotic devices market with a market share of 47.8% in 2024, owing to the growing installation of advanced robotic platforms in hospitals and ambulatory surgical centers to support high-precision orthopedic interventions and improve surgical consistency

Report Scope and Orthopaedic Surgical Robotic Devices Market Segmentation

|

Attributes |

Orthopaedic Surgical Robotic Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Orthopaedic Surgical Robotic Devices Market Trends

Integration of AI and Data Analytics for Enhanced Surgical Precision

- A significant and accelerating trend in the global orthopaedic surgical robotic devices market is the deep integration of artificial intelligence (AI) and real-time data analytics into robotic systems, enabling surgeons to achieve higher precision, consistency, and optimized surgical outcomes

- For instance, Smith+Nephew’s CORI Surgical System leverages advanced 3D analytics and AI-driven intraoperative planning to enhance the accuracy of knee and hip replacement procedures, minimizing variability across surgeries. Similarly, Zimmer Biomet’s ROSA Robotics platform integrates real-time data feedback to support surgical decision-making and implant alignment

- AI integration in orthopedic robotic systems enables features such as predictive surgical planning, personalized alignment guides, and post-operative performance tracking, leading to improved patient recovery. For instance, Stryker’s Mako system uses machine learning algorithms to adjust surgical parameters based on patient-specific anatomical data, ensuring precision and repeatability

- The convergence of robotics, AI, and data analytics allows hospitals and surgical centers to enhance procedural efficiency while reducing revision rates and surgical fatigue through more consistent outcomes. Through digital dashboards, surgeons can monitor patient progress, implant performance, and procedural data from multiple cases

- This trend toward more intelligent, data-driven, and interoperable robotic platforms is transforming orthopedic surgery into a more predictive and outcome-oriented discipline. Consequently, companies such as THINK Surgical are developing open-platform robotic systems with AI-based adaptability for use across various implant brands and surgical workflows

- The demand for robotic systems with AI-enhanced surgical planning and data integration capabilities is growing rapidly across hospitals and specialty clinics, as healthcare providers increasingly prioritize precision, efficiency, and personalized patient outcomes

Orthopaedic Surgical Robotic Devices Market Dynamics

Driver

Rising Demand for Minimally Invasive and Precision Orthopedic Procedures

- The increasing preference for minimally invasive orthopedic surgeries, coupled with the rising prevalence of musculoskeletal disorders and osteoarthritis, is a major driver propelling the adoption of robotic-assisted surgical systems

- For instance, in May 2024, Stryker Corporation announced the expansion of its Mako robotic-assisted platform for partial knee and total hip replacements across multiple global hospitals, emphasizing precision and faster recovery. Such advancements by major manufacturers are expected to drive market growth during the forecast period

- As patients and surgeons seek improved accuracy, reduced recovery times, and fewer complications, robotic-assisted devices provide enhanced visualization, reproducibility, and optimal implant alignment, making them increasingly preferred over traditional techniques

- Furthermore, the growing number of hospitals and ambulatory surgical centers investing in advanced robotic systems highlights the industry’s transition toward technology-driven precision medicine in orthopedics

- The efficiency of robotic-guided surgeries, coupled with reduced hospital stays and post-operative complications, continues to encourage adoption among healthcare institutions worldwide. In addition, continuous R&D efforts by manufacturers to improve system usability and cost-effectiveness further accelerate market expansion

- The increasing integration of robotic systems with digital imaging and navigation software enhances surgical predictability and patient-specific customization, driving confidence among orthopedic surgeons

Restraint/Challenge

High System Cost and Technical Complexity in Integration

- The high capital investment required for robotic surgical systems and the associated maintenance costs remain major challenges to widespread market adoption, especially in cost-sensitive regions

- For instance, advanced robotic systems such as Stryker’s Mako or Zimmer Biomet’s ROSA can cost several hundred thousand dollars, limiting accessibility for smaller healthcare facilities or those in developing countries

- Moreover, the technical complexity of integrating robotic systems into existing surgical workflows and the steep learning curve for surgeons can slow down the rate of clinical adoption and return on investment

- Concerns regarding the need for extensive surgeon training, software upgrades, and compatibility with various implant systems add further operational challenges for healthcare providers

- While technological advancements are gradually reducing costs and improving usability, affordability and system adaptability remain critical factors influencing the speed of global adoption. Addressing these issues through training programs, modular system designs, and cost-efficient models will be essential for sustained market growth

- Furthermore, regulatory approval delays and stringent compliance requirements in various countries can extend product launch timelines and hinder faster market penetration for innovative robotic platforms

Orthopaedic Surgical Robotic Devices Market Scope

The market is segmented on the basis of component, clinical application, and end-user.

