Global Osteopenia Treatment Market

Market Size in USD Billion

CAGR :

%

USD

15.40 Billion

USD

21.57 Billion

2024

2032

USD

15.40 Billion

USD

21.57 Billion

2024

2032

| 2025 –2032 | |

| USD 15.40 Billion | |

| USD 21.57 Billion | |

|

|

|

|

Osteopenia Treatment Market Size

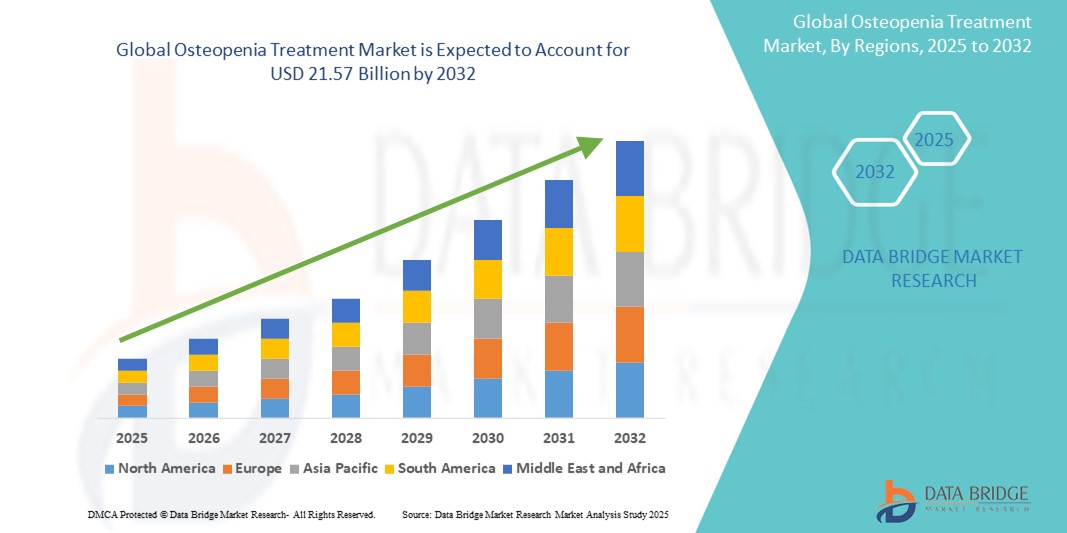

- The global osteopenia treatment market size was valued at USD 15.40 billion in 2024 and is expected to reach USD 21.57 billion by 2032, at a CAGR of 4.30% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within bone health diagnostics and therapeutic advancements, leading to increased awareness and early detection of osteopenia, especially in aging populations across both developed and developing regions

- Furthermore, rising patient demand for effective, minimally invasive, and long-term solutions for managing bone mineral density (BMD) loss is establishing pharmacological and non-pharmacological osteopenia treatments as essential components of preventive healthcare. These converging factors are accelerating the uptake of Osteopenia Treatment solutions, thereby significantly boosting the industry's growth

Osteopenia Treatment Market Analysis

- Osteopenia treatment solutions, including pharmacological therapies, nutritional supplements, and lifestyle interventions, are increasingly vital in mitigating the progression to osteoporosis in at-risk populations, particularly older adults and postmenopausal women. Growing awareness about bone health and early screening practices is accelerating market demand across both developed and emerging regions

- The increasing global burden of low bone density and sedentary lifestyles is fueling the demand for osteopenia treatment. Key treatment options such as bisphosphonates, calcium and vitamin D supplements, hormone replacement therapies (HRT), and newer biologics are gaining traction as patients and clinicians prioritize early intervention

- North America dominated the osteopenia treatment market with the largest revenue share of 41.6% in 2024, driven by high healthcare spending, well-established diagnostic infrastructure, and increased awareness campaigns promoting bone mineral density testing. The U.S. leads the region due to early adoption of preventive healthcare measures and widespread availability of prescription therapies and OTC supplements targeting bone health

