Global Osteoarthritic Pain Market

Market Size in USD Billion

CAGR :

%

USD

7.53 Billion

USD

12.84 Billion

2025

2033

USD

7.53 Billion

USD

12.84 Billion

2025

2033

| 2026 –2033 | |

| USD 7.53 Billion | |

| USD 12.84 Billion | |

|

|

|

|

Osteoarthritic Pain Market Size

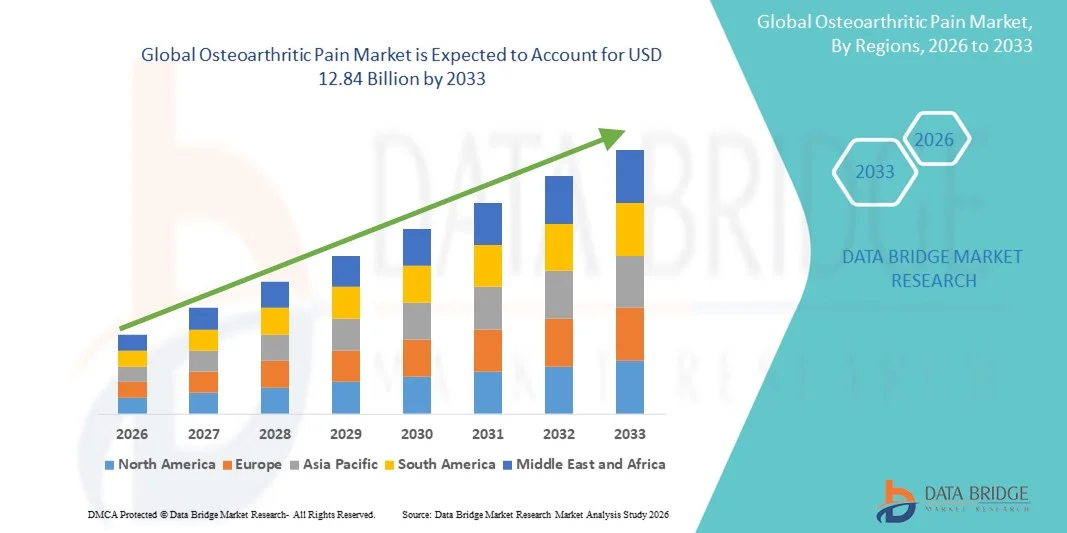

- The global osteoarthritic pain market size was valued at USD 7.53 billion in 2025 and is expected to reach USD 12.84 billion by 2033, at a CAGR of 6.90% during the forecast period

- The market growth is largely fueled by the rising prevalence of osteoarthritis and continuous advancements in pain management therapies, leading to increased demand for effective osteoarthritic pain treatments across both hospital and homecare settings. Factors such as aging populations, increasing obesity rates, sports injuries, and sedentary lifestyles are significantly contributing to the growing patient pool worldwide

- Furthermore, increasing patient awareness, improved diagnosis rates, and strong demand for long-term, safe, and effective pain relief solutions are establishing osteoarthritic pain therapies as a critical component of musculoskeletal disease management. These converging factors are accelerating the uptake of osteoarthritic pain solutions, thereby significantly boosting the overall growth of the market

Osteoarthritic Pain Market Analysis

- Osteoarthritic pain therapies, encompassing pharmacological treatments, injectables, and non-pharmacological interventions, are increasingly critical in managing chronic joint pain across aging populations in both clinical and homecare settings. The rising prevalence of osteoarthritis, driven by aging demographics, obesity, sports injuries, and sedentary lifestyles, is significantly increasing the global demand for effective pain management solutions

- The escalating demand for osteoarthritic pain treatments is primarily fueled by improved disease awareness, earlier diagnosis, and a strong preference for long-term, safe, and minimally invasive pain relief options. Advances in drug formulations, biologics, viscosupplementation, and regenerative therapies are further supporting sustained market growth

- North America dominated the osteoarthritic pain market with the largest revenue share of approximately 39% in 2025, supported by a high prevalence of osteoarthritis, strong healthcare infrastructure, favorable reimbursement policies, and widespread adoption of advanced pain management therapies. The U.S. accounted for the majority share in the region, driven by high treatment rates, strong pharmaceutical presence, and continuous clinical innovation