- By Component

On the basis of component, the orthopaedic surgical robotic devices market is segmented into instruments & accessories and robotic systems. The Robotic Systems segment dominated the market with the largest revenue share of 47.8% in 2024, driven by the increasing adoption of advanced robotic platforms across hospitals and surgical centers. These systems offer superior precision, reproducibility, and improved patient outcomes in joint replacement and spinal surgeries. Growing technological innovations, such as AI-based navigation and 3D imaging integration, are enhancing system efficiency and surgeon confidence. Moreover, leading manufacturers such as Stryker, Zimmer Biomet, and Smith+Nephew continue to expand their robotic system portfolios through software upgrades and product launches, further solidifying this segment’s dominance. The rising demand for minimally invasive surgeries and the integration of robotics with data-driven surgical planning are major contributors to this growth.

The Instruments & Accessories segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the growing procedural volumes and increasing replacement needs for consumable components such as robotic arms, sensors, and surgical tools. As robotic systems become more widely deployed, the recurring demand for disposable and reusable instruments to maintain precision and sterility continues to rise. The growing emphasis on procedure customization and compatibility with different implant types also drives innovation within this segment. In addition, service-based business models offered by manufacturers—providing consumables and maintenance as part of system packages—are boosting steady revenue growth for instrument suppliers.

- By Clinical Application

On the basis of clinical application, the market is segmented into upper extremities, lower extremities, and others. The Lower Extremities segment dominated the market with the largest revenue share of 49.6% in 2024, primarily due to the high prevalence of knee and hip joint disorders requiring robotic-assisted joint replacement surgeries. Lower extremity robotic systems enable surgeons to achieve precise bone resections, implant alignment, and improved soft tissue balancing, which directly correlate with faster patient recovery and lower revision rates. The increasing aging population and high incidence of osteoarthritis have fueled the demand for robotic-assisted total knee and hip arthroplasty. Furthermore, hospitals are increasingly standardizing robotic-assisted joint replacements as a preferred procedure due to proven clinical efficacy and reduced postoperative complications.

The Upper Extremities segment is expected to register the fastest CAGR from 2025 to 2032, driven by expanding robotic applications in shoulder, elbow, and wrist surgeries. The growing clinical focus on upper limb robotic assistance stems from its capability to improve precision in joint resurfacing and implant positioning in small and complex anatomical structures. For instance, ongoing advancements in compact robotic arms and 3D-guided visualization systems are enabling surgeons to perform intricate upper limb procedures with minimal invasiveness. The adoption of robotic systems in upper extremity reconstruction and fracture management is anticipated to grow further as new platforms gain regulatory approval and clinical validation.

- By End-User

On the basis of end-user, the market is segmented into hospitals, ambulatory surgical centers (ascs), and specialty clinics. The Hospitals segment dominated the global market with the largest revenue share of 58.4% in 2024, attributed to the widespread availability of advanced robotic platforms, skilled surgical professionals, and strong financial capacity for technology investment. Hospitals serve as the primary centers for complex orthopedic procedures, such as joint replacements and spinal surgeries, which require integrated robotic and imaging systems. Moreover, growing hospital collaborations with medical device manufacturers for robotic surgery training and research programs further strengthen this segment’s dominance. The ability of hospitals to perform high-volume surgeries and provide comprehensive postoperative care makes them the leading end-user in the market.