- Asia-Pacific is expected to be the fastest-growing region in the osteopenia treatment market with a projected CAGR of 8.9% from 2025 to 2032, fueled by rising healthcare awareness, aging populations in countries like Japan and China, and improved access to diagnostic and treatment services. Government-backed health programs and increased vitamin D deficiency screenings are further contributing to growth

- The Bisphosphonates segment dominated the osteopenia treatment market, with a market revenue share of 38.6% in 2024, attributed to their efficacy in slowing bone loss and increasing bone density, making them a widely prescribed treatment for osteopenia and early-stage osteoporosis

Report Scope and Osteopenia Treatment Market Segmentation

|

Attributes |

Osteopenia Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Osteopenia Treatment Market Trends

“Technological Advancements and Personalized Medicine Driving Innovation”

- A significant and accelerating trend in the global osteopenia treatment market is the advancement of targeted therapies and personalized treatment protocols tailored to individual patient profiles, including genetic predisposition and bone density metrics. These developments are significantly enhancing treatment efficacy and patient adherence

- For instance, the increasing use of dual-energy X-ray absorptiometry (DEXA) and bone turnover markers is allowing clinicians to more accurately assess fracture risk and monitor treatment response in osteopenic individuals, thereby optimizing medication regimens and improving outcomes

- Biopharmaceutical companies are actively investing in the development of novel therapeutic agents such as anabolic bone-forming drugs and selective estrogen receptor modulators (SERMs) that provide benefits beyond traditional bisphosphonates. These treatments are designed to not only slow bone resorption but also stimulate bone formation, offering a dual-action mechanism critical for osteopenia management

- The introduction of once-weekly or monthly dosing options, as well as injectables with extended release profiles, has greatly improved patient convenience and compliance, especially for elderly populations who may struggle with daily pill regimens

- Regulatory bodies and healthcare systems are increasingly supporting early screening and preventive treatment strategies, further fueling the market. Preventive care approaches—particularly in postmenopausal women and aging males—are encouraging earlier intervention, which is essential to halt progression from osteopenia to osteoporosis

- With the convergence of diagnostics, pharmacology, and patient-centric care models, the global osteopenia treatment market is undergoing a transformative phase. Stakeholders are focusing on holistic approaches that combine lifestyle interventions, dietary supplements, and pharmacological therapies to address bone health comprehensively

Osteopenia Treatment Market Dynamics

Driver

“Growing Need Due to Rising Osteopenia Cases and Aging Population”

- The increasing prevalence of osteopenia, particularly among the aging population and postmenopausal women, is a significant driver for the heightened demand for osteopenia treatment solutions

- For instance, in April 2024, Amgen Inc. expanded its bone health portfolio by enhancing access to Prolia (denosumab) across Asian and European markets, emphasizing its role in preventing bone loss in at-risk populations. Such strategic expansions by key players are expected to drive the osteopenia treatment industry growth over the forecast period

- As awareness about early bone density screening grows and consumers become more informed about the risks of fractures and progression to osteoporosis, there is a rising demand for proactive treatment

- Furthermore, the growing focus on preventive healthcare and increasing physician recommendations for early-stage treatment options such as bisphosphonates, calcium, vitamin D supplementation, and lifestyle modification are driving the adoption of osteopenia treatment across clinical and homecare settings

- The convenience of oral medications, availability of over-the-counter supplements, and development of patient-friendly injectables are key factors propelling market adoption. Additionally, the emergence of telehealth platforms and digital patient engagement tools are helping to expand treatment reach in underserved areas

Restraint/Challenge

“Limited Awareness and High Cost of Advanced Therapies”

- Limited awareness about osteopenia as a serious precursor to osteoporosis poses a key challenge, particularly in developing regions where bone health is often underdiagnosed

- In many low- and middle-income countries, healthcare systems may not prioritize bone density screening, leading to a lack of early detection and treatment

- Moreover, the relatively high cost of certain advanced therapies such as injectable biologics (e.g., denosumab or teriparatide) can act as a barrier for uninsured or underinsured populations

- Insurance reimbursement for osteopenia treatments is often inconsistent, and out-of-pocket costs for supplements or diagnostic tests such as DEXA scans may deter early intervention

- Overcoming these challenges requires public health campaigns to improve awareness, increasing access to affordable diagnostics, and expanding insurance coverage for osteopenia management. Additionally, innovations in low-cost therapeutic options and digital tools for bone health monitoring can support wider adoption and adherence

Osteopenia Treatment Market Scope

The osteopenia treatment market is segmented on the basis of type, route of administration, and distribution channel.