- Asia-Pacific is expected to be the fastest growing region in the osteoarthritic pain market during the forecast period, registering a CAGR of around 7.8%, driven by rapidly aging populations, increasing healthcare expenditure, rising awareness of joint disorders, and expanding access to pain management therapies in emerging economies such as China and India

- The Oral segment dominated the largest market revenue share of 61% in 2025, due to ease of administration, patient convenience, and widespread physician preference

Report Scope and Osteoarthritic Pain Market Segmentation

|

Attributes |

Osteoarthritic Pain Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

• Pfizer Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Osteoarthritic Pain Market Trends

Shift Toward Targeted and Long-Acting Pain Management Therapies

- A major and accelerating trend in the global osteoarthritic pain market is the growing shift toward targeted, long-acting pain management therapies that aim to provide sustained symptom relief while minimizing systemic side effects. This trend is driven by the chronic nature of osteoarthritis and the need for therapies that improve long-term patient compliance and quality of life

- For instance, in June 2024, Flexion Therapeutics continued the expanded adoption of its extended-release intra-articular corticosteroid therapy for osteoarthritis knee pain, designed to deliver prolonged pain relief for up to three months with a single injection, demonstrating the market’s movement toward localized and long-duration treatment options

- Pharmaceutical companies are increasingly focusing on localized drug delivery systems such as intra-articular injections, topical formulations, and sustained-release analgesics to address inflammation and pain directly at the affected joint site

- This approach reduces reliance on frequent oral dosing, which is often associated with gastrointestinal, cardiovascular, and renal side effects, particularly among elderly patients who represent a large share of the osteoarthritis population

- Biologic-based therapies and novel molecular targets are also gaining attention, as research efforts intensify toward disease-modifying osteoarthritis drugs (DMOADs) that can slow disease progression while managing pain

- The rising emphasis on personalized pain management and longer-acting formulations is reshaping treatment protocols and influencing future product development strategies in the Osteoarthritic Pain market

Osteoarthritic Pain Market Dynamics

Driver

Rising Prevalence of Osteoarthritis Due to Aging Population and Lifestyle Factors

- The increasing global prevalence of osteoarthritis, driven by aging populations, rising obesity rates, and sedentary lifestyles, is a key driver fueling demand for osteoarthritic pain management therapies worldwide

- For instance, in March 2025, the World Health Organization highlighted osteoarthritis as one of the fastest-growing causes of disability globally, reinforcing the urgent need for effective pain management solutions and supporting sustained growth in the Osteoarthritic Pain market

- As life expectancy increases, a larger proportion of the population is experiencing age-related joint degeneration, significantly expanding the patient pool requiring long-term pain management

- Obesity further accelerates joint wear and inflammation, particularly in weight-bearing joints such as knees and hips, increasing the demand for pharmacological and non-pharmacological pain relief solutions

- Greater awareness among patients and healthcare providers regarding early diagnosis and pain management is also contributing to higher treatment adoption rates

- In addition, advancements in diagnostic imaging and clinical assessment tools are enabling earlier intervention, further driving the uptake of osteoarthritic pain therapies across both developed and emerging markets

Restraint/Challenge

Side Effects of Long-Term Drug Use and Limited Disease-Modifying Options

- A major challenge restraining the osteoarthritic pain market is the risk of adverse side effects associated with long-term use of commonly prescribed pain medications such as NSAIDs, opioids, and corticosteroids

- For instance, clinical safety warnings issued in 2023 regarding prolonged NSAID use highlighted increased risks of gastrointestinal bleeding and cardiovascular complications, leading to caution among physicians and patients when managing chronic osteoarthritic pain

- The lack of widely approved disease-modifying osteoarthritis drugs means that most available therapies focus only on symptom relief rather than slowing or reversing disease progression

- This limitation often results in prolonged dependency on pain medications, increasing the likelihood of side effects, treatment fatigue, and reduced patient adherence over time

- Regulatory scrutiny surrounding opioid prescriptions has further restricted their use, limiting options for patients with severe pain who do not respond adequately to first-line therapies

- Overcoming these challenges will require continued investment in safer long-term therapies, the development of disease-modifying treatments, and greater emphasis on combination approaches integrating pharmacological and non-pharmacological pain management strategies

Osteoarthritic Pain Market Scope

The market is segmented on the basis of Disease Type, Diagnosis, Treatment Type, Drug Class, Route of Administration, Dosage Form, Application, and End User.