The Ambulatory Surgical Centers (ASCs) segment is projected to witness the fastest growth from 2025 to 2032, driven by the global shift toward outpatient orthopedic surgeries and the rising adoption of cost-efficient robotic systems. ASCs are increasingly integrating compact and mobile robotic systems that enable same-day joint procedures with minimal recovery time. The expansion of reimbursement coverage for outpatient robotic surgeries and the growing preference for shorter hospital stays are fueling this trend. In addition, manufacturers are tailoring robotic solutions for smaller surgical settings, making advanced orthopedic robotics more accessible to ASCs. The focus on patient convenience, operational efficiency, and affordability positions ASCs as a rapidly growing end-user segment in the orthopedic surgical robotics landscape.

Orthopaedic Surgical Robotic Devices Market Regional Analysis

- North America dominated the orthopaedic surgical robotic devices market with the largest revenue share of 43% in 2024, supported by high healthcare expenditure, early technology adoption, and a strong presence of key manufacturers in the U.S., where robotic systems are being rapidly integrated into orthopedic centers and specialized surgical networks

- Healthcare providers in the region prioritize precision-driven and minimally invasive surgeries, with hospitals and surgical centers increasingly integrating robotic systems to enhance clinical outcomes and reduce recovery times

- This widespread adoption is further supported by robust reimbursement frameworks, significant investments in healthcare innovation, and the presence of key industry leaders such as Stryker, Zimmer Biomet, and Smith+Nephew, establishing North America as a leading hub for robotic-assisted orthopedic surgery adoption and technological advancement

U.S. Orthopaedic Surgical Robotic Devices Market Insight

The U.S. orthopaedic surgical robotic devices market captured the largest revenue share of 83% in 2024 within North America, driven by early adoption of robotic-assisted technologies and the increasing demand for precision-based orthopedic procedures. Hospitals and surgical centers across the U.S. are rapidly incorporating robotic systems for joint replacement and spine surgeries to enhance patient outcomes and minimize recovery times. The country’s well-established healthcare infrastructure, strong reimbursement framework, and continuous R&D investments by companies such as Stryker, Zimmer Biomet, and THINK Surgical are fueling market expansion. Moreover, growing surgeon training programs and technological integration with AI and data analytics are strengthening the U.S. position as a global leader in orthopedic robotics.

Europe Orthopaedic Surgical Robotic Devices Market Insight

The Europe orthopaedic surgical robotic devices market is projected to grow at a substantial CAGR throughout the forecast period, driven by rising demand for minimally invasive orthopedic procedures and strong government support for medical technology adoption. Increasing prevalence of bone and joint disorders, coupled with the expansion of specialized orthopedic clinics, is fostering greater use of robotic-assisted systems. European healthcare providers are emphasizing precision surgery and faster patient recovery through digital integration. The region is witnessing increased adoption across public and private hospitals, particularly for hip and knee arthroplasties, as robotics becomes a standard in advanced surgical suites.

U.K. Orthopaedic Surgical Robotic Devices Market Insight

The U.K. orthopaedic surgical robotic devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the growing acceptance of robotic-assisted knee and hip replacements within both NHS and private hospitals. Rising awareness of the clinical benefits of robotic precision, such as improved implant alignment and reduced postoperative complications, is encouraging adoption. Furthermore, the U.K.’s investments in healthcare digitization and surgical innovation are fostering partnerships between hospitals and medical device manufacturers. The ongoing focus on patient outcomes and surgical efficiency continues to strengthen the U.K.’s orthopedic robotics landscape.

Germany Orthopaedic Surgical Robotic Devices Market Insight

The Germany orthopaedic surgical robotic devices market is expected to expand at a considerable CAGR during the forecast period, fueled by the country’s leadership in medical engineering and strong emphasis on surgical accuracy and automation. German hospitals are increasingly adopting robotic systems to enhance procedural outcomes in joint and spine surgeries, supported by favorable reimbursement policies and government innovation initiatives. The integration of robotics with digital imaging and navigation software aligns with Germany’s focus on precision medicine. Moreover, growing collaborations between hospitals and technology providers are advancing the nation’s orthopedic robotics capabilities.