- By Type

On the basis of type, the osteopenia treatment market is segmented into bisphosphonates, calcitonin, hormone therapy, parathyroid hormone related therapy (PTHrP) Analog, selective estrogen inhibitors modulator, and others. The bisphosphonates segment dominated the largest market revenue share of 38.6% in 2024, attributed to their efficacy in slowing bone loss and increasing bone density, making them a widely prescribed treatment for osteopenia and early-stage osteoporosis. Their long-standing use, cost-effectiveness, and strong clinical validation contribute significantly to their dominance in the market.

The selective estrogen inhibitors modulator (SERM) segment is expected to register the fastest CAGR of 22.3% from 2025 to 2032, driven by the growing preference for non-hormonal, bone-strengthening therapies especially among postmenopausal women. The ability of SERMs to mimic estrogen’s protective effect on bones without stimulating breast or uterine tissue is gaining interest among physicians and patients seeking safer alternatives.

- By Route of Administration

On the basis of route of administration, the osteopenia treatment market is segmented into oral, injectables, and others. The oral segment held the largest market revenue share of 57.9% in 2024, driven by patient preference for non-invasive, easily administered medications, particularly bisphosphonates and vitamin D/calcium supplements. Oral administration is convenient for long-term treatment and has better patient compliance compared to other routes.

The injectables segment is anticipated to witness the highest CAGR of 19.4% from 2025 to 2032, owing to the growing use of injectable agents such as denosumab and teriparatide, which are used for patients at higher risk of fracture or those who cannot tolerate oral therapies.

- By Distribution Channel

On the basis of distribution channel, the osteopenia treatment market is segmented into hospital pharmacies, retail pharmacies, and others. The retail pharmacies segment accounted for the largest market share of 49.3% in 2024, supported by the wide availability of oral bisphosphonates, calcium, and vitamin D supplements. The ease of access, over-the-counter availability, and pharmacist counseling contribute to strong consumer demand in this channel.

The hospital pharmacies segment is projected to grow at the fastest CAGR of 20.1% during 2025 to 2032, driven by the rising number of hospital visits for bone health assessments, especially among the elderly, and the administration of injectable treatments that require medical supervision.

Osteopenia Treatment Market Regional Analysis

- North America dominated the osteopenia treatment market with the largest revenue share of 41.6% in 2024, driven by a growing aging population, rising awareness of bone health, and the increasing prevalence of osteoporosis and osteopenia among postmenopausal women

- The availability of advanced treatment options and the presence of major pharmaceutical players further support regional growth

- The U.S. holds a significant position in this market due to its proactive healthcare system, high healthcare expenditure, and widespread access to early diagnostic tools and bone density screening

U.S. Osteopenia Treatment Market Insight

The U.S. osteopenia treatment market captured the largest revenue share of 61.0% within North America in 2024, driven by the rising incidence of osteopenia due to sedentary lifestyles, nutritional deficiencies, and aging demographics. Increased awareness about preventive bone health, along with reimbursement coverage for diagnostic and therapeutic procedures, further accelerates market growth. The presence of leading companies offering bisphosphonates, hormone therapy, and selective estrogen receptor modulators enhances treatment accessibility across hospitals and retail pharmacies.

Europe Osteopenia Treatment Market Insight

The Europe osteopenia treatment market is projected to expand at a substantial CAGR during 2025–2032, primarily propelled by favorable government policies, high public awareness campaigns for osteoporosis prevention, and the aging population in Western Europe. Countries such as Germany, France, and the U.K. are leading adopters of osteopenia therapeutics due to robust healthcare infrastructure and increased bone density testing. The market also benefits from innovation in drug delivery and patient-specific treatment regimens.