- By Disease Type

On the basis of disease type, the Osteoarthritic Pain market is segmented into Hip, Wrist, Spinal, and Finger Joints. The Hip segment dominated the largest market revenue share of 37% in 2025, owing to the high prevalence of hip osteoarthritis among the elderly population globally. Increasing age-related degeneration, sedentary lifestyles, and obesity contribute to rising hip joint impairments. Hospitals and orthopedic clinics are witnessing high demand for hip-related treatments, including surgical interventions and advanced pharmacological therapies. Moreover, the hip segment is prioritized in clinical research and government healthcare initiatives for early diagnosis and treatment. Increasing awareness about minimally invasive hip replacement surgeries and rehabilitation programs is further propelling revenue growth. Insurance coverage for hip procedures in developed regions also supports market dominance. The growing number of hip replacement surgeries, coupled with advancements in prosthetic implants and pain management therapies, reinforces the segment’s leading position. Rising incidence of osteoarthritis due to aging populations in Europe, North America, and Asia-Pacific also contributes significantly to market share. Pharmaceutical companies are focusing on developing targeted therapies for hip OA, boosting revenue potential. Additionally, favorable reimbursement policies in key regions are facilitating patient access, further strengthening the segment’s dominance.

The Spinal segment is expected to witness the fastest CAGR of 8.7% from 2026 to 2033, driven by increasing cases of vertebral osteoarthritis and degenerative spine conditions. Rising sedentary lifestyles, obesity, and occupational strain are leading to higher spinal joint degeneration. Technological advancements in spinal imaging and minimally invasive surgical procedures are creating new treatment opportunities. Governments and healthcare providers are promoting early diagnosis of spinal osteoarthritis to prevent long-term complications. Increasing patient preference for non-invasive pain management and physical therapy interventions is also driving adoption. Pharmaceutical companies are developing injectable therapies and viscosupplements specifically for spinal joints. Rising research funding in spine-related osteoarthritis therapies and growing awareness about spinal health in emerging economies are boosting segment growth. The increasing aging population in Asia-Pacific and Latin America contributes to the surge in spinal OA cases. Additionally, digital tools and rehabilitation programs supporting spinal health further accelerate growth. Healthcare providers are collaborating with biotechnology firms to improve spinal treatment outcomes. Improved access to specialized spine care centers in urban areas also supports rapid adoption.

- By Diagnosis

On the basis of diagnosis, the Osteoarthritic Pain market is segmented into Magnetic Resonance Imaging (MRI) and X-Rays. The MRI segment dominated the largest market revenue share of 58% in 2025, due to its superior ability to detect early cartilage degeneration, soft tissue damage, and joint inflammation. Hospitals and diagnostic centers are increasingly adopting MRI for precise osteoarthritis assessment. MRI facilitates pre-surgical planning and monitoring of treatment efficacy, further enhancing its adoption. The rising prevalence of chronic osteoarthritis cases drives demand for high-resolution imaging. Government and insurance support for advanced imaging procedures also boosts revenue. MRI’s non-invasive nature, combined with high diagnostic accuracy, encourages physicians to prefer it over traditional methods. Additionally, ongoing technological advancements, such as high-field MRI and 3D imaging, are expanding clinical applications. Major diagnostic centers are investing in MRI infrastructure, particularly in North America and Europe. The trend of personalized medicine and patient-specific treatment plans further emphasizes MRI usage. Hospitals offering specialized orthopedic care rely heavily on MRI for treatment planning. The growing geriatric population and the increasing burden of osteoarthritis globally support market dominance. Rising research funding for imaging innovations also strengthens this segment.