Asia-Pacific Orthopaedic Surgical Robotic Devices Market Insight

The Asia-Pacific orthopaedic surgical robotic devices market is poised to grow at the fastest CAGR of 25.1% during 2025 to 2032, driven by expanding healthcare infrastructure, rising medical tourism, and increasing awareness of robotic-assisted surgery benefits. Countries such as China, Japan, South Korea, and India are witnessing surging demand for robotic systems as hospitals upgrade their surgical capabilities. Government support for healthcare modernization and domestic production of affordable robotic platforms are accelerating regional adoption. The growing burden of osteoarthritis and fractures among aging populations further enhances the demand for precise and efficient robotic-assisted orthopedic surgeries.

Japan Orthopaedic Surgical Robotic Devices Market Insight

The Japan orthopaedic surgical robotic devices market is gaining momentum due to the country’s advanced healthcare ecosystem and technological innovation culture. Rising elderly population and growing demand for minimally invasive surgeries are driving the adoption of robotic-assisted orthopedic procedures. Japanese hospitals are integrating robotics into orthopedic departments to address the need for accuracy and faster recovery. Moreover, Japan’s leadership in robotics manufacturing and its focus on AI-driven surgical planning are supporting the rapid growth of this market segment. The convergence of robotics, imaging, and precision instruments continues to define Japan’s orthopedic surgery advancements.

India Orthopaedic Surgical Robotic Devices Market Insight

The India orthopaedic surgical robotic devices market accounted for the largest market revenue share in Asia-Pacific in 2024, supported by rapid urbanization, a growing middle-class population, and rising healthcare investments. The demand for robotic-assisted orthopedic procedures is increasing in both metropolitan and tier-2 cities as hospitals strive to enhance surgical precision and patient recovery rates. The government’s “Make in India” initiative and focus on healthcare digitization are driving domestic manufacturing of robotic systems. In addition, expanding private hospital networks and medical tourism are positioning India as one of the most dynamic emerging markets for orthopedic surgical robotics.

Orthopaedic Surgical Robotic Devices Market Share

The Orthopaedic Surgical Robotic Devices industry is primarily led by well-established companies, including:

- Stryker U.S.)

- Zimmer Biomet (U.S.)

- Smith+Nephew (U.K.)

- Medtronic (Ireland)

- Globus Medical (U.S.)

- Renishaw plc (U.K.)

- THINK Surgical (U.S.)

- CUREXO, INC. (South Korea)

- Corin Group (U.K.)

- Arthrex, Inc. (U.S.)

- Brainlab (Germany)

- MicroPort Orthopedics (U.S.)

- Tinavi Medical Co., Ltd. (China)

- Maxx Orthopedics (U.S.)

- Exactech, Inc. (U.S.)

- OrthoSensor, Inc. (U.S.)

- Intellijoint Surgical (Canada)

- Monogram Orthopaedics (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Blue Belt Technologies (U.S.)

What are the Recent Developments in Global Orthopaedic Surgical Robotic Devices Market?

- In April 2025, THINK Surgical announced the first use of the partnership between Maxx Orthopedics’ Freedom® Total Knee Implant System and the THINK TMINI Miniature Robotic System in the U.S., following FDA clearance for implant compatibility in representing a further step toward integrated implant-robot ecosystems

- In June 2024, Smith+Nephew launched its CORIOGRAPH Pre-Operative Planning & Modeling Services along with its RI.KNEE ROBOTICS 3.0 software, enabling more personalized robotic-assisted knee surgery workflows and enhancing surgeon planning efficiency and implant alignment accuracy

- In September 2023, THINK Surgical’s TMINI™ Miniature Robotic System obtained FDA 510(k) clearance was used for the first time at Washington Hospital Healthcare System for total knee replacement surgeries, showcasing a wireless handheld robotic handpiece system that supports multiple implant platforms

- In April 2023, Monogram Orthopaedics announced the successful completion of the first fully remote simulated robotic surgery in orthopaedics, marking a milestone in remote surgical simulation and training for robotic-assisted orthopaedic procedures

- In January 2021, DePuy Synthes (a subsidiary of Johnson & Johnson) received U.S. FDA 510(k) clearance for its VELYS™ Robotic‑Assisted Solution designed for use with the ATTUNE® Total Knee System. This table-mounted robotic solution was built to integrate into existing OR workflows and provide more accurate bone resections in total knee arthroplasty

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.