U.K. Osteopenia Treatment Market Insight

The U.K. osteopenia treatment market is anticipated to grow at a substantial CAGR during the forecast period, driven by a high prevalence of osteopenia among postmenopausal women and the elderly. Strong public health initiatives, such as the National Osteoporosis Society’s screening campaigns, and access to specialist care via the NHS, are further supporting diagnosis and treatment. Additionally, the rising adoption of selective estrogen receptor modulators and calcitonin-based therapy is boosting therapeutic sales across retail and hospital pharmacies.

Germany Osteopenia Treatment Market Insight

The Germany osteopenia treatment market is expected to expand at a noteworthy CAGR during the forecast period, owing to advanced diagnostic facilities and a strong focus on preventive health. With over 20% of the population aged above 65, the country sees high demand for bone-strengthening drugs like bisphosphonates and parathyroid hormone analogs. Local pharmaceutical manufacturing and stringent regulations around postmenopausal bone loss are shaping treatment trends in both urban and rural regions.

Asia-Pacific Osteopenia Treatment Market Insight

The Asia-Pacific osteopenia treatment market is poised to grow at the fastest CAGR of 8.9% from 2025 to 2032, and accounted for 20.5% of the global market revenue in 2024, led by rapid urbanization, changing dietary patterns, and increasing life expectancy in countries such as China, Japan, and India. Government efforts to promote bone health awareness and the introduction of cost-effective generics are making treatment more accessible. Additionally, the shift from injectable to oral therapies is gaining traction due to patient preference.

Japan Osteopenia Treatment Market Insight

The Japan osteopenia treatment market held a market share of 31.8% within Asia-Pacific in 2024, driven by its rapidly aging population—over 28% of citizens are above 65. With a strong cultural emphasis on preventive care, Japan has a high uptake of bone density testing and non-invasive therapies. Market growth is driven by new drug launches, academic research on bone metabolism, and collaborations between hospitals and pharma companies for elderly care innovations.

China Osteopenia Treatment Market Insight

The China osteopenia treatment market accounted for the largest revenue share of 38.7% within Asia-Pacific in 2024, supported by its expanding middle class, large aging population, and increased access to healthcare services in Tier 2 and Tier 3 cities. Public health campaigns and digital health platforms are accelerating early diagnosis and treatment initiation. The domestic production of bisphosphonates and hormone therapies also boosts affordability and adoption across both urban and rural populations.

Osteopenia Treatment Market Share

The osteopenia treatment industry is primarily led by well-established companies, including:

- AbbVie Inc. (U.S.)

- Amgen, Inc. (U.S.)

- Actavis Plc. (Ireland)

- Lilly (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- GSK plc (U.K.)

- Merck & Co AG (Switzerland)

- Novartis AG (Switzerland)

- Novo Nordisk A/S (Denmark)

- Pfizer, Inc. (U.S.)

- Teva Pharmaceuticals Industries Ltd. (Israel)

Latest Developments in Global Osteopenia Treatment Market

- In March 2024, Bone Health Technologies (BHT) secured a USD 5 million funding round aimed at advancing care for individuals with low bone density. This funding round attracted investments from Esplanade Ventures, Berkeley Catalyst Fund, and Terumo Medical, a prominent figure in medical technology globally. The funding infusion comes at a pivotal moment as BHT approaches the final stages of obtaining de novo FDA clearance for its Osteoboost vibration wearable

- In January 2024, Bone Health Technologies, a leader in bone health solutions, unveiled Osteoboost following FDA clearance. This innovative device represents the first non-pharmacological prescription treatment for postmenopausal women diagnosed with osteopenia. The wearable belt administers precise, calibrated vibrations to the lumbar spine and hips, aiming to mitigate the decrease in bone strength and density. The approval of Osteoboost introduces a groundbreaking therapeutic option for low bone density, representing a milestone in women's health advancements

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.