The X-Ray segment is expected to witness the fastest CAGR of 6.2% from 2026 to 2033, driven by its cost-effectiveness, wide availability, and faster diagnostic process. X-rays are commonly used in outpatient clinics and primary care settings for initial osteoarthritis assessment. Developing regions are increasingly relying on X-rays due to limited MRI accessibility. Improved X-ray technologies, including digital radiography, enhance diagnostic efficiency and image clarity. Rising awareness about early diagnosis in emerging economies supports segment growth. Healthcare providers are combining X-rays with AI-based image analysis for better interpretation, further boosting adoption. X-ray’s non-invasive, quick, and low-radiation methods make it suitable for routine check-ups. Expansion of diagnostic networks and mobile imaging units in Asia-Pacific also drives growth. Increasing prevalence of joint injuries from sports and occupational hazards contributes to rising X-ray usage. Cost reimbursement schemes for X-ray diagnostics encourage patients to undergo imaging. Collaboration between hospitals and diagnostic equipment manufacturers is enhancing accessibility. Additionally, X-ray-based screening programs for osteoarthritis in senior care facilities support rapid CAGR.

- By Treatment Type

On the basis of treatment type, the Osteoarthritic Pain market is segmented into Medication, Surgery, and Therapy. The Medication segment dominated the largest market revenue share of 52% in 2025, driven by the widespread use of NSAIDs, corticosteroids, and analgesics for pain management. Medications offer quick relief from osteoarthritis symptoms and are often prescribed as first-line treatment. The growing geriatric population and rising prevalence of OA globally further strengthen medication adoption. Pharmaceutical companies continue to develop novel pain-relief drugs targeting specific OA pathways. Hospital pharmacies and retail channels facilitate easy access to medications. Awareness campaigns by healthcare providers on symptom management encourage early medication use. The cost-effectiveness and convenience of medications compared to surgery drive higher adoption rates. Insurance coverage for prescription drugs also supports segment dominance. Advancements in drug formulations, including extended-release options, improve patient compliance. Continuous research in OA pharmacotherapy further enhances market potential. OTC availability of certain medications contributes to revenue growth. Government initiatives to manage chronic pain also support this segment.

The Surgery segment is expected to witness the fastest CAGR of 9.1% from 2026 to 2033, fueled by increasing demand for joint replacement procedures and minimally invasive surgical options. Rising incidences of severe osteoarthritis, particularly in hip and knee joints, are driving surgical interventions. Advancements in robotic-assisted and arthroscopic surgeries enhance procedural safety and outcomes. Patients increasingly prefer surgery for long-term relief when conservative treatments fail. Government healthcare programs and insurance reimbursements in developed regions encourage adoption. Increasing awareness about postoperative rehabilitation programs boosts patient confidence. Growth of orthopedic centers and surgical infrastructure in emerging markets contributes to market expansion. Collaboration between device manufacturers and hospitals ensures availability of innovative implants. Rising sports injuries and accidents requiring corrective surgery further drive demand. Population aging in Asia-Pacific and Europe increases surgical needs. Research in biomaterials for prosthetic implants is accelerating market growth. Expansion of medical tourism for joint surgeries is also fueling the CAGR.

- By Drug Class

On the basis of drug class, the Osteoarthritic Pain market is segmented into Nonsteroidal Anti-Inflammatory Drugs (NSAIDs), Opioids, Viscosupplements, Corticosteroids, and Others. The NSAIDs segment dominated the largest market revenue share of 46% in 2025, due to their high efficacy in reducing pain and inflammation in osteoarthritis patients. NSAIDs are widely prescribed across hospitals, clinics, and home care settings, making them the primary choice for symptom management. The over-the-counter availability of certain NSAIDs also drives usage among mild-to-moderate OA patients. Increasing prevalence of hip, knee, and spinal osteoarthritis globally supports market dominance. Pharmaceutical companies are continuously investing in the development of selective COX-2 inhibitors to reduce gastrointestinal side effects, further enhancing adoption. Healthcare professionals favor NSAIDs for short-term pain relief, as they provide faster outcomes compared to other drug classes. Insurance reimbursement for prescription NSAIDs supports revenue growth. Patient adherence is high due to oral administration convenience. Clinical guidelines for OA management consistently recommend NSAIDs as first-line therapy. Continuous research on combination therapies and extended-release formulations strengthens the segment. Government campaigns raising awareness about early OA management contribute to the adoption rate.

The Viscosupplements segment is expected to witness the fastest CAGR of 10.3% from 2026 to 2033, driven by increasing demand for joint lubrication therapies and minimally invasive treatment options. Viscosupplements, including hyaluronic acid injections, are preferred for knee osteoarthritis and patients unsuitable for surgery. Rising geriatric population and increased sports-related joint injuries drive usage. Advances in injection techniques, longer-acting formulations, and improved safety profiles boost clinical acceptance. Outpatient clinics and specialized orthopedic centers are adopting viscosupplements as part of non-surgical management. Insurance coverage for viscosupplement injections in developed countries encourages usage. Patient preference for delayed surgery and minimally invasive treatment further supports growth. Clinical studies demonstrating efficacy in pain reduction and joint function enhancement increase physician confidence. Market expansion in Asia-Pacific, driven by urbanization and awareness, contributes to CAGR. Collaborative initiatives between pharmaceutical companies and hospitals improve access. Physician training programs enhance adoption in emerging markets. Growing R&D in viscosupplement-based regenerative therapies accelerates market growth.

- By Route of Administration

On the basis of route of administration, the Osteoarthritic Pain market is segmented into Oral and Non-Oral. The Oral segment dominated the largest market revenue share of 61% in 2025, due to ease of administration, patient convenience, and widespread physician preference. Oral medications include NSAIDs, opioids, and corticosteroids, which are primarily prescribed for home care and outpatient settings. Patient compliance is higher with oral formulations compared to injections or topical therapies. Hospitals, clinics, and pharmacies are the main distribution channels supporting market revenue. The cost-effectiveness and over-the-counter availability of oral medications also contribute to dominance. Physicians favor oral therapies for chronic osteoarthritis management due to predictable dosing and flexibility. Government guidelines support oral pharmacological interventions as first-line therapy. The rising geriatric population and increasing prevalence of osteoarthritis globally further reinforce dominance. Ongoing research in oral sustained-release formulations enhances efficacy and patient adherence. Marketing and awareness campaigns by pharmaceutical companies strengthen market presence. Additionally, convenience in travel and home care boosts adoption. Insurance coverage for prescription oral drugs provides additional market support.

The Non-Oral segment is expected to witness the fastest CAGR of 9.5% from 2026 to 2033, driven by increasing adoption of injectable and topical therapies, including viscosupplements and corticosteroid injections. Non-oral routes are preferred for localized pain management, particularly in knee and spinal osteoarthritis. Hospital-based outpatient procedures and specialized orthopedic clinics are driving adoption. Improved administration techniques and minimally invasive delivery methods enhance patient comfort and compliance. Rising awareness of side-effect minimization with targeted therapies supports growth. Pharmaceutical innovation in transdermal gels, patches, and injectables increases market penetration. Expansion of physiotherapy and rehabilitation clinics offering combined non-oral therapies accelerates adoption. Emerging markets are witnessing rising investments in specialized injection centers. Physician training and patient education programs increase confidence in non-oral treatments. Collaborations between pharmaceutical companies and healthcare providers improve accessibility. Aging populations in Asia-Pacific and Latin America further fuel demand. Regulatory approvals for newer formulations also contribute to segment CAGR.

- By Dosage Form

On the basis of dosage form, the Osteoarthritic Pain market is segmented into Solid, Liquid, and Semi-Solid. The Solid segment dominated the largest market revenue share of 55% in 2025, primarily due to the high consumption of tablets and capsules, which offer convenience, ease of storage, and precise dosing. Solid dosage forms are widely used across hospitals, clinics, and home care settings, supporting adoption. Patient compliance is higher with orally administered tablets and capsules. Pharmaceutical companies continue to invest in extended-release and combination formulations to enhance efficacy and convenience. The cost-effectiveness of solid dosage forms compared to injectables boosts market share. OTC availability and robust distribution channels in pharmacies reinforce dominance. Solid dosage forms are preferred for chronic OA management due to predictable pharmacokinetics. Research institutes and clinical trials favor solid formulations for large-scale studies. Geriatric patients prefer easy-to-swallow tablets. Marketing campaigns and insurance coverage support adoption. Widespread awareness regarding chronic pain management further strengthens dominance.

The Liquid segment is expected to witness the fastest CAGR of 8.8% from 2026 to 2033, fueled by increasing use of oral suspensions, syrups, and injectable solutions. Liquid forms are suitable for pediatric, geriatric, and patients with swallowing difficulties. Hospital pharmacies and outpatient clinics are adopting liquid therapies for precise dosing and rapid absorption. Advances in formulation technology and taste masking improve patient compliance. Injectable liquid therapies, including corticosteroids and viscosupplements, drive adoption in specialized orthopedic centers. Physician preference for quick-acting liquid treatments supports market growth. Non-oral liquid forms are gaining traction in home care settings due to ease of administration. Expanding geriatric population and rising prevalence of severe OA cases contribute to CAGR. Market growth is further supported by increasing awareness and physician education. Emerging economies are experiencing higher adoption due to improved access to liquid medications. Research in targeted liquid formulations enhances segment potential.

- By Application

On the basis of application, the Osteoarthritic Pain market is segmented into Hospitals, Clinics, Medical Institutes, Research Institutes, Pharmacy, and Others. The Hospitals segment dominated the largest market revenue share of 48% in 2025, driven by the high patient inflow and the availability of comprehensive treatment options under one roof. Hospitals are the primary sites for advanced imaging, diagnosis, and therapeutic interventions including NSAIDs, corticosteroids, and viscosupplement injections. Integration of multidisciplinary care teams ensures holistic pain management, boosting adoption. Availability of specialized orthopedic departments and physiotherapy units enhances hospital-based treatment. Insurance coverage and reimbursement policies favor hospital-administered therapies. Hospitals are preferred for both chronic and acute OA cases due to access to trained medical staff and monitoring facilities. Government and private hospitals across developed countries drive large-volume prescriptions. Increasing prevalence of hip, knee, and spinal OA cases further consolidates dominance. Clinical trials and research partnerships also reinforce hospital utilization. Hospitals offer both outpatient and inpatient treatment, supporting continuous care. Expansion of hospital networks in emerging economies further strengthens market share.

The Clinics segment is expected to witness the fastest CAGR of 10.5% from 2026 to 2033, fueled by increasing demand for outpatient care, cost-effective treatment, and convenience for patients. Clinics offer quick consultations, prescription management, and follow-up care without hospital admission. Rising awareness of osteoarthritis management among urban populations drives clinic visits. Physiotherapy clinics and orthopedic specialty centers are adopting multi-modal approaches including medication, therapy, and non-invasive injections. Clinics provide personalized care and patient education programs, increasing compliance. Expansion of private clinics in Asia-Pacific and Latin America supports segment growth. Telemedicine integration for prescription renewals and follow-up care accelerates adoption. Clinics are preferred for minor or early-stage OA treatment, providing quicker access than hospitals. Collaboration with pharmaceutical companies ensures supply of latest medications. Clinics also cater to home care patients with consultation and prescription services. Government support for community-based outpatient centers enhances expansion. Patient preference for shorter waiting times and lower costs drives clinic utilization.

- By End User

On the basis of end user, the Osteoarthritic Pain market is segmented into Professional Care and Home Care. The Professional Care segment dominated the largest market revenue share of 57% in 2025, attributed to treatment under physician supervision in hospitals, clinics, and specialized orthopedic centers. Professional care ensures accurate diagnosis, monitoring, and management of OA using advanced imaging (MRI and X-ray) and therapeutic interventions. Availability of trained staff for administration of injectables, therapy, and post-operative care drives adoption. Insurance coverage and reimbursement policies favor professional care. Hospitals and clinics adopt multi-disciplinary treatment protocols, improving patient outcomes and reinforcing market dominance. Integration of clinical trials and research-based therapies strengthens utilization in professional care settings. Professional care is particularly important for severe OA, multi-joint involvement, and post-surgical rehabilitation. Rising geriatric population and increasing prevalence of chronic OA support segment growth. Government and private healthcare initiatives enhance access to professional care services. Educational programs for healthcare professionals improve adherence to treatment guidelines. Expansion of orthopedic and rheumatology departments in developed countries further supports dominance. Collaboration with pharmaceutical companies ensures access to latest medications and therapies.

The Home Care segment is expected to witness the fastest CAGR of 11.2% from 2026 to 2033, driven by increasing patient preference for self-management and convenience. Home care includes administration of oral NSAIDs, topical creams, and physiotherapy exercises under remote guidance. Rising awareness of disease management and availability of digital health platforms support home care adoption. Telemedicine and mobile applications enable monitoring of medication adherence and pain levels. Growing geriatric population and limited mobility patients drive home-based treatments. Cost-effectiveness and reduced hospital visits are major advantages. Expansion of home healthcare providers and pharmacies offering delivery services enhance accessibility. Patient education on OA management and lifestyle interventions improves compliance. Home care adoption is increasing in emerging economies due to lack of nearby professional care facilities. Collaborative programs between healthcare providers and home care services accelerate usage. Increased availability of OTC medications supports segment growth. Lifestyle modifications, exercise therapy, and diet management under home care improve long-term outcomes. Awareness campaigns by patient advocacy groups further drive adoption.

Osteoarthritic Pain Market Regional Analysis

- North America dominated the osteoarthritic pain market with the largest revenue share of approximately 39% in 2025, supported by a high prevalence of osteoarthritis, a well-established healthcare infrastructure, favorable reimbursement frameworks, and widespread adoption of advanced pain management therapies

- The region benefits from early diagnosis, strong physician awareness, and high patient access to pharmacological and non-pharmacological treatment options, including NSAIDs, opioids, corticosteroid injections, and biologics

- Continuous clinical innovation, strong pharmaceutical presence, and increasing focus on improving quality of life for aging populations further support market leadership across both hospital and outpatient care settings

U.S. Osteoarthritic Pain Market Insight

The U.S. osteoarthritic pain market captured the largest revenue share within North America in 2025, driven by high treatment rates, a large aging population, and significant disease burden associated with knee, hip, and hand osteoarthritis. The presence of leading pharmaceutical companies, strong R&D investments, and frequent product launches for pain relief and disease management contribute to sustained market growth. Additionally, favorable insurance coverage and increasing adoption of minimally invasive pain therapies continue to propel the U.S. market.

Europe Osteoarthritic Pain Market Insight

The Europe osteoarthritic pain market is projected to expand at a steady CAGR throughout the forecast period, driven by an aging population, rising prevalence of musculoskeletal disorders, and strong public healthcare systems. Increased focus on early diagnosis, rehabilitation programs, and guideline-based pain management is supporting demand across hospital and specialty clinic settings. Growing awareness of long-term joint health and quality-of-life improvement is further boosting market expansion.

U.K. Osteoarthritic Pain Market Insight

The U.K. osteoarthritic pain market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by increasing incidence of osteoarthritis among the elderly population and improved access to pain management services through the National Health Service (NHS). Government initiatives promoting chronic pain management, along with growing use of non-opioid therapies and physical rehabilitation, are contributing to market growth.

Germany Osteoarthritic Pain Market Insight

The Germany Osteoarthritic Pain market is expected to expand at a considerable CAGR, driven by strong healthcare infrastructure, high awareness of joint disorders, and widespread availability of advanced pain management treatments. The country’s emphasis on evidence-based care, physiotherapy integration, and innovative pharmaceutical solutions supports sustained demand across both inpatient and outpatient treatment settings.

Asia-Pacific Osteoarthritic Pain Market Insight

The Asia-Pacific osteoarthritic pain market is expected to grow at the fastest CAGR of around 7.8% during the forecast period, driven by rapidly aging populations, rising healthcare expenditure, increasing awareness of joint disorders, and expanding access to pain management therapies. Improving diagnostic capabilities and growing penetration of pharmaceutical treatments in countries such as China and India are significantly contributing to regional growth.

Japan Osteoarthritic Pain Market Insight

The Japan osteoarthritic pain market is gaining momentum due to one of the world’s fastest-aging populations and a high prevalence of osteoarthritis-related conditions. Strong healthcare coverage, early adoption of advanced pain therapies, and a focus on maintaining mobility and independence among elderly patients are key factors driving market growth in the country.

China Osteoarthritic Pain Market Insight

The China osteoarthritic pain market accounted for a significant revenue share in Asia Pacific in 2025, driven by a rapidly growing elderly population, rising healthcare spending, and increasing awareness of osteoarthritis treatment options. Expanding access to hospitals, growing pharmaceutical manufacturing capacity, and government initiatives aimed at improving chronic disease management are key factors propelling market growth in China.

Osteoarthritic Pain Market Share

The Osteoarthritic Pain industry is primarily led by well-established companies, including:

• Pfizer Inc. (U.S.)

• Johnson & Johnson (U.S.)

• AbbVie Inc. (U.S.)

• Eli Lilly and Company (U.S.)

• GlaxoSmithKline plc (U.K.)

• Sanofi S.A. (France)

• Novartis AG (Switzerland)

• Bayer AG (Germany)

• Horizon Therapeutics plc (Ireland)

• Zimmer Biomet Holdings, Inc. (U.S.)

• Stryker Corporation (U.S.)

• Smith+Nephew plc (U.K.)

• Flexion Therapeutics (U.S.)

• Pacira BioSciences, Inc. (U.S.)

• Anika Therapeutics, Inc. (U.S.)

• Fidia Farmaceutici S.p.A. (Italy)

• Bioventus Inc. (U.S.)

• Teva Pharmaceutical Industries Ltd. (Israel)

• Sun Pharmaceutical Industries Ltd. (India)

• Dr. Reddy’s Laboratories Ltd. (India)

Latest Developments in Global Osteoarthritic Pain Market

- In August 2022, Grünenthal announced the enrollment of the first patient in its global Phase III clinical programme for resiniferatoxin (RTX), an innovative non‑opioid investigational therapy targeting pain associated with osteoarthritis, marking a key milestone in the development of a potential new class of pain‑relief treatments. This Phase III programme, conducted across approximately 200 study sites with more than 1,800 patients, aimed to enable future regulatory submissions in the U.S., EU and Japan

- In November 2024, Genascence Corporation disclosed that the U.S. Food and Drug Administration (FDA) granted Fast Track Designation to GNSC‑001, a potential first‑in‑class gene therapy for knee osteoarthritis, signalling regulatory support for next‑generation disease‑targeted approaches beyond conventional pain management. Fast Track status is intended to expedite the development and review of drugs for serious conditions with unmet needs

- In February 2025, Zydus Lifesciences received final FDA approval to manufacture and market an ibuprofen/famotidine combination tablet (Duexis), a formulation used to relieve symptoms of osteoarthritis while reducing the risk of gastrointestinal ulcers in patients also taking NSAIDs, enhancing symptomatic pain management options. This approval supports broader treatment offerings in established OA pain segments

- In February 2025, Aurora Pharmaceutical announced the availability of EquiCoxib, an FDA‑approved generic equivalent of firocoxib, a non‑steroidal anti‑inflammatory drug (NSAID) used to treat pain and inflammation associated with osteoarthritis, helping expand access to cost‑effective symptomatic treatments. The availability of generic alternatives often drives competitive pricing and broader patient use

- In March 2025, Advanced Clinical (a global clinical trial services organization) disclosed its partnership and commencement of a multi‑site, randomized, double‑blind study (PARA_OA_012) to evaluate injectable pentosan polysulfate sodium (iPPS) for knee osteoarthritis pain reduction, reflecting ongoing efforts to improve pain and functional outcomes with novel therapies across international patient cohorts. This study aims to advance evidence for a new treatment class

